Energy management: Most consumers and businesses push for cleaner energy Deloitte Resources 2018 Study

16 May 2018

Marlene Motyka United States

Marlene Motyka United States Suzanna Sanborn United States

Suzanna Sanborn United States Andrew Slaughter United States

Andrew Slaughter United States Scott Smith United States

Scott Smith United States

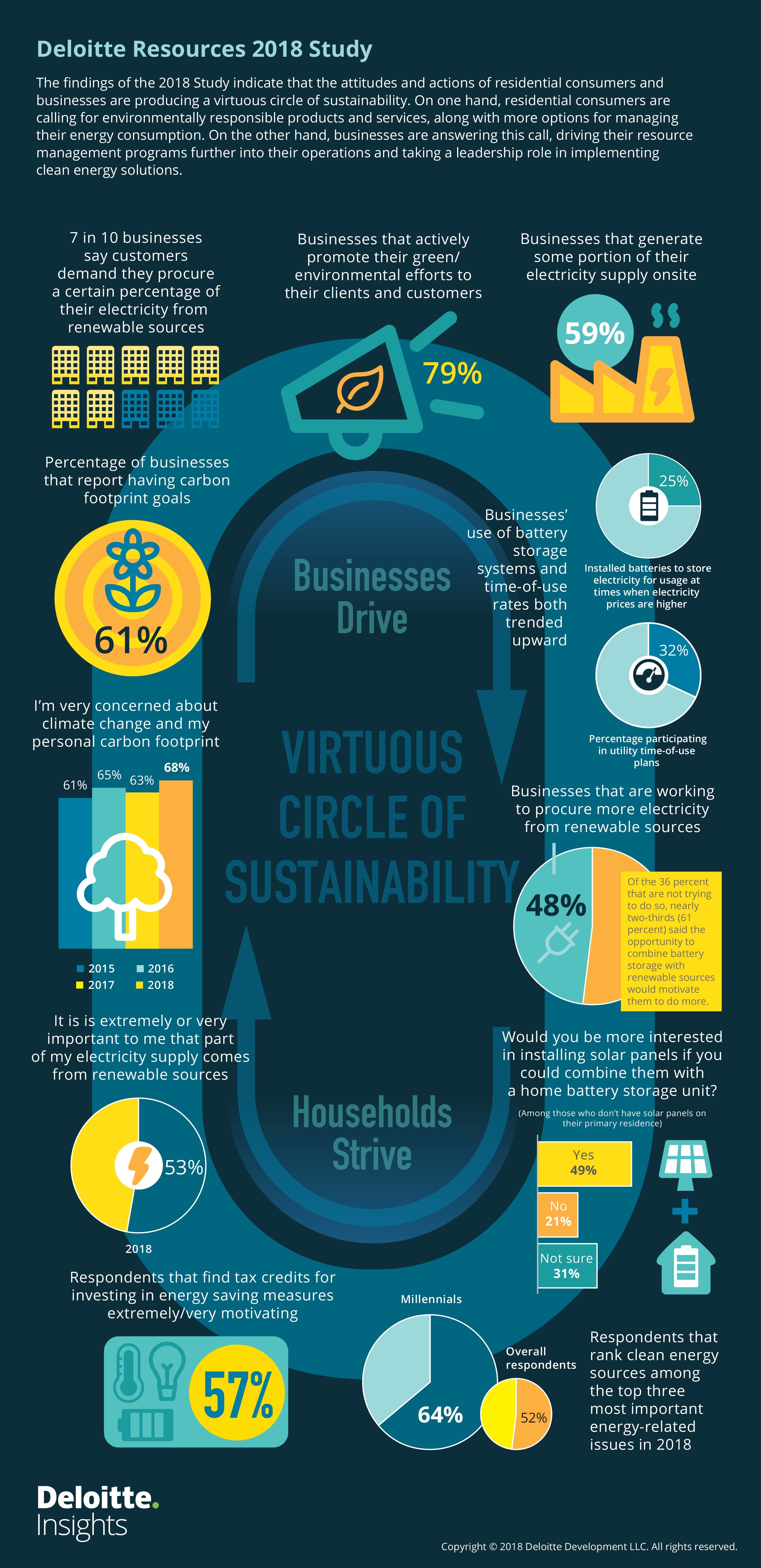

Businesses and consumers are producing a virtuous circle of sustainability, with each group appearing to drive the other toward cleaner, greener energy and sustainable practices. Our eighth annual energy resources study examines these and other findings.

