Mergers and acquisitions for growth Trends in the US consumer products sector

03 December 2018

Mergers and acquisitions remain a potential expeditious route to achieve business growth among consumer product companies, even with the uncertainties of transaction success. Awareness of business-model coherence and a pragmatic approach to integration can contribute to success.

Persistent growth in mergers and acquisitions

A 2016 article in the Harvard Business Review indicates that approximately 70–90 percent of global acquisitions are “abysmal failures.”1 Despite this rate, companies are commonly willing to take risks on pursuing mergers and acquisitions (M&As). For example, our analysis shows that in the consumer products sector alone, the average transaction value has doubled in the last three years compared to the average for 2010–2014. Notwithstanding the uncertainty about transaction success and the cyclical nature of consolidation,2 which is influenced by industry shifts and economic cycles, M&A activity can be one expeditious route to help attain business growth and achieve a long-term edge in the marketplace.

Learn more

Read more from the Retail & consumer products collection

Sign up to receive related content from Deloitte Insights

Transpiring against a backdrop of macro elements, such as the global economic and political environment, market volatility, regulatory overhauls, interest rate concerns, and disruptive technologies, M&A deals in the consumer products sector continue steadily. Our analysis of 8,000 completed and 600 pending deals in the consumer products industry from January 2010 to October 2018 suggests that multifaceted motivations drive consumer products deals. Further, informed by an analysis of global transactions and a deep dive into activity in the global deal capital—the United States—our analysis indicates that:

- While there have been some fluctuations in M&A activity since 2010, the overall trend indicates that consumer products companies continue to actively seek inorganic growth, both globally and in the United States.

- The United States continues to dominate the global M&A scene, both as an investor and as a destination. The trended US data shows consistent growth over the last eight years, with the exception of 2016.

- In terms of deal characteristics for the US market, domestic acquisitions constitute most of M&A activity. A typical US deal, whether inbound or outbound, is most likely to be small or midsized. Most consumer products buyers tend to prefer consumer products companies as targets, and specifically, within this sector, the food and beverage industry has been the hotspot of activity. Similar to global consumer products deals, the US deals are largely driven by the intent to improve geographic presence, to expand distribution networks by entering newer channels, or to focus on backward integration to establish better control on the sourcing side of the supply chain.

Research methodology

Our insights are based on a comprehensive Deloitte analysis of more than 8,000 completed and 600 pending deals. Information was extracted from Thomson SDC Platinum and covers the period from January 2010 through October 2018. We examined global deals made by consumer products companies in the food and beverage, apparel and footwear, household products, and personal care industries. We considered majority-stake acquisitions that granted the buyers 50 percent or more control of the company targeted for purchase. To capture the deal-count correctly, the analysis also included deals where transaction values were not disclosed. We excluded instances where a global parent company invested in its own subsidiary or transactions that occurred between subsidiaries of a common parent company.

The following discussion delves into these findings in more detail, provides a perspective on what our study suggests with regard to near-term activity, and outlines questions companies would likely benefit from considering in order to improve the likelihood of success when contemplating a transaction.

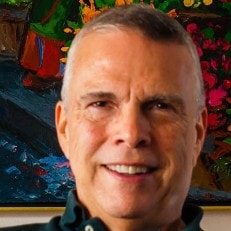

Motives behind global consumer products M&A activity

Our comprehensive analysis of 8,000 deals over the last eight years revealed a range of motives behind the global consolidation activity (figure 1). Our assessment of the prevalence of each motive is also listed in figure 1. These themes are multidimensional and can offer a strategic advantage when correctly timed and completed in compliance with antitrust laws.

The motive to strengthen operations through geographical expansion has driven the majority of deals over the past eight years. Interestingly, the number of deals aimed at expanding into secondary and new markets is almost double than those meant for expansion in primary markets. This likely indicates that consumer products companies have adequately explored growth opportunities in their domestic markets and are looking to tap into new markets. Companies have also sought to improve cost efficiency, and expand products and services offerings through acquisitions. These, either individually or coupled with other major motives, have consistently driven the majority of noteworthy deals since 2010.

Mega deals do not take place in a vacuum and potentially can result in a series of additional ones. An interesting case study of a multifaceted deal is the US$100 billion plus megamerger between Anheuser-Busch InBev (AB InBev) and SABMiller in 2016, then claimed to be the third-largest acquisition in corporate history and the largest in the United Kingdom.3 The merger of these two of the “big three” global beer companies involved multiple motives—and complications. Further, another reason this deal is interesting is because of how one primary deal gave rise to many more deals owing to the nature of the circumstances involved.

Motives

Like most deals in the past few years, AB InBev’s chief acquisition motive was to improve geographical presence, especially in emerging markets with notable growth prospects, such as Africa and Latin America. AB InBev’s already-strong foothold in developed markets was expected to be complemented by SABMiller’s presence in developing markets, specifically its 30 percent market share in Africa. Apart from this, the deal would help AB InBev defend its market share in mature markets as younger consumers increasingly opted for craft beers.

Challenges

Nonetheless, this growth opportunity came with a compromise for AB InBev as it looked to secure the European Commission’s antitrust clearance, a law to ensure that deals do not hurt consumer prices, and competition. After due deliberation, the regulator consented to the mega-deal, but with conditions. One such condition was that AB InBev sell SABMiller’s entire beer business in Europe. AB InBev complied and carried out select, strategic dispositions to comply with regulatory requirements, recovering over one-fourth of its deal value for SAB Miller.

Byproducts

The mega-deal resulted in three more deals in three different geographies, each impacting AB InBev differently.

- United States: Sale of SABMiller interest in MillerCoors to Molson Coors: This deal enabled Molson Coors to strengthen operations in primary and new geographies. Specifically, it gave the company the global rights to the Miller brand, and the right to continue selling brands it then held in its US portfolio. Also, AB InBev was not allowed to acquire any other brewer, including craft brewers, without the consent of the Department of Justice, making it difficult for the company to grow this segment in the United States, where it had over 40 percent market share but was facing declining beer sales volume.

