Industry 4.0 and distribution centers has been saved

Industry 4.0 and distribution centers Transforming distribution operations through innovation

13 September 2016

Warehouse-based stockpiling of inventory has been transforming into high-velocity distribution centers, which are increasingly considered strategic to providing competitive advantage. Industry 4.0 can aid the distribution center’s evolution, enabling adaptable, automated systems that can work with humans.

Recent years have seen the rise of connected technologies throughout the manufacturing and distribution value chain.1 This marriage of digital and physical systems—known as Industry 4.0—has paved the way for increasingly connected experiences that impact everything from product design and planning to supply chain and production.2 Beyond the processes of designing and producing goods, however, the technologies inherent in Industry 4.0 can also impact the manner in which finished goods are moved, warehoused, and distributed.

Beyond the processes of designing and producing goods, the technologies inherent in Industry 4.0 can also impact the manner in which finished goods are moved, warehoused, and distributed.

Industry 4.0 technologies enable warehousing facilities to adapt to significant changes in their business. The last several years have seen the migration away from warehouse-based stockpiling of inventory to high-velocity operations, pushing more products through the same physical assets while bringing down overall costs. Known as distribution centers (DCs) rather than warehouses, they are an important component of the supply chain infrastructure and are increasingly treated no longer as cost centers, but rather as strategic facilities to provide competitive advantage. As the need for greater order customization, shorter lead times, better quality control, reduced labor costs, and higher production output is increasing, adaptable advanced technologies are emerging as a solution to achieve these goals.

The use of advanced, connected technologies in DCs is not new. In the past, these technologies were mainly limited to automated systems used to increase material-handling productivity—systems that had to be kept separate from workers for safety,3 and that required high standardization of processes and products due to their lack of adaptability. This lack of adaptability—or “smartness”—meant that a great deal of upfront customization and programming was required to ensure proper functioning, as systems could not adapt easily to changing demands.4

Industry 4.0 technologies can help pave the way for the evolving DC, enabling automated systems to adapt to their environment and tackle tasks more efficiently, while working with humans. Technologies such as low-cost sensors, computer vision, augmented reality (AR), wearables, Internet of Things (IoT),5 robotic prehensility, human-robot safety, analytics, and high-performance computing—all inherent in Industry 4.0—are being used to enhance existing automation. At the same time, they are also enabling new types of smart automation that can help transform DC operations.

In this paper, we examine the evolution in DC functionality and explore applications of emerging Industry 4.0–driven technologies to enable a more flexible, adaptive, and productive DC. Finally, we consider the ways in which these new technologies will impact talent needs, business strategies, and data management for DCs.

Digital manufacturing enterprises and Industry 4.0

The Industry 4.0 technologies that enable digital manufacturing enterprises (DME) and digital supply networks (DSN) involve the integration of digital information from many different sources and locations to drive the physical act of manufacturing and distribution. This integration of information technology (IT) and operations technology (OT) is marked by a shift toward a physical-to-digital-to-physical connection. Industry 4.0 combines the IoT and relevant physical and digital technologies, including analytics, additive manufacturing, robotics, high-performance computing, artificial intelligence and cognitive technologies, advanced materials, and AR,6 to complete that cycle and digitize business operations.

The concept of Industry 4.0 incorporates and extends the IoT within the context of the physical world— the physical-to-digital and digital-to-physical leaps that are somewhat unique to manufacturing and supply chain/supply network processes (figure 1). It is the leap from digital back to physical—from connected, digital technologies to the creation of a physical object—that constitutes the essence of Industry 4.0 that underpins DME and DSN.7

Even as we explore the ways in which information creates value, however, it is important to understand value creation from the perspective of the manufacturing value chain. Throughout the manufacturing and distribution value network, business outcomes may emerge from the integration of IT and OT via Industry 4.0 applications. For further information, visit Industry 4.0 and manufacturing ecosystems: Exploring the world of connected enterprises.8

The evolution of automation: New demands on distribution centers

Automation has long provided cost-effective solutions for meeting market needs, such as space savings and improved productivity. For example, automated depalletization and palletization processes, as well as pallet or case storage, are increasingly being adopted by DCs because they offer very low costs for high volume and standardized products.9 Likewise, dock unloading and loading can also be fully supported by automated equipment, although it requires standardized trailers, products and containers, and high throughput to ensure economic viability.

