Charting superior business performance has been saved

Charting superior business performance The drivers of breakthrough financial results

13 January 2015

Better maps. Better navigation. Better learning. All three are essential on the journey to exceptional business performance. See how we analyze financial results to make an otherwise nebulous idea concrete and actionable.

The journey to exceptional

Most every company seeks to improve its results—higher profitability, stronger growth, superior value creation. This quest for better business performance is a kind of journey: The point of departure is your company’s current outcomes, the destination is your desired future performance, and the challenges of navigation, piloting the ship, and coping with stormy seas are the effort required to get there.

Unfortunately, this journey is far less like a modern cruise and far more like the voyages of discovery of the 16th to the 18th centuries. The crews of Barbosa, Columbus, and Drake set forth, not with charts based on satellite imagery, but with maps that were the products more of imagination than exploration. Tracking progress was not done with a GPS device that places a ship within feet of its true position, but with sextants and dead reckoning. And successfully making the voyage was not abetted by reliable weather forecasts, but turned as much on the caprices of fate as it did on the seaworthiness of the ship and the crew.

There are, of course, innumerable industry specific operational measures of performance that we might have focused on. This report focuses exclusively on financial measures of business performance, however, so that it might uncover general principles that apply to as many industries and circumstances as possible.

First, this report will give you a better map. Just as shoals and currents can impede or speed a ship’s progress, trends and variability in industry performance shape the route to better results. But, like early maps, the contours of industry-level results—if they inform decision making at all—are too often highly imperfect, based on too few performance measures, too short a time period, or insufficient analysis. This report and its companion website will offer a more nearly complete picture of the relevant context of business performance. This can help companies establish aggressive, but reasonable, targets for improvement.

Second, this research will equip you to more accurately identify your starting point, set your destination, and track your progress by exploiting the significance of relative business performance in setting goals and strategic priorities. Setting objectives should not depend solely on knowing, for example, that one’s return on assets is 5 percent and that the target is 10 percent, any more than seafarers could safely rely solely on latitude to fix their positions. The longitude of a business’s performance is its relative position—how its financial results compare with the relevant competition. Early estimates of longitude were consistently unreliable, with sometimes catastrophic results. The research discussed below reveals that, similarly, many companies today have a potentially dangerously inaccurate sense of their relative position.

Third and finally, early explorers would try to learn as much as possible from those who had successfully completed similar journeys. Not surprisingly, it is also common and sound practice to look to high-performing companies for insight into how to improve one’s own performance. Doing this effectively demands distinguishing the truly competent from the merely lucky. But where many ships’ captains were likely humble enough to be thankful for fair weather, extensive and popular research shows that the role of luck in determining corporate outcomes is too often overlooked.1 This report describes one way to think about superior performance in ways that allow managers to learn from the truly exceptional, and so avoid the pitfalls associated with chasing the shadows cast by the only superficially superior.

Better maps. Better navigation. Better learning. All in the service of better business performance.

Better maps

A ship’s course can be dramatically affected by the currents, tides, and trade winds it must navigate. Similarly, a company’s long-term results can be dramatically affected by long-run macro-level trends. Consequently, a voyage to improved business performance is greatly aided by a more accurate map of the oceans one hopes to navigate.

