Global renewable energy trends Solar and wind move from mainstream to preferred

14 September 2018

Technological innovation, cost efficiencies, and increasing consumer demand are driving renewables—particularly wind and solar—to be preferred energy sources. We examine seven trends that are driving this transformation.

Executive summary

Having only recently been recognized as a “mainstream” energy source, renewable energy is now rapidly becoming a preferred one. A powerful combination of enabling trends and demand trends—evident in multiple developed and developing nations globally—is helping solar and wind compete on par with conventional sources and win.

Learn More

View more content for the Power & Utilities sector

Subscribe to receive content related to Energy & Resources

The first enabler is that renewables are reaching price and performance parity on the grid and at the socket. Second, solar and wind can cost-effectively help balance the grid. Third, new technologies are honing the competitive edge of wind and solar.

Demand from energy consumers has mostly coalesced around three goals that the first three trends have enabled renewables to best fulfill. With varying degrees of emphasis on each goal, consumers are seeking the most reliable, affordable, and environmentally responsible energy sources.

Chief among these consumers are cities integrating renewables into their smart city plans, community energy projects democratizing access to the benefits of renewables on and off the grid, emerging markets leading the deployment of renewables on their path to development, and corporations expanding the scope of their solar and wind procurement.

These trends will likely continue to strengthen through two mutually reinforcing virtuous circles. The deployment of new technologies will help further decrease costs and improve integration. This will enable a growing number of energy consumers to procure their preferred energy source and accelerate national energy transitions across the world.

Enablers

Longstanding obstacles to greater deployment of renewables have lifted, thanks to the three enablers: rapidly approaching grid parity, cost-effective and reliable grid integration, and technological innovation. Once dismissed as too expensive to expand beyond niche markets, solar and wind can now beat conventional sources on price while increasingly matching their performance. The idea that renewables present many integration problems in need of solutions has reversed: The integration of solar and wind is beginning to help solve grid problems. Finally, renewables are no longer waiting for supporting technologies to mature, but instead seizing cutting-edge technologies to pull ahead of conventional sources.

I. REACHING PRICE AND PERFORMANCE PARITY ON AND OFF THE GRID

The speed of solar and wind deployment and their steeply declining cost curves have surprised even the most optimistic industry players and observers. Ahead of projections and despite lingering perceptions to the contrary, wind and solar power have become competitive with conventional generation technologies across the top global markets, even without subsidies.

Wind and solar have reached grid price parity and are moving closer to performance parity with conventional sources. In fact, the unsubsidized levelized cost of energy (LCOE) for utility-scale onshore wind and solar PV generation has dropped even with or below most other generation technologies in much of the world.1 While resources such as combined-cycle gas turbines (CCGT) have more flexibility to follow the load curve, increasingly affordable battery storage and other innovations are helping smooth the effects of wind and solar intermittency, giving them more of the reliability required to compete with conventional sources. From a price perspective, onshore wind has become the world’s lowest-cost energy source for power generation, with an unsubsidized LCOE range of US$30–60 per megawatt hour (MWh), which falls below the range of the cheapest fossil fuel, natural gas (US$42–78 per MWh).2

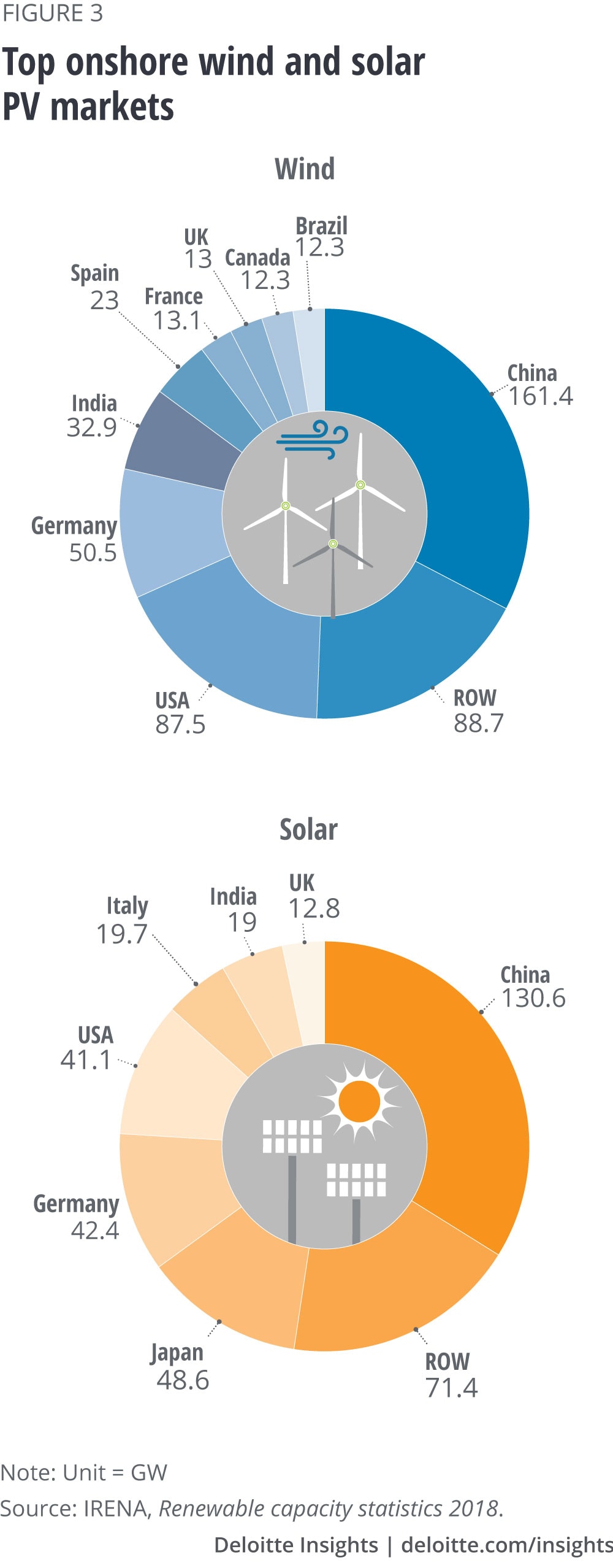

By the end of 2017, onshore wind capacity had more than doubled over the 2011 capacity of 216 gigawatts (GW): A total of 121 countries had deployed nearly 495 GW of onshore wind power, led by China, the United States, Germany, India, Spain, France, Brazil, the United Kingdom, and Canada—and onshore wind had reached price parity in these nine countries.3 In the United States, the lowest costs are in strong wind regions such as the Great Plains and Texas, while the highest are in the northeast.4 Globally, the lowest costs are in the nine leading countries, as well as Eurasia and Australia.5

