Disclosure of long-term business value has been saved

Disclosure of long-term business value What matters?

19 July 2013

- Eric J. Hespenheide, Dr. Dinah A. Koehler

Decision science methods can allow companies to determine the materiality of environmental, social, and governance topics in a way that is objective, robust, and replicable.

Executive summary

Sustained and superior performance depends, in part, on effective measurement, management, and disclosure of traditional financial metrics. There are many other metrics, such as those used to evaluate environmental, social, and governance (ESG) performance; resource efficiency; business model resilience; innovative capacity; brand strength and corporate culture, which can be just as informative on how a business is creating value. There is a lot to be said for building a business that outperforms on these metrics—especially when competitors miss, ignore, or simply misunderstand how they can drive business value and growth opportunities. CFOs, with their unique, cross-functional vantage point, need to consider more than their results for the next quarter and a wider range of stakeholders—customers, suppliers, consumers, employees, non-governmental organizations, and communities—that play an important role in an organization’s success.

This research takes an in-depth look at how companies determine materiality in the ESG context, and discusses the challenges managers face and how these impact what type of data is disclosed. Today, most companies that measure these nontraditional metrics disclose most of the information in a separate sustainability report—yet this is likely to change. The challenge faced by all public and private companies is how to determine what information to disclose. Many companies are trying to apply the principle of materiality from traditional financial reporting to this new set of performance metrics, but this remains difficult terrain because there is little hands-on guidance about precisely what to do. Simply put, managers have neither the tools nor the approach to make these decisions efficiently and rigorously. The result is data that is difficult to use for making business decisions, both inside a company and externally.

Materiality determination is one of the most complicated ESG-related decisions for senior management, which faces considerable uncertainty related to ESG topics. With limited resources at hand, managers should choose a small set of material performance indicators that inform on valuation impacts and consistently report data, and they should focus less on trying to satisfy every one of the company’s stakeholders. Furthermore, ESG materiality determination need not be a qualitative “finger to the wind” exercise. Decision science methods can help corporate leaders and CFOs effectively leverage the intelligence that is gained from all key stakeholders by applying a more structured approach to stakeholder engagement. They can also help management make strategic choices, including capital budgeting decisions. More importantly, the result is quantitative and based upon fundamental insights into how complex decisions are made.

The changing view of business value

Emergent natural resource constraints, global demographics and politics, environmental degradation, and increasing severity of weather events will continue to generate volatility and uncertainty in the global marketplace. At the same time, social movements, combined with Internet-enabled interconnectivity, have unleashed a significant leap in transparency, some of it forced on companies. Corporate leaders are constantly reminded that the public and other stakeholders expect companies to demonstrate their social value and ensure long-term sustainability and profitability. Indeed, when it comes to hot-button issues like sustainable forestry or employment policies, social activists tend to pressure not only one company but also its industry peers.1 Furthermore, one company’s negative reputation event can be felt across several industries.2 As these forces converge and intensify, they challenge CFOs to reconsider a traditional reporting model that may not effectively meet today’s information needs. Those that do are in good company. Today, 60 percent of CFOs at large global enterprises—with average annual revenue of $17 billion—believe that sustainability challenges will change financial reporting and auditing.3

“ESG performance needs to be understood by CFOs “as generating long-term shareholder value.”” —Dave Stangis, vice president, CSR and Sustainability, Campbell’s Soup Company

A sharper focus on long-term success reveals that business value can only be created and sustained if the underlying assets—financial, human, manufactured, social, or natural—are not depleted but in many cases increased. What matters is not only a company’s financial performance but also its performance on dimensions that are “intangible” and measured in non-financial units. Non-financial metrics can provide insights into long-term organizational strategies that depend on a company’s intellectual capital, customer loyalty, and resilience in the face of rapidly shifting marketplace demands, among other intangibles. Research finds that most businesses face a large gap between how well they measure non-financial performance and what in fact drives stock market and long-term financial performance.4 Furthermore, closing that gap is likely to lead to improved financial performance. Historical data shows that capital markets today more closely track a company’s intangible assets than its tangible assets. Intangible assets include a company’s R&D, brand, reputation, management of environmental and social externalities, and social license to operate (see figure 1). In short, traditional financial metrics provide insight into a company’s short-term performance but may not be the best way to measure long-term value creation.

