Industry 4.0 and manufacturing ecosystems has been saved

Industry 4.0 and manufacturing ecosystems Exploring the world of connected enterprises

23 February 2016

The marriage of advanced manufacturing techniques with information technology, data, and analytics is driving another industrial revolution—one that invites manufacturing leaders to combine information technology and operations technology to create value in new and different ways.

“INDUSTRIE 4.0 connects embedded system production technologies and smart production processes to pave the way to a new technological age which will radically transform industry and production value chains and business models.”

—Germany Trade and Invest1

Manufacturers face changes on multiple fronts. Advanced manufacturing—in the form of additive manufacturing, advanced materials, smart, automated machines, and other technologies—is ushering in a new age of physical production.2 At the same time, increased connectivity and ever more sophisticated data-gathering and analytics capabilities enabled by the Internet of Things (IoT) have led to a shift toward an information-based economy. With the IoT, data, in addition to physical objects, are a source of value—and connectivity makes it possible to build smarter supply chains, manufacturing processes, and even end-to-end ecosystems.3

As these waves of change continue to shape the competitive landscape, manufacturers must decide how and where to invest in new technologies, and identify which ones will drive the most benefit for their organizations. In addition to accurately assessing their current strategic positions, successful manufacturers need a clear articulation of their business objectives, identifying where to play in newly emerging technology ecosystems and (as important) what are the technologies, both physical and digital, that they will deploy in pursuit of decisions they make about how to win.4

As these waves of change continue to shape the competitive landscape, manufacturers must decide how and where to invest in new technologies, and identify which ones will drive the most benefit for their organizations. In addition to accurately assessing their current strategic positions, successful manufacturers need a clear articulation of their business objectives, identifying where to play in newly emerging technology ecosystems and (as important) what are the technologies, both physical and digital, that they will deploy in pursuit of decisions they make about how to win.4

The charge is perhaps easier to execute in theory than in practice. Despite the hype around advanced digital and physical technologies, many are not well-understood.5 Likewise, many stakeholders are unclear as to what all this connectivity means for their companies—and for the broader manufacturing ecosystem.6

One thing is certain, however: It would be folly to underestimate the crucial role the flow of information plays in the physical aspects of advanced manufacturing. In order to fully realize the opportunities both of these domains present, it is crucial to integrate the two—use the digital information from many different sources and locations to drive the physical act of manufacturing. In other words, integrate information technology (IT) and operations technology (OT) to forge a stronger manufacturing organization—a state that we and others refer to as Industry 4.0.7 Also known as SMART manufacturing or Manufacturing 4.0, Industry 4.0 is marked by a shift toward a physical-to-digital-to-physical connection.

While Deloitte refers to smart, connected manufacturing as Industry 4.0, several other commonly known terms may point to the same phenomenon. These include:

Industrial Internet

Connected Enterprise

SMART Manufacturing

Smart Factory

Manufacturing 4.0

Internet of Everything

Internet of Things for Manufacturing

In this report, we offer a perspective to help manufacturers navigate toward an Industry 4.0 future. We do so by examining the flow of information in intelligent production and connected supply chains—that is, systems that inform and coordinate the manufacturing, distribution, and aftermarket process—through the lens of Deloitte’s Information Value Loop (IVL). We then review the impact of the IVL on the manufacturing value chain. In the remainder of this article we will:

- Explain the term “Industry 4.0,” its history, and the expanding breadth of the concept

- Review the fundamentals of Deloitte’s IVL framework and its relation to Industry 4.0

- Identify two strategic areas—growing the business and operating the business—and six transformational plays that encompass the core opportunities for manufacturers to create with Industry 4.0 technologies

- Uncover key challenges for Industry 4.0 deployments

From the old world to the new: Defining Industry 4.0

Rooted in the notion that the swarm of connected, smart technologies could marry—and thus revolutionize—production, the term Industry 4.0 encompasses a promise of a new industrial revolution, the fourth such transformation in the history of manufacturing (see figure 1 for a summary of the industrial revolutions).8

The definition for Industry 4.0 was first introduced in 2011 at the Hannover Messe trade fair, and was the subject of an Industry 4.0 working group established by the German federal government.9 Germany Trade and Invest (GTAI) defines Industry 4.0 as:

A paradigm shift . . . made possible by technological advances which constitute a reversal of conventional production process logic. Simply put, this means that industrial production machinery no longer simply “processes” the product, but that the product communicates with the machinery to tell it exactly what to do.10

GTAI further adds that Industry 4.0 represents “the technological evolution from embedded systems to cyber-physical systems,” an approach that “connects embedded production technologies and smart production processes.”11 In other words, Industry 4.0 is a state in which manufacturing systems and the objects they create are not simply connected, drawing physical information into the digital realm, but also communicate, analyze, and use that information to drive further intelligent action back in the physical world to execute a physical-to-digital-to-physical transition.

