Supplying the future of mobility has been saved

Supplying the future of mobility Automotive suppliers in the evolving transportation ecosystem

17 October 2016

Can auto suppliers keep pace with the changes and challenges of the emerging transportation ecosystem? In the future of mobility, automakers are looking to suppliers to deal with everything from new lightweight materials and radical redesigns to innovative hardware and software.

Introduction

Explore

Visit the Future of Mobility collection

Watch a video of Ben's journey

Listen to the podcast

Subscribe to receive updates on Future of Mobility

Explore Deloitte Review, issue 20

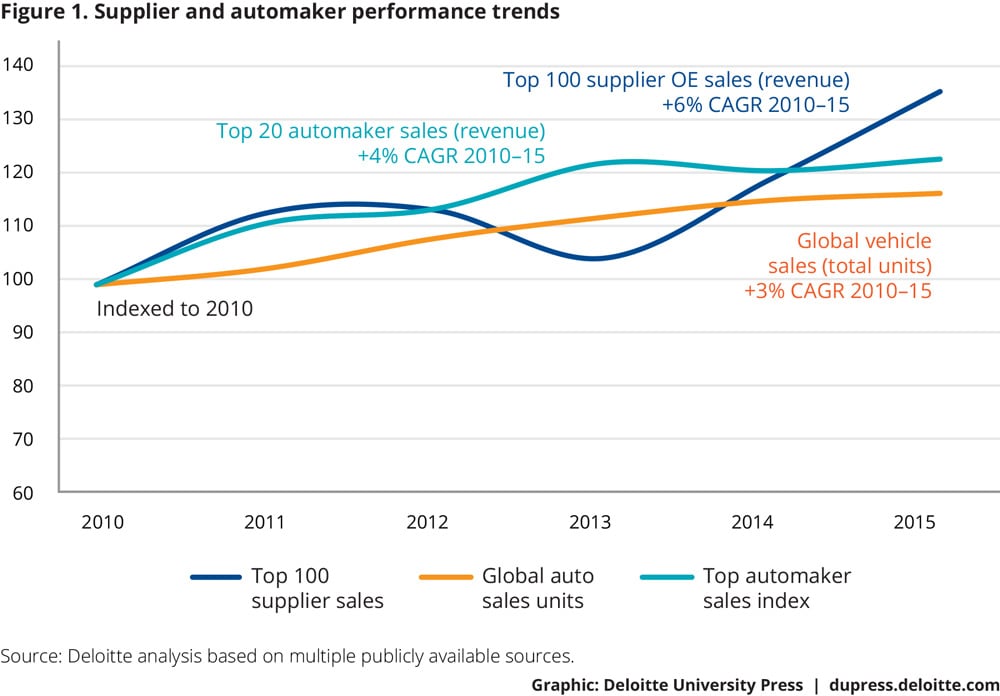

In navigating the past several years, auto suppliers have encountered any number of speed bumps and traffic delays. Leaders at original equipment (OE) suppliers have tackled automaker demands for productivity gains, stricter environmental and safety regulations, increasing liability for warranties and recalls, and the relocation of capacity as automakers have pushed into emerging markets. And somehow, through all the uncertainty and upheaval, suppliers have thrived: Since 2010, OE sales revenue growth has outpaced that of the top automakers (see figure 1).

Indeed, macroeconomic conditions have fostered healthy growth in the automobile industry overall, with US vehicle sales volume reaching record highs in 2015.1 But the extended global auto industry is facing what could be its most dramatic challenges in a century—driven by a convergence of technology, regulatory, and consumer trends—and suppliers seem right in the middle.

The fundamental transformation taking shape is grounded in a wide range of advances. New powertrain technologies promise reduced emissions and substantially simpler vehicles. Lightweight materials have reduced weight by as much as 700 pounds in certain vehicle models, without affecting performance and safety.2 The average new vehicle has computer systems that run on more than 100 million lines of software code,3 leading to cars that are increasingly sophisticated and connected. And shared mobility services and Level 4 autonomous vehicles have the potential to halve the cost of driving while reducing personal vehicle ownership and changing the mix of vehicles manufactured and sold.4

The future of mobility appears to have already begun presenting new challenges to suppliers across the industry. Cockpit and electronics suppliers are often compelled to match the intuitive interfaces found on today’s most popular consumer electronics and mobile devices. More and more, powertrain suppliers are expected to offer both advanced control systems and lower cost but longer-lasting components. And interior and exterior suppliers can struggle to create compelling and differentiating growth narratives for their investors. (See sidebar, “Perspectives on potentially disruptive trends.”5)

The magnitude of challenges that suppliers face is likely to increase. Portfolio economics may be challenged as value shifts toward software and systems that define the ride experience. New entrants have already started upending competition in the supply base and are likely to continue to do so. Selling parts, components, and systems may be insufficient to deliver desired returns to shareholders, necessitating that suppliers look to new offerings and adjacent markets. And in order to access the assets and capabilities to compete in the future, suppliers may have to collaborate across a web of relationships with participants different than those in today’s more linear supply chain.