These value drivers increasingly influence investor decisions, whether or not they immediately deliver ROI. Evidence is growing that there are causal links between how a company manages ESG issues and valuation impacts. For example, preservation of the social license to operate can explain the difference in valuation of two gold mines identical on traditional key valuation variables: the amount of gold in the ground, the cost of extraction, and the global price of gold.5 Once you have lost control over an intangible asset, such as reputation or legitimacy, it takes much more work to recoup an element of control.6

Measuring ESG performance can lead to better business decisions and help managers uncover “blind spots,” according to Emma Coles, vice president of Corporate Responsibility at Ahold Group. For example, by tracking greenhouse gas emissions, managers can uncover opportunities to cut energy costs and identify environmentally benign sources of energy. With more CFOs considering ESG performance as part of strategic risk management,7 competition between companies will also be defined by how managers learn to mitigate these risks and take advantage of the resulting opportunities—strategies that are more likely to be rewarded by shareholders.

As stewards of capital and value, CFOs need to pay attention to these changing expectations and avoid erosion of market value by incorporating a broad range of intangibles in business decisions. This may entail difficult short-term trade-offs between performance measured in a variety of units (financial and non-financial) over various relevant time horizons. However, using a single scale to compare tangibles and intangibles can help companies make these complex decisions more effectively and ultimately improve long-term business value.

Information vortex

Of the 250 largest companies in the world (G250 companies), 95 percent now issue separate sustainability reports.8 Moving forward, it is likely that there will be greater alignment of traditional financial reporting and reporting on ESG topics.9 The international initiative for integrated reporting is proposing integrating the disclosure of standard financial information with ESG information to provide a more complete view of the commercial, social, and environmental context within which a company operates.10 Importantly, integrated reporting will likely require reporters to make valuation impacts of ESG information more explicit. The “total mix” of information involved in these decisions can be overwhelming.

Right now, there is often a disconnect between what ESG information companies disclose to their stakeholders and the data that actually drives management and investment decisions. Some think companies disclose too much information, others complain about too little information, and most agree that it is hard to know which information is business-critical for the long run.

For this reason, the discussion among reporters and users of ESG information has focused on the principle of materiality—a term drawn from financial accounting practice—as the essential filter for disclosing ESG information that is useful to the economic decisions of an interested user. Although based on the traditional definition of materiality from financial reporting, commonly used guidance on ESG materiality determination more explicitly incorporates a company’s (internal and external) stakeholders in the process.11 A stakeholder is any group or individual who can affect or is affected by the actions of an organization, and whose interests should be considered.12 Stakeholders may be helped (or harmed) by a particular business strategy, and it is up to managers to determine whether this might be material.

ma·te·ri·al·i·ty

Definitions of materiality

A matter is “material” if there is a substantial likelihood that a reasonable person . . . relying upon the report would have been changed or influenced by the inclusion or correction of the item . . . financial management and the auditor must consider both “quantitative” and “qualitative” factors in assessing an item’s materiality.

SAB 99

Information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on the size of the item or error judged in the particular circumstances of its omission or misstatement. Thus, materiality provides a threshold or cut-off point rather than being a primary qualitative characteristic that information must have if it is to be useful.

IAASB Framework for the Preparation & Presentation of Financial Statements, paragraph 30.

A meaningful definition of materiality must effectively identify information that, if omitted or misstated, would significantly misrepresent an organization to its stakeholders and thereby influence their conclusions, decisions, and actions for a particular company at a specified place and point in time.

AA1000 Assurance Standard

Material topics include direct and indirect impacts (immediate, gradual/cumulative, and visible/invisible) on an organization’s ability to create, preserve, or erode economic, environmental and social value for itself, its stakeholders, and society at large.

GRI Technical Protocol

Materiality threshold is a concept employed in the process of verification. It is often used to determine whether an error or omission is a material discrepancy or not. It should not be viewed as a de minimis for defining a complete inventory or a permissible quantity of emissions that a company can leave out of its inventory.

