Shifting into high gear Health systems have a growing strategic focus on analytics today for the future

15 minute read

28 March 2019

- Alison Hagan United States

- Casey Graves United States

- Dan Kinsella United States

Wendy Gerhardt United States

Wendy Gerhardt United States

The health care industry is counting on analytics to unlock value from evolving and new data sources. But have health systems moved the needle on investment in and use of analytics since our last survey in 2015?

Have the adoption and application of analytics lived up to the hype? Over the past several years, the health care industry has often amplified analytics as the missing key to unlock value during a time of shrinking margins, smaller budgets, and shifting payment models. In addition, emerging technologies such as artificial intelligence (AI) now hold promise to finally leverage electronic health records (EHR) and other health and health care data sources with predictive analytics to improve clinical care and costs. Have health systems invested in and stepped up their game with analytics?

Learn More

Explore the Health care collection

Read more from the Analytics collection

Subscribe to receive related content from Deloitte Insights

The Deloitte Center for Health Solutions conducted research to see if health systems have increased their investments and use of analytics for clinical, operational, and financial functions. In late 2018, we surveyed 56 chief information officers (CIOs), chief technology officers (CTOs), and chief analytics executives at health systems. We wanted to understand today’s landscape and compare it with findings from our 2015 survey on the same topic.

What is analytics?

“Analytics” refers to the systematic use of technologies, methods, and data to derive insights and enable fact-based decision-making for planning, management, operations, measurement, and learning.

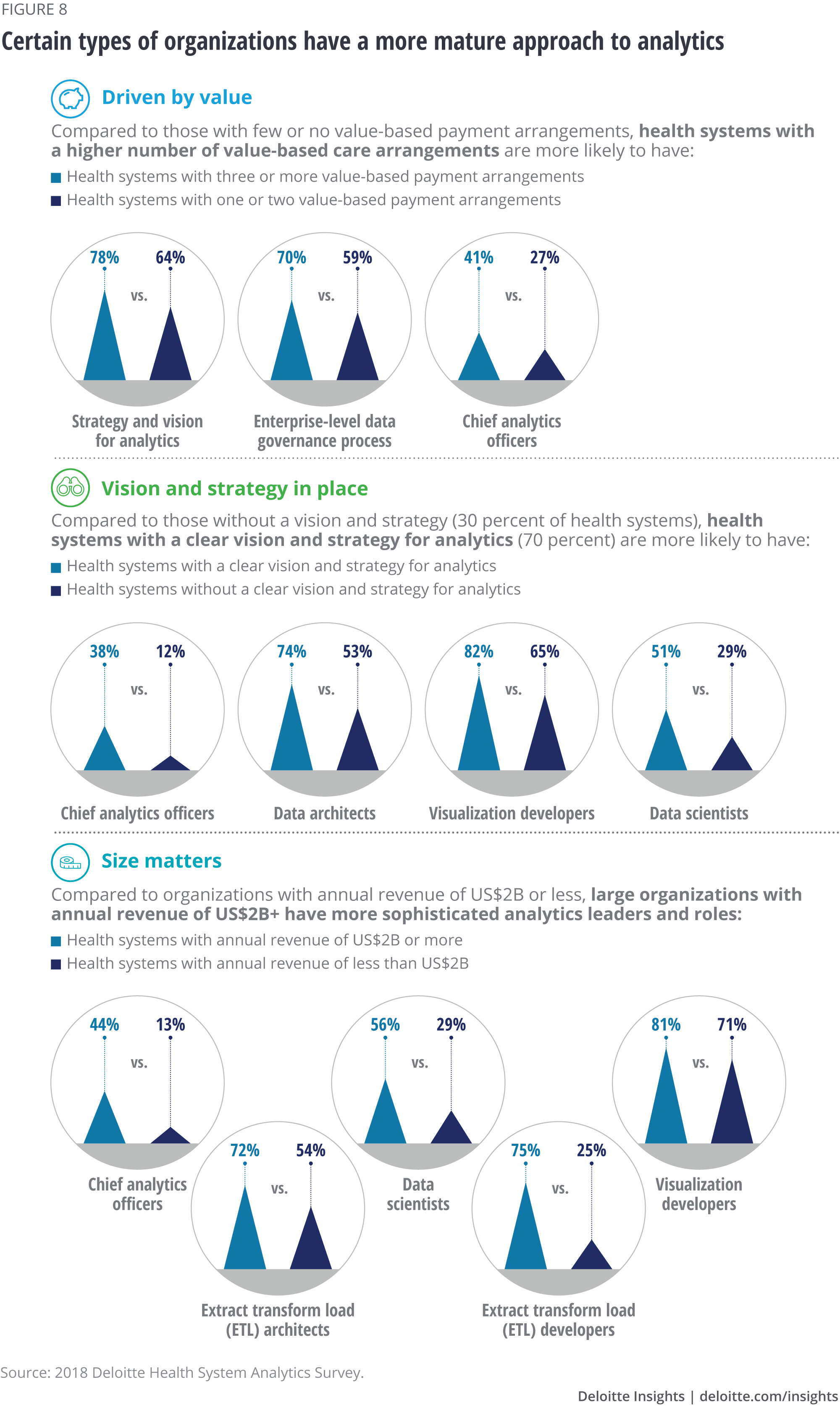

We found that in the past three years, adoption and interest in analytics at health systems have accelerated. Analytics is not only growing in focus and importance for health systems, but organizations perceive analytics to be more important than ever to their strategies. For example:

- When it comes to analytics, health systems in 2018 are more likely to have:

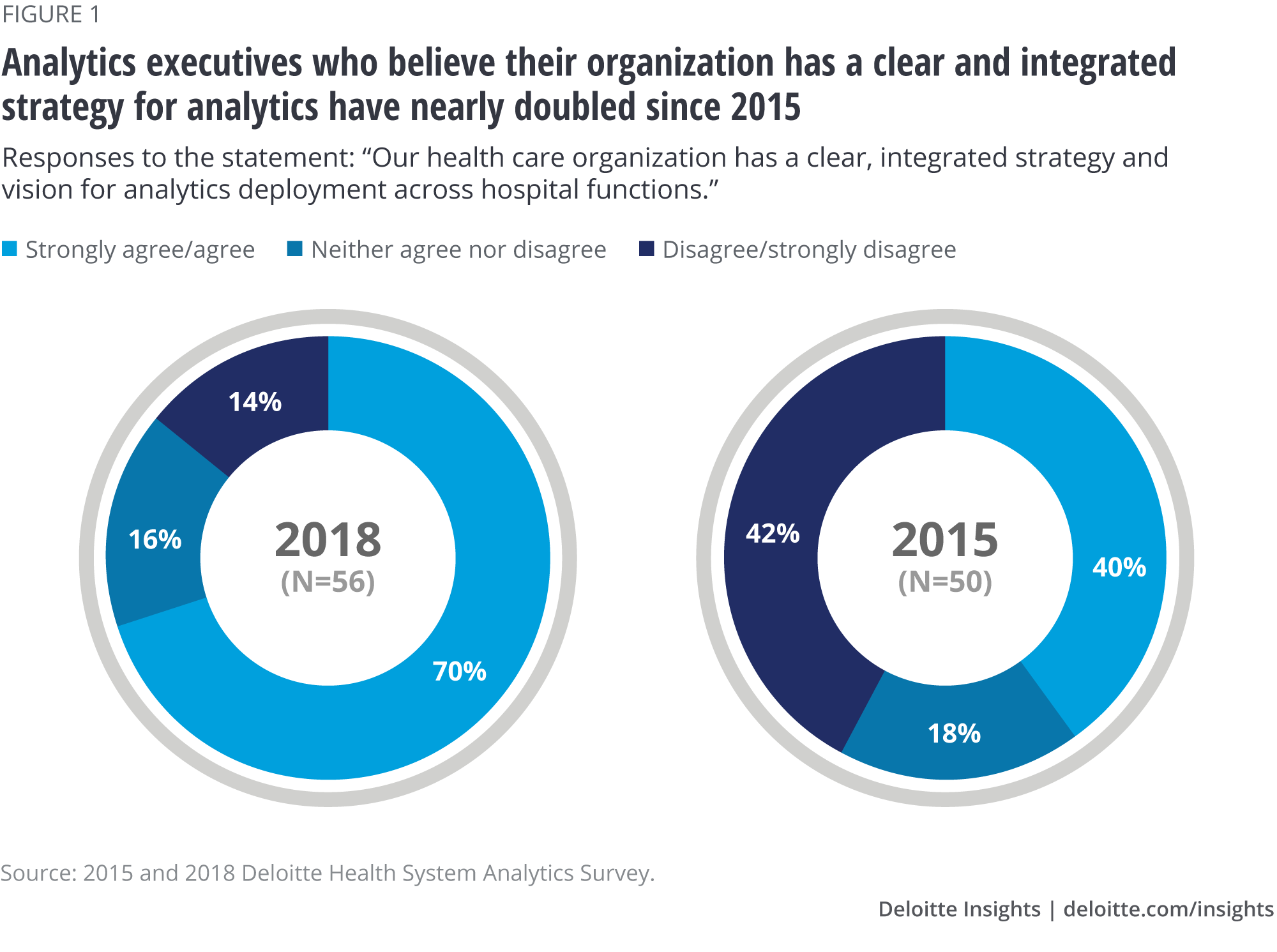

- Defined strategies and visions (70 percent in 2018 vs. 40 percent in 2015);

