On behalf of Deloitte, we would like to warmly welcome you to Switzerland.

We are pleased to present our current edition of the Living and Working in Switzerland brochure, which has been prepared to provide you with an overview of some of the important issues that may affect foreign nationals moving to Switzerland.

This publication aims to give information of a practical nature, as well as factual information concerning taxes and other employment-related matters in Switzerland. It is not intended to provide in-depth answers to specific questions and it should be treated as a general outline only.

We hope this booklet provides you with useful information and first guidance about living and working in Switzerland.

Country Background

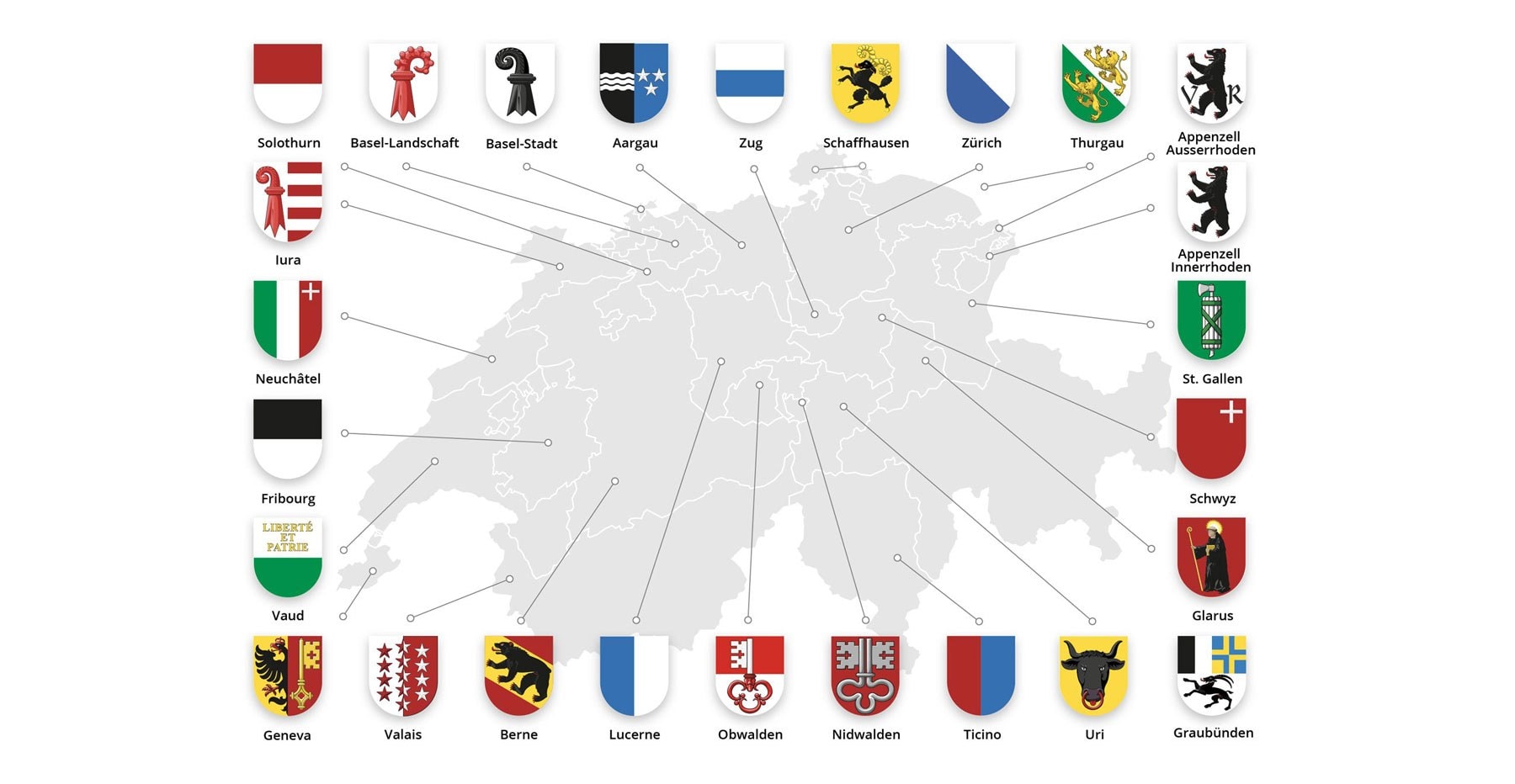

Located at the heart of Europe, Switzerland is the second oldest federal state in the world after the United States of America. The country is divided into 26 states, which are known as cantons. They originally united to form the Confederation with the adoption of the Constitution of 1848 – the only exception is the canton of Jura which separated from the canton of Berne in 1979. Berne is the capital city of the Swiss Confederation.

Today the total population in Switzerland is about 8.4 million, most of whom live in the major cities – Zurich, Basel, Geneva and Berne. In comparison with other European countries, the proportion of foreigners is particularly high in Switzerland representing around 25% of the resident population. The vast majority of foreign residents come from Europe – Italy (15.4%), Germany (15.1%) and Portugal (13.1%). However the proportion of residents who come from other continents is slightly increasing.

Switzerland’s economy is fairly robust in terms of gross domestic product (GDP). If we consider GDP per capita, it is among the richest countries in the world. The main sources of Switzerland’s GDP include services (71%), industry such as machinery manufacture, pharmaceuticals production and watchmaking (27%).

Switzerland is known for its high standard of living, attracting many professionals and their families from around the globe – Zurich and Geneva are regularly ranked as being amongst the best cities in the world in which to live.