The emergence of a new mobility ecosystem offers suppliers new choices for where to play and how to win. This article proposes five strategic plays that offer distinct positions from which suppliers can choose to compete in specific parts of their business portfolio or all of it. Implementing these plays may require difficult choices and tradeoffs, but suppliers acting today to establish a sound position for the future can increase their likelihood of thriving through the period of change ahead.

The emergence of a new mobility ecosystem offers suppliers new choices for where to play and how to win.

The cars of the future

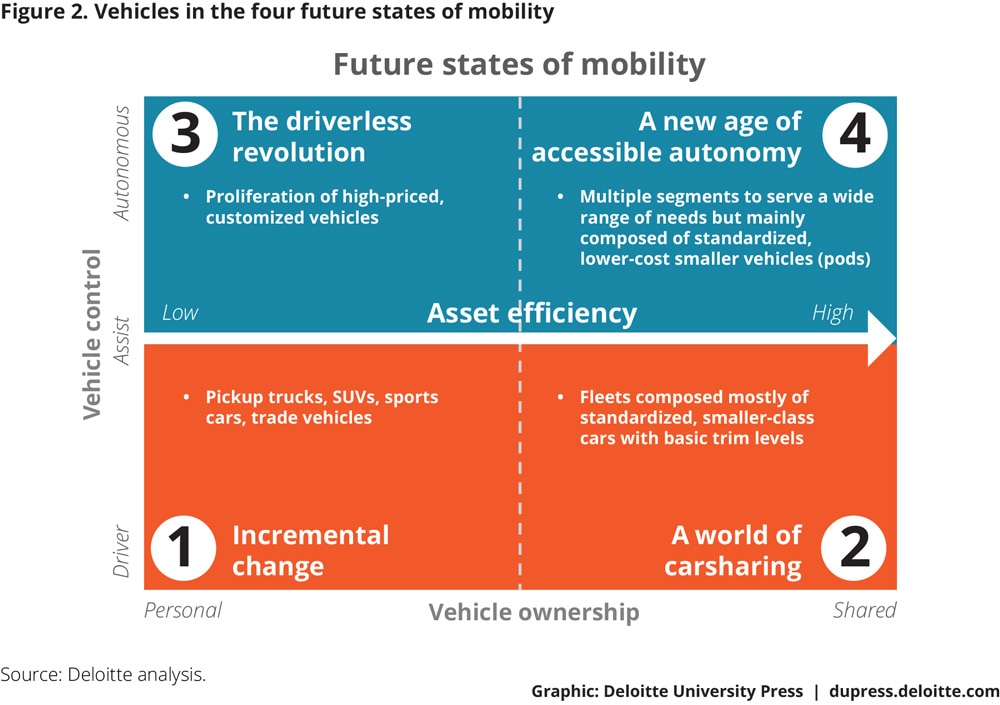

In The future of mobility,6 we concluded that four future states of mobility will co-exist at the intersection of two key trends: the emergence of autonomous vehicles and shifts in mobility preferences giving rise to shared access to transportation.

These states represent a segmentation of how mobility may be consumed in the future. Each state may require different types of vehicles to satisfy consumer needs as people seek to travel from point A to point B. As the mix of vehicles sold changes, so will the mix of parts, components, and systems supplied, as well as services provided (see figure 2).

Future state 1: Incremental change

As is largely the case in the industry today, vehicles will likely continue evolving to accommodate the needs of individual drivers and their passengers. The prevailing vehicle designs of today are unlikely to change substantially. New features are likely to continue to be an important differentiator, and design, development, and production processes are likely to stay in line with the industry’s current practices.