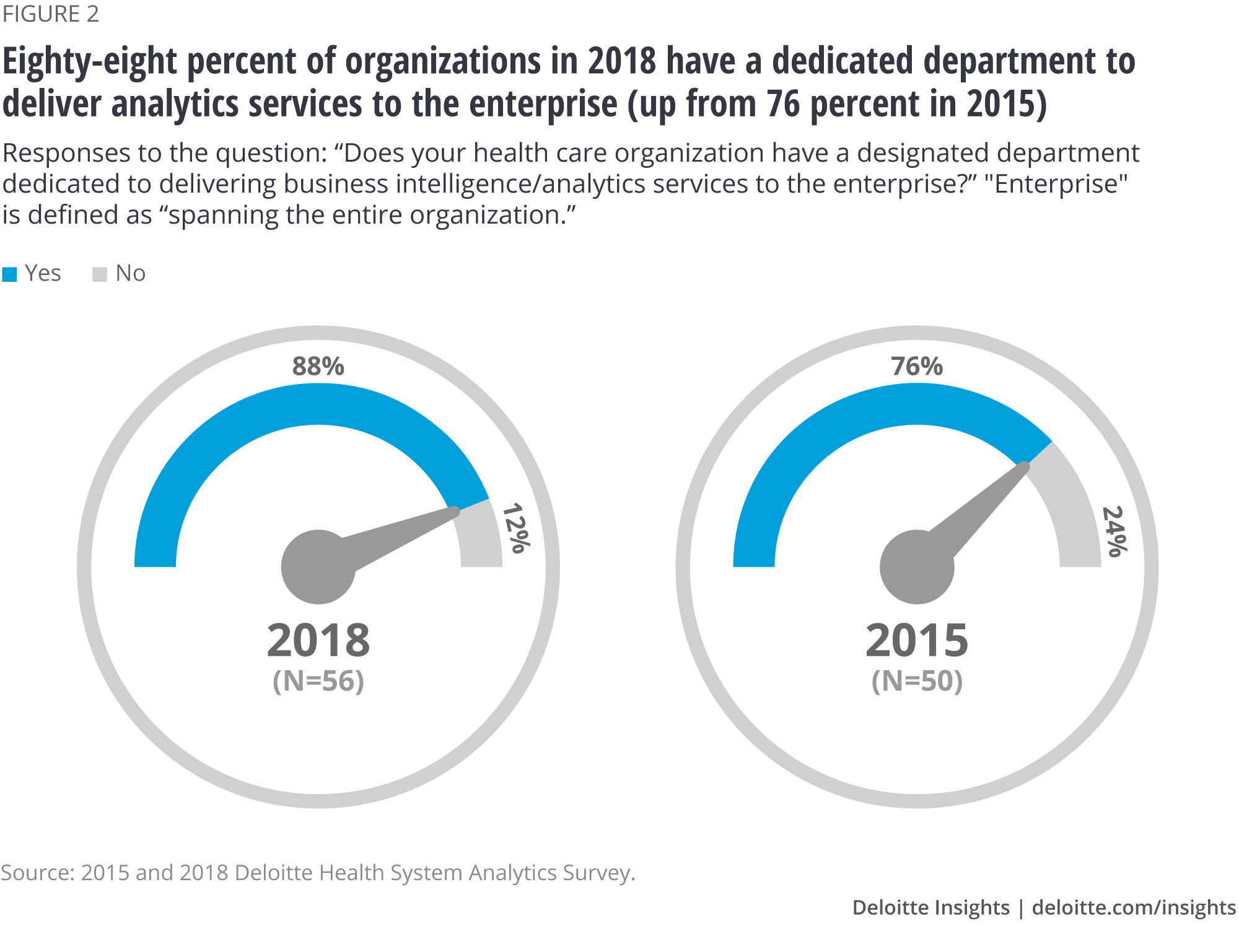

- Dedicated departments (88 percent in 2018 vs. 76 percent in 2015); and

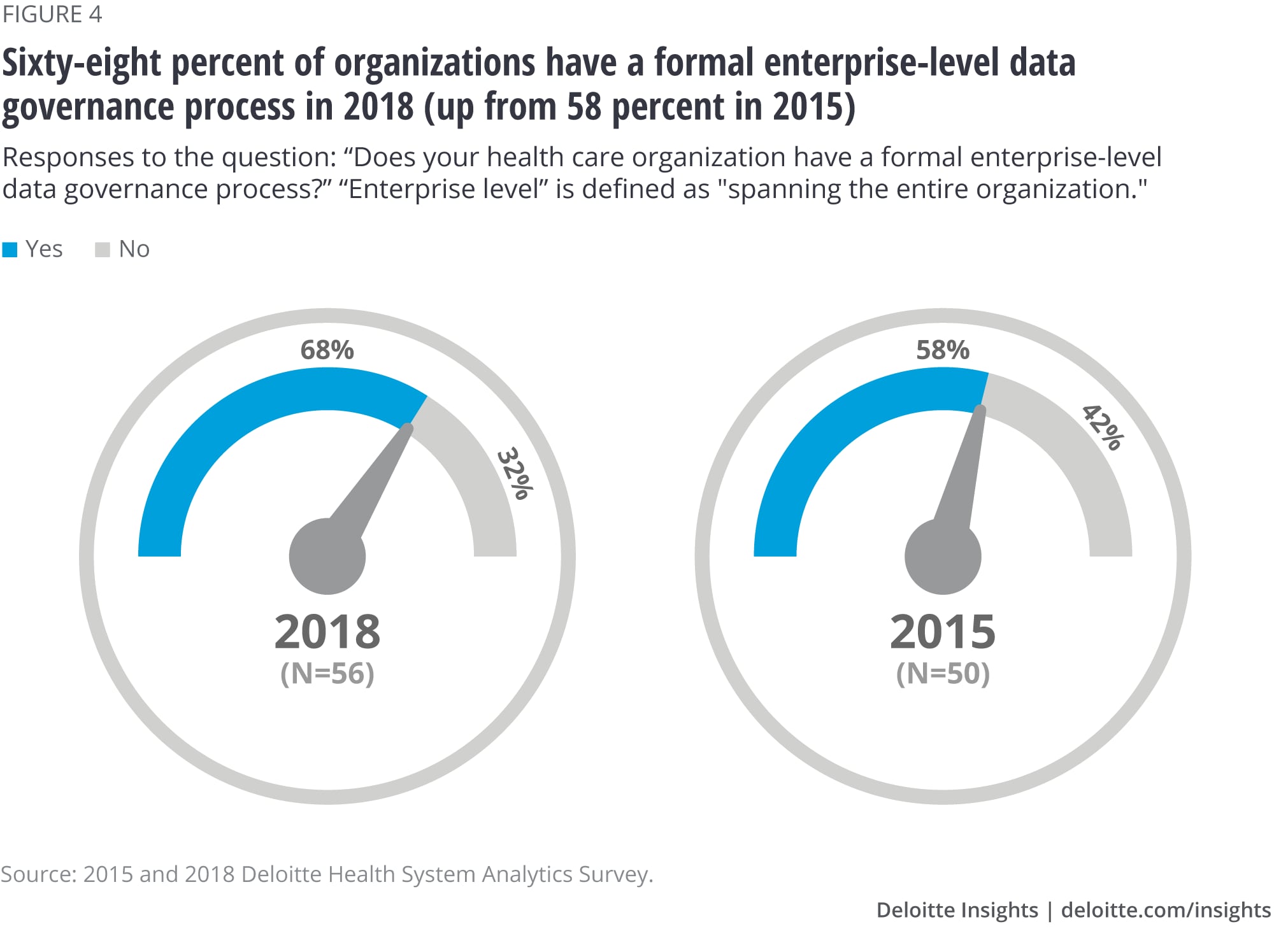

- Centralized governance models (68 percent in 2018 vs. 58 percent in 2015).

- Health systems see the growing importance of analytics in their organizations:

- Organizations are now more likely to have a C-suite role dedicated to analytics (30 percent had a chief analytics officer in 2018 vs. 12 percent in 2015).