Immigration roadmap

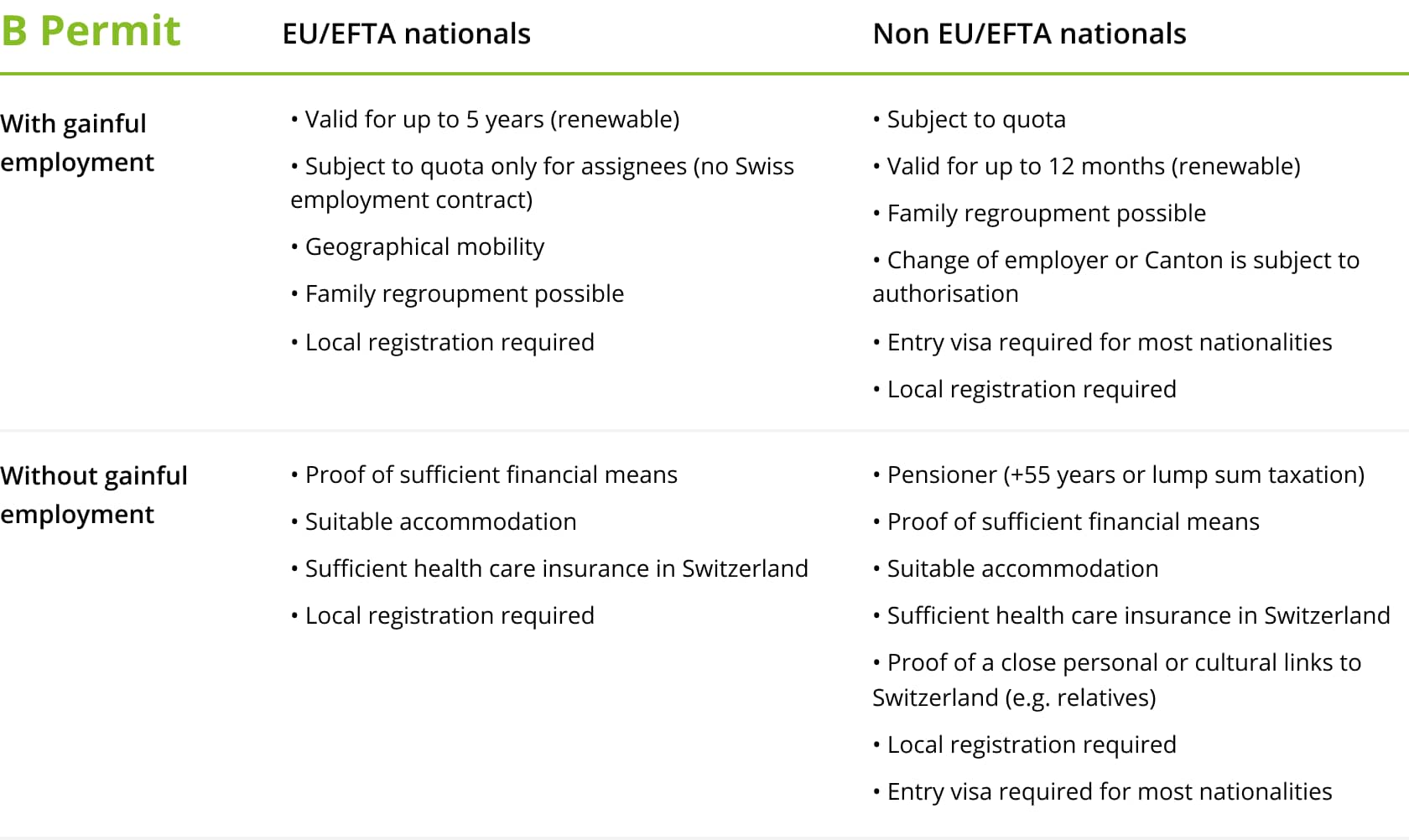

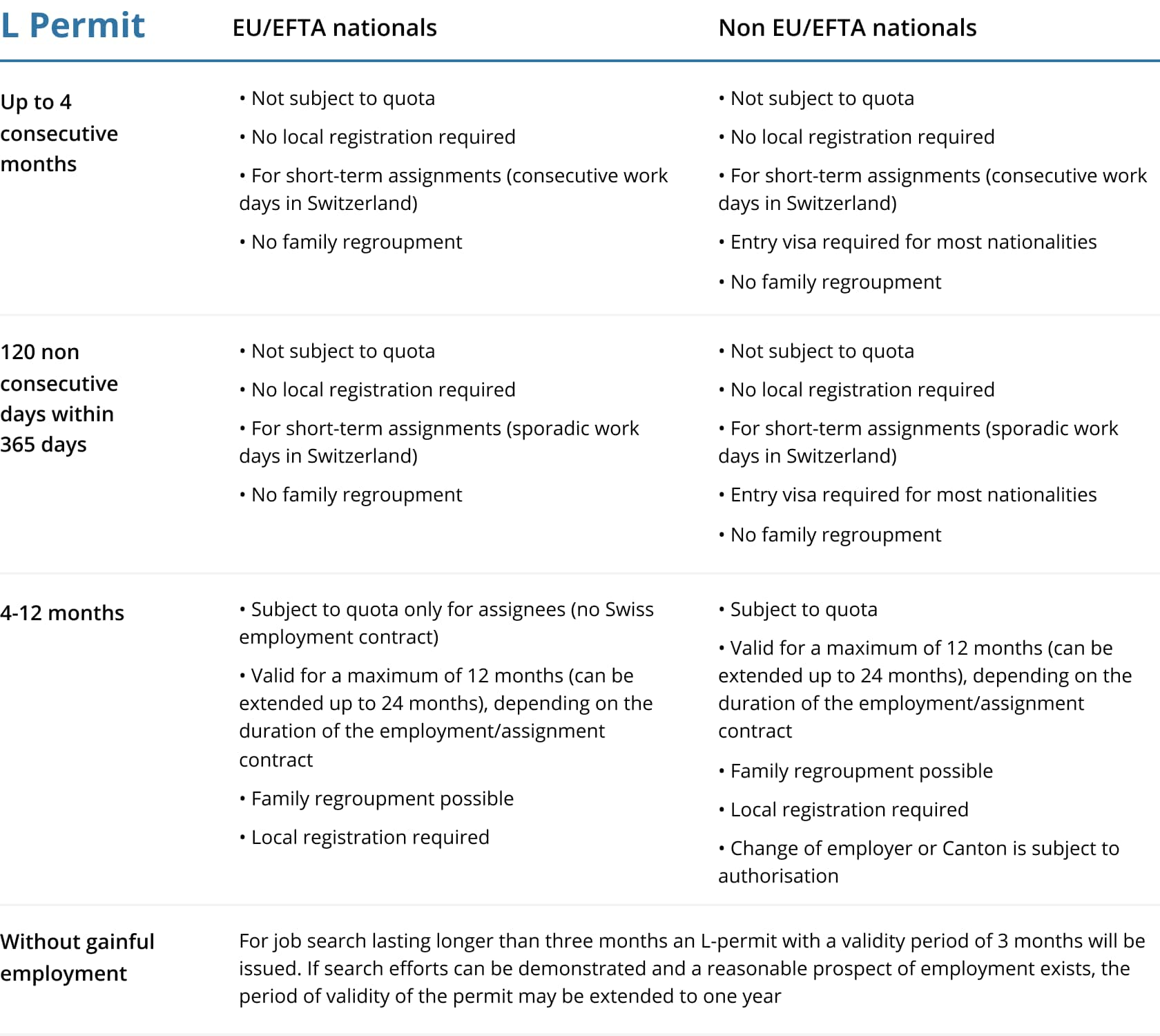

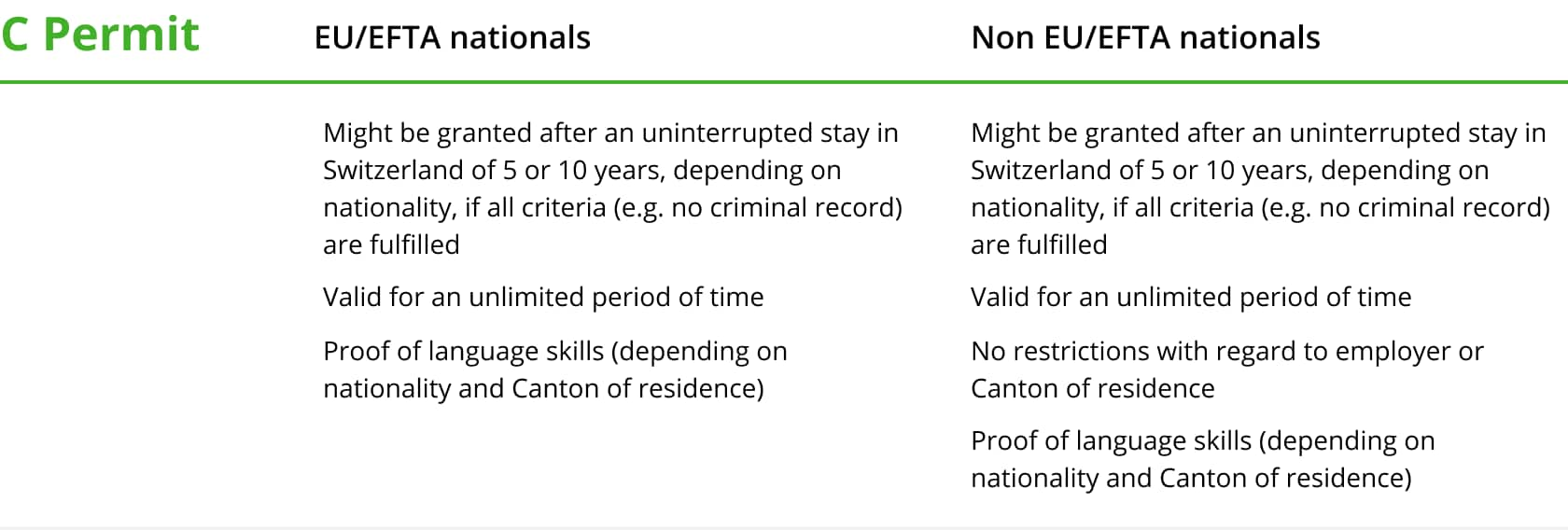

Switzerland has a dual immigration system

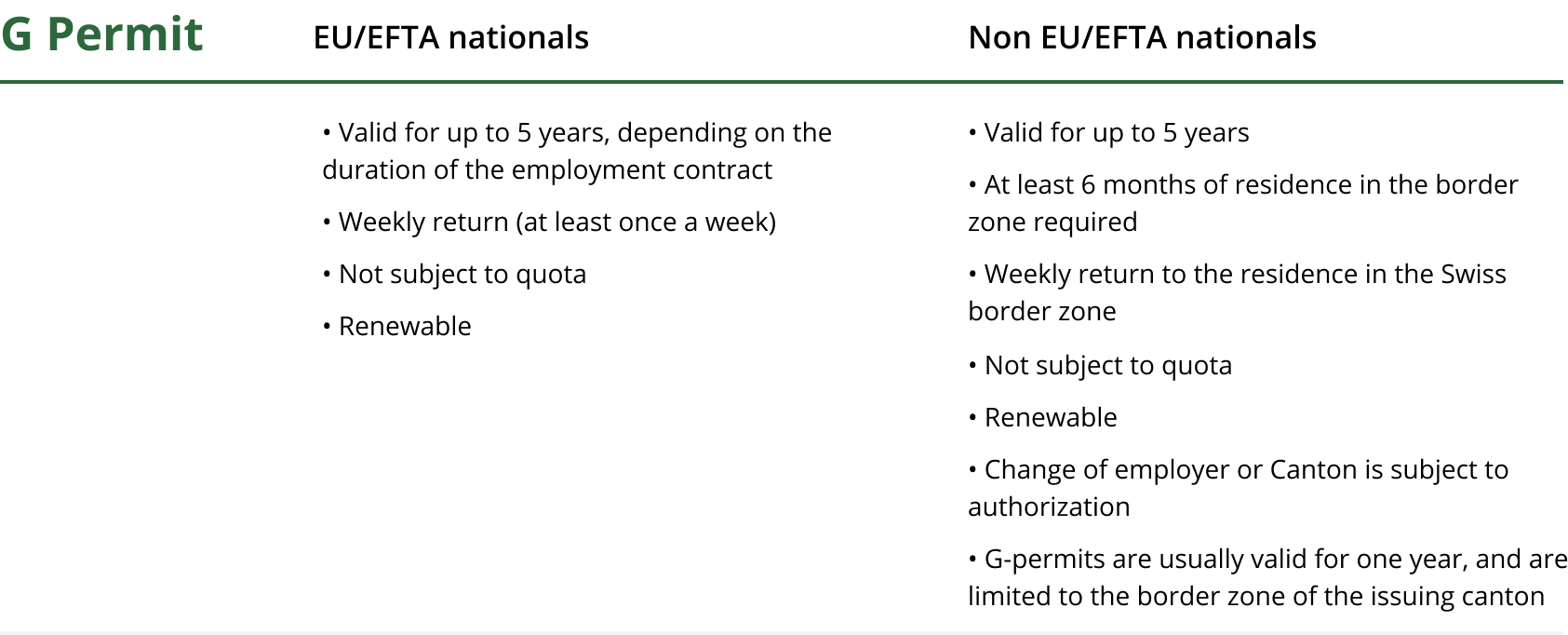

EU/EFTA nationals (i.e. EU citizens as well as citizens of Norway, Iceland and Liechtenstein, due to BREXIT this applies to UK nationals only until 31.12.2020) benefit from the Agreement on the Free Movement of People, and therefore have a legal right to obtain a work permit based on a signed Swiss employment contract. They receive their work permit upon registration at their local community office of their domicile in Switzerland.

EU/EFTA nationals on assignment to Switzerland (no Swiss employment contract) for more than 90 days per calendar year are not covered by the Agreement on the Free Movement of People. A work permit application has to be approved in advance.

The Swiss salary levels have to be respected and additionally all assignment related costs for accommodation, food and travel have to be covered by the employer. The applicable Swiss salary level has to be individually calculated depending on several parameters such as education, age, professional experience or responsibilities. The processing time with the authorities amounts to around 3-6 weeks.

