Accelerating digital transformation in banking Findings from the global consumer survey on digital banking

16 minute read

09 October 2018

Consumers around the globe expect their banks to act and interact more like top technology brands. Our latest global consumer survey on digital banking reveals where the gaps are—and what banks can do to meet heightened expectations.

Digital engagement is key to optimizing the consumer experience

The banking industry is in a digital arms race. In 2018, banks globally plan to invest US$9.7 billion to enhance their digital banking capabilities in the front office alone.1 For many retail banks, online and mobile channels have become as important—if not more important—than branches and ATMs.

Learn more

Read more from the Financial services collection

Subscribe to receive related content

Explore the interactive dashboard

This article is featured in Deloitte Review, issue 24

Download the issue

Banks around the world are already realizing how investments in digital technologies could benefit customer acquisition and satisfaction. For example, Bank of America currently receives more deposits from its mobile channel than it does from its branches.2 The bank’s CEO Brian Moynihan recently stated that investing in digital banking capabilities has helped improve customer satisfaction.3

But satisfaction is relative. As leading technology brands, such as Apple, Amazon, or Google, have become the gold standard for digital engagement, many consumers now have a stronger emotional connection with these brands than they have with their primary banks, as we will see in the subsequent sections in the report. If banks want to keep up, they have to engineer the digital experience they offer to make these emotional connections, which, ultimately, could translate into sticky interactions and more profitable customers.

The Deloitte Center for Financial Services surveyed 17,100 banking consumers across 17 countries in May 2018 to measure the current state of banks’ digital engagement. We asked respondents how frequently they use different channels and services, with an eye on digital transactions. We also captured consumers’ expectations and perceptions of digital banking capabilities, and the likelihood of using additional digital banking services in the future. (See interactive for more information and a breakdown of results by country.)

[ View interactive graphic fullscreen ]

The survey results support Deloitte’s belief that restructuring organizations around different stages of customer interaction will be the next frontier for digital banking. Specifically, this will require integrating digital services across five stages—adoption, consideration, application, onboarding, and servicing—to drive holistic engagement. We believe the results clearly show that banks need to expand their focus beyond increasing and enhancing digital service offerings to transform themselves into truly effective digital organizations.

This study is the latest of a suite of thought leadership efforts by Deloitte that address digital banking, a topic of the utmost importance to the industry’s future (see sidebar, “Digital banking research from Deloitte”).

Of course, banking systems and the behaviors of consumers vary across markets in different geographies. As such, we highlight country differences along the way to offer a perspective of consumers’ relationship with their banking institutions in individual countries. A subsequent report and interactive will dive deeper into these geographic differences and their reasons.

About the study and methodology

The Deloitte US Center for Financial Services fielded a global digital survey in May 2018, querying 17,100 respondents in 17 countries. We set minimum quotas for age and gender for each of the 17 countries. The survey emphasized consumers’ digital engagement, including channel preferences for various banking activities and buying new products, their emotional connection to their banks, and other attitudes and perceptions about their primary banks.

To understand whether there were different segments with characteristics within our global sample, we performed cluster analyses of channel usage data for 13,912 eligible respondents.4 We found that one algorithm in particular yielded the most statistically significant and meaningful results. The input data for the cluster analysis was:

- How frequently the respondents use bank channels: bank branch, ATM, contact center, online banking service, and mobile banking app.

- Which channels they prefer to access a range of services: transactional (withdraw money, pay bills), informational (inquire bank balance, inquire about a bank product, update account details), problem resolution (dispute a transaction, report lost or stolen debit/credit card), and product application (apply for a loan).

The results revealed clear differences regarding digital attitudes and behaviors among consumers. Across the globe, consumers fell into one of three distinct segments: traditionalists, online embracers, or digital adventurers. Please read more about the segment characteristics in “The digital-emotional connection” section later in the report.

The survey data reported are unweighted, and we caution that the interpretations maybe limited to the samples we included in the study.