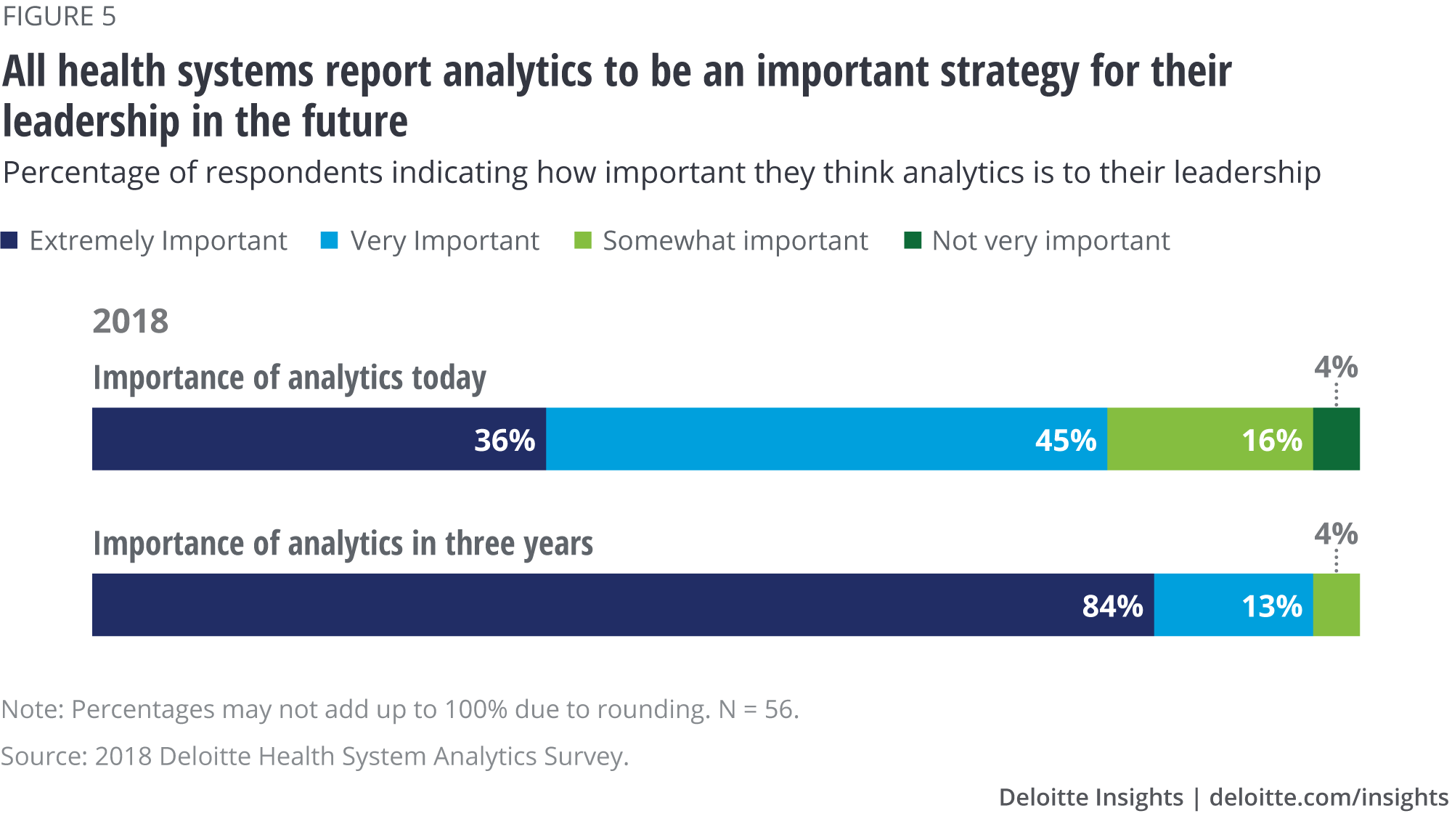

- More executives—84 percent—say that analytics will be extremely important for their organization’s strategies in three years, compared to 36 percent who say analytics are extremely important today.

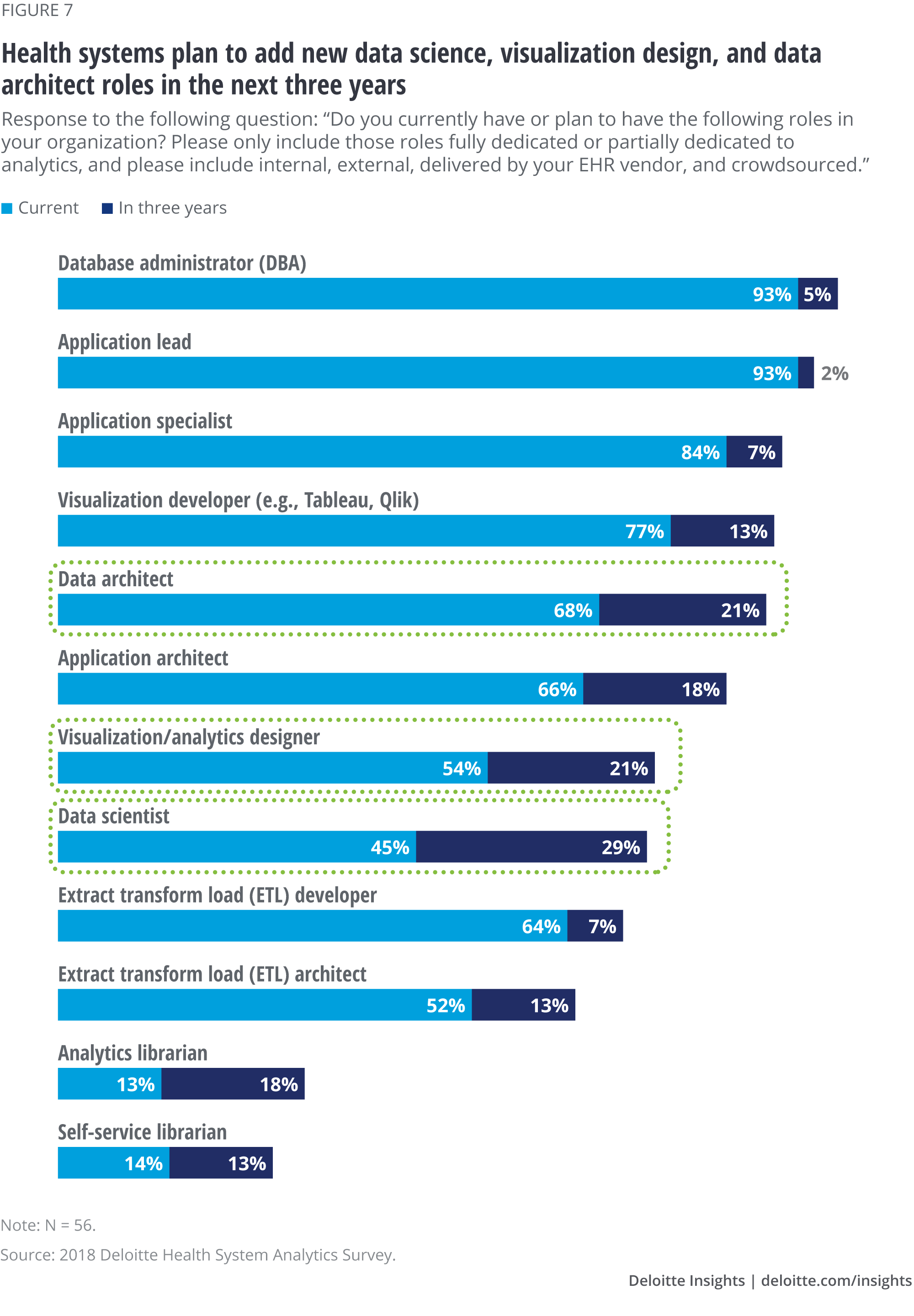

The survey findings also indicate increasing investments in analytics infrastructure, resources (dollars and people), and scope. Organizations are also shifting from hiring for roles involved in building analytics infrastructure to roles that understand the data—in the next three years, more health systems are planning to hire:

- Data scientists (29 percent);

- Visualization designers (21 percent); and

- Data architects (21 percent).