Population, industry, and sector

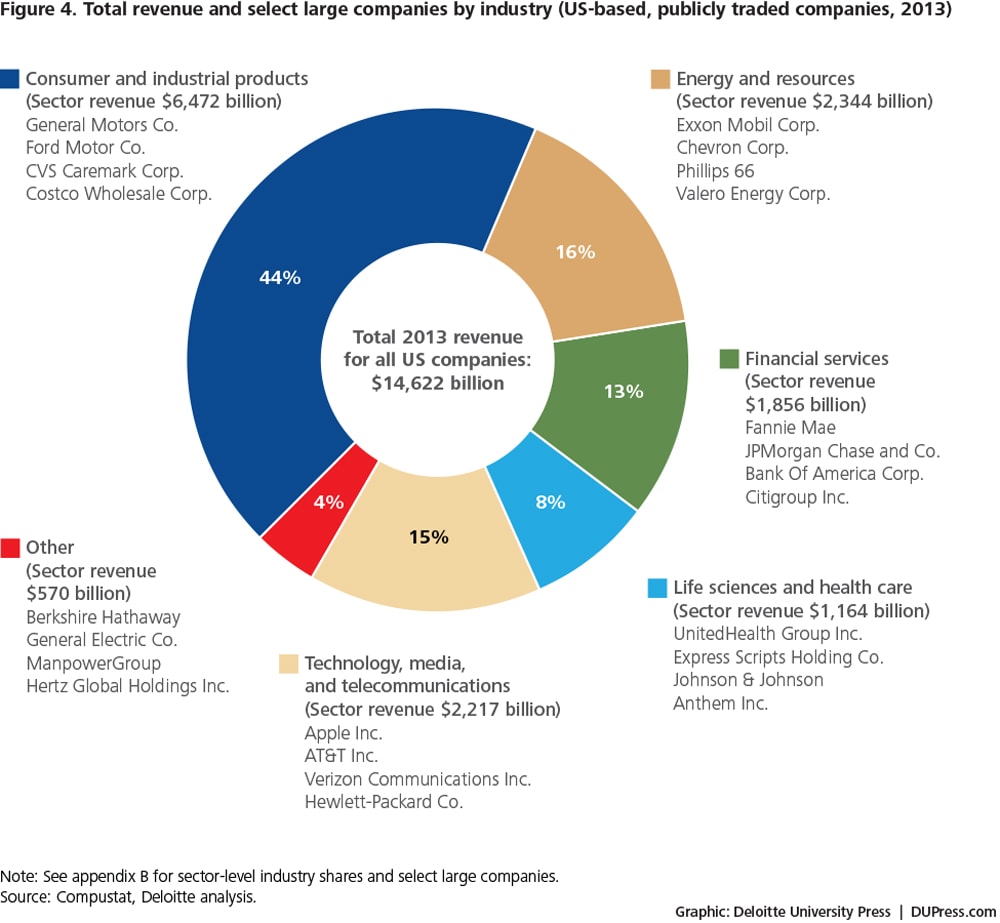

This analysis focuses on the performance of US-domiciled, publicly traded companies.2 Call this the population (figure 1).

The population of US-based, publicly traded companies is dynamic and varied, and not nearly as dominated by corporate leviathans as one might think. For example, companies with annual revenue of up to $50 million increased steadily from 1980 to 2000, rising from 2,272 to 3,610. Since 2000, the number has dropped to 1,758; even so, in 2013, companies up to $50 million in revenue were still 35.8 percent of the population, down from 44.9 percent in 2000.

This large and diverse population is divided into six industries (figure 2), each based on the connection of companies within a value chain—or, more descriptively, a value web, since companies within an industry often are suppliers, collaborators, and partners of each other. For example, the life sciences and health care (LSHC) industry consists of companies that collectively generate value by improving human health. Pharmaceutical companies are both suppliers to and customers of medical devices companies, both of which sell to hospital systems, which are closely tied to health insurance providers.

Comparing trends in performance between the population and industries, as well as among industries, reveals where value is being created. Industries that are growing faster, are more profitable, or enjoy greater equity valuations can offer compelling opportunities for growth, or be sources of insight into new strategies for success in your own industry.

The companies within an industry can be very different, as illustrated by our LSHC example, and so it is useful to divide industries into sectors (figure 3). Sectors within an industry consist largely of companies that share fundamental and defining value-creation processes. As a result of this commonality, companies in the same sector often compete with each other.

For example, life sciences is a sector within the LSHC industry, and two different life sciences companies that focus on hip implants are very likely competitors. It is not this competition that defines the sector, however, since a life sciences company that focuses on personal blood monitoring equipment no more competes with a hip implant company than it does with an auto manufacturer. The monitoring device company and the implant company do, however, have a shared focus on creating value through a variety of (generally, but not exclusively) mechanical or electronic solutions to human health problems. This focus tends to drive a commonality of business models and approaches to creating value that justifies looking at the performance of these companies collectively.

Just as the analysis of industry within the context of the population reveals potentially significant differences and similarities in long-term trends, knowing which sectors are growing the fastest, are the most profitable, or are generating the most value can be sources of critically important insight. Some of these industry- and sector-level shifts play out over decades and go almost ignored despite their impact, while others can arrive abruptly and so be dismissed as one-time anomalies rather than the beginning of permanent change. Consequently, understanding what industry and sector you compete in and how its fortunes are waxing and waning over time is critically important to understanding the high-level forces that constrain and enable your performance.

Measuring performance

The map is never the territory, and there is no one true representation of any geography. Similarly, there is no one measure of business performance that captures everything that matters to everyone. Consequently, this report looks at three broad measures: profitability, growth, and value.

Profitability

A company’s ability to generate profit determines its solvency. Simply measuring the dollar value of profits could be misleading, however, as this would lead us astray thanks to the different magnitude of profits generated by companies of different sizes. Instead, profitability is measured, a ratio of income to the value of some or all of the assets or capital required to generate that income.

In this report, we have chosen three measures of profitability from which to construct the map of business performance: return on assets (ROA), free cash return on assets (FCROA), and return on equity (ROE).

Growth

For each of the three measures of profitability, a company’s level rather than the change is of interest: A company that maintains a high level of profitability has achieved something significant even if growth in profitability has slowed or stalled.

Revenue is a different story. Companies that merely “stay big” are different from those that continue to grow. Consequently, growth in revenue is the relevant measure. Since revenue growth spans decades, and because inflation can distort results, annual revenue figures are deflated to express growth in real terms.

Value

One measure of a company’s value to shareholders is the market value of its equity. As with profitability, however, absolute market value is of less interest than a ratio of market value to the replacement value of the assets required to generate that value. This is known as Tobin’s q; the estimate used here is denoted as Q.3 A Q value of 1 means that the company’s stewardship of the assets is “value neutral”: The company creates a dollar of value for shareholders for each dollar it would take to replicate the assets under its control. In contrast, values greater than 1 imply that the company is able to generate more than a dollar of value for shareholders for each dollar of assets, and so the company’s stewardship is value-enhancing. Values less than 1 imply that the company is destroying value.4

Changes in Q are not analyzed, nor are total shareholder returns (TSR), because increases in these values are largely a function of “upside surprises.” A company that is growing predictably and is predictably profitable, even at a high level on both measures, can be expected to have market-average increases in equity value. Consequently, as with profitability, we believe that a company that sustains a high Q value has achieved a noteworthy result, even in the absence of growth in this measure.