Locally hired non EU/EFTA nationals are only granted a work permit if no equivalent candidate could be found on the Swiss employment market and effective and extensive recruitment efforts can be proven (requirement). Exemptions are applicable for intra company transfers of highly specialised employees or for positions in managerial roles.

For intra company assignees (no Swiss employment contract), the precedence is not applicable under the condition that the assignees have been employed for at least 12 months.

For all non EU/EFTA nationals the Swiss salary levels have to be respected. Most non EU/EFTA nationals have to pick up an entry visa in order to enter Switzerland for work and/or residence. The processing time with the authorities for the work permit including the entry visa amounts to around 4-8 weeks.

In the framework of the registration procedure, foreign employees from EU/EFTA states may work in Switzerland for up to 90 working days per calendar year without a work permit, but registration is mandatory. Applicable for locally hired EU/EFTA nationals for up to 90 days per calendar year accounted per employee.

For assigned EU/EFTA nationals with an employer domiciled in an EU/EFTA country the 90 days per calendar year are accounted per foreign employer. For non EU/EFTA nationals the online notification system is only possible, if the employees were holding a work and residence permit in an EU/EFTA country for at least 12 months.

- The registration has to take place at least 8 days before taking up work in Switzerland.

- The registration needs to be done by the employer.

- The authorities need to be notified about every change in your online notification immediately (e.g. postponement of the work days, cancellation of notification).

- No local registration required.

- No family regroupment.

A gainful activity of a foreign national in Switzerland requires a work permit.

Business meetings are allowed without work permit (Schengen Rules apply) and visa requirements are applicable for most non EU/EFTA nationals. Persons from EU/EFTA member states, regardless of their qualifications, are granted easy access to the Swiss labour market under the Agreement on the Free Movement of Persons. By decree of the Federal Council, workers from third countries, as they are referred to, are admitted in limited numbers to the labour market in Switzerland, if they are well qualified.

Living in Switzerland

Moving to a new Country is a significant decision. There are many aspects that must be considered, from cost‑effective tax planning to selecting the right school for accompanying children. This publication gives practical guidance on some of the issues faced by individuals relocating to Switzerland.

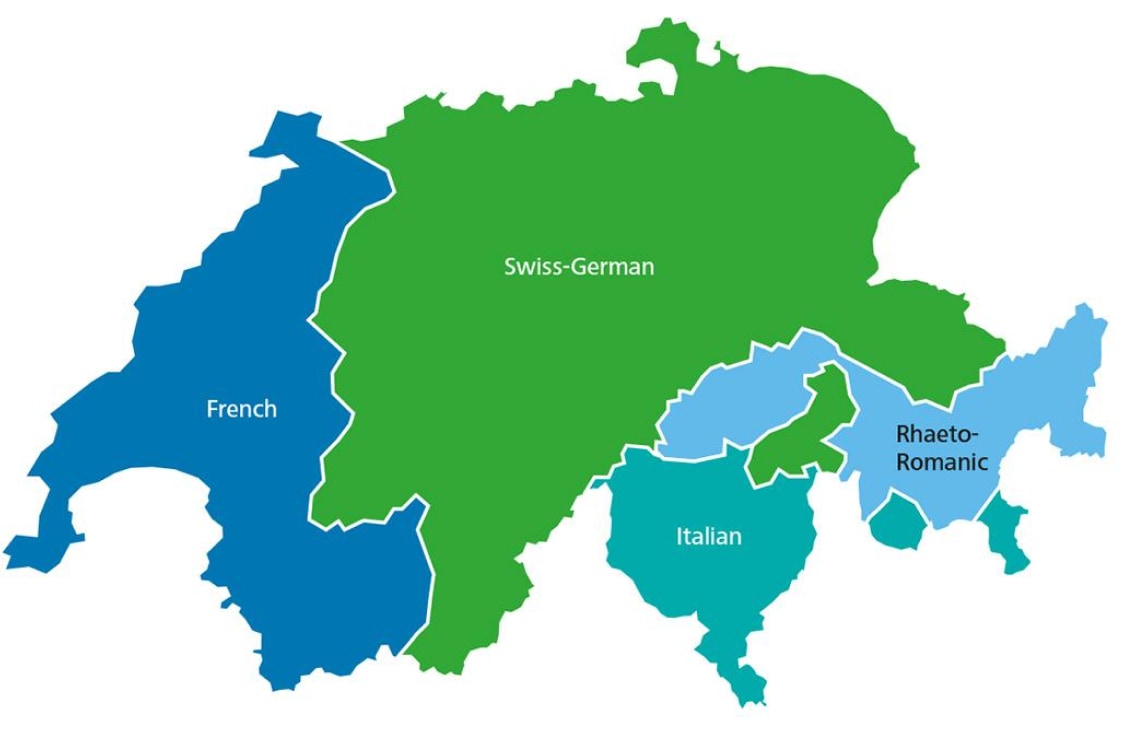

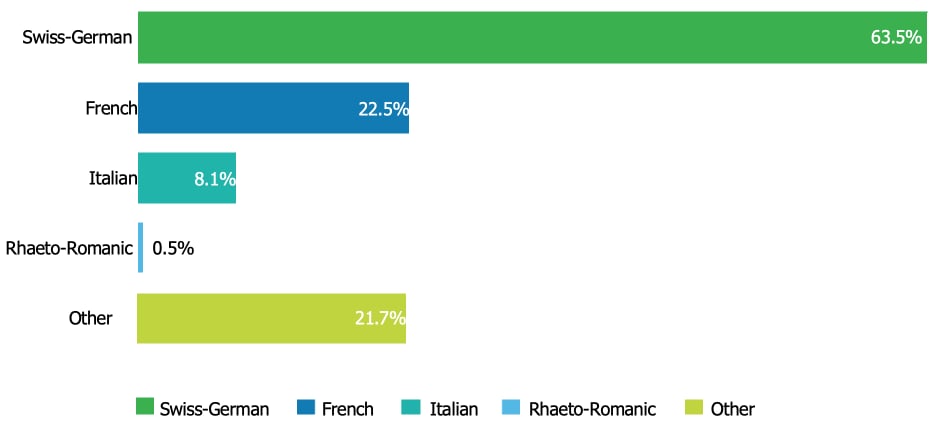

Even though Switzerland is a small country, its people speak no less than four different languages: German, French, Italian, and Rhaeto-Romanic.

Everything from the list of the ingredients on the package of groceries to official government documents has to be printed in three different languages (German, French and Italian).

The German speaking Swiss speak a different form of German than the Germans or the Austrians, called “Swiss-German” or “Schweizerdeutsch”. To make it more complicated, each canton has its own dialect and there is no written Swiss-German at all. Fortunately, the Germans, Austrians, and Swiss-Germans use the same written German language, which is close to the so-called “high German,” the standard for the German languages.

The French and Italian speaking Swiss also have a unique version of their language that differs from their neighbours, but the difference is mainly in vocabulary and is not as dramatic as in the case of Swiss-German.

The other official language is Rhaeto-Romanic, a very old language (considered so because new words are not introduced, but instead taken from German) that is spoken within a limited region of Switzerland. Even though there are only a few villages where they still speak this language, there are nonetheless five different dialects.

Currency and foreign exchange

The currency is the Swiss Franc which is divided into 100 cents (rappen/centimes/centesimi). Swiss coins are available in 5, 10, 20, and 50 cents, as well as 1, 2, and 5 franc amounts. Bank notes are printed in denominations of 10, 20, 50, 100, 200, and 1’000 francs. The official abbreviation of the Swiss Franc is CHF, although it is common to see SFr. and Fr. used as well. There are no currency or exchange control restrictions in Switzerland.

Banking

Switzerland is a country with an efficient and established banking system. Current account services are available through the major banks, the Post Office Bank, Cantonal Banks, and private banks. For more information about setting up a Swiss bank account, refer to the websites of any of the major banks in Switzerland, including:

All invoices in Switzerland are required to be issues on a standard payment form (einzahlung/versement/versamento), regardless of who issues the invoice. Payment can then be made in cash at the post office (assuming you bring the payment slip), at your bank, at your bank’s automated bank machine, or via your bank’s online banking system.

Public Holidays

Some holidays are specific to individual cantons. However, there are some national public holidays, listed below.

- January 1 - New Year’s Day

- April (variable) - Good Friday

- April (variable) - Easter Monday

- May (variable) - Ascension Day

- May (variable) - Whit Monday

- August 1 - Swiss National Day

- December 25 - Christmas Day

- December 26 - Day After Christmas

If one of these days falls on a weekend, it is not usual for the following weekday to be given off “in lieu”.

Office and retail hours

Most offices are open from 08:00 until 17:00, Monday through Friday, although banks and government buildings may close earlier. Shops are usually open from 09:00 until 18:30, Monday through Friday, and on Saturday from 09:00 until 17:00 (with shops in the city staying open later). In certain cities, shops will stay open until 21:00 on one day of the week. Shops are closed on Sunday, with the exception of shops in airports, train stations or some tourist areas.

Postal services

The post office hours in Switzerland vary depending on the size and location of the post office. Locations in the city center or near airports/train stations may open later.

There are two postal categories: Tariff A Priority (for next day delivery in Switzerland) and Tariff B Standard (for delivery within two to four days in Switzerland).

The Swiss housing market is difficult in certain locations given the limited supply of housing. Prices for the purchase and rental of property remain relatively high, especially in urban areas.

Renting property

It is possible to arrange for housing individually through resources available to the public. There are still listings in the local or regional newspapers, but more often information is nowadays available on the internet. By subscribing to various dedicated websites, vacancies can be found, but information may be limited as properties are not always advertised on the internet due to the short vacant period between renters. Acting quickly is highly recommendable as properties are usually rented in a short amount of time.