While 84 percent of executives think that analytics will be extremely important in the next three years, one in three of the organizations does not have an integrated strategy for analytics. Health systems that are lagging should put together a plan as a first step. Defining an organizational vision and strategy for analytics that is linked to the organization’s overall business strategies and goals can get health systems on the path toward maturity and stepping up their game. Health systems with mature analytics capabilities, on the other hand, should consider shifting into high gear. They can revisit their analytics strategy and vision to take advantage of opportunities with emerging technologies and pilot AI and predictive analytics.

Most respondents agree that health systems need analytics to provide data-driven insights to improve costs and quality of care, manage population health and bear financial risk, and engage customers. No longer is analytics relegated to the IT department. Data and analytics can support every function in the health system, enable transformation, and position organizations for success in the future.

Introduction

To many in health care, analytics is the answer to whatever ails the industry. Analytics is a necessary capability to help shift to value-based payment models and can help health systems deliver higher quality of care while improving operations and lowering costs. It is also important for strategies and initiatives that depend on data mining—such as understanding social determinants of health and the importance of customer experience and preferences. Heading into the future, data analytics is one of the backbones for health systems seeking to use emerging technologies such as AI and robotic process automation (RPA) to transform their care delivery or workforce.

Our 2015 survey on the same topic found that health systems’ investments in analytics were growing. In 2015, the size of the health care analytics market globally was estimated at US$4–5 billion.1 In 2018, the estimates are closer to US$15 billion.2 Expectations are that it will grow to over US$50 billion by 2024.3 With analytics being so critical to health system strategies and the market continuing to grow, how have investments taken shape, specifically within organizations, and in which areas are companies investing? The Deloitte Center for Health Solutions surveyed 56 health systems to understand the importance of analytics to organizations and where organizations are focusing their efforts.

Survey methodology

The Deloitte Center for Health Solutions conducted an online survey in late 2018 of 56 chief information officers (CIOs), chief technology officers (CTOs), and chief analytics executives. Following the same methodology as our 2015 survey, we sought to understand health systems’ analytics investments, priorities, opportunities, and challenges. Both surveys targeted health systems with annual revenue of US$500 million or more and included a mix of academic medical centers, integrated delivery networks, multistate health systems, for-profit systems, and free-standing hospitals.

The importance of analytics is growing among health systems

Health systems are making analytics a priority, as their planning, governance, and investments show. They recognize its importance for their strategies today and even more so for the future. We measured changes in analytics maturity across four areas, including having:

- A defined strategy and vision;

- A dedicated analytics department;

- Chief analytics leadership; and

- A formal data governance process.

One of the main foundations of analytics maturity is having a defined strategy and vision for deploying analytics across all hospital functions, beyond the information technology (IT) department. A majority (70 percent) of respondents agree that their organization has a clear and integrated strategy and vision for analytics (figure 1). The percentage of organizations with a strategy and vision has nearly doubled since 2015, the largest increase since 2015 across the four foundational areas of analytics.

Since our 2015 survey, we found an increase in the percentage of health systems that have the other three elements in place as well: a dedicated analytics department, chief analytics leadership, and a formal data governance process (figures 2, 3, and 4).

Case study: Developing a vision and governance to move toward more sophisticated analytics

Hartford HealthCare (HHC) is a nonprofit integrated delivery system in Connecticut with six hospitals and a growing ambulatory and physician network. Following several years of significant investment in infrastructure and enterprise applications including enterprise resource planning (ERP) and EHR, HHC experienced the typical growing pains that come with multiple acquisitions and disparate software systems. Leadership realized that insights derived from a more effective analytics platform could help it achieve its goals in value-based care, patient experience, growth, quality and safety, and efficiency.

Getting started with analytics was a combination of executing on near-term projects around data excellence and developing an enterprise flight plan that made the case for multiyear capital and operating investments. Its focus and vision for the past few years has been getting information into the hands of decision-makers for both clinical and financial performance. HHC’s analytics strategy execution includes:

- Communicating a vision for data-driven insights for all clinical and business decisions;

- Collecting and integrating clinical data from affiliated physicians using other software systems;

- Standardizing tools and data;

- Training department heads on which data and visualization tools are available; and

- Creating meaningful reporting for its Medicare Shared Savings Program (MSSP) participants and more broadly.

Looking to the future, HHC is building its machine learning capabilities and leveraging its standardized data sets to improve patient access and quality of care. While it is still early for results, the use of machine learning is promising for integrating scientific research with clinical care and for improving quality and value. In the next three to five years, it hopes to have both machine learning and AI capabilities in place. “It is really about getting past all these growing pains we have today ... gathering the data, standardizing, and visualizing. We want to get [in three to five years] to where we are using machine learning and AI to solve complex problems,” says Richard Shirey, HHC’s CIO.

Analytics will increase in importance over the next three years

Although organizations currently recognize the importance of analytics in executing various strategies, even more view analytics as being important in the next three years (figure 5). Thirty-six percent of respondents think that analytics is extremely important to their leadership today, but 84 percent say it is going to be extremely important in the next three years.