Demand for traditional passenger vehicles is expected to decline as shared mobility and autonomy become more prevalent. The sales mix in future state 1 may over time skew toward vehicles demanded by enthusiasts and special-purpose users, such as sports cars, SUVs, luxury models, pickup trucks and jeeps, and trade/agricultural/utility vehicles. Car buyers in more densely populated locations where shared mobility options are abundant may shift toward future states 2 and 4 (see The future of mobility: What’s next?7, in which we explore this shift and its implications in depth). And those in suburban and rural geographies—with longer driving distances where sharing may be less practical—who can afford to buy their own autonomous vehicles will likely move into state 3. These changes would leave behind a demand profile for state 1 that is characterized by lower sales volumes with a mix including more specialty vehicles and fewer highly standardized passenger cars.

Future state 2: A world of carsharing

As shared mobility likely grows to satisfy more and more consumers’ local transportation needs, multivehicle households may begin reducing the number of cars they own. Some may eventually abandon ownership altogether. Some estimates suggest that one car sold for use in a carsharing arrangement has the potential to displace as many as 11 sales for personal use.8

The mix of vehicles sold for use under carsharing and ride-for-hire services in future state 2 is likely to be skewed toward smaller, more fuel-efficient vehicles that offer a comfortable but basic ride experience and a low total cost of ownership. Today, the lowest-cost cars to drive for UberX are compact models with estimated five-year total cost of ownership between approximately $30,000 and $33,000.9 Growth in the compact segment could come at the expense of other segments that are more profitable for automakers. As a result, suppliers may face new price reductions.

Shared vehicles generally have higher utilization and annual miles driven; this would reduce payback periods on more expensive alternative powertrain technologies. Electric vehicles that were not economical when driven 10,000–15,000 miles annually pay off when instead driven 70,000 miles or more annually as part of a ridesharing or carsharing service.10 Higher utilization would also lead to faster replacement cycles on parts. Alternatively, more durable parts could see sufficient demand to warrant commercialization: Shared car buyers may be willing to pay more up front if they rarely have to invest in replacing or maintaining the vehicle.

Growth of carsharing and ridesharing may create the business case for OEMs to further optimize vehicle designs for shared uses. These models could see increased electronics content to enrich the passenger experience and may even warrant new interior configurations to increase capacity and comfort. Over time, an entirely new category of vehicles could emerge to serve the needs of shared-car buyer and passengers.

Future state 3: The driverless revolution

The third state is one in which fully autonomous driving technology11 proves viable and safe, and individuals opt to purchase and use their own vehicle(s). This future would see proliferation of highly customized, personalized vehicles catering to families’ or individuals’ specific needs. As fully self-driving technology finds its way into the market, consumers are likely to place much more emphasis than they do today on the rider experience. Expectations of interiors and electronics in particular may change when vehicle owners can take their eyes off the road and begin to rethink comfort, entertainment, and productivity.

Pace of change may be accelerated or delayed by regulations around autonomous driving. While many automakers and suppliers have aspirations to put self-driving vehicles on the road by the early part of the next decade, regulation will likely influence where and by when autonomous technology can be deployed at scale. With the recent issue of the US Department of Transportation’s Federal Automated Vehicle Policy,12 we see the first regulations around safety of autonomous vehicle technology beginning to take shape.

Customization and vehicle finishing is likely to happen closer to time of sale. As a result, the market may shift more toward build-to-order models, increasing need for flexible and just-in-time production. New types of interior content for personally owned autonomous vehicles may emerge, along with new design and fabrication competencies.

Vehicles sold in this future state are likely to be sold to premium-segment buyers who are less price-sensitive than mass-market buyers. Shared mobility’s more compelling economics, especially for the less affluent, may provide a viable and potentially more attractive substitute to ownership, and in doing so could limit penetration of personally owned autonomous vehicles.

As in other premium markets, those who control the customer relationship and delivery of customized product are likely to capture greater value.

Future state 4: A new age of accessible autonomy

The fourth future state depicts mobility consumption in autonomous, shared vehicles. Mobility management companies and fleet operators are likely to offer a range of passenger experiences to meet widely varied mobility wants and needs at differentiated price points.

The dominant vehicle may be a utilitarian electric pod. Although such vehicles may not be widely observed on the roads for a few years, the implications for volume and content per vehicle could be profound. Simple, electric vehicles could serve a large portion of individual and family transportation needs, possibly reducing demand for traditional internal combustion engines and their many parts and related systems in the vehicle. And if far, far fewer accidents occur as autonomous technologies gain collective driving experience, many of the heavy parts and systems in the vehicle dedicated to passenger safety may become less necessary.

If far, far fewer accidents occur as autonomous technologies gain collective driving experience, many of the heavy parts and systems in the vehicle dedicated to passenger safety may become less necessary.