Utility-scale solar PV is hot on wind’s heels: It is the second-cheapest energy source. The high end of solar PV’s LCOE range (US$43–53/MWh) is lower than that of any other generation source.6 A record 93.7 GW—more than the total capacity in 2011 (69 GW)—was added globally in 2017 across 187 countries, bringing the total capacity to 386 GW, led by China, Japan, Germany, the United States, Italy, India, and the United Kingdom.7 Solar has reached price parity in all these markets except Japan, one of the world’s highest-cost solar markets, primarily due to high capital costs. As Japan transitions to competitive auctions, solar price parity is expected between 2025 and 2030. In the United States, the lowest costs are in the southwestern states and California.8 Globally, Australia has the lowest costs for solar PV and Africa has the highest due to investment costs.9

Beyond the leading countries, wind and solar price parity is also within sight worldwide as the cost gap widens between these and other generation sources. Except for combined-cycle gas plants, the LCOEs of all conventional sources and nonintermittent renewables have either remained flat (biomass and coal) or increased (geothermal, hydropower, and nuclear) over the past eight years, while the LCOEs of onshore wind and utility-scale solar PV have, respectively, fallen by 67 percent and 86 percent as the cost of components has plummeted and efficiency has increased—two trends that are projected to continue.10 According to Bloomberg New Energy Finance, onshore wind and solar PV generation costs have already fallen 18 percent in the first half of 2018.11 In Europe, Japan, and China, competitive auctions are a major factor further bringing down costs by driving subsidy-free deployment at lower prices.

Upgrading, or “repowering,” wind turbines in the developed world is also pulling global average costs downward by raising capacity factors. In addition, developing world costs could fall as global developers and international organizations team up to facilitate project development. Such partnerships are helping resolve the resource dissonance created by the fact that Japan, Germany, and the United Kingdom have some of the poorest solar resources but are global solar leaders, while Africa and South America, respectively, have the greatest solar and wind resources, but these remain largely untapped.12 As wind and solar capacities grow, many conventional sources will start operating at lower capacity factors, causing the LCOEs of both existing and new-build conventional projects to increase. The cost of new solar and wind plants could eventually be not just lower than the cost of new conventional plants, but also lower than the cost of continuing to run existing plants globally. This was already demonstrated by Enel’s winning bid last year to build a combination of wind, solar, and geothermal plants in Chile that will sell power for less than the cost of fuels for existing coal and gas plants.13

Offshore wind and CSP also reaching parity

Offshore wind and concentrating solar power (CSP) are also reaching parity, with LCOE ranges that intersect with the higher end of coal’s range, but remain above the range for gas-combined cycle. A record 4.9 GW of offshore wind came on line in 2017 across 15 countries, bringing the total capacity to 19.3 GW, mostly located in the United Kingdom, Germany, China, and Denmark.14 Offshore wind has reached parity in Germany and Denmark and is projected to do so in the United Kingdom between 2025 and 2030 and in China by 2024.15 The United States has only one offshore wind farm, but the project pipeline is growing, mostly along the highly competitive northern Atlantic coast. As more projects are deployed, the LCOE of US offshore wind is expected to fall to levels in Europe and China, and reach parity within the next decade. In terms of plants that use CSP technology, Spain (2.3 GW) and the United States (1.8 GW) lead the 4.9 GW, 15-country market, but neither has added capacity since 2013 and 2015, respectively. The other CSP markets, from highest to lowest capacity, are South Africa, India, Morocco, United Arab Emirates, Algeria, Egypt, China, Australia, Israel, Italy, Thailand, Germany, and Turkey.16 The lowest LCOEs are in China and South Australia.17 CSP is not at parity anywhere yet, but a series of recent record-low auction results point to competitiveness with fossil fuels by 2020.18 By nature of its technology, CSP also includes storage, enabling performance parity with conventional energy sources.

Utility-scale solar and wind combined with storage are increasingly competitive, providing grid performance parity in addition to price parity. With the addition of storage, wind and solar become more dispatchable, eroding the long-held advantage of conventional energy sources. While the cost of renewables plus storage is higher, they can provide capacity and ancillary grid services that make them more valuable. Regulatory and market structures determine whether the additional value can be monetized. But even if the services cannot be sold, this combination is more valuable because operators can supply more of their own needs and potentially time shift the use of grid-supplied electricity to off-peak, cheaper hours. Renewables combined with storage are also reaching price parity as lithium-ion battery costs have fallen nearly 80 percent since 2010 and solar penetration has increased.19 All the top solar markets have utility-scale projects that include storage. In the United States, the storage market frontrunner, solar-plus-storage is already so competitive in some markets that developer Lightsource has announced all its bids in the west will include storage.20 Factoring in the investment tax credit, the United States will see solar-plus-storage projects at parity beginning next year in Arizona, followed by Nevada and Colorado, which will also feature wind-plus-storage at parity.21 A recent RMI study shows that renewables plus storage can be combined with distributed resources and demand response to create “clean energy portfolios” that provide the same grid services for less than it costs to build a new gas plant today, and less than it will cost to run an existing one as early as 2026.22

Utility-scale grid parity is not the only factor, as distributed renewables such as rooftop solar are reaching socket price and performance parity. In this case, price parity is reached when self-generation becomes less expensive than retail electricity bills. Commercial solar PV has reached unsubsidized socket parity in parts of all the top solar markets that are at grid parity, except for India.23 Incentives such as tax credits and net metering have made residential solar PV competitive in these markets too, and mandatory for new construction in California beginning in 2020. Solar installers are increasingly combining battery storage with residential solar. US homeowners deployed as many residential storage systems in the first quarter of 2018 as in the past three combined, mostly in California and Hawaii.24 Residential solar-plus-storage is currently cheaper than utility retail rates in 19 US states, as well as in several regions of Australia and Germany, where, respectively, 40 percent and 50 percent of residential solar PV systems installed in 2017 included storage.25 Australia and Europe have more residential and commercial rooftop solar than utility-scale solar capacity, raising the prospect of distributed versus utility-scale solar-plus-storage becoming the defining energy resource competition when grid and socket parity are reached.

