Digital media segments: Looking beyond generations For media and entertainment companies, age really is only a number

05 October 2018

Kevin Westcott United States

Kevin Westcott United States Jeff Loucks United States

Jeff Loucks United States Shashank Srivastava India

Shashank Srivastava India David Ciampa United States

David Ciampa United States

Who’s watching? For media and entertainment companies, it’s no longer adequate to only sort customers into demographic brackets. New patterns of media consumption suggest that M&E firms should look to viewer behavior more than age.

Introduction

From the beginning, most media and entertainment companies have lumped customers into demographic brackets; it’s long been the simplest, most straightforward way to classify customers for advertisers and content development. But age has always been a simple metric, as are gender and income.1 And for M&E, the story that demographics tell is increasingly incomplete—still valuable for some applications but often needing further illumination.

Learn More

Read the full report and view the infographic

Listen to the podcast

How do your habits measure up? Take the interactive survey to find out.

Explore the Thinking Fast charticle series on Deloitte.com

Learn more about the Center for Technology, Media and Telecommunications

Subscribe to receive related content

As technology becomes increasingly democratized and accessible, M&E and cable TV companies are shifting from focusing on the usual indicators—for instance, TV ratings for the prized 18–to–35 bracket—to looking more closely at media consumption behavior patterns. This doesn’t mean that, for instance, every network needs to emulate Netflix, with algorithms allowing it to develop some 75,000 different content genres.2 But it suggests that providers could look to adopt a more granular and behavioral approach to consumer relationships. Analysis from the 12th edition of Deloitte’s Digital Media Trends Survey indicates that measurement of media consumption behavior could provide a more granular approach to sustainably acquiring, engaging, and retaining customers.

Do M&E companies need to change how they view consumers?