The value of the Industry 4.0 concept can be enhanced through a clarification of the role played by technologies that facilitate the physical manipulation of objects.

To illuminate its concept of Industry 4.0, GTAI invokes the concept of Cyber-Physical Systems (CPS)—technologies that marry the digital and physical worlds,12 typically via sensors affixed to physical devices and networking technologies that collect the resulting data.13 This concept is remarkably similar to the more commonly referenced IoT.14

Deloitte accepts the GTAI definition and believes the value of the Industry 4.0 concept can be enhanced through a clarification of the role played by technologies that facilitate the physical manipulation of objects. Manufacturing leaders must understand how both control systems in the factory and manufacturing execution systems—also known as operations technologies (OT)—and general corporate function and capability that synchronizes across functional systems—also known as information technologies (IT)—are co-evolving in ways that will bring profound opportunity and change to their business. Understanding how the various information technologies interplay with the physical world to drive innovation is a good place to start.

Deloitte has developed in-depth research and analysis focused on the impact of the Internet of Things and the ways in which the flow of information can enable organizations to create and capture value. Visit http://dupress.com/collection/internet-of-things/ to read the full series, learn more about the Information Value Loop, the functions of its various stages and value drivers, and see examples of its application in various sectors and scenarios.

Connectivity, information, and action: The Information Value Loop and Industry 4.0

Inherent within manufacturing is the process of information creation, communication, and action. While its output is a physical object, manufacturing inevitably begins with information: A design is created via drawing, design software, or the scanning of a physical object, creating data.15 These data are then communicated to machines that execute the design, bringing it forth from the digital to the physical realm. Ideally, data from the process of creation (and subsequent use) is further captured, sparking ongoing cycles between the digital and physical realms. It is here that the overlap between the concepts of Industry 4.0 and the IoT becomes apparent.

It is the leap from digital back to physical—from connected, digital technologies to the creation of a physical object—that constitutes the essence of the Industry 4.0 concept.

The IoT is a crucial—perhaps the most crucial—element of Industry 4.0.16 The IoT concept has gained traction in recent years as the importance of connectivity—both in creating products and services and increasing satisfaction among customers and clients—has become better understood.17 Currently, a host of connected technologies is advancing rapidly, including high-quality sensors, more reliable and powerful networks, high-performance computing (HPC), robotics, artificial intelligence and cognitive technologies, and augmented reality.18 Taken together, these technologies can change manufacturing in profound ways. Our analysis of the resulting flows of information motivates a framework that captures the series and sequence of activities through which organizations create value from information: the IoT Information Value Loop (IVL) (see figure 2).

The IVL is initiated through an action. Measurement of the state or behavior of things in the physical world gives rise to (creates) information that is subsequently communicated, aggregated, and analyzed (passing through the stages in the IVL) in order to inform future action. In general IoT contexts, the value of information varies depending on attributes related to its magnitude, risk, and time.19 Thus, it is important to be strategic in creating and/or controlling the flows of information enabled by evolving digital technologies. Here companies will always need to decide where to play and how to win.