II. COST-EFFECTIVE AND RELIABLE GRID INTEGRATION

One of the most often cited obstacles to the deployment of solar and wind energy has been their intermittency. The situation is reversing: Wind and solar may soon cease to appear as problems to be solved, but rather as solutions to grid balancing. Indeed, renewables have not been as difficult or costly to integrate as anticipated. What’s more, they have demonstrated an ability to strengthen grid resilience and reliability and provide essential grid services.

The intermittency challenges of wind and solar may be overstated. Most countries and regions are at renewable penetration levels that require minimal adjustments to the grid: Renewables either barely register at the system level or require only small changes in operating practices and in the use of existing resources.26 In countries or regions with a high penetration of renewables, requiring more complex systemic changes, conventional energy sources are adjusting to enable more renewables to be integrated cost-effectively. For example, across the European Union, China, and India, operators have retrofitted conventional combined heat and power plants to produce heat without electricity, and coal and CCGT plants to provide additional flexibility and stability. Interconnection with neighboring markets is another key tool that Northern Europe and regions of the United States have successfully pursued, since the aggregation of renewables spread over a larger territory can more cost-effectively smooth their output and eliminate curtailment.27

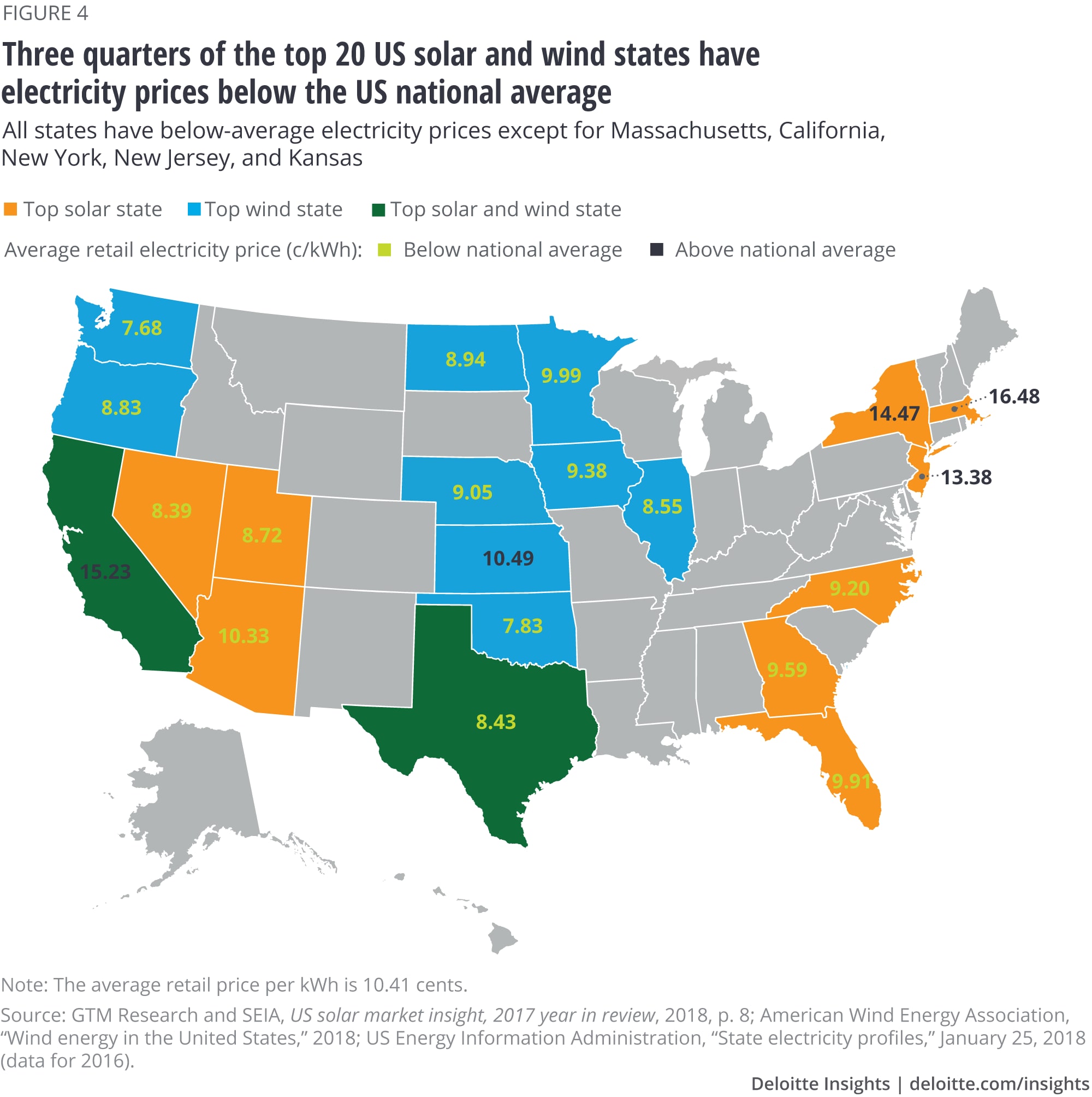

Wind and solar place downward pressure on electricity prices. In theory, because solar and wind have zero marginal generation costs, they displace more expensive generators and reduce electricity prices. In global practice, the deployment of solar has flattened midday price peaks, while wind has lowered nighttime prices.28 Three-quarters of the top 20 US solar and wind states have electricity prices below the US national average; a quarter are among the nation’s 10 states with the cheapest electricity, including the wind leader Texas.29 Wholesale prices in the top European solar and wind market, Germany, have more than halved over the past decade. In Denmark, which has the world’s highest share of intermittent renewables (53 percent), electricity prices exclusive of taxes and levies are among the lowest in Europe. Lawrence Berkeley National Laboratory estimates that once the United States reaches Denmark’s penetration levels of 40–50 percent renewables, some states will see the dawn of “energy too cheap to meter.”30

Growing shares of wind and solar pair with greater grid reliability and resilience. US states with the fewest outages are among the top solar and wind states.31 Over the past decade as wind production increased 645 percent in Texas, the state’s grid reliability metrics significantly improved.32 The grids of Germany and Denmark have also become more reliable over the past decade, even as the latter has seen wind and solar produce 90 percent of the power consumed in its western region for a fifth of the year. The interconnected Danish and German grids are currently two of the world’s most reliable.33 European data shows that unplanned outages form a minority of onshore and offshore wind outages, whereas most coal and gas plant outages are unplanned; onshore wind has fewer and shorter outages and recovers faster than any other generation source.34 In instances where extreme weather conditions have tested grid resilience, renewables compensated for fuel-based resource shortfalls. Wind broke generation records when the United Kingdom faced a natural gas shortage during a winter storm in 2018, and beat generation expectations in the United States when coal piles froze during the 2014 polar vortex or soaked during Hurricane Harvey in 2017.35

