Talent Edge 2020: Perspectives from the Consumer and Industrial Products Industry has been saved

Talent Edge 2020: Perspectives from the Consumer and Industrial Products Industry An industry view of the "Talent Edge 2020: Blueprints for the New Normal" survey

01 December 2010

Consumer and industrial product companies have found it challenging to compete for talent globally and manage talent training programs. An industry with a high-level of layoffs nonetheless faces talent shortages in the critical areas of growth and innovation. This report is based on the findings of the Talent Edge 2020: Blueprints for the New Normal report, which includes a survey of about 300 senior executives worldwide.

Key findings

What exactly is the “new normal” in Consumer and Industrial Products (C&IP)—and what strategies will allow leaders to attract and retain the talent needed to compete? How should globalism and an aging workforce play into a plan for the future?

To address these questions, Deloitte launched Talent Edge 2020, a survey of more than 300 senior executives and talent managers worldwide, representing large companies across a range of industries. Below are the key findings:

The great rebalancing.

C&IP leaders are struggling to find the appropriate equilibrium between austerity measures and investment for future expansion. C&IP executives ranked competing for talent globally (42%) and managing/delivering training programs (39%) highest among the top talent issues.

Many C&IP executives say competing for talent globally is their most pressing talent concern.

The talent paradox means key shortages.

High unemployment rates in the U.S. and abroad have not created a uniform talent surplus. Instead, many C&IP executives predict serious talent shortages in areas responsible for innovation and growth, such as R&D (74%) further executive leadership (60%). And despite a weak job market, retaining employees at all levels was listed as a pressing talent concern by 37% of surveyed executives.

Uncertainty about proper headcount.

C&IP companies report a higher level of layoffs (63%) than other industries (55%) and there appears to be uncertainty about future layoff plans. While 53% of the executives surveyed expect further layoffs over the next six months, 7% say they don’t know.

Global talent competition top of mind.

Concerns about global talent suggest that many executives see emerging markets as their company’s most promising opportunity. For example, automotive production stretches globally and requires talent specialized by region. In the Process & Industrial Products sector, a head start in an emerging market can provide significant competitive advantage.

The great recession leads to “great rebalancing”

Cutting costs has been eclipsed as the top C&IP company concern by performance and new product needs. This suggests that while austerity is still the dominant mood, the need for growth is moving to the front burner.

Better products, new customers overshadow cost. In December 2009, a majority of C&IP executives surveyed (57%) cited cutting and managing costs as their top priority. Today, this figure has dropped to 33%, while the need to grow is rising in importance. Improving top- and bottom line performance has increased significantly from 29% to 37%. Expanding into global/new markets jumped from 14% to 27%. Investing in innovation and R&D rose from 11% to 27% (see figure 1).

The growing importance of workforce flexibility. C&IP companies appear to be ahead of other industries when it comes to thinking about workforce flexibility. Nearly three of four C&IP executives surveyed (74%) expect an increase in workforce flexibility compared to 63% across all industries.

The talent paradox. Even with high unemployment, executives foresee talent shortages in areas critical to innovation and research. Aerospace & Defense companies urgently need science, technology, and engineering talent.

The automotive sector confronts growing demands for greener engine technologies, coupled with an increasing integration of mechanical, electrical, and software engineering. Both require specialized R&D knowledge.

Figure 1. What are your organization’s most pressing talent concerns today?

Creating and retaining leaders

As the global workforce continues to age and the massive Baby Boomer generation begins to enter retirement, executives and talent managers are deploying a variety of strategies to fill the leadership pipeline at their companies.

Workforce planning. Among the C&IP executives surveyed, more than seven out of 10 expected to increase their focus on workforce planning (77%) and performance management (76%).

Building emerging leaders. A high percentage of respondents also plan to increase focus on building emerging leaders (73%), developing high-potential employees (72%), and retaining employees with critical skills (72%). This suggests the C&IP leaders are committed to indentifying the talent and leadership required for their organizations’ success.

The top talent management programs have metrics in place. When it comes to leveraging metrics and key performance indicators to support their programs, C&IP organizations showed a slight lead over other industries. More than half (66%) of C&IP executives surveyed reported they have world-class (17%) or good (40%) metrics or key performance indicators to support their talent management programs. On the other hand, almost a third of C&IP respondents consider their metrics only adequate (17%), sparse (13%), or entirely missing (3%).

