Perspektiver

FP&A and Business Finance Perspective on Sustainability

Taking Sustainability from Compliance to Impact

The importance of Financial Planning & Analysis (FP&A) and Business Finance departments in propelling sustainability from being merely a compliance obligation to a value-generating initiative cannot be overstated. Over the years, these departments have improved enterprise performance management and financial business partnering, demonstrating the potential for similar integration with sustainability efforts. Nonetheless, the critical integration of sustainability into the broader enterprise performance management framework necessitates a comprehensive approach. This integration is likely to showcase a competency gap and highlight the need for organizational decisions throughout the process to ensure its optimal impact. These are the key conclusions formulated by 14 FP&A and Business Finance professionals across the Danish C25 and large-cap companies.

FP&A and Business Finance Has an Opportunity to Lift Sustainability from Compliance to Impact: three take-aways on adaption

Presently, the domains of sustainability in finance can be split into two primary sections: a compliance reporting segment and an enterprise performance management component. The escalating evolution and enlargement of compliance reporting responsibilities such as CSRD and EU taxonomy are clearly evident. Since adaptation to these requirements is non-negotiable, they have been added to the roster of 'license-to-operate' duties for Finance departments. Nonetheless, with sustainability measures progressively being embedded into executive incentive structures, the process of incorporating sustainability into performance and decision-making mechanisms must improve.

However, sustainability has, in most places, not actively been integrated in target-setting and performance plans. It currently resides as an appendix to existing performance reviews. This is where the role of FP&A and Business Finance becomes crucial in defining an organization's sustainability narrative and plans, by leveraging activities that are already within their purview – ultimately to enhance long-term stakeholder value creation and impact through the integration of sustainability into enterprise performance management.

Our discussion leads to three core propositions regarding the integration of sustainability into enterprise performance management and business partnering.

First Insight: The Integration of Sustainability in Enterprise Performance Management – A New Dimension to Existing Processes

