COVID-19 return-to-the-workplace strategies Emerging lessons and key questions for financial services leaders

13 minute read

15 May 2020

Considerations FSI leaders now face as they map out when, how—and sometimes, if—operations may resume in workplaces around the world.

Key messages

View sections

Over the past two months, most people across the globe have shifted to working from home, reinventing themselves both personally and professionally. To no one’s surprise, it’s been an equally transformative experience for financial services institutions (FSIs). Now, another transformation is emerging: While the pandemic appears far from over, some regions are gradually beginning to re-open. Will the financial services industry follow suit? If so, when and how?

Learn more

Learn more about connecting for a resilient world

Read more about reopening the workplace

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

A mid-April Deloitte survey of 100 senior FSI executives with responsibility for crisis management and business continuity planning revealed that at least half of respondent firms are developing COVID-19 operational contingency plans spanning at least the next three months. Part of the complexity around re-opening has to do with the scale and scope of FSI real estate. From office towers to data centers to bank branches, the industry is also the second largest in terms of office space leasing, accounting for more than 15 percent of total office leasing activity.1

There have already been some announcements: Capital One recently disclosed that they will not have any broad return to work until at least September.2 Goldman Sachs has begun a gradual return to work through May in Hong Kong and a few other areas, but anticipates that a single strategy will not be appropriate for all of their global locations.3 Some firms are learning from their global operations and likely will apply lessons from areas that have already re-opened: The Canadian insurer Manulife increased its in-office employees in China from 25 percent to 75 percent within four weeks of reopening.4

This is consistent with what we’re hearing in conversations with firm leaders, who suggest that they believe this will likely play out over an extended period: One firm leader we spoke with said they hope to return 40 percent of their employees to the office by August 2021. Overall, the reality is that there isn’t any urgency to return to a physical space; many firms have adapted to the remote work environment and significant health, safety, and sanitation challenges remain. This is especially true in investment management, where many firm leaders have reported a smooth and successful transition to remote work and are assessing the risk-reward trade-offs of even a gradual return. Even as plans emerge, many leaders are still in the early stages of developing return-to-workplace strategies, and planning maturity levels vary. While some have created steering committees and sophisticated scenario-based plans, others are only starting to review basic decisions about how many spaces to open and how to open them.

