How are global shippers evolving to meet tomorrow’s demand? The future of the movement of goods

19 minute read

11 December 2019

Michael Daher United States

Michael Daher United States Marcello Gasdia United States

Marcello Gasdia United States Omar Hoda United States

Omar Hoda United States William (Bill) Kammerer United States

William (Bill) Kammerer United States

Consumers are ordering ever more items and expect them to be delivered ASAP. How are transportation and logistics providers coping with the pressure—and preparing for the future of the movement of goods?

Introduction

Tomorrow’s consumers probably won’t give much thought to the brilliant orchestration behind package delivery windows slimming down from days to hours and minutes. And they may not spend much time marveling over their ability to effortlessly coordinate delivery locations, times, and returns with busy schedules, or track a specialty product mile by mile as it makes its way from overseas. As with most tech-enabled convenience, novelty quickly fades to expectation. And considering the innovation gaining momentum in transportation and logistics, consumer expectations will only continue to rise.

Learn more

Explore the Future of mobility collection

In a hurry? Read a brief version from Deloitte Review, issue 26

Download the issue

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

It’s this customer-centric control and convenience that will inevitably define the future of the movement of goods—and the businesses that thrive in it. But getting there demands change. Rising expectations are clashing with industrial-age transportation technology and the limitations of traditional supply chain practices, pushing players to evolve.1