WBCSD/WRI GHG Protocol, revised

Companies that follow the Global Reporting Initiative (GRI) guidelines should consult with internal and external stakeholders when undertaking an ESG materiality determination to assess (among others):

- An organization’s overall mission and competitive strategy

- Significant financial impacts, both in the near term and over longer time horizons

- An organization’s influence on upstream (e.g., supply chain) and downstream (e.g., customers) entities

- International standards and agreements with which an organization is expected to comply

- Issues identified by expert communities or through impact assessment methodologies

- Broader social expectations

- Impacts that affect the ability to meet current needs without compromising future generations

Materiality of ESG data—like materiality for any input in investment decision-making—should be related to valuation impacts (e.g., through future earnings growth prospects, or potential impacts on balance sheet liabilities and risks). Both managers and investors need to understand that ESG performance is material to financial and stock market performance, according to Erika Karp, head of Global Sector Research, UBS Investment Bank. For example, during a 2004 drought in the Indian state of Kerala, the local government revoked Coca-Cola’s license to operate and ordered the company to shut down its $25 million plant. In the United States, college students began boycotting Coke products. At its peak, the plant filled approximately 1.1 million bottles a day and injected more than $50 million a year into the Indian economy. After a two-year trial, Coca-Cola convinced a court that drought was to blame for the dry wells and not the company, which was drawing water from a different aquifer. Coca-Cola has since established itself as an industry leader on water management. Nevertheless, the Kerala case presents a long-tailed risk: The bottling plant remains shut and, in 2011, the local government passed a law holding Coca-Cola liable for $48 million in damages to the local community.13

Yet to more successfully integrate ESG data into valuation analysis by the full range of investors, investors want it to be quantitative, reported consistently over several years, and conducive to comparisons both within and between industries. This is usually not the case. Rather than rely on ESG information disclosed by companies, a growing number of investors prefer to build their own ESG databases (e.g., Goldman Sachs’s GS Sustain and UBS) or use data from ESG data providers, such as MSCI, Asset4, or Trucost. Where possible, interested investors use ESG information to assess risk and return implications, evaluate management quality, engage with companies and inform proxy voting, and develop customized investment products or portfolios.14 According to Dan Hanson, portfolio manager at BlackRock, regardless of whether investors explicitly apply the “ESG” label to these characteristics, investors routinely consider corporate culture, management behavior, employee and customer engagement, and governance issues as fundamental inputs in investment decision making.

Corporate ESG disclosure

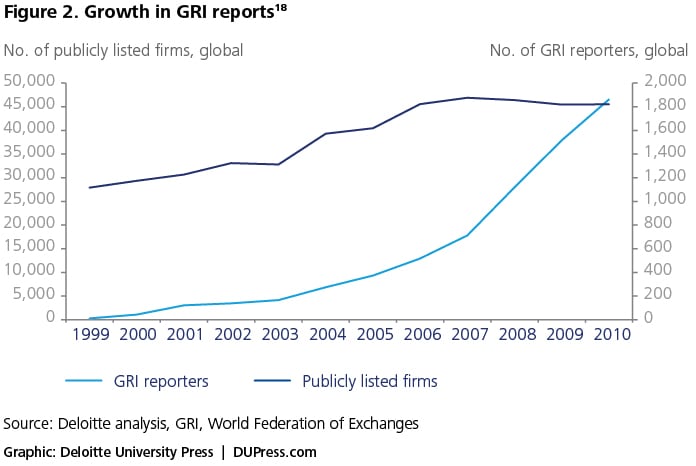

The GRI G3/G3.1 Sustainability Reporting Guidelines have become the de facto global framework for ESG disclosure. Since the release of the first version (G1) in 2000, usage of the guidelines continues to grow compared to growth in publicly listed companies (see figure 2). In total, the fraction of publicly listed companies that issue a sustainability report is small; however, the largest global companies are the most likely to disclose ESG information,15 and already in 2007 constituted an aggregate market value of over 10 percent of US market capitalization.16

Since its establishment 13 years ago, the GRI has emphasized disclosure. To this end, the GRI created various application levels that offer companies a graduated approach to reporting.17 Companies at the highest application level (A) disclose more than 100 indicators in some industry sectors. In 2010, 28 percent (526) of GRI reports achieved application level A, including 378 that were externally assured (A+) (see figure 3). As the list of performance indicators grew, so did concerns that many were irrelevant to business and sustainability decisions. Consequently, GRI has reduced the number of key performance indicators (KPIs) over time (see figure 4). The 53 G3.1 core KPIs are assumed to be more material by GRI—such as energy consumption, materials used, employee turnover, fines and penalties under regulations, and screening of suppliers on human rights issues.