Proliferation of niche autonomous vehicle types (retail on wheels, medical services, freight deliveries, etc.) could also occur. These new vehicle forms would require new categories of in-car content, outside-of-vehicle infrastructure (for example, sensors and charging stations), and new body types to serve specialized customer types, and are likely to emerge for a variety of business and consumer uses.

For auto suppliers, these changes would mean dealing with an increasingly complex and fragmented demand environment. The types of vehicles and infrastructure required to satisfy consumer needs often vary between future states. And because the four states will likely co-exist for decades, suppliers may either need to manufacture and service parts and systems for numerous, different vehicles simultaneously, or narrow their focus and become more specialized.

Profound challenges along the road ahead

The future of mobility—in each of the four future states—likely holds significant challenges, as well as opportunities, for OE suppliers. We have identified five key issues that suppliers may need to address as they define and execute strategies to win in the evolving mobility ecosystem.

Attractiveness of conventional parts segments changing dramatically

With the emergence of different kinds of vehicles and mobility options, some parts segments may experience significant value creation, growing to represent a larger proportion of the overall supply market. This would occur at the expense of other segments’ growth, as commoditization and price contraction, in addition to shrinking volumes, diminish their attractiveness. (See sidebar, “Segment prospects for future growth and profitability.”)

Electronics and electrical components are expected to see their share of content in the vehicle and market sizes increase substantially. Major growth drivers could include penetration of electric vehicles, increased dependence on electronics to enhance mechanical system performance (i.e., advanced electronics control units and powertrain control modules), and greater use of sensors, cameras, radar, and other components. Advanced electronics are likely needed to meet increases in emissions and efficiency standards. Vehicles are requiring more and more electrical power and the means to distribute it.

At the same time, drivers and passengers often demand more advanced audio, telematics, infotainment, e-commerce, and other sophisticated HMI technologies. These systems drive the need for additional electronics content and connected services, more powerful in-car computing resources, and high-resolution touch and head-up displays.

Combined, the features provided by these sophisticated electronics are likely to increasingly be primary determinants of choice for consumers of personally owned vehicles. And as shared vehicles become simpler in the future, especially in future state 4 where no-frills pods prevail, the infotainment and connectivity technologies may be critical in delivering desired passenger experiences.

Of course, braking, suspension, and steering will remain necessary as long as vehicles continue to travel on roads, but these features are likely to become much less differentiated. Most ridesharing passengers may not look for high levels of on-the-road performance, and in autonomous vehicles where driver feedback loses relevance and the vehicle is precisely controlled, these parts will likely become largely commoditized. Regenerative braking in electric vehicles reduces wear and tear and may drive down demand for replacement brake parts considerably. And electric cars with wheel-based motors reduce demand for conventional axles.

Body glass could become more important in the future if the need for metal and plastic structural components declines and future designs feature more glass for greater visibility. We may see designers integrate more and more displays into the glass, enhancing the rider experience.

Unless magnetic-levitation technologies and supporting infrastructure become unexpectedly cost-effective and popular, wheels and tires will still be needed to move vehicles. With carsharing, the aftermarket replacement cycles on tires and other “maintenance parts” could likely accelerate. But as with parts such as brakes, wheels and tires will need to meet only certain standard performance specs. This is not to say that opportunities for high degrees of performance differentiation will vanish—drivers willing to pay for personally owned vehicles will presumably still care about the on-the-road driving experience.

These are just a few examples of how the content mix in vehicles could see dramatic shifts. The shift in that mix, coupled with overall volume declines, will likely lead to a bifurcation of the market. On the one side, many parts may become commoditized and need to be standardized considerably to stay competitively priced. These parts would be sold in high volumes and require major, consolidated global scale to operate effectively. And suppliers of such parts would rely more and more on consolidating supply and achieving scale to continue to create shareholder value. On the other side, we are likely to see high fragmentation with a few major leading innovators plus many smaller niche suppliers taking differentiated approaches to design and development of high-value parts and product offerings. Across all parts segments, and throughout the supporting infrastructure beyond the vehicle’s walls, the Internet of Things and its proliferation of sensors can enable suppliers to gather reams of new data on parts’ performance and environment. Advanced analytics and real-time processing may allow parts and vehicle systems to reach new levels of performance, durability, and efficiency.13

Advanced analytics and real-time processing may allow parts and vehicle systems to reach new levels of performance, durability, and efficiency.