Wind and solar can become important grid assets. Intermittent renewables are already helping to balance the grid. For example, wind power helped decrease the severity of most of the northern Midcontinent Independent System Operator’s steepest three-hour load ramps in 2017.36 But conventional generation still provides virtually all essential grid reliability services related to frequency, voltage, and ramping. That may change, though, as smart inverters and advanced controls have enabled wind and solar to provide these services as well or better than other generation sources.37 When combined with smart inverters, wind and solar can ramp up much faster than conventional plants, help stabilize the grid even after the sun sets and the wind stops, and, for solar PV, show much higher response accuracy (respond faster and with the required amount of power) than any other source.38 Smart inverters can also turn distributed resources into grid assets with minimal impact on customers and make these resources visible and usable to utilities. The few jurisdictions leveraging these capabilities have mandated them (e.g., Quebec), allowed renewables to sell ancillary services in their markets (e.g., Italy), and/or created new services markets (e.g., the United Kingdom).39

III. TECHNOLOGY FOR AUTOMATED, INTELLIGENT, BLOCKCHAINED, AND TRANSFORMED RENEWABLES

New technologies involving automation, artificial intelligence (AI), and blockchain, as well as advanced materials and manufacturing processes, can accelerate the deployment of renewables. The technologies range from those streamlining the production and operation of renewables (automation and advanced manufacturing) to those optimizing their use (AI in weather forecasting), improving the market for renewables (blockchain), and transforming the materials of solar panels and wind turbines (advanced materials). These technologies support the previous two trends by helping to further decrease costs and facilitate integration.

Automation is dramatically cutting time and costs for solar and wind production and operations. FirstSolar automated its US manufacturing plant last year and tripled the size of its panels at a cost that undercut its Chinese competitors by 30 percent by transforming production from a hundred-step, multiday process to one that takes just a few steps and hours.40 Automation also has significant operational implications for offshore wind, which accounts for more planned maintenance outages per installed GW than any other generation technology.41 In July, the world’s largest offshore wind farm deployed fully automated drones and cut the inspection time from two hours to 20 minutes.42 Looking ahead, crawling robots currently under development will enable automated microwave and ultrasonic inspections of the internal structure and materials in solar panels and wind turbines.

Automated processes collect troves of data that AI can help analyze for predictive and prescriptive purposes.

AI finetunes weather forecasting to optimize the use of renewable resources. Weather forecasting is a key component in the integration of renewables because weather shapes the availability of wind and solar resources, as well as their consumption. On a cold windy day, both supply and demand for wind power might increase, whereas a windy night might see increased supply and unchanged demand. An AI system can process satellite images, weather station measurements, historical patterns, and data from wind turbine and solar panel sensors to forecast weather, compare the forecasts against reality, and adjust its model through machine learning to produce increasingly accurate forecasts. AI systems can process hundreds of terabytes of data and provide frequent forecasts at a highly granular level. National forecasting systems in the leading solar and wind markets have integrated AI and driven significantly improved accuracy and cost reductions for operators.43 For example, the AI-based Sipreolico, Spain’s national wind forecasting system, halved the number of errors in 24-hour forecasts in seven years of operation. Hyperlocal AI forecasting models can now be implemented in a week almost everywhere.44 In addition, IBM is currently working with the US National Center for Atmospheric Research to create the first global weather forecasting model, which will bring AI capability to underserved markets.45

Another technology that could benefit underserved markets is blockchain.

The case for blockchain is compelling for energy attribute certificates. The electricity sector is rife with possible applications for blockchain. One of the clearest use cases is energy attribute certificate (EAC) markets—predominantly renewable energy certificates (RECs) in the United States and Guarantees of Origin (GOs) in Europe. EACs are conceptually simple: Each energy attribute credit certifies 1 MWh of tradable renewable electricity generation. However, the tracking process involves a complex, expensive, and time-consuming interplay of multiple parties that is exposed to fraud. By providing a shared and trusted master list of all transactions, blockchain obviates the need for registry providers, brokers, and third-party verification.46 The automated process can become transparent, cheap, quick, and accessible to small players. Blockchain EACs would also help resolve the many trust and bureaucratic hurdles that are especially acute in developing countries, which have struggled to get EAC markets off the ground (see Powered by blockchain: Reimagining electrification in emerging markets).47 Both startups and established players have started exploring EAC blockchains, with a power company and stock exchange recently partnering to create a proof of concept.48

Meanwhile, two proven concepts have paved the way for paradigm shifts in the field of advanced materials and manufacturing.

Advanced materials and manufacturing: Perovskite and 3D printing are poised to revolutionize the solar and wind industries. Perovskite has been the fastest-developing solar technology since its introduction, making efficiency gains that took silicon over half a century to achieve in less than a decade.49 In June 2018, a British and German startup demonstrated a record 27.3 percent conversion efficiency on perovskite-on-silicon tandem cells in laboratory settings, beating the laboratory record of standalone silicon cells.50 Belgian researchers achieved similar efficiency the following month, and both claim that over 30 percent efficiency is within reach.51 Perovskite has a simpler chemistry, the ability to capture a greater light spectrum, and higher efficiency potential than silicon. Perovskite can also be sprayed onto surfaces and printed in rolls, enabling lower production costs and more applications. Perovskite modules may be commercialized as early as 2019.52

On the wind front, additive manufacturing is paving the way for the use of new materials. Two US national laboratories collaborated with the industry to manufacture the first 3D-printed wind-blade mold, significantly reducing prototyping costs and time, from over a year to three months.53 The next frontier is to 3D print the blades. This would enable use of new combinations of materials and embedded sensors to optimize the blades’ cost and performance, as well as onsite manufacturing to eliminate logistical costs and risks. Manufacturers plan to start with on-demand 3D printing of spare parts at wind farms to reduce costs and downtime for repairs.54 GE is already using additive manufacturing to repair and improve wind turbine blades.55

Manufacturers are heavily investing in these new technologies because they anticipate growing demand for solar and wind power.

Demand

Cities, communities, emerging markets, and corporations are increasingly driving demand for renewables as they seek reliable, affordable and increasingly clean energy sources. Thanks to the enabling trends, solar and wind power are now best positioned to deliver on all three of these goals. Smart renewable cities (SRCs) see renewables as an integral part of their smart city strategies; community renewable energy is empowering consumers to access electrification or exercise electricity choice; emerging markets are embracing solar and wind as the best means to power their development strategies; and corporations are procuring renewables to improve their bottom line while greening their operations.