See endnote 18

See endnote 18

In practice, interpretations of what is material vary greatly. Many companies disclose only a handful of indicators, and few explain why an indicator is not disclosed. For example, research finds that of the 100 Best Corporate Citizens in 2010, fewer than half assess which ESG issues might be material, and less than a quarter disclose the results or their methodology in a sustainability report or SEC Form10-K.19 While GRI recommends that materiality determination should be conducted at all GRI application levels, companies issuing an A-level report are more likely to do this and disclose their results.

Companies that undertake a materiality analysis tend to consult with internal and external stakeholders, industry peers, and media reports. The extent to which a company can influence an issue also figures in the identification of material ESG topics. Some companies disclose a summary of their materiality determination in a materiality matrix on the company website. These matrices frequently follow the template provided by the GRI in its G3 guidelines to help companies identify which topics should be covered more in the report (see figure 5).20

It is plausible that disclosure of more ESG information is an indication of better-informed management and higher-quality data. Research finds that companies with better sustainability performance tend to issue sustainability reports and seek third-party assurance.21 GRI application level A reporters, who disclose more information, are more likely to engage third-party assurers, opposed to having the GRI spot-check the report or self-declaring the application level of the report (see figure 6). For example, sustainability reports that are audited tend to include more environmental information compared with those that are not audited, shown here as a percent of the number of environmental metrics a company can disclose relative to the set of environmental metrics available via Bloomberg terminals (see figure 7).

See endnote 22

Challenges to ESG materiality determination

Living up to the spirit of the GRI guidelines can be difficult, and disclosure decisions based upon stakeholder judgment are problematic. Broad-based stakeholder engagement is often perceived as either risky or too expensive and may not be widely supported by management. Today, many organizations disclose what data they have available, in areas where they invest considerable resources, and believe they can influence or demonstrate progress. As a result, sustainability reports are often criticized for only including information that paints a favorable picture of a company’s sustainability efforts. If, and once, ESG data is intended to support investor decisions, omission of negative information may be considered misleading.

Scaling ESG materiality

For many managers, understanding ESG materiality means constant one-on-one stakeholder consultation and risk management throughout the year. The intelligence gained is often used to inform the reporting process and to improve a company’s responsiveness to stakeholder demands. Shell, SAP, and others bring together stakeholder panels to discuss topics that might be material. Yet other companies design surveys to understand stakeholder sentiment. Not all paths necessarily lead to a complete list of material ESG topics.

Figuring out what information is material both to the business and its stakeholders means that managers need to balance financial outcomes with a multitude of non-financial outcomes measured in a variety of units and over varying time horizons. They also need to understand how stakeholders view a company’s behavior and what marks the threshold between responsible and irresponsible corporate behavior.23 Without a robust method for addressing these challenges, “few companies are thinking about materiality in terms of rigor and replication,” notes Dave Stangis, vice president, CSR and Sustainability at Campbell’s Soup. No surprise then that the GRI has concluded that identification of material ESG topics is one of the most difficult, underdeveloped, and least systematized aspects of reporting for many companies.24

Fundamentally, what is needed to rank ESG material topics by their relative importance is a credible numeric scale. For the purpose of business decisions the scale should be in currency units. Many organizations, due in part to disclosure requirements,25 are monetizing the costs imposed by mandated clean-up, resource conservation, ecosystem restoration, or broader environmental impacts. For example, Puma recently issued a revised profit/loss statement adjusted to incorporate the costs of carbon emissions and water use.26 However, for many potentially material ESG issues, valuation is difficult, missing, or based upon assumptions that are often challenged.