New offerings challenging traditional ones for share of value

Suppliers may face additional challenges and opportunities as offerings other than tangible parts, components, and systems compete for share of a vehicle’s total value. For suppliers, this means that offerings that enhance mobility and ride experience, rather than the physical vehicle itself, will likely become increasingly important. Data and analytics-based services and solutions, new service businesses sold to OEMs, and new types of vehicle content and corresponding consumer services (such as in-car on-demand food and beverage and “retail on wheels,” large viewing and/or augmented-reality screens, and streaming in-car entertainment) only scratch the surface of potential offerings—although these areas are likely to be hotly contested and not every supplier will have the desire and necessary competencies to compete for share of value in them.

With more and more consumers likely thinking of mobility as a service rather than a product, suppliers may need to place longer-term bets to ensure they remain relevant and to create and lead the way into markets that do not yet exist.

In addition, future states 2 and 4 may create opportunities for suppliers to serve fleet owners/operators directly to meet their service and other fleet management needs. Vehicles in future state 4 are likely to be lightweight, electric vehicles with simple architectures and content profiles. Suppliers might even consider whether integrating forward into full vehicle manufacture, to produce shared autonomous vehicles that have significantly less complex designs, would be an attractive business to add to their portfolio. Increased miles driven by shared vehicles could create opportunities in aftermarket repair and maintenance models, with increased proliferation of predictive and over-the-air maintenance models.

Suppliers will have to act swiftly to be early entrants into some of these new business models and solutions. The value ascribed to the physical vehicle itself is likely to shrink in the presence of higher-value-added offerings external to the vehicle. With more and more consumers likely thinking of mobility as a service rather than a product, suppliers may need to place longer-term bets to ensure they remain relevant and to create and lead the way into markets that do not yet exist.

Software proliferating throughout the vehicle

With more than 100 million lines of code on average expected in each vehicle by 2020, software has already started and will continue to play a significant role in the automotive industry. The dashboard will likely continue to be an operating-system battlefield, with cars becoming increasingly connected. This means that software engineering and systems integration, rather than mechanical or physical engineering, may become a key performance enabler and a significant point of differentiation between suppliers. Historically, the leading innovators in vehicle technologies have changed frequently, and with the increasing ubiquity of software, incumbent suppliers are likely to face their fiercest competition from players outside the industry, such as consumer electronics companies, nimble start-ups, and tech giants of today.

The integration of agile methodologies of software development and testing with the hardware-oriented, linear, prolonged product development cycle has already emerged as one of the most significant technical challenges that suppliers continue to try to overcome. Not only will all suppliers likely need to meet a base level of software capabilities, but suppliers may also need to determine how they would use software and enhanced content to create competitive advantage or simply seek to maintain parity with the competition. In either case, suppliers will likely need to consider strategies to accelerate product development cycles to match those of their new competitors, and how they can obtain the talent and capabilities they need to be successful in this space.

Competitive landscape undergoing transformation

The blurring of industry lines is attracting new players that create value in ways different from traditional suppliers. Consider companies such as LG, which is supplying at least 11 systems to the new Chevy Bolt (including the motor, inverters, power control, module, and heating and air-conditioning system).14 We have already seen new suppliers emerge in the electronics and software spaces, challenging industry conventions. The new entrants sometimes bring different capital structures, operate at accelerated paces, and often hold massive cash reserves—strengths that may help them flourish in the segments where value can be increasingly captured.

Four types of competitors to the major incumbent suppliers are likely to present the greatest threats:

Technology giants. These companies can define ecosystem platforms and dominate in software and big data. They often have experience in managing multiple revenue models, creating and running ecosystems on their platforms, and may not be bogged down by heavy capital assets. Google’s Self Driving Car project and Android Auto mobile platform, which can control the car’s dashboard, are prime examples.

Consumer electronics companies. Their brand names, accelerated development cycles, and ability to produce at massive scale may allow these companies to move into automotive supply by meeting the electronics and technology needs of the automakers in ways that incumbents may not be able to do easily today. Samsung entering the car infotainment space—and its move to do so through acquisition—indicates that company’s possible intent to play a central role in delivery of the future in-vehicle consumer experience.15

Emerging, focused players. The expanding role of software and electronics in delivering performance seems to have lowered barriers to entry into the supplier industry. Some firms could succeed by applying existing capabilities to specific areas in the vehicle, such as NVIDIA using its graphics processing unit technology to power autonomous drive technology. Many automotive start-ups have emerged, as well, including those that focus on over-the-air updates, human-machine interface technologies, collection of data on driving behavior, and cloud-based vehicle analytics platforms. Many start-ups have also emerged to advance electric vehicle technologies. These types of players could excel because of their ability to act nimbly in the market, respond quickly to consumer needs, and attract top talent.