IV. SMART RENEWABLE CITIES

SRCs recognize that solar and wind can power their smart city goals. Most of the world’s population now lives in growing cities, some of which have taken a proactive “smart” approach to managing their infrastructure with connected sensor technology and data analytics. The focus of more advanced smart cities is to enhance quality of life, competitiveness, and sustainability (see Forces of change: Smart cities).56 Solar and wind are at the intersection of these goals because they contribute to depollution, decarbonization, and resilience while enabling clean electric mobility, economic empowerment, and business growth. SRCs capitalize on this confluence. The biggest SRCs are doing this by transforming their existing infrastructure, while the newest ones are building it from scratch.

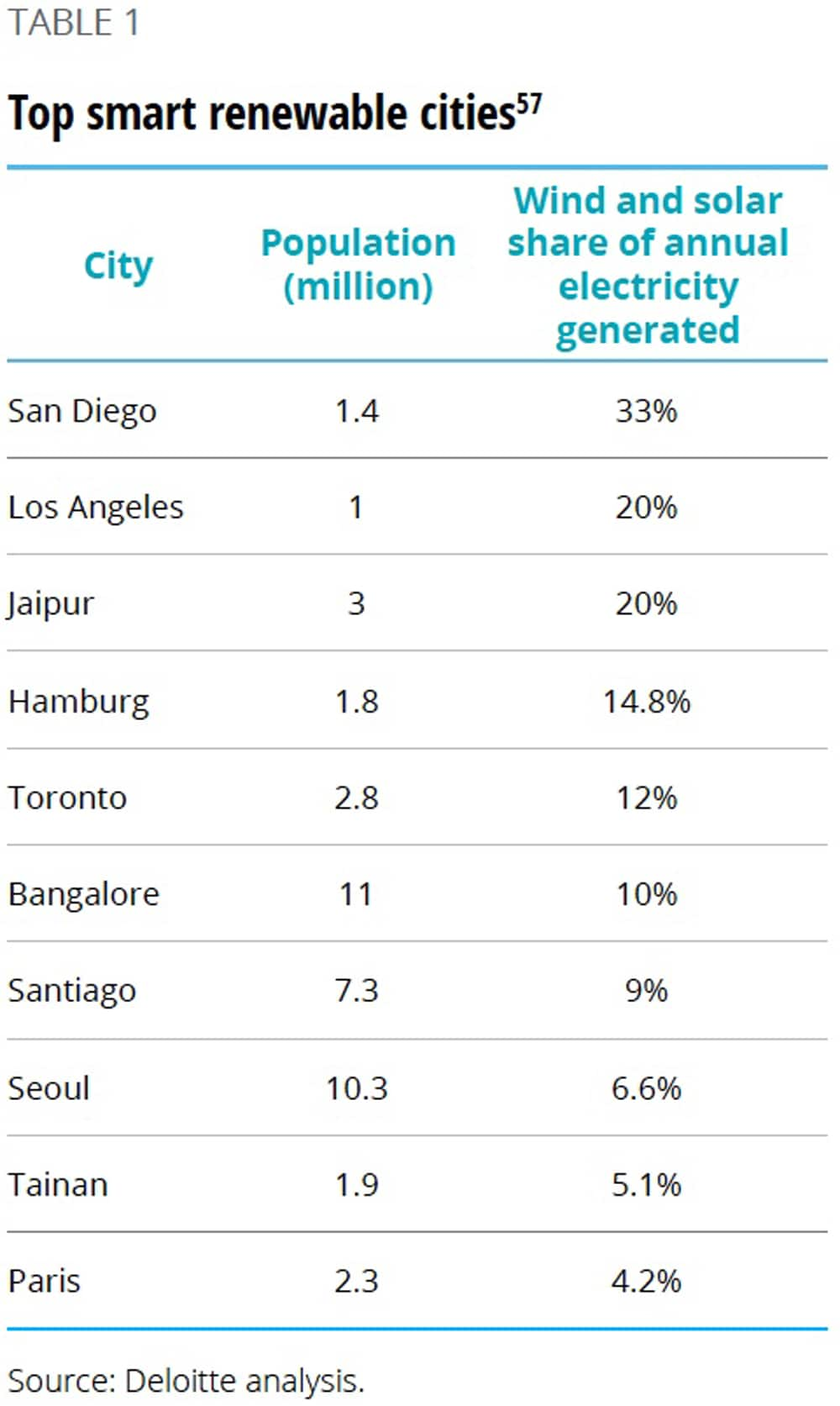

The biggest: Million-people SRCs. SRCs can be defined as cities with solar and/or wind power and a smart city plan that includes a renewable energy component. Table 1 lists the cities with over a million people by their share of power generation from wind and solar. San Diego is the global leader. Solar and wind already account for over a third of its electricity mix, and the city has a 100 percent renewables target by 2035. San Diego is also a locally driven SRC—while the US government is stepping back from climate commitments, San Diego has vowed to continue its deployment of renewables.58 The city also has a more ambitious renewable target than California’s statewide target. Meanwhile, the leading city in Asia, Jaipur, is a nationally driven SRC. India’s national government created a 100 Smart Cities Mission that included a solar energy requirement.59 Jaipur does not have a renewable target, but will benefit from ambitious state and national targets set this year. Jaipur’s key SRC initiative is rooftop solar powering of infrastructure, beginning with eight metro stations that will be entirely solar-powered during the day.60 Finally, the European leader Hamburg is a locally and supranationally driven SRC. While Germany does not provide a national smart city strategy or facilitate access to funding, the European Union provides many platforms and funding sources supportive of SRC initiatives.61 Hamburg has drawn on these to help position itself as a European hub for renewable research and companies in addition to deploying renewables. These SRCs share the challenge of transforming existing infrastructure and systems into smarter, more renewable ones.

Greenfield SRCs can create them from scratch.

The newest: Greenfield SRCs. Unencumbered by legacy development, entrenched interests, and red tape, greenfield SRCs can build a model city that showcases and tests the latest technology. Peña Station Next is an aerotropolis that seeks to capitalize on a strategic location at a train station between the booming city of Denver and its growing airport—two stakeholders in this project.62 The 382-acre community is powered with an islandable rooftop solar-plus-storage microgrid owned by Xcel Energy and operated by Panasonic, another two key partners in the smart city’s development. The National Renewable Energy Laboratory (NREL) is also partnering with the city to help create a net-zero energy and carbon-neutral community plan. In Canada, Quayside is a greenfield SRC located within the top-10 SRC of Toronto. Rooftop and wall-mounted solar will power the 800-acre waterfront neighborhood developed in partnership with Alphabet’s Sidewalk Labs.63 Finally, last year the Saudi Crown Prince announced a US$500 billion plan for a 10,000-acre greenfield SRC by the Red Sea called NEOM, with the ambition of becoming an international hub akin to Dubai.64 The plan envisions a city running entirely on solar and wind power paired with storage, and features a bridge across the sea to Egypt.