Consequently, prioritizing and selecting material ESG topics is a highly subjective exercise in understanding and sorting through what information might be important to various stakeholders. The problem is that preparers, auditors, and report users don’t agree on ESG materiality. Research shows that report users tend to adopt lower materiality thresholds than either preparers or auditors,27 and interest in ESG data varies between equity analysts and fixed income investors.28 For example, the former are more interested in ESG disclosures and greenhouse gas emissions, while the latter are more interested in governance disclosure.

By default, corporate managers end up weighing stakeholder feedback on what is material based on how they perceive each stakeholder’s legitimacy, urgency, and relative power, along with considering their subjective values and vested interests, which are very hard to compare.29 The outcome does not necessarily contribute to management efforts to build long-term business value. The process, as outlined by GRI,30 may fail in both identification and prioritization of potentially material ESG topics (see table 1). For report users, investors, and auditors, the outcome raises questions about what is disclosed versus omitted.

Table 1: Weaknesses in GRI KPI selection process

| Process weakness | Outcome |

| Materiality determination is not fully considered, especially at the highest GRI application level |

|

| Step 1: Identification of relevant topics No guidance on how to determine which stakeholders are most important |

|

| Step 2: Prioritization Not clear how to establish what is significant to the company and its industry, by size of potential impact and over what time horizon |

|

Source: Deloitte analysis

Defining ESG materiality

The expansion of the term “materiality” to include impacts on stakeholders is more aspirational than it is practical. Ultimately, “it is the job of the company to determine materiality,” notes Bruno Bertocci, managing director, Global Equity Portfolio Manager at UBS Global Asset Management. For investors, materiality pertains only to the disclosure of ESG information that informs an understanding of changes in company valuation. Susanne Stormer, vice president of Corporate Sustainability at Novo Nordisk concurs, noting that to be material, topics need to be important to how both business and investment decisions are made.

Based upon this research, Deloitte finds that materiality of ESG topics can be understood as a linear cascade of interconnected decisions, shown in figure 8.31 The process starts with stakeholders who decide whether or not to react to corporate behavior with a certain probability (P). Not all corporate behavior triggers stakeholder action. It is conditional on the probability that stakeholders perceive that the company’s behavior creates or destroys significant amounts of value related to the topics they consider important (e.g., impact on personal health or on the immediate family, community, environment, and resource availability):

P(action) | P(value creation or destruction)

Stakeholder actions include boycott, activism, divestiture, seeking employment, or buying more or less of a product. The strength of action depends on the level of concern and the importance of the impact within its sustainability context. Stakeholder perceptions, which are subjective and specific to a particular context, establish what ESG topics are relevant and have the potential to become material to the company.32 Stakeholders also help a company understand which ESG performance targets should be considered in a business strategy.

Once relevant topics have been identified based upon internal and external stakeholder input, the next step is to identify which are material. The materiality filter should capture ESG topics—which may be of concern to multiple stakeholder groups—with the greatest potential to impact company valuations within a time frame identified by management. This can include a loss of license to operate, change in cash flow, and reputational or brand value losses across a range of relevant time frames. These business impacts may be material relative to a company’s total business footprint, in terms of its size (e.g., revenue), the percent of sales or number of SKUs likely to be impacted, and geographic reach.

The materiality filter should also capture a company’s operational risks, i.e., its vulnerability to ESG risks, relative to its resilience. A company’s vulnerability is influenced by regulatory risks (both present and future), volatility of commodity supplies and prices, natural catastrophes, and the company’s ability to influence both upstream and downstream entities to mitigate the risks. Even low-probability risks with a material business impact should be considered, particularly if the impact is significant, such as the disruptions in Intel’s supply chain due to flooding in Thailand.33 Issues with an indirect impact, such as inherent risks not within a company’s immediate control (e.g., volatility of water supply or crop failures due to temperature rise), cannot automatically be overlooked. Finally, changes in demand and trends in consumer preferences may create risks, but they can also reveal new opportunities to generate long-term value.