The contours of business performance

As with the explorers of old, although our maps are improving, they are far from perfect. Performance data can be very noisy, thanks to extreme outliers and sometimes large yearly fluctuations. This can make it challenging to identify meaningful trends, even when examining decades of data.

Figure 5 shows the distributions of our five measures of performance. ROA and FCROA show dramatic spikes at 0 percent, and all three measures of profitability are strongly peaked in the middle with long tails in both directions. Q values and revenue growth are not as peaked, but also have long tails. As a result, the interquartile ranges of these distributions tend to be rather narrow, while the ranges can be extreme.

These features of these distributions can make it difficult to gain meaningful insight into relative position using a straightforward ranking. Extreme outliers, both positive and negative, can be the result of large external shocks rather than keen strategic insight or operational excellence. In addition, macro-level trends over time can obscure true relative performance.

For example, at the population level, a straightforward linear extrapolation suggests that median ROA for our population is headed for negative territory in the very near future. The same analysis from 2000–2013—at 14 years of data, hardly a short-term perspective—suggests a strong, if volatile, upward trajectory. What should we conclude?

To compensate for this variability, we have adopted a nonlinear, quantile regression method that estimates, rather than merely describes, the median ROA for our population from 1980 to 2013.5 What emerges is a clear downward trajectory, with a flattening out beginning in 1990 (figure 6).

However, the central tendency of a measure subject to significant variability is not the full story. We can paint a more nearly complete picture by showing the trends for the 25th and 75th percentiles (figure 7).

What emerges is a trend of overall decline in ROA, but with material differences by level. At the 75th percentile, the drop is from 8 percent to a low of 5 percent, recovering to 6 percent more recently. This implies that achieving top-quartile performance is getting slightly more difficult. The median has fallen from 4 percent to a stable 1 percent, implying that the performance required for a middling result is stable. At the 25th percentile, a precipitous drop from 0 percent to a low of -14 percent has been significantly reversed, recovering over the last 10 years to -8 percent. In other words, for a time there seemed to be a high tolerance for extreme negative results. More recently, however, public companies—either through performance improvements or selection pressures—are no longer swimming in quite so deep an ocean of red ink.

Return on assets is only one measure, of course. Trends in the two other profitability measures fill in additional valuable detail. The three are unanimous in describing a decline and recovery in performance at the 25th percentile. No matter the measure, there is less room for extreme negative outcomes than there once was. However, where ROA and ROE are still a long way off from their levels above 0 percent in 1980, FCROA, although below 0 percent at the bottom quartile, is two percentage points above its 1980 level.

There is a message here for poor-performing companies: Although “they” are, no doubt, eager to be more profitable, there is a new urgency to this imperative. The well-known “Red Queen effect,” of having to run just to stand still, seems to be especially acute at the bottom of the distribution.6 Remaining in the middle of the pack, in contrast, takes about the same level of performance it always has.

At the median and 75th percentile levels, we see, in contrast, that FCROA has remained quite stable, budging barely at all. And at these levels of performance, we see a strong and sustained convergence of ROA with FCROA. Return on equity, which, at these quantiles, had run 10 to 12 percentage points above FCROA, has declined (like ROA), but (like ROA) in ways that suggest a convergence—but on a difference of seven to eight percentage points.

The implications of these trends are subject to some interpretation. It is possible that declining ROA and ROE signal declining profitability. Alternatively, the steady performance of companies as measured by FCROA, and the convergence of ROA and ROE with FCROA, might mean that changes in ROA and ROE are a function of changes in accounting rules (see sidebar, “The impact of accounting rule changes on ROA”).

The impact of accounting rule changes on ROA

A company’s ROA is calculated using its audited financial statements. Consequently, the standards governing how those statements are prepared have a significant impact on the ROA that a company reports, and changes in those rules can change ROA without there being any change in the underlying economic reality. These standards, known as Generally Accepted Accounting Principles (GAAP), do not change capriciously, however. Rather, since the early 1970s, GAAP has been set by the Financial Accounting Standards Board (FASB, pronounced “Fazbee”) in order that, on balance, a company’s financial statements might more accurately reflect a company’s financial position.

Deloitte’s7 National Office of Accounting Standards and Communications conducted an analysis of rule changes introduced by the FASB that were deemed, at least potentially, to affect ROA. Quantitatively and definitively concluding whether these changes have, in general, increased or decreased reported ROA proved impractical. However, a qualitative assessment reveals that many of the changes seem to decrease ROA.

For example, Financial Accounting Standard (FAS) 13, implemented in 1977, and FAS 98 (1988) increased the amount of leased assets on a lessee’s balance sheet in ways that served to decrease the ROA of these companies. FAS 94 (1989) affected consolidations in ways that would typically decrease reported ROA.

With rare exceptions, no single ruling should be expected to have a material impact on the median ROA of thousands of public companies. Yet the steady stream of rules that, in the main, point toward lowering ROA provides at least suggestive support for a material contribution by changes in accounting rules to the observed downward trend among all public companies. That this decline in ROA is not mirrored in our estimate of FCROA, either overall or in any of our industries or sectors, while ROA and FCROA appear to be converging at every level of analysis, further supports this conclusion.