Satisfaction with banking is relative

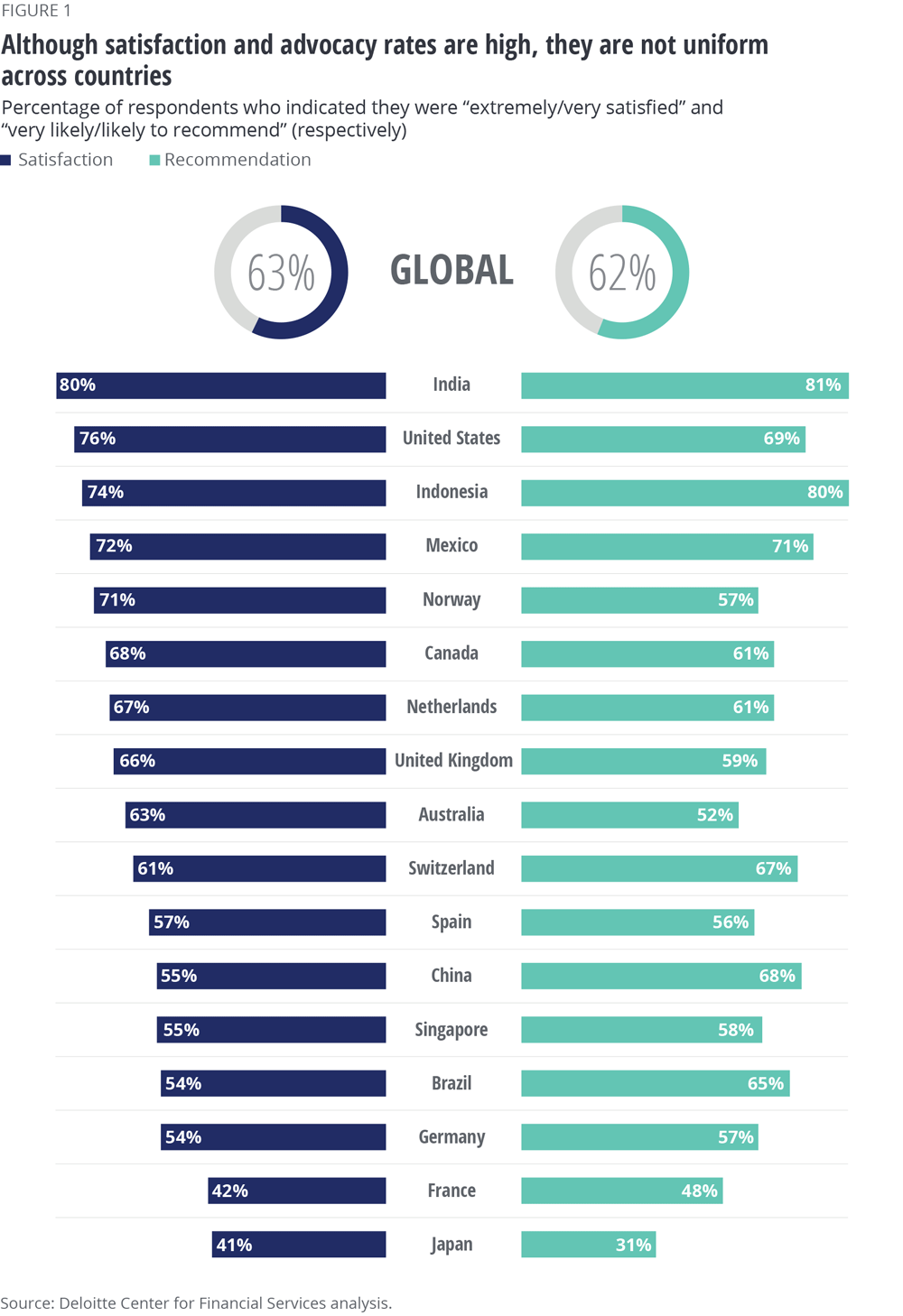

The Deloitte Center for Financial Services’ global survey of banking consumers confirmed a finding that we have observed in other Deloitte studies: Consumers’ overall satisfaction with their primary banks is generally high.5 Nearly two-thirds of consumers in our global sample are either completely satisfied or very satisfied with their primary bank. Satisfaction varies country by country, however (figure 1).

Within the Asia Pacific region, for example, consumers in India and Indonesia are more satisfied with their banks than are those in Singapore, Australia, or Japan. In Europe, consumers in Norway and the Netherlands are more satisfied with their banks than are those in Germany, France, or Spain. Comparing satisfaction levels across the Atlantic, consumers in the United States and Canada are generally more satisfied with their banks than their European counterparts are.

These patterns are mirrored when determining whether consumers would advocate for their banks. Nearly two-thirds of consumers in our survey said they would recommend their primary bank to friends and family (figure 1). A higher proportion of consumers in India and Indonesia are likely to recommend their banks than are those in Japan, Singapore, or the United States.

But these questions measure emotional engagement with broad strokes; they do not paint a full picture of customer satisfaction. As banks embrace varied strategies to differentiate themselves, they need to pay close attention to how they make their customers feel so they can build sticky relationships.6 According to a Harvard Business Review article, emotionally connected consumers are 35 percent more valuable than highly satisfied consumers.7 In our study, the top 25 percent of respondents who ranked their bank the highest using six positive descriptors also have a higher number of products with their primary bank.