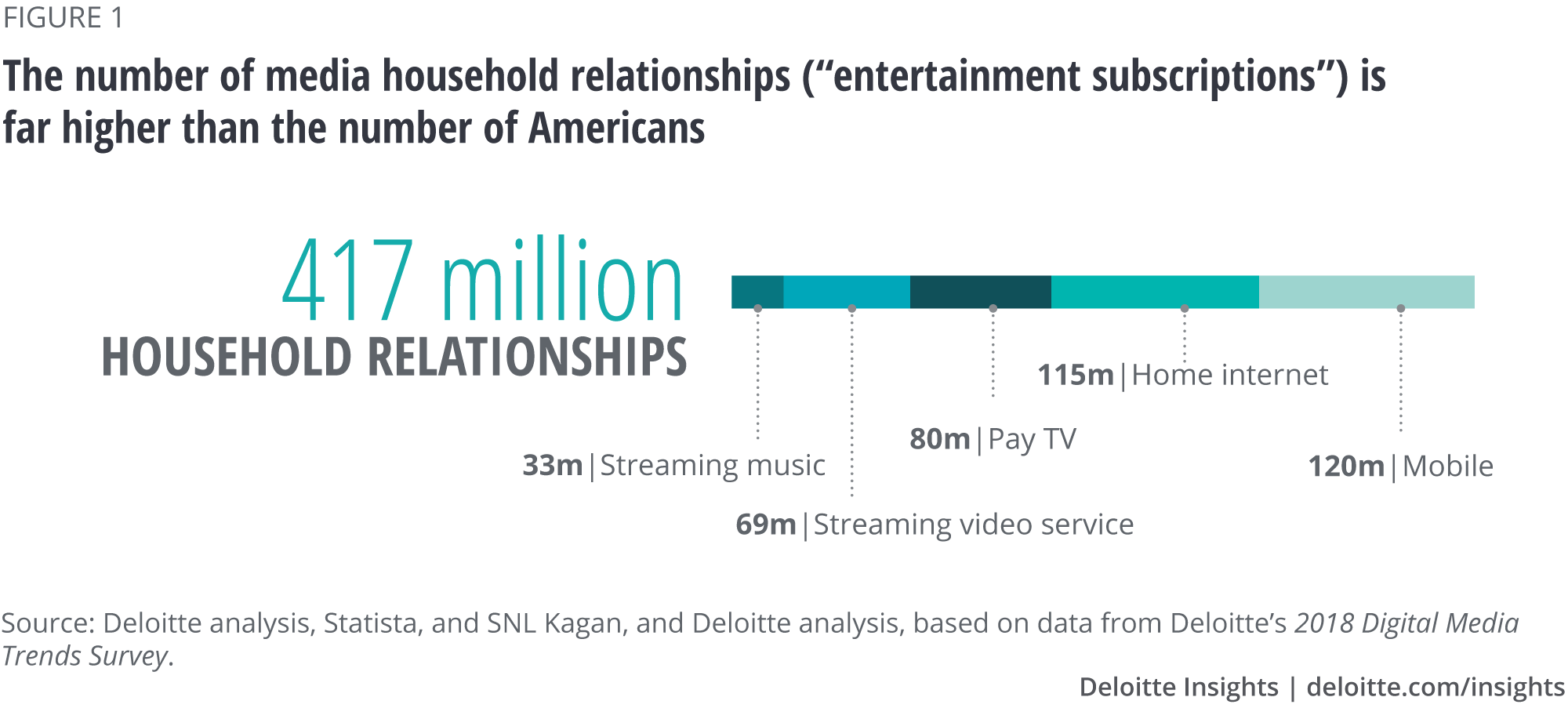

For many years, each American household got one bill from its M&E provider. Today, as companies introduce innovations and services fragment, the customer universe has expanded dramatically, not least because individuals have their own smartphones. In fact, US companies can now target more than 400 million potential household media relationships across home internet, mobile cellular, pay TV,3 and online video and streaming music services (“entertainment subscriptions”). (See figure 1.)

Rapidly developing technology has not only disrupted industries and business models—there is evidence it is changing consumer behavior and reshaping how companies should view their customers.4 M&E companies’ outreach campaigns and efforts to make technology user-friendly has paid off with older generations, whose behavior is mimicking younger generations’.5 Indeed, results from the 12th edition of Deloitte’s Digital Media Trends Survey indicate that the behaviors of Gen Z (ages 14–21), millennials (ages 22–37), and Gen X (ages 38–53)6 are converging. For example, in 2017, 70 percent of Gen Z households had a streaming subscription, closely followed by millennial (68 percent) and Gen X (64 percent) households. Similarly, half of Gen X respondents reported that they play video games frequently, almost matching Gen Z and millennial respondents.7 As a result, many M&E providers are struggling to segment media consumption habits based only on generational behavior. Demographic generalizations—such as the assumption that people of the same gender and in a similar age and income bracket will consume products and services the same way, and be engaged by the same marketing ploys—are less accurate than they used to be.

Today, of course, far more information is available about personal preferences, purchases, and more. In the digital era, continuously connected consumers are leaving a trail of information through every digital transaction—be it watching an online video,8 searching for and buying something online, or skipping an ad prior to viewing a web video. Even taking privacy concerns into account, M&E companies can effectively follow this contextual information trail to more accurately target consumers with marketing and suggestions.9 Netflix, for example, is not only a leader in user experience and original content—it powers its future by collecting and analyzing data every time a customer interacts with its platform.10 By adopting advanced metrics such as behavioral segmentation, an M&E provider can likely better service customers through an optimized product mix and more intuitive customer relationships.

Introducing behavior-based personas

The M&E consumption landscape has changed significantly over the past few years. While the emergence of internet-based services has boosted streaming traffic, interactive mobile apps and declining mobile data prices have contributed to the exponential growth in mobile video consumption.11 Our new survey highlights three key consumer behaviors that are disrupting the M&E industry:

Video streaming. The rise of video streaming has disrupted the way people consume content. For a significant proportion of American households, the days of watching programming based on a preset broadcast or cable TV schedule are over. The growth of nonlinear alternative OTT platforms that feature high-quality, original content is driving consumers away from linear formats such as pay TV.

Mobile video. The pervasiveness of smart devices and enhanced coverage of high-speed mobile data are allowing consumers to watch video content anywhere, anytime. This is driving growth in average video consumption and usage hours.

Subscriptions to multiple services. Modern consumers now enjoy an unparalleled choice of M&E offerings, especially in the world of OTT services. While some consumers are using the additional services to complement existing ones, others are substituting them for legacy services. These behaviors have a direct bearing on the subscription base of M&E companies. The success of direct-to-consumer platforms has ushered in a new era of nimble, digital-first businesses—beyond just media—and transformed consumer expectations and behavior.

To help distinguish various market segments, we focused on these three key consumer behaviors and conducted a cluster analysis of the 2,088 US respondents to the Digital Media Trends Survey. The analysis revealed five personas that