Digital R&D has been saved

Digital R&D Transforming the future of clinical development

Biopharma R&D has changed the face of disease management over the years. Yet many in the field admit that clinical development has fallen behind in adopting digital technologies, which have the potential to change how research organizations can engage with patients, innovate in patient care, and execute processes to drive efficiencies. While digital transformation is a complex, resource-intensive, and lengthy undertaking, the rewards are well worth the effort.

Executive summary

Learn More

In a hurry? Read a brief version from Deloitte Review, issue 23

Read the related "My Take" and blog post

Explore additional research

Create a custom PDF or download Deloitte Review, issue 23

In the last decade, biopharma companies successfully brought to market many breakthrough treatments that have transformed deadly diseases into manageable chronic conditions, raised the standards of medical care, and helped improve the quality of patients’ lives.

However, many in biopharma R&D admit that the current high-risk, high-cost R&D model is unsustainable. A number of clinical trial activities still use the same processes as in the 1990s, and the clinical development enterprise has largely failed to keep pace with the ever-growing amounts of real-world evidence, genomics information, and emerging data sources (such as biosensors). Harnessing this data could help demonstrate that new treatments result in differentiated improvements in patient and health economic outcomes. Yet companies are challenged to generate this evidence as efficiently as possible to allow for meaningful return on R&D investment.

Digital technologies can transform how companies approach clinical development by incorporating valuable insights from multiple sources of data, radically improving the patient experience, enhancing clinical trial productivity, and increasing the amount and quality of data collected in trials. Collectively, digital technologies can help achieve the following strategic objectives in clinical development:

- Engage effectively with patients and stakeholders through targeted, omni-channel interactions to meet their needs and foster loyal relationships

- Innovate in patient care by catalyzing the development of products and services to deliver value for patients, health care providers, and payers

- Execute efficiently by digitizing and rationalizing processes to drive efficiencies, cycle time reductions, and cost savings

But where is the industry in adopting these transformative technologies? We interviewed 43 leaders across the clinical development ecosystem to understand the current level of adoption of digital technologies and how it can be accelerated. We found that the industry has been slow to digitize its clinical development processes, and that digital adoption varies widely. Even the most advanced organizations are simply piloting several technologies in different areas of clinical development, focusing on piecemeal solutions or new tools to support the existing process.

Our research and client experience suggest that digital transformation is a complex, resource-intensive, and lengthy undertaking. But the rewards can be significant: Early adopters can benefit from better access to and engagement with patients, deeper insights, and faster cycle times for products in development. Many in our study expressed a desire to be fast followers, but given the complexity of operationalizing a digital strategy, the reality is that undue delay could put organizations at a competitive disadvantage.

At the same time, our research also indicates that biopharma companies and contract research organizations (CROs) will need to overcome several challenges to realize the potential of digital in clinical development: immature data infrastructure and analytics, regulatory considerations, and internal organizational and cultural barriers. Biopharma companies should consider building updated data infrastructure and governance, engaging early with regulators to discuss new technologies, and developing a measured approach to evaluating and implementing technologies within their organizations. CROs can enable this change by advancing interoperable digital platforms and vetting promising technology applications. Cross-industry consortia could help advance the industry as a whole by offering a forum to share early successes and supporting the development of standards.

The time to act is now. Biopharma companies that do not pursue a comprehensive digital clinical strategy risk falling behind.

The promise of digital

The industry is under pressure to develop innovative medicines; demonstrate differentiated value to patients, providers, and payers; and reduce cost and time to market to maximize return on investment. Deloitte’s analysis of return on pharmaceutical R&D investments for a cohort of 12 large biopharma companies shows a sustained decline from 10.1 percent in 2010 to 3.2 percent in 2017.1

As the industry looks for ways to improve the performance of today’s R&D model, many companies are turning to digital technologies. Most think of digital as a collection of technologies, platforms, and advanced analytics, such as connected devices, mobile applications, artificial intelligence, machine learning, and robotic processes. As companies look to apply these technologies either individually or in combination to perform operational activities, such as recruiting patients, improving adherence, and capturing and analyzing data, it could, however, be useful to conceptualize digital not simply as a platform or technology, but as a way of doing things differently. In our view, digital provides opportunities to:

- Engage effectively with patients and investigators through targeted, omni-channel interactions to meet their needs and foster loyal relationships

- Innovate by catalyzing the development of products and services to drive value for patients, health care providers, and payers using data and innovative platforms such as digital endpoints, real-world evidence, and telemedicine

- Execute efficiently by digitizing and rationalizing processes to drive efficiencies, cycle time reductions, and cost savings

Looking at digital through this lens can help shift the focus from individual technologies and solutions to how these technologies collectively can help accomplish bigger clinical development objectives and identify strategic opportunities that a narrow technology-centric view might miss.