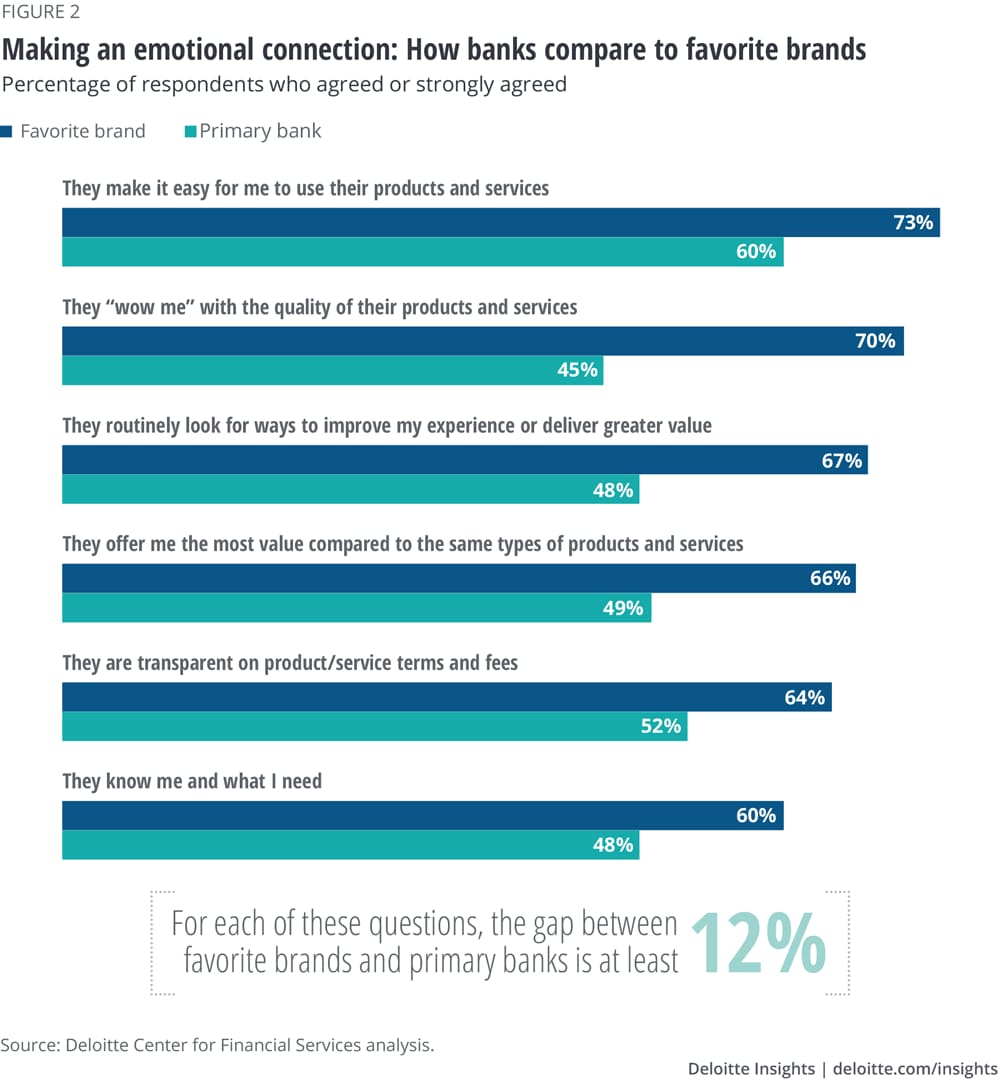

Importantly, though, our survey also showed that banks lag behind other brands in building these emotional connections. Best-in-class digital service providers, including Apple, Google, Amazon, Samsung, and Microsoft, topped the list. Figure 2 shows the percentages of how consumers ranked their banks on these six descriptors compared to these top brands. In short, these results show that consumers feel these favorite brands outperform their banks in providing quality, convenience, and value via an exceptional digitally driven consumer experience.

The rate of digital adoption is encouraging, though transactional in nature

Our survey also indicates that consumers are ready for a higher level of digital engagement from their banks. Many consumers already interact with digital banking channels quite frequently, which is a highly positive development. Although branches and ATMs are still used by slightly more banking customers, online and mobile channels are not far behind. Eighty-six percent of consumers use branches or ATMs to access their primary bank; 84 percent use online banking; and 72 percent use mobile apps to access their primary bank.

But more tellingly, digital channels are used more frequently than branches and ATMs (figure 3) across all generations, and in all countries. This clearly presents an opportunity for banks; if they can improve their digital offerings, they could increase customer engagement.

However, a country-by-country breakdown reveals some curious exceptions. Japan, in particular, stands out from the crowd with only 7 percent using online and 6 percent using mobile banking more than five times a month. This result is not completely surprising, however: A 2016 Meiji Yasuda study revealed that 70 percent of internet users in Japan used cash to pay at a physical store.8 China and Singapore, both known for populations that are digitally savvy,9 also fall into this category, but not to the same extent.

Among the other countries surveyed, though, the general trend is that many more banking interactions are made online and via mobile devices than through ATMs and branches. This is a good start. The first step toward improved brand recognition is to get in front of the customer as often as possible.

While the frequency of digital channel usage is a positive sign, there is an important distinction to make here regarding quantity versus quality of interactions. Our survey showed that digital channels are mostly limited to informational and transactional services that have been available through online banking for at least 15 years, such as transfering money, updating account details, and checking account balances.

