Tempering the utopian vision of the mobility revolution

8 minute read

04 January 2019

As global consumers start to critically evaluate advanced vehicle technologies and whether they are willing to pay for them, utopian visions of future mobility systems may not be as close as we thought, leaving OEMs in the precarious position of needing to push forward on costly R&D programs with little assurance of ROI.

Most scenarios involving future transportation systems center on the hyper-optimistic view that everyone will take full advantage of integrated, electrified, shared mobility networks that have unfettered the ordinary consumer from the bonds of fossil fuels and personal vehicle ownership. The benefits of this potential future are undeniable, and giving people an idea of what transportation could be like is important. Yet there are still many hurdles to clear. And perhaps one of the most important, yet often overlooked, is the question of consumer adoption. What proportion of people, for instance, will actually buy an autonomous vehicle (AV) or use shared transportation? Will this proportion be enough to transform mobility on a large scale? Is it possible that such technologies and behaviors will remain niche phenomena in a future that looks more or less the same as today?

Learn more

Learn about this trend in Italy: L’auto del futuro, secondo i consumatori - Per gli italiani è ibrida e sempre più connessa

Explore the Future of Mobility collection

Subscribe to receive related content

Download Deloitte’s 2019 Automotive News supplement

This article is featured in Deloitte Review, issue 25

Download the issue

Download the Deloitte Insights and Dow Jones app

In this article, we look at four automotive trends that are foundational to the future of mobility—vehicle autonomy, electrification, connectivity, and shared transportation—through a global consumer lens using results from the 2019 Deloitte Global Automotive Consumer Study. Our overall takeaway: Significant challenges remain that may be overlooked by industry players so focused on developing the technology that they forget to ask whether anyone will use it.

Global consumers appear to be pumping the brakes on AVs

One of last year’s most interesting study findings was a general warming toward the concept of self-driving vehicles, signaled by a precipitous drop in the percentage of consumers that believe that AVs will be unsafe. This was attributed, in part, to people’s increasing exposure to a variety of AV initiatives and real-world pilots via broad media campaigns.

However, in this year’s study, something quite unexpected happened. Rather than decreasing further, the percentage of people viewing AVs as unsafe has all but completely stalled in virtually every market around the world (figure 1).

The obvious question: What caused the strong positive momentum toward perceived self-driving vehicle safety to evaporate? The answer could be rooted in the very same media that captured consumers’ attention in the first place. Widespread coverage of even the very small number of accidents involving AVs may be shaping public perception, with nearly two-thirds of consumers in Republic of Korea, the United States, India, and China agreeing that media reports of accidents involving AVs have made them more cautious of the technology.

Consumers also want governments to up their regulation game: An overwhelming percentage of consumers in most countries indicated they wanted “significant oversight.” In fact, consumer trust in traditional original equipment manufacturers (OEMs) bringing AV technology to market continues to slip. Even in Germany, where trust in OEMs has traditionally been fairly solid, this proportion has dropped to 33 percent from 51 percent in 2017. This may be due, in part, to the black eye German automakers suffered in the wake of the “dieselgate” scandal.

Our study results reveal that people are turning to existing technology companies, perhaps because of exactly these reasons. This trend is troublesome for automakers making enormous investments to develop AV features, and fortuitous for new industry entrants that are looking to disrupt the mobility space. Indeed, government standard-setting for, say, data communication and programming outcomes could change consumer perception and help the AV industry.