While first-generation greenfield smart cities were criticized for their ghost town aspect, resulting from a focus on technology over people, these new SRCs seek to weave into the existing urban fabric, with Peña Station serving as a “living lab” for Denver, Quayside as a “model sustainable neighborhood” for Toronto, and NEOM as a “connectivity hub” for Asia and Africa. Solar and wind power are integral to their plans. While Peña Station and Quayside are small SRCs, they can provide proofs of concepts for technologies and business models that can then be scaled in big cities. NEOM can do the same at a much greater scale. With so much freedom, the challenge for greenfield SRCs is to narrow the options down to a combination worth exploring.

Greenfield renewable projects are also key to areas that are not connected to an electric grid.

V. COMMUNITY ENERGY OFF AND ON THE GRID

The original trend toward “community solar” has expanded into “community energy” with the addition of storage and management systems that allow more flexibility. The expansion has resulted in new ways for community energy to serve off-grid and on-grid areas. In off-grid areas, it can now provide electrification at price and performance parity with other options. In on-grid areas, its ability to power communities independently of the grid fulfills resilience and self-determination goals. In both situations, many countries have embraced community energy as it democratizes access to the benefits of renewables deployment.

In off-grid areas, community renewable energy can provide optimal electrification. Community energy in off-grid areas can be defined as community-owned partnerships that enable electrification and reinvest profits in the community. Projects mostly consist of solar-plus-storage microgrids in rural areas with sufficient population density. The main driver for solar-powered microgrids is their cost-effectiveness relative to fuel-powered microgrids, a grid extension, kerosene lamps, or diesel generators. Renewable microgrids are also generally more reliable than the grids in developing countries.65 Nongovernmental organizations (NGOs) have primarily initiated and funded these community energy projects. The advantage of community energy over other electrification models is strong community buy-in and empowerment. The same rationale applies to many island markets and remote areas in developed countries. On the flipside, some communities in developed countries are pursuing community renewable energy as a means to go off grid. This is notably the case in Australia, where community energy grew strongly in 2017.66 In an effort to generate electricity that's more reliable, affordable, and clean than what their national grid provides, communities such as the Tyalgum Energy Project are developing self-sufficient renewable microgrids that could sell excess power back to the grid or disconnect from it completely.67

In areas with developed electric grids, community energy provides shared ownership or access to wind and solar resources. Energy cooperatives are the most common structures and involve shared citizen ownership and operation of renewable resources. Germany is the global energy cooperative leader: Over two-fifths of renewable energy installed in the country last year was cooperative-owned, and Germany recently implemented new rules to level the playing field for energy cooperatives to participate in power auctions.68 Denmark also strongly supports energy cooperatives, requiring a 20 percent local community share in all wind projects.69 The energy cooperatives have contributed to strong citizen engagement and support for the deployment of renewables in these two countries. Spurred by a national competition, the Danish island of Samsø successfully transitioned from an entirely fossil fuel-dependent market to a 100 percent renewables-fueled one in under a decade with a community energy model.70 Energy cooperatives are also the pioneers of community energy in the United States, as discussed in Deloitte’s Unlocking the value of community solar.71 Cooperatively owned utilities, driven by member customer demand, account for over 70 percent of US community solar programs,72 while larger utilities account for the majority of capacity. Almost half of US households and businesses cannot host a solar system for lack of suitable or accessible roof space; community energy enables them to buy electricity from a shared solar project and receive a credit on their utility bill. Third-party providers administer two-thirds of community solar capacity, primarily to commercial customers and mostly in Colorado, Minnesota, and Massachusetts, with utilities accounting for the rest and primarily serving residential customers.73 Low costs, customer demand for renewable energy, and resilience concerns are driving the strong demand for community energy. The latter is reflected in Massachusetts’ Community Clean Energy Resilience Initiative (CCERI) grant program to protect communities from electricity service interruptions.74 Many communities that have experienced blackouts in the aftermath of natural disasters or severe weather events are turning to community renewable microgrids as a resilience tool to protect critical infrastructure. This is the case in Japan, which has a national resilience plan supportive of community energy.75

While cities and communities are increasingly relevant actors in the deployment of solar and wind power in developed markets, the national level is most relevant in emerging markets.