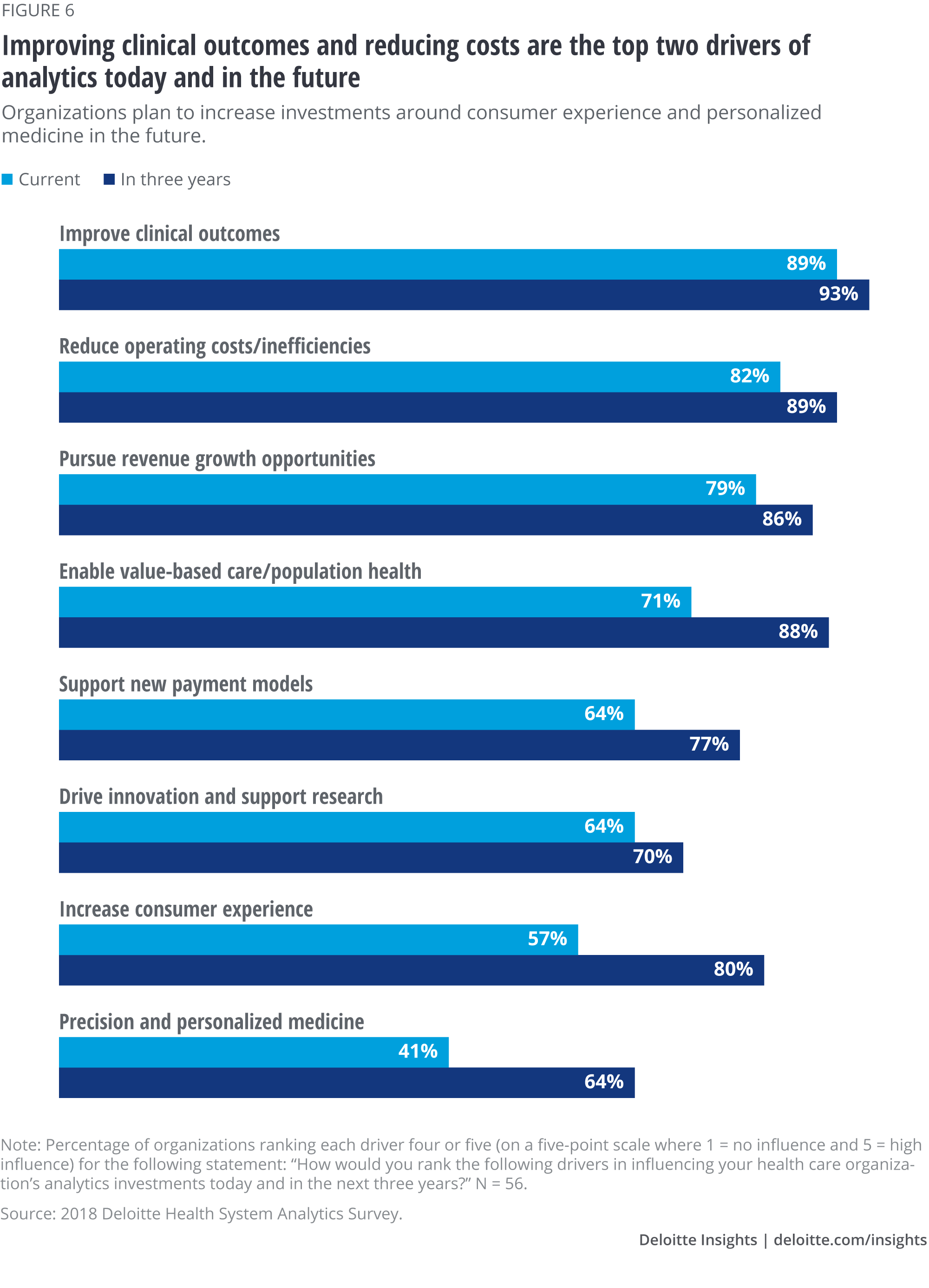

Organizational strategies are driving investment in analytics

Health systems have several organizational strategies and goals that are driving investment in analytics budgets. Nearly 90 percent of survey respondents consider clinical outcomes the biggest driver of analytics investments today and over 80 percent say reducing costs is the biggest driver (figure 6). In the next three years, respondents anticipate that the focus of analytics will still be on driving improvements in cost and quality. However, there is a rise in investments driven by consumerism, precision- and personalized-medicine, and value-based contracting. While 57 percent rank consumerism a driver of analytics investments today, this number rises to 80 percent when the timeline is moved to three years, indicating that this is an area of rising importance as far as analytics investments are concerned.

Case study: Real-time insights and a purposeful approach to clinical improvement

Providence St. Joseph Health (PSJH) is a Catholic health system located in seven states across the western United States and includes 50 hospitals. PSJH has been building analytics capabilities over the past several years, aiming for a “best of breed” philosophy when selecting partners for technology vendor solutions. THe organization is transitioning its entire system to one Epic EHR platform and investing in a data lake for all data sources. Other activities the health system is taking up to improve its analytics capabilities include:

- Piloting efforts before taking them more broadly;

- Improving the turnaround time of data collection and analysis;

- Applying lessons learned from other industries on new technologies; and

- Aligning with broader organizational strategies.

As the organization’s senior vice president (SVP) and chief medical information officer (CMIO), Michael Marino, DO, says, “Everything has turned into a value discussion versus clinical or financial in isolation.”

