Power struggle: Customers, companies, and the Internet of Things has been saved

Power struggle: Customers, companies, and the Internet of Things Deloitte Review Issue 17

28 July 2015

The data flowing through the Internet of Things can change the relationships between customers and companies, sometimes benefiting both parties. But sometimes customers, companies, or both can find themselves either failing to benefit from or potentially disadvantaged by various IoT-enabled deployments, compromising the sustainability of a given strategy.

Subscribe to receive IoT insights

Explore the Internet of Things collection

As the Internet of Things (IoT) permeates people’s daily lives, potentially useful information can now be created every time someone adjusts a thermostat or turns an ignition key or pedals a home-gym exercise bike. These data have the potential to change dramatically the relationships between customers and companies.  Sometimes the benefits to both parties will be immediate and obvious: Companies will better anticipate customer needs and serve them effectively, and customers will get better products and services at a lower total cost.

Sometimes the benefits to both parties will be immediate and obvious: Companies will better anticipate customer needs and serve them effectively, and customers will get better products and services at a lower total cost.

But sometimes customers, companies, or both can find themselves either failing to benefit from or potentially disadvantaged by various IoT deployments. By understanding the forces that distort the benefits of these new technologies, it will be possible to resist them and instead shape how these technologies are used in more mutually beneficial ways.

Deloitte Review, issue 17

See the full issue

Join the conversation

#DeloitteReview

These concerns are not born of dystopian fear-mongering. New technologies routinely inspire new business models that leave one side or the other at a disadvantage. Consider Craigslist, whose revenues represent a tiny fraction of those lost by the newspapers it disrupted.1 Similarly, new technologies can become endemic and unavoidable, leaving customers with no viable option save to adopt them, whatever their misgivings might be; the most obvious examples are credit cards and search, which generate much of the consumer data driving online advertising.2 Very often, customers lack full knowledge of what data they are providing, to whom, and why, yet feel they have no choice but to participate in the market for information on their personal behavior—information that is accessible to anyone but them.3 Consequently, although customer behavior suggests a willing acceptance of a fair bargain—the free use of social media or search services in exchange for giving up personal data—the underlying model potentially violates norms of fairness, portending a possible backlash.4

The information value loop

The suite of technologies that enables the IoT promises to turn almost any object into a source of information about that object. This creates both a new way to differentiate products and services and a new source of value that can be managed in its own right.

Creating value in the form of products and services gave rise to the notion of a “value chain”—the series and sequence of activities by which an organization transforms inputs into outputs. Similarly, realizing the IoT’s full potential motivates a framework that captures the series and sequence of activities by which organizations create value from information: the Information Value Loop.

Note first that the value loop is a loop: An action—the state or behavior of things in the real world—gives rise to information, which then gets manipulated in order to inform future action. For information to complete the loop and create value, it passes through the stages of the loop, each stage enabled by specific technologies. An act is monitored by a sensor, which creates information. That information passes through a network so that it can be communicated, and standards—technical, legal, regulatory, or social—allow that information to be aggregated across time and space. Augmented intelligence is a generic term meant to capture all manner of analytical support, which collectively is used to analyze information. The loop is completed via augmented behavior technologies that either enable automated autonomous action or shape human decisions in a manner that leads to improved action.

The amount of value created by information passing through the loop is a function of the value drivers identified in the middle. Falling into three generic categories—magnitude, risk, and time—the specific drivers listed are not exhaustive but only illustrative. Different applications will benefit from an emphasis on different drivers. (See “The more things change” in this issue for a description of the value drivers.)

IoT applications similarly risk tipping too far in either direction. An ill-considered push for competitive advantage could well overreach and drive away skittish customers. Alternatively, building too dominant an advantage may leave customers feeling exploited or coerced, a position unlikely to prove viable in the long term. If we understand the forces that can distort IoT deployments in undesirable ways, we will be better able to actively manage how technologies are used and shape new business models to create a sustainable, mutually agreeable exchange of value between companies and their customers.

An (im)balance of power: The dynamics of value capture

By leveraging the IoT, advanced analytics allow companies to aggregate, store, and analyze data in real time, creating a competitive advantage over companies that are less information-driven. The Information Value Loop captures how information generated by IoT technologies can be used to create value (see inset “The Information Value Loop”).

Many applications of IoT technologies have little direct impact on how value is allocated between companies and customers. For example, increased efficiencies within a value chain or smoother, more flexible, and responsive flow in a supply chain might reduce costs for a company or better differentiate its products. In such cases, the company captures effectively all the value because it controls the entire loop. (See “Forging links into loops” in this issue.)