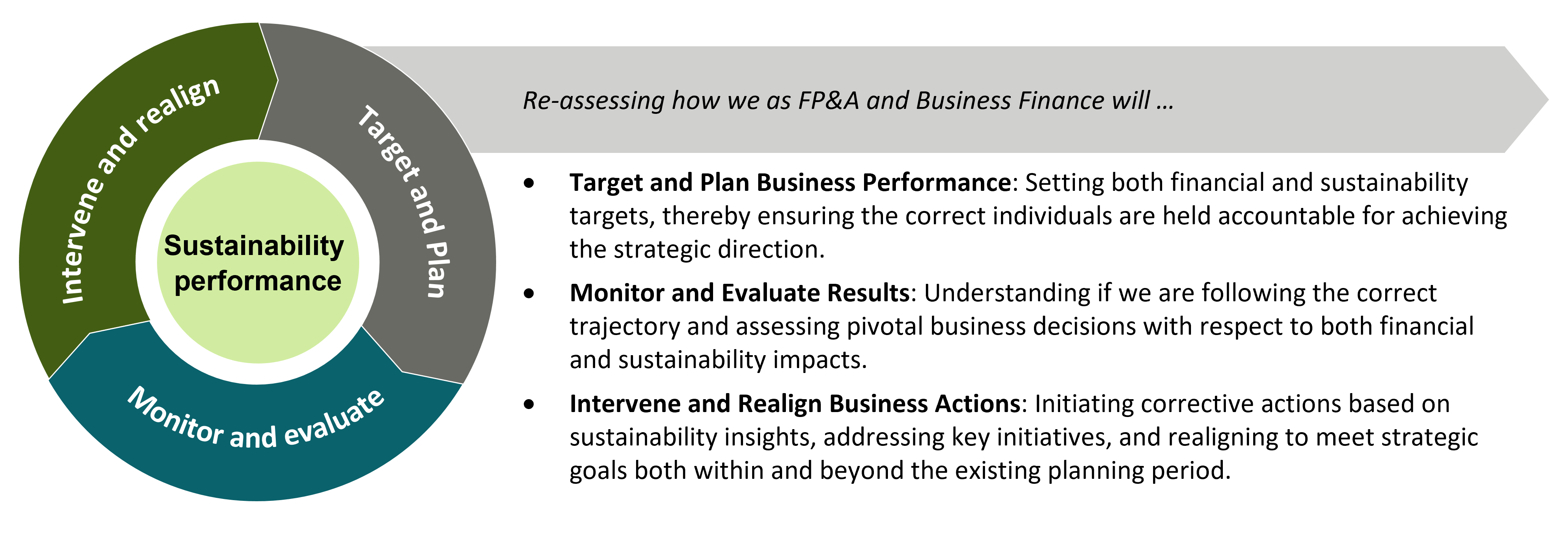

Sustainability is steadily emerging as a fundamental element of an organization's strategic direction. This evolution is motivated not only by ethical considerations but also by its commercial viability. Given all factors being equal, this shift should naturally influence our approach to performance management. Sustainability should be viewed as an additional dimension that needs to be holistically integrated into our current performance processes and ways of working. This new dimension to our existing performance model necessitates understanding of who within our value chain is accountable for various aspects of our sustainability strategy. This includes determining how we will quantify it in relation to our profit and loss and current performance measures, as an embedded part of decision-making – ‘just’ as it has been done for areas such as employee satisfaction and similar over time. Ultimately, this new dynamic requires FP&A and Business Finance to reassess how we:

Sustainability as a dimension must introduce an added variable to the performance management agenda without requiring a modification in its operation. The key requirement is simply to understand the new business dynamics prompted by the inclusion of sustainability into the equation.

Second Insight: Navigating Potential Competency Gaps as FP&A and Business Finance Integrate Sustainability – A Potential Challenge and Intriguing Opportunity

Over time, the role of a financial business partner has transformed, demonstrating a maturity trajectory focusing on improved value creation. FP&A and Business Finance have been pivotal in nurturing the talent necessary to advance this agenda across the enterprise.