Historically, however, automation in DCs has been limited, allowing only for similar product shape and type handling and requiring high levels of standardization, as in the examples described above. Additionally, many robots and automated systems have been kept separate and cordoned off from human workers due to safety concerns, limiting the ways in which these tools could streamline and improve warehouse processes.10 Thus while automation could speed processes and lower costs, it could only do so under highly prescribed conditions.

At the same time, the ways in which DC facilities are being used are changing. This evolution is, in turn, driving a growing need for smarter, more adaptable automation. DCs are expected to accommodate a shorter, faster supply chain by supporting shortened product life cycles, and to move products as quickly as possible, so much so that DCs now are also known as “throughput centers.”11 They are increasingly expected to offer critical supply chain capabilities such as omnichannel capabilities, reverse logistics, return handling, and value-added services ranging from product assembly to product labelling, repacking, and repair. In addition, DCs are also increasingly expected to store a broader range of products with specific requirements in terms of dimensions, temperature, fragility, and safety obligations.12 While this increases the range of products that can be handled, it also increases the resources needed to handle them to support the value-added services.

E-commerce fulfillment centers perhaps best typify the above challenges: They experience fast-enough throughput to justify automation, but they also must house a wide variety of extremely diverse products and endure volatile seasonal demand. Thus smart automation should be highly flexible in terms of product handling, as well as be able to adapt to variable demand and to interact with other systems and human employees during peak demand periods that may require additional resources to handle increased workloads. These pressures, in turn, make the facilities more complex and their actions more labor-intensive.

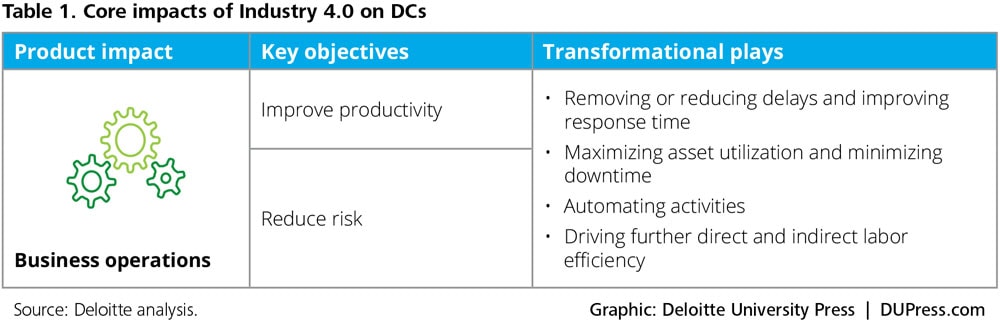

As the evolving needs of DCs move beyond the capabilities of simple automation, the risks—of damaged, expired, or lost products, too-slow processing, and other inefficiencies—and productivity challenges grow. Industry 4.0 technologies can allow DCs to evolve to meet the new demands placed upon them, while improving productivity and reducing risk through much more reliable and consistent productivity and output (table 1).

As the evolving needs of DCs move beyond the capabilities of simple automation, the risks—of damaged, expired, or lost products, too-slow processing, and other inefficiencies—and productivity challenges grow.

Going from automated to truly “smart”: Using Industry 4.0 technologies to adapt to changing DC demands

Meeting the objectives and enabling the benefits described in table 1 necessitates the implementation of intelligent monitoring and control technologies capable of managing and optimizing supply chain networks and adapting to the new demands placed upon DCs. Advancements in Industry 4.0 technologies have made it possible for DCs to leverage both standalone and integrated automation and other robotic technologies for truly intelligent systems—while working safely alongside humans.13