Generally flat profitability has been accompanied by a concave growth curve that is especially pronounced at the 75th percentile: rising from 16 percent in 1980 to a peak of just over 31 percent in 1997, and since falling back to 14 percent. Our estimate of Tobin’s q shows a similar trajectory, but skewed in a way that suggests it lags growth: rising from 1.05 in 1980 to 1.85 in 2004, and since falling back to 1.6.8 If the trend of the last 30 years continues, one might expect to see values of Tobin’s q at the high end continue to fall, perhaps all the way back to 1980 levels.

Further insight can be gained by decreasing the scale of our map to capture trends at the industry level (figure 9). Perhaps the most interesting feature at this resolution is the relationship among profitability, growth, and value. For individual companies, this relationship can be highly complex and variable, because profitability, growth, and value can each lead or lag either or both of the other two measures. For example, the value that equity markets put on a company rises and falls based on changes in expectations of future growth and profitability. When expected increases materialize, value proves a leading indicator. When expected increases fail to materialize, or measures even fall, in ways that cause markets to revise those expectations, value falls, and so begins to look like a lagging indicator of growth or profitability.

Similarly for growth and profitability: Strong or increasing profitability can be evidence that a company has found a winning formula, while the profits themselves provide the fuel needed for the investments required to grow. In this case, profitability leads growth. Yet, in other circumstances, companies with bright prospects might need to invest heavily in order to realize their promise, thereby growing rapidly but depressing profitability. Only when these investments begin to bear fruit—quite often after growth rates have slowed—will profits begin to flow. In this case, growth leads profitability.

At the industry level, however, the relationship among these variables seems more stable and easily discerned. Most every industry has generally flat profitability, yet experiences an increase in growth rates. Where growth increases significantly, profitability tends to dip. This suggests that growth leads profitability—in colloquial terms, you have to spend money to make money. Value then follows growth, both up and down, for when growth falls, even if profitability recovers, value falls, too.

It would appear that, at the aggregate level, the more things change, the more they stay the same. In general, levels of profitability, growth, and value have not changed in almost 35 years, and where the levels are materially different, they are trending toward a convergence with historical values. The end of the Cold War, four recessions, three foreign wars, two stock-market bubbles, and the rise of the Internet . . . and the picture of corporate performance that emerges is one of underlying stability.

This might be seen as boring, but we choose to see it as rather comforting. Companies are profitable, but not increasingly profitable, suggesting a competitive market. Companies are growing, but not without limit, suggesting dynamism. Companies are creating value for shareholders, but this is not disconnected from the fundamentals of profitability and growth. In short, a long view from a high perch suggests that the system is behaving as one might hope.

Better navigation

The maps available to 18th-century navigators had become quite serviceable. To use a map effectively, however, you must find yourself on it, determine your starting point, find your destination, and track your progress along the way. That requires a system of coordinates.

When sailing the oceans, we can use latitude and longitude. When it comes to business performance, we use absolute and relative financial performance. In absolute terms, we are well served if we know whether a company is profitable or unprofitable, growing or shrinking, or creating or destroying value before thinking about where to go next. We have an even better picture if we also know that a company is at the bottom, in the middle, or near to the top of its peer group.

We typically assess absolute performance using measures such as percentage points of profitability or revenue growth. Often, a company’s results are not placed in the context of long-run trends at the population and industry level; absolute results are, at best, half the story. The relationship between absolute and relative performance can change significantly, making it more or less difficult to achieve similar outcomes over time.

In this way, absolute performance is rather like latitude, which has long been reliably estimated thanks to the celestial truths upon which it is based. The number of parallels and the constant distance between them are necessary consequences of the Earth’s shape. Their positions are determined by the Equator, the midpoint between the tropics of Cancer and Capricorn—the northern and southern limits of the sun’s seasonal wobble across the sky.

Measuring relative performance, however, is much more like the measurement of longitude was more than 300 years ago.9 Accurately and reliably fixing one’s longitude vexed early nautical navigators because doing so demanded that they know the time in two places at once: aboard ship, and at a location of known longitude. They knew the time aboard ship easily enough thanks to celestial observation. But the pendulum-based clocks of the age were foiled by the ship’s motion, so sailors had no way of keeping track of the time back at port.

The solution was found in the late 18th century by John Harrison, a self-taught clock and watch maker, who invented a reliable marine chronometer that made determining longitude almost trivial.10 The Earth rotates 360 degrees every 24 hours, so every 15 minutes that a ship is behind the time at the prime meridian equates to one degree longitude west. In other words, Harrison solved for longitude by enabling ships to know the time in two locations at once.

When it comes to determining business performance, we have long lacked an analogous ability. For example, it is fairly common practice for companies to benchmark their performance against a select group of companies. We look at total revenue to take the measure of our adversaries, compare stock price increases to get a sense of how investors feel about companies’ respective prospects, and we might even compare profitability to understand who is better at turning revenue into income.

This approach can be misled by the inherently noisy nature of corporate performance. A company’s industry and size each have an enormous impact on its financial results. Consequently, when comparing companies from different industries or of different sizes, we cannot be sure if we are seeing differences driven by the behaviors or capabilities of the companies, or simply differences arising from their different circumstances.

To correct for this, we often only compare a company with other similar companies. Unfortunately, seeking a peer group of similarly sized companies in the same industry too often leaves too few companies to compare against one another. Small samples mean that yearly fluctuations in company-level performance driven by good or bad luck can lead to extreme outcomes, both positive and negative.