Alternatively, the services of a real estate or relocation agent can be used to help review housing options. The biggest benefit of using an agent is the fact that agents often have access to properties before they are listed on the open market. The agent can also assist in prioritising a specific rental application above other applications, although the final decision is always made by the landlord (there is no requirement for the landlord to accept the first application for a rental property). When determining the overall cost of the rental property, it should be considered whether any charges are included in the monthly rent, such as utilities, cable television, etc. It is standard for landlords to request a security deposit of up to three months rent.

Related links

Purchasing property

The purchase of property can take time and will also affect an individual’s tax situation (see our separate section on the tax issues related to real estate). The advice of a qualified real estate professional should be sought when purchasing a property in Switzerland, as they can explain the various fees that will be due upon purchase, including transfer taxes, notary fees, and land register fees (approximately 6-7% of the purchase price should be budgeted for these fees).

The Bilateral Agreement on the Free Movement of Persons provides that, effective 1 June 2002, an EU/EFTA national holding a residence permit and resident in Switzerland enjoys the same rights as Swiss citizens with regard to the purchase of real estate. In addition, C permit holders, regardless of nationality, have the same rights as Swiss citizens to purchase real estate. Those individuals can acquire real estate in Switzerland such as a principal residence or a second home, a holiday home, land to build on, or an investment in a property.

EU nationals and cross-border workers (irrespective of nationality) who are not resident in Switzerland may acquire real estate if necessary for their gainful activity. Otherwise, the acquisition of a second residence or of holiday accommodation requires the granting of authorisation from the local authorities.

Individuals are required to pay at least 20% of the purchase price of a personal-use primary property as a down payment (i.e. the maximum amount of the mortgage is 80%). Generally, two mortgages are set up and the main one does not require amortisation of capital. Individuals can also use their pension capital (2nd and 3rd pillar) to finance the purchase of real estate in Switzerland, but only for a principal residence.

Purchasing property in Switzerland may have significant impact upon an individual’s tax position. Fiscal advice should therefore be sought prior to any property purchase.

Utilities

Individuals are often required to organise their utilities by arranging the services with the relevant company. In some cases, e.g. apartments in the city center, the arrangement of utilities can happen relatively quickly. However, it can take more time in an older home or for residents in rural locations, depending on the amount of work involved.

The telephone system in Switzerland is managed by Swisscom. To have a telephone line installed or connected an individual will need to contact them. After registering with Swisscom, a different service provider can be chosen from a variety of companies.

There is a wide range of internet service providers, which vary by geographic location. Some will also provide telephone options.

The public utility system (i.e. electricity, water) is usually managed by the cantons and the process will vary from canton to canton, as well as from city to city. As with Swisscom, one should expect to pay a deposit to have the services turned on and to register an individual account. Some utility companies will invoice based on estimated usage (usually from the preceding tenant) and will then adjust for the actual usage once a year or upon the closing of an individual’s account.

Television and radio

Television signal systems vary from country to country, even within Europe, so an imported television may not receive a signal in Switzerland.

Few basic channels can be received with an aerial only, but a satellite or cable hook-up is needed to access anything more than this basic service. It is possible to receive US and UK television broadcasts either via self-set up or through the local satellite dealers, although a supplemental fee is due for this service.

Every Swiss household is obliged to pay a television and/or radio license fee that is centrally collected through a company called SERAFE. All individuals whether they own a functioning radio or television or not are required to register with SERAFE upon arrival in Switzerland.

The Swiss education system is the responsibility of the cantons, so the process may vary from canton to canton.

Public Schools

Public schools are funded by the cantons through tax revenue, so there are no additional fees for schooling at public schools. Children living in Switzerland are required to attend an educational institution, either private or public, from age 6 or 7. The compulsory education usually starts at the age of 4 and lasts for 11 years.

The public school system in Switzerland is divided into the following sections:

- Nursery school (Kindergarden): for ages 4 to 6, usually two years before entering primary school. This school is mandatory in most cantons.

- Primary school: for ages 6 to 12. Primary school encompasses grades one through six.

- Secondary school: for ages 12 to 15. Secondary school is designed to prepare the child for the post‑secondary schooling. Compulsory education is completed when graduating from secondary school.

- Post-secondary school: for ages 15 and up. Post‑secondary school can be a high school or an apprenticeship of 3 to 4 years, depending on the career plans of the student.

The public education system in Switzerland has a reputation for high quality and tough standards. Upon arrival in Switzerland, individuals wishing to register their children in public schools are required to contact the cantonal education department and will be required to provide them with a copy of a work/residence permit and proof of health and accident insurance for the child.

Switzerland has an extensive network of roads ranging from multi-lane highways to small country roads. The major roads are always well-maintained and Swiss drivers are extremely courteous on the roadways, making driving in Switzerland relatively simple. Driving is on the right side.

Driver’s licence

Individuals are required to have a valid driver’s licence to drive in Switzerland. Foreigners who are living in Switzerland are allowed to drive for up to one year on their home country driving licence or an international driving licence, assuming they meet the minimum legal driving age of 18 years old (21 for large trucks). To obtain a Swiss driver’s licence, an individual will have to apply at the local motor vehicle division with the following items:

- Completed application to exchange their foreign licence for a Swiss licence.

- The original foreign driver’s licence for exchange or for the authorities to stamp as “invalid in Switzerland”.

- A certificate from a Swiss certified optician that the eye examination has been passed, which costs about CHF 25 (the motor vehicle department can provide a list of certified opticians in a specific area).

- One colour passport-sized picture.

- A copy of the Swiss permit (the actual permit must be brought along when applying for the licence).

In most cases, home country or international driving licences can be converted to a Swiss licence within the first year in Switzerland without taking an examination or practical driving test. Individuals from certain countries may be required to pass a practical driving test, but not the written exam.

Individuals who fail to convert the licence to a Swiss licence within one year from their arrival will have to take both the written and practical exams to obtain their Swiss licence.

Buying or importing a car

An individual must have a residence permit (or at least the permit number) before they can purchase a car in Switzerland. Purchasing a car from a dealer is the simplest approach, as the dealer will usually take care of all registration items. However, it is possible to purchase from a private individual, with many listings being available on the internet.

Cars are required to pass a strict mechanical evaluation by the motor vehicle department on a periodic basis (usually every 2-5 years, depending on the age of the car). Any mechanical problems that are discovered must be corrected, and the vehicle re-examined by the motor vehicle department, within a short period of time. When purchasing a car in Switzerland, the buyer should question when the car last underwent this mechanical evaluation.

After any purchase, an individual will need to obtain a licence plate and a “circulation permit”, as well as to take out insurance through a private insurer before the car can be driven in Switzerland. Proof of insurance and the grey “circulation permit” are the first things the police will ask for upon any traffic control.

A car can be imported into Switzerland, provided the following documents are available:

- Proof of car insurance by an insurance company registered in Switzerland;

- An expert report with the official customs stamp and/or additional customs authorisation;

- The date the vehicle was first registered from the original registration card;

- Technical data of the vehicle, such as engine size, weight, and maximum speed; and

- An antipollution maintenance card established in Switzerland after the proper tests have been completed.

There is an exemption under Swiss law that allows an individual to import their personal car without taxes or duties as part of their move to Switzerland, provided that they have owned the vehicle for six months prior to the move to Switzerland and they continue to own the vehicle 12 months after arrival in Switzerland

Otherwise, Swiss VAT (7.7%) and car tax (4%) – both calculated on the car’s value – are payable upon importation of a car. Custom duties may also be charged, depending on the country of construction (not the country where the car was purchased) and the weight of the car. It may be possible to reclaim VAT paid in the country of purchase in certain circumstances.

In addition, the car will have to undergo a technical evaluation (as discussed above) and may require additional updates to be compatible with the Swiss system, such as ensuring the speedometer shows kilometres.

Car insurance

Insuring a car in Switzerland is both mandatory and costly (relative to other countries). There are three types of insurance in Switzerland:

- civil responsibility

- comprehensive coverage

- accident insurance.

All cars are required to have civil responsibility cover as a minimum; this covers injury and damage inflicted on a third party. The comprehensive coverage – which covers collision, theft, vandalism, etc. to the car – and accident insurance for passengers are both optional.

Practical tips

For any travel on the motorway, an annual (calendar year) highway sticker needs to be purchased. These stickers are available at the border crossings and most petrol stations for currently CHF 40. The speed limit on the highway is 120km/h unless posted otherwise, whereas the speed limit in towns is generally 50km/h.

Drivers should pay attention for photo radars, both in the cities and on the motorways. Drivers caught exceeding the limit will receive a traffic ticket.

All passengers are required to wear their seatbelts. Drivers generally travel in the right lane unless passing another car. If a car behind flashes their lights or puts on their turn signal, it is a sign that they would like to pass. Swiss drivers will not honk the horn unless it is an emergency or someone has made a serious traffic error (as it is generally against traffic regulations to use the horn).

Labour Law

The Swiss employment contract should stipulate most of the terms of an individual’s employment in Switzerland, including the working hours, vacation entitlement, place of work, etc. Employer policies and procedures should be studied carefully as they often form part of the employment contract.

Employment contracts in Switzerland are subject to a trial period, which may vary depending on the employment contract. Once the trial period has passed, the employment contract may be cancelled if proper notice is given as follows (according to the dispositiv provisions of Swiss labour law):

- Up to one year of service: one month’s notice (at the end of a month).

- As of the second year of service and up to the completion of the ninth year of service: two month’s notice (at the end of a month).

- As of the tenth year of service and later: three month’s notice (at the end of the month).

The individual employment contract or a company policy might stipulate a different notice period, but it may not be less than one month.

Termination of the employment contract should be communicated via registered mail by either party. A letter notifying the intention to end the contract must reach the employer or the employee by the last working day of the month for the notice to be effective for that month.