Low-cost suppliers. By establishing aggressive new cost norms, closing the traditional gap between low-cost and high-quality parts (especially in commoditized parts segments), and penetrating local access in certain markets, low-cost suppliers can succeed in this new competitive landscape, but likely only if they can deliver at required quality levels.

Incumbent suppliers, particularly those that are slow to change or unable to act nimbly as a result of inertia or corporate culture, could be on uneven footing when competing with more agile entrants and may struggle to survive. Incumbents seeking to increase their probability of success should consider taking action now to structure their portfolios with a strategic balance of near- and long-term bets in order to strengthen competitive positioning of their businesses.

Supply chains evolving into value webs

In the new mobility ecosystem, the traditional linear value chain may be deconstructed and evolve toward a value web. Companies may much less often add value sequentially as a part or component moves through a set of serial production processes. Instead, suppliers might exist throughout the ecosystem; they may be called upon to add value in planned and ad hoc production cycles. Hierarchical supplier relationships may evolve into networks of specialized technology experts and integrating platform providers.

Competitors in one area may be partners and collaborate in others. Flexibility could be a critical condition for participation. And as iterative, innovation-oriented collaborative “coopetition” becomes the norm, the ability to transact through multiple types of commercial relationships will likely become a prerequisite for success. Companies throughout the automotive value chain—in both the car manufacture and sales portion (for example, Tier 1 suppliers, automakers, and dealers) and the car usage portion (for example, repair service providers, parking and infrastructure providers, and content and connected service providers) of the value chain—will likely need to work closely together. Suppliers may not be able to build or buy the capabilities they need to create unique value without large capital outlays and, thus, would need to determine how to access them through partnerships, collaborations, or other creative commercial arrangements.

In the new mobility ecosystem, the traditional linear value chain may be deconstructed and evolve toward a value web. Companies may much less often add value sequentially as a part or component moves through a set of serial production processes. Instead, suppliers might exist throughout the ecosystem; they may be called upon to add value in planned and ad hoc production cycles. Hierarchical supplier relationships may evolve into networks of specialized technology experts and integrating platform providers.

In this emerging value web, data and access to it become a major success factor. Supplier success may depend on the ability to share and receive knowledge and insights throughout the ecosystem to drive production of goods and services, and on partnerships with both OEMs and smaller players that give access to talent and capabilities. The ability to gain trust and negotiate across the value web will likely be necessary in the new mobility ecosystem.

Strategic plays for the future

Given the transformation of industry structure and dynamics under way, suppliers will likely need to consider how well their portfolio of businesses is positioned to address the transition. That could require simultaneously assessing volume and commoditization risks to certain parts of their portfolio, while thinking through investments potentially required to monetize new opportunities in other parts of their portfolio. Key choices they face could include where to embrace new business models and offerings, whether to innovate into new product segments, and how to create and sustain advantage in the traditional parts and supply business given the market’s changing competitive dynamics. In this section, we offer five potential plays for different types of businesses suppliers have in their portfolios. It is important to realize that these strategic plays are not mutually exclusive, nor are they “sequential strategies.” Suppliers could make these choices simultaneously, and different strategies could apply to parts of their business portfolios.

Consider figure 3, starting on the x-axis. Supplier businesses in largely commoditized segments, where performance innovation in the future is likely to be minimal, may need to consider different strategic plays than suppliers that operate in businesses with sustained, rich, consumer-driven innovation opportunities. From each starting point, suppliers can consider whether they want to achieve growth in the future from continued focus on sales of parts, or through new business models that potentially take them into new roles in the mobility ecosystem (moving upward on the y-axis).

Figure 3 illustrates the five potential strategic plays. Supplier businesses in more commoditized segments can make three potential plays: (a) win on cost and scale, (b) find a differentiated niche, and (c) go beyond the core of automotive supply into new business models. Those starting with businesses that today are driven heavily by differentiating performance innovation for which customers are willing to pay more face a core choice whether to remain traditional suppliers and (d) lead performance innovation or (e) trailblaze into new mobility business models centered on differentiated offerings.

Win on cost and scale

Some may choose to remain traditional suppliers to the major automotive manufacturers. For many parts and components that face commoditization, consolidating the supply base to create scale and relentlessly focusing on cost leadership could prevail as the main source of competitive advantage.