- China: Sale of stake in joint venture CR Snow to China Resources Beer (CRB): The deal gave CRB, which already owned 20 percent share in the Chinese beer market by volume, a complete ownership of the CR Snow subsidiary. It helped CRB strengthen its operations in its primary market. This was a concern for AB InBev as it struggled to grow its 19 percent market share in China in the face of then-declining industry volumes due to economic uncertainty.

- Europe: Sale of a few premium European brands to the Asahi Group: AB InBev’s disposal of select brands to Asahi Group gave the Japanese beermaker Asahi a foothold in Europe. The brands—including Peroni Nastro Azzurro, Grolsch, and Meantime—became part of Asahi UK, an entity developed to drive the super-premium beer sector in the region. In this instance, the deal enabled Asahi to reap substantial benefits in terms of geographical expansion in new/foreign markets as well as opportunity to offer new products.

This mega-deal in the beer industry points us to a range of motives that fuel thousands of deals globally. The following section provides insights into the trended deal activity that spurred from similar strategies implemented by global consumer products companies.

Globally, consumer products companies continue to actively seek inorganic growth

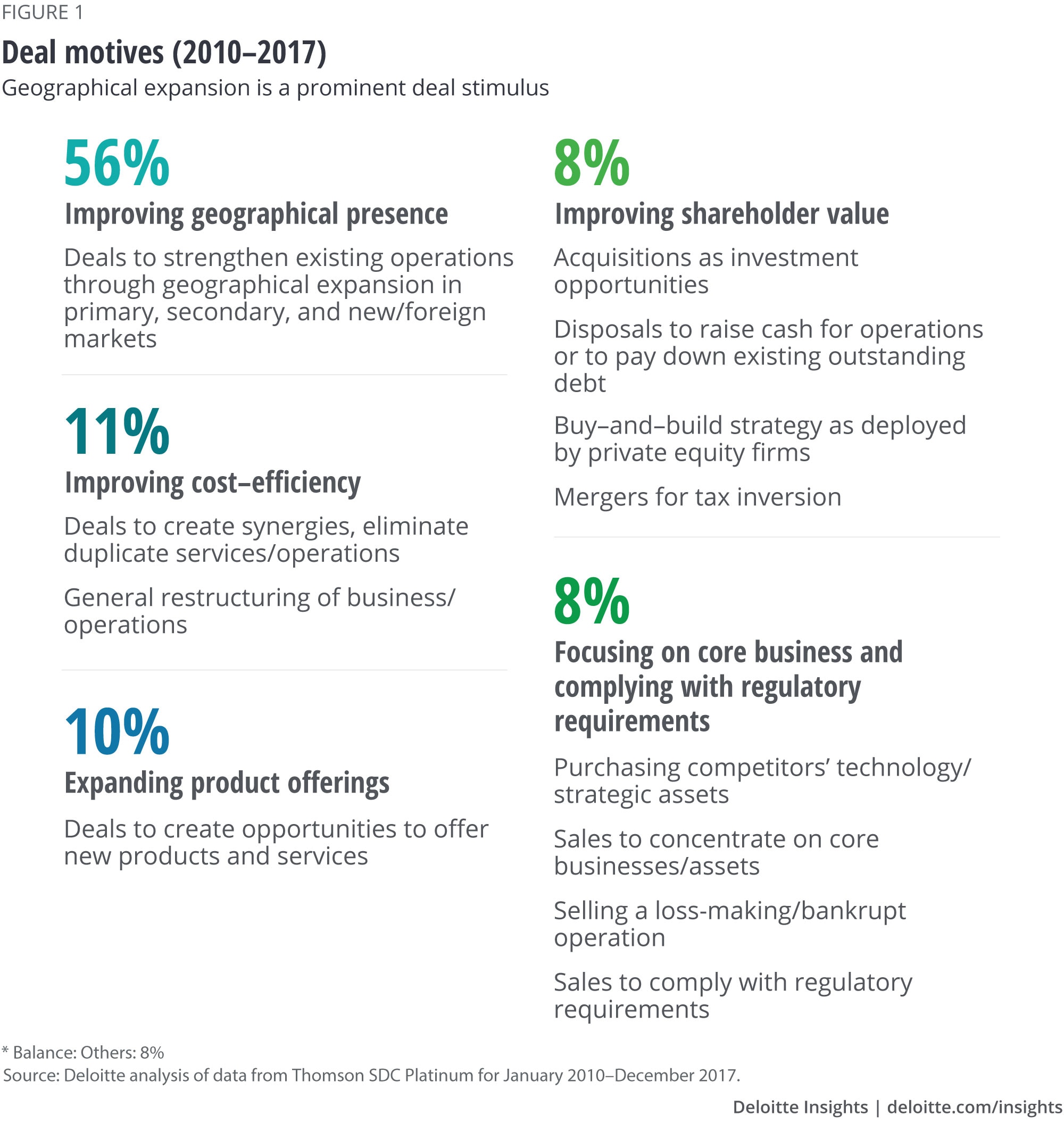

The year 2015 marked a milestone in consumer products M&A activity in terms of both deal volume (surpassed 1,000 deals) and value (surpassed US$100 billion), indicating that consumer products majors are increasingly looking to expand across geographies to drive sales and profitability (figure 2). Thus far, these companies have diligently driven market penetration in their home markets, but now, perhaps finding it challenging to achieve significant new growth, are looking at secondary or new markets to tap into.

In terms of value, global deal activity was quite stable during 2010–2013 and subsequently grew at a compound annual growth rate (CAGR) of 33 percent till 2016. By volume, this corresponded to a 3 percent CAGR increase. In 2017, volume declined 4 percent year over year. This decline in the volume was noteworthy, as it corresponded to a 42 percent decline by value.

The decline was mainly caused by the 80 percent drop in inbound deal value in consumer products in Europe, particularly in the United Kingdom. The United Kingdom, typically one of the most active European countries with regard to M&A, saw a significant drop of 97 percent in inbound deal value during this period. This was likely due to uncertainty around Brexit that may have made investors anxious about the growth in the immediate future. Notably, as global consumer products companies looked at alternative destinations for investment, it was not the other European Union countries that benefited from an increase in attention. In fact, by deal volume, 20 of the 32 countries studied experienced a decline, likely bringing increased attention to the United States for potential investments.

Some of the decline in global activity in 2017 can also be attributed to the Asia Pacific region, where despite higher inbound deal count in 2017 than in 2016, deal value suffered owing to fewer mid- and large-sized deals.