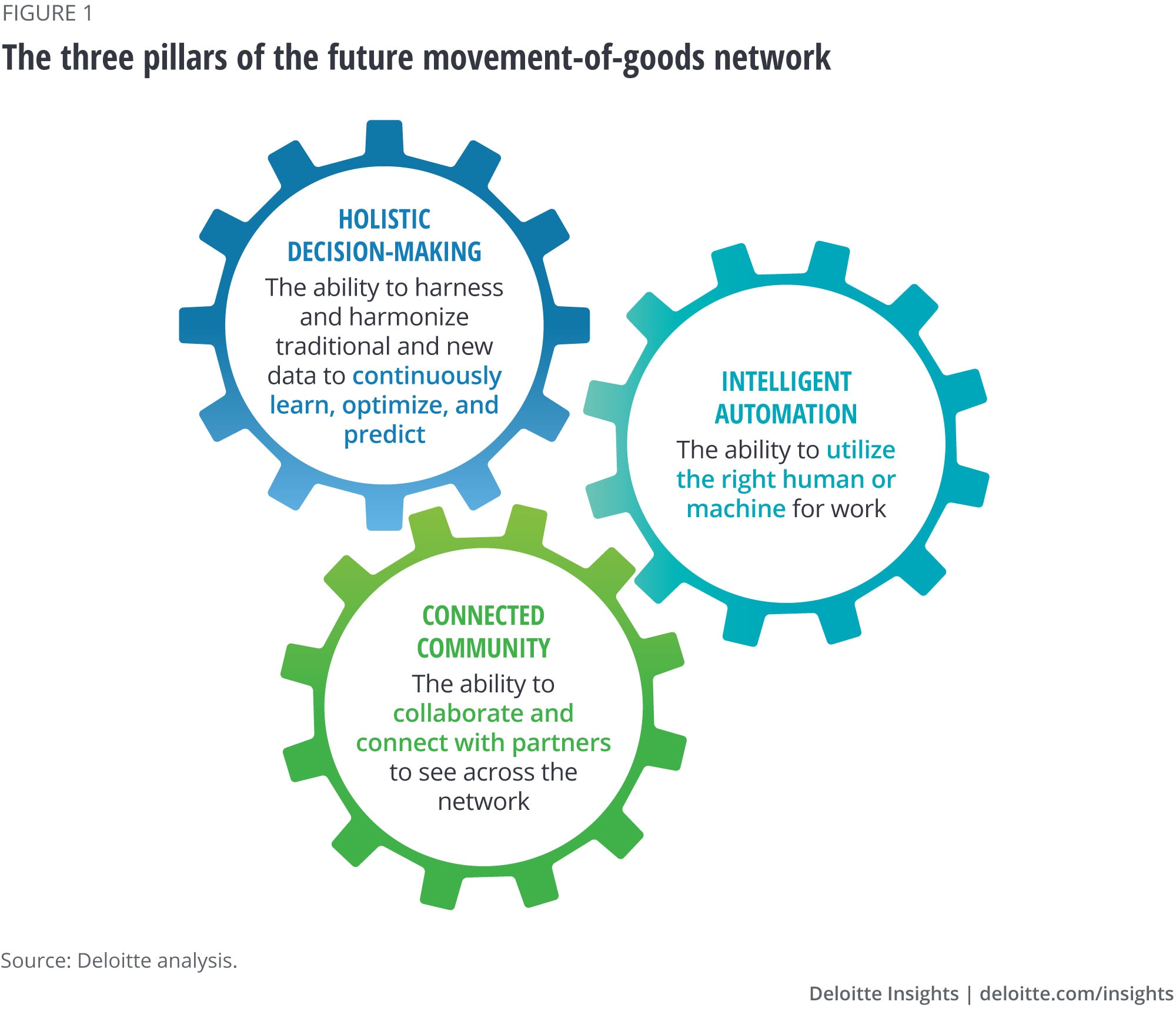

While still in early stages, the foundations of a next-generation global movement-of-goods network are actively forming. We are already seeing progress across the three pillars that will underpin the future network: connected community, the ability to collaborate and connect with partners to see across the network; holistic decision-making, the ability to harness and harmonize traditional and new data to continuously learn and predict; and intelligent automation, the ability to utilize the right human or machine for the task at hand and automate digital processes (figure 1).

As these capabilities mature, they will increasingly intersect and reinforce one another, creating the positive feedback loop that forms the backbone of the future of movement of goods. Tangible progress that consumers can experience and feel will likely come in incremental waves over the coming years—somewhat obscuring the critical turning point now being reached behind the scenes. Enabling technology platforms are converging, helping a codependent but highly fragmented global network of transportation and logistics providers, ocean carriers, retailers, and other large shippers to evolve into more integrated, intelligent, and automated end-to-end networks that can move more goods more quickly to more places, and with more transparency and efficiency than today.

The changes underway can appear daunting, particularly to legacy incumbents more focused on solving pressing challenges than building toward a future that can seem distant and ill-defined. But below we discuss specific, tangible actions that players across the movement-of-goods spectrum can take today to pave the way for a more integrated and intelligent tomorrow. And whether you operate trucks, trains, planes, or ships—or rely on any of them to send or receive goods—it’s imperative to begin your journey now. As pressures mount on the global freight system, business-as-usual is likely to become unsustainable.

A necessity and opportunity

Rising delivery expectations aside, simply maintaining today’s delivery speeds amid rising global parcel volume points to an enormous throughput challenge. The problem stems from a global population that is swelling, urbanizing, gaining purchasing power, and shifting to e-commerce—all at the same time. The combined impact is staggering: In China, for example, daily parcel deliveries are on pace to hit 145 million by the end of 2020, nearly tripling from 57 million in 2015.2 Today’s goods volume will likely be a shadow of future demand.

Overstretched infrastructure limits the ability to throw more capacity at the problem. In the United States, total vehicle miles traveled is growing three times faster than new road construction,3 with congestion already costing the trucking industry an estimated US$90 billion in operating costs every year, concentrated in the urban final mile.4 Other critical infrastructure, including ports and airports, are struggling to keep up, and a multitrillion US infrastructure deficit5 makes short-term relief unlikely.

The open seas—the global supply chain’s only segment with virtually unlimited capacity—offer a glimpse into just how much the network wants to flex to meet rising demand. Over the past two decades, container ships have nearly doubled in capacity, with little thought given to what happens when these massive ships try to pull up to the same old ports. Recent US port performance data hints at the rising friction. Container volume at the top 25 US ports is rising 7 percent annually, helping contribute to a 3 percent uptick in vessel dwell times as ships jostle for limited space in an environment where problems such as crane malfunctions and labor strikes can already bring port operations to a virtual standstill.6 In February 2019, West Coast ports were still backlogged from the previous holiday season, a bottleneck exacerbated by retailers rushing inventory into the country in an attempt to get in front of potential tariff increases.7

Like other bottlenecks across the movement of goods, a problem at ports is not a problem for only ports. It’s an ecosystem issue: First-mile delays bleed into intermodal rail and drayage operations, regional warehouses, and retailers, who often pay a premium scrambling to source new supply at the last minute, incurring extra storage fees and stock-outs. Apparel retailer Lululemon estimated a US$10 million loss in holiday sales due to port congestion in 2015.8