Framed in this manner, a company is obligated to spend the requisite time and money to implement processes and controls to help ensure accurate, timely, and complete disclosure on material ESG topics and use the data for internal decision-making processes. In addition, full disclosure of material data to stakeholders will allow them to make better-informed decisions about the long-term prospects of the company. The obligation does not stop there. Materiality also implies that the company will manage the identified issues.

Consequences for data users

Because most ESG disclosure is still voluntary and only loosely validated by many market players, the data can be inconsistent and incomparable across companies. Qualitative analysis of eight companies in the automotive, financial services, pharmaceuticals, and sporting goods industries finds that comparability has not improved over several iterations of G3 reporting.34 Even companies within the same industry that report at the A level do not disclose the same core set of GRI indicators and do not disclose in the same units or geographic scope. For example, Citigroup and Barclays disclose only 26 percent of the same indicators in their first G3 report, which falls to 20 percent in the second G3 report. Reporting also differs in the apparel companies even though they have a similar supply-chain geographic footprint. In fact, the amount of data disclosed either increases or decreases from year to year for even this small sample, making it doubtful that the data is comparable over time.

More recent research of over 4,000 sustainability reports from 2005–2009 finds a significant number of data omissions, unsubstantiated claims, and inaccurate figures. Irregularities in carbon emissions are evident in almost half of the companies studied, including data omitted from subsidiaries or operations in certain countries.35

Consider a snapshot of voluntary disclosure of environmental data—commonly believed to be more complete and quantitative compared with social and governance data. As of 2009, Bloomberg has been collecting ESG data (120 core variables, some dating back to 2007) from corporate sustainability reports and greenhouse gas (GHG) data submitted to the Carbon Disclosure Project. Deloitte’s analysis of Bloomberg’s 2009 data shows that disclosure of environmental measures varies considerably between industry sectors for the subset of actively traded public companies that follow GRI guidelines (see table 2) Disclosure tends to be greatest in the Energy and Basic Materials sectors and overall is biased toward qualitative information (coded as a binary variable) related to policies (see also figure 9), which is more challenging to integrate into quantitative financial analysis.36 Surprisingly, there is limited disclosure of compliance costs, which is mandated in many jurisdictions by regulatory entities (e.g., the United States EPA’s ECHO database).

Table 2. Percent environmental data disclosed by indicator type and industry, N=873 companies

| Industry sector | Policy | Packaging/waste | GHG emissions | Energy | Compliance cost |

| Energy | 90% | 41% | 37% | 34% | 13% |

| Basic materials | 90% | 49% | 34% | 42% | 16% |

| Consumer, cyclical | 82% | 37% | 33% | 34% | 14% |

| Utilities | 80% | 50% | 35% | 32% | 13% |

| Consumer, non-cyc | 79% | 42% | 30% | 42% | 18% |

| Technology | 77% | 38% | 31% | 38% | 16% |

| Industrial | 76% | 40% | 29% | 32% | 14% |

| Financial | 75% | 24% | 30% | 40% | 18% |

| Communications | 72% | 36% | 33% | 41% | 19% |

| Diversified | 64% | 27% | 30% | 35% | 18% |

| Overall data | 79% | 39% | 32% | 37% | 16% |

Table 2 Legend:

Policy Sustainable packaging, investments in sustainability, emission reduction initiatives, environmental supply chain management, green building policy, waste reduction policy, environmental quality management policy, climate change opportunities discussed, climate change policy, new products climate change, biodiversity policy, energy efficiency

Materials Hazardous waste, total waste, waste recycled

GHG Total CO2 emissions, CO2 intensity per sales, CO2 intensity per EBITDA, GHG scope 1, GHG scope 2, GHG scope 3, total GHG emissions

Energy Total energy consumption, renewable energy use

Compliance Cost Environmental fines number, environmental fines amount, environmental accounting cost

Source: Deloitte analysis, Bloomberg ESG data, 2009

The path forward: Enhanced stakeholder engagement

Solutions that improve both the quality and utility of the ESG information range from mandated disclosure to a more rigorous materiality determination process. At one end of the spectrum, mandating ESG disclosure may drive transparency on how companies create long-term value. It may help managers regain public trust, and society may benefit from wider adoption of socially responsible management practices. These benefits are likely to be even greater in countries with more effective enforcement and where sustainability reports are more frequently assured.37 Mandated ESG disclosure is gaining ground in South Africa and the European Union.38 Already, 55 of the world’s stock exchanges are encouraging disclosure by issuing sustainability indices or via mandates, such as those issued recently by the Securities and Exchange Board of India. Yet widespread mandated disclosure is expected to be several years off.