Some applications, however, make customers the linchpin of their value loops; the “thing” about which companies want more information is the customer. The act that is sensed—creating the information on which subsequent stages of the value loop function—is customer behavior, and it is customer behavior that companies hope to influence by completing the value loop.

A value loop is sustainable when both parties capture sufficient value, in ways that respect important non-financial sensibilities. For example, retailer-specific and independent shopping apps can use past browsing and purchasing history—along with other behaviors—to suggest targeted products to particular customers, rather than showing everyone the same generic products, as on a store shelf.5 Customers get what they want, and companies sell more.

On the other hand, many consumers are sensitive to what they may perceive as manipulative use of the data they generate—or even to reminders that a faceless corporation controls those data—and may be leery of overly precise targeting. Companies that use consumer information to capture value at the customer’s expense can tip the balance too far in their own favor and undermine a given value loop. For example, when a leading online retailer enacted a dynamic pricing strategy based on customers’ previous spending behavior and implied price thresholds, customers balked.6 Similarly, a social media website faced criticism for its experimentation on users’ feeds to explore how social-media posts affected moods or voting behavior.7 Such instances, along with several well-publicized data breaches, have given rise to movements such as MIT professor Alex “Sandy” Pentland’s New Deal on Data, a set of principles predicated on the notion that customers are entitled to more control over the data companies are gathering.8

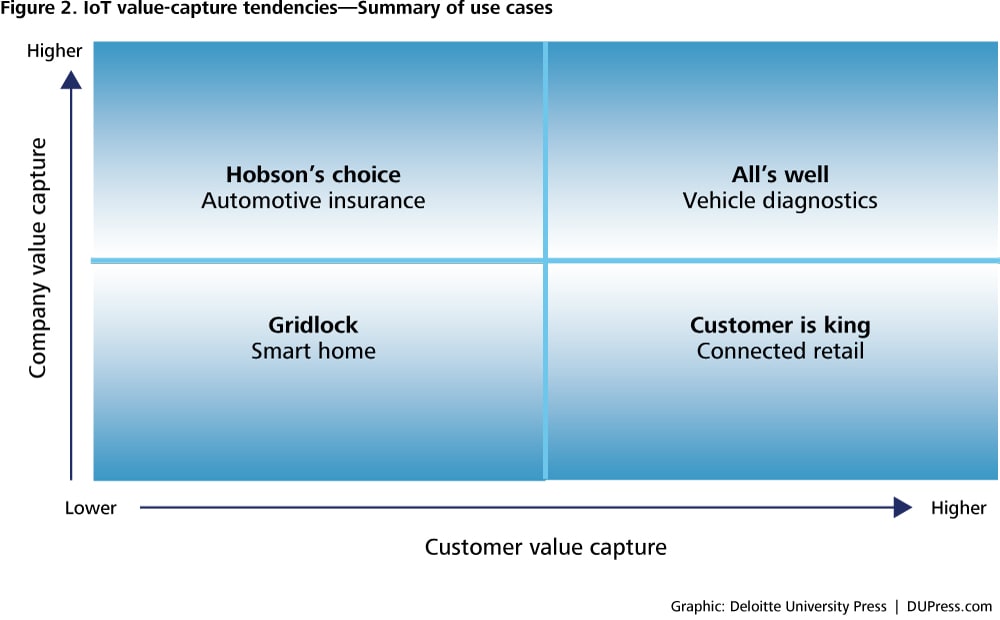

There are four possible outcomes to the value-capture question:

All’s well: Sufficient value is created, and that value is shared between customers and companies sufficiently equitably such that both parties are better off and feel fairly treated.

Hobson’s choice: A Hobson’s choice exists when you’re free to decide but only one option exists; thus, it is really no choice at all. A famous example is that of the Model T, for which Henry Ford stated, “Any customer can have a car painted any color that he wants so long as it is black.”9 Even when customers come out ahead compared with their former options, their implied powerlessness can lead to feelings of unfairness.

Gridlock: In their quest for value capture, both sides are pulled in opposite directions, with neither able to move toward an optimal outcome. Here, both parties recognize IoT enablement as something that should lead to success, but neither party is able to reach it, since their competing interests or different value drivers are working at cross purposes.