Orchestrating around these bottlenecks remains an enormous challenge, with fragmentation at the core of the issue. A global shipment can involve up to 30 different organizations and more than 200 different interactions, but without horizontal connectivity to each other, cargo owners or the end customer can make coordination difficult.9 This is a systemic challenge across the movement of goods, perhaps nowhere more pronounced than the trucking industry, where only about 10 percent of the roughly 470,000 US carriers—about one-third of the capacity—are fleets with more than six trucks.10 The limited connectivity between carriers and shippers makes it difficult to tap into unused capacity, estimated at 20 billion empty miles every year in the United States alone.11 These empty miles aren’t just a cost issue. Poor utilization impacts demand planning and route optimization, making it difficult to keep up with rising customer expectations. Retailers and other high-volume shippers struggle with different shades of the same problem. While many establish integrated supply chains with larger contract manufacturers and suppliers, control tower visibility is often limited by their long tail of smaller partners still relying on manual processes.

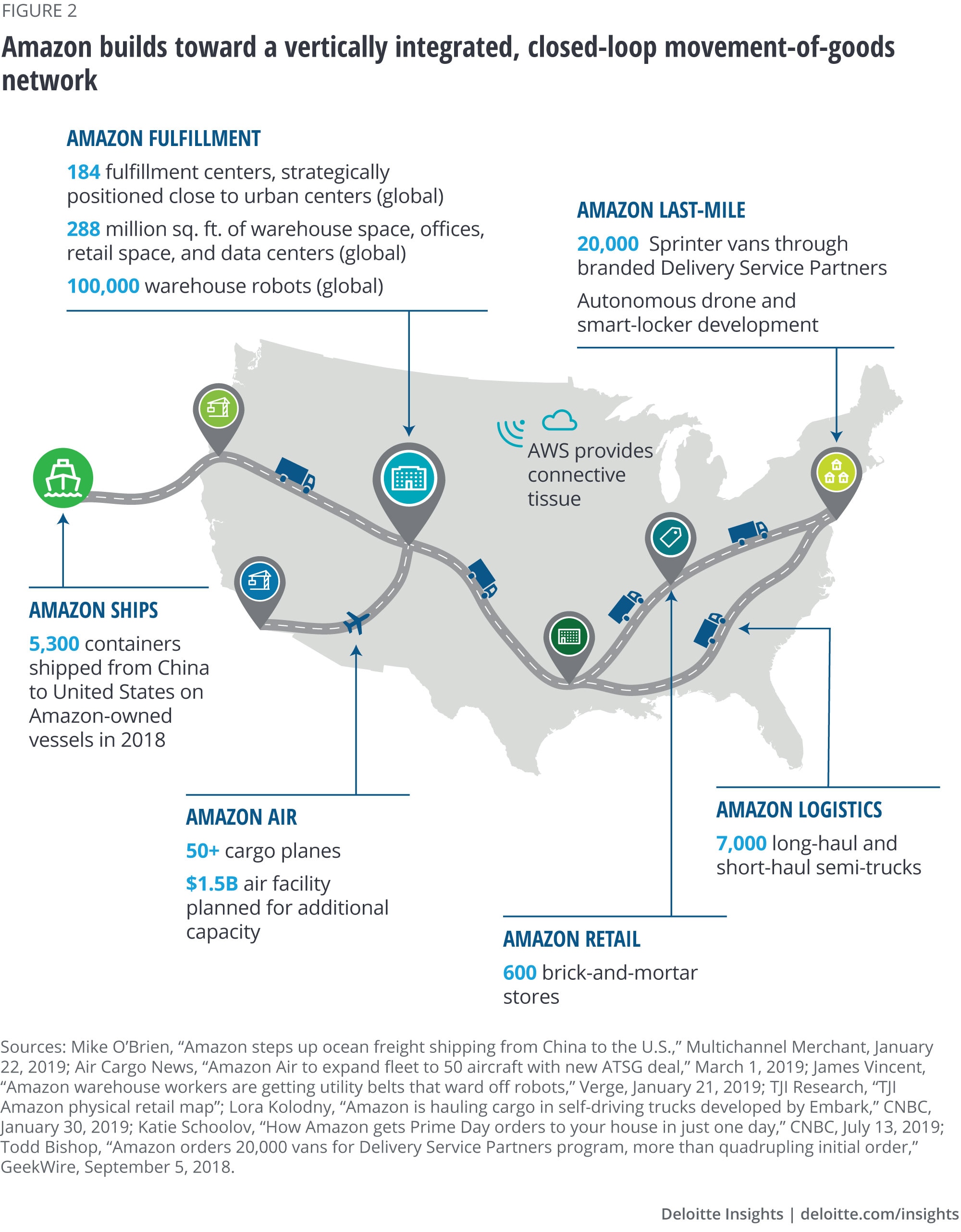

Amazon’s connected community

Meanwhile, a paradigm-changing player is showing what’s possible with a truly integrated, start-to-finish supply network—and highlighting the threat to incumbents that fail to adapt their own operations. The movement of goods from China to the United States on Amazon-owned vessels in 2018 marked the completion of the world’s first end-to-end, shipping network—the last missing leg joining a chain of cargo planes, fulfillment and distribution centers, long and short-haul trucks, a rapidly expanding last-mile network through branded delivery service partners, and of course, Amazon.com. There is little coincidence that the e-commerce giant redefining delivery is slowly (but deliberately) building toward a vertically integrated, closed-loop network. Uninterrupted visibility into when goods enter Amazon’s ecosystem from manufacturers, and the movement of those goods between warehouses and sort centers, leaves few black holes—a key part of how the brand can guarantee its growing base of global Prime customers two-day shipping on more than 100 million different items.

As Amazon CFO Brian Olsavsky said on the company’s Q4 2018 earnings call, “We can invest selectively because we have more perfect information. We know where we’re moving things between warehouses and sort centers, and by not involving third parties all the time, we can find that we can extend our order cutoffs.”

Amazon has built an end-to-end infrastructure that allows them to meet and exceed the very expectations they’ve had a hand in shaping. But legacy incumbents are evolving to provide the counterweight, driving investment and innovation at the core pillars of a new freight ecosystem.

The pillars of a new freight ecosystem

With limited physical infrastructure, new digital infrastructure and processes are needed to increase throughput, reduce friction, and improve transparency and coordination. We see three pillars to the emerging movement of goods ecosystem: connected community, holistic decision-making, and intelligent automation. Forward thinkers are beginning to see the opportunities to differentiate across all three of these dimensions.

Pillar 1: Driving end-to-end transparency through connected community