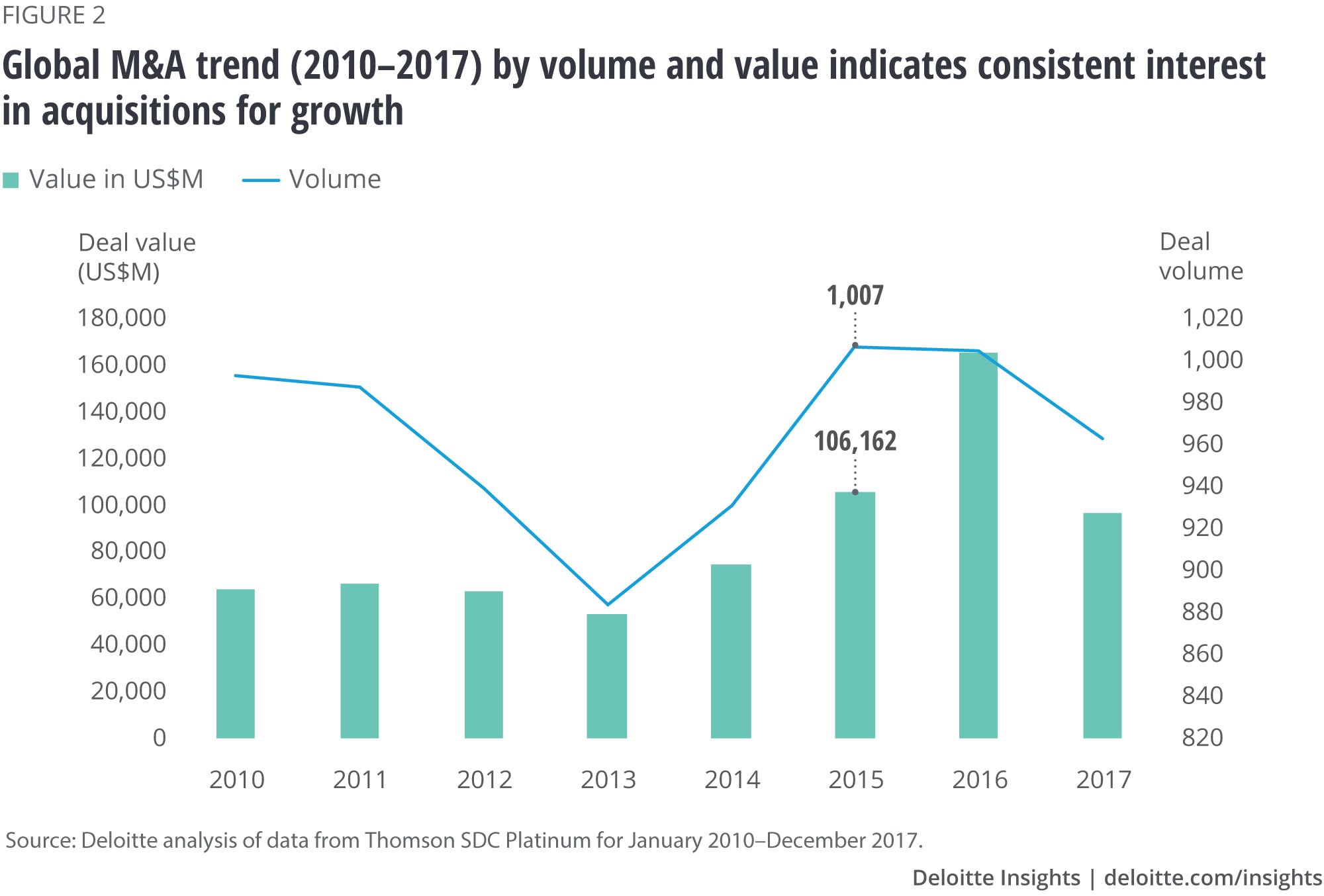

United States remains a dominant global M&A participant, both as an investor and as a destination

In terms of both inbound and outbound activity, the United States ranked the highest in each of the last eight years, both by value and by volume. During 2010–2017, the United Kingdom, Japan, France, and China have consistently featured among the top 5 countries by volume, albeit with fluctuating rank order. Although these countries have shown steady deal activity by volume, they lag the United States by a wide margin. Figure 3 illustrates the top global investors and destinations by value in 2017, when for the very first time in the last eight years, the Czech Republic and Germany joined the United States in the top 5 by value list owing to mega acquisitions in those regions.