Customer is king: Although particular IoT deployments might make economic sense for companies, customers end up capturing a disproportionate share of the new value created, pulling this outcome more in the customers’ favor; Craigslist is an obvious example.

The first of these is the most sustainable; the other quadrants exert a sort of gravitational pull on IoT deployments due to the nature of the bottleneck in the relevant value loop. Whoever controls the bottleneck is typically best positioned to capture a disproportionate share of the value created. How the stakeholder who controls the bottleneck treats this strategic high ground strongly influences the eventual outcome. (A bottleneck occurs at that stage in the value loop where the flow of information, as measured by the pertinent value driver, is at a minimum.10)

Through the examination of four case studies, we will see how and why the value loop’s underlying structure pulls a given IoT deployment in a particular direction. More importantly, we will also examine how leading companies are effectively overcoming these underlying tendencies and shaping their approaches to IoT deployments in ways that more closely resemble an ideal state of mutual value creation and capture.

All’s well: Vehicle diagnostics

The automotive sector adopted connected services early on, embedding GPS capabilities in many cars by the mid-1990s.11 Since then, the number of sensors per car and the range of actions they monitor have dramatically increased and are projected to soon reach 200 sensors per car.12 Vehicles are already able to connect to other systems,13 and software providers such as Blackberry’s QNX and Elektrobit provide user interfaces and syncing for the connected car.14 Sixty million cars—more than half of those on US roads—are expected to be Internet-linked by 2020, capable of communicating with other vehicles and infrastructure.15

Consider the impact of this new capability on maintenance. Customers often have little understanding of which repairs are necessary, feel inconvenienced by having to go without their car during maintenance periods, and are frustrated by potential overcharges.16 In response, automakers are embedding sensors that can run a wide range of reliable diagnostics, allowing a car to “self-identify” service issues, rather than relying on customers (“Where’s that squeaking coming from?”) or mechanics (“You might want to replace those brake pads, since I’ve already got the wheels off”). This creates a level of objectivity of obvious customer value and enables automakers to differentiate their products. Interactive features that work with customers’ information can further add value by, for example, potentially syncing with an owner’s calendar to schedule a dealership appointment at a convenient time and reserving a loaner vehicle for the customer, pre-programmed with his preferences to minimize the frustration of driving an unfamiliar car.17

In this scenario, both parties collaborate to provide and act on data, in a mutual exchange of value. The customer captures value in multiple ways: He enjoys increased convenience and decreased frustration, improved vehicle performance and longer operating life, reduced maintenance charges, and—since almost everything about this interaction is automated—fewer occasions for perceived exploitation at the hands of unscrupulous service providers.

Value capture extends to companies in the form of ongoing customer interaction. Linking maintenance programming to the dealership encourages customers to return for tune-ups rather than go elsewhere, ideally leading to continued purchases in the long term. OEMs can also access data regarding vehicle maintenance issues and may be able to identify systematic malfunctions worthy of greater attention. Dealers also have an opportunity to make inroads into an untapped market: Currently, just 30 percent of drivers use the dealer for routine maintenance, while 70 percent use an independent mechanic, even while still under warranty.18

There are always bottlenecks, however, and how each stakeholder responds to them says much about this model’s sustainability and opportunities for future value creation. For example, customers must act on the information they receive: No matter how helpful the IoT can be in proactively recognizing problems, booking appointments, and easing the process, the driver still has to honor the appointment—inconvenient even with scheduling assistance. Additionally, challenges go beyond inconvenience or preference for private mechanics: To save money, 40 percent of drivers skip routine maintenance.19 To alleviate this bottleneck and complete the value loop, automakers might consider offering additional incentives—loyalty programs or add-ons, such as a discounted oil change or an additional month of connected services, may enhance customer responsiveness.

Hobson’s choice: Automotive insurance

Auto insurers typically rely on proxy indicators such as credit scores and demographic data to assess risk profiles—and thus rates—when underwriting coverage.20 Companies use this information to differentiate between chance and behavioral risk and adjust pricing on the latter.21 Ideally, insurance premiums would reflect the cost all drivers must bear as a result of “bad luck” (chance risk) and the behavioral risk arising from behaviors under their control. However, the line between the two can sometimes be imperfect, and what seems like chance can actually be a behavioral issue, such as a tire blowout that appears to be terrible luck but may in fact be due to the driver’s failure to keep his tires properly inflated and rotated regularly.22 Imperfections in estimates of both types of risk, and imperfections in differentiating between the two, mean that risk pools include drivers with different risk profiles. Invariably, lower-risk drivers end up subsidizing higher-risk drivers.