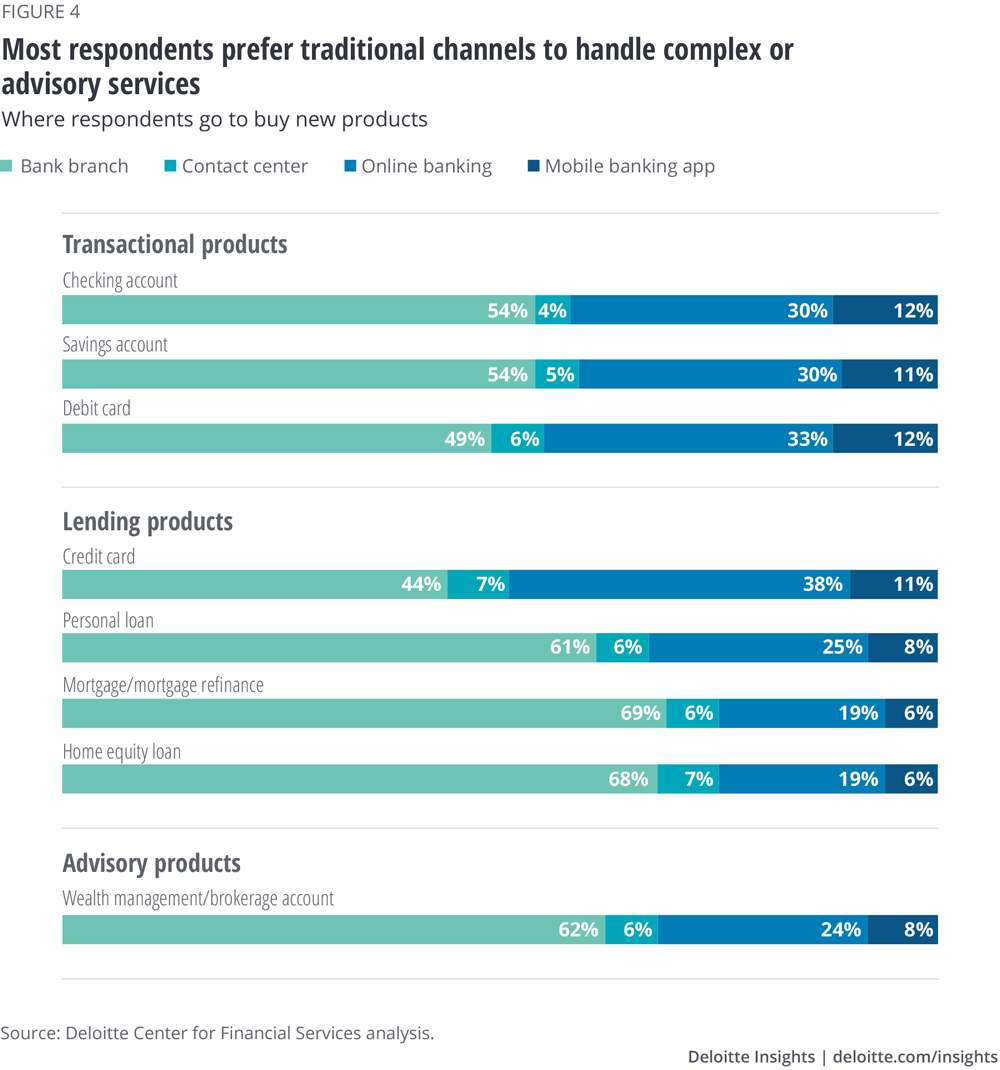

Many consumers still prefer traditional channels over digital channels for complex or advisory services, however. Of the respondents who filed a complaint with their bank, 42 percent used contact centers, 26 percent used branches, and only 30 percent used digital channels (online or mobile). The trend is also true for applying for new products, especially loans that require multiple verification and documentation steps (figure 4). Interestingly, consumers were split in their preference to use online and mobile channels versus branches when applying for payment cards (debit and credit cards) and basic transactional products (payment and savings accounts).

And although few banks allow their customers to apply for a consumer unsecured term loan or small business loan through digital means, nonbank fintechs have been allowing this for almost a decade and some banks have followed suit.10 Yet, for the most part, retail banks still require human intermediaries and cumbersome nondigital documents to process loan applications.11

Further, banks’ “pull” approach versus a “push” approach to digital service could be standing in the way of creating emotionally engaging digital interactions. Today’s consumers still come to the bank’s platform to meet their needs—be it monitoring account details or understanding their spending patterns—and banks tend to react to their needs. Meanwhile, fintechs have shown a better way to digitally engage consumers through a “push” strategy that includes sending them intelligent, tailored insights based on their spending behavior or notifying them about discounts or loyalty offers at nearby retailers.12 Although banks have made the important step of making the login process easier by having mobile devices remember information in a secure manner, they can invoke more push strategies, such as providing customers with alerts regarding unusual movement in their accounts.13