Addressing fragmentation through connected communities is among the greatest challenges and opportunities facing transportation and logistics. But the horizontal partnerships forming around ports serve as a strong example of what’s possible.

Integrated data platforms, such as those found in Hamburg and Rotterdam, exchange critical port information—including ship arrival and departure times—to participating ports, shipping lines, and marine terminals coordinating drayage. Powered by cloud, integrated platforms handle large transaction volume between disparate applications, and enable ports to orchestrate the network with real-time data exchange, optimizing ship course and speed, vessel berthing, ship offloading, and response to schedule changes. The collaboration has already led to a 20 percent reduction in dwell times for ships that can cost up to US$80,000 per hour to operate.12

The significance of this platform is a mindset shift as well as a technological one. Ecosystem participants, some direct competitors, are collaborating to digitize and connect. And in the case of new smart ports, all stakeholders have been given an active seat at the table during planning and development, helping to create open platforms with mutual benefit.

Accompanying integrated platforms created by the physical movers, pure technology players—from startups to projects backed by industry incumbents—are investing billions to mature the world of digital freight.13 While digital platforms that match cargo to available capacity in real time are certainly not new, they are proliferating in number and, more importantly, expanding beyond their historical concentration in spot-trucking to different points of the value chain, from air and ocean to rail and B2B freight.

Some platforms are even taking digital freight end to end. Cainiao, China’s leading digital logistics business connecting e-retailers with end-to-end logistics, is achieving enormous scale. The brand has already amassed more than 90 trucking and air carriers, six digital fulfillment hubs, 266 IoT-connected warehouses, and a variety of last-mile networks, including self-pickup locations, smart lockers, and express couriers.14 Their ability to see across the growing network, and marry it all with AI applications to match shippers to the lowest-cost and fastest routes is driving a significant competitive advantage. Cainiao is already processing an average of 42 million packages per day, with ambitions to deliver an online order anywhere in the world in under three days.15

In theory, digital freight seems like a quick fix for a fragmented industry. But it’s not so simple (see sidebar, “The interoperability hurdle”). The proliferation of new platforms will not lead to freight markets that follow the laws of perfect competition overnight, if ever. Platforms of Cainiao’s size are rare. Most struggle to grow the partnerships needed to achieve scale—and, in a way, create fragmentation themselves as vertical stacks of integrated products. But similar stories have played out in other industries. History suggests that waves of consolidation and evolution in digital freight might be inevitable. In the early days of online travel, for example, hundreds of online travel agencies—most regional, with limited inventory—connected travelers to the world’s hotels and airlines. After decades of consolidation, only a handful of global players command significant market share, and their content is further aggregated by a handful of leading travel metasearch platforms.