In other words, our assessment of others’ performances is foiled by the motion of competitive context and company attributes, just as shipboard motion foiled pendulum-based clocks.

This matters because an inaccurate assessment of a company’s rank can mislead business leaders when setting performance improvement targets. For example, underestimating one’s rank can lead to vigorous efforts devoted to solving problems that don’t exist—the analog of changing direction when safe harbor is just over the horizon. Similarly, should measurement error lead a company to conclude that it is doing really quite well when in fact the opposite is true, the result may be complacency and unexpected ruin—the analog of sailing onto rocks thought to be many leagues distant.

Quantile regression allows us to control for three factors that tend to drive company performance but that lie outside of a company’s control—year, industry, and company size—yet still use all of our data. This allows the estimation of benchmarks for performance that are conditional on the circumstances facing an individual company. In other words, the method can compare each company’s performance to the expected level of performance for a company of the same size and industry. Since we know the performance the company actually has, we can compare the two and conclude what is the company’s underlying relative performance.

Where Harrison’s maritime chronometer allowed navigators to know the time in two places at once, quantile regression allows us to compare the performance of the same company in two different positions at once.

Point of departure

If you want to get somewhere, it helps to know where you’re starting from. Determining your starting location in relative terms can result in some dramatic differences when compared to more conventional approaches.

For example, in 2013, the unadjusted 10th-percentile cutoff in life sciences and health care for ROA is -73.0 percent (figure 10). When we adjust for size, the lowest 10th-percentile cutoff rises to -19.0 percent (for the largest companies) and rises to -18.0 percent for the smallest. The unadjusted median is -3.4 percent, but for companies with less than $500 million in assets, the cutoff is 6.5 percent. At the upper end, the uncorrected 80th percentile is 7.7 percent, but ranges from 9.3 percent to 10.3 percent when corrected for size.

These benchmarks can vary significantly across industries. For example, Q at the 10th percentile for companies with greater than $25 billion in assets is -1.2 in the financial services industry but 1.9 for the same size band in life sciences and health care. At the 90th percentile for the same two industries, the cutoffs are 1.9 and 4.9, respectively.

Of course, the importance of relative performance and the significance of industry differences when assessing any financial results is not news—any more than the significance of longitude was news to 17th-century mariners. Unfortunately, if our survey results are representative, it appears that executives are, in general, no better at estimating relative performance than were their nautical counterparts of centuries ago.

We fielded a survey of corporate executives asking each to tell us their company’s performance on ROA, ROE, revenue growth, and total shareholder return, and to estimate the percentile rank11 for each of these performance levels.12 We then translated the absolute performance provided by respondents into relative percentile ranks, correcting for industry and company size.

Figure 11 shows the correlation between self-reported and actual percentile ranks for the four measures we examined. The diagonal line indicates perfect correspondence between a respondent’s estimate and our estimate of the company’s percentile rank. The results reveal that there is effectively no relationship between the two. What’s more, those who expressed the highest confidence in their estimates were no more accurate than those who were less sure. The implication is that if we are to take the importance of relative performance seriously, we would do well to adopt a more quantitative and rigorous approach.

Choosing a destination

It is not enough merely to wish to improve a company’s performance. One must specify at least two other parameters: by how much one wishes to improve, and by when. Characterizing performance in absolute and relative terms can help with both.