Research approach

Deloitte interviewed 43 industry stakeholders involved in the drug development process to:

- Explore where the industry sees value and opportunities for digital in the clinical development process

- Understand reasons behind the relatively slow pace of adoption of digital technologies in clinical development

- Uncover strategies to overcome barriers and accelerate the adoption of digital in clinical trials

For the purposes of our research, we defined “digital” to our interviewees as a collection of the following technologies:

- Social media and online platforms

- Mobile applications, wearables, biosensors, and connected devices

- Automation (robotic process automation and robotic and cognitive automation)

- Cognitive technologies (machine learning, artificial intelligence, natural language processing, natural language generation)

- Analytics and visualization

- Blockchain

- Virtual/augmented reality

Value levers for digital technologies in clinical development

Digital technologies have helped change the way retail, finance, and banking industries communicate with and deliver their products and services to customers.

Through the course of our interviews, we heard that digital technologies have the potential to transform clinical development as well—especially in the way companies engage, execute, and innovate. Applied to trials, these technologies can address many of the pain points faced by patients, investigators, and trial staff.

Engage: Patient-centric clinical development

As consumer expectations evolve, trial participants will likely demand a more patient-friendly clinical trial experience. Yet the industry has often been slow to meet even the most basic of expectations. As the vice president (operations) of a CRO said,

“If you think about the logistics—driving or taking transport to the site, parking, checking in, sitting in a waiting room, only to answer a few questions . . . All of that could be obviated by mobile technology. Patients will push back against research studies that ask them to come in for nonsensical visits.”

Digital technologies can support many of the goals of patient-centricity by making trial participation less burdensome and more engaging and by redefining how patient care is delivered during clinical trials.

- Collaborate with patients in the research process

Companies could gain more insight from trial participants by treating them as collaborators instead of subjects in the research process. Although not a standard approach for the industry just yet, forward-looking clinical teams have responded to this demand by incorporating patient inputs into the trial process. This can be achieved through patient representation on advisory boards, study pilots, surveys, focus groups, and crowdsourcing technologies. These clinical teams also incorporate patient feedback on their trial experience and use this information to shape the final product.

- Ease patient access and reduce the burden of trial participation

Travelling to clinical sites for assessments, sometimes several times a month, is a major burden for trial participants. In fact, 70 percent of potential participants in the United States live more than two hours away from the nearest study center, which often impacts their willingness and ability to participate.2

Virtual trials make it possible for patients to participate in studies from the comfort of their homes, reducing or even eliminating the need to travel to sites. Such trials leverage social media, e-consent, telemedicine, apps, and biosensors to simplify recruitment, communicate with patients, and support both passive and active data collection (see case study 1).

- Transform patient care during a clinical trial

Digital technologies can provide more comprehensive tools to patients and clinicians than are available today. They can help engage patients continuously throughout the clinical trial experience and help improve patient care management during clinical trials.

For instance, text messaging and smartphone apps can remind patients to take their medication, record health data, answer patients’ questions in real time, and schedule their visits.

Innovate: Drive greater product value through new approaches and insights

Digital technologies can help companies develop a better value proposition by operationalizing the drivers of patient value and achieving significant advances in study methods that traditional approaches cannot deliver.

- Improve adherence to therapy

Adherence to therapy ensures that the effect of an investigational drug is fully reflected in the data. However, high adherence rates can be hard to achieve and verify using traditional methods. A senior scientific director at a midsize biopharma company describes the problem:

“We found that based on blood samples on the pharmacokinetic monitoring, 35–40 percent of patients had no drug on board. This drug had a half-life of 5.5 days. This meant those patients didn’t skip just one dose, they hadn’t taken the drug for up to two weeks.”

Adherence tools such as AiCure use facial recognition to confirm that the medicine has been ingested and generate nonadherence alerts to investigators.4 Case study 2 describes another example of an adherence solution.

- Increase the statistical power and sensitivity of clinical studies

More frequent data collection (daily, hourly, or continuously) via sensors and wearables can generate much more data and produce more sensitive measurements than periodic standard clinical assessments. As a result, the effect of therapy can be demonstrated with shorter studies and fewer patients, requiring less effort and cost for recruitment and retention (see case studies 3 and 4).

- Capture patient-centered endpoints and support product value propositions

Some interviewees note that the ability to measure endpoints important to patients, such as quality of life or the ability to perform specific daily activities (such as getting up and down the stairs), will help drive market access and adoption.

Many endpoints used in trials today only offer a glimpse into a patient’s physical and mental functioning at a given point in time. Advances in sensors and mobile technologies have made it easier to continuously collect patient-generated data, also referred to as digital endpoints (see case study 4). Additionally, new technologies make it possible to collect patient-reported outcomes electronically, including the ways in which an intervention impacts a patient’s quality of life. Analytical insights on clinical and patient-reported outcomes can provide competitive advantage and support the case for reimbursement.