US consolidation trend reveals steady interest in M&A activity for growth

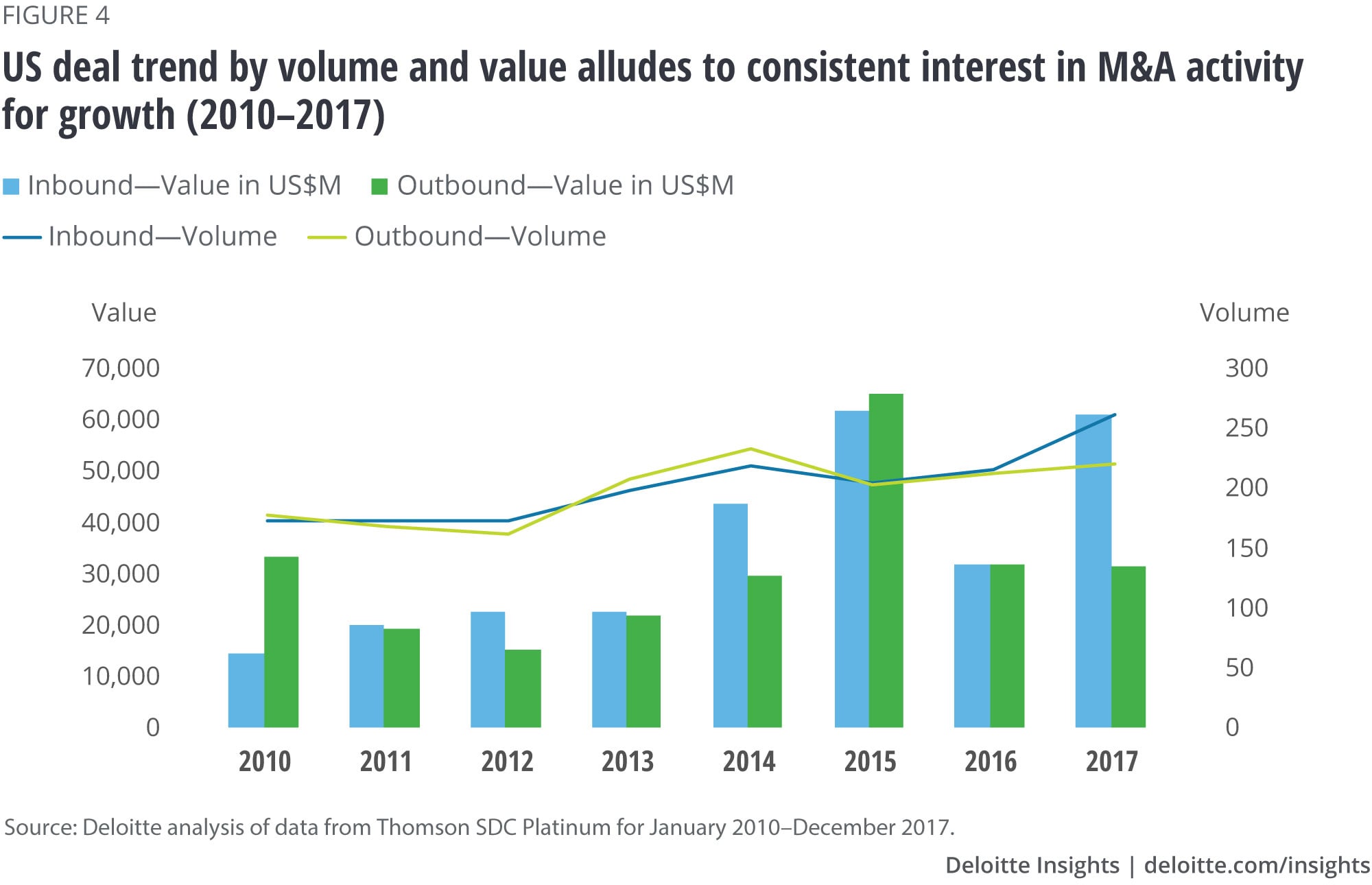

Deal activity in the US consumer products sector has grown consistently in the last eight years, with the exception of 2016 (figure 4). This can likely be attributed to a range of factors including the then-impending US presidential election, the political uncertainty surrounding Brexit, and depressed crude oil prices.4

Overall, the US inbound consumer products activity rose at a CAGR of 5 percent by volume during 2010–2017. The growth trend holds true for deal value as well, which posed a CAGR of 20 percent.

Deal characteristics and the trends they signal

Domestic deals constitute the majority of US M&A activity: Our analysis indicates that consumer products companies in the United States are most inclined to make local acquisitions—US domestic activity accounted for 89 percent of deals by both volume and value in 2017. Their next significant preference is for the European region, specifically the United Kingdom. This preference continued even in 2017 when the United Kingdom saw an overall dip in M&A activity due to uncertainty around Brexit. Given the activity thus far in 2018, the US interest in UK acquisitions seems likely to continue.