Electrification could make a more immediate impact on global mobility

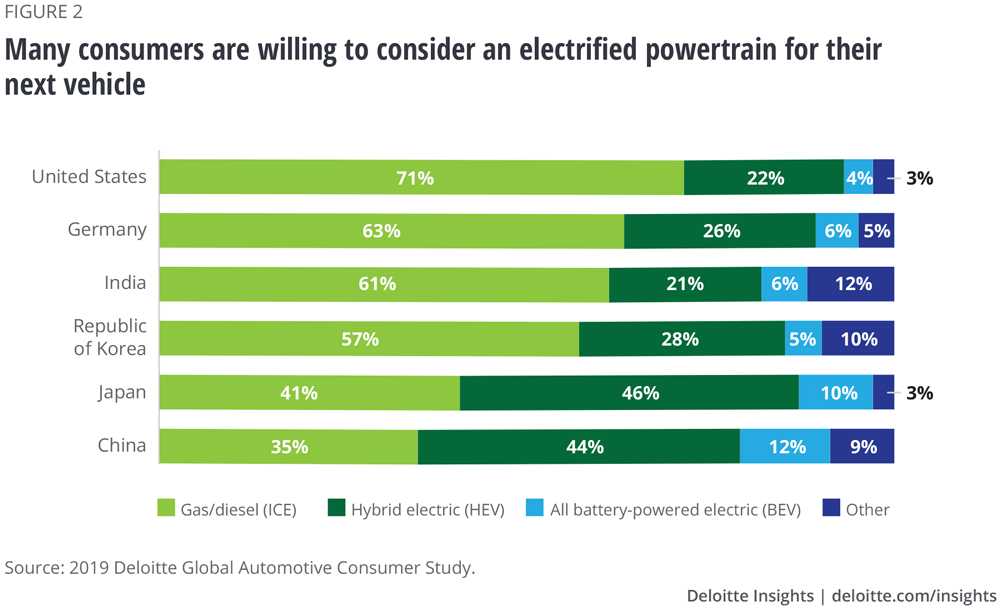

Study results indicate that many consumers are considering an electrified powertrain as a viable option for their next vehicle (figure 2). However, even though global growth in electrified vehicles (EVs) is expected, it will likely play out somewhat differently depending on the market.1

- China is strengthening its policy ecosystem to drive EV growth to address domestic pollution concerns, reduce its reliance on imported oil, and stake a claim to leadership in the next era of global mobility.

- The share of diesel vehicles in the EU-15 region declined from a high of 56 percent in 2011 to 45 percent in 2017.2 More recently, diesel share in the European Union fell sharply to 37 percent in the first half of 2018 from 43 percent in the first half of 2017.3 Some European countries, including Norway, Britain, France, and the Netherlands, have even announced plans to ban the sale of conventional gas- and diesel-fueled vehicles over the next two to three decades.

- EV adoption in North America is likely to lag due to a low-fuel-price environment, relaxed emissions standards, and a tighter tax-rebate policy.

Even if one accepts the most optimistic forecast for global EV sales over the next decade, this number is still a drop in the bucket compared to the more than 1.2 billion fossil-fueled vehicles currently on the road.4 With a life expectancy of more than 10 years, these traditional vehicles will likely remain the dominant automobile type for some time to come. In addition, our study results indicate that consumers in most countries remain hung up on (increasingly unfounded) concerns about battery-electric vehicle (BEV) range, charging time, and safety. Instead, people are looking to hybrid electric vehicles (HEVs) as the interim answer. Interest in HEVs in Japan, for instance, grew from 38 percent of consumers in last year’s study to 46 percent this year.5

Getting consumers to pay for increased connectivity could be a challenge

Industry estimates suggest that worldwide sales of connected cars will reach 72.5 million units in 2023, up from just 24 million units in 2015.6 However, consumers in different markets perceive the benefits of increased vehicle connectivity differently. For example, twice as many people in China and India than in Japan and Germany agreed that increased connectivity will lead to substantial benefits. However, less than half of surveyed US consumers (47 percent) were bought into the idea.

Part of what may be driving concerns about vehicle connectivity is the increasing number and type of sensors to track everything from powertrain performance and operational statistics to geolocation information and occupant wellness. Not all types of data collection are getting a full endorsement from consumers. Sixty-three percent of people in the United States are concerned about biometric data being captured and shared with external parties; 40 percent of people in China and Japan say the same. Nonetheless, interest in connected features such as traffic congestion tracking and road-safety alerts is universally high, which strongly aligns with the most important aspect of mobility for at least one-third of consumers, which is getting to their destination in the least amount of time.

Are consumers willing to pay to gain access to advanced connected vehicle features? The answer is a resounding “maybe.” In Germany, 43 percent of consumers said they would not pay any more for a connected vehicle, and another 40 percent said they would only pay up to €600 more. A similar story plays out in the United States, where one-third of consumers would not pay more and another 42 percent would only pay up to US$500 more. And although a far greater proportion of consumers in Japan (72 percent) would pay more, their upper limit was only ¥50,000 (approximately US$450). Indian (50 percent) and Chinese (43 percent) consumers were willing to pay more than ₹25,000 and CN¥2,500, respectively (roughly US$350).

The mobility revolution is running up against entrenched consumer behavior

There are a few “immutable truths” about consumer behavior: (1) Consumers are unwilling to compromise, (2) their usage patterns are difficult to change, and (3) they don’t like sharing. For example, study results indicate that 56 percent of Americans are not interested in carpooling services, and German consumers prefer to use their vehicle daily (47 percent of consumers now and 46 percent three years from now). Finally, multimodal transfers in one trip are largely an occasional undertaking for most: 39 percent of US consumers say they never combine different modes in a single trip, and while one-third of Japanese consumers say they do so at least once per week, another 58 percent indicate that this is an ad-hoc occurrence.