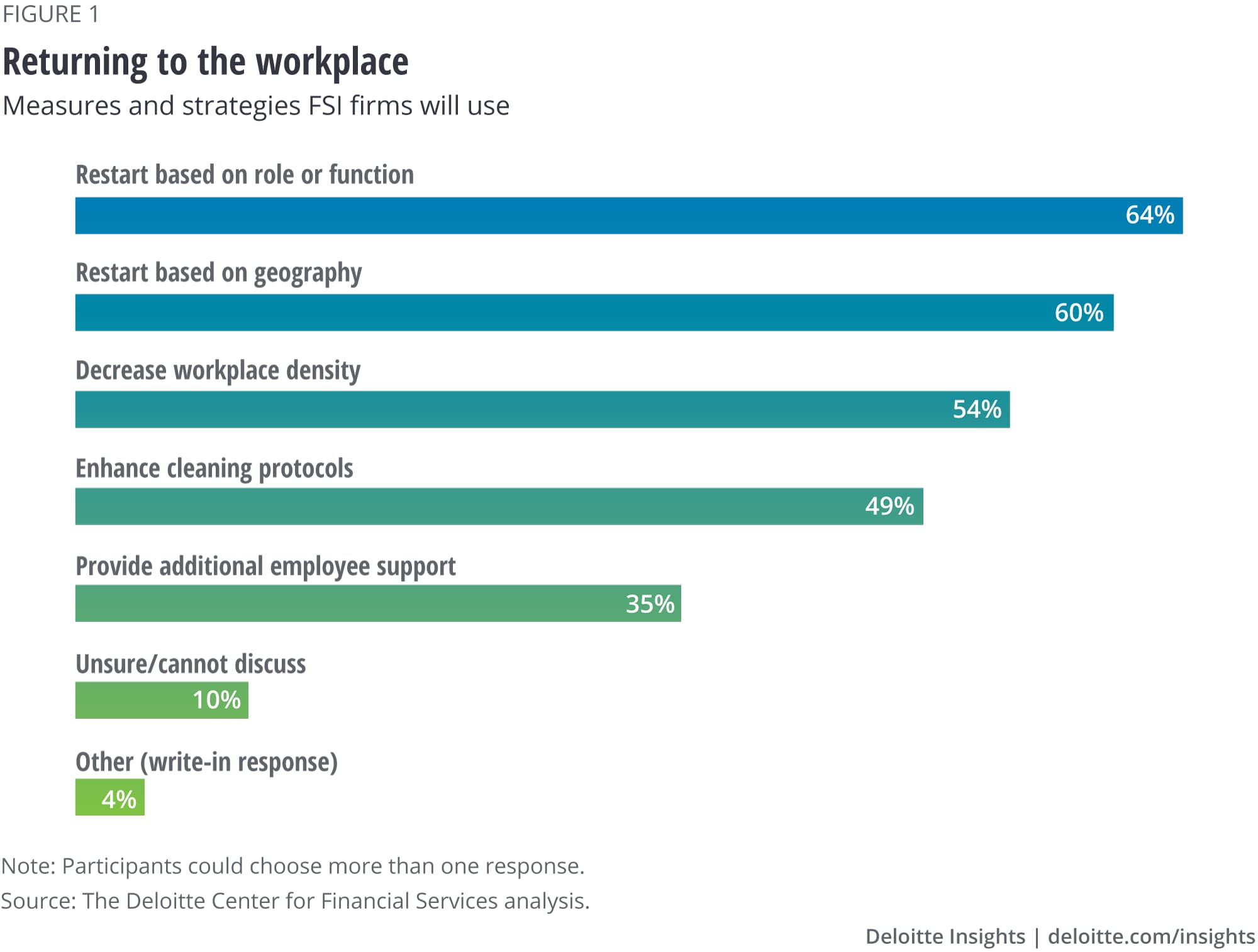

Our survey responses reveal that restart plans were likely to be role-specific or geography-specific, or a combination of the two (figure 1). Respondents also cited density reduction, sanitation, and employee support measures as key factors in their return-to-work strategies. Let’s look at these initiatives in turn.

Sections

Who needs to return? Who doesn’t?