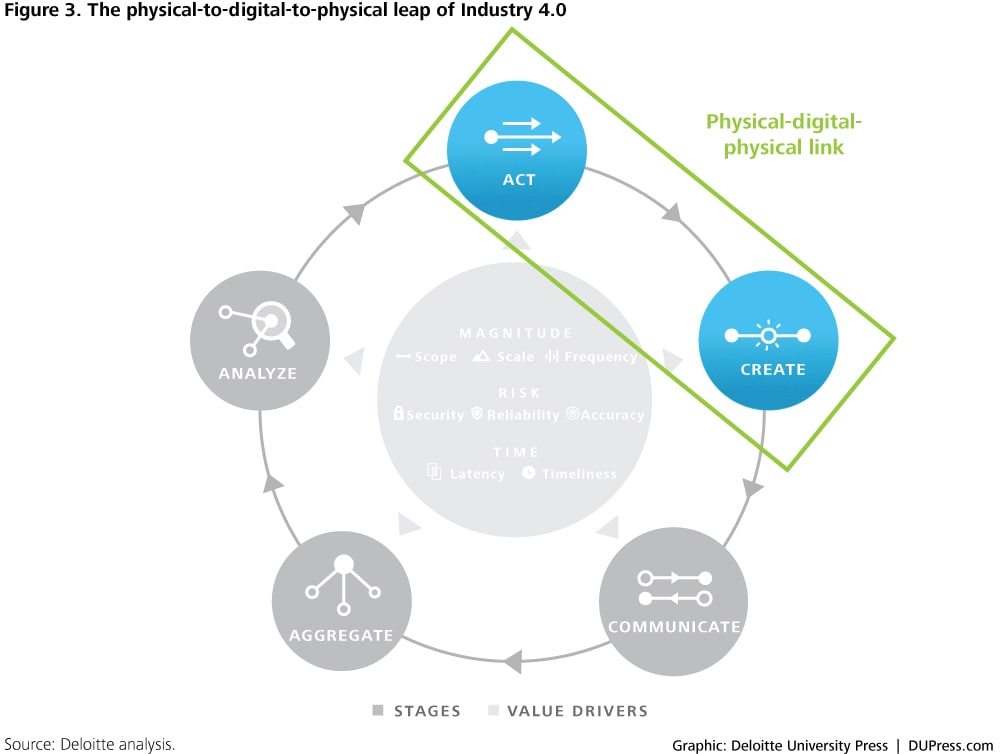

The Industry 4.0 concept incorporates and extends the IoT at the nexus of the act and create stages of the IVL—namely, the physical-to-digital and digital-to-physical leaps that are somewhat unique to manufacturing processes (figure 3). It is the leap from digital back to physical—from connected, digital technologies to the creation of a physical object—that constitutes the essence of the Industry 4.0 concept.20 It is here that we will focus our analysis.

Industry 4.0 represents an integration of IoT and relevant physical technologies, including analytics, additive manufacturing, robotics, HPC, artificial intelligence and cognitive technologies, advanced materials, and augmented reality,21 that complete the physical-to-digital-to-physical cycle.

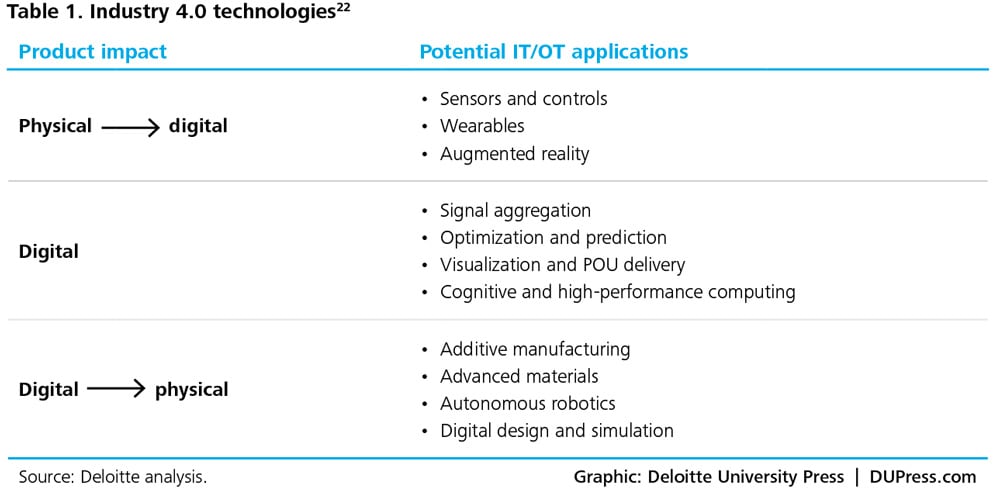

Manufacturing leaders have the opportunity to develop improved operations strategies and to realize key business objectives based on the technologies they may choose to employ at various points in the manufacturing value chain. Some of the technologies that encapsulate the physical-to-digital-to-physical reach of Industry 4.0 are listed in table 1.

For further information about these and other advanced, connected technologies, please visit the Deloitte University Press series:

- Internet of Things: http://dupress.com/collection/internet-of-things/

- Additive manufacturing: http://dupress.com/collection/3d-opportunity/

- Analytics: http://dupress.com/collection/analytics-emerging-technologies/

- Cognitive technologies and artificial intelligence: http://dupress.com/collection/cognitive-technology/

Integrating the digital and the physical to achieve business objectives

Even as we explore the ways in which information creates value, it is important to understand value creation in manufacturing from the physical perspective. Creating value in the form of products and services gave rise to the notion of a manufacturing value chain: the series and sequence of activities through which an organization transforms inputs into outputs, and ultimately sells, delivers, and continues to support those outputs for customers. Note that, in contrast to the IVL, the manufacturing value chain is generally perceived to be linear, befitting its focus on the production of physical objects. We posit that by augmenting the value chain with Industry 4.0 technologies, information generated in various stages can inform other points, making the structure—while still linear—far more dynamic and, from an information perspective, a circular feedback loop.

