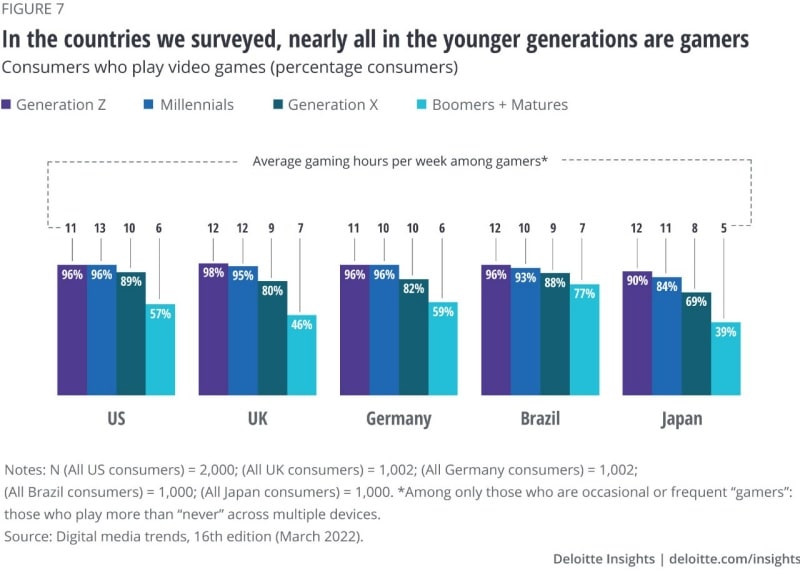

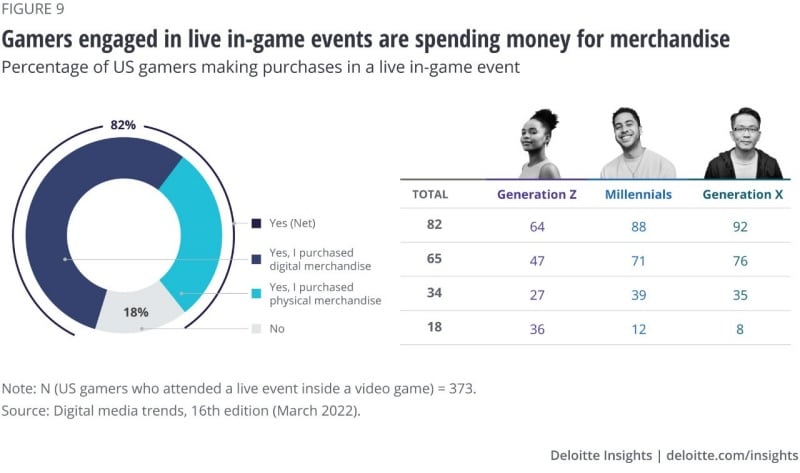

Meanwhile, thanks to smartphones, competitive esports, and rich, Hollywood-level experiences that cast the player as the star, gaming has gone global and expanded across generations. Gaming may have started as an individual experience, but it is now highly social. And game companies have evolved to monetize many aspects of gaming, from subscriptions, in-game purchasing, and extensible games that operate more like services, to embracing the social experience of gaming with multiplayer, branded content, and virtual goods.