But what are the implications? And where are the opportunities? For regional parcel carriers and logistics providers, the improved, real-time visibility into available cargo and tech-enabled coordination could be what’s needed to materially improve utilization. The ability to leverage the assets of other carriers through shared models could help expand coverage and monetize or acquire additional capacity, enabling fleets that flex with demand or create new revenue streams. A single 26-foot truck traveling 100 miles per day can generate up to US$3,300 per month.16 For retailers, the additional freight services and crowdsourced assets offer new opportunities to meet growing last-mile and peak season demand. As comfort with sharing models and crowdsourcing rises, retailers will have fresh options for moving goods between stores or middle mile.

The interoperability hurdle

While digitization matures, the movement of goods will still need better connective tissue to seamlessly move information and value across heterogenous global logistics platforms, particularly critical information such as bills of lading, certificates of origin, insurance verification, and invoicing. Even as EDI-based transactions digitize many of these processes, there remains plenty of paper-based exchange.

While nascent, blockchain offers a promising path forward, making information and transactions more visible, secure, and lower-latency across global stakeholders. But blockchain solutions are only as powerful as the community consensus, adoption, and scalability behind individual protocols. And currently, competing consortiums are developing different standards on different chains. The emergence of blockchain consortiums in logistics, from the Blockchain in Transportation Alliance to Cargo Smart, offer promise that a collection of standards for blockchain and distributed ledger applications in logistics will eventually emerge. From there, to realize its full potential, blockchain technology may need to reach a Wi-Fi- or Bluetooth-like breakthrough in scalability and chain-to-chain interoperability.

Critical questions remain around the path to standardization, including whether a single organization or consortium can develop standards on an entire industry’s behalf, or whether blockchain standards will manifest from the strongest commercial solutions. But like the impact of a standard container size on global supply chain efficiency, the potential impact of digital standards is too difficult to ignore, and in time, the industry will likely find a way to make it happen.

Pillar 2: Driving agility through holistic, data-driven decision-making

Many of today’s global movers are already data-driven. For example, the quantitative rigor that a logistics provider might use to design a custom supply chain for a global retailer is quite sophisticated—as are the range of increasingly integrated transactional systems, enterprise resource planning systems (ERPs), transportation management systems (TMS), warehouse management solutions (WMS), and software tools used to manage those operations.

But where today’s global movers need to focus is compressing the time between data collection and meaningful action. Global supply chains can be planned with immense precision, but dealing with unpredictable environments and rising consumer demands requires the agility to react to changing network conditions with dynamic decisions and, perhaps in the not-too-distant future, to tailor microsupply chains for each product and customer.

Early adopters are not only finding success from a mix of new data sources from connected assets, cargo, and warehouses—in some cases, they are harmonizing these new data streams with transportation management, inventory management, and other supply chain functions. These capabilities serve as early signals that traditional, linear supply chains are just beginning to collapse into more dynamic digital supply networks, where once-isolated data sources—such as operations data, connected assets and cargo, and historic data—begin centering around a digital core that provides real-time decision support.17

The transition is starting. Ocean shipping giant Maersk already commands a fleet of 270,000 IoT-enabled cold containers, transmitting data on temperature, location, and refrigeration power supply to the cloud, helping automate oversight, exception alerts, and quality control processes at ports.18 In transportation, DHL recently announced its goal to have 10,000 IoT-connected trucks operating in India by 2028, estimated to provide over 95 percent reliability for inventory and temperature tracking for perishable goods in the region.19

In retail, sensor data is being aimed at significant pain points, such as supply chain visibility and inventory management. Keeping hundreds of distribution and retail locations stocked with the right levels of inventory while simultaneously creating a virtually endless aisle to online customers is the complexity behind an estimated US$2.1 trillion in overstocks and out-of-stocks across the US retail industry.20

As companies become more involved in digital transformation and build their capabilities, they are likelier to realize its benefits—and keep investing to further grow their expertise. This snowball effect of investment and success is exemplified by the long-term rollout of UPS’s dynamic routing system Orion. Orion’s first generation was far from real-time, but its yield of US$100 million in annual savings spurred investment for second-generation upgrades, bringing the system into real-time through delivery information acquisition devices that communicate optimized routes to drivers while on the road.21 Planned upgrades may incorporate a driver’s remaining pickup and delivery requests, as well as external data sources such as traffic and weather.