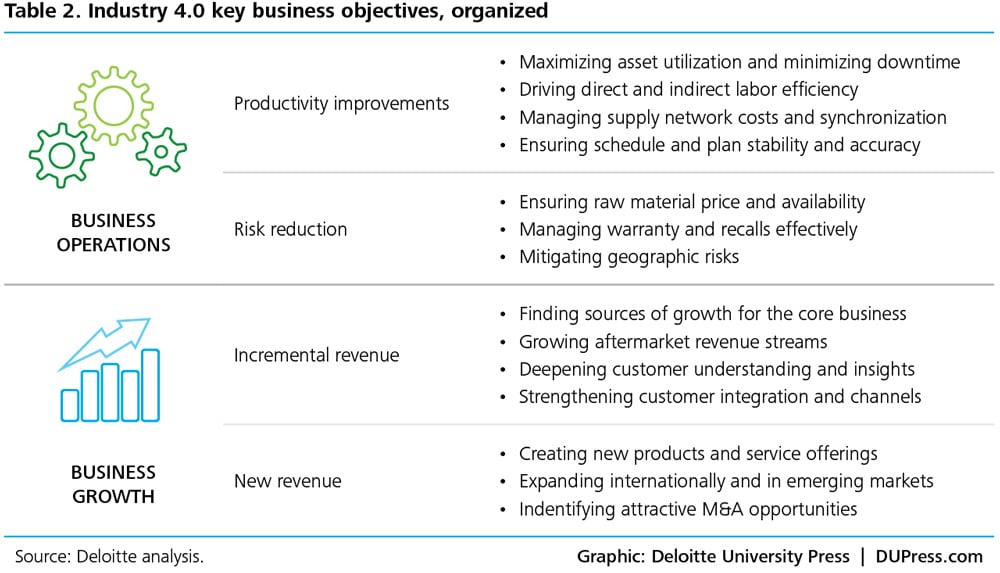

Throughout the manufacturing value chain—from design and development to manufacture, sale, and service—business outcomes may emerge from the integration of IT and OT. Broadly speaking, we identify two business imperatives for manufacturers: operating the business and growing the business. Within these imperatives exist four core business objectives: productivity, risk reduction, incremental revenue, and new revenue. Myriad sub-objectives can fall under these categories (see, for example, table 2) that define the tactical approaches for managers to deliver value. Some, as we will discuss, can be addressed more readily through Industry 4.0 technologies; others can be achieved via more traditional methods.

Depending on where a manufacturer’s focus lies, it may pursue different opportunities within the manufacturing value chain. Indeed, both operating and growing the business map to different areas across the value chain. The prioritization of operations versus growth can serve as a guide as to which areas of the value chain merit the greatest attention.

For example, the first stage of the manufacturing value chain focuses on R&D and design, areas where Industry 4.0 technologies can accelerate and improve the design cycle, reducing time to market, and linking design to smarter products. Stakeholders most impacted by Industry 4.0 at this stage will likely be design engineers. At the other end of the value chain, new or incremental revenue—and business growth—can emerge from Industry 4.0 applications in the form of new and improved products and services. Stages at the middle of the value chain—planning, factories, and support—can use Industry 4.0 technologies to transform operations in various ways. Each of these uses of connected technologies includes its own IVL, in which manufacturers may encounter bottlenecks that may impede optimal outcomes. In these cases, it is important to identify technology solutions that can address each bottleneck, a topic we will explore at length in subsequent research.

Figure 4 shows six of the transformational plays that we have identified in our work related to Industry 4.0.

Here, we will explore each of these transformations to better understand the stakeholders and processes they most impact, and to offer use cases to promote better understanding of potential business value.23

Growing the business: Applying Industry 4.0 to build revenue

On either end of the manufacturing value chain, Industry 4.0 technologies can enable business growth. In particular, in the R&D and design, sell and deliver, and support stages, various physical-to-digital, digital-only, and digital-to-physical connections can transform engineering, customer interaction, and even the products themselves.24