VI. EMERGING MARKETS AS LEADING MARKETS

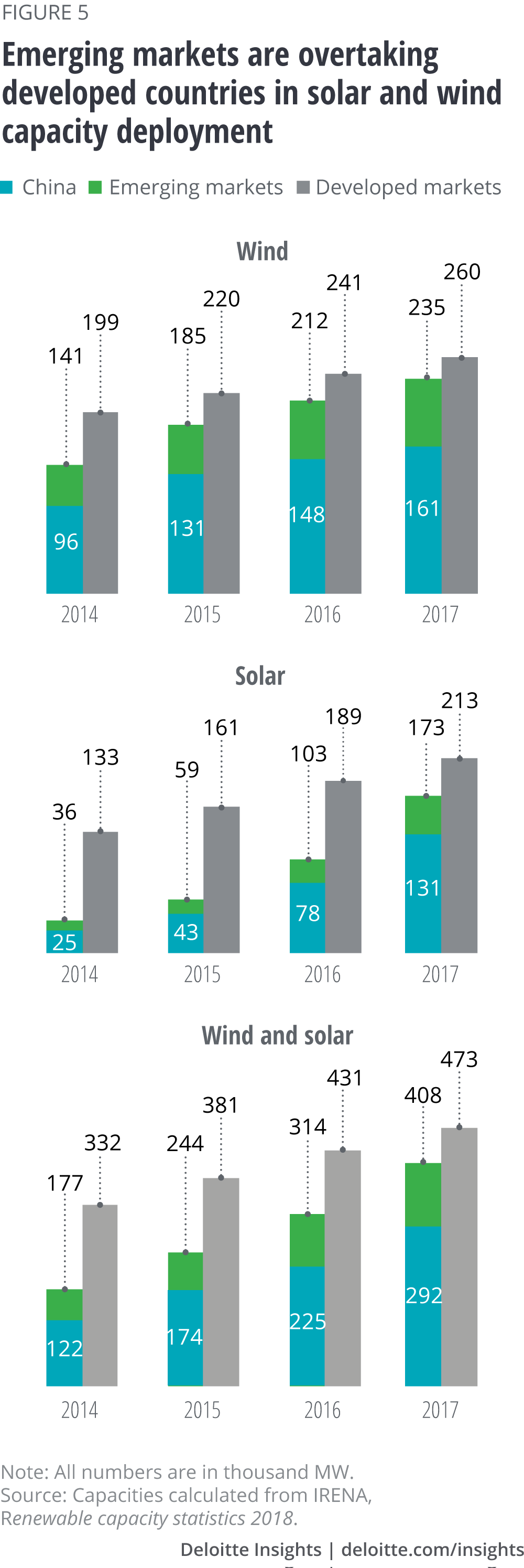

The solar and wind industries and markets started and matured in the developed world (defined as the 33 high-income OECD members), but their center of gravity has shifted to emerging markets (all nondeveloped countries). In 2013, emerging markets surpassed the developed world in onshore wind growth, and in 2016, solar PV growth; in 2017, they accounted for 63 percent of global new investment in renewable energy, widening the investment gap with developed countries to a record high.76 Today, their cumulative capacity is on the verge of surpassing that of the developed world (figure 5). Emerging markets have helped bring down the cost of renewables, allowing them to leapfrog developed countries in the deployment of renewables, pursue less carbon-intensive development, and innovate in ways that also benefit the developed world.

As the global leader, China is propelling the ascent of emerging markets in renewable energy growth. China recorded the largest solar and wind growth and total installed capacities in 2017 and is the only market above 100 GW for both sources. China alone accounted for over half of new solar capacity installations as well as two-thirds of global solar PV panel production in 2017. Eight of the top ten solar PV suppliers are Chinese, and the top three Chinese wind companies together account for the largest wind market share.77 China is also the only country to rank among both the top 10 recipients of emerging market cross-border clean investment and the top 10 investors, and the only emerging market among the latter. From the record cross-border clean investment year of 2015 through the first half of 2017, China invested US$2.23 billion in wind and solar in 11 other emerging markets, and received US$1.34 billion in wind and solar investments from 13 investor countries.78

Even without China, emerging markets are driving renewable energy growth and have the greatest potential to drive future growth. Emerging markets sans China are not ahead of the developed world in terms of wind and solar capacity added annually, but China’s share of emerging markets’ added capacity decreased from 2016 to 2017 for both wind and solar.79 In other areas, emerging markets outside of China are leading the way. Auctions for solar and wind capacity hit their most recent records in Mexico and the United Arab Emirates (UAE), which, respectively, recorded the world’s lowest bids for wind and solar in 2017. Auctions have helped turn India into the world’s most competitive renewables market, with new players joining the fray.80 India and Turkey doubled their solar capacities in 2017, and the former recently raised its already lofty renewable energy target to 227 GW by 2022.81 Emerging markets have accounted for all new CSP capacity over the past two years; South Africa was the only country to bring new CSP capacity on line in 2017, while the UAE announced the world’s largest CSP project, slated to be operational in 2020. The countries with the highest renewable energy investment as a share of GDP are also all emerging markets, including the Marshall Islands, Rwanda, Solomon Islands, Guinea Bissau, and Serbia.82 Finally, the largest untapped market for electrification, Sub-Saharan Africa, presents a huge opportunity for renewable energy growth. For the most marginalized unelectrified populations in low-density areas, pay-as-you-go solar home systems are often the best electrification option. The International Energy Agency estimates that in the next two decades, most people without electricity will gain access through decentralized solar PV systems and microgrids.83

Emerging markets are incubating innovation. Developed countries have benefitted from market and product designs that initially took off in emerging countries. For example, renewable energy auctions are a trend that emerging markets embraced first and that has brought steep declines in renewable prices across the globe.84 Some solar and wind products designed in and for emerging markets are also now being deployed in developed markets in a process of reverse innovation. For example, microgrids designed to electrify off-grid areas in developing countries have found applications in remote mines in developed countries.85

More broadly, corporations play a growing role in facilitating transfers between developed and developing countries that promote renewable energy growth.

VII. THE GROWING SCOPE OF CORPORATE INVOLVEMENT

Corporations are procuring renewable energy in new ways, with a growing number of industry sectors involved. Power purchase agreements (PPAs) are becoming the preferred tool as corporations become increasingly concerned about the quality of their procurement: The gold standard is additionality, that is, assurance that the procurement creates measurable, additional renewables capacity. PPAs provide the greatest additionality, but are primarily accessible to large corporations. Aggregation is starting to expand access to smaller players. The largest corporations are also requiring and helping smaller companies to procure renewables as they have encompassed supply chains in their renewable targets.