The notice period begins after the receipt of this letter and the salary continues to be paid during the notice period according to the employment contract. The final salary payment should include a prorated 13th monthly salary (if a 13th month salary payment is part of the employment contract) and any residual vacation balance should be taken during the notice period or paid in full.

Employment cannot be terminated by the employer under any of the following circumstances:

- During pregnancy and during the first 16 weeks after birth.

- During military and other officially required services, or 4 weeks before or after such services if they exceed 11 days.

- During absences due to sickness or accident, but only within:

– 30 days if during the first year of employment;

– 90 days from the 2nd to 5th year of employment; and

– 180 days from the 6th year of employment.

For instance, the employer cannot terminate the employment contract of the employee during the first 30 days of sickness leave in the first year of employment. However, the employment contract can be terminated after the 30‑day period has passed, even if the employee is still ill.

Income and wealth taxation

Switzerland’s complex income tax system is structured around the three layers of government: federal, cantonal (or state), and communal (or city). In most cantons, the majority of the tax burden comes from the cantonal taxes.

Swiss taxes are levied on at least three different levels:

- The direct federal tax (marginal rate: 11.5%) is uniform throughout Switzerland and only due on income.

- The cantonal tax varies from canton to canton and is levied on income and wealth.

- The communal tax can vary from community to community, is levied on income and wealth and is normally calculated as multiple or percentage of cantonal tax.

- Church tax is levied in many (but not all) cantons on the income and wealth of individuals affiliated to one of the three official Swiss church communities (i.e. roman‑catholic, Christ‑catholic and Swiss protestant). Church tax is typically levied as percentage of cantonal tax. Individuals affiliated to a different church community (e.g. Jewish, Muslim, Buddhist) or agnostic taxpayers are exempted from Swiss church tax.

Income and wealth tax rates are typically progressive on the federal and cantonal level. The maximum income tax rate including federal, cantonal and communal taxes (but excluding church tax) is between approximately 21% and 46%, depending on the canton and commune while the marginal wealth tax rate can vary from around 0.15% to 1% depending on canton and commune as well.

For individuals, the Swiss tax year equals the calendar year, but split years apply for individuals who start or end being subject to Swiss taxation.

The taxation of income and wealth in Switzerland is dependent on the individual’s tax residence status. A foreign individual who is regarded as a tax resident in Switzerland will in general be subject to tax on worldwide income and net wealth while a non‑resident taxpayer is only subject to Swiss taxation on Swiss sourced income and Swiss situs assets (e.g. real estate).

Resident taxpayers

Individuals qualify as tax resident in Switzerland based on domestic legislation if:

- Their tax home (i.e. centre of vital interests) is located in Switzerland; or

- They spend 30 consecutive days in Switzerland (minor interruptions abroad are ignored) while performing a gainful activity; or

- They spend 90 consecutive days in Switzerland (minor interruptions abroad are ignored) without performing a gainful activity.

In practice, each individual who is registered as resident with the local authorities is – presumably - regarded as fiscally resident based on domestic legislation.

International legislation (i.e. double tax treaties or other international conventions) can override Swiss taxing rights. An individual qualifying as fiscally resident in another country at the same time might therefore be (partially) exempted from Swiss resident taxation based on a specific double tax treaty.

Non‑resident taxpayers

Individuals who do not qualify as Swiss tax resident based on domestic or international law might still be subject to Swiss taxation as non‑residents on certain Swiss sourced income and/or Swiss situs assets. Non‑resident taxation based on domestic legislation is for example due on the following income and assets:

a. Gainful activity (employed or self-employed) performed on Swiss territory; or

b. Directors’ fees paid by Swiss based companies; or

c. Pensions (especially second pillar pensions) paid by a Swiss pension plan provider

d. Gainful activity performed in international traffic (e.g. on board of a ship or aircraft ) for a Swiss based employer

International legislation (i.e. double tax treaties) might overrule or limit the Swiss taxing rights.

Resident individuals are in principle subject to Swiss taxation on their worldwide income and wealth. Domestic legislation, however, allows the following items to be exempted with progression from Swiss taxation:

- income deriving from and the value attributable to foreign real estate; and

- self‑employed income deriving from and assets attributable to a foreign place of business or permanent establishment; and

- income attributable to equity based incentive schemes that has been earned prior to taking up Swiss tax residency.

Further income and wealth items might be exempted with progression based on international legislation (i.e. double tax treaties).

Any items (income or wealth) exempted with progression will be taken into account in order to determine the applicable tax rate (i.e. progression impact), but will not be subject to Swiss taxation.

The Swiss income tax basis is rather broad. Taxable income includes active (e.g. income from any gainful activity as well as pension income) and passive (e.g. interest, dividends, rental income) income. The most important exception from this general rule relates to capital gains on privately held movable assets (e.g. shares and bonds) that in general remain tax‑free. Capital gains on business assets are subject to ordinary income tax while capital gains on properties located in Switzerland are normally taxed separately from any other income at a special cantonal (and sometimes communal) capital gains tax.

Only 70% of the gross dividends deriving from qualified shareholdings (i.e. taxpayers owning 10% or more of the company’s capital) are taxed at the federal level. Most cantons provide similar (or even slightly higher) exemptions for such qualified dividends on the cantonal tax level.

Subject to wealth tax are basically all of an individual’s assets with the exception of pension entitlements (Swiss and foreign) and household goods (e.g. furniture, clothes etc.). The taxable assets would for example include bank balances, securities of any kind and other investments, real estate (the value of foreign real estate is exempted with progression), cars, boats and planes as well as precious metals or art. In general, the fair market value of all the assets as at the end of the tax period (31 December or the date that an individual breaks Swiss tax residency) is subject to Swiss wealth tax. Only Swiss real estate is taxed on the normally lower tax value as determined by the cantonal tax authorities where the property is located. Any outstanding liabilities (e.g. mortgages, student loans, car loans, outstanding credit card balances) at the end of the tax period can be deducted from the value of the assets so that only the net wealth is subject to taxation.

Swiss law allows various deductions from gross income in order to arrive at the net taxable income. The most important deductions (non‑exhaustive list) are:

- All employee contributions to the Swiss (and comparable foreign) social security system and pension plans can be deducted from taxable income. This also includes additional voluntary contributions to a qualified Swiss pension plan to close past contribution gaps and voluntary contributions to the Swiss 3rd pillar a retirement saving plans. Contribution caps for the voluntary contributions must be observed.

- Employees can claim a deduction for the commuting costs (normally limited to public transport) for the daily commuting between home and the place of work. The deductions are often limited to a maximum annual amount (CHF 3’000 for federal tax and various other limits for cantonal taxes). In addition, costs for professional education (of the taxpayer, not the dependent children!) and general business expenses not reimbursed by the employer can be deducted.

- Interest charges (e.g. mortgage interest, credit card charges, student loan interest etc.) can be deducted from taxable income up to an annual limit equal to the gross investment income (i.e. interest, dividends and rental income) plus CHF 50’000.

- Childcare costs can only be deducted for children younger than 14 years old provided that both parents are objectively (due to work, education and/or disability) unable to care for the child themselves. The actual costs up to an annual limit (different limits for federal and cantonal taxes) can be deducted.

- Deduction can be claimed for periodic alimony payments to former spouses and minor children (younger than 18 years old). One‑time settlements upon divorce are typically not deductible.

- Contributions to Swiss based and recognised charitable organisations can be deducted while contributions to foreign organisations tend to be not deductible.

- Employees qualifying as Expatriates for Swiss tax purposes can claim additional deductions from taxable income or can be reimbursed tax‑free for certain assignment related costs. The special section dealing with the Expatriate status provides more details in this respect.

Additional deductions (e.g. non‑reimbursed healthcare costs exceeding a certain threshold, asset management costs) as well as personal exemptions (for taxpayer, spouse, dependent children and/or other dependents) might be available. Different regulations and limitations can apply for federal and cantonal tax purposes.

Individuals qualifying as Expatriates for tax purposes can claim additional deductions or be reimbursed tax‑free for certain assignment related allowances. In order to qualify as Expatriate and individual must be:

- a foreign national (Swiss nationals cannot qualify as Expatriates);

- an executive or specialist; and

- be assigned to Switzerland by a foreign employer for a period not exceeding five years.

Individuals qualifying as Expatriates can claim the following deductions or be reimbursed on a tax‑free basis for the following assignment related allowances:

- actual relocation costs (shipping of household goods and travel costs for Expatriate and any accompanying family members) at the start and the end of the assignment; and

- fees for international schools for children accompanying the Expatriate to Switzerland provided these children are unable to go to public schools due to language issues; and

- reasonable Swiss housing costs provided that the Expatriate keeps his or her former principal residence in the home country available during the Swiss assignment.

Despite of various efforts to harmonise the interpretation of Expatriate qualification mentioned above there are still significant cantonal differences. Individuals who qualify as Expatriate in one canton might therefore not be recognised as Expatriate in a different canton. This has to be examined on a case-by-case basis.

In addition, there are significant inter‑cantonal differences with respect to the deductions (or tax‑free reimbursements) allowed. The term “reasonable” is for example not defined by the legislation resulting in different limitations in different cantons.

In some cantons it is possible (or even recommendable) to obtain binding rulings with respect to the Expatriate status for certain populations. These rulings that are binding for all employees living in the canton with which the ruling has been agreed aim to agree on more objective qualification conditions and clear definitions and limitations for additional deductions (or tax‑free reimbursements). In certain cantons (especially in Geneva) it might even be possible to agree on standard deductions that do not depend on the actual costs incurred.

Employees who are required to travel extensively can be reimbursed with a standard representation allowance for small expenses (up to CHF 50 per occasion) incurred during such business travel. These representation allowances must be agreed with the competent cantonal tax authorities and remain free of income tax and social security contributions. In return, the employees are typically unable to claim reimbursement of small business expenses up to CHF 50 per occasion.