Digging deeper: C&IP survey responses suggest a movement to tailor retention initiatives by generation. For Generation Y, nonfinancial incentives topped the list, with company culture, flexible work arrangements, new training programs, and individualized career planning tying at 21%. Additional compensation ranked last as a motivator for Gen Y employees. For Generation X, additional compensation and career opportunities (e.g., leadership development programs) tied for first place at 22%. Additional bonuses and customized/individual career planning for Gen X followed closely at 21% each. Baby Boomers were seen as favoring greater health and pension benefits (33%), followed by bonuses/financial incentives (23%) and additional compensation (22%). Veterans were seen as favoring benefits (31%) and opportunities for community involvement through corporate social responsibility initiatives (20%).

Figure 2. Which strategic issues currently capture the most management attention at your organization?

Designing for the future of C&I

Leaders with their eyes on the future recognize that powerful forces shaping the economy didn’t pause during the Great Recession—they accelerated. This awareness argues against a return to pre-recession thinking in favor of facing the new reality in which business must operate.

The right people in the right jobs in the right places. A global marketplace means that organizations must have effective systems for identifying talent in emerging markets.

Best technology not yet integrated into talent management. While more than a third of the executives surveyed (34%) reported they have a strategy for implementing talent technology solutions, 42% are still running pilot programs or are in the evaluation stage (18%) (see figure 3). The most popular talent management applications were in the areas of succession planning (56%) and recruitment (54%).

Even with slow recovery, turnover has been greater than expected. In July 2009, 46% of the C&IP executives surveyed expected turnover to increase 12 months after the recession. In October 2010, 64% of the executives surveyed indicated they experienced an actual increase in turnover during the last 12 months. And a solid majority (63%) expect turnover to continue to increase during the next 12 months. This makes retention a key priority for the C&IP industry.

Figure 3. Where does your company stand with respect to implementing new HR/talent technology solutions?

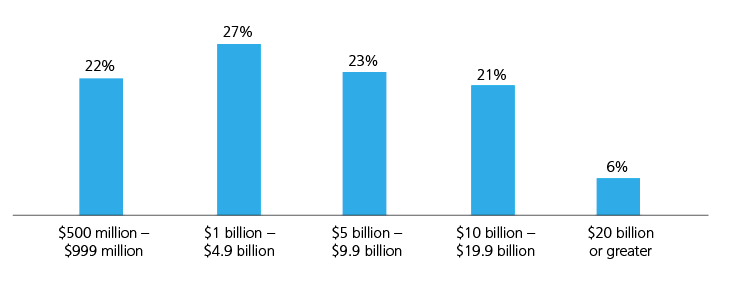

Figure 4. Company revenues during the most recent fiscal year

Survey demographics

Talent Edge 2020 is a follow-up to the Managing Talent in a Turbulent Economy survey series. This survey is the first in a post-recession longitudinal study being conducted by Deloitte with Forbes Insights.

Figure 5. Company categories

The survey explores the changing talent priorities and strategies of global and large national companies. This report features results from an October 2010 survey that polled 334 senior business leaders and human resource executives at large businesses in the Americas, Asia Pacific, and Europe, the Middle East, and Africa. Ninety-four respondents were from the C&IP industry. For more information visit www.deloitte.com/us/talent.

Sixty percent of the executives surveyed held board, CEO, CFO, CHRO, or other C-suite positions. Survey respondents were employed by companies with annual revenues of more than $500 million. More than seven in 10 (72%) respondents work for companies larger than $1 billion in revenues, and 30% reported their companies generate revenues higher than $10 billion.

Participating executives are evenly dispersed throughout the world’s three major economic regions: 36% in the Americas, 34% in the Asia Pacific region, and 30% in Europe/Middle East/Africa. Survey participants represent a broad set of industries, including Consumer/Industrial Products (28%), Technology/Media/ Telecommunications (28%), Life Sciences/Health Care (18%), Financial Services (11%), and Energy/Utilities (7%).

© 2021. See Terms of Use for more information.