The IoT can create value for insurers via usage-based insurance (UBI), in which behavior—driving frequency, tendency to speed, short stops—is monitored via telematics. This creates more accurate data and ideally leads to more precise behavior-based pricing for customers. Data gathering can be accomplished through manufacturer-installed sensors, insurer-provided equipment, and mobile apps.23

However, customers remain understandably reluctant to participate in a program that exposes their driving behaviors to insurers. Forty-seven percent of the driving population opposes UBI under any circumstances, with one in four interested only if provided incentives24—although this may change as younger adults, more accepting of UBI, grow to comprise a larger percentage of drivers.25

To develop personalized insurance products, insurers require data in sufficient scope (for example, when and how much a person drives, where and at what speeds, and so on) and at sufficient scale (that is, on sufficient numbers of customers) to make personalized insurance actuarially sound and economically viable. Low customer adoption threatens both of these value drivers (scale and scope). Customers are therefore the bottleneck at the Create stage of the loop.

The underlying pull in this scenario, however, is toward the adoption of something customers might otherwise resist. Drivers must buy insurance, and insurers value a better assessment of customer-specific risk. Currently, insurers offer discounts to incent customers to participate in UBI. Some insurers might not compel customers to provide personal driving data, but they would then be in a position—and perhaps economically compelled—to charge higher premiums than for drivers willing to turn over data, even as they are beginning to charge riskier drivers more based on the data they already possess. When the bottleneck is the customer but the solution lies with the company, customers face Hobson’s choice.

Some carriers are deploying UBI in ways that seem designed to redress this possible imbalance and sidestep backlash, including value-added features such as real-time traffic alerts, facilitation of roadside assistance, location of stolen vehicles, and geo-fencing.26

A second option that might encourage participation—and break through the Create bottleneck—may be for UBI carriers to proactively offer personally relevant, behavior-based safety advice to those whose data they collect. This helps drivers to correct risky behaviors, increases their satisfaction, and, by reducing customer accidents, increases the actual value created in the form of shrinking risk pools.27 Indeed, some insurers are already taking this step. Another option is for insurers to make more transparent the data they collect on each driver, so customers can see how they were rated and why. Gamification may also increase engagement and motivate participation, if only to compete and improve against other drivers.

Thirty-six percent of all auto insurers are projected to use UBI by 2020.28 As UBI evolves and insurers are better able to predict and price risk, the process will continue to evolve. Indeed, in March 2015 Progressive announced a change in its approach to its UBI program, Snapshot, imposing a surcharge on riskier drivers. Currently effective only in Missouri, it is expected to roll out to other states in the future. Through the program, customers who display riskier behavior will receive a surcharge when renewing their policies. Through this new approach, all drivers receive a discount at Snapshot sign-up, and those who prove to be the riskiest drivers will be charged higher rates to offset those concessions. Progressive estimates 8 of 10 will receive discounts while the rest will receive no discount or a surcharge.29

As UBI evolves, there is a danger that customers—aware of the power balance shifting—will feel exploited. Resisting this pull toward an insurer-weighted value-capture model is potentially an important part of realizing UBI’s full potential. For companies, it is important to remember not to let the balance of value capture tip too far, even when the customer has no other choice.

Gridlock: Smart home

By the end of 2015, 13 percent of US homes are predicted to have smart energy-management systems installed, while 20 percent are expected to have connected security systems.30 Ideally, smart homes adjust via communication between connected devices without the homeowner’s intervention, according to customer behavior, preferences, and schedules, indeed, extending enterprise building automation to the residential space.31

As is sometimes the case with developing technology, the reality does not yet match the potential. A lack of standards means that not all devices can connect to the same hub, necessitating multiple apps to individually manage heating, lights, and so on. Consequently, customers are more likely to install only one or two smart home technologies, which in turn undermines the economics of installing any at all.

Smart home technologies extend beyond connected thermostats and lightbulbs to platforms that connect entire home ecosystems. These tools integrate some or all of lighting, smart meters, sound systems, and alarm systems, enabling customers to manage all connected devices through one interface, treating their home as a single entity. Sensors in homeowners’ mobile devices can also alert connected devices within the home to the owner’s location. If the owner is far away, for example, the air-conditioning system can be triggered to shut off; if the thermostat registers an empty home, the lighting can be programmed to dim.32

As is sometimes the case with developing technology, the reality does not yet match the potential. A lack of standards means that not all devices can connect to the same hub, necessitating multiple apps to individually manage heating, lights, and so on. Consequently, customers are more likely to install only one or two smart home technologies, which in turn undermines the economics of installing any at all: No single device is enough to create true “home automation” convenience or cost savings. Without a platform and the ability to control all their utilities, homeowners cannot create data of sufficient scope to enable the system to analyze and act in ways that generate sufficient value for them.