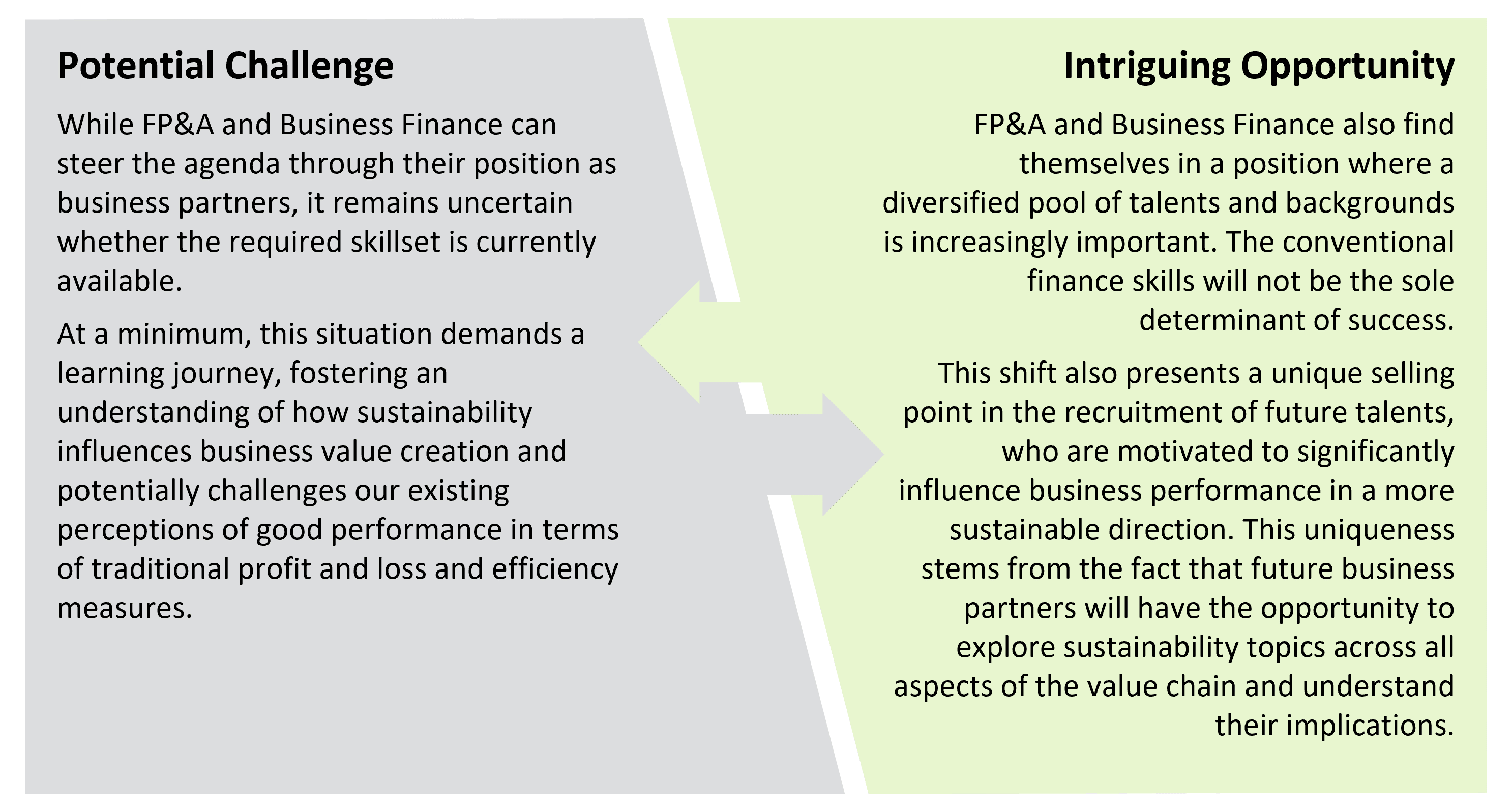

Historically, the key ingredients for successful business partnering have been centered around mastery within financial acumen, business understanding, and stakeholder intimacy/trust. As sustainability becomes a key value driver for organizations, it effectively introduces a fourth essential component to this blend. Consequently, FP&A and Business Finance face both a challenge and an intriguing opportunity:

In summary, FP&A and Business Finance control the playing field where sustainability must be evaluated as an integral part of driving business impact and performance. Although this may expose potential competency gaps, it also presents an opportunity to seek a more diversified talent pool, thereby serving as an appealing selling point for future talents.

Third Insight: The Path to Full Integration of Sustainability in FP&A and Business Finance Operations – A Stepwise Progression

Accepting the premises outlined in the first two insights, we find ourselves striving for a target where sustainability is seamlessly woven into our existing finance practices, thus becoming a fully integrated effort. Concurrently, we are faced with a potential resource and skill challenge that may extend beyond the remit of FP&A and Business Finance.