To agree on representation allowances with the competent cantonal tax authorities mainly results in an administrative simplification for employer and employees to reimburse small business expenses. Especially in Geneva, representation allowances can, however, be an interesting tax planning tool because the amounts granted by the Geneva tax authorities (normally around 5% to 10% of compensation up to an annual maximum of CHF 100’000) are significantly higher than in other cantons (most other cantons would not grant allowances of more than CHF 24’000 per annum for top executives and lower amounts for lower level employees).

The Federal Tax Administration FTA provides a tool to obtain an estimate of the tax burden in the main cantons of Switzerland. To access the tool, please visit the following website: Tax Calculator (admin.ch).

The tax calculator offers simplified, quick calculations of tax burdens, taking into account flat-rate deductions. You can also enter further details and deductions to obtain detailed calculations. The calculations are neither binding nor guaranteed. Your actual tax assessment may be different.

The remuneration paid by or on behalf of Swiss based employers to Swiss resident foreign employees not holding a permanent residence permit (= C permit) and not married to a Swiss spouse or C permit holder is subject to tax at source (i.e. withholding tax on wages). These Swiss resident taxpayers only can and must file a Swiss tax return if:

- their annual(ised ) gross remuneration exceeds a certain threshold (CHF 500’000 in Geneva and CHF 120’000 in all other cantons); or

- they have other income and wealth exceeding a certain threshold that is determined by their canton of residence (e.g. CHF 2’500 of income or CHF 200’000 of wealth in the canton of Zurich).

In the first scenario (i.e. annual gross remuneration exceeding a certain threshold) the final individual tax liability will be determined on the tax return filed. The tax already withheld at source will be credited against this final liability and the taxpayer will either receive a refund or will have to pay an additional amount.

In the second scenario (i.e. other income and wealth exceeding a certain threshold) the tax withheld at source will remain the final tax liability on the employment income. The tax due on the additional income and/or wealth is determined based on the return filed and must be paid in addition.

Employees whose salary is subject to withholding tax and whose annual (or annualised) gross income does not exceed the cantonal threshold can apply to the competent cantonal tax authority (deadline: 31 March of the year following the tax year - no extension possible!). The application is only possible to correct a possibly incorrect gross salary, an incorrect withholding tax rate or an incorrect rate-determining income.

If a person subject to withholding tax wishes to claim deductions, this must be done via the tax return procedure. A distinction must be made here as to whether the person is resident in Switzerland for tax purposes or not:

- Persons who are resident in Switzerland for tax purposes can claim deductions without restrictions via the tax return procedure. It is important to note that once a person has opted for the tax return procedure, a tax return must be submitted every year thereafter.

- Persons who are not resident in Switzerland for tax purposes can only claim deductions if they fulfil the requirements of "quasi residency". In other words, more than 90% of the worldwide family income must be subject to Swiss taxation. The application and the review of whether a tax return can be submitted must be carried out each year.

- The submitted tax return is binding in any case, even if it has negative consequences for the taxpayer.

Due to the various procedures, different deadlines and processes must be taken into account.

The filing deadline for Swiss tax returns (for resident and non‑resident taxpayers) is in general 31 March of the year following the tax year. Since the deadline is set by cantonal legislation each canton must, however, be checked separately. Most cantons allow this deadline to be extended easily, but the length of the extension can differ from canton to canton.

Married couples are in general obliged to file a joint return declaring the income and wealth of both spouses and of any minor children (i.e. children younger than 18 years old). In return, they are taxed at a special tax rate for married couples (at the federal level) with a lower progression and are granted higher standard deductions and personal exemptions than single individuals. Some cantons provide partial splitting systems (and higher deductions/exemptions) in order to achieve equal (or at least similar) treatment between married couples and single individuals.

Since the enactment of the Swiss legislation on the recognition of same-sex relationships as per 1 January 2007 registered same‑sex partners qualify as married couples for Swiss tax purposes.

Each tax return is formally assessed by the competent cantonal (or communal) tax authorities. The assessment is a formal decision whether the return is accepted as filed or whether changes are imposed. The assessment can be appealed within 30 days upon receipt. Depending on the canton it can easily take 12‑18 months from the date the return has been filed until the final assessment is issued.

Non‑resident taxpayers whose Swiss sourced income is subject to tax at source or any other Swiss income tax withholding are typically (irrespective of their nationality) not obliged to file a Swiss tax return. Whether they are able to file a return or a tariff correction (see the respective section for resident taxpayers) depends very much on the situation and the applicable cantonal rules and practices. This should therefore be checked carefully on a case‑by‑case basis.

Non‑resident taxpayers owning real estate located in Switzerland are – on the other hand – normally obliged to file an annual Swiss tax return irrespective of whether rental income is generated or not. A review on a case-by-case basis will even be more important with regards to the change in the source tax legislation as per January 2021.

The lump sum taxation is a special tax status available to foreign nationals who:

- take up residence in Switzerland for the first time ever or after an absence of at least 10 years; and

- do not perform any gainful activity in Switzerland.

Individuals benefitting from this special tax regime are not subject to Swiss taxation on their worldwide income and net wealth, but based on their worldwide expenditure (living costs). The minimum taxable income and wealth is typically agreed with the competent cantonal tax authorities in a binding ruling upon application prior to taking up Swiss tax residency.

These minimums are compared annually to the Swiss sourced income and the foreign sourced income for which relief from foreign taxation is obtained based on a Swiss double tax treaty. The taxpayer is taxed on the higher of the two at the ordinary progressive Swiss income and wealth tax rates applicable in the specific canton and community of residence.

Some cantons (e.g. Canton of Zurich, Schaffhausen, Basel-City, Basel Country and Appenzell Ausserrhoden) have abolished this special tax status and consequently do not offer lump sum taxation for individuals residing in these cantons.

This special tax status can be an attractive tax planning tool for wealthy foreign taxpayers who want to relocate to Switzerland.

There are no federal estate, inheritance or gift taxes, but basically all cantons (with the exception of the canton of Schwyz) levy these taxes. In a few cases, inheritance, property and gift taxes are also levied by the communes.

An individual becomes liable to Swiss inheritance or gift tax upon:

- Inheriting assets from a person whose last residence was in Switzerland; or

- Receiving a gift from a donor resident in Switzerland; or

- Receiving real estate located in Switzerland either as a gift or as an inheritance. Liability to taxation does not depend on the nationality of the deceased or of the donor, nor on the place of residence of the heir or donor.

Transfers (i.e. gift and inheritance) to spouses are exempted from inheritance and gift tax in all cantons while transfers to direct descendants (i.e. children, grand‑children) are exempted in most cantons.

The tax rate for other transfers is normally progressive and depends on the competent canton (and/or community), the relationship between the two parties and the amount or value transferred. The marginal tax rate can be in excess of 50% in some cantons.

Switzerland introduced a value added tax (VAT) in January 1995 that is similar to the tax charged by other European countries. Liechtenstein has taken over the Swiss VAT system and, thus, Switzerland and Liechtenstein form one VAT territory. The VAT rate for most purchases in Switzerland is currently 7.7%, although some items are taxed at a reduced rate (currently 2.5%).