In contrast, economies of scale drive providers of home-automation technology, toward developing and marketing point solutions: just lights, just a thermostat, and so on. The unfortunate result is that customers and companies see potential value in smart homes, but each party prioritizes different value drivers. Customers and companies are pulled in opposite directions, and neither can move easily in the direction of value capture—a metaphorical gridlock in this particular value loop.

Several smart home device makers are working to address this gridlock through programs such as the AllSeen Alliance and the Open Interconnect Consortium (OIC), which foster interoperability and create standards for smart home devices.33 Founded in 2013, the AllSeen Alliance uses AllJoyn, an open source software, as its preferred software; members self-certify compatibility with other AllSeen Alliance products. Fifty-three companies have joined the Alliance, including Sony, Cisco, Qualcomm Connected Experiences, and Microsoft.34 Likewise, in July 2014, Intel, Dell, and Samsung announced the OIC, whose goal is to develop standards and connectivity requirements for all IoT systems.35 Insteon and Nest (through its Works with Nest program) have also opened up their APIs to enable interoperability with other makers.

In addition, to offset the cost to customers of installing devices and thereby achieving the necessary scope, some providers offer rebates, which can be effective: Consumer interest in smart technologies climbs to 48 percent if a 43 percent rebate is offered on the purchase price of a $175 smart device.36

Another option, however, may be retrofitting—offering devices that turn traditional gadgets into connected ones, creating an easy-to-use, all-home solution out of what the homeowner already has. In this way, companies can sidestep a considerable hurdle: customers’ reluctance to replace traditional appliances that may already work perfectly well or their tendency to wait out the long appliance life cycle to purchase a connected replacement (a typical security system can last 20 years; thermostats can last up to 35).37 Companies have already begun to offer relatively cost-effective all-home retrofit solutions, which also carry the benefit of being less difficult to install. Sense Mother, for example, offers a starter kit including a hub and four “motion cookies” that homeowners can program to serve any function and affix to anything, including lights, entertainment devices, appliances, or walls (to monitor temperature). All sensors are tracked and can be programmed to work together. Customers can also reprogram cookies to serve other functions when a previous use—say, monitoring a baby—is no longer necessary. This negates the need for multiple costly devices, since homeowners can simply purchase additional cookie packs or reuse old ones when needed.38

It is very likely worth rising to the challenges associated with breaking this gridlock. Just 2 percent of consumers have smart home automation systems for controlling multiple functions, but 21 percent could see (themselves) owning one.39 Retrofit devices may increase interest still further. It will require material effort to align customers’ and companies’ value drivers, but in so doing, all stakeholders have the potential to capture value.

Customer is king: Responsive retail

Retailers appear to recognize IoT as a viable way to reach customers. US retailer spending specifically on IoT-enabled in-store offers is expected to grow 23 percent between 2014 and 2018, reaching $223 million. Retailers are projected to invest $466 million annually in the technology by 2017.40 IoT-enabled shopping scenarios suggest ways to leverage information flowing in real time via sensors, along with customer data generated on previous occasions—to push out personally relevant products and information. IoT can also help companies manage inventory and steer customers to where products are in stock.41

Responsive versus predictive: An analysis

In the retail scenario, the customer receives information only for items in which she has already displayed an active interest. Since the information is pushed to the customer, she invests no extra time or effort beyond the same initial research and store trip she would have taken without the IoT, which serves here as an enhancement.

This particular approach—responsive analytics, that is, responding to the customer’s interests at the time they are demonstrated—may consider the customer’s perceptions more appropriately than predictive analytics.

Responsive analytics entails knowing what the customer needs on that particular occasion and providing relevant guidance based on previous and current behaviors—even if the customer herself is anonymous.