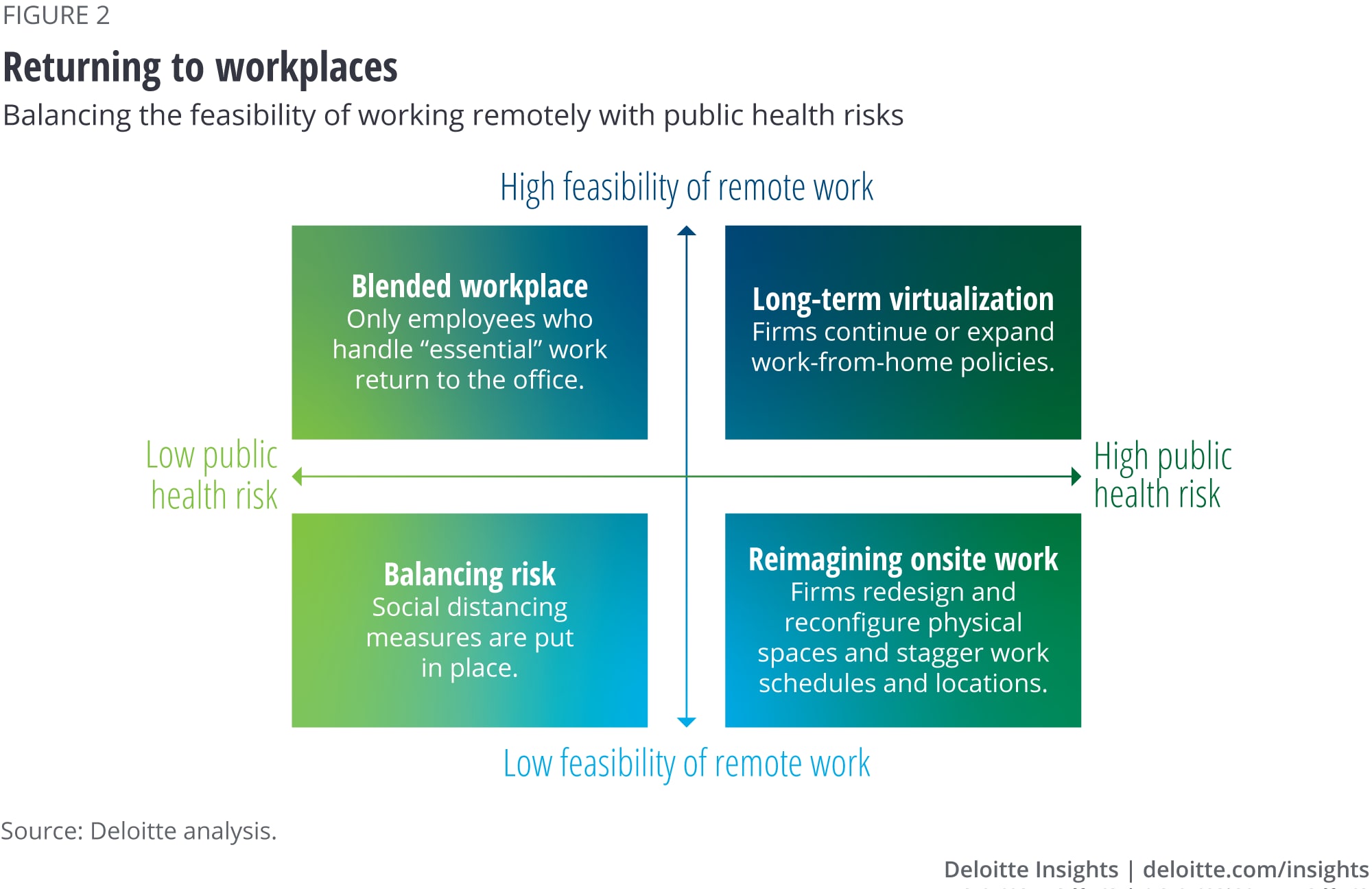

Leaders should consider several factors when deciding who needs to return to the workplace. To ensure an effective and successful re-entry, leaders can first create a centralized working group to oversee the entire situation that can coordinate with the leadership team and execute plans. Next, they could define critical business services and use a decision matrix to determine which jobs and roles would need to be located in workplaces versus those that could be done remotely. As the Goldman Sachs example suggests, re-entry is not expected to be a one-size-fits-all proposition. When assessing the range of approaches available, leaders can consider both roles and locations in terms of feasibility of remote work and the risk to public health (figure 2).

Any return-to-work analysis should consider the rapid acceleration of tech-enabled remote work. For example, while bank tellers may seem an obvious choice to be among the earliest to return to their workplaces, some banks are developing touchless interactive teller machines to enhance the drive-thru experience, reducing the need to have tellers onsite.5 Claims adjusters have made a similar adjustment. Historically, adjusters have needed to travel to assess damage as part of the settlement process, but new tools have been deployed that allow this to be done remotely.6 In contrast, while traders have mostly made the shift to home-based work, the lack of available turrets, along with potential compliance concerns, may require them to return to the trading floor as soon as feasible. Many other roles fall somewhere in between: Employees who serve in marketing roles, for example, can do most of their work remotely, although they may need to come into the office periodically to attend group meetings. For such roles, firms could consider select in-office days or staggered work hour options.

In the longer term, many companies are evaluating permanent remote work for some of their workforce. Based on conversations with industry leaders, some companies may consider remote working for 30 percent to 35 percent of their workforce on a more permanent basis. This may also result in companies exploring alternate talent models, such as gig workers or contract employees, increased opportunities to automate manual processes, and a re-evaluation of disaster recovery/back-up sites.

Sections

Are the workplaces ready?

From a business perspective, many employees understand why they may need to return to the office, but it is important that they feel ready, willing, and able to come in. Some may have responsibilities at home, such as child care or elder care. They may also have safety concerns, as consumers do.7 Some large banks and investment management firms have rolled out employee experience surveys to gauge comfort levels in returning to the workplace. Other firms are considering implementing “opt-in” programs for their workers who wish to return.