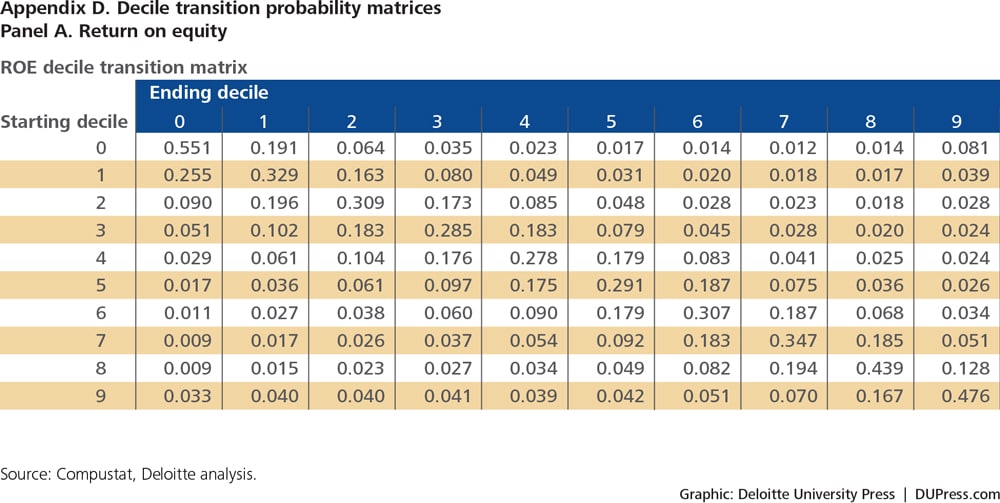

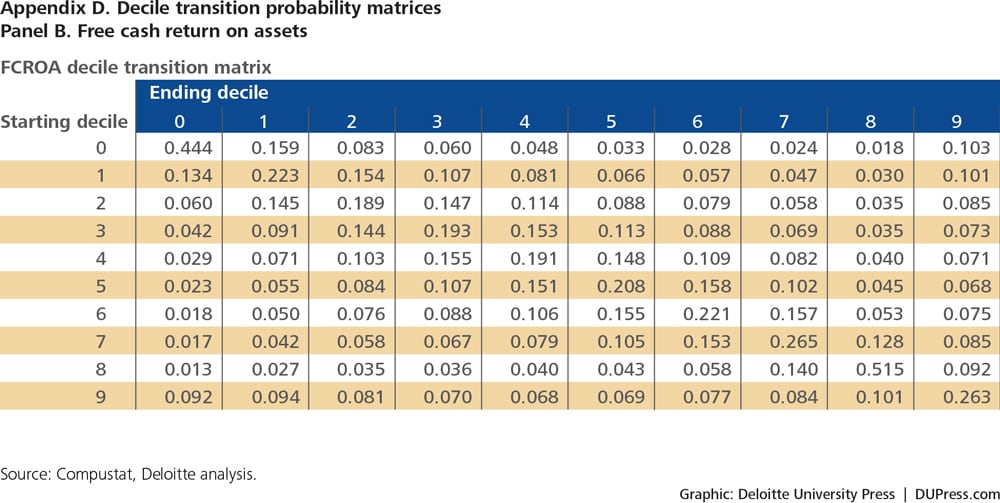

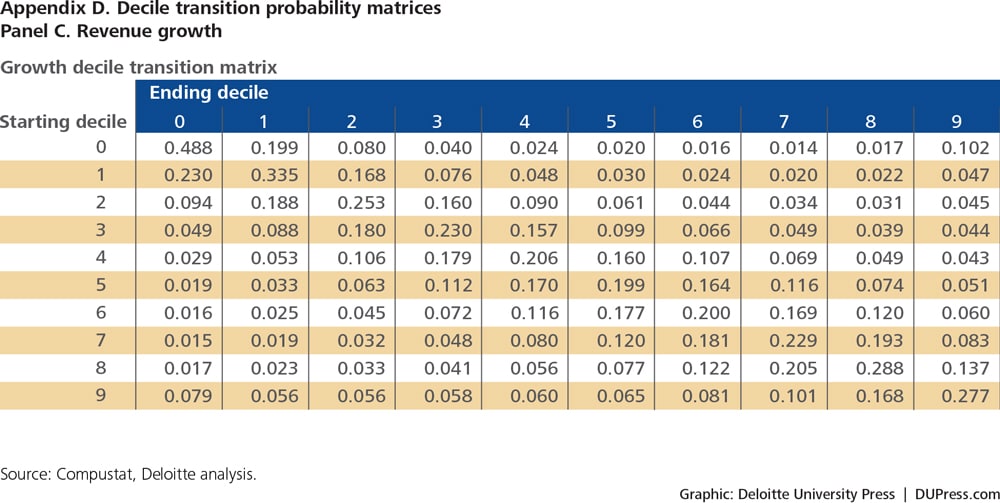

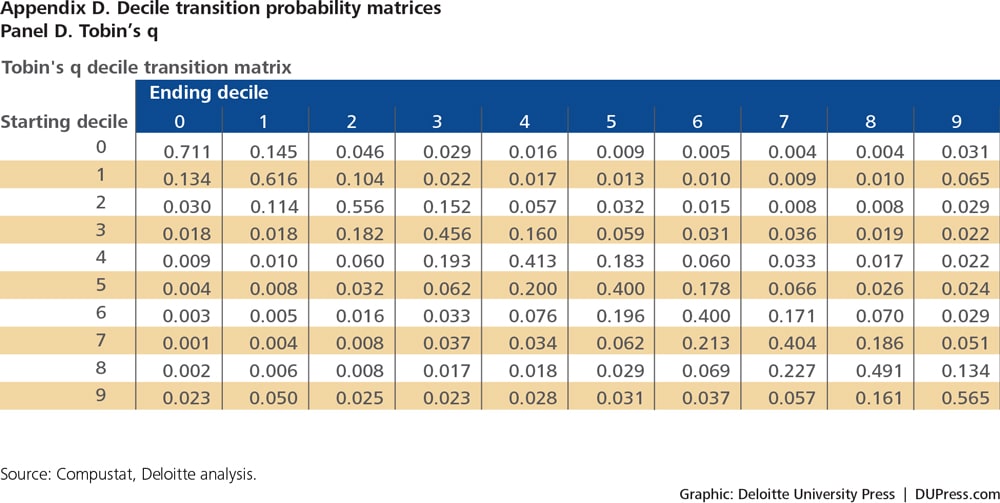

For each of the five performance measures discussed here, we calculated the frequency with which companies were able to transition from each decile of performance to every other decile of performance in a single year (figure 12). The probabilities in each cell are unique to each performance measure, but the structure of each table turns out to be essentially the same.

Not unsurprisingly, large leaps are quite rare; perhaps more surprisingly, staying right where you are is the likeliest outcome. Perhaps most surprisingly of all, performance is stickiest at the extremes: Companies with particularly poor and particularly good performance have the strongest tendencies to repeat in subsequent years.

Note that even when beginning from the middle of the distribution—the 5th decile (50th percentile) of performance—a company has barely better than a 10 percent chance of making it into the 7th decile (70th percentile) or higher, and less than a 3 percent chance of making it into the 9th decile (90th percentile) of performance. The implication is that few companies make the leap from mediocre to superior in one bound. Instead, most companies aspiring to dramatic improvements in business performance would do well to steel themselves for a several-year-long journey, a dogged plod upward through the deciles.