ESG materiality determination would certainly be easier if there was solid evidence of the valuation impacts. Research and assessment on various ESG topics continues apace, but is often hampered by lack of data from companies, inconsistent reporting and the challenge of identifying the most appropriate valuation model. Quite often the impact is hard to monetize, though the evidence of a stock price impact related to ESG performance appears to be getting stronger.39

On the other end of the spectrum, it should be possible to develop a materiality determination process based on stakeholder input that is objective, robust, and replicable. In essence, the identification of material ESG information requires a structured process that explicitly incorporates the subjective judgments of internal and external stakeholders and yields an internally consistent ranking of ESG topics by their relative importance to the company’s long-term performance.

Using decision sciences to determine materiality

ESG materiality determination is a complex decision. There are many unknowns and choices. Yet we make complex decisions every day. For example, when buying a car, a certain attribute, such as safety, may matter more than other attributes, such as design or fuel efficiency. We weigh each in our mind and set up an implicit subjective ranking based only on a handful of attributes that really matter to the decision.

Decision sciences develop systematic analysis methods for making hard choices under uncertainty given a set of alternatives that can be specified and attributes that the decision maker values or prefers. Methods are commonly used in operations research, systems analysis, and management sciences. Multi-attribute decision analysis has been used in the public and private sectors in a variety of scenarios, including capital budgeting, nuclear waste disposal site selection, and the dissolution of apartheid in South Africa.

Decisions that involve multiple stakeholders, multiple alternatives, multiple attributes, and uncertainty require a more structured approach. Decision science methods, such as analytic hierarchy process (AHP) or multi-attribute decision analysis (MADA), guide a stakeholder panel with structured questions to create a preference ranking of various issues along a single numeric scale. (See the sidebar with the case study “Decision science in action,” on the use of AHP to develop weightings across 13 environmental impact categories for life cycle assessment.) Comparisons are set up between different issues or outcomes based upon information that can be carefully measured or roughly estimated, including those aspects that are commonly called tangible or intangible assets. Most importantly, these methods are designed to capture subjective judgment with all its imperfections and biases. For example, multi-attribute decision analysis methods are being used to assess the impact of tangible and intangible benefits and costs in capital budgeting decisions and valuation analysis.40

Decision science methods would allow managers to identify material ESG topics more objectively, transparently, and efficiently based on stakeholder input, and to prioritize these for measurement, reporting, and resource allocation. In comparison, popular approaches to stakeholder engagement, such as one-on-one consultations, panels, and focus groups may appear less expensive and less risky because the company can select which stakeholders to include, but the process tends to be inefficient and unstructured (see table 3 for a comparison of certain pros and cons of various techniques). Even stakeholder engagement that is highly inclusive and transparent does not automatically yield a robust way to synthesize the results and prioritize a variety of potentially material ESG topics based on their relative importance.

Table 3: Comparison of stakeholder engagement techniques

| 1-1 | Panel/focus group | Survey | Decision science | |

| Pros |

|

|

|

|

| Cons |

|

|

|

|

Source: Deloitte analysis

The same can be said of surveys, which are generally not well-suited to capturing fluid, complex, and uncertain issues such as sustainability because the method of questioning is more static. Survey results cannot yield a relative ranking of ESG topics, because the scales are ordinal rather than numeric. Decision science methods, on the other hand, yield a single numeric scale for ranking and weighting ESG topics more rigorously and efficiently.