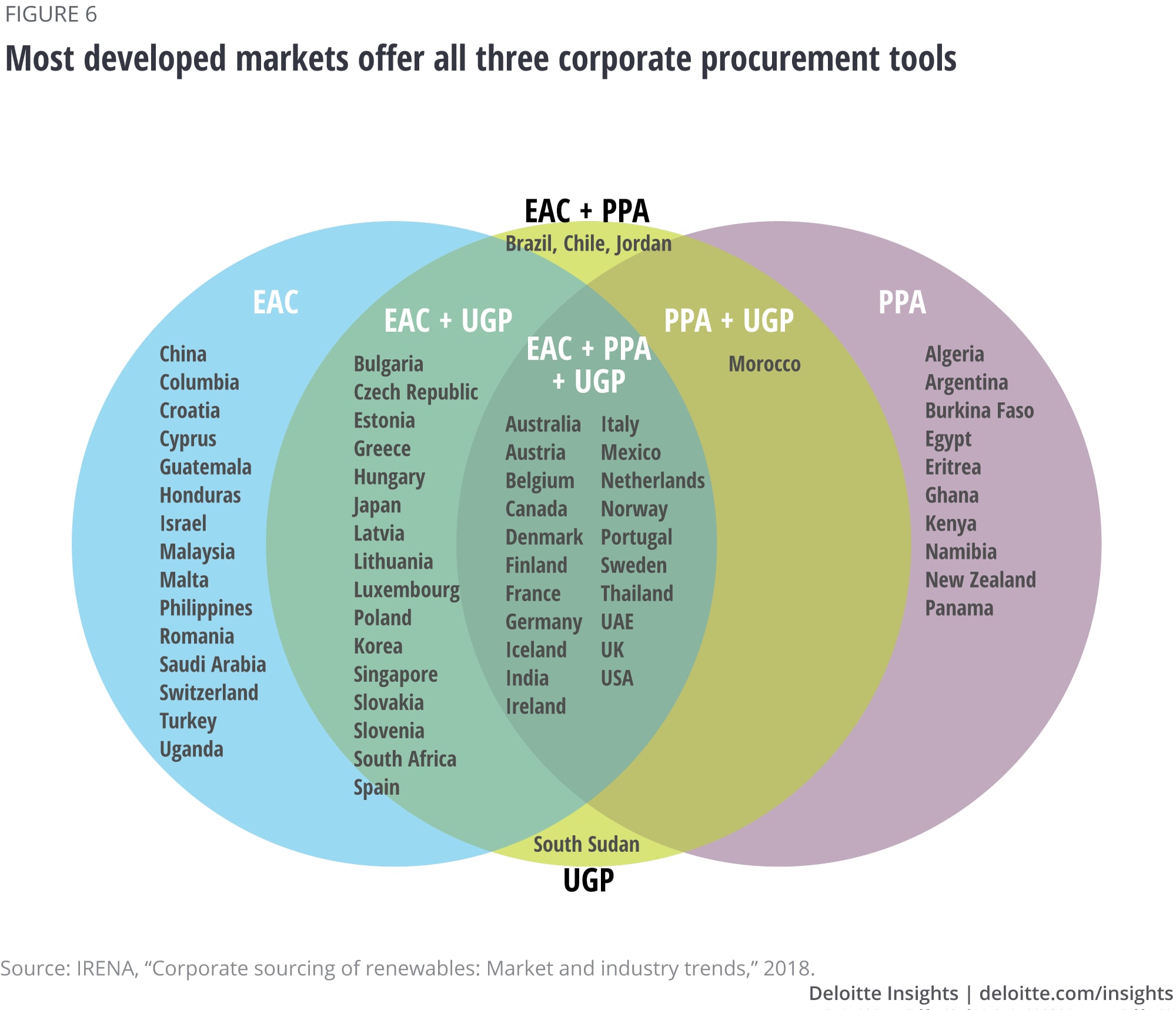

PPAs are the most rapidly growing corporate procurement tool. Corporations sourced 465 terawatt hours (TWh) of renewables globally in 2017 through self-generation or procurement.86 Three procurement tools are available to various extents across the 75 countries where corporations are sourcing renewables: EACs, utility green procurement programs (UGPs), and PPAs.

EACs, the most widely used procurement tool, are available in 57 countries and are easy to procure. They allow companies to certify compliance with government renewable requirements or voluntary targets. However, they do not capture the full cost benefit of renewables and may not always provide additionality. UGPs are available in 39 countries, mostly in Europe, but are the least used and least transparent tool. They are often tied to EACs and share the same drawbacks. PPAs are available in 35 countries and rapidly spreading. In 2017, corporations signed a record 5.4GW of renewable energy PPAs in 10 countries.87 By the end of July 2018, corporations had already far surpassed this record, with 7.2 GW purchased in 28 markets.88 PPAs offer greater additionality and cost savings over EACs and UGPs, but also over typical electricity prices. However, they are more difficult for smaller players to access. They are a preferred tool for companies with electricity costs exceeding 15 percent of operational expenditures.89 Most of these companies actively manage energy procurement since it represents a significant outlay.

All three tools are available in North America and most European countries. These developed countries continue to be the leading corporate procurement markets, and information technology remains the leading sector. However, companies in other sectors are increasing renewable procurement as well, and emerging markets are making it easier. Emerging markets India and Mexico also offer a full toolkit and are seeing growing multinational and national corporate procurement.

A corporate compound effect can be achieved through aggregation and supply chains. Two-thirds of Fortune 100 companies have set renewable energy targets and are leading global corporate procurement through PPAs. Many of them have joined RE100, a group of 140 companies (as of September 2018) that have committed to sourcing 100 percent of their electricity from renewables.90 These are all positive developments, but the renewable corporate procurement momentum can only be sustained if many smaller companies join the effort and are able to access the full corporate procurement toolkit. As argued in Deloitte’s 2017 report Serious business: Corporate procurement rivals policy in driving growth of renewable energy, small- and medium-sized businesses represent the next wave of opportunity. Through aggregation, smaller players can form partnerships to jointly execute a utility-scale PPA. Some project developers are now meeting these smaller companies halfway by aggregating a series of PPAs. Last year, a Fortune 1000 company signed a PPA for 10 percent of an 80 MW wind project. The company will benefit from the project’s economies of scale, while the developer will benefit from a diversified customer base and financial risk pool consisting of several smaller companies.91 This same company more recently collectively purchased 290 MW of renewable capacity with three companies, including a top procurer of renewables that provided access and favorable PPA terms the other partners would not have been able to otherwise secure. The scope of corporate procurement is also growing through supply chains. A third of RE100 companies have expanded the 100 percent renewables target to encompass their supply chain. This larger scope has the additional benefit of bringing multinational corporate expertise and capital to the renewables sector in emerging markets. A leading corporate procurer of renewables recently created a US$300 million clean energy fund to invest in the development of 1 GW of renewable energy in China, a model it hopes to replicate elsewhere.92

Conclusion

Solar and wind power recently crossed a new threshold, moving from mainstream to preferred energy sources across much of the globe. As they reach price and performance parity with conventional sources, demonstrate their ability to enhance grids, and become increasingly competitive via new technologies, deployment obstacles and ceilings are dissolving. Already among the cheapest energy sources globally, solar and wind have much further to go: The enabling trends have not even run their full course yet. Costs are continuing to fall, and successful integration is proceeding apace, undergirded by new technologies that are bringing even greater efficiencies and capabilities.

Meanwhile, the demand for renewables is inexorably growing. Solar and wind power now come closest to meeting three energy consumer priorities: reliability, affordability, and environmental responsibility. In leading renewable markets such as Denmark, supranational, national, and local community interests are aligned on these goals. In others, such as the United States and Australia, where the national leadership is retreating on decarbonization efforts, cities, communities, and corporations have become the most relevant actors. They have stepped up to fill the vacuum and demand has continued to grow. Finally, the emerging markets that will see the most significant growth in electricity demand as they develop and/or electrify have leapfrogged into a position of solar and wind leadership. The case for renewables has never been stronger.

© 2021. See Terms of Use for more information.