We can combine the benchmarks for given quantiles of performance with this transition matrix to create rough approximations of the likelihood of specific changes in absolute performance contingent upon performance measure, industry, and company size category.

Specifically, a company can use the performance benchmarks in figure 10 to find its current and targeted future performance in absolute terms and look up the relative performance implied by each in the column headings. The probability of achieving such an increase is given in the transition probability matrix (figure 12).

For example, a life sciences and health care company with between $1 billion and $10 billion in assets and a current-year ROA of 2 percent lands between the 30th and 40th percentile. If next year’s targeted ROA is 7 percent, that’s between the 60th and 70th percentile. Transitioning from the 3rd to the 6th decile or better in one year has a probability of 10.5 percent.

These probabilities provide a quantitative baseline for assessing the suitability of a given performance target. A company’s circumstances might well suggest that a dramatic improvement in performance is necessary and possible. But now, those judgments can be informed by an additional objective evaluation of what targets might make sense and how aggressively to pursue them.

Better still, enhancing our views on absolute performance with the relative dimension permits priorities to be set in a more considered way. For example, should a company focus on increasing growth or profitability? Part of the answer to that question might well lie in understanding a company’s relative performance on each.

Note that, in all cases, the analysis enabled by the tables in this report is illustrative only.

Better learning

Making a voyage for the first time through even well-charted waters can be a challenge. It only makes sense to try to learn from those who have already gone where you hope to travel, to draw lessons from their travails and triumphs.

It is common and sound practice to look to high-performing companies for insight into how to improve one’s own performance. Central to this approach is identifying genuine high performers. There’s a problem, though: How can you be sure that you are learning from true seafarers and not the merely lucky? Just as calm and storm affect the fate of any journey, luck—both good and bad—affects every company’s pursuit of exceptional performance.

As a result, companies that we might be tempted to see as “great” thanks to seemingly sustained, superior performance may simply be beneficiaries of good luck. We have found that on the order of just 5 percent of the companies lionized in popular management studies have achieved statistically significantly superior performance.13

Addressing the problem head-on has required that the construction of a new statistical method for the analysis of business performance. The intent is to identify those companies that have been good enough for long enough to justify the belief that their results are primarily a consequence of company-level attributes rather than their circumstances. To learn from the best, companies must be able to confidently identify them.

Identifying exceptional companies

The method for identifying exceptional companies begins where the assessment of relative performance leaves off.14

For any of a number of performance measures, quantile regression is used to translate the annual performance of every company in our population into relative terms. For example, each company’s ROA in absolute terms is expressed in percentage points—4.3 percent, 5.1 percent, and so on. That performance is turned into a string of percentile ranks: 74, 82, and so on. A percentile transition probability matrix is then constructed based on observations of how frequently companies transition from one percentile rank to another in subsequent years, similar to the decile transition probability matrix in figure 10.15

The methodology then involves running a series of simulations using the same number of companies with the same starting positions and observed lifespans from 1966 to 2013 as appear in the actual population. Their observed starting points and lifespans are as shown in figure 13.

Using the percentile transition matrix, each company's performance over its observed lifetime is simulated. Repeated simulations generate a distribution of lifetime performance patterns. That is, for every observed lifetime and starting point it generates expected patterns and levels of annual performance expressed in percentile ranks.

Using the percentile transition matrix, each company's performance over its observed lifetime is simulated. Repeated simulations generate a distribution of lifetime performance patterns. That is, for every observed lifetime and starting point it generates expected patterns and levels of annual performance expressed in percentile ranks.

The string of annual relative performance measures is then smoothed by calculating a moving average over a given “observation window” using a weighting function that favors observations closer to the focal year. The weighting strikes a balance between filtering out short-run variation and remaining sensitive to potentially significant fluctuations.16

To illustrate how the method extracts signal from the noise of annual performance, consider the actual data below on a disguised company; call it Alpha. Alpha’s annual return on assets is shown relative to its sector’s 95th percentile (figure 14). (The axis values are not given to preserve the company’s anonymity. Scales across charts will be consistent, however, for ease of comparison.) At first glance, Alpha appears to have periods of strong performance, but there is seemingly dramatic variation. It is not intuitively obvious whether this company has ever put together a string of superior performance sufficiently better than countenanced by luck alone.

Alpha’s absolute ROA is translated into relative percentile ranks using quantile regression. This yields a sequence of annual observations that are translated into a moving average as the observation window moves along the time series and the weighting algorithm is applied (figure 15). The resulting annual values can then be compared with our cutoff for exceptional performance and the probability of having observed a false positive. Taken together, we can assess annually the probability that Alpha is in a run of exceptional performance.

Now the signal emerges. When the probability of being exceptional is above 0.5 and the false positive probability is 0.3 or lower, the methodology says Alpha is exceptional. These two conditions are met from 1985 to 1993, when it dips ever so slightly below that cutoff for 1994 and 1995. It is then strongly above that cutoff until 2005, when it falls dramatically and stays low. This suggests that, on ROA at least, Alpha enjoyed an essentially unbroken run of exceptional performance from 1985 until 2004. The sawtooth pattern of absolute ROA has at its core a steady stream of outstanding performance in the early years, and the seeming decline since 2005 is no illusion.

