Cloud case studies

Major bank reinvents its lending system in the cloud

Thirteen weeks from project inception to first commercial use

A bank worked with Deloitte on its new cloud-based Digital Lending System to define the characteristics the technology itself would need to meet its mission.

A large European bank had a long track record of lending to small and medium enterprises (SMEs), but found its competitive position challenged by faster-growing, more technology-centric small entrants. All the while, developments such as strict new capital requirements and a flattening yield curve further eroded the traditional advantages of size. Traditional banking assets, like brand recognition and a large customer base, didn’t provide the speed and ease borrowers were looking for—advantages they were getting from new, smaller banks that used more flexible technology.

The bank had been investing in digital updates to familiar processes. Now it pivoted to aim higher—to position itself at the center of a broad ecosystem of SME services and offer a better customer journey. The first element of this ecosystem would be a renewed commercial lending system that offered the streamlined application process, mobile access, and fast approval decisions that customers wanted.

“The bank had been investing in digital updates to familiar processes. Now it pivoted to aim higher—to position itself at the center of a broad ecosystem of SME services and offer a better customer journey.“

What happened next

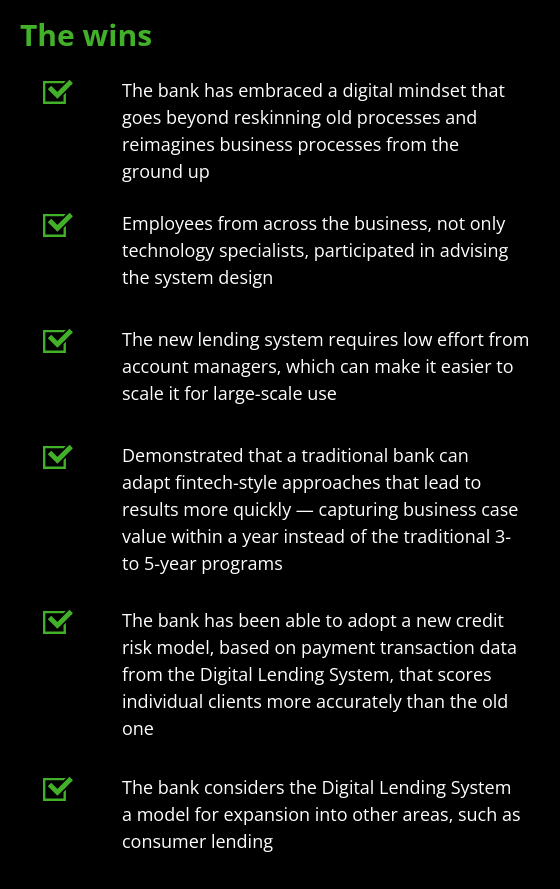

The bank worked with Deloitte to determine what customer standards its new cloud-based Digital Lending System should satisfy, and to define the characteristics the technology itself would need to meet its mission. For the customer perspective, the teams interviewed more than 3,500 commercial borrowers to learn their priorities and frustrations, and also invited input from employees throughout the organization.

To set the bar for the technology, Deloitte and the bank established a “three lens” standard for any undertaking: It had to be desirable, viable, and feasible. Deloitte’s OpenDATA platform, powered by AWS, satisfied those criteria thanks to the cloud’s modular, flexible, and scalable programming environment.

This allowed the bank to move from traditional development to an Agile process, and the lending system served its first customer only 13 weeks after the project began. Credit applicants can use a mobile interface to submit necessary documentation, and an artificial intelligence-powered risk engine calculates the customer’s credit forecast in seconds, leading to a loan decision in less than 15 minutes.

To allow for speed and allow the project to “fail forward” the way a nimble FinTech entrant can, the team decided to start at the edge of the organization rather than the core. Because this approach proved the business case quickly and showed customer value, two new teams have branched off from the original to make the transformation more comprehensive: one to integrate similar innovations into the core business, and one to focus on further innovations such as application programming interfaces (APIs) that can drive third-party integrations and new lending products.

This transformation has demonstrated the potential for this bank and other financial institutions to bring similar OpenDATA-driven innovations to other functions such as lending, mortgages, digital payments, compliance, and transaction monitoring. This cloud-based approach can help build increased engineering capabilities that span geography and forge new connections with other industries.

By the numbers

13 weeks: 13 weeks from project inception to first commercial use of a minimum viable product (MVP)

15 minutes: Clarity (and a committed offer) for the client in 15 minutes, which used to take weeks

9 points: Customer satisfaction scores have improved from a 6.8 to 9

75 - 90%: Estimated potential cost savings regarding retail account management (acceptance) of 75–90%

10 billion: Estimated handling of ~€10bln in yearly retail production less than 2 years after project start

<3 weeks: Build of automated application process for a new corona-related loan product took <3 weeks