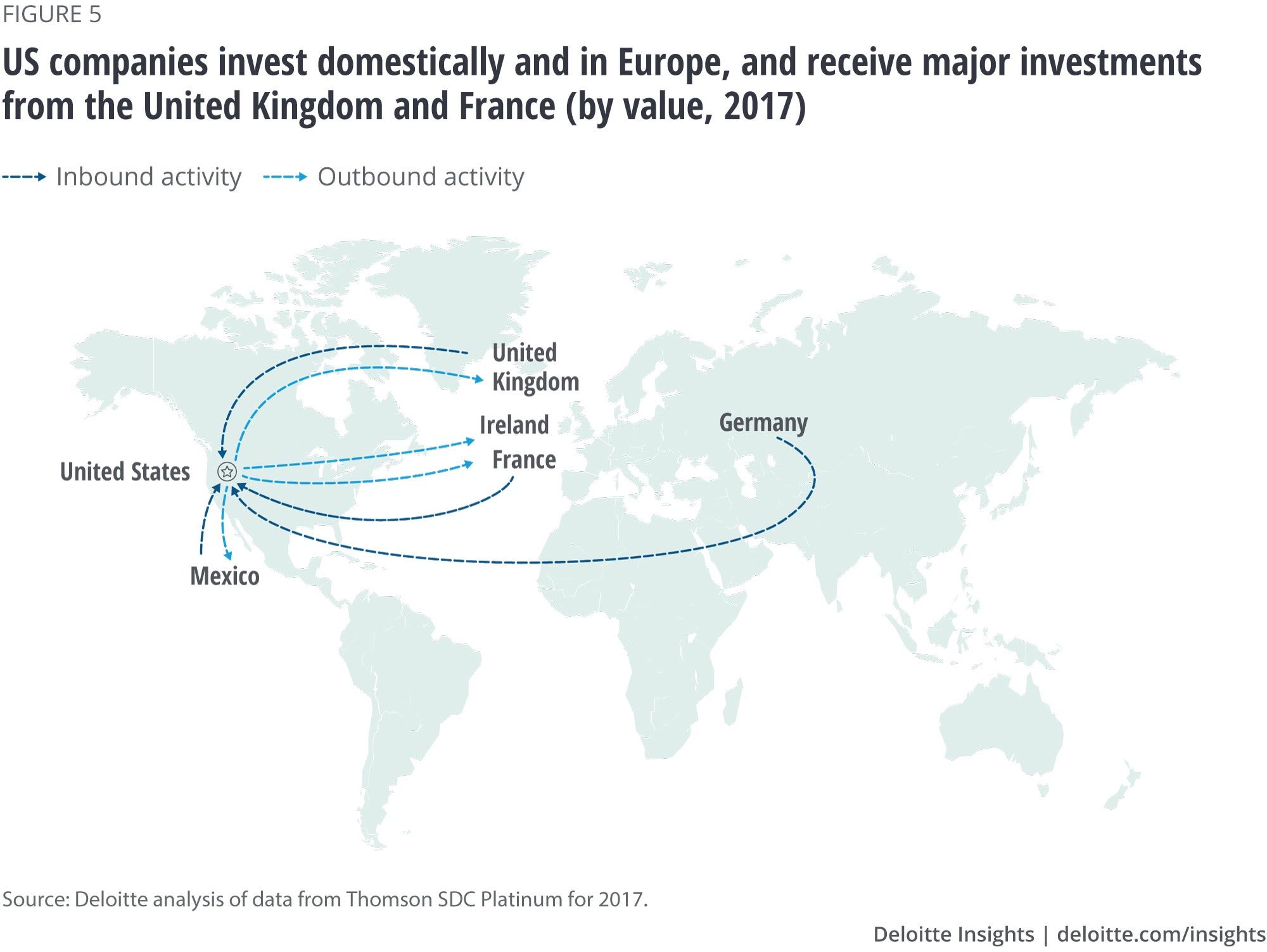

Apart from significant investments in the United States and the United Kingdom, the consumer products buyers in the United States have made consistent acquisitions in Canada, and have invested in Asia-Pacific too, albeit sparingly. In terms of inbound activity, the United States received significant foreign investment from the United Kingdom and France in the form of a few, but major deals (figure 5), with the two nations accounting for about half of the total inbound US deal value from a mere 6 percent of transactions in 2017.

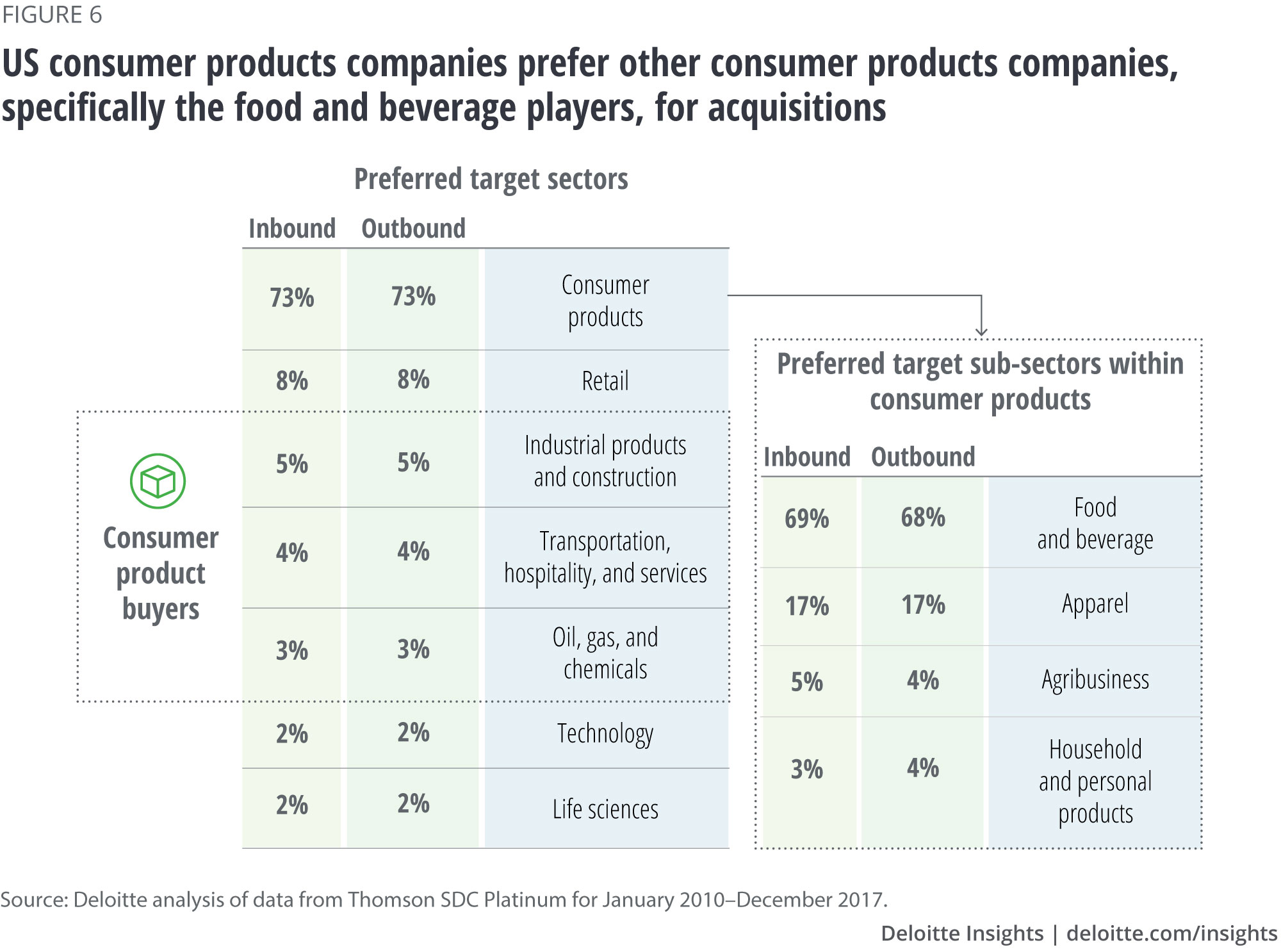

The food and beverage industry is the hotspot of M&A activity within consumer products: Most acquisitions by consumer products companies over the last eight years have been within the consumer products sector. This supports our view that the primary reason for M&A is growth either via geographic expansion or through portfolio diversification. Our analysis also revealed the other top sectors and sub-sectors within consumer products where these buyers have preferred making acquisitions since 2010 (figure 6).

Specifically, in 2017, three out of four completed deals included consumer products targets, with a total value amounting to 80 percent of the annual deal value. Another sector of consumer products interest, as indicated in figure 6, is the closely aligned retail sector, perhaps because it can further consumer products companies’ distribution efforts. The other targets likely help consumer products companies address a need either within the supply chain or around consumer preferences.