In the future, digital endpoints and health outcomes captured in a real-world setting could also support value-based contracting. This data could demonstrate to patients, providers, and payers that the expected therapeutic and economic value defined in clinical trials is being delivered.

- Get new insights from existing data

As companies apply artificial intelligence and advanced analytics to data assembled from different sources (real-world evidence, claims, and completed and ongoing studies), they can begin to uncover new insights. These insights may suggest potential new indications, a different safety profile or response to treatment in certain patient subgroups, or predictions around the likelihood of compounds to succeed in trials.

- Reduce the number of patients needed to study investigational treatments

Novel approaches to study design, such as synthetic trial arms or master protocols, can reduce the number of patients required to test investigational treatments.

A synthetic trial arm uses data from previously completed trials or real-world evidence to create a “control” study group that receives a placebo or standard of care treatment. This approach is particularly useful in rare disease trials or when a placebo approach is not appropriate or ethical, as is often the case in oncology.

Master protocols—where several companies or teams study competing treatments for a similar patient population in an umbrella or a platform trial*—can achieve a similar goal.

In-silico trials can eliminate the need for phase 1 trials that test the safety of compounds in healthy subjects. Instead, safety is evaluated using advanced computer modeling.

Execute: Gain efficiencies, optimize time and cost

As clinical trials grow in scope and complexity, digital technologies can optimize trial operations. Some companies are starting to use these technologies and realize the benefits described below. These are just a few examples from our interviews; digital can give rise to many other operational efficiencies.

- Expedite patient enrollment, improve retention, and increase the diversity of the study population

Traditional recruitment approaches have largely failed to garner study participants who reflect real-world patients. Regulators, treating clinicians, and payers stress the need for greater demographic heterogeneity in study populations. Digital technologies can support the recruitment of a more diverse and representative study population (see case study 5). This could also help sponsors better understand the benefits and risks of new therapies across different subpopulations before going to market.

Furthermore, digital technologies can significantly improve recruitment efficiency by reducing the effort and cost involved in patient identification. Today, approaches range from simple advertising on the Web and online patient communities to targeting patient opinion leaders through social media to mining unstructured patient data (social media, electronic health records [EHRs], lab results, pathology reports). Some solutions help patients find trials while others help investigators find patients (see case studies 5 and 6).

- Improve investigator productivity

Site staff and investigators have to input data into multiple sponsor and CRO systems that rely on “different electronic data capture (EDC) systems, each with its own portal, its own system, its own adverse-event reporting,” a process an interviewed investigator describes as “maddening.” Technology can reduce this burden by digitizing standard clinical assessments, automating data capture, and sharing data across these multiple systems (see case study 7). Cognitive technologies can generate action items for physicians and nurses based on protocol requirements (for example, which labs and procedures a particular patient needs on that visit), assist in scheduling patient visits, and pre-populate patient data into EDC systems.

- Identify unproductive sites for early intervention or shutdown and support risk-based monitoring

Analytic platforms can assemble and visualize data from multiple sites, providing a real-time view of site performance. Cognitive technologies (such as machine learning and natural language processing) can analyze site performance data, stratify sites based on their productivity and data quality, and recommend that site monitors visit higher-risk sites. These targeted site visits could inform decisions to offer remedial training to investigators, exclude certain data from the analysis, or shut down unproductive sites early, saving hundreds of thousands of dollars for sponsors and CROs.

- Reduce manual effort on repetitive tasks

Robotic and cognitive technologies can automate repetitive tasks, improving timeliness and accuracy. For instance, workflow automation can create drafts of standardized contracts such as investigator, site, and confidentiality agreements, shortening study start-up time.9 Cognitive technologies can identify patient data points to be captured as per protocol, check for missing data, and reconcile entries with past inputs to highlight inconsistencies to study coordinators. And natural language processing can be used to complete sections of the dossier for submission, for instance, to prepopulate standard information (such as patient demographics tables) into the final clinical study report. This can save effort and cost, as well as reduce compliance risk and overall time to market.10

State of play in digital

Most interviewees admit that biopharma has been slow to experiment with digital technologies and integrate them into routine operations. However, that doesn’t mean these technologies’ potential has gone unnoticed. Many large companies have set up innovation groups and allocated budgets to fund pilots, although so far, these pilots have not yet scaled into pivotal studies. They range from leveraging real-world evidence for better trial design to collecting novel endpoints via sensors to using natural language processing to automate the writing of some portions of clinical study reports.

So far, most digital pilots have been piecemeal solutions that bring about incremental improvements to existing processes. There are, however, a few examples of transformative approaches that could change the way trials are conducted. One such area is the use of telemedicine and sensors to conduct trials virtually, enabling patients to participate with minimal disruption to their daily lives (see the sidebar “Clinical trials of the future”).

Figure 2 summarizes the market activity around digital innovation in clinical development based on our interviews.