Instrumentation only looks to accelerate. According to a recent Deloitte executive study, supply chain was rated among the biggest opportunities for IoT technology.22 The growing interest, combined with improving interoperability, latency, and protocols for 5G-to-5G device communication, and falling sensor costs, will continue to make piloting and scaling new solutions cheaper and faster. With time, data-driven decision-making will likely get more sophisticated, expanding connectivity with smart city sensors, predictive traffic flow models, and other data sources.

Competing in the future of the last mile

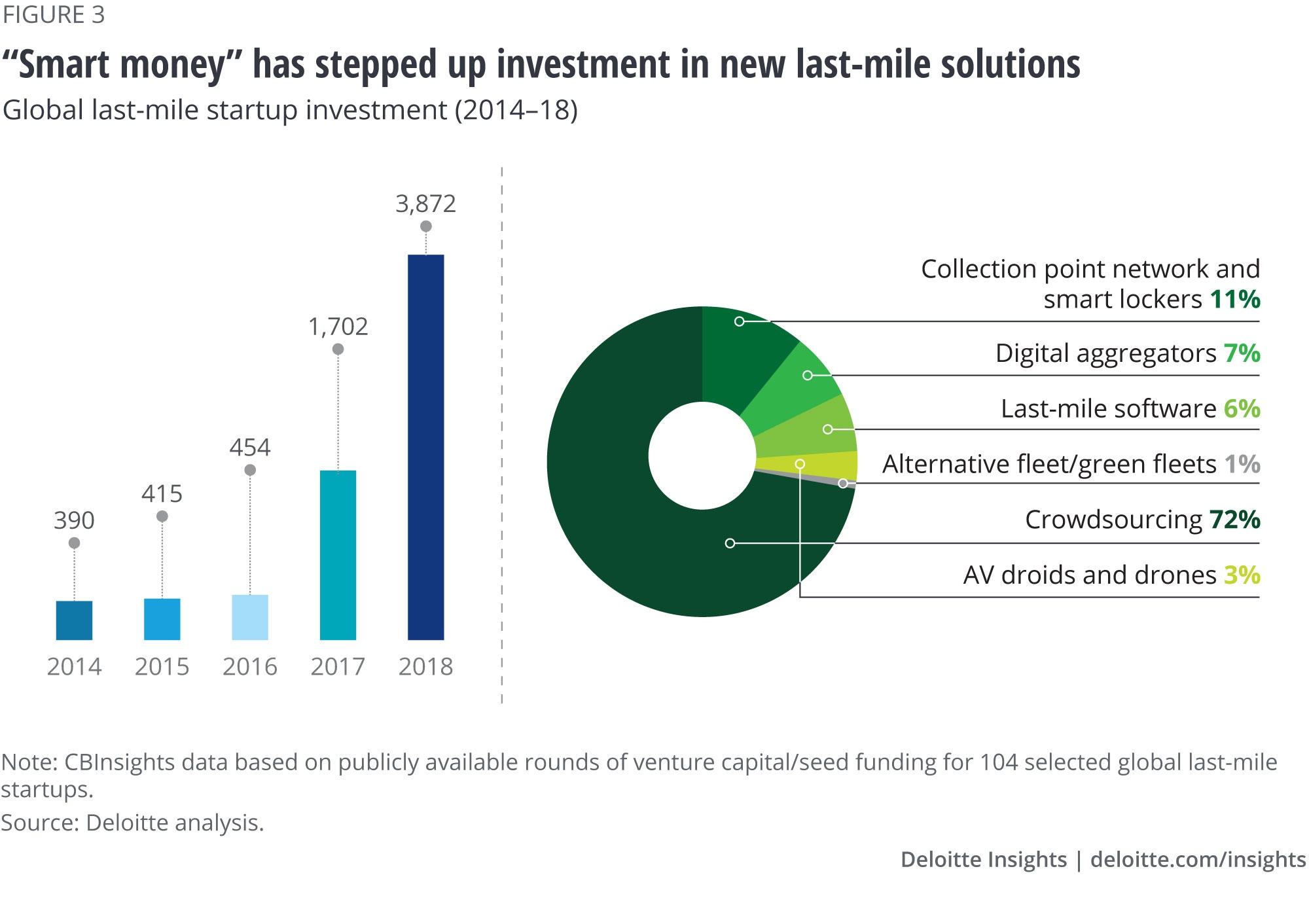

Data-driven decision-making will likely be critical to success in the future of the last mile. A swell of startups and traditional players are racing to introduce new last-mile solutions in what is often the most unpredictable, congested, and costly leg of the goods journey. Aiming to capitalize on gaps in customer speed and flexibility demands, venture capital is pouring into the space. Investment in innovative last-mile startups exploded from US$390 million in 2014 to US$3.9 billion in 2018.23 The injection of smart money hints not only at imminent change but at the enormous convenience and flexibility coming to consumers through new last-mile channels. While investments concentrate on crowdsourcing, investors are also looking at a mix of collection-point networks, smart lockers, connected courier fleets, autonomous droids and drones, and green fleets to meet new demands.

New last-mile channels signal an incoming rush of convenience for the customer—but immense complexity for providers. Traditional last-mile practices will likely fade, as providers will need to orchestrate more volume through the right channels in real time.

An evolving last-mile landscape brings important implications for traditional logistics providers and retailers, along with even more questions. Considering the potential distribution power and speed from the blend of new channels, the battle for the customer may play out not in the last mile but among providers competing to provide the best service in the last 1,000 feet. How will logistics providers with millions invested in traditional last-mile transportation assets navigate the years ahead? How do traditional players leverage a mix of acquisitions, partnerships, and organic innovation to build out profitable last-mile capabilities at global scale, or partner with municipalities to drive success in cities with unique transportation infrastructure and variation in autonomous regulation?

Pillar 3: Automating the network

While visions of self-driving robo-taxis in cities grab much of the limelight, autonomy and robotics bring similar implications for the future of the movement of goods. Evidence of maturing automation can now be found at every step in the chain, and while still some ways away, the foundations of a global, touchless supply chain are actively forming.