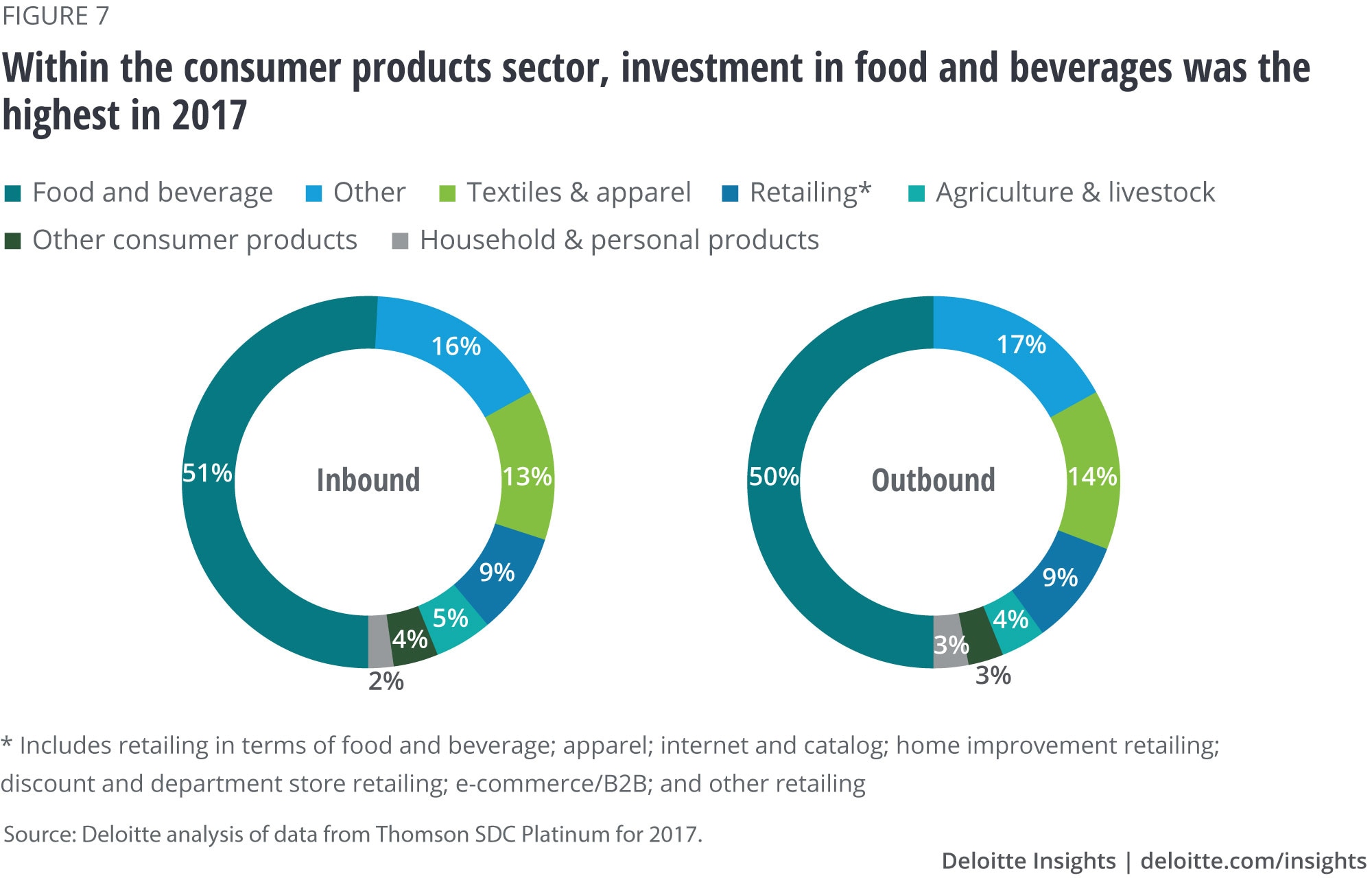

At the sub-sector level, for both US inbound and outbound deals, food and beverages is the most attractive segment within consumer products, followed by apparel, retail—particularly food & beverages retailing—and agribusiness (figure 7). In fact, these sub-sectors have consistently been attractive to the investors, in that order, since 2010. Acquisitions in the food and beverage space are likely to steadily grow primarily because this sub-sector is seeing the most flux in terms of consumer preferences, whether for convenience, wellness, alternate food sources, sustainability, conscientious sourcing, and/or food traceability.

That said, recently consumer products companies have started carrying out nontraditional deals as well, such as buying technology companies,5 mostly to acquire online capabilities to expand their digital reach. These capabilities can give them access to both better customer insights and advanced analytics. Since such acquisition targets have different business models, consumer products companies would likely benefit from a deliberate focus integrating the business goals and strategies of the two consolidating entities to truly extract the value from such transactions.