The digital-emotional connection

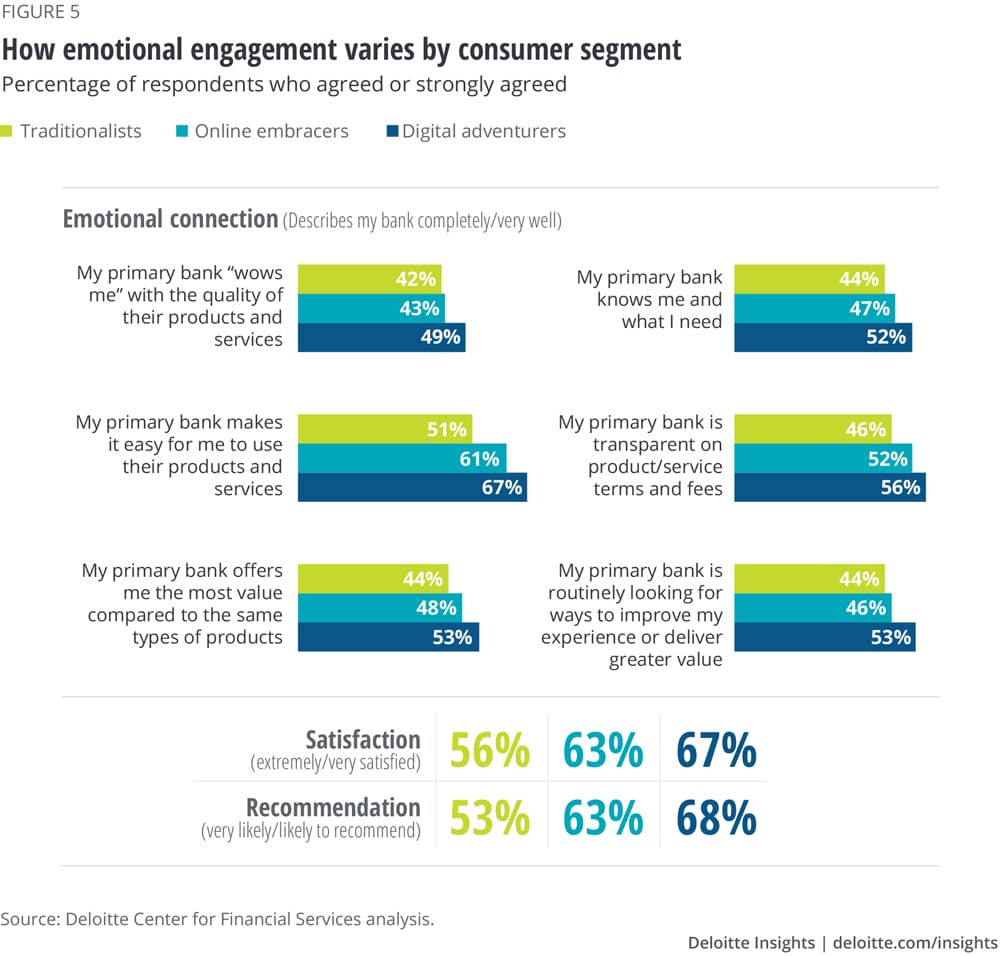

To dig deeper into digital engagement, and understand how it varied across customer segments, we ran a cluster analysis (see “About the study and methodology” section). The analysis of nearly 14,000 global respondents14 confirmed a positive relationship between digital usage and emotional engagement in three distinct consumer segments. We’ve named these groups traditionalists, online embracers, and digital adventurers.

- Traditionalists comprised 28 percent of the sample. They are light digital users who do most of their banking in branches and through ATMs. Nearly one-half of these respondents who check their bank balances used ATMs; a fifth used branches. Of the traditionalists who transferred money from one account to another, one-third used ATMs while another one-third used branches.

Nearly one-quarter of traditionalists have never used online banking to access their primary bank. Their reluctance to use mobile apps is even higher—44 percent have never used mobile apps to access their primary bank. Even among users of online and mobile banking in this segment, only one-tenth have used these channels 10 or more times in a month. Traditionalists also hold fewer products, such as debit and credit cards, than the other segments.

- Online embracers comprise the largest segment, at 43 percent. They are more digitally engaged with their banks than are traditionalists, but prefer online over the mobile app channel for types of transactions that banks have spent years perfecting online, such as balance and transaction inquiries, transferring funds, and paying bills. They have higher product holdings than traditionalists and transact with their banks more frequently, but not all the time; about 20 percent of online embracers accessed their bank online more than 10 times a month, and 25 percent accessed their mobile apps more than 10 times per month.

- Digital adventurers comprised 28 percent of the sample; millennials comprised the highest share of adventurers compared to the other segments. Like online embracers, this group exclusively uses mobile and online channels to inquire about their account, transfer funds, and pay bills; however, many more adventurers are comfortable, and prefer, to perform them on their mobile devices. As an example, 48 percent of digital adventurers transfer money person-to-person (P2P) online and 44 percent do so on mobile apps, while 52 percent of online embracers make P2P transfers online and 37 percent prefer to do so on mobile apps.

Digital adventurers also own many products, but they transact much more frequently than online embracers do. Over half of users of online and mobile banking in this segment have accessed these channels 10 or more times a month. A significant proportion of digital adventurers prefer to use online and mobile channels combined more than visiting a branch to apply for simple products such as debit cards and checking accounts. And although just under 32 percent and 11 percent would prefer to apply for a personal loan online and on their mobile app, respectively, this compares to 25 percent and 7 percent for online embracers and only 17 percent and 6 percent for traditionalists.

Most tellingly, digital adventurers demonstrate the highest levels of satisfaction and advocacy for (are most likely to recommend) their primary banks. And they also generally express a deeper emotional engagement with their primary banks compared to online embracers and traditionalists (figure 5), at least in absolute terms.

When looking at digital adventurers’ emotional engagement with their banks compared to their favorite brands, an interesting twist emerges. Although digital adventurers are the most emotionally engaged banking consumers in absolute terms, the gap between engagement with their favorite brands and primary bank is higher for four of the six parameters (figure 6). Banks have some road to travel, if their most satisfied, seemingly more engaged consumers are not as “wowed” by banking services as they are with their favorite brands.15 This is where we ask ourselves, “Are banking consumer relationships truly sticky? If these favorite brands become financial services providers, then what?”