Many new Industry 4.0–driven technological advancements (such as vision picking) are evolutions of current technologies (such as voice picking) deemed to be standard capabilities in most technologically current DCs. Several other, more novel technologies are in the development phase and may be only a few years away from more widespread use. Each, however, harnesses smart Industry 4.0 technologies, such as sensors, artificial intelligence, AR, and autonomous vehicles, to create a more adaptable facility. Notable technologies include:

- Vision picking as an extension of voice picking via AR

- Adaptive robots and connected automated guided vehicles

- Semiautonomous, flexible machines for value-added services

- Fully automated picking and quality assurance to adjust to rapid changes in demand

- Next-generation distribution operation systems

- Smart, automated facility management for greater efficiency

- Safety enhancements and modularity

From voice picking to vision picking via AR

Voice picking

Also known as voice-directed warehousing, voice picking uses speech recognition to direct warehouse workers where to go and how to find desired objects in a DC. Using voice picking rather than scanning barcodes, completing paper documentation, or typing in a computer system frees up workers’ hands and enables them to work more efficiently and quickly.14 Voice-centric solutions have helped DC operations redefine and streamline processes and further reduce operational costs. Further productivity gains achieved from voice picking include improved accuracy in processes such as replenishment, processing, and loading. Voice picking can also improve worker flexibility, enabling them to condense tasks and work across multiple warehouses to cope with seasonality.

Vision picking

Vision picking represents an evolution in the process toward less standardized activities. Vision picking uses AR to overlay graphical images over workers’ line of vision, enhancing the view of physical objects with additional information and providing digital information about physical objects.15 Vision picking often also provides a real-time user interface capability with objects and digital devices and can be used within warehousing operations, transportation optimization, last-mile delivery, and enhanced value-added services.

Although AR and vision picking are in relatively early stages of adoption in logistics, the technology could offer significant benefits. It can enable users to find objects faster and more accurately, reducing costs and lowering inefficiencies. DHL and Ricoh, for example, tested the devices in a Netherlands warehouse and observed a 25 percent increase in picking efficiency during the testing period.16 The process is also hands-, scanner-, and paper-free, and has the potential to reduce training time for new employees and bridge language barriers with staff.17 It can also reduce the need to segregate different types of products as well as help identify the precise positioning of one case among many. This can greatly impact warehouse layout, and receiving and putaway productivities.

Several companies are in the late field-test phase of mobile AR tools, such as head-mounted display cameras.18 Some of these vision-picking systems offer real-time object recognition, barcode reading, indoor navigation, and integration of information with the warehouse management system (WMS).19 Vision systems may also offer features such as digital picking lists in the picker’s field of vision via augmented-reality-enabled glasses that show the best route for completing the task, thus reducing total travel time. The system’s image recognition software could use automated barcode scanning capabilities to check whether the worker has arrived at the right location, and then guide the worker to the shelf with the right item. The worker can then scan the item and register this process simultaneously in the WMS, enabling real-time stock updates. 20

Adaptive robots and connected automated guided vehicles

Although assembly lines and automation worked fine for repetitive tasks, changes in shopping behaviors, increasingly complex demands on DCs, and the wide variety of objects contained in a facility necessitate a smarter, more flexible solution. Typically, automated guided vehicles (AGVs) are used to transport goods throughout the warehouse by following markers or other navigation guides.21 These advanced sensor technologies, coupled with connectivity, enable robots to adjust to their surroundings and even correct for errors they may encounter, establishing a digital record about the physical environment and using it to generate how they move about the physical space.

Amazon Robotics, formerly Kiva Systems, has designed robots to move racks irrespective of product size and shape of objects within the racks. The robots—or pods—are controlled by a centralized computer using a secured Wi-Fi network for communication. They use infrared technology for obstacle detection and floor cameras to read QR codes on the ground to determine their location and direction. The key to the robotic warehouse’s success is not the robot but the brain behind the system; robots can learn, self-adjust, and “crowdsource” (aggregate and share data from other pods to troubleshoot issues they may encounter).22 Amazon uses the robots in its DCs, stating that they improve productivity and jobs within its warehouses.23 By the second half of 2015, Amazon had deployed more than 30,000 of these robots across 13 facilities.24 The Amazon Robotics system can also point workers to objects within the factory, speeding picking processes, and can self-organize the warehouse.25 While the Amazon Robotics system is proprietary, similar technologies are available more broadly, such as those that can pick individual items from shelves or work alongside humans, gathering the objects they pick manually.26