Firms, of course, also must comply with government health and safety mandates. In the United States, for example, the Occupational Health and Safety Administration (OSHA) guidelines include a wide range of hygiene, cleaning, sanitation, safety, and social distancing measures that companies must follow to minimize the risk of COVID-19 exposure in their workplaces.8 That said, the mission of making employees and customers feel safe enough to return to offices, banks, and other physical spaces falls squarely on management.9

Implementing social distancing measures

Social distancing measures include factors such as reviewing seat-sharing policies, preparing structured shared-seating programs, staggering work hours, and using large meeting rooms for smaller groups. To support social distancing, some firms are also deploying contact- and workspace-tracing apps.10

Extra planning will also be needed for office towers to ensure distancing measures are followed in elevators and lobbies so people can move throughout the building in an orderly and timely manner and avoid crowding. A large services firm recently conducted a simulation that showed it can take as much as two and a half hours to move people into and out of a fully occupied downtown office tower, revealing the need to stagger entry and exit times. Corporate real estate leaders will have to look at contracts for leased space to determine who would be responsible to implement these changes and will need to work collaboratively with landlords during the planning and implementation phases.

Regardless, most workplaces were not designed so that people could remain distant from one another. Due to pervasive space constraints, returning to previous models will present ongoing challenges. This is why some respondents said their companies are exploring ways to revamp onsite positions into ones that could be handled remotely.

Enhancing health and sanitation efforts

Companies may consider using smart building management capabilities, such as predictive maintenance solutions, air quality sensors, UV cleaning, infrared temperature cameras, and HEPA air filters for both owned and leased spaces. These can help bolster confidence among employees that they will be safe when they return to work: One of the key reasons the Chinese workforce was open to returning to the office quickly was the use of advanced and high-quality air filtration systems.11 Companies may also consider increasing the frequency of cleaning, especially of common areas and meeting places.

It’s also critical for firms to implement pandemic management protocols (PMP), which may include use of personal protective equipment for staff, procurement and use of masks and gloves, temperature screening, a dedicated quarantine room, and maintenance of appropriate social distancing measures for customers, employees, and third-party vendors. A few large institutions are conducting daily temperature checks for all in-office employees. Companies could also provide whole-health benefits and even onsite medical staff.

Sections

How will the employee and customer experience need to change?

With mass virtual work established, leaders will need to re-evaluate existing employee engagement practices as firms take a gradual approach to return to work. In light of growing concerns among employees about the safety of shared workspaces, one insurance company is redesigning its agile work environments within office buildings. Similarly, an investment management firm had adopted a more open workplace environment to encourage collaboration and creativity, which will now need to be dialed back. Many leaders are exploring how the emerging hybrid operating model—some workers in the office, and some remaining at home—will impact firm culture.

Respecting individual employee needs and preferences

Companies will likely have to reorient all levers of employee engagement: work protocols, orientation programs, well-being initiatives, teambuilding efforts, and rewards and recognition programs. For onboarding and training, many investment management firms use an apprentice-based model to train new associates, which will likely have to shift to more digital models. Firms should therefore also update employee handbooks to include new norms for both in-office and virtual work environments. One such initiative was undertaken at the Canadian insurer Manulife. The company ramped up the digital interaction skills of its 12,000 agents in China to increase client engagement and enable remote sales.12

FSIs are also reassessing technology protocols, processes, and the use of performance management tools. Many firms have had controls in place that restrict some activities, such as document printing to in-office locations. When their workers moved home, this slowed down performance of both administrative and client service tasks. As a result, some employees have been emailing operational reports and other documents to their personal accounts so they can print these documents at home. Firms will also need to re-implement control standards for trading operations across the board. While some traders move back to the office, others may be still at home, where they are now operating under a set of rules that were somewhat relaxed by regulators. These operating environments will need to be harmonized.

Client onboarding, too, will need to move away from certain practices, such as requiring signatures on paper documents. Another consideration is that collaborative work environments have made it possible to take quick action during a typical workday in the office. But since many schools are operating remotely and onsite summer and after-school programs are being cancelled or postponed, employees may have significant child care and other responsibilities at home. This will require leadership flexibility to manage changing productivity levels for workers remaining at home. Indeed, one leader in investment management suggested that child care is a challenge they haven’t cracked the code on yet.