Segment characteristics are not uniform by country

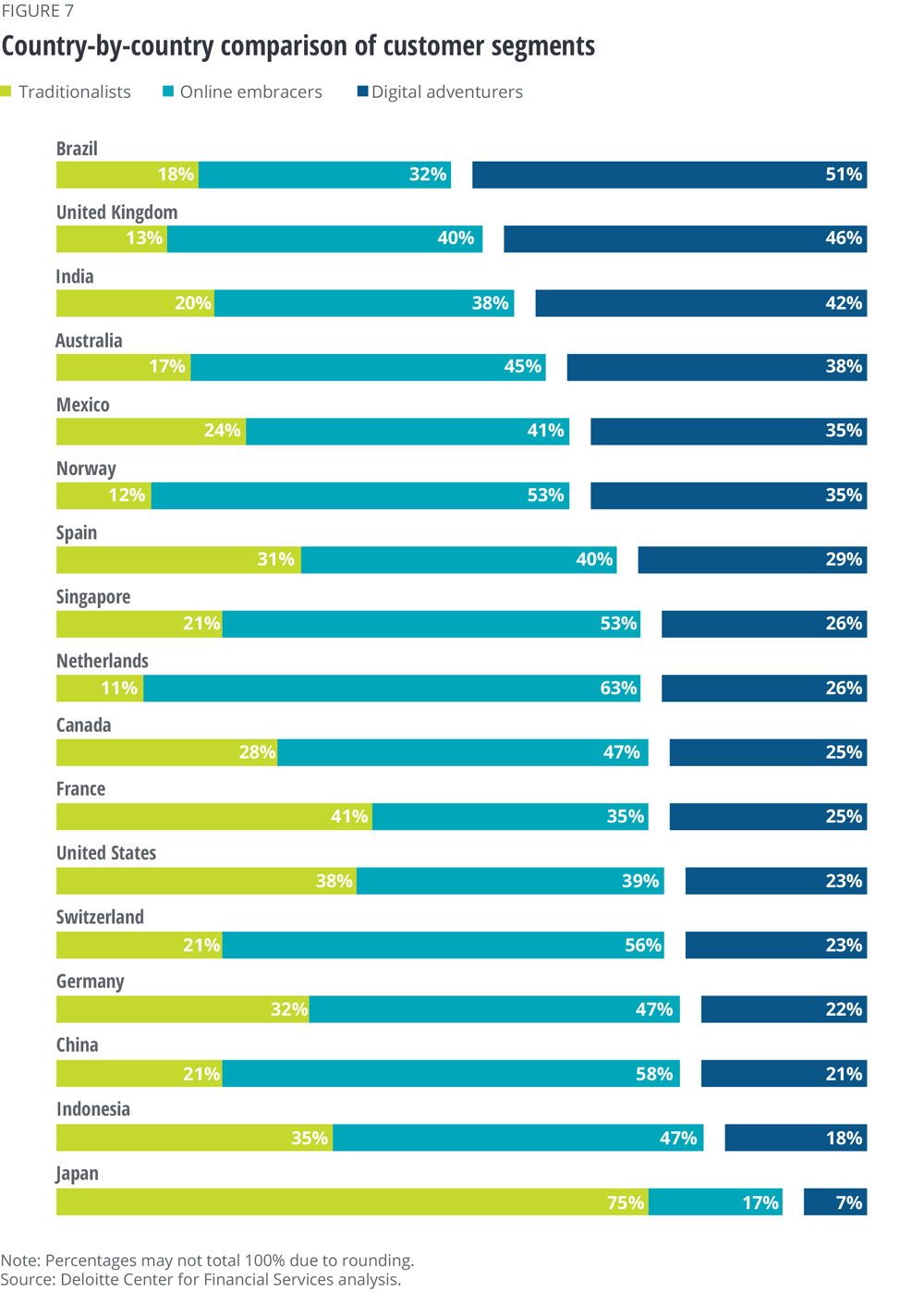

We also analyzed how the segments we described above are distributed across the 17 countries included in our study (figure 7).

Predictably, when looking at clustering by country, 75 percent of respondents in Japan, a digital banking laggard, are traditionalists. Next in line are France, the United States, and Indonesia, with 41 percent, 38 percent, and 35 percent of their samples, respectively, falling into the traditionalist category. The decades-old and resilient branch infrastructure could potentially explain high composition of traditionalists in developed economies. However, the case of a developing country like Indonesia featuring a higher composition of traditionalists compared to the global average merits additional analysis.

The Netherlands boasted the highest composition of online embracers (63 percent), followed by China (58 percent), Switzerland (56 percent), Singapore (53 percent), and Norway (53 percent). High internet connectivity in most of these countries potentially explains their reliance on digital. For instance, the Netherlands ranked among the top four countries in the 2017 Digital Economy and Society Index (DESI), which measures digital performance and competitiveness in Europe.16

Of the 17 countries studied, Brazil has the highest representation of digital adventurers compared to the global average. Meanwhile, the United Kingdom and India, comprising 46 percent and 42 percent of digital adventurers in their samples, respectively, mirror the global story more closely with higher satisfaction and high digital use. We will explore the country differences and drivers of respondents’ digital behavior in subsequent publications and an interactive feature.

More real in digital and digital in real

Digital channels can provide an effective gateway to emotionally connect an organization to its consumers. Technology companies that are consumers’ favorite brands not only have best-in-class digital capabilities; they also do a superior job integrating digital and physical environments and integrating both strategically to foster an emotional connection.17 Amazon’s digital prowess allows customers to discover, research, and buy products in minutes, while enabling its physical supply chain to deliver the goods most efficiently. Merging the physical with the virtual/digital is key to superior customer experience: putting the “real in digital and digital in real.”