Another company has autonomous mobile robots, called “bots,” that use a mix of sensors and wireless communications to autonomously move cases and totes around without colliding with each other.27 These autonomous machines can be reassigned to different tasks as required. Their software guides them within a configurable and dense storage structure while maximizing the use of each bot. The bots are not only leveraged for tasks such as transportation of products to and from storage, but also for moving products between different processing areas, including to fully automated robotic depalletization and palletization areas.

Semiautonomous, flexible machines for value-added services

Several companies are also working on automating outbound packaging (bag or box), shipping, and gift wrapping for unit picking. One sensor manufacturer has designed universal final packaging machines using sensor detection technology with automatic format adjustment capabilities.28 The sensors embedded in these machines can detect changes in product characteristics such as size and shape, and automatically notify the control system to reset the packaging configuration to ensure the correct packing box is used. This smart, automated process reduces the time required to manually change configuration, adjust the machine, and put the machine back into operation. Additionally, in cases of incorrect classification, the product is automatically rejected without having to stop the system, reducing productivity slowdowns. In these cases, sensors provide digital information about physical conditions; that digital information enables the machine to adjust its physical movement accordingly. The sensors also provide data to enable predictive maintenance.

Fully automated picking and quality assurance to adjust to rapid changes in demand

While many tasks, such as visual recognition, are still better done by humans, current developments in advanced, automated technologies may begin to tip the balance toward machines. For example, companies such as Dematic and Invata Intralogistics are working on AS/RS29 multi-shuttle technology targeted to DCs experiencing rapid growth and changes in product demand profiles. The system is flexible and can adapt to almost any shape or size building, including existing buildings with lower ceilings.30 Another organization is working on fully automated picking with its Pick-It-Easy Robot.31 The device has image recognition and processing capabilities, is highly flexible, and can accept almost any dimension of source containers. The company is also working on developing receiving and order-picking validation technology, which can perform full checks of articles picked automatically, ensuring higher inbound processing accuracy.

While many tasks, such as visual recognition, are still better done by humans, current developments in advanced, automated technologies may begin to tip the balance toward machines.

Next-generation distribution operations systems

The increasing focus on omnichannel capabilities places great pressure on DCs to keep up with a higher number of orders, including rapid processing, to improve economies of scale and ensure high throughput. These throughput pressures are paving the way for the emergence of new modular technologies that bridge real-time, automated materials handling systems on the floor (including warehouse control software, programmable logical controllers, and electrical systems) and complex transactional systems that manage orders, customers, and inventory (including WMS and enterprise resource planning systems).

These technologies, known as warehouse execution systems (WES), optimize warehouse performance by constantly monitoring automated assets and balancing them through changes in order fulfillment requirements and labor resources.32 WES capabilities span from higher-level functions such as order processing and wave management,33 down to more traditional WCS-level functions such as routing and controlling automated equipment. One critical function is called waveless (pull-based) processing, where WES constantly receives order requirements from host systems and releases the related work to the optimal machine and labor resources, rebalancing the workload if processing in one zone is moving faster than in other zones.34 In this way, digital information drives and adjusts physical movement.

Smart, automated facility management for greater efficiency

Industry 4.0 technologies are also finding applications within DC facility management. For example, complex and intelligent management systems can be remotely controlled to closely monitor environmental features such as humidity or HVAC, and to maximize energy efficiency. Sensors can be used by IoT applications to gather data about operating conditions. These data points are then analyzed to proactively manage buildings to better ensure efficiency. Those technologies also enable the identification of different layers of the building to analyze possible interdependence between systems, services, and operations. IoT applications and cloud-based devices are expected to ease building management.35