PSJH’s goal is to deliver insights in real-time or in as short a turnaround time as possible. This has particularly helped improve clinical care, thereby enabling the system to bear financial risk. One pilot involves integrating the system’s supply chain database with its EHR to support a pop-up for physicians showing the wholesale cost of an ordered drug or test along with pricing for comparable treatments. The pilot showed that physicians choose the lower-cost option when efficacy is comparable, resulting in a marked reduction in cost of care. “Go for small successes and then slowly build on that,” says Dr. Marino.

Investments in resources and capabilities are growing

Not only are health systems prioritizing analytics to support and execute their organization’s strategies, they are also planning on investing more in analytics resources and capabilities in the future. Analytics is playing a broader part in enabling an organization’s critical strategies and focus for the future.

Our survey found increases in both budget and number of staff allocated to analytics for many of the surveyed organizations. In the next three years, organizations plan to increase their spending on analytics not just in information technology (IT) but in the overall business. Half of our respondents anticipate allocating 4 percent or more of their IT operating budget (not including capital budget) to analytics in three years (vs. 32 percent today).

Organizations are increasing the number of staff supporting analytics throughout the enterprise, not just in the IT department. In 2018, we found that the majority of organizations (39 percent) had 11 to 25 employees dedicated to supporting analytics; in 2015, the majority (36 percent) had 10 or fewer such workers. While “shadow IT” (projects that are managed outside of and without the knowledge of the IT department) remains a problem for some, organizations are also recognizing that embedding analysts in select departments outside the IT department can help bring analytic insight more broadly to the organization. In addition, the type of staff organizations are hiring is shifting from those building analytics infrastructure to roles related to understanding the data—more health systems are planning to hire data scientists (29 percent), visualization designers (21 percent), and data architects (21 percent) over the next three years (figure 7).

The type of staff organizations are hiring is shifting from those building analytics infrastructure to roles related to understanding the data—data scientists, visualization developers, and data architects.

In addition, organizations are using increasing numbers of data sources and expanding the types of data sets they are using for analytics. In 2018, the top three external data sources that were integrated into analytics were: health plan claims (73 percent), Centers for Medicare and Medicaid Services (CMS) data (73 percent), and financial benchmarking data (71 percent). The use of social determinants of health data is expected to grow most in the next three years: While 38 percent of respondents said their organizations use it currently, 77 percent anticipate they will use it in three years.

Case study: Taking analytics to the next level

An academic medical center (AMC) in the Midwest has been improving its analytics capabilities for the past decade. It is now focused on integrating AI and machine learning into its broader organization for a multitude of insights. With a strongly integrated scientific research and clinical care model, staff and physicians have a greater understanding of data and insights and have higher expectations for it as well. “The demand for data and insights is insatiable,” says the CIO of the AMC.

The AMC now has 150 AI and machine learning projects throughout the organization focused on:

- Creating machine-assisted abstracts from patient registries and other data sources

- Extracting data from devices and integrating it with other data sources

- Experimenting with predictors for disease and treatment pathways

The AMC looks to global data management companies outside of health care—such as Google, Microsoft, or Amazon—to inform its ambitions for analytics use. It believes that better managing data and using advanced tools like AI and machine learning will take it to the next level of insights for scientific discovery and patient improvement.

Stepping up the analytics game and shifting into high gear

Analytics is a critical enabler of strategy execution and transformation, and it helps position organizations for the future. Although analytics can be an expensive investment and complicated to implement, some organizations have overcome these challenges and started down the path of building analytics capabilities. Others have not. Going by the percentage of organizations that have the four foundational pillars of analytics in place compared to 2015, the gap between mature analytics organizations and others is growing. Those with more mature analytics capabilities should keep moving down the path. Lagging health systems should start to catch up before the gap widens, and should consider accelerating their analytics investments. They should:

- Make a plan; define an organizational vision and strategy for analytics that is linked to the organization’s overall business strategies and goals.

- Develop a capabilities strategy for analytics that includes talent, tools, and vendor partnerships.

- Involve clinicians to focus beyond the business need for analytics.

Many organizations that invest a focused part of their budget in analytics and have a vision, strategy, centralized governance, dedicated department, and leadership have this capability at the forefront of their strategies. They recognize that analytics is critical for care and business model transformation. To evolve this capability further, more mature health systems should:

- Revisit their analytics vision and strategy. Pick one or two projects a year to push the organization from its comfort zone. Is there anything new that is worth considering? Where should the organization begin to leverage AI or cognitive computing?

- Expand beyond business and financial analytics and further involve clinicians with analytics. What are some use cases for quality improvement that analytics can enable?

- Focus on data excellence. How to ensure the quality and standardization of data?

As health systems look to the future, we believe the self-service model of using analytics will be the ultimate goal. Having data-driven, real-time insights accessible to the entire organization through analytics can be a critical enabler for executing on their strategies. All health systems should continue down the path of adopting and maturing their analytics capabilities—data and understanding data will be critical for decision-making.

© 2021. See Terms of Use for more information.

Explore the Health Care collection

-

Health care Collection

-

How physician networks can help bring down health care costs Article6 years ago

-

Physicians are willing to manage cost but lack data and tools Article6 years ago

-

Digital R&D: Transforming the future of clinical development Article7 years ago