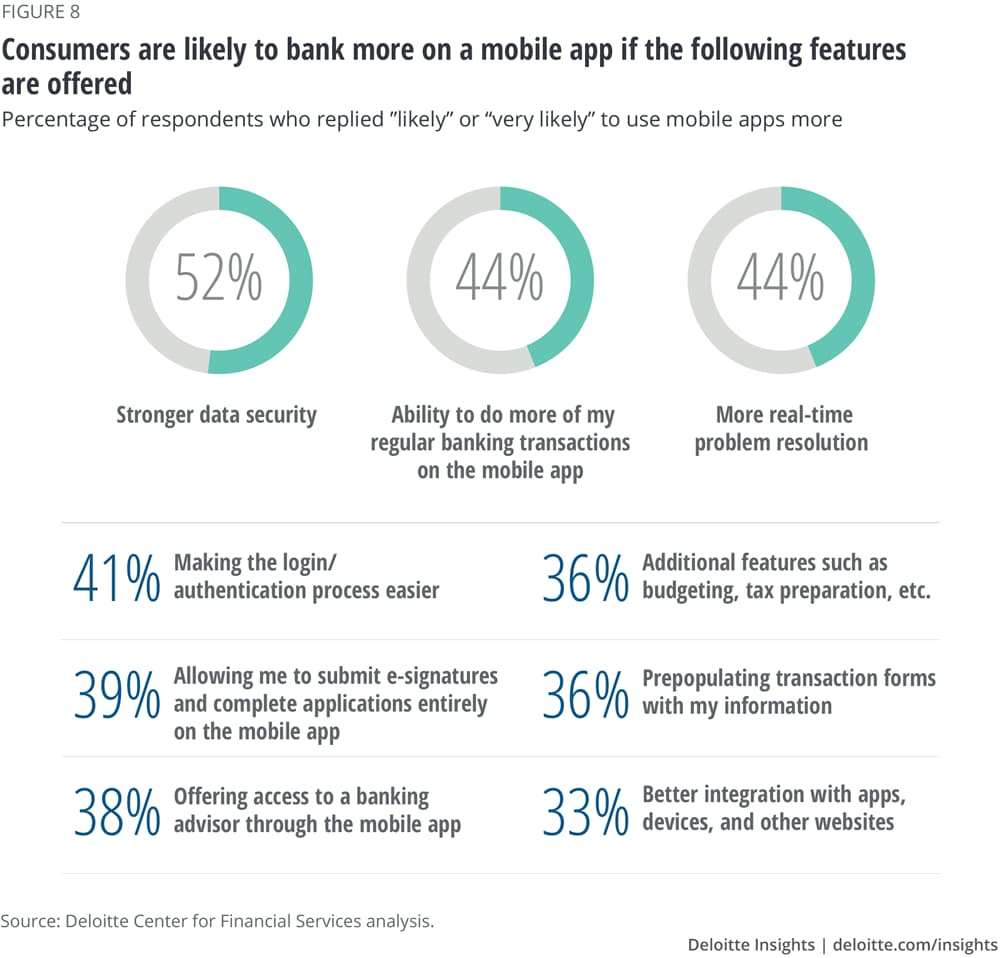

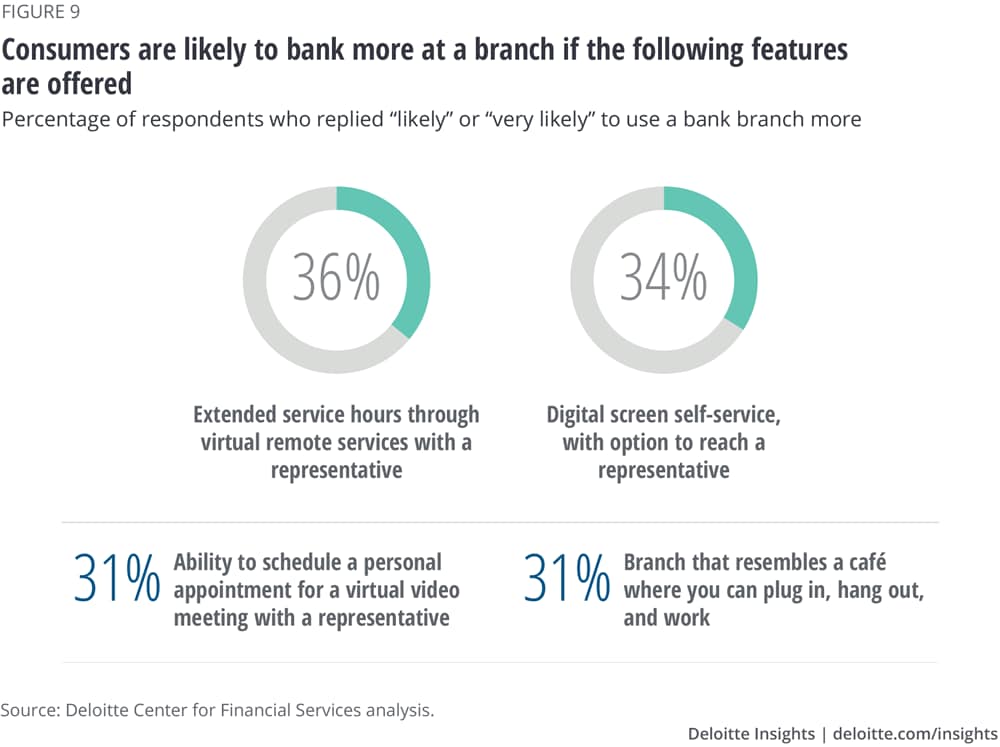

According to our survey, consumers are more likely to increase use of digital channels (both online and mobile) if banks increase security, provide more real-time problem resolution, and allow for more regular banking transactions to be handled digitally (figure 8). On the other side, adding digital self-service screens at brick-and-mortar locations, or being able to connect with a bank representative virtually will increase consumers’ likelihood to use branches (figure 9). Putting the real in digital and the digital in real is clearly a route that banks must take in their digital transformation efforts. Following are some suggestions:

Bolster security measures for all consumers. With all three segments, stronger digital security will likely increase the likelihood that customers will use digital channels in the future. Security concerns are especially acute for traditionalists; in fact, this is why some traditionalists have never used online or mobile banking to access their primary banks.

Bolstering security using tools such as biometrics is paramount. These are already being widely used. For example, ANZ bank customers can make payments of more than US$1,000 via mobile app using Voice ID technology and no additional authentication.18 Banks should advertise such security features more prominently and differentiate messaging for different segments.