Safety enhancements and modularity

Safety enhancement is a crucial feature of robot actuation and sensors, enabling highly automated technologies to operate in an environment in which human and robots can work together. Embedded sensors automatically detect when a human enters or approaches their zone and immediately adjust robots’ activity to promote human safety. Humans and robots can then work in collaboration in DCs. Those technologies maximize machine efficiency while allowing for more flexible operations, and digitally analyze data to adjust physical movement and improve safety.36

Moreover, Industry 4.0 eases programming of automation equipment with capabilities such as over-the-air updates. It also paves the way for modularity, allowing robots to self-reconfigure to perform different tasks and to adapt to new conditions.37 Robots can thus evolve in a constantly changing DC environment by dynamically tailoring themselves to various tasks and being redeployed on different duties as needed, without more programming or integration. They can also adapt to hazardous environments and handle items of various sizes and positions.

Integrating the digital and the physical in the warehouse: DC transformation has ripple effects across the supply chain

Each technological advancement has the potential to transform the DC in meaningful ways: making it more flexible, efficient, competitive, and increasing the role it plays along the manufacturing and distribution value chain. Industry 4.0–driven technologies such as those described here can be leveraged to transform the supply chain; with respect to DC, Industry 4.0–driven transformations to supply networks and logistics are more broadly relevant. Yet it is important to note that DC operators can leverage smart, automated technologies to realize additional benefits, using information from throughout the supply chain to inform DC operations, and vice versa.

Below, we discuss the impacts of Industry 4.0–driven transformations in planning and inventory, and supply networks and logistics, as well as their impact on DC growth and innovation.

Information shared inside the organization and across the chain

Within the supply chain, Industry 4.0 technologies can enable organizations to better plan for demand and more accurately manage inventory within the DC. This is due, in part, to the higher traceability of products enabled by connected technologies.38

Industry 4.0 technologies can also have an impact beyond the confines of the facility, by collecting large amounts of operational data and making it available to the up- and downstream supply chain. This can enhance operations planning, provide valuable product information for upstream R&D and planning, or even allow business intelligence programs to guide future improvements in the DC itself.

Industry 4.0 technologies can also have an impact beyond the confines of the facility, by collecting large amounts of operational data and making it available to the up- and downstream supply chain.

Procurement

Industry 4.0 technologies can also impact procurement as well, via the ability to automatically compare characteristics of all products received such as quantities, weight, dimensions, and colors, with expected characteristics (based on purchase order data) in order to control for discrepancies. In the case of unexpected differences, the entity in charge of compliance can be alerted, or revised characteristics can be automatically updated in inventory management systems to ensure accuracy. Solutions such as automated depalletizing cells can manage receiving processes and automatically communicate accuracy-related issues regarding received quantities, dimension, UPC, weight, color, or condition of the product to suppliers, who can make adjustments as needed or confirm shipments.

Supply planning and optimized resource allocation

Since Industry 4.0 technologies offer the promise of gathering and exchanging data through the cloud, they can enable real-time sharing of information across supply chain stakeholders.39 As a result, the accuracy of customers supply and lead time planning can be improved due to better visibility of inventory levels within DCs. As more smart devices exchange information, improved data flow and activity synchronization, such as order status updates to logistics providers and customers, can help supply chain stakeholders better allocate resources to critical tasks, maximizing the efficiency of supply chain.40 Additionally, data generated through Industry 4.0 technologies can be used for pricing optimization, accounting, and billing.41

Adapting to a brave new world: Making the transition toward increased DC automation

The move toward smarter, more flexible systems and advanced technologies inherent in Industry 4.0 also necessitates a shift within the organization itself. While automation technologies can be configured to match the organization’s goals, the organization may likewise need to be reshaped to maximize gains from automation. Most specifically, the organization may experience changing talent needs due to the need for a different spectrum of qualifications and a growing need for more sophisticated data management capabilities.

Changing talent needs

Despite the developments in Industry 4.0 technologies for DCs and the increasing development and use of automated technologies, total automation of DC operations seems unlikely in the foreseeable future. While it would be technically feasible to automate day-to-day operations in an ever-increasing number of situations, full automation is seldom the most cost-effective solution, especially when operations are not always the same day after day. Peak inventory or throughput periods, one-time value-added tasks, and product replacement periods are still more effectively addressed with human intervention.