Finally, given the wide-ranging changes in how physical space may be used, firms should deploy change management and communications cascades to help customers and employees feel safe returning to these spaces. Leaders will have to educate and guide customers about PMP and social distancing measures by posting signage about social distancing and handwashing in their retail locations.13

State Street’s return-to-work plan in China14

State Street had 90 percent of its employees working remotely during the COVID-19 spread. In its Hangzhou office in China, State Street prioritized health, safety, and well-being of employees while drafting its return-to-work plan. The company followed all required health, sanitation, and social distancing measures to make offices ready for employees to return. Employees were given a choice to return and were offered a handbook that outlined the protocols for in-office work and mobility. In the first wave, the team leaders returned to office. Thereafter, frequent and increased communication between team leaders and remote employees helped instill confidence among the staff; because of this, most employees chose to return to the office. State Street has also increased flexibility in roles, which has resulted in higher operational resilience. It plans to use its learnings from China and combine it with local factors and government guidelines to develop plans to re-enter offices in other countries. Overall, the company’s emphasis on gradual re-entry, office space readiness, and employee safety will be the guiding forces behind all re-entry decisions.

Redesigning spaces and practices for customer comfort

Many firms with retail footprints, such as bank branches and investor centers, have remained open, using drive-thru facilities to avoid contact. For example, 80 percent of Chase branches are open with reduced staff.15 In other parts of the industry, a few companies are evaluating real estate space requirements based on the number of employees who worked at each site. One insurance company CFO said they hope to convert offices with fewer than 10 people to remote models.

More PPE, such as plexiglass dividers, may need to be added: While tellers have long been separated from the banking floor, firms may want to adopt a similar approach for their higher net worth clients seeking investment advice. And while some banks had moved to a concierge-style approach, with customer service associates walking around branches with tablets in hand, this practice will have to be adjusted, at least for the foreseeable future. Banks could also consider reopening some branches with an appointment-only approach for customers who require in-person service.16

As these locations re-open, following the lead of major retailers may be considered. Leaders will need to assess how customer preferences are evolving in their re-entry plans, since consumer comfort with face-to-face contact will take time to rebound. A recent Deloitte global consumer sentiment tracker of retail shopping preferences revealed that only about one-third of US consumers feel safe going to stores.17 Firm leaders should factor in these concerns in their planning, evaluating how they may impact customer service in the short term and, ultimately, engendering and maintaining brand trust. One investment management leader felt that their firm’s brand and reputation in the long run will be influenced by how they manage both employee and customer experience during this time.

Sections

Remaining flexible and agile: How can leaders piece this together?

There is no one-size-fit-all solution to re-entering workplaces. Each company will have to make decisions based on its strategy, resources, and focus area. Leaders should consider detailed scenario planning, factor in all the above-mentioned variables, and conduct cost-benefit analyses. Using an algorithm and a data-backed approach may yield more accurate forecasts and enable more informed decision-making.

Even as firms re-enter, leaders should prepare for future scenarios such as another potential stay-at-home order in case the pandemic spread resurfaces or increases. Finally, firms may even have to make it an iterative process and show agility and flexibility to learn and adapt based on the experience in the initial weeks of re-entry.

Overall, the COVID-19 pandemic has hastened the future of work across industries. Financial services firm leaders are facing the future head-on right now. Leaders should strive to find a balance between revenue and cost, while remaining committed to their organizations’ purpose and ensuring that employee and customer well-being remain top priorities.

© 2021. See Terms of Use for more information.

More on COVID-19

-

The essence of resilient leadership: Business recovery from COVID-19 Article4 years ago

-

The heart of resilient leadership: Responding to COVID-19 Article5 years ago

-

COVID-19 and the investment management industry Article5 years ago

-

COVID-19 potential implications for the banking and capital markets sector Article5 years ago

-

Confronting the COVID-19 crisis Podcast4 years ago

-

Connecting for a resilient world From Deloitte.com