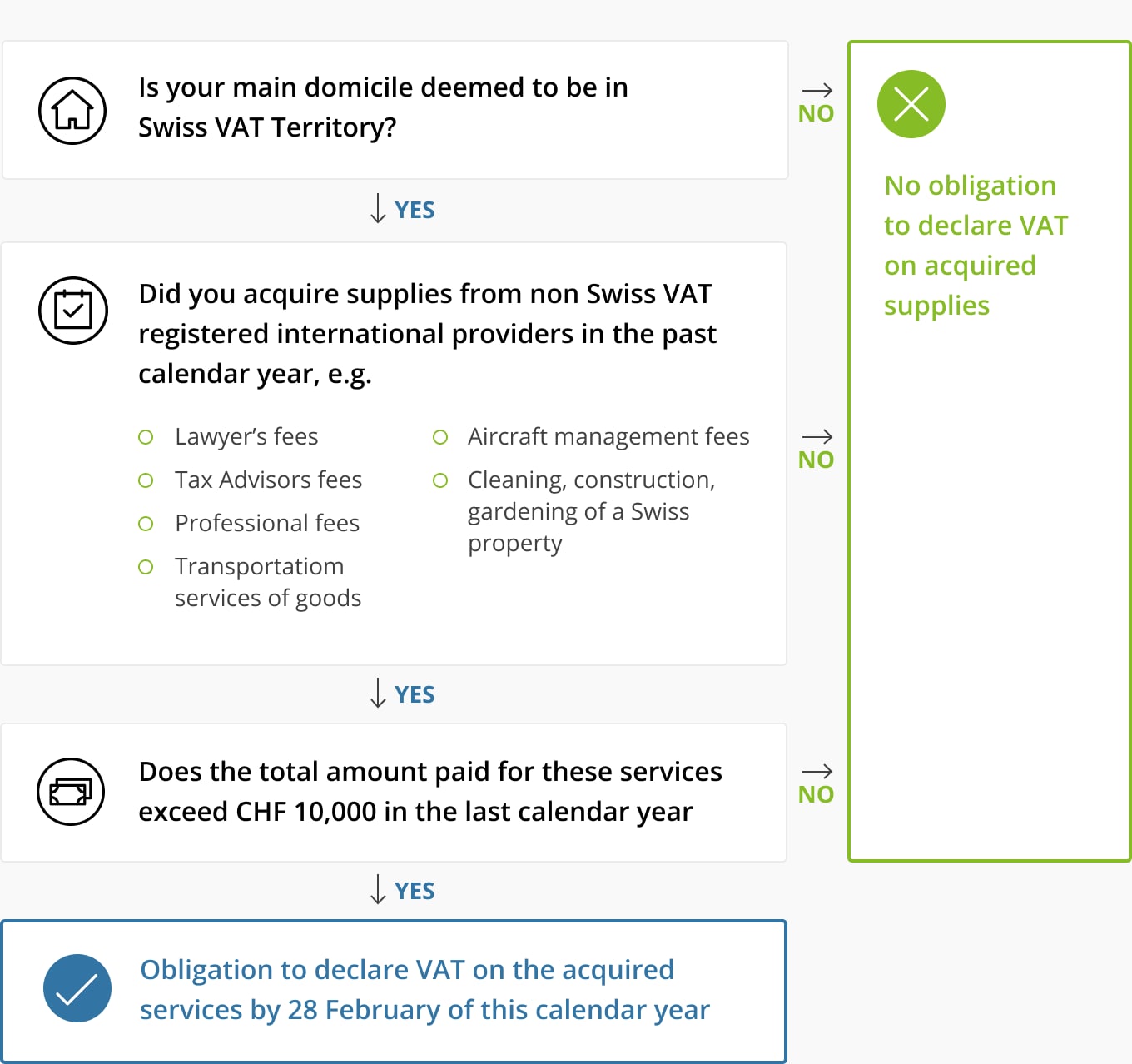

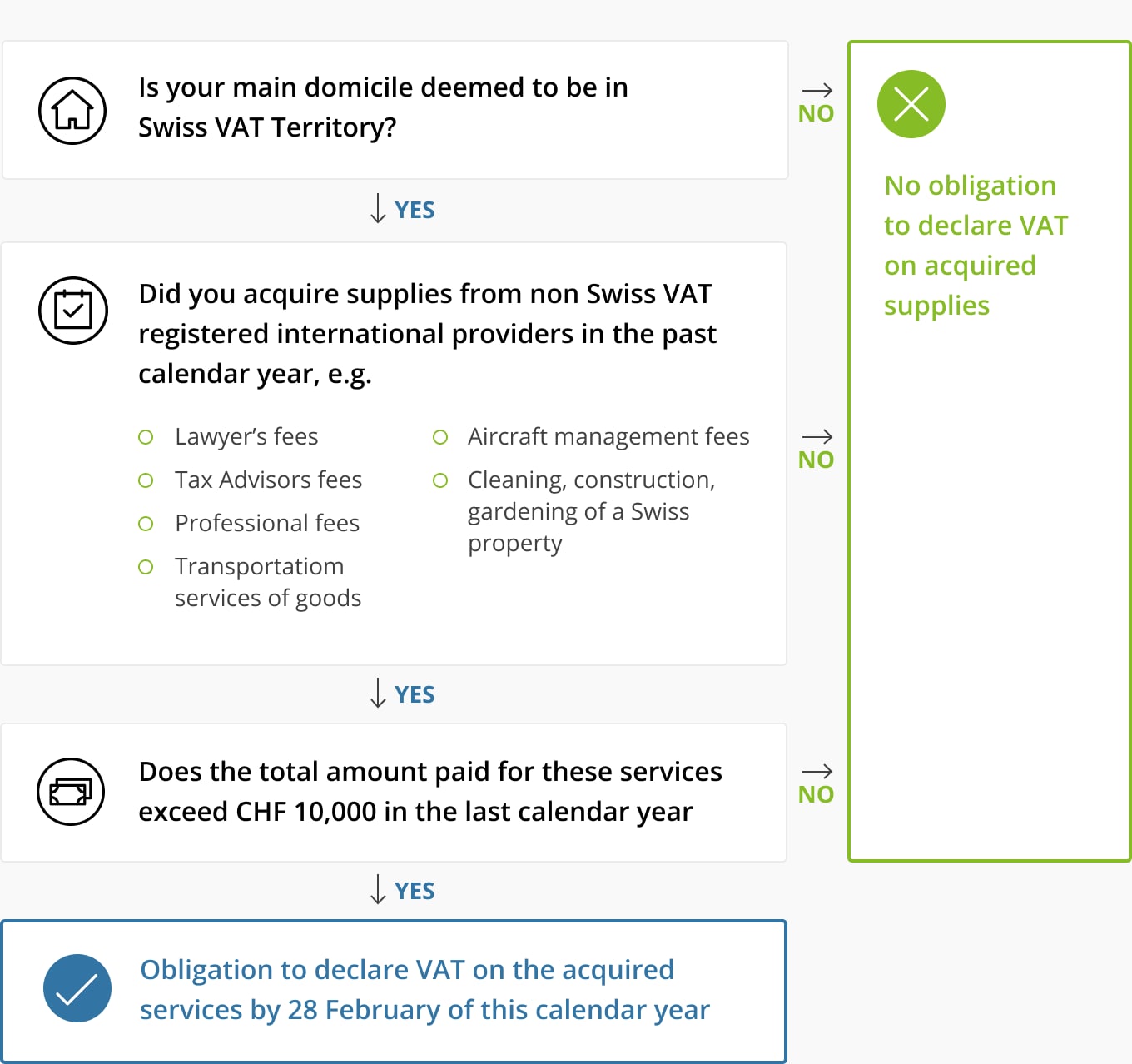

Private individuals resident in Switzerland or Liechtenstein have to declare Swiss acquisition VAT, if they acquire supplies from non Swiss VAT registered providers domiciled outside Switzerland/ Liechtenstein for more than CHF 10’000 in the calendar year. Such supplies can be lawyer’s fees, tax advisors fees, professional fees, transportation of goods or installation services related to a Swiss property. In case the threshold of CHF 10’000 is met within one year, the total amount incurred in that year has to be declared at the latest by 28 February of the following year to the Swiss / Liechtenstein Federal Tax Administration.

Supplies provided be foreign businesses* not VAT registered in Switzerland are subject to acquisition VAT:

- Lawyer's fees

- Tax Advisors fees

- Professional services

- Financial Accounting and private account administration

- Mobile phone subscription**

- Electronic services**

- Aircraft or yacht management fees

- Cleaning, construction, gardening of a Swiss property

- Valuation of art work

- Advisory work for interior architecture and interior-design

*In case the services are provided on an employment relationship between the foreign provider and Swiss recipient no VAT applies

**Relevant for years up to and including 2017

Not impacted supplies

- Supplies of goods subject to import VAT, including car maintenance abroad

- Services linked to the place of the supplier, e.g. healing treatments, therapies, nursing, personal hygiene, marriage, family and life counselling, social services and social welfare services and child and youth care

- Medical care carried out by medical staff

- Services of travel agencies

- Services linked to the place where carried out, such as:

-Entry to an event

-Restaurant services

-Passenger transportation - Services taxable at the place where a property is located, such as:

-Brokerage, management, survey and valuation of property

-Services in connection with the preparation or creation of rights in rem - Services in connection with the preparation or the coordination of construction services, such as architectural, engineering and construction supervision services

-Surveillance of properties and buildings

-Accommodation services - Cleaning, construction and gardening of a property abroad

Household goods and any collections, animals or cars can be imported into Switzerland duty‑free at the time of the change of residency. The imported goods must have been used personally abroad for at least 6 months before the importation date and they have to be continued to be used thereafter. It is possible to import household effects within two years after the change of residency provided the conditions mentioned above are met.

Clearance of household effects must occur at the time of the change of residency (relocation of the goods) and within the opening hours of customs offices for merchandise. For the first importation, the completed application form 18.44 needs to be presented at the customs office. Immigrants from the 25 initial EU States as well as from Norway, Iceland and Liechtenstein may prove the change of residency with an employment contract, lease or confirmation of notice of departure from the country of departure. If emigrating from a different country, an assurance of a Swiss residence permit has to be provided to the customs authorities.

Crossing the border with cats, dogs or ferrets

The animals need to be microchipped, own a pet passport and hold a valid rabies vaccination to enter Switzerland. There are several more restrictions depending on the country of origin. Further information are provided on the website of the Federal Food Safety and Veterinary Office.

Travelling to Switzerland, allowances and duty‑free limit

When entering Switzerland, personal belongings, travelling provisions and the fuel in the tank of your vehicle are considered as import tax free and import duty‑free. For all other goods, tax and duty will be charged depending on the quantity and the value of the articles being carried. The following chart provides an overview on the allowance of tax and duty‑free importation into Switzerland.

Source: ezv.admin

Indirect Taxes

Switzerland introduced a value added tax (VAT) in January 1995 that is similar to the tax charged by other European countries. Liechtenstein has taken over the Swiss VAT system and, thus, Switzerland and Liechtenstein form one VAT territory. The VAT rate for most purchases in Switzerland is currently 7.7%, although some items are taxed at a reduced rate (currently 2.5%).

Private individuals resident in Switzerland or Liechtenstein have to declare Swiss acquisition VAT, if they acquire supplies from non Swiss VAT registered providers domiciled outside Switzerland/ Liechtenstein for more than CHF 10’000 in the calendar year. Such supplies can be lawyer’s fees, tax advisors fees, professional fees, transportation of goods or installation services related to a Swiss property. In case the threshold of CHF 10’000 is met within one year, the total amount incurred in that year has to be declared at the latest by 28 February of the following year to the Swiss / Liechtenstein Federal Tax Administration.

Supplies provided be foreign businesses* not VAT registered in Switzerland are subject to acquisition VAT:

- Lawyer's fees

- Tax Advisors fees

- Professional services

- Financial Accounting and private account administration

- Mobile phone subscription**

- Electronic services**

- Aircraft or yacht management fees

- Cleaning, construction, gardening of a Swiss property

- Valuation of art work

- Advisory work for interior architecture and interior-design

*In case the services are provided on an employment relationship between the foreign provider and Swiss recipient no VAT applies

**Relevant for years up to and including 2017

Not impacted supplies

- Supplies of goods subject to import VAT, including car maintenance abroad

- Services linked to the place of the supplier, e.g. healing treatments, therapies, nursing, personal hygiene, marriage, family and life counselling, social services and social welfare services and child and youth care

- Medical care carried out by medical staff

- Services of travel agencies

- Services linked to the place where carried out, such as:

-Entry to an event

-Restaurant services

-Passenger transportation - Services taxable at the place where a property is located, such as:

-Brokerage, management, survey and valuation of property

-Services in connection with the preparation or creation of rights in rem - Services in connection with the preparation or the coordination of construction services, such as architectural, engineering and construction supervision services

-Surveillance of properties and buildings

-Accommodation services - Cleaning, construction and gardening of a property abroad

Household goods and any collections, animals or cars can be imported into Switzerland duty‑free at the time of the change of residency. The imported goods must have been used personally abroad for at least 6 months before the importation date and they have to be continued to be used thereafter. It is possible to import household effects within two years after the change of residency provided the conditions mentioned above are met.

