The value of online banking channels in a mobile-centric world

2 minute read

13 December 2018

It may be a mobile-first world, but consumers still use—and sometimes prefer—online banking channels. Here are some key lessons our global consumer survey on digital banking revealed about online banking usage.

Many banks around the world are aggressively pursuing a mobile-first strategy. Some have launched mobile-only bank brands to fend off fintech challengers,1 while a vast majority are enhancing their mobile apps with new features such as person-to-person payments, personal financial management tools, and virtual assistants.2

While this focus on mobile banking is well deserved, lately, there seems to be little discussion about the role of online banking in a mobile-dominant world. As more and more customers adopt mobile banking, will online banking remain relevant—and if so, how?

Learn More

Read more about the findings of the global consumer survey

Subscribe to receive related content from Deloitte Insights

Findings from Deloitte’s global digital banking survey of 17,100 consumers across 17 countries on their digital banking behaviors and channel usage suggest banks should continue to invest in making online banking a seamless and high-quality customer experience. The survey findings reveal online banking may remain a key channel of customer interactions in the forseeable future, even among mobile banking users.

Our survey found 73 percent of respondents globally use online banking at least once a month, compared to 59 percent who use mobile banking apps. Moreover, it revealed no generational differences in how frequently online banking is used—baby boomers use online banking just as often as tech-savvy millennials.

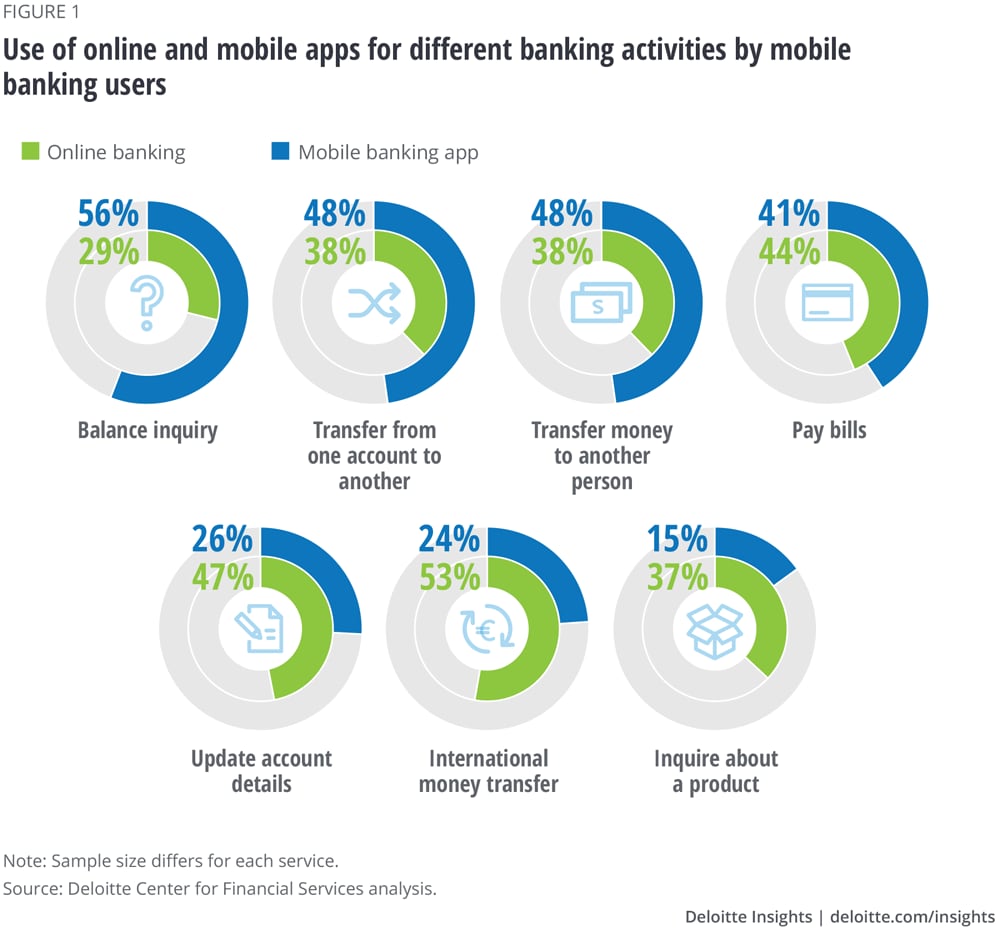

Even more interesting, mobile banking customers3 who responded to our survey continue to use online banking channels extensively: Ninety-four percent use the online channel at least once a month. These respondents said they use mobile banking for relatively simple and quick transactions, such as transferring money or balance inquiries, but prefer to go online to transfer money internationally, inquire about products, or update account information.

When selecting a primary bank (the bank that handles most of their banking needs), seven out of 10 survey respondents said having a consistent experience across channels, including mobile and online, was extremely important or very important to them. Our survey also showed customers globally are more likely to use online banking more frequently if banks increase security, provide more real-time problem resolution, and allow more regular banking transactions to be completed online.

Overall, these findings suggest that as banks continue to invest in improving and enhancing mobile capabilities, there are potential challenges if banks allow mobile banking to fully eclipse online banking. Instead, banks should continue to enhance the value proposition of the online channel, focusing on evolving the online banking experience rather than seeing it as a phase-out to mobile. To do this, banks should aim to provide a more seamless experience between online and mobile channels and purposefully measure online customer engagement to meet evolving customer needs and preferences.

© 2021. See Terms of Use for more information.

Explore more in banking

-

The digital banking global consumer survey Article6 years ago

-

Pricing innovation for credit cards Infographic

-

Millennials and digital banking Article7 years ago

-

Pricing innovation in retail banking Article8 years ago