Growing consumer demand for environmentally responsible products and services, along with residential consumers’ interest in managing their own energy consumption, is driving more businesses toward sustainable energy sources and prompting many to take a leadership role in implementing clean energy solutions. At the same time, residential consumers are seeing businesses act and beginning to learn from their example.

Learn More

Download the summary or full report and view the infographic

Register now for the 2018 Deloitte Renewable Energy Seminar

Subscribe to receive Power & Utilities sector updates

That’s the overarching theme that emerges from the eighth annual Deloitte Resources 2018 Study, which asked more than 1,500 US residential consumers and 600 US businesses about their attitudes and actions regarding energy management.

The findings suggest that residential consumers and businesses are engaged in a mutually reinforcing relationship where residential consumers’ interest in reducing their carbon footprint—and in using digital technologies to help them do so—is leading many businesses to develop and deploy new tools for monitoring and reducing energy consumption, evolve their energy management policies and practices, explore expanding their use of renewable energy sources, and integrate their resource management programs more closely with their operations. And as businesses take these actions, residential consumers are watching and learning, and ultimately striving to do more to pursue greener energy practices.

That businesses are responding to consumer demand for cleaner energy is clear. Seven in ten businesses in the study said that their customers expect them to procure a certain percentage of their electricity from renewable sources. This demand for greener energy is having a ripple effect throughout the supply chain: 21 percent of surveyed businesses cited the need to meet supplier/business partner requirements as a primary motivation for their companies’ resource management efforts. Many consider renewables to be a large part of the answer, with nearly half (48 percent) of business respondents saying that they are working to procure more electricity from renewable sources.

For their part, consumers continue to profess a growing concern about their impact on the environment. Residential consumers, particularly younger ones, seem increasingly keen on using clean energy sources in general, and on expanding the use of wind and solar power more specifically. Indeed, residential solar is increasingly being seen as a clean, affordable, and resilient source of energy; several negative perceptions about solar seem to be waning as consumers become more familiar with the technology.

While the desire to use cleaner energy sources and save costs on electricity bills was the main driver for their increased interest in renewable energy, consumers also link renewables to other benefits such as job creation and economic growth. Energy independence is also seen as an important potential benefit, with 76 percent responding that greater development of renewables can be extremely or very impactful in achieving energy independence. Perhaps based on this belief, the consumers surveyed overwhelmingly believed that the US government should shape the country’s energy strategy.

Despite the groundswell of support for renewables, household participation in green energy programs remains low. Only 14 percent of surveyed consumers say that they’ve ever been offered green energy—and of those that have been offered green energy, only 6 percent have purchased it. Expense emerged as the top barrier among those who declined the offer. Yet consumer interest in green energy programs seems to outpace opportunities to participate in them. Among consumers who had not been offered green energy or were unsure if they had, nearly half (45 percent) claimed that they would like to have the chance to purchase it.

What does all this mean for electricity providers? For one thing, it seems to challenge utilities to get to know their customers to a much greater extent. For residential consumers, the consequences of their energy management decisions could be significant, since greener solutions such as solar PV, batteries, and home automation systems generally involve a greater upfront investment and longer-term commitments than conventional energy sources. But consumers may not know where to turn when seeking to learn more about new energy technologies. Utilities will need to find a way of addressing these insecurities in order to break through and meet consumer needs before potential competitors step in.

On the business side, the specter of utility disintermediation continues to rise as more and more companies take energy matters into their own hands. Fifty-nine percent of businesses surveyed this year say they generate some portion of their electricity supply onsite, citing price certainty, diversification of energy supply, cost savings, and resiliency as the top reasons for doing so. These motivations suggest that businesses want to have greater control over their energy supply in terms of price, quality, and reliability than would be possible if they were wholly dependent on external providers. Here, utilities would do well to understand their business customers’ needs in detail to identify areas where they can add value. Making it easier for businesses to evaluate offerings, manage their energy supplies, and deploy batteries and renewables will likely be key to winning and retaining corporate customers.

Read the full Deloitte Resources 2018 Study, Energy management: Businesses drive and households strive