Industry inertia—Late adopters risk falling behind

There is no track record of success by waiting.—Vice president of strategic operations, CRO

“Herd mentality” is how some interviewees describe the industry’s position on innovation, admitting that biopharma has been slow to embrace innovation. Many companies are waiting for someone else to take the first step. Interviewed experts opine that adoption will take off when one or two early adopters demonstrate a superior process and manage to get regulatory approval. Results and learning from such successes coupled with a regulatory precedent could push others to follow suit.

While this may seem like a safe approach on face value, several interviewees caution against it.The long cycle times of clinical development programs, where the design of early-phase trials has downstream implications on later phases is the main reason some believe the wait-and-see approach is a losing proposition. Explains a veteran scientist and president of a clinical technology and analytics company:

“Having a better measurement of an endpoint that I couldn’t have unless I do things digitally is [a competitive advantage]. If somebody else has gone to the regulator or payer with a better measurement and I haven’t even started to think about it, they just completely moved the goal posts on me competitively.”

Even though innovation comes with significant costs, most interviewees believe the benefits outweigh the risks. “The risk that you take the wrong bet is probably smaller than the risk of not moving,” says the global head of pharma portfolio management in a large biopharma company. Interviewees note that pilots rarely result in complete failure. At a minimum, organizations walk away with learnings that can be applied to future studies: how patients misuse devices, the right cadence of interactions with patients, the extra time it takes site staff to teach patients how to use technology.

Like any innovation, digital is a journey, and organizations can anticipate both false starts and quick wins. Even being a fast follower, which by definition requires the ability to move quickly, can be elusive. Organizations with serious intentions of moving quickly could find themselves lagging behind as unexpected challenges set them back. Those that have not yet started could find themselves on the back foot when others demonstrate success.

Strategic and operational issues impede progress for major stakeholders

Who in the clinical development ecosystem will drive the adoption of innovation? We have found that given the constraints stakeholders in the clinical development ecosystem face, it may be difficult for any one player to be successful independently. For many organizations we interviewed, partnerships are central to the success of their digital programs.

Biopharma companies. Innovation is currently happening in pockets within biopharma companies; however, strategic and operational issues can limit progress (described in more detail later in this report). An inherently risk-averse culture steers organizations away from exploring technologies for high-priority and potentially high-value clinical programs for fear of slowing down trial execution. Many large biopharma companies are also saddled with complex and slow-moving organizational structures. Small biopharma companies, on the other hand, may be nimbler, but have limited resources, which constrains their ability to make larger technology plays.

CROs. Our research suggests that biopharma clients do not think of CROs as champions of innovation. Some interviewees point to a tension between preserving an existing CRO business model optimized for the current drug development process and the need to experiment, which can disrupt familiar processes, threaten job functions, and undermine the CRO revenue model.

“With a focus on operational effectiveness and efficiency, CROs operate like machines. The idea of a well-oiled machine is predicated on repeatability, doing things the same way, consistently. However, this created a system that is averse to making purposeful changes to these well-oiled processes: ‘We get things done, and reasonably fast.’ But what was reasonable in the past is not appropriate for the future. Somebody in my role asks to break the machine because we want to do things differently. We create tension and animosity. This is where culture has to adapt over time,” says the vice president of strategic operations at a CRO.

A few oppose this view, suggesting that CROs can gain the most from transformative digital innovation, as they will likely be pushed toward a capitated payment model that rewards efficiency. They expect CROs to choose to bring new technology through mergers and acquisitions and partnerships with technology players.

Technology companies. Technology companies focused on the clinical development space offer promising solutions, but many find it challenging to understand the heavily regulated biopharma environment. Biopharma companies are often reluctant to be the technologists’ “beta testers” for new, unproven solutions.

A few interviewed experts expect innovation to come from outside the industry, perhaps from large technology companies such as Amazon or Apple Inc. eyeing the health care space. These companies have access to ever-growing amounts of consumer health data that could prove valuable in clinical development, from understanding disease onset and progression to identifying early safety signals or food and drug interactions to engaging with patients for clinical trial participation and awareness. For most, working with these technology companies is new territory, but this could become an essential element of biopharma companies’ digital strategy.

Cross-industry collaboration can accelerate adoption

One way companies can experiment without incurring too much risk is through participation in industry consortia, and this is a key component of digital strategy for several interviewees.