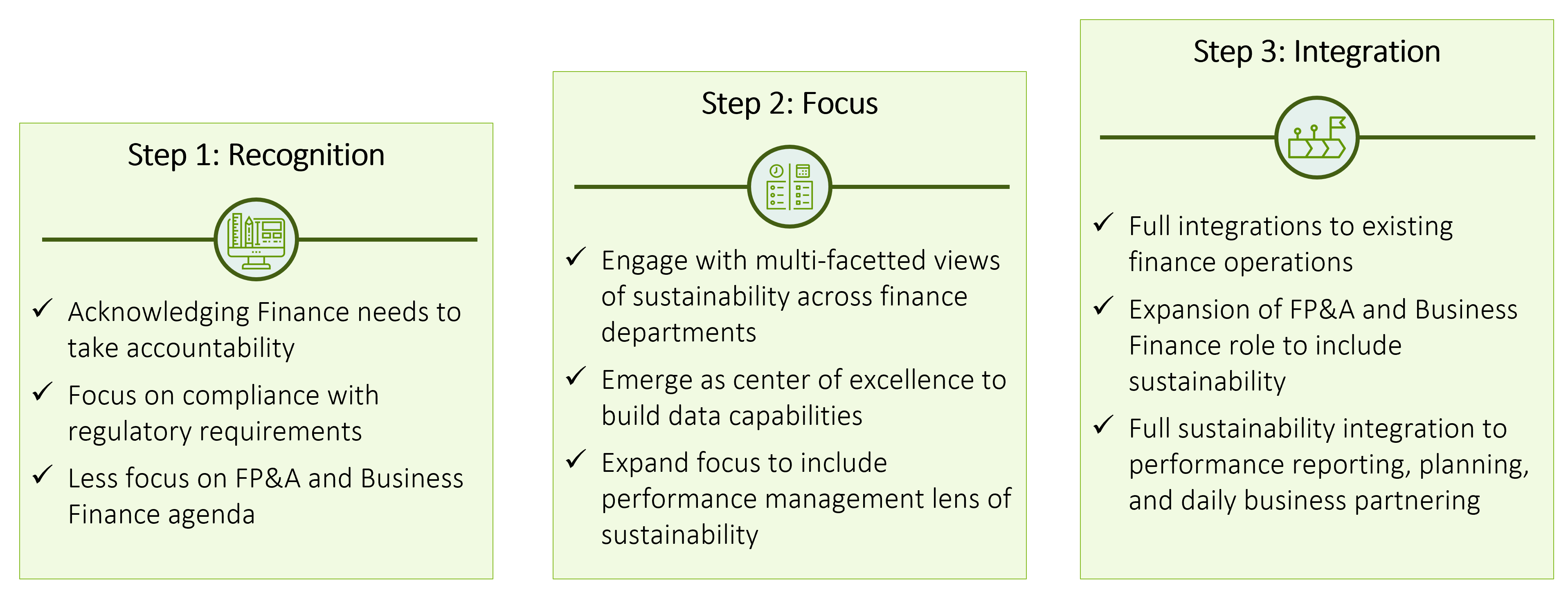

The proposed hypothesis suggests a gradual progression towards the target state, fostering growth and maturation in processes, competencies, data, and technology. We propose the following stages:

- Step 1 – Recognition: The first step is acknowledging sustainability as an integral part of the finance organization's scope. Typically, this stage revolves around aligning with regulatory requirements, siloed from many of the existing finance activities. As a result, FP&A and Business Finance can be left with minimal ability to influence the agenda, if they do not actively push towards step 2.

- Step 2 – Focus: The subsequent stage revolves around accepting the need to establish a focused effort, where finance functions engage with multi-facetted views of sustainability. The engine for this effort will likely emerge as a center of excellence, serving to enhance the level of knowledge and particularly data skills, while building an engine capable of addressing both regulatory and performance relevant skills. FP&A’s policy-making role for performance management and data understanding is critical. Here, the collaborative mechanisms in Finance, especially between FP&A, Business Finance, and a potential Sustainability Center of Excellence, will be put to the test.

- Step 3 – Integration: The ultimate ambition is full integration of sustainability into existing Finance operations, hereunder the expansion of FP&A and Business Finance role to include sustainability in enterprise performance management activities. Achieving this stage will be significantly challenging if the previous step has not been executed effectively. Thus, the reality will likely involve a gradual 'decentralization' of the sustainability effort, embedding it fully into performance reporting, planning, and daily business partnering across FP&A and Business Finance, as general skill levels and knowledge around sustainability increase across departments. This could take various forms, potentially involving the addition of a Sustainability Performance & Analysis (SP&A) team or role to the existing FP&A team.

As we progress towards step 3, one of the key success factors is to integrate sustainability finance through processes and roles, rather than key individuals. This mirrors the approach taken over the years in designing functionally and process-led finance organizations. Thus, we also expect this to be a gradual maturity journey, where above point of view serves as initial reflections to embed impact considerations in tandem with the evolving compliance agenda.

Contacts

- Philip Lerche, VP Group Financial Planning & Performance – Vestas

- David Kowalczyk, VP Business Finance & System – Hempel

- Anders Rytter Mikkelsen, VP Group Finance, Insights & BI – Novo Nordisk

- Andreas Bay Rasmussen, VP Head of Business Finance – ChrHansen

- Morten Guldager, SVP Global Financial Planning & Analysis – Scandinavian Tobacco Group

- Jeannette Wengel, Director Group Controlling & Reporting – Rockwool

- Jens Bak-Holder, Senior Director Global FP&A – Falck

- Nicolai Bjerregaard-Skytte, SVP FP&A and Commercial Finance Europe – Nilfisk

- Rasmus Lund, VP Group FP&A – Pandora

- Danni Aakeson, Senior Director Group Reporting and Financial Planning – WSAudiology

- Jon Østergaard Horn, VP Group FP&A – FLSmidth

- Casper Albæk, VP Performance Management – Danish Crown

- Christian Bækdal, Partner Enterprise Performance Management – Deloitte

- Rasmus Rosbæk, Manager Enterprise Performance Management – Deloitte