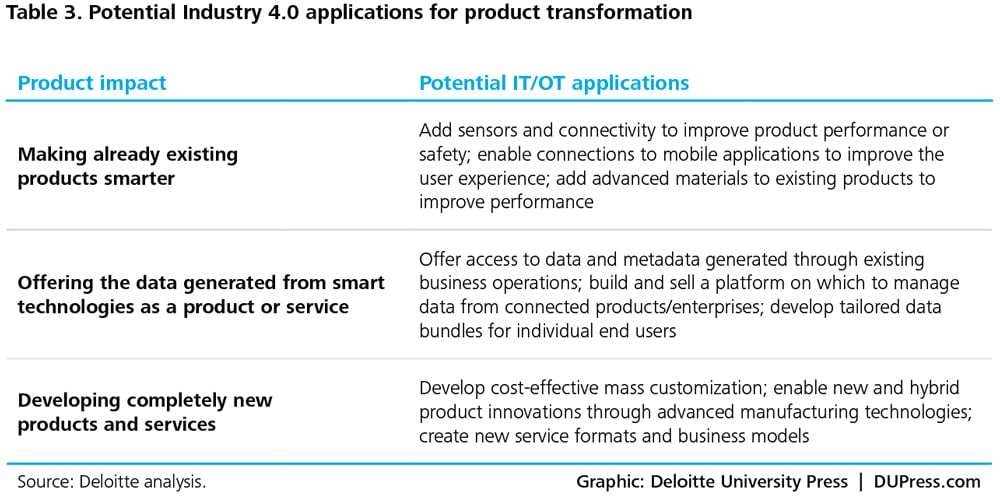

Products: Creating smart products and services

Products in the age of Industry 4.0 run the technological gamut. The use of IT such as sensors and wearables and OT such as advanced manufacturing in the form of additive manufacturing, advanced computer numerical control, and robotics can enable product improvements in various ways (table 3).

Indeed, manufacturers are already using advanced OT (such as additive manufacturing) and advanced IT (in the form of scanning and embedded sensors) to create new products and improve upon old ones—delivering new levels of value to customers, along with new data products.

In one such example, OT and IT are being used in the mass customization of medical implants—devices needed by many individuals, but each with its own unique geometry and circumstances. At its 3D Medical Applications Center (3D-MAC), Walter Reed National Military Medical Center manufactures prosthetics by scanning the patient’s individual anatomy, enabling it to use additive manufacturing technologies to fabricate a fully customized fit.25

Similarly, OT and IT are enabling the production of customized helmets for contact sports. Researchers at the University of California, Los Angeles (UCLA), and Architected Materials are developing technologies to improve the protection offered by football helmets. By taking a 3D scan of players’ heads, helmets can be built to individual measurements.26 Embedded sensors are also used to detect the magnitude of impacts and report the data via an app—creating a completely new data product.27

Similar applications can be envisioned in business-to-business settings where the application of scanning/digital design, digital manufacturing, and field sensors will change the value proposition for industrial products. Indeed, General Electric’s power and water division is implementing digital twinning for the parts it supplies to power plants, wind farms, and electrical grids. Using sensors and controls, signal aggregation, and HPC, it is developing real-time digital simulation models of its real-life, physical parts operating within the plant. These cloud-based “digital power plant” models will enable plant operators to know the condition of parts, optimize power, determine the right time for machinery maintenance, and simulate various conditions to understand how they might impact the plant.28

Customers: Connecting and integrating in new ways

Data and information gathered through intelligent products and services can enable manufacturers to better understand their customers. Indeed, customer experience in the age of Industry 4.0 is driven not just by the physical object, but also by the data and information—and analytics—that make the customer’s interaction with that object more transparent and impact the customer-manufacturer interplay in various ways (table 4).

The information gathered from customers can be used to price and sell products and services more intelligently. For example, Deutsche Bahn AG, a European cargo rail consortium, integrated its extensive network of railway monitoring sensors with its customer ordering and billing database and added in additional real-time data around traffic and capacities to generate intelligent pricing models customized to a client’s needs and the current conditions.29 For its part, rideshare service Uber uses data from its drivers and customers to power an algorithm that calculates surge pricing, a dynamic pricing model meant to adjust prices upward when demand is high.30

IT and OT can potentially drive product and service improvements, as well as more intelligent asset utilization. Further, this data can work both ways: Not only can information be sent to the manufacturer and its partners, but also back to the customer via smart apps that offer user-experience enhancements. In one such example, a pharmaceutical company considered integrating smart monitoring sensors into its inhaler product line to gather real-time data, with the goal of analyzing it and providing insights to both patients and their physicians.31

Engineers: Accelerating innovation and design cycles

At the start of the manufacturing value chain, products are developed and designed. Various Industry 4.0 technologies—notably OT technologies such as additive/advanced manufacturing and IT, digital tools such as CAD, and simulation—can come into play to impact the process in several key ways (table 5).

The use of digital-to-physical manufacturing technologies such as additive manufacturing in rapid prototyping can speed up the design process as well as the production of end-use products, thus reducing supply chain dependencies.33 Ford estimates that its use of rapid prototyping during vehicle design can save it weeks, with additively manufacturing prototypes taking hours to fabricate rather than the 4 to 6 weeks taken by typical machine tooling approaches, bringing automobiles to market months earlier.34 Using advanced manufacturing technologies can also enable engineers to optimize manufacturability, as they can evaluate product design options based on the eventual assembly process.35

John Deere uses augmented reality to allow customers to test and provide feedback on early design concepts, so that it can adjust and redevelop designs.