Winning on cost and scale could require massive scale and footprint in order to serve increasingly global OEM platforms.The most likely route to necessary scale is through acquisition, so we can expect suppliers to pursue consolidation, especially in future years if volume begins to decline and simpler vehicles begin comprising an increasing proportion of the market.

Winning on cost and scale could require a massive footprint in order to serve increasingly global OEM platforms.

As with traditional commodity-type businesses, margins are likely to be lower in this volume-oriented play, and suppliers and their shareholders would need to be comfortable with this economic reality.

Further, because products would need to be lowest-price yet still meet reasonable standards of performance and quality, the need to invest in leading-edge product innovation will likely be seemingly less important than focus on operational excellence and process innovation.

For suppliers seeking to win on cost through horizontal consolidation, success will likely depend upon available capital to pursue acquisitions, integration approaches that are consistently and reliably applied, standardization of products, and strict management of cost and quality through process innovation.

In-vehicle software is unlikely to provide competitive advantage in segments where cost leadership will be the winning factor. Suppliers may instead deploy software into their product to maintain minimum performance requirements. More importantly, they can seek to use analytics on the data gathered by sensors throughout the vehicle and software to automate and maximize efficiency of production wherever possible in order to achieve the lowest cost position and deliver desired margins.

Find a new niche

This complementary play to “win on cost and scale” may see suppliers making choices to narrow business focus, from competing broadly in predominantly commoditized segments to securing a niche where they can deliver new performance innovations and achieve higher returns.

This play likely involves a reduction in scale and scope, as well as a concerted effort to build more robust R&D and software capabilities in order to create advantage around differentiated products.

Likely areas of focus for niche players include many segments that might see continued incremental innovations such as interiors and infotainment, braking, steering, suspension, axles and drivetrain components, passenger restraints, wheels and tires, engine cooling, and climate control. These areas are likely to see continued need for product innovations used in specialty (e.g., trade, retail) and performance environments (e.g., racing, driving enthusiast) under future state 1 and premium vehicle models sold in future state 3. Niche suppliers may also pursue geography-specific innovations.

Suppliers will likely need to assess whether they have the appropriate product innovation and R&D capabilities or can obtain them to sustain a leading position in the niche they pursue. Further, in many cases, software may serve to enhance product functionality and achieve new levels of performance previously unattainable through purely mechanical systems. In both areas, suppliers might be going against broader-based players that have already established capabilities allowing them to stay at the cutting edge of innovation. This competitive dynamic underscores the importance of pursuing a niche focus in this play. In order to be successful, niche suppliers may need to play in areas that the broader-based performance leaders are less willing or able to pursue with speed and agility.

Go beyond the core of automotive supply

The final strategic play for supplier businesses that are largely commoditized today or will face major pressure toward commoditization in the future likely involves expanding beyond the traditional supplier business model into new business models in the broader future mobility ecosystem.

These new business models could be built around largely commoditized products in the car or outside of it, such as fleet management operations, EV charging networks, or aftermarket service and repair operations. They could also be built around differentiated products, though the choice to move from a commodity-product-focused business to one that is more differentiated, as in the “find a niche” strategic play, could be a more difficult play to make.

In order to be successful, niche suppliers may need to play in areas that the broader-based performance leaders are less willing or able to pursue with speed and agility.

For example, suppliers that currently have both OE and aftermarket parts businesses may choose to extend their foothold in the aftermarket or the vehicle use ecosystem more broadly. They could develop new business models around aftermarket parts (for example, predictive maintenance offerings or direct-to-consumer replacement parts subscriptions). They could develop and bring to market new business models related to infrastructure operations, such as comprehensive autonomous vehicle service solutions for fleet owners, or even full vehicle assembly businesses for new OEs that seek to produce much smaller, lightweight electric pods or other small fleets of custom, shared self-driving cars for use in future state 4.

This strategic play offers suppliers who face declining volumes and price and margin pressures due to commoditization of their traditional businesses the greatest potential for long-term value creation and capture, provided that they pursue the right markets and offerings. But it also offers the greatest challenges and obstacles because of the high degree of investment and transformation required.

We now examine two potential strategic plays that suppliers already on the leading edge of performance differentiation could make.

Lead performance innovation

This play represents the dominant strategy for many industry-leading suppliers today. By providing differentiated products for which OEMs and consumers alike are willing to pay more, suppliers can continue to win in the new mobility ecosystem.

