Təhlil

Həyat elmlərinə qlobal baxış

Ehtiyatla nikbin gələcəyə doğru

Qlobal həyat elmləri sahəsi bugünkü dəyişgən bazarda iqtisadi qeyri-müəyyənlik, qiymət təzyiqləri, yenilik və dəyərə tələbin artdığı, istehlakçı münasibətlərinə çox diqqət və daim dəyişən tənzimləyici və risk mühitində necə fəaliyyət göstərir ?

Mətn ilə tanış olun

- Download the report

- Infographic

- Embracing exponential changes in technology

- Embracing geopolitical change

- Building an adaptable organization for the future of work

- Building a culture of courage to help counter uncertainty

- Building data integrity, maximizing the value of data

- Building patient trust and centricity

- Building a smart, cross-functional regulatory approach

- Growing through partnerships and new operating models

- Explore previous outlooks

- Follow us on social media

- Key contact

Overview

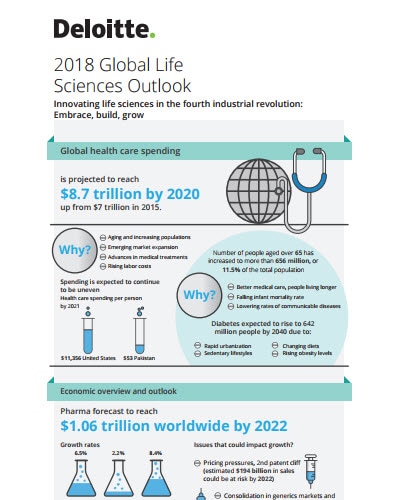

With the arrival of the fourth industrial revolution, the life sciences sector continues to embark on a transformative technology journey. Companies, today, are preparing for the future by embracing these technologies and building a patient-centric culture. Strategic alliances and new operating models are also contributing to overall growth in the sector. With growth, comes some uncertainties, arising from pricing pressures, value-based contracting, geopolitical climate, and policy changes. But, companies are taking measures to withstand these challenges. This 2018 outlook reviews the current state of the global life sciences economy and explores the trends impacting life sciences companies as they Embrace, Build and Grow for the future. It also outlines a few suggestions for the stakeholders to address these uncertainties and the strategies they need to adopt to thrive in the coming year.

Global life sciences sector issues in 2018

Embracing exponential changes in technology

AI and cognitive technologies, automation and computing power are advancing at an accelerating rate. Continuous manufacturing technology and Robotic Process Automation (RPA) are shortening production times and increasing process efficiencies. These technologies are benefiting patients and clinical trial productivity but also lead to increase in data volume, further leading to the need for scale and security in the business. Companies are partnering with large and small technology companies to derive insights from the high volumes of data generated from EHRs, claims, clinical trials and other sources.

Key takeaway:

While the adoption of cloud can provide on-demand scale for increasing data volume, its combination with new age big data technologies can help manage Real-World Data (RWD). Companies can streamline the drug discovery process by deploying AI algorithms that can analyze large data sets from clinical trials, health records, and genetic profiles. 3D printing and gene therapy may disrupt the sector by offering customized, targeted patient treatment, including newly approved CAR-T therapies.

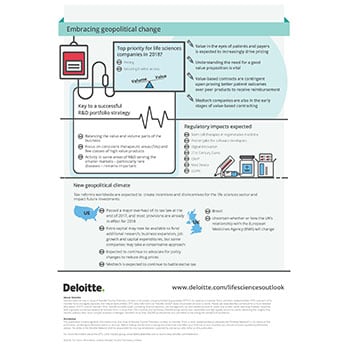

Embracing geopolitical change

Pricing, along with securing market access, is expected to continue to be a top priority for life sciences companies in 2018. The need for a good value proposition is vital as the value perceived by patients and payers is expected to increasingly drive pricing, and not simply cover R&D expenses. The uncertainties around geopolitical boundaries and policies, and changing tax reforms in some parts of the world may urge life sciences companies to develop action plans to mitigate potential risks, revisit their investment decisions, and take advantage of potential opportunities.

Key takeaway:

While precision medicine can address the growing demand from payers for more personalized therapies, value-based contracting models can help amortize costs for high-cost treatments such as curative therapies. Maintaining a balance between the value and volume parts of the business will be seen as a key to a successful R&D portfolio strategy. Regulatory bodies need to build new frameworks for comprehensive science-based policies to help organizations offer quickly accessible innovative therapies to patients.

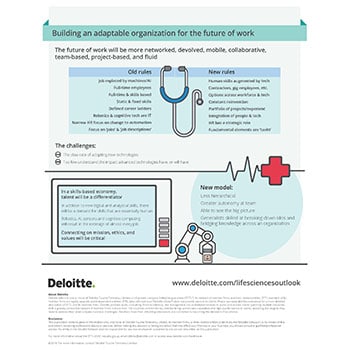

Building an adaptable organization for the future of work

Building an organization of the future is one of the most important challenges for health care and life sciences human resource leaders. The future of work will be more networked, devolved, collaborative, project-based, and mobile. The key trends that will impact the future of work are:

- Organizations with less hierarchy and more autonomy at team and individual level.

- Culture is critical, and grows in importance at scale.

- A skills-based economy where talent will be a differentiator.

- Robotics, AI, sensors and cognitive technologies will help redesign almost every job.

Key takeaway:

Life sciences organizations need to focus on redesigning jobs and tasks by utilizing the more essential human skills and integrating them with technology to achieve efficiency. For example, embracing Robotic Process Automation (RPA) can help clinical researchers improve the accuracy and quality of the research processes in R&D and drug safety.

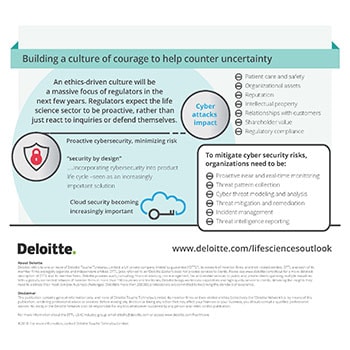

Building a culture of courage to help counter uncertainty

The ethically-driven life sciences sector is constantly being monitored by the regulatory authorities. 2018 will see leaders emphasize the right and uniform tone across the organization to build a culture of integrity. Apart from human error, it is the interconnected systems which can lead to cyber risk which has the potential to impact patient care and safety, organizational assets, reputation, intellectual property, customer relationships and regulatory compliance. Life science leaders need to continue to be vigilant of high profile, vulnerability disclosures.

Key takeaway:

Forward-thinkers will need to anticipate the potential ethical challenges in the machine-run world and build the kind of AI-infused world they want to live in. Medical device manufacturers need to adopt ‘security by design’ approach where a device is designed from the ground up to be secure instead of adding security features after it has been delivered and deployed. To mitigate cyber security risks, organizations will need to avoid disconnected governance and establish real-time monitoring, cyber threat modeling and analysis, and threat mitigation and remediation.

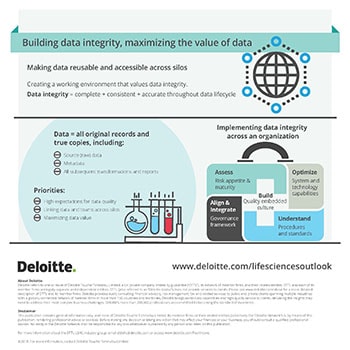

Building data integrity, maximizing the value of data

In 2018, regulatory bodies will have high expectations for data quality and integrity due to the adoption of cloud, automated systems, and advanced technologies in life sciences. Companies are looking at making data accessible across the organization and breaking down the silos in which departments operate. This can help companies derive insights to drive value-based pricing and improve market access.

Key takeaway:

Building cross-functional teams can help life sciences companies break down silos, so that knowledge can be shared between departments and therapeutic areas. The value of data can be maximized by companies through end-to-end evidence (E2E) management. The increased access to such Real-World Data (RWD) would allow companies to leverage Real-World evidence (RWE) helping them streamline the development process and drive down costs.

Building patient trust and centricity

Pharma companies have been inclined towards adopting digital technologies for advancing patient centricity. But, low level of health and digital literacy and corporate reputation can undermine patient trust and ultimately engagement. Here are a few technologies which can transform the patient journey in the future.

- Embedded blockchain technology to improve efficiency, safety and traceability

- Gamification to enhance patient engagement and health literacy

- 3D printing to transform all stages of the pharma value chain

- Optimizing the potential of the connected patient to develop solutions based on the outcome

Key takeaway:

New clinical trials involving patient representatives can help increase acceptance by payers and providers and improve demonstration of value directly to patient groups. Stakeholders need to look at health apps which improve patient engagement by means of health literature. Adopting companion diagnostics can also help patients determine the best treatment and correct dosing, as well as improve adherence.

Building a smart, cross-functional regulatory approach

In the future, regulators will look at ways to measure a ‘culture and quality index’ for life sciences companies. Regulators will continue to modify their policies to keep pace with the increased use of connected devices in the life sciences space. The life sciences sector is gradually moving towards self-regulatory models for some components of the regulatory process, where companies provide metrics on their internal processes and outcomes for monitoring by the regulatory bodies. The future can also lean towards a holistic approach where regulators across the globe collaborate to monitor the sector.

Key takeaway:

Life science companies making investments in unifying data are expected to realize benefits across the organization, not just for compliance purposes. There could be significant investments in the compliance space, but companies will look at creating business-building synergies across industry segments and product lifecycle stages to become compliant.

Growing through partnerships and new operating models

While technology partnerships which allow companies to become more patient-centric and digitally-enabled across commercial and clinical spaces have been common, significant investment in non-asset based R&D partnerships such as academia is now visible. Clinical partnerships have allowed coordinated research efforts through master protocols, helping researchers evaluate more than one or two treatments in more than one patient type or disease. New operating models such as Everything-as-a-Service (XaaS) help companies envision business capabilities, products, and processes as a collection of horizontal services that can be accessed and leveraged across organizational boundaries.

Key takeaway:

Companies will need to partner with regulators to create sustainable innovation, ensuring new products progress efficiently through the pipeline. Businesses are also looking at adopting direct to patient distribution models that could reduce distribution spend and improve patient experience. Internally, several companies have established cross-functional steering committees to integrate R&D functions with commercial, medical affairs, clinical, market access and also key areas of external partners.

Visit our 2018 Global health care outlook to learn more about the trends and issues impacting the health care sector.

Explore our previous outlooks

Review or download previous life sciences sector outlooks.

2017 - Global life sciences outlook

2016 - Global life sciences outlook

Mətn ilə tanış olun

- Download the report

- Infographic

- Embracing exponential changes in technology

- Embracing geopolitical change

- Building an adaptable organization for the future of work

- Building a culture of courage to help counter uncertainty

- Building data integrity, maximizing the value of data

- Building patient trust and centricity

- Building a smart, cross-functional regulatory approach

- Growing through partnerships and new operating models

- Explore previous outlooks

- Follow us on social media

- Key contact

Recommendations

Gələcək aydınlanır

2020-ci ilə qədər olan dövr üçün tibbi-bioloji elmlər sahəsində inkişaf proqnozu