The past few years have seen a large increase in R&D-focused partnerships through industry consortia such as the Clinical Trial Transformation Initiative (CTTI) and TransCelerate. Such partnerships have been instrumental in increasing our understanding of complex conditions and novel biomarkers, improving the ability to measure disease progression, and exploring the clinical benefits of combination treatments.11 Consortia are a good model for activities that require industry-wide consensus, such as standards development and presenting a collective voice to regulators in shaping regulatory guidance on new issues. Possible benefits of industry consortia to digital adoption in clinical development include:

- Minimizing risks through shared investments in joint projects

- Incorporation of multi-stakeholder perspectives (patients, investigators, treating clinicians, payers, regulators)

- Access to interdisciplinary expertise around analytics, endpoint validation, and technology development

- Data-sharing

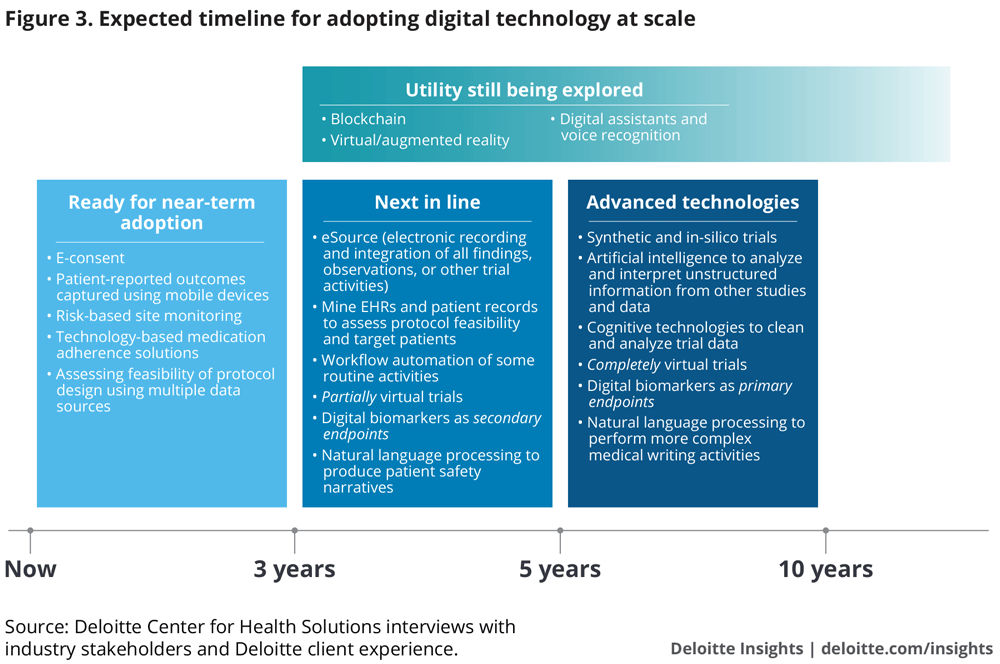

Expected technology adoption timeline

Although trials have become larger and more complex over the past decade, the impact of technology is only being felt recently. We have yet to explore the full benefits of digital technologies.—Senior vice president, head of clinical operations at a large pharma company

Several interviewees referred to EDC adoption as a yardstick for how soon digital technology can be adopted at scale. Though EDC was introduced two decades ago, widespread adoption has happened only over the last 8–9 years, with some trials still using paper for capturing data.

We have classified technologies into three categories for their upscale and adoption. For this analysis, we define “adoption” as usage in at least 20–25 percent of late-stage clinical trials—a threshold that we believe creates a critical mass for upscale. Our estimated times to adoption are based on views from pharma and CRO executives (in addition to Deloitte’s client experience). We believe this is a conservative view—some stakeholders, for example, technology companies, are much more bullish.

0–3 years. Ready for immediate adoption: Easier to integrate into existing processes, these technologies are approaching maturity and widespread adoption. This category includes technologies to assess protocol design and patient inclusion-exclusion criteria, obtain e-consent, capture patient-reported outcomes, and support medication adherence and site analytics. Interviewees expect these to be used in many clinical trials now and in the next 2–3 years.

3–5 years. Next in line: A number of these technologies are in pilot stages at some organizations. Examples include artificial intelligence to mine EHRs for patient identification, sensors to measure endpoints in partially virtual trials, and cognitive technologies for automating routine activities and even elements of medical writing. Early adopters and fast followers are currently piloting these technologies in phase 2 and will likely gradually move to using them in late-stage trials. Therefore, we estimate adoption for this cohort within 3–5 years.

5–10 years. Advanced technologies: Entirely virtual trials and digital biomarkers as primary endpoints could happen over a 5–10-year timeframe for early adopters.

Organizations that have not piloted next-in-line technologies in early stage trials between now and the next 1–2 years may take another 2-3 years to implement them in their pivotal trials. With some catching up to do, late adopters will probably take 5–10 years to partially virtualize trials and incorporate novel endpoints and cognitive technologies beyond pilots.

Utility still being evaluated: Adoption of these technologies is expected to be variable, as most organizations are still in the early stages of exploring their utility. Based on our interviews, this category includes virtual and augmented reality, digital assistants (such as Alexa and Google Home), voice recognition, and blockchain. A few interviewees talked about the possibility of using virtual and augmented reality for training investigators and patients. Some are contemplating the use of digital assistants for medication adherence, as well as to assess vocal and speech pattern biomarkers. These biomarkers could be useful in trial recruitment, tracking disease progression, or testing drug efficacy for neurological, mental health, and respiratory conditions. Potential use cases for blockchain are detailed in the sidebar.