Emphasize the convenience of digital with traditionalists. A big reason many traditionalists do not use digital channels is that they simply do not see their merit. Therefore, raising awareness around the convenience of banking on-the-go (mobile) or banking from anywhere (online) is pivotal. Consider boomers and seniors who may be hesitant to use digital channels. In 2016, Capital One bank in the United States partnered with Older Adults Technology Services (OATS), a nonprofit, and Grovo, a digital learning platform, to develop a training program, “Ready, Set, and Bank.”19 The program consists of short online videos and live classes to educate seniors on the basics of online banking, such as setting account alerts.

As banks add more digital features in branches (digital in real), branch professionals should step up a campaign to demonstrate to these consumers how easy it is to use a digital screen or a tablet for simple transactions, including paying bills, transferring money, or even applying for a debit card. (More than 50 percent of traditionalists reported not owning one!) Once traditionalists become more comfortable with using branch-based digital tools, representatives should then familiarize them with mobile banking. Helping them download the bank’s mobile app should be easy to do, considering 92 percent of traditionalists already own a smartphone.

Expand mobile apps’ capabilities to simplify its user interface to engage online embracers. Last year, we predicted that mobile devices would replace branches as the central channel around which other channels revolve.20 Now, online embracers are much more comfortable with online banking than they are using mobile banking apps. Banks should seek to encourage this segment’s engagement on mobile apps.

Among other reasons, a factor limiting embracers’ mobile banking usage could be the app’s limited functionalities compared to online banking portals. To increase online embracers’ willingness to use mobile banking, banks should focus on making mobile apps more intuitive and more comprehensive. Here, a good example is the iPhone®. For more than a decade, each iPhone® iteration has achieved massive market share by providing an intuitive and elegant user experience, coupled with comprehensive functionalities.21 In addition, while some banks may fear cannibalization, cross-promoting mobile apps on online portals could help create a richer, more versatile consumer experience.

Transform mobile as an experiential channel for digital adventurers. Digital adventurers are already avid users of banks’ digital channels. They expect more from their primary banks, which can be seen in the gap in emotional connection between their favorite brands and primary bank. With this segment, banks should use mobile as a differentiator to build sticky experiences. Though digital adventurers choose mobile apps as much as online websites for bank interactions, they primarily use mobile for transactional services, such as paying bills or checking balances, and basic product applications.

Here, banks could position chatbots as the go-to help tool or letting consumers directly connect to a bank representative in the mobile app. These are good starting points, as this segment expects more real-time problem resolution in digital banking channels. In fact, enthusiasm among adventurers could be dampened by apps that lack customer service avenues.22

Consider the launch of digital-only banks. JPMorgan Chase rolled out a mobile-only bank, Finn, which targets millennials.23 Marketed as an independent brand, Finn lets consumers make deposits, transfer payments using the Zelle payment system, and activate a Finn debit card using the app. It provides multiple features to help consumers manage their money in a simple and convenient way. For example, its “Pocket Your Pennies” feature transfers any change left from consumers’ checking account purchases to their savings accounts.24 Further, the rule-based “Autosave” feature gives a new dimension to banks’ traditional recurring deposit service. A consumer hoping to fund a weekend trip with friends can create a rule to save US$5 for every US$30 spent until the savings reach US$1,000.

Moreover, banks can encourage digital adventurers to step up their use of digital channels by simply providing smarter account opening features. Options such as prepopulating forms on websites and apps, making authentication easier, and allowing e-signatures or fingerprint scanning will likely simplify and enrich consumers’ product buying experiences.

Lastly, break the channel silos. Branch, ATMs, online, mobile, and call centers all need to be connected, along with third-party digital assistants such as Google Home and Amazon Alexa. Consumers’ fascination for omnichannel experiences is real. Seventy percent of consumers in our study consider a consistent experience across channels to be extremely important or very important in selecting their primary bank. Therefore, banks must have a seamless flow of data across all channels. Having a 360-degree view of consumer interactions across channels, products, and systems will pay off by building stickier emotional engagement.

The case for accelerating digital transformation

Of course, these are broad recommendations and as such, they will not uniformly fit the different consumer banking systems, experiences, and cultures of every country.

However, despite these differences and nuances across geographies, we noticed a common, key theme: There needs to be an evolution in how consumers interact with their banks, and customers are expecting that progression to begin now. Picture these scenarios: Consumers hanging out at or working from café-resembling bank branches, interacting with their bank’s mobile apps as integrally and joyfully as they do with social media apps, or reporting lost/stolen card using the bank’s app instead of dialing the call center. These are not mere possibilities of distant future; they are the kinds of experiences many customers already expect—and have come to know—from the brands they most trust.

As the progression unfolds, human interactions will likely remain important, especially for milestone decisions in consumers’ financial journeys. However, digital will be at the heart of personalizing consumers’ day-to-day interactions to enhance their emotional connection to bank brands. And in many countries, mobile will likely become the epicenter of banks’ digital transformation strategies.

Further, branches, ATMs, online banking portals, and mobile apps will likely take different avatars in the coming years, infusing more real life in digital and more digital in real life. And as this happens, perhaps some channels could become more prominent than others. For instance, if mobile apps evolve as the go-to help tool for consumers, this could minimize the need for call centers.

Perhaps the key takeaway we gleaned from the survey is that customer satisfaction is relative. In the end, to capture the hearts, minds, and wallets of customers, banks will need to accelerate their digital transformation and reconfigure each channel to serve every need customers have. Only this level of transformation is likely to strengthen banks’ emotional ties with consumers and earn them a top spot in the list of consumers’ favorite brands.

© 2021. See Terms of Use for more information.