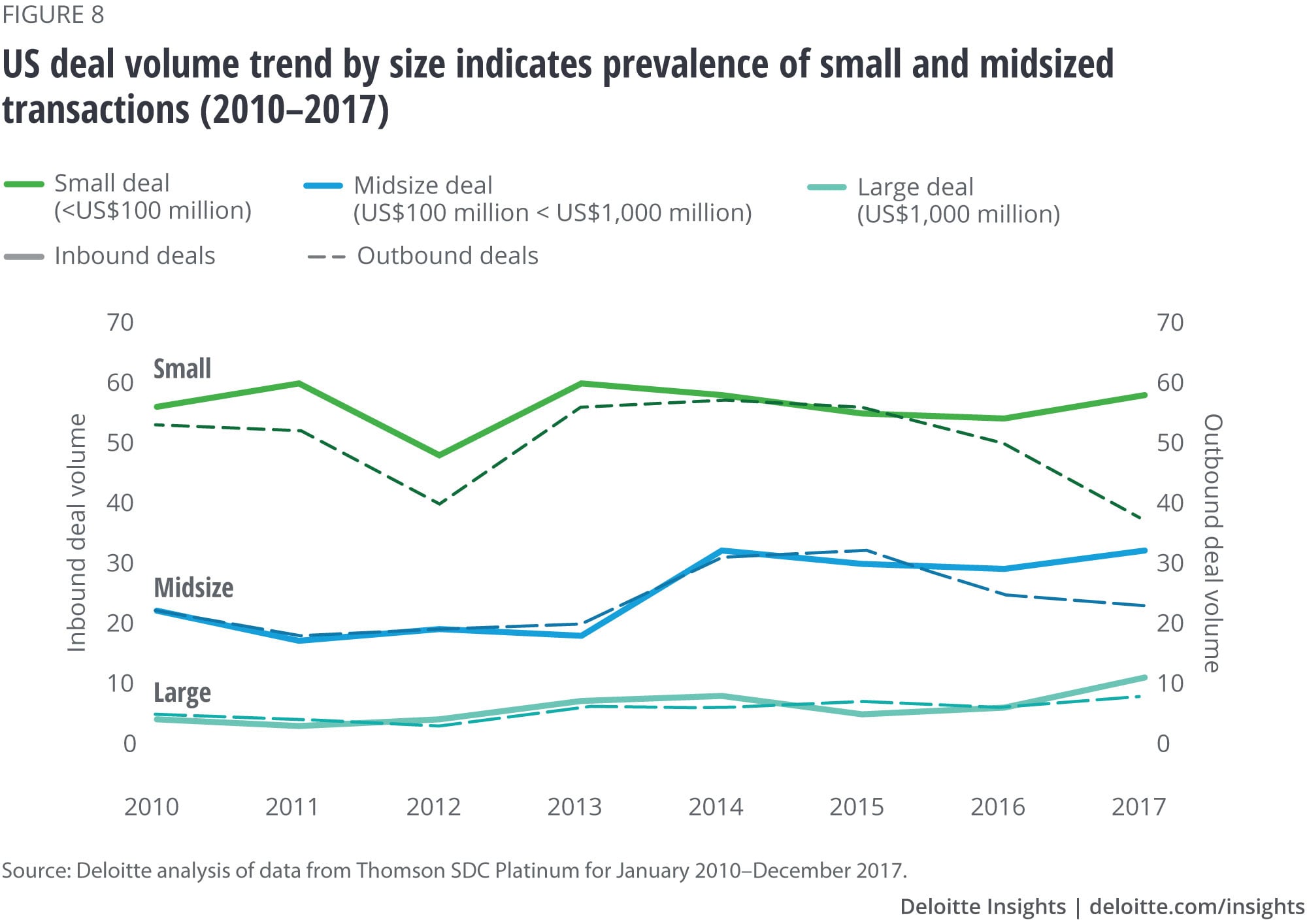

A typical consumer products deal in the United States, whether inbound or outbound, is most likely to be small or midsized: Overall, most deals across the years have involved small and midsized target companies. The 2017 data indicates that small deals have slowed while midsized deals have relatively picked up (figure 8). Also significant in 2017 was the number of large-ticket deals, which almost doubled compared to 2016.

An examination of deals by industry indicates that the majority of large deals comprises consumer products buyers acquiring consumer products targets. At the same time, where consumer products buyers acquired technology companies, deals have been mostly small and seldom midsized. Such small and relatively frequent acquisitions enable the consumer products companies to better respond to emerging consumer preferences, get a head start on a trend, explore newer channels, achieve leading-edge logistics, or feed the innovation pipeline. This approach can be more expedient, rather than companies having to struggle with existing “too-large-to-be-nimble” operations.

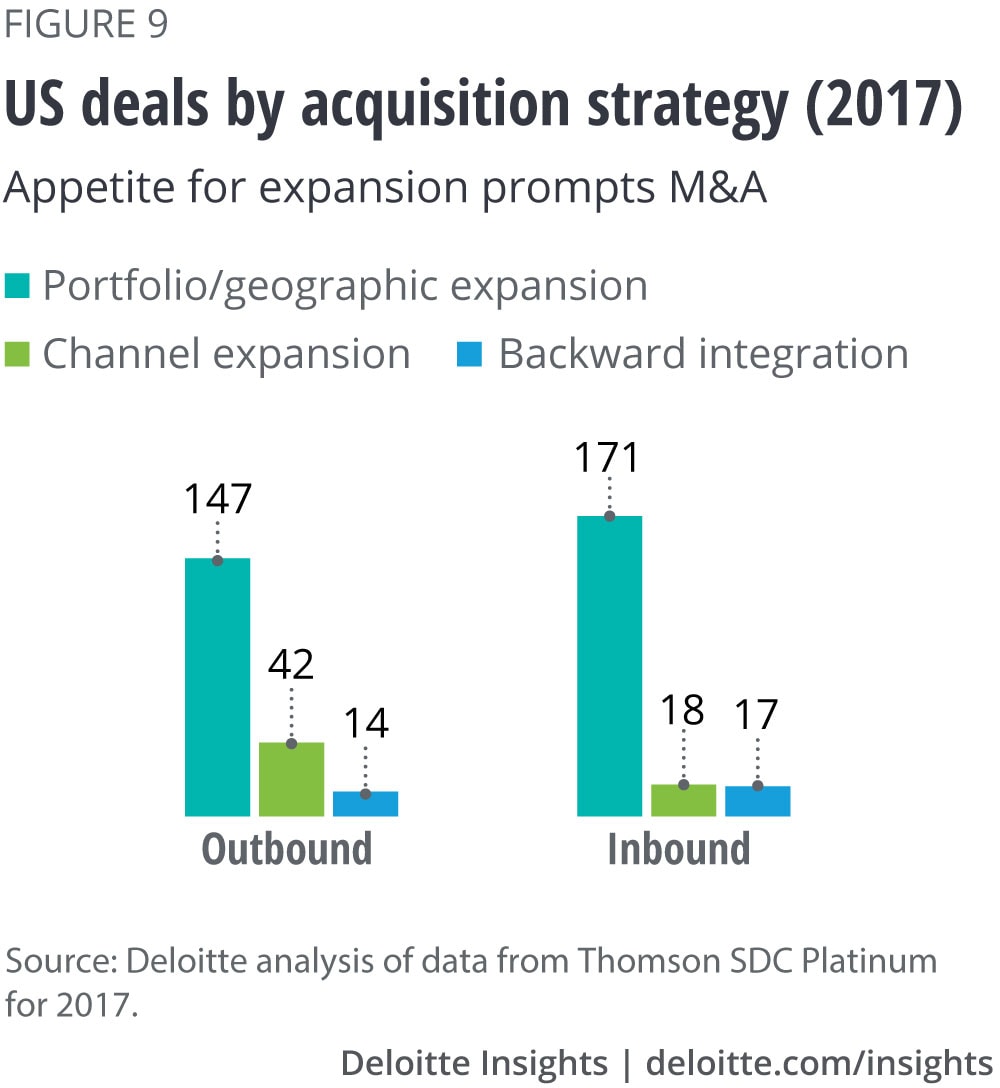

Similar to global consumer products deals, geographic expansion drives most acquisitions in the United States: In the case of both inbound and outbound US deals, the trend points to three notable strategies driving acquisitions.