Who's exceptional?

It is one thing to argue that a particular method of understanding business performance is conceptually valuable and theoretically sound. What really matters, however, is whether or not that approach actually yields new insights into how the world works.

For example, every mapmaker must address the challenge of rendering the curved surface of a globe on the flat surface of a plane. Any given solution to this is called a “projection,” and the world looks very different depending on which projection you use.

The most famous is Gerardus Mercatur’s, published first in 1569. His particular objective was to create a consistent and mathematical formula that preserves the angles of straight-line course, called rhumb lines, to both the parallels and meridians, which makes for much easier navigation. This convenience comes at the expense of preserving an accurate representation of the relative sizes of landmasses: Greenland appears about the same size as Africa when Africa is actually 14 times larger, while Europe seems about the same size as South America rather than half of it.

Other projections have different merits at the expense of different compromises. The azimuthal equidistant captures all distances along the meridians and directions from the center point correctly, but not along the parallels. This projection is particularly useful for, among other things, aiming directional antennae, since the relative positions of all landmasses are captured correctly. And the Stabius-Werner cordiform captures distances from the North Pole, but instead of focusing on the meridians, it captures distances along the parallels (figure 16).

Most students of business performance have some sort of “projection” they use to think about which companies are higher or lower performing. Some approaches might place an emphasis on time horizon, looking at longer or shorter periods. Some might focus on specific measures of performance such as growth. Depending on your projection, you will view the world in a particular way.

The projection of business performance presented here is based on two premises: the importance of relative performance, and the value in separating “signal from noise.” In this report, these principles are applied to seven measures of financial results: profitability, growth, and value (respectively, P, G, and V), plus the four combinations formed from these three, where the combination measures are constructed out of geometric means of the annual percentile ranks of the measures being combined.17

We do not favor any one measure over any other. Any company that qualifies as exceptional on any one measure is deemed an exceptional company. Applying this projection to the more than 5,000 US-domiciled, publicly traded companies that were active as of 2013, fewer than 500—or less than 10 percent of the total population—are exceptional on one or more of our seven measures.

As with maps, there is no one projection that is “right.” Every attempt to capture an endlessly complex reality in a necessarily finite model must accept sometimes painful trade-offs. Different ways of thinking about performance will, of course, typically yield different results. This method does not capture what the world truly “is,” for this is an unattainable goal. Rather, this approach reveals something potentially important about the world, and therein lies its value.

It is also important to note that this method is not predictive: The claim is not that, because a company is identified as exceptional as of 2013, it will continue to be exceptional for any specified period of time into the future. Companies can suffer sudden and extreme exogenous shocks that overwhelm their abilities to respond. More prosaically, the method is based on the statistical analysis of publicly available data, which in turn is drawn from corporate filings, which do not always perfectly capture company performance in real time; for example, subsequent restatements of financial performance might change our results.

Consequently, what the method reveals is the company-level detail that emerges when looking at business performance as multidimensional—that is, in terms of profitability, growth, and value—and taking seriously the different influences of system-level variation (“luck”) and company-level effects (“skill”).

Perhaps most helpfully, this approach offers the possibility of uncovering the drivers of exceptional performance.

What performance is versus what performance means

Making sense of business performance is, at first blush, an entirely straightforward exercise. To know whether one company has performed better than another, one need simply understand the ordinal ranking of numbers—a task not beyond the ken of most four-year-olds. If one grasps the idea that 12 is larger than 7, one has about all the conceptual tools needed to determine which company is the most profitable, which the fastest-growing, and which has generated the most value.

This report has hopefully shown that moving past the almost simplistic analysis of what performance is to an understanding of what performance means—what it says about the company that generated that performance—demands an approach that goes far beyond rank-ordering numbers.

Charting superior business performance began by providing better maps, outlining the contours of relative performance by industry and sector over the last 35 years. What emerged was a pattern of almost cyclical change and a suggestive lag between changes in profitability and growth, the fundamental drivers of value, and estimates of future value as captured by our approximation of Tobin’s q.

Next came the challenge of navigation, focusing on the need to understand business performance in relative as well as absolute terms. This was not a trivial undertaking, for although many have an intuitive sense of why relative performance matters, most of the more widely used methods can be poor substitutes for the insights generated by a careful application of powerful statistical tools.

Business performance, it appears, is as much about stability as it is about change. Dramatic short-run changes are quite unlikely, and so any company that seeks to improve its performance from poor or mediocre to exceptional can expect to have to march its way up through the deciles. Short cuts are likely to be difficult to find and harder to follow.

Putting it all together revealed a small but non-trivial number of companies that qualified as exceptional on at least one measure—nearly 500 in total.

* * * * * * * * * * * * * *

The quest for exceptional business performance will remain evergreen precisely because it is a relative construct. Even as specific methods for differentiating oneself from the competition are found, they will be disseminated and emulated in a manner that erodes the very differentiation they serve to replicate.

But even if one cannot remain in port for long, the voyage is still worth making. And it is our hope that this effort to chart superior business performance will help speed you on your journey. Anchors aweigh!

Appendix A: Total number of companies by industry and sector (US-based, publicly traded companies, 1980-2013)

Share of industry revenue and select large companies by sector (US-based, publicly traded companies, 1980-2013)

Appendix C: Performance benchmarks by industry (US-based, publicly traded companies)