Industry 4.0 technologies can drive improved engineering effectiveness via digital design and simulation. This can take the form of virtual product development and testing. John Deere uses augmented reality to allow customers to test and provide feedback on early design concepts, so that it can adjust and redevelop designs. The company estimates that having its engineers use virtual reality simulations to design the air-handling subsystem on its JD 7760 cotton harvester reduced the design cycle time from 27 months to 9 months, and reduced design costs by more than $100,000.36

These tools can also take the form of open source innovation, allowing freelance design to improve products through open sharing of intellectual property. Local Motors, for example, crowdsources many designs among customers and enthusiasts in the community, holding design competitions and allowing clients to have a strong hand in the design of its cars. The company takes an open approach to intellectual property, and maintains that doing so fosters innovation and collaboration.37

Operating the business: Using Industry 4.0 technologies to increase productivity and reduce risk

Industry 4.0 technologies also enable improved operations. In the “plan,” “source,” and “make” stages of the value chain, various physical-to-digital and digital-to-physical connections can transform planning, support and factory operations.

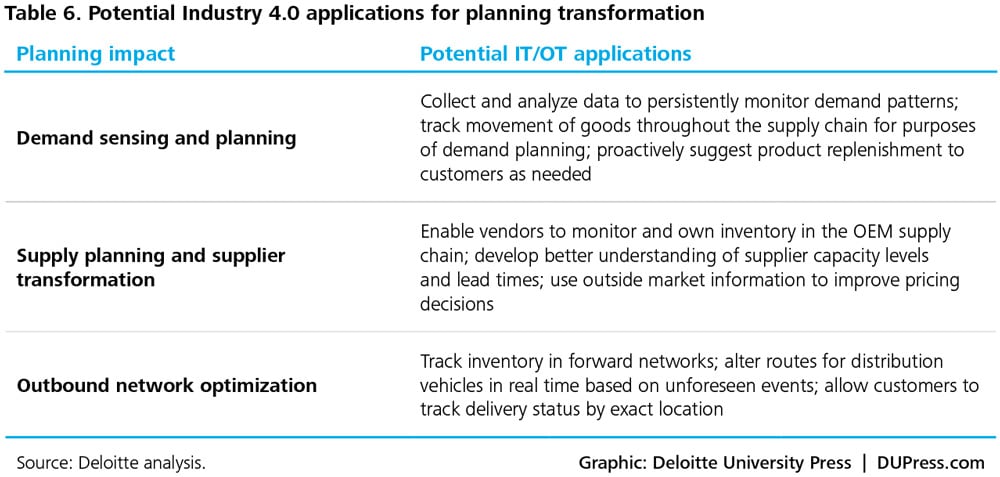

Planning: Predicting changes and responding in real time

When planning for production, manufacturers often encounter a host of uncertainties across the manufacturing value chain. IT and OT can support several transformations in this area (table 6).

Demand sensing and planning using IT (for example, sensors, signal aggregation, optimization, and prediction) enable manufacturers to gather data throughout the value chain. Data can be analyzed to uncover patterns, track movements, and, ultimately, understand what customers want, and where—so they can better plan to provide it at the right time and place.

For example, Ridgeline Pipe Manufacturing, a manufacturer of polyvinyl chloride (PVC) pipes, dealt with constantly changing customer demand and short lead times. The company needed to anticipate and plan in the face of uncertain demand, rapidly adjust to unforeseen changes, and reduce production changeover time. Using legacy systems, waste, costs, and inflexibility had risen to unacceptable levels.38 The company adopted a flexible production platform, in which automated production controllers managed the manufacturing equipment while providing access to information on diagnostics and performance.39 The system also analyzes production data to offer predictive failure analytics.40