Opportunities for blockchain in clinical development

Blockchain technology provides a shared immutable record of transactions stored on an unalterable digital ledger. In clinical trials, blockchain could enable highly secure data storage, making it difficult to tamper with trial data and results. While few of our interviewees see the need for such levels of security now, blockchain technology has several potential uses in clinical trials in the future.

Collaborative information-sharing: Using blockchain, companies can securely share study data, such as patient information and adverse events with companies they collaborate with or interim results with sponsors and regulators. The technology can also be used to manage and track informed consent across multiple sites, systems, and protocols.

Protocol management: Blockchain can provide an immutable record of any changes or updates to the study protocol to reduce risks to the credibility of the research process resulting from failure to adhere to protocol amendments.

Comprehensive patient profiles: Building a comprehensive patient data profile from multiple data sources (real-world evidence, EHRs, and claims data) requires data harmonization, security, and privacy. A blockchain solution managed among multiple patient data stakeholders can link disparate patient data records to the correct patient.

Digital adoption expected to vary across geographies

Interviewees noted that the rate of adoption of digital technologies could vary across geographies.- US and Northern European markets will probably lead. Robust infrastructure and widespread use of mobile devices and EHRs indicate opportunities for quicker adoption of other digital technologies.

- The United States is perceived as the most conducive market from a regulatory and technology standpoint. Despite technological similarities with the United States, more stringent privacy rules and regulatory differences among EU member countries make them more complex to navigate. For instance, in Germany, there are laws against using a patient’s date of birth, as it is considered protected patient information.

- Asian markets (India and China) and Eastern Europe are expected to be next in line. Improvements in broadband connectivity and widespread mobile device acceptance could drive adoption.

Considerations for adopting digital at scale

Despite much experimentation, the path to scaled adoption of digital is not obvious and it is possible that companies will develop different approaches to scaling things up. Currently there are several barriers to adoption, including:

Immature data infrastructure and analytics

Many data platforms used in clinical trials today are not conducive to digital innovation.

Interviewees describe how in a typical pharma company “you will find 30–50 tech platforms and clinical systems” and this “archaic and fragmented infrastructure” does a poor job of facilitating data flow. This limits pharma’s ability to efficiently perform activities such as designing in-silico trials and synthetic trial arms.

Access to external data (EHRs, claims, genomic databases) is also necessary to support clinical operations. Today, such access can be difficult.12 Academic researchers, investigators, CROs, and sponsors need to share data efficiently with each other. We also heard of differences in patient data privacy rules across geographies, as well as a need for additional consent if patient data is to be used outside of the clinical trial at hand. Yet there is a lack of data standards and master data for data-sharing among multiple EDC systems, between EHR and EDC, and among stakeholders. Some biopharma companies deal with interoperability across their own studies by dictating data management rules to their vendors, specifying which data platforms vendors may use, and how they should deliver the data.

People are looking at platforms and are realizing that the way you run clinical trials will not be with a lot of small different systems held together with bubble gum and duct tape. You need a foundational infrastructure that will include broad capabilities to manage clinical, financial, and operational data, and have the future capabilities related to data science.—President, technology and analytics company

The challenge of interoperability and data-sharing is not insurmountable. For instance, some solutions sit on top of EDCs and are system-agnostic. Many interviewees believe it is possible for the industry to design data systems that can enable real-time secure data-sharing and analytics across stakeholders in the clinical development value chain: trial sites, clinicians who provide services (remotely or onsite), CROs, and pharma clinical teams.13

Stakeholder implications

Companies can begin taking steps to address some of the data-related issues.

Biopharma:

- Begin developing data infrastructure and data governance for internal data assets to enable the analysis of internal data across studies

- Ensure that patient consent allows the use of data for secondary analysis

- Participate in public-private partnerships or industry consortia to help define data standards and data-sharing agreements

CROs:

- Look beyond building dashboards for site identification and monitoring. Focus on building integrated, system-agnostic digital platforms that can capture, integrate, and analyze data across the clinical trial process

Regulatory considerations

The FDA’s significant advances in regulatory science can enable companies to incorporate new endpoints, tools, and sources of data in drug development. Legislation passed as part of the 2016 21st Century Cures Act enables the agency to establish a review pathway for biomarkers and other development tools that could shorten drug development time. Existing guidance already provides a solid foundation for companies interested in exploring digital technologies in clinical development. Indeed, interviewed companies running pilots with digital technology have found that regulatory agencies are open to novel solutions, and that early dialogue with regulators can inform the best course of action to validate and incorporate new tools and endpoints in clinical trials.