The greatest opportunities for performance innovation are likely to manifest in areas that enhance the in-car passenger experience—the entertainment system and the interior (car window TV screens, zone based on-demand audio visual experiences, etc.)—and in areas that make the vehicle more efficient and environmentally friendly.

One major theme for performance innovation could be increasing comfort, entertainment, and productivity during occupancy of a vehicle that either someone else is driving or is driving itself. The electronics in the car, the human-machine interfaces, the hardware to support high-load computing, the connected car, and the many other related systems may make up a larger and larger share of the overall vehicle bill of materials, and the suppliers that can consistently deliver cutting-edge and, importantly, reliable performance can win.

And while some interior parts businesses tend to be highly competitive today, seating and other in-car comfort amenities could be increasingly important to satisfying customer preferences. Especially in personally owned autonomous vehicles—where the car may serve as an extension of the owner’s living space—opportunities for customization and the need to provide choice and optionality can create exciting opportunities for innovation-oriented suppliers.

Electric vehicle technologies are likely to continue their rapid pace of development. Innovation today is largely focused on increasing battery performance as well as energy efficiency and recovery through all of the car’s systems. These will likely continue to be hot areas of innovation, since these technologies are just starting their development journey, as opposed to combustion engines, which automakers have refined and enhanced for more than a century.

Trailblaze into the future

The final strategic play involves starting from a position of a differentiated supply portfolio today and expanding into new business models and offerings to serve the needs of the broader mobility ecosystem through nontraditional supplier business models. This play is similar to the “go beyond the core” play, except that starting from the position of operating a business around a portfolio of differentiated products today offers more potential opportunity spaces into which to expand.

“Trailblazers” could seek to establish themselves as the new vanguard of automotive suppliers. They may be more willing to take higher risks (and potentially receive higher returns) than their more traditional supplier-product-focused counterparts. They are likely to build strong brands that consumers come to know and respect as differentiating. Some may seek to upset the traditional industry structure by adding or increasing direct consumer-facing activities. They can find new ways to offer and service highly differentiated parts in both the OE sales and aftermarket sales environments; they may create new service-based offerings for OEMs and other suppliers alike to differentiate their revenue sources. They could explore new ways to charge based on usage and consumption rather than on one-time sales. Some may jump into future state 4 by entering the autonomous-pod manufacturing and/or on-demand customization. In short, they may generally push the boundaries of what’s possible in order to remain innovative and at the cutting edge of the mobility ecosystem.

Each strategic play likely requires a supplier to first take a thorough and hard look at its businesses and product lines and ensure that its overall portfolio is optimized and built for advantage (see the Deloitte perspective The crux of corporate strategy: Building an advantaged portfolio16). Then, with clarity on the portfolio that provides the greatest probability for future success, suppliers can turn to taking distinct actions to organize and build the capabilities needed to win. (See sidebar, “Perspectives on the most important actions to take today.”)

Most importantly, suppliers can choose which areas of the market offer greatest growth and profitability prospects for their business. For many, future success may come down to making bold plays that create temporary discomfort and ambiguity. But choices can be made about where to compete and where not to compete, and executed against with conviction.

For many, future success may come down to making bold plays that create temporary discomfort and ambiguity.

Conclusion

For every player in the emerging mobility ecosystem, the future looks to hold both opportunities and profound challenges, and suppliers are no exception.

Supplier businesses may face dramatic changes in their fundamental economics, as certain areas of the market contract considerably while others experience greater take rates and continued growth. New offerings could fight for share of the consumer’s wallet dedicated to mobility, and suppliers may have an opportunity to extend their footprint into the broader mobility ecosystem through new business models. Software might become more and more a critical source of differentiation for certain suppliers, but all will likely have to advance their digital capabilities to keep pace in productivity and hope to stake out new territory. And new players have entered the supplier market in recent years, bringing different competencies and mind-sets than the automotive suppliers that have long dominated the industry.

The plays that incumbent suppliers can make to survive and thrive in the new environment often depend on the companies’ starting points. For suppliers with businesses in largely commoditized product segments, plays to “win on cost and scale,” “find a niche,” and “go beyond the core of automotive supply” likely offer sound strategies to achieve future successes. For suppliers with businesses in high-differentiation segments, plays to “lead performance innovation” and “trailblaze into the future” could offer potential for rich returns as long as suppliers clearly define their strategic choices and execute with focus. Implementing these plays may not be easy, especially for traditional suppliers with long-established business plans and networks, but it’s essential that companies make clear strategic choices now in order to stake out advantaged positions from which to compete in the future of mobility.