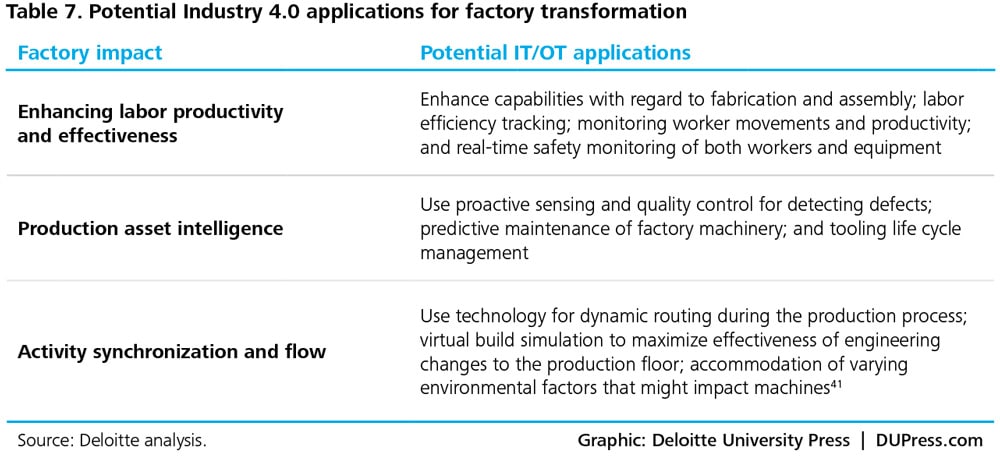

Factory: Creating a digital link between OT and IT

Perhaps no other segment better encapsulates the physical-to-digital transformation inherent in Industry 4.0 than the intelligent factory. The industry 4.0-enabled factory utilizes physical-to-digital technologies such as augmented reality, sensors and controls, wearables, and the Internet of Things to track movement and production, monitor quality control, and manage the tooling life cycle, among other capabilities. In this way, Industry 4.0 on the factory floor can enable enhanced capability effectiveness, production asset intelligence, and activity synchronization and flow (table 7).

Industry 4.0 technologies can enable safer conditions for workers, enhancing labor productivity and effectiveness. Joy Global, a mining equipment manufacturer, added about 7,000 sensors to its remote-controlled extraction device, enabling it to mine in extremely deep mineshafts—areas often dangerous to workers who typically perform the work.42 Similarly, Boeing uses a positioning system to pinpoint worker location and assess the status of their safety harnesses, improving worker safety.43

Beyond labor productivity and safety, IT/OT can transform product asset intelligence. Harley Davidson, for example, uses smart systems to detect defects during production processes. A smart system in its York, Pennsylvania, plant monitors equipment performance and initiates action autonomously.44 Upon detection of measurements beyond acceptable ranges, the machinery is automatically adjusted, preventing malfunctions.45

Learning the causes behind a failure can enable manufacturers to more effectively address the root of the problem, rather than its symptoms.

Beyond avoiding proactive quality control, IT can impact activity synchronization and flow. With its Plant Floor Controls Network, General Motors uses sensors to measure humidity levels in its plants and direct physical action on the shop floor based on this physical-to-digital information cycle. Should levels in one area rise too high, vehicle bodies are automatically re-routed to less-affected areas, reducing the need for repainting and avoiding downtime.46

Support: Automating and scaling aftermarket operations

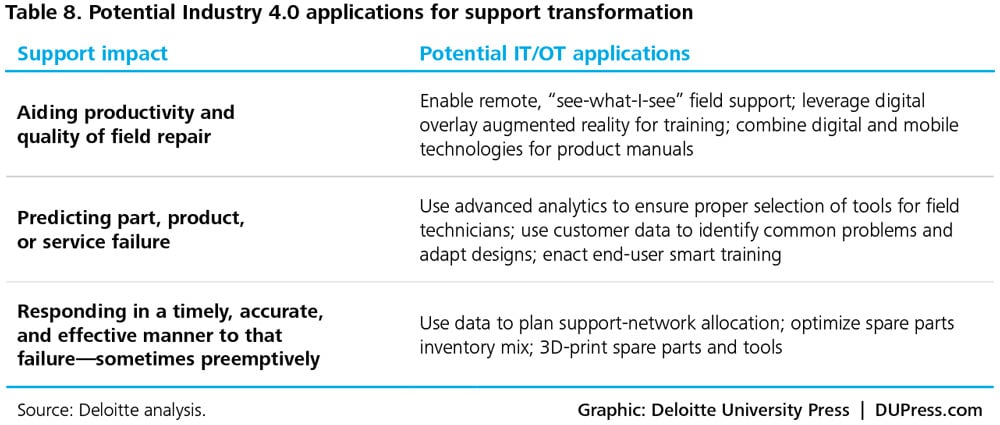

Once a part or product has been developed, manufactured, shipped, and sold, Industry 4.0 technologies can impact support in at least three key ways (table 8).47

Learning the causes behind a failure can enable manufacturers to more effectively address the root of the problem, rather than its symptoms. For example, Schneider Electric examined both maintenance and historical data collected over the course of one year for a 110 MW steam model turbine which had required regular, ongoing maintenance for an escalating series of ongoing breakdowns, realizing that technicians had been addressing symptoms rather that root causes for a quality issue. Analysis enabled Schneider to address the root cause—thermal expansion problems—before they led to “symptoms”—bearing vibration—that caused equipment shutdowns. The company estimates that predictive maintenance offers millions of dollars in potential savings along with far fewer days of equipment downtime.48

In another predictive analytics example, Caterpillar is partnering with a company named Uptake, analyzing data gathered through telematics devices in its machinery to predict failures and engage in proactive repair. The companies see future opportunities to monetize this capability by offering new data products and services to customers.49

When responding to field failures, wearables and augmented reality can allow remotely located technicians to walk users through maintenance procedures. An industrial equipment manufacturer, for example, faced challenges as it expanded its operations to China, including increased operational costs and more frequent downtime of machinery. These issues were, in large part, rooted in a shortage of seasoned talent to train employees within the new manufacturing facilities. The manufacturer piloted a smart-glass, wearable technology so that remote experts could see alongside the equipment operators in the facility, and offer step-by-step instructions and training. These improvements were also accompanied by risk reductions in the overall production process due to better quality management.50

Looking ahead

Companies implementing or planning to implement Industry 4.0 practices can face several challenges that relate to the management and integration of IT and OT. While some have an organization-level impact, other challenges exist at the broader, ecosystem level. These challenges are heightened as connected technologies evolve at a rapid pace.