Some point out that the use of digital technology is a continued evolution of drug development science and that existing regulatory and scientific frameworks apply. As the president of a technology and analytics company explained:

“Endpoints we are approving on drugs today did not exist 30 years ago. Our industry is so well-equipped to look for more specific indicators of efficacy. If we only stop worrying about whether the data is coming from a sensor and start treating it in the same way you might use a new genetic biomarker, then you might realize you have all the tools you need.”

Technology validation

All interviewees agree that questions about the safety, performance, and reliability of new technologies need to be addressed before these technologies are used in clinical development. For this reason, most interviewed companies prefer to use technologies and devices considered to be clinical grade. Others pursue independent validation to help ensure that new technologies offer sufficient reliability to collect digital endpoints. Organizations new to digital technologies as well as technology companies from outside the industry may benefit from the collective experience and educational resources assembled by industry consortia.14

We have observed that technology vendors themselves have vastly different levels of familiarity with regulatory and compliance requirements. Some have a sophisticated understanding of specific validation and data security requirements. Others, typically outside the biopharma industry, admit that they do not fully grasp the regulatory process. The FDA is piloting an initiative aimed to expedite the regulatory review of medical software developed by technology companies with demonstrated commitment to organizational excellence and culture of quality (see the sidebar“FDA pilots pre-certification program to regulate software as a medical device”).

FDA pilots pre-certification program to regulate software as a medical device

The FDA has recognized the need for a new regulatory paradigm to evaluate rapidly advancing technology and provide clearance for clinical use. As part of its Digital Health Innovation plan, the agency is piloting a novel risk-based approach to regulating medical software (software as a medical device, SaMD). A key component of the new regulatory framework is the FDA Pre-Certification Program, which would enable organizations that can demonstrate a commitment to a culture of quality and organizational excellence (CQOE) to go through an expedited and predictable approval process. Organizational excellence could be measured through a standard set of yet-to-be-determined key performance indicators (KPIs) and measures, quantified through an overall aggregate CQOE score and displayed through an organizational excellence scorecard. This framework links excellence outcomes to specific measures that help FDA understand an organization’s level of commitment to patient safety, clinical responsibility, product quality, cybersecurity consciousness, and a proactive culture. The FDA seeks to raise the bar for quality and use the pre-cert program as a way to assess the likelihood of a company’s ability to create SaMD products that meet the FDA’s standards for excellence.

The program would enable lower-risk digital health products to go to market with little or no regulatory scrutiny and focus limited resources on higher-risk product reviews. Companies that receive pre-certification status will be required to demonstrate consistent and reliably high-quality software design and validation and ongoing maintenance of their software products.15 The FDA has selected nine companies to participate in the pre-cert pilot program, including technology companies such as Apple Inc., FitBit, and Verily, as well as some life sciences companies.16 One of the key goals of the pilot program is to collect information from pilot participants and test organizational excellence KPIs and measures. The inputs from pilot program participants and from the broader SaMD ecosystem stakeholders should inform the FDA’s decisions regarding KPIs, measures, and thresholds for evaluating each organization’s culture of quality and organizational excellence.

Capturing the patient’s voice

The industry is still struggling to define the science of patient input: capturing the patient’s voice using rigorous and scientifically sound methodology. Right now, it is experimenting with how to best capture and integrate patient input throughout the clinical development process. Unlike patient-reported outcomes collected in a structured way as part of a study protocol, patient experience can come in unstructured form, and trial staff may not record it in a consistent fashion. For instance, a patient may find the experience of using a study product a big improvement over the standard of care. Today, there is no systematic way to capture such information and incorporate it into decision-making in a scientifically sound manner.

At the same time, the industry is awaiting guidance from the FDA, as required by 21st Century Cures, on how patient experience data should be collected and used in drug application review.17 Public-private partnerships can spur progress in defining the science of patient input, how digital tools can help, and how that information will be used in regulatory decision-making. For example, the FDA announced the establishment of a Patient Engagement Collaborative, a public-private partnership with the Clinical Trials Transformation Initiative, which aims to provide a forum to discuss how to achieve more meaningful patient engagement in medical product development and other regulatory issues.18

Stakeholder implications

Several recommendations on how companies may navigate some of these challenges arise from our research. Biopharma:

- Enter into a dialogue with the regulatory agency as early as possible and discuss how the data will be validated and how mobile devices and digital endpoints can be used to best support study objectives

- Share data with the agency (from early-phase trials, observational data, or precompetitive collaborative studies) to get inputs before incorporating new technology into drug development programs

CROs:

- Play a role in exploring and vetting technology vendors entering the space, qualifying them quickly, providing them with the requisite clinical operations and compliance support so that they can design technology to be operationalized for the correct use cases

- Be the clearinghouse for validated technologies and vendors

Internal organizational and cultural barriers

Risk-averse culture

In our interviews, rarely did we hear of a lack of C-suite support or acceptance; rather, resistance seems to be driven by the culture, and tends to come from within product development teams themselves.