Predictive analytics, however, takes this conceit one step further by extrapolating other recommendations for which a customer has not yet exhibited an active interest, and may thus overstep: Customers know their data is being gathered and analyzed, but they do not want to feel too watched, and they may want to feel they have some say in the matter (“opting in”). Augmented intelligence should make the shopping process more tailored, not purport to know more about the customer than the customer herself does. At the very least, the perceived benefits from sharing data—such as increased savings or more personalized service—should outweigh the perceived loss of privacy and provide a benefit in exchange.42

In contrast to offerings in automotive insurance, vehicle diagnostics, and smart-home devices, IoT-enabled customer-centric retail programs may bring together information from products and information about the product, to (ideally) enhance the customer experience with the retailer and the product. To be sure, by providing customers with more personally relevant information, retailers endeavor to provide greater customer value, but the products are—in some cases—no different than before.

In the IoT age, information is a powerful value-creation tool: It offers customers the ability to make more informed decisions, and it offers companies the opportunity to differentiate themselves from competitors.

Consider an existing customer who shops in-store, online, and via a fitness retailer’s app. In downloading the app, she creates an account, enters required personal information, and uses the app occasionally to browse. She buys fitness gear through the app or retailer’s website but sometimes experiences price constraints, has second thoughts, or buys in-store. Based on her browsing and purchasing behavior on the app and website, in-store purchases, prior reaction to offers, and personal information provided during interactions, the fitness-apparel chain aggregates information that it can then use to tailor offers specifically for her. The retailer can also integrate other online behavior into a 360-degree view of the customer.43

When the customer visits the physical store, she is recognized via beacon technology, prompting a welcome message on her app via the homepage. The customer can click the “exclusive offer” tab and view personalized offers based on purchase and most-recently-browsed history.

After reviewing available offers and upcoming events, the customer visits the running department. A second beacon recognizes that she has entered that department and shares relevant information, including product ratings, popular items, and targeted offers. Information might include the department’s most popular purchases over the last week or discounts on sneakers the customer has browsed online or via the app. The retailer may also provide offers for complementary products within the running section.

Once the customer decides to purchase, she heads to the cashier, where a third beacon recognizes her and communicates with a CRM system to push offers to the point-of-sale system. If the customer accepts the offer, it is redeemed successfully. As the customer leaves, a final beacon recognizes her, and her app thanks her for shopping.44

Here, the customer benefits, from customized offers and, either through competitive shopping or price-matching guarantees, the best available price. The retailer benefits—it makes a sale, increases customer satisfaction, gathers more customer data for future shopping encounters, and converts a browser into a buyer—but sells its products based entirely on customer-provided data, upon which it is dependent to function as intended.

Customer bottlenecks occur with the timeliness value driver, during the act stage. Customers will not be compelled by any and every offer to act, particularly when they can easily compare prices and make decisions largely based on the best (lowest) offers they receive. Thus, time is of the essence: providing engaging experience and relevant offers as quickly and effectively as possible. Additionally, personalization—knowing what that customer wants and making relevant suggestions, offering loyalty points, and providing only personally relevant deals—may be the best differentiator for retailers to push through bottlenecks in the value loop, compel future purchases, and capture value of their own. At the same time, companies must be careful not to take relevance too far and risk alienating customers by implying an ominous omniscience.45

Retailer bottlenecks fall between the analyze and act stages. When a customer navigates a store in search of a product, information must be transmitted in real time (latency), often enough to detect changes (frequency), and acted upon immediately (timeliness) with individually relevant messaging (accuracy) while the opportunity for her to adapt her actions based on the information is highest. Sending an offer after the customer has left the store or abandoned her online shopping cart would be too late.

The road to balance

In the IoT age, information is a powerful value-creation tool: It offers customers the ability to make more informed decisions, and it offers companies the opportunity to differentiate themselves from competitors.

In any given deployment, however, underlying tendencies drive value allocation between companies and customers in ways that might undermine long-term sustainability. It can require a deep understanding of how information creates value and the drivers of value allocation to resist falling prey to dysfunctional tendencies.

One way to begin developing an economically sustainable and mutually beneficial result is to examine how a company is using IoT technologies using the Information Value Loop (See The more things change in this issue). Identifying where the bottlenecks lie, how each party is motivated to respond, and seeking to shape both incentives and the value loop itself puts companies more in control of their destinies.

Second, taking a hard look at who benefits most from each IoT-enabled transaction, understanding when a lopsided value-capture outcome tips too far and becomes unsustainable, and taking steps to correct it may also lead to long-term success.

Lastly, an honest assessment of where IoT investments may not have an appreciable benefit—or may decrease one’s potential for value capture—is just as crucial to a company’s IoT strategy as knowing the right places to invest.