Autonomous cargo ships are in development, while some ports already feature an entirely robotic ship offloading process. Nearly 50 companies are progressing on AV technology, and many, such as Embark, Waymo, and Tesla, are focusing efforts on trucking.24 Warehouse robotics that lift, move, and sort are widely in use and gaining dexterity. Ocado, an online-only UK supermarket, can process 3.5 million items per week in highly automated warehouses working around the clock. And last-mile automation, from drones to droids, are transitioning from concept to pilots. Flytrex, an on-demand drone delivery startup, delivers packages in Iceland,25 while some grocers deliver fresh produce in Arizona with autonomous delivery vehicles.26

These concepts could be the early foundations of a touchless supply chain. But capturing the concept’s full potential will likely require rethinking entire logistics systems to take full advantage of a constant flow, including an evolution away from the fixed “collect in the evening and deliver during the morning” approach toward a fluid system of continuous movement and supply—as well as key transactions configured entirely around human labor. Some processes, such as truck-loading at warehouses, for example, can be reimagined in their entirety. By combining emerging autonomous warehouse technology with autonomous self-driving systems for long-haul transport, new types of vehicles can begin hauling trips as soon as they receive cargo. These new freight transport vehicles could range in size—and seamlessly pass through automated warehouses and distribution centers.

There will likely be a blurring of lines between the movement of goods and people. The digital management infrastructure that powers new mobility ecosystems designed for urban transport may be vital to, for instance, logistics providers and retailers in the last mile. Companies such as AEV Robotics are already designing modular vehicle systems for cities that allow businesses, city planners, and fleet managers to configure autonomous solutions for a multitude of applications.27 A variety of functional pods can be placed over autonomous, electric chassis, from on-demand ride-hailing to medical services, industrial applications, same-day delivery, and fresh food retail.

The future of work in freight

The increasing power and capability of machines will ultimately transform work and change what organizations ask of employees in terms of required skills and roles. As shipping and transportation businesses begin to embark on more significant transformations around automation, it can be difficult to envision precisely what those new roles would be. Some may be relatively simple to predict, such as training workers to use new, advanced technologies to augment and assist with familiar tasks. Others will likely be wholly new, taking greater advantage of the unique skills humans possess that machines do not. While some work will be fully automated, certain signals—such as the fusion of facial and voice recognition technology in more advanced robotics—strongly suggest a future of close human-to-robot collaboration, and the automation of niche processes within existing human jobs. Ultimately, businesses need to be thinking now about the types of skills that will be needed in the future, how already existing roles could evolve and transform, and where, precisely, those new, value-added roles will emerge.