- Most acquisitions occurring within the consumer products industry signal US companies’ motives to grow through portfolio and geographic expansion (figure 9).

- The consumer products buyers looked to channel expansion, acquiring retail players, to likely diversify their distribution network or enter newer channels.

- Companies focused on backward integration where acquisitions were made in the sourcing side in the supply chain.

In the light of the increased emphasis on both responsible sourcing and traceability of raw materials, companies will likely continue pursuing backward integration to exercise more control over their sourcing.

Closing thoughts: Considerations for consumer products companies

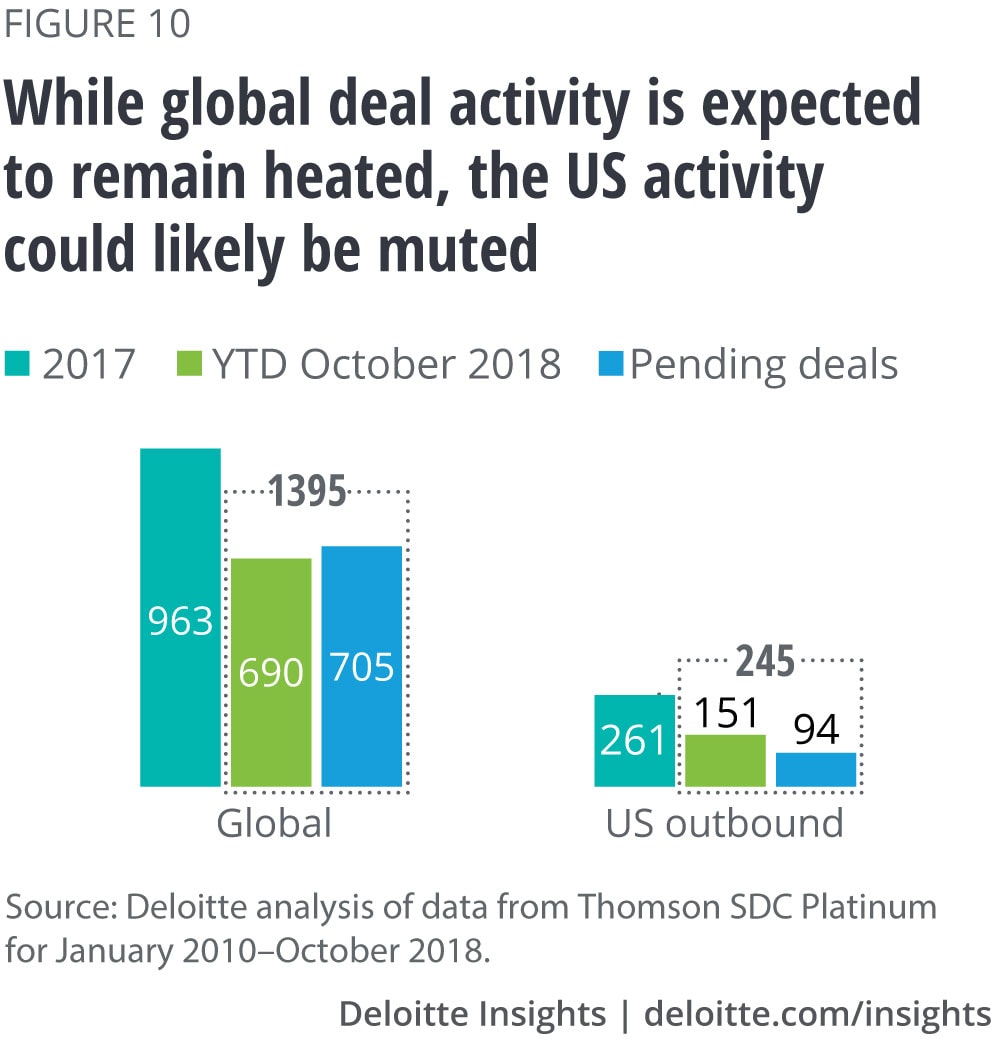

Several factors (such as year-to-October 2018 deals, and deals announced in 2017 and 2018, but pending execution) indicate that global deal activity is likely to remain heated in the near future (figure 10). The US outbound deal activity—based on only two components of activity, including year-to-October 2018 closed deals and the deals announced so far—appears subdued.

Further, our analysis of trended data thus far shows that most of the deal activity in the United States would probably be small or midsized, in the domestic space, and would be aimed at geographical expansion. Several consumer trends are likely to continue influencing M&A, including continued interest in health and wellness, convenience, influence of generations, and increased consumer spending on the back of elevated consumer confidence.6

Overall, M&A can only be successful if the deal participants are cognizant of the compatibility of their business models. For example, business results are often more favorable in cases of complementary mergers, where a company acquires a smaller target with a similar business model, resulting in a combined company whose overall business model is relatively unaffected by the transaction.7 This business-model coherence can enable the most efficient use of a company's resources, attention, and time. Conversely, when a company acquires another with a different business model, regardless of the size, the result can be a sudden or dramatic reduction of coherence. This could have a detrimental impact on business performance and value creation, as has been illustrated by many deals in the past.8

As consumer products companies continue to explore the inorganic growth avenue, they would likely benefit from a comprehensive understanding of characteristics associated with the deal life cycle that can influence the overall success of the transaction.9 A few key aspects worth considering include:

- Was their target a good, strategic fit in the first place?

- Was effective due diligence performed?

- Did the acquirer pay a fair price for the target?

- Was the integration well handled?

Consumer products companies seeking successful transaction outcomes could benefit by developing a strategy to diligently extract value from the deal, even after the execution is complete. Deep consideration of several factors, including business-model coherence, scale, probability of creating synergy, and the likely effect of the deal on the competitive landscape, can enable companies to make informed decisions on whether to move forward with potential transactions.