- Talent and workforce—In the process of trying to integrate IT and OT through the use of Industry 4.0 practices at the organization level, companies often face a shortage of talent to plan, execute, and maintain new systems.51 The number of engineers trained in handling unstructured data and big data tools—crucial for the type and scale of data generated by connected systems—is gradually increasing, but still falls far short of anticipated demand.52 The challenge extends to the shop floor as well. With vast experience in conventional manufacturing, many leaders feel uncomfortable with advanced manufacturing: They simply have less experience with the properties and behavior of materials, as well as the technologies and methodologies that use them. This can result in a tentativeness or unwillingness to adopt new approaches.53 We believe these leaders should adopt a proactive stance toward workforce development when considering Industry 4.0 applications. They may include partnering with outside organizations, high schools, technical colleges, and universities to develop an ongoing flow of workers versed in and attracted to advanced digital and physical manufacturing technologies.

- Standards and interoperability—From a broader, ecosystem-wide perspective, many of the systems underpinning Industry 4.0 applications are proprietary and can present integration challenges. A lack of interoperability poses a significant challenge for full adoption of Industry 4.0 technologies.54 Peer consortiums, industry associations, and government bodies are working to establish competing sets of standards, but it is currently unclear which will prevail.55 Managers should work with partners to stay current on evolving standards in order to maximize the value delivered by Industry 4.0 investments.

- Data ownership and control—As more stakeholders across the value chain become connected, questions will arise within the ecosystem regarding who owns the data generated and how to ensure appropriate privacy, control, and security.56 These questions grow thornier as suppliers and manufacturers become increasingly intertwined. Suppliers and vendors throughout the supply chain—right up to end-use retailers and customers—could potentially stake a claim on the data generated within their particular sphere, and perhaps even beyond. As this information can be used to drive product improvements, use of components, and efficiencies within the supply chain, it is particularly valuable. Managers should therefore pay close attention to the covenants they sign related to data ownership and access. Identifying and controlling bottlenecks in the flow of data is likely to yield important opportunities for value creation and capture.57

- Security—In addition to data ownership, security is often cited as a concern in implementing Industry 4.0 practices.58 Complex cryptographic algorithms might improve the security of devices, but this often comes at the cost of higher power consumption. This security-power trade-off becomes more important as deployments scale. Retrofitting old systems to new Industry 4.0 applications may also increase security risks, as the old systems were not designed to be connected in this way. In order to manage security risks, companies need to secure their systems, be vigilant to avoid new risks, and be resilient to limit the damage and restore operations.59 As a result, managers should adopt a proactive stance toward cybersecurity. When it comes to planning for Industry 4.0, the time to address security issues is up front, rather than as a follow-on task.

Conclusion

Despite the challenges, there is little doubt that penetration of Industry 4.0 concepts in companies’ manufacturing processes and supply chains will grow. Information flow, advanced technologies, and materials—in other words, the IT and OT that comprise Industry 4.0—make it possible to manufacture entirely new things in entirely new ways and revolutionize supply chains, production, and business models. It is difficult to overstate the importance of the interplay between IT and OT. Business leaders should not consider applications of one without the other, and in order to realize the full benefits of Industry 4.0, they must be truly integrated—working together to inform each other.

As the integration of information technology and operations technology evolves, manufacturers will need to assess not only where they are but where they wish to be—decisions that will dictate the types of information they will need to gather, analyze, and act upon. By integrating the information identified through the Information Value Loop, where the focus lies along the manufacturing value chain, organizations can understand which types of information will be most relevant to them as they seek to transform either their business operations, or growth, or both.

Effective use of information can in turn impact key business objectives such as business growth and business operations, and transformation can be possible across the value chain and its various stakeholders. The path to realization of Industry 4.0 involves a clear understanding of the ways in which the physical can inform the digital, and vice versa.

Deloitte Consulting LLP’s Supply Chain and Manufacturing Operations practice helps companies understand and address opportunities to apply Industry 4.0 technologies in pursuit of their business objectives. Our insights into additive manufacturing, IoT, and analytics enable us to help organizations reassess their people, processes, and technologies in light of advanced manufacturing practices that are evolving every day.