Using decision sciences to identify material ESG topics requires a multi-stakeholder panel—ideally composed of companies and their industry peers, employees, investors, auditors, consumers, experts, and other important stakeholders. The panel membership should be revisited over time to help ensure comprehensive input on the full range of ESG topics a company can face. The criteria for determining ESG materiality should be broadly applicable across multiple ESG topics and fairly constant (e.g., a time horizon of one to three years), although time frames should be adjusted to reflect an organization’s planning cycle. Ultimately, the criteria should more efficiently identify a smaller set of ESG topics that are considered material to a company from year to year. With several iterations of this approach, we would expect a stable (time-invariant) set of KPIs across all industry sectors or within an industry sector to emerge—ideally enabling the standardization needed on ESG topic disclosure, even though valuation effects may not yet be fully understood.

By focusing only on those ESG topics most likely to be material, managers can limit the amount of effort expended on measurement and disclosure. They can also make more strategic decisions on and investments into real value creation instead of reacting to external pressures in an ad hoc manner, which to many investors could appear more like philanthropy than strengthening long-term business performance.

Recalibrating materiality

Running a business is not a popularity contest. Not all issues raised by stakeholders are material to a business, though many may be relevant. However, managers put their assets and long-term growth prospects at risk by ignoring the interests of both internal and external stakeholders. Rather, managers need to demonstrate that they have considered each of their stakeholders in a transparent, unbiased, and robust manner with the understanding that not all stakeholder interests will be material to the business.

Materiality of ESG topics needs to be tied to potential valuation impacts on the business, even over the long term and when these impacts are uncertain. Otherwise, much of the ESG information that is disclosed will likely remain marginal to business and investment decisions. The selection of ESG metrics needs to be tied to corporate strategy, value drivers, organizational objectives, and the competitive environment—using a combination of quantitative and qualitative information. The challenge faced by companies that disclose ESG information is that in many cases the valuation impact of ESG topics is not well understood and there are far too many ESG topics to choose from. The question we have raised here is: With so much uncertainty and complexity, can companies successfully prioritize ESG topics to disclose only those that are material?

Certainly, the process would be much easier if we had a single scale to effectively balance a company’s needs with those of its stakeholders, and to prioritize ESG topics by their relative likelihood to be material. Managers need a quantifiable manner in which to balance these needs and calibrate whether their company is fully achieving its potential to create value. That scale is not yet in dollars and cents, so we have to look elsewhere.

Given today’s immature state of knowledge on ESG valuation impacts, decision science methods are a powerful tool that can help managers develop a single scale and structure some of the complexity involved in ESG topics, including the subjective biases of multiple stakeholders. Using these methods can augment the credibility of ESG materiality determination and can allow business leaders to better defend their decisions about ESG management, investment, and disclosure on matters of value to their myriad stakeholders. With these decision tools in hand, business leaders can shed more light on how superior performers create long-term business value and sustain the underlying asset base—financial, human, manufactured, social, and natural.

Decision science in action:

Weighting environmental impacts

In May 2007, the National Institute of Standards and Technology (NIST) used the analytic hierarchy process to create a new weight set in version 4.0 of the BEES (Building for Environmental and Economic Sustainability) software as an alternative to older, more subjective weightings. The resulting set of weights for 13 environmental impact categories was used to generate a total score in life cycle assessments (LCA) of alternative building products (see figure 10). The panel—composed of LCA experts, users, and producers—was asked to evaluate one year’s worth of US flows (e.g., annual emissions, energy use, and water demand from the entire US economy) for each impact over three time horizons: short term (0–10 years), medium term (10–100 years), and long term (100+ years). For example, the panel evaluated the estimated long-term effect of a year’s greenhouse gas emissions on the environment and human health.

The result is a more objective ranking based on the concerns of multiple stakeholders without favoring any single stakeholder. Figure 10 shows how the NIST panel placed greatest weight on the impacts of today’s greenhouse gas emissions on global warming; however, experts and users were more concerned than producers. Facing such a disagreement, the decision maker can decide which stakeholder’s viewpoint to emphasize.

Where time horizons are important, as in long-term decisions, this aspect can be incorporated into the questions posed to the panel. Perceptions vary by time horizon (see figure 11). In the long-run view, this analysis indicates that global warming is more important than other environmental impacts. The panel was also asked to assess the relative importance of different time horizons, resulting in the largest weight placed on the long time horizon (45 percent), compared with the short term (24 percent).