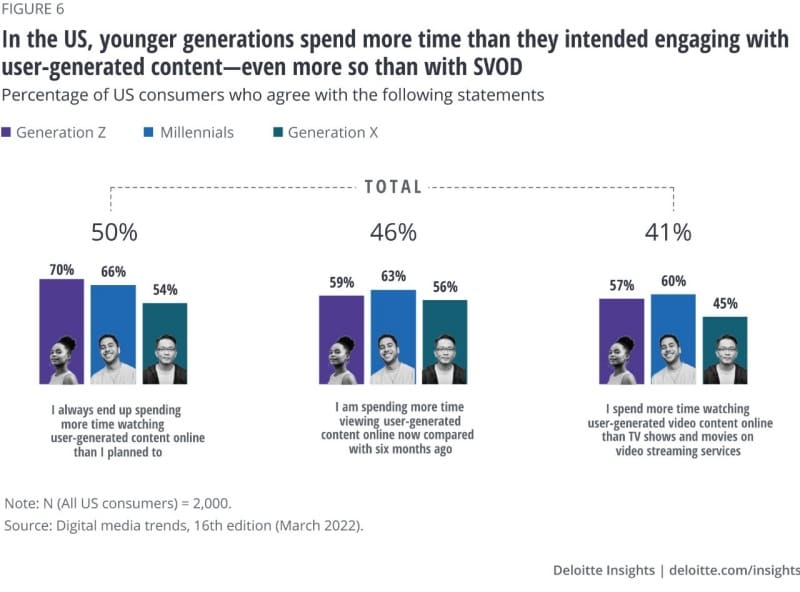

Although SVOD broke apart the cable bundle, since then, streamers and studios have mostly focused their innovation strategies on content delivery and licensing rights. Social media and gaming companies have been quickly evolving their business models and products, leveraging technology, and capitalizing on behaviors. This doesn’t mean all digital media must become social and interactive. But SVOD services should be aware that more audiences are finding entertainment, community, and even meaning, elsewhere.