Innovation is often siloed and isolated from the bigger organization, and piloted innovations tend to remain the purview of innovation groups and may not be representative of programs in the development portfolio. Besides, there is no clear pathway for scaling innovation to the larger organization. We also heard that at some organizations, innovation budgets are not used for implementation beyond pilots, making it harder to convince clinical development groups to fund the adoption of technology they perceive as unproven. A senior vice president of business development and commercial strategy at a clinical data services company describes such a scenario:

“What was initially identified as a great opportunity—good technology, with ROI, can save money, reduce dirty data—when it got rolled out, there was a lot of resistance: ‘I know we used it in your group, but my study is different. It’s a large phase 3 study and it’s too risky.’”

Disciplined change management can help overcome many organizational and cultural barriers. Education about the new technologies and processes and showcasing how they impact outcomes and day-to-day activities could be part of the change management initiatives. A chief product officer at a clinical technology company offers a word of advice:

“We need to make people more comfortable that technology will make the trial process easier, more effective, and engage patients better, and not ruin the way they are conducting trials, which has been their daily work over the last 30 years.”

In addition, interviewed experts suggest that organizations:

- Gain and/or maintain leadership support in therapeutic areas and clinical operations; find a champion from clinical operations or therapeutic area for each pilot

- Align digital/innovation team objectives with key therapeutic areas’ development portfolio

- Enable and create incentives for close collaboration or cross-pollination between innovation and clinical teams. Embed innovation people in clinical teams or vice versa

- Allow innovation groups to use their budgets for subsidizing clinical operations activities when new technologies are used

Lack of a systematic approach to measuring success

Lack of success metrics may be a barrier to broader organizational adoption. While the industry is running pilots, few companies have begun systematically assessing and communicating financial ROI from them.

Currently, the value of many pilot programs is measured by their impact and benefit. Time savings are the biggest indicator of ROI. Improved data quality and more powered studies—through additional data points, more accurate data collection, or decreases in protocol deviations and amendments—are an important consideration for many trials, especially if this can help demonstrate the differentiated value of a product to a payer.

Innovation champions should develop tangible ways to measure and broadly communicate the relative impact of technology to aid decisions about scaling up. For example, applicability across the portfolio might be one criterion. A measured approach can help prioritize and determine which technologies should be considered for pilot and scale-up.

The approaching period of digital due diligence

Interviewees hypothesized that the next five years will be a period of digital due diligence—a thoughtful and intensive evaluation of digital technologies with intent to incorporate them into routine clinical operations. This may involve:- A systematic approach to undertaking an increasing number of digital pilots with a more diverse set of digital technologies than today, including pilots in pivotal phase 3 studies

- Clearly defined success metrics to gauge the ROI on digital technologies, such as the ability to accelerate time to market and reduce costs, collect data to support value-based reimbursement, improve investigator and patient experience, and ease integration into existing processes and infrastructure

- Strategic selection of technologies most useful and capable of being brought to scale, based on therapeutic area focus, development portfolios, and success of pilots

Talent shortage

Developing in-house analytics and technology expertise is an enormous human resource challenge. Such talent is often in short supply, and biopharma companies have to compete not only with one another but also with the technology sector and other industries. There is also a perception that the life sciences industry does not have the cachet of the tech sector to attract this talent. Efforts to elevate digital and analytics roles to the C-suite may begin to change the industry’s image.

The industry can also gain access to interdisciplinary analytics expertise through partnerships with technology and analytics companies as well as academia.

We excel at scientific innovation first, this is our core. Execution or optimizing hasn’t been a predictor of success or a focus in our managerial intentions, but that’s changing, although it won’t change overnight by sheer willpower.—Global head, pharma portfolio management, large biopharma company

Path forward

Adopting a digital mind-set is a new business imperative. Clinical development is not just a scientific undertaking. A comprehensive digital R&D strategy can be critical to enable companies to move and process large amounts of data effectively, to make data-driven scientific and business decisions quickly and accurately, and to generate evidence in support of future product value propositions. This will require new capabilities, new skill sets, and new partnerships.

Appendix: Detailed research methodology

We set out to answer several questions about the state of digital in clinical development.

- Where does the industry see value and opportunities for digital in the clinical development process?

- Which technologies, pilots, and use cases are seen as promising and which ones are ready for upscaling?

- What are the reasons behind the relatively slow pace of adoption of digital technologies in clinical development?

- What strategies can be used to overcome barriers and accelerate adoption and implementation of digital in clinical trials?

In July–October 2017, we interviewed 43 individuals involved in the clinical research process representing various stakeholders across the industry, as detailed in table 1.

* An umbrella study evaluates multiple therapies for a single disease. A platform trial is a more complex design to study multiple therapies for a single disease, but these therapies are allowed to enter or leave the platform based on a decision algorithm. For more information, refer to Janet Woodcock and Lisa M. LaVange, “Master protocols to study multiple therapies, multiple diseases, or both,” The New England Journal of Medicine.