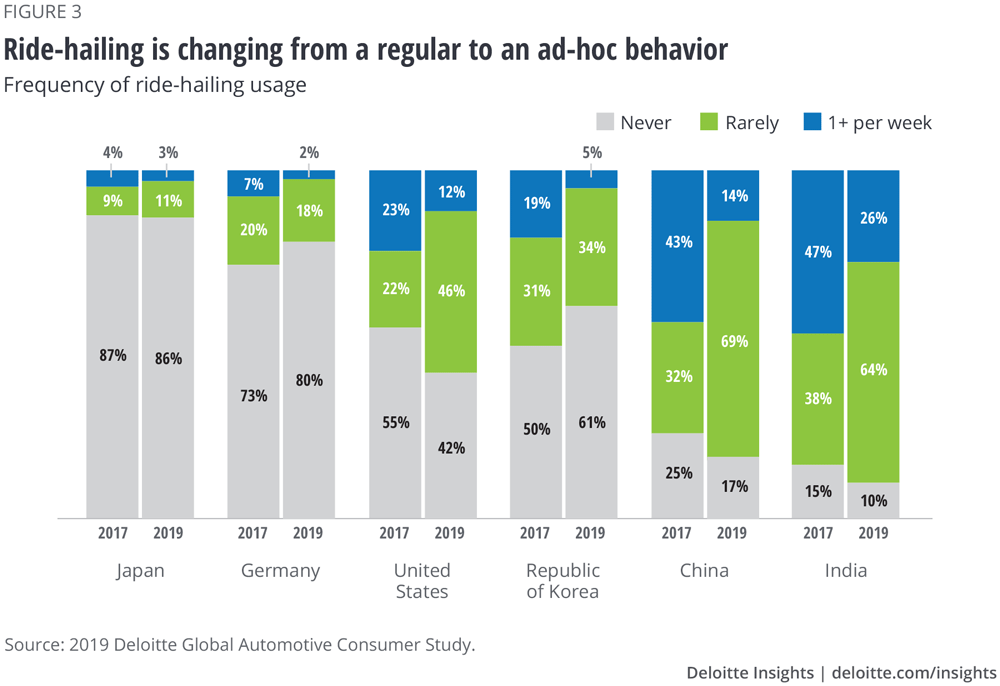

Even ride-hailing, which is often held up as the epitome of the new mobility-as-a-service (MaaS) transportation model, has experienced an interesting transformation over the last few years (figure 3). In 2017, 23 percent of US consumers used ride-hailing at least once a week, and another 22 percent used it occasionally. Fast-forward to 2019 study results, and the percentage of regular users has halved, while the proportion of occasional users has increased twofold. China and India are no different. This could be worrisome to both established and emerging ride-hailing brands, as the window of opportunity to create a dominant market position is likely rapidly closing as traditional competitors race to catch up on the consumer interface and integrated payment fronts.

Addressing these issues could be fairly simple, however, if OEMs and other new mobility players are able to maintain current levels of investment in developing MaaS models. Study results indicate that not only are younger consumers more interested in using new mobility services than older people, but a greater percentage of them also wonder whether they need to own a vehicle. Focusing on younger consumers to get them to try new, integrated transportation solutions more often may be the key to cementing that behavior until it just becomes the way mobility works.

Companies across the global automotive ecosystem could do well to carefully consider the following points:

- Given that consumer interest in AVs has stalled, governments should provide regulatory leadership. Establishing critical standards for AV development and use could address safety concerns, and it may also help the industry converge on technology solutions while reducing the cost of regulatory compliance.

- Interest in vehicle electrification is growing, but it will likely take several decades before a wholesale global transformation occurs. A strong government push to encourage EV adoption through strict environmental controls and attractive tax incentives can help EVs find a solid foothold in many markets.

- Consumers may not be prepared to properly compensate OEMs for enhanced connected capabilities, given widespread concerns regarding data security and cost.

- Pushing forward with new visions of integrated mobility systems means tackling some basic human behavior patterns. Encouraging younger consumers to embed new mobility behaviors into their daily routines may be the only way to get to an integrated, electrified, shared future of mobility, assuming industry players can hold out long enough for that transformation to take place.

Explore the Future of Mobility

-

Future of Mobility Collection

-

The future of mobility: Ben's journey Video8 years ago

-

The future of freight Article7 years ago

-

The future of auto retailing Article9 years ago