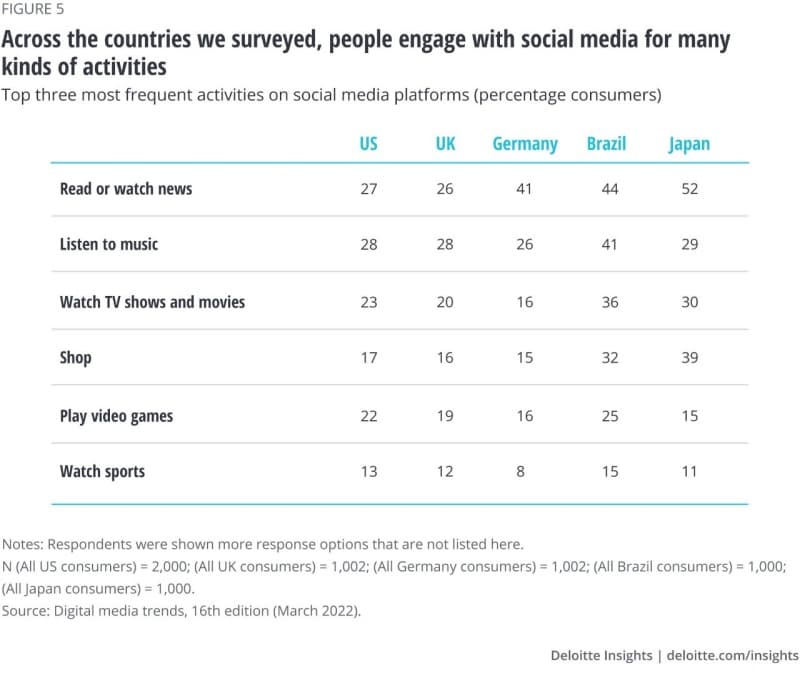

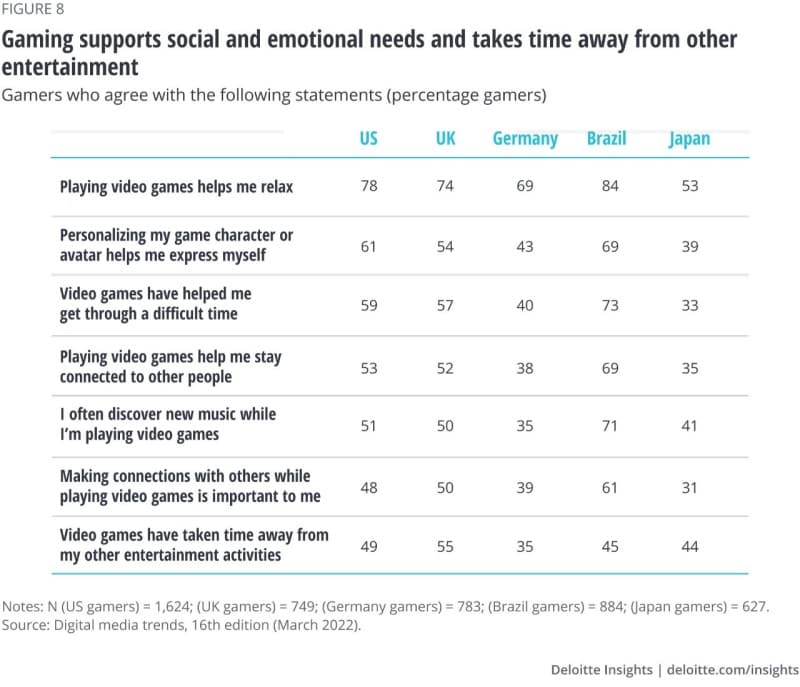

This year’s study expanded beyond the United States: We also included the United Kingdom, Germany, Brazil, and Japan—areas where media and entertainment companies are competing for digitally mature audiences. Overall, the trends we’re seeing in the United States are echoed in these countries, with the same generational contours. Amidst a global pandemic that has constrained in-person activity, people and companies are being accelerated into digital life, setting the stage for the current excitement about the metaverse—where virtual spaces become common destinations for work and play. But these shifts were already in place before COVID-19. With millions recording themselves doing the latest viral dance moves, influencers driving sudden demand spikes for products, top musicians delivering other-worldly concert experiences to global gaming audiences, and virtual goods becoming valuable and scarce with non-fungible tokens (NFTs) and cryptocurrencies, digital life may be gaining on so-called real life.

Social media broke open the TV screen and made fame much more accessible. Gaming enables us to act in the movie. Media and entertainment executives—and especially those in SVOD—should be thinking hard about how people socialize around entertainment and how entertainment itself is becoming more personalized, interactive, and immersive. The business models that have brought them this far, and even the technologies they have relied on, may not carry them through the next wave of change.

The SVOD conundrum

The shift to streaming video has been extremely successful at disrupting television, though potentially far less profitable.1 Like TV and movies before them, SVOD companies have relied on the innate emotional and intellectual value of their stories to engage audiences and monetize their attention. But will people always value this kind of passive, lean-back-and-watch experience? That’s the big question. As more major media providers launch their own streaming video services, competition among them has heated up, just as their value proposition to audiences may be losing some of its luster.

For top SVOD services, growth in North American subscribers has slowed.2 As they pursue global markets, and as those markets mature, they may be facing the same challenge. For consumers, getting their entertainment through the fragmented SVOD landscape requires more effort and, increasingly, nearly as much money.3 Over the past two years, US consumers have become increasingly frustrated when they lose content to other services, have to manage multiple subscriptions, and receive poor recommendations.

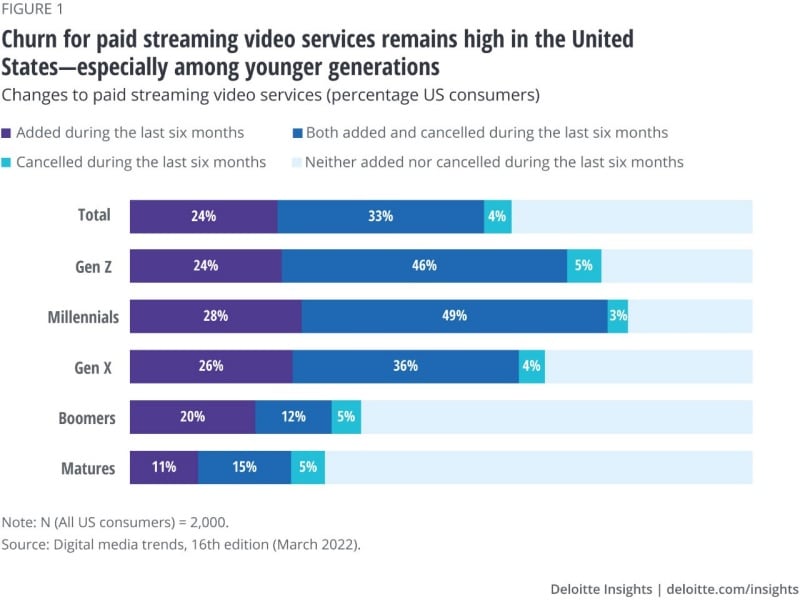

These conditions lead to churn: when people cancel, or both add and cancel, a paid SVOD service. In the United States, the average churn rate has remained consistent since 2020 at about 37% across all paid SVOD services (figure 1).4 It should be noted, however, that churn for a given service might be significantly lower than the overall average. In the United Kingdom, Germany, Brazil, and Japan, the overall churn rate is closer to 30%. (This number varies for each country, largely driven by subscription penetration and number of SVOD services.)