As the level of automation increases in distribution centers and overall labor is reduced, the need for highly trained professionals to manage these highly automated operations, such as IT engineers, maintenance employees, and operations analysts, may increase. These roles have consistently been ranked as some of the most difficult to fill by employers globally in the past 10 years, with talent shortages mainly due to the lack of available applicants (35 percent), lack of technical competencies (34 percent), or lack of experience (22 percent). These talent shortages are particularly notable among DCs located in sparsely populated geographic areas, where there may be a smaller talent pool.42 Organizations may need to consider approaches to reskilling or upskilling current workers, or training local talent to meet the needs of the DC.43

As the level of automation increases in distribution centers and overall labor is reduced, the need for highly trained professionals to manage these highly automated operations, such as IT engineers, maintenance employees, and operations analysts, may increase.

A growing need for data management

A continuous increase in the number and complexity of connected devices, and a corresponding growth in information generated, has created more data. This wealth of data does not come without its challenges, however; organizations must be able to aggregate it from numerous sources, store it, analyze it, secure it, as well as sort through it to determine what is useful.44 Thus design of the system architecture is critically important to ensure machines and systems can interoperate—a challenge when dealing with both older and Industry 4.0–driven machinery. Moreover, data must be shareable, understandable, and able to be processed and updated reliably, all while limiting security risks arising from increased integration and expanded access between systems.45

While the troves of data generated through automated processes can improve DC management, managers need advanced tools to support data analysis. The tools provided with the applications are often limited in terms of variety and depth of analysis and can track only operational and system KPIs. A newer breed of data analytics and visualization tools, however, can be directly connected to the ecosystem to gather and analyze terabytes of data. Industry 4.0 technologies using complex algorithms, pattern recognition, or machine learning capabilities can further use the data to plan and optimize operations.

Implementing Industry 4.0 for the distribution center

As DCs evolve into an increasingly crucial element of the supply chain, they need to adapt to new expectations for quickly handling an ever-more diverse set of goods—all while performing additional value-added tasks not traditionally associated with warehouses. Current and emerging Industry 4.0 technologies can enable greater operational flexibility, reduce operational costs, drive more modular and adaptable automation, and promote business growth. The transition toward Industry 4.0 technologies in distribution centers will drive changes throughout the DC, from reconfiguring the workforce to managing, analyzing, securing, and acting upon data.

As DCs look to implement Industry 4.0 technologies, they can:

- Assess current needs within the supply chain to determine when and where Industry 4.0–driven automation can help, and where it may be worth waiting. Consider which technologies are already available to significantly reduce costs and risk, and which investments may be worth waiting to make at a later time, when technological advancements may result in significant improvements over current capabilities.

- Develop a talent strategy to address new talent needs created by Industry 4.0–driven technologies, and continuously assess the organization’s evolving needs to proactively prepare for talent gaps that may exist in the future, particularly those focused on maintaining and managing Industry 4.0–enabled assets.46 This can also help DCs evaluate what can be done today to find talent that can both support and be ready for an increased level of automation.

- Monitor emerging trends that might influence supply chain requirements or demands on DC functionality, examine new opportunities to improve distribution operations, and gather competitive intelligence to benchmark performance and monitor potential market threats. This will enable effective planning and decision making in a field that will be evolving at a rapid pace in the next decade.

- Plan for data management, reliability, and security in an increasingly complex system. Data management systems are a major part of the implementation and functioning of Industry 4.0 technologies and should be considered critical to the success of the endeavor. The ability to gather, analyze, act upon, and safeguard information is crucial to the Industry 4.0–driven DC.

The impact of Industry 4.0 technologies on distribution centers can enable more effective facilities. It is critical for leaders to proactively evaluate the impact of distribution trends along with the potential benefits of using Industry 4.0 technologies, as this can allow executives to plan effectively to meet the business’s future objectives in a field that will be rapidly changing over the next decade.

© 2021. See Terms of Use for more information.