The merging roads ahead

The pillars of the future movement-of-goods ecosystem are being rapidly developed. Players are investing in new ways to digitize and connect in more open, connected communities, driving holistic decision-making into core processes, and automating across the network—but this is only the beginning of the journey (figure 4). Over the short term, global movers need to be focused on scaling these core capabilities—but pilots should be targeted at the intersections of these pillars. The true value of these enabling technologies will unlock as they converge. For example, as connected communities grow in parallel with maturing IoT and blockchain standards, critical supply chain data will begin to flow more freely across the network, amplifying the power of cognitive technologies to drive improved holistic decision-making. In a similar vein, when holistic decision-making merges with automation, the power of automation will shift from cheaper to smarter, as cognitive technologies and predictive insights feed into a growing robotic network, creating intelligent supply chains that can not only see into potential bottlenecks but orchestrate around them.

More importantly, the convergence of these capabilities leads to the creation of the physical-digital-physical loop, the continuous and cyclical flow of information and actions between physical and digital worlds.28

What can it look like when connected community, holistic decision-making, and intelligent automation converge? Consider the online retailer that reimagines truck loading:

Connected community. RFID labels and beacons tag goods entering a regional distribution center that serves dozens of downstream warehouses and hundreds of stores. Connected inventory management systems link incoming SKUs to stored data about the items, including dimensions and weight, whether the item is stackable or needs to be rack-shipped, and whether it is perishable or needs cold storage.

Holistic decision-making. Here, decision engines go to work, computing optimal load-building based on available transportation assets and where items need to go and when.

Intelligent automation. Finally, warehouse robotics, armed with loading instructions, find and group items and pallets in advance of the trucks’ arrival at the distribution center. Ultimately, the retailer minimizes transport costs by improving trailer utilization.

Implementing solutions such as these can be a massive undertaking. A critical part of the transition is ensuring that logistics partners are open and willing to collaborate along the entire journey, as these transformations extend beyond organizational boundaries. Companies may look to identify smaller pockets of the network to test pilots and scale.

As transportation and logistics companies design, pilot, and scale new digital solutions, they must also be thoughtful about long-term tax implications. How organizations capture cost savings and value derived from digital innovation can significantly impact their global tax posture. Innovation teams should align with their organization’s tax function early in the innovation cycle, strategically planning for the location of IP ownership and key leadership roles within redesigned supply chain models to help facilitate the efficient capture of cost savings created through digital innovation.

Where to begin: Building a foundation around three core pillars

Over time, a global population of consumers demanding greater delivery volume, speed, flexibility, transparency, and convenience will force the movement of goods network to adapt. Signs of change are well underway and increasingly centered on core building blocks: connected community, holistic decision-making, and intelligent automation.

For global movers, building a solid foundation around these capabilities is crucial. Figure 5 suggests strategic questions that leaders could begin asking as they continue their journey.

Staying engaged

For many providers and retailers, keeping faith in the great promise that technology has offered the logistics industry, and the customers it serves, can be difficult. Utopian visions around complete control-tower visibility and proactive exception management can remain elusive, particularly for those sifting through mountains of paperwork from overseas suppliers. But staying engaged is a necessity. Signals of imminent change are emanating from every corner of the global movement of goods. Transformation is a long journey, but even incremental digitization of logistics operations can deliver plenty of benefits.

As legacy shipping companies and retailers race with the likes of Amazon and new entrepreneurs to solve some of delivery’s biggest pain points, it’s difficult to predict exactly what will work best in the long run. Will predictive supply chains mature into self-learning, fully automated chains? Will they operate on top of self-sufficient energy grids? Could millions of dollars of unpurchased goods autonomously rove city perimeters, allowing for instant delivery as orders are placed while goods are in motion?

Nothing is certain. But leaders should be looking to build businesses toward a movement-of-goods network that is adaptable to change.

© 2021. See Terms of Use for more information.

Explore the Future of mobility collection

-

The future of auto retailing Article9 years ago

-

Keeping London moving Article5 years ago

-

Auto executive/adviser Larry Burns sees the future of mobility Article6 years ago

-

The future of parking Article6 years ago

-

Regulating the future of mobility Article6 years ago