Clearance of household effects must occur at the time of the change of residency (relocation of the goods) and within the opening hours of customs offices for merchandise. For the first importation, the completed application form 18.44 needs to be presented at the customs office. Immigrants from the 25 initial EU States as well as from Norway, Iceland and Liechtenstein may prove the change of residency with an employment contract, lease or confirmation of notice of departure from the country of departure. If emigrating from a different country, an assurance of a Swiss residence permit has to be provided to the customs authorities.

The animals need to be microchipped, own a pet passport and hold a valid rabies vaccination to enter Switzerland. There are several more restrictions depending on the country of origin. Further information are provided on the website of the Federal Food Safety and Veterinary Office.

When entering Switzerland, personal belongings, travelling provisions and the fuel in the tank of your vehicle are considered as import tax free and import duty‑free. For all other goods, tax and duty will be charged depending on the quantity and the value of the articles being carried. The following chart provides an overview on the allowance of tax and duty‑free importation into Switzerland.

Source: ezv.admin

Other federal taxes

There is a stamp duty levied on security transactions in Switzerland by the broker involved in the transaction. This transfer tax of 0.3% for foreign securities and 0.15% for Swiss securities is levied by the broker as part of the transaction fees.

Federal withholding tax is levied at 35% on investment income (such as dividends and interest over CHF 200 per annum) derived from deposits with Swiss banks, Swiss investment fund income, as well as on bonds and bond‑like loans from Swiss debtors. This withholding tax is either fully reimbursed or fully credited against the Swiss tax liability for Swiss resident taxpayers, provided the investment and the income are properly declared in the tax return.

The aim of the federal withholding tax is to ensure that interest and dividends received by domestic taxpayers are properly declared as taxable income, and to charge non-resident recipients of interest and dividends with a final tax. However, foreign recipients of interest and dividends may be granted a full or partial refund if a double tax treaty exists between Switzerland and their country of residence.

The European Union Savings Directive is an agreement between EU countries to exchange information (effective as of 1 July 2005) on interest paid to individuals residing in another EU country.

The agreement between the EU and Switzerland stipulates that the interest payments made by a Swiss paying agent to beneficial owners who are individuals and residents of an EU member State are subject to EU source tax of 35% (from July 2011). Interest payments made on debt‑claims issued by Swiss debtors are excluded from the EU source tax, as they are already subject to Swiss withholding tax at 35%. Indeed, all interest payments subject to Swiss withholding tax will be excluded from EU source tax. In addition, and provided EU source tax is due, a beneficial owner can avoid the tax withholding by expressly authorising his Swiss paying agent to report the interest payments to the Swiss Federal Tax Administration.

Tax treaties

Switzerland has an extensive network of tax treaties designed to minimise any double tax exposure. The tax treaties normally cover the double taxation of income, but some cover both income and wealth taxation.

The application of the tax treaties and the interpretation of the rules can be quite complex. As a result, specialist advice should be sought before making any decisions based upon applying the treaty rules.

Switzerland does not have any double taxation treaties on gift taxes. However, Switzerland has concluded tax treaties with certain countries regarding the double taxation of estates or inheritances. These treaties can help minimise any potential double taxation, but some, such as the US/Swiss treaty, are very limited in their scope.

Albania, Algeria, Anguilla, Antigua, Argentina, Armenia, Azerbaijan, Australia, Austria, Azerbaijan, Barbados, Belarus, Bangladesh, Belgium, Belize, Bulgaria, Canada, Chile, China, Chinese Taipei (Taiwan), Colombia, Croatia, Czech Republic, Cyprus, Denmark, Dominican Republic, Egypt, Ecuador, Estonia, Faroe Islands, Finland, France, Gambia, Georgia, Germany, Ghana, Greece, Grenada, Hong Kong, Hungary, Iceland, India, Indonesia, Iran, Ireland, Israel, Italy, Ivory Coast, Jamaica, Japan, Kazakhstan, Kuwait, Kosovo, Kyrgyzstan, Latvia, Liechtenstein, Lithuania, Luxembourg, Malawi, Malaysia, Malta, Mexico, Moldova, Mongolia, Montenegro, Montserrat, Morocco, Netherlands, New Zealand, North-Macedonia, Norway, Oman, Pakistan, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Serbia, Slovakia, Singapore, Slovenia, South Africa, South Korea, Spain, St. Christophe, Nevis, Sri Lanka, St. Lucia, St. Vincent, Sweden, Tajikistan, Taiwan, Trinidad & Tobago, Thailand, Tunisia, Türkiye, Turkmenistan, United Arab Emirates, United Kingdom, United States of America, Ukraine, Uruguay, Uzbekistan, Venezuela, Vietnam, Virgin Islands, Zambia.

Copies of the text of the tax treaties can be found on the website of the State Secretariat for International Finance SIF.

Contact us

Renaat Van den Eeckhaut

Partner, Global Employer Services Leader Switzerland

+41 58 279 6986

About Deloitte Global Employer Services (GES) practice

Deloitte is a leading accounting and consulting company in Switzerland and provides industry specific services in the areas of Audit, Risk Advisory, Tax & Legal, Consulting and Financial Advisory. With nearly 2,100 employees operating out of six locations in Basel, Berne, Geneva, Lausanne, Lugano and Zurich (headquarters), Deloitte serves companies and institutions of all legal forms and sizes in all industry sectors.

The Global Employer Services (GES) practice

With a globally connected network of member firms in more than 150 countries, Deloitte brings world class capabilities and deep local expertise to help clients in the area of Global Mobility. Our Global Employer Services practice’s priority is to help employers and their workforce find solutions to the employment, tax and HR challenges they face when doing business across borders.

How we can help you

Deloitte’s dedicated Global Employer Services specialists in Switzerland, together with our established global network provide services can assist you in the following areas: Global Mobility Tax and Social Security, Immigration, Global Mobility Compensation, Mobility Advisory, Technology and Analytics, Reward, Employment Tax and Share Plans.

Zurich

Pfingstweidstrasse 11

8005 Zürich

Tel: +41 (0)58 279 60 00

Fax: +41 (0)58 279 66 00

Basel

Meret Oppenheim-Platz 1

4053 Basel

Tel: +41 (0)58 279 90 00

Fax: +41 (0)58 279 98 00

Geneva

Rue du Pré-de-la-Bichette 1

1202 Geneva

Tel: +41 (0)58 279 80 00

Fax: +41 (0)58 279 88 00

Lausanne

Rue Saint-Martin 7

1003 Lausanne

Tel: +41 (0)58 279 92 00

Fax: +41 (0)58 279 93 00

Lugano

Via Ferruccio Pelli 1

P.O. Box 5520

6900 Lugano

Tel: +41 (0)58 279 94 00

Fax: +41 (0)58 279 95 00

Social security and pensions

Swiss social security contributions are mandatory for residents of Switzerland (except for minors), unless covered by a valid exemption through continued membership in the home country’s system. In this case a Certificate of Coverage must be obtained from the authorities in the home country through the home country employer. The Swiss social security system is based on a three-pillar system as follows:

The social security contribution rates applicable for 2020 are summarised in the Health Insurance section.

Swiss social security contributions are tax deductible (employee contributions) or tax‑free (employer contributions). Contributions to foreign social security schemes are treated in the same way to the extent that these foreign contributions are similar or at least comparable to the Swiss social security contributions.

You can find more information on the OASI webpage.

As with Swiss social security (first pillar), affiliation to a pension fund (second pillar) is mandatory for all Swiss employees below retirement age (currently 64 years for women and 65 years for men) and therefore every Swiss employer must establish or join a recognised Swiss pension scheme.

However, under a valid certificate of coverage, the employee is exempted from mandatory Swiss pension fund contributions. If the employee remains affiliated to the home country pension scheme, the (employee) contributions into the foreign plan might be fully tax deductible as long as this foreign pension plan broadly corresponds to a Swiss plan. A review of the foreign plan is therefore necessary to see if recognition in Switzerland can be obtained.

In addition, anyone arriving in Switzerland with the intention of staying must take out Swiss health insurance within three months, which should cover them from the arrival date. Health insurance is mandatory for all Swiss residents and is organised privately, although some employers may choose to subsidise a collective private plan. The Swiss government will ask for documentation to prove that all members of an individual’s family have appropriate health insurance.

Social health insurance gives everyone living in Switzerland access to adequate health care in the event of sickness, and accident if they are not covered by accident insurance. Health insurance in Switzerland generally covers the cost of outpatient treatment, doctors (general practitioners), hospitals, pharmacy, etc. Broadly speaking, everyone is responsible for 100% of their health care expenses up to a certain amount (which can be chosen individually between CHF 300 and CHF 2,500 and which impacts the level of health insurance premiums payable), plus 10% (in general) of any costs above this amount up to an annual cap. The insured may choose any health insurer, and the insurer must accept the insured irrespective of age and state of health, and without any reservations or qualifying period.

Health Maintenance Organizations, or HMOs, are a relatively new concept in Switzerland and may not provide the same discounted costs on health care as they provide in other countries.

International health plans (e.g. CIGNA) are typically not recognised and are therefore not sufficient to fulfil the above-described legal obligations but each situation needs to be considered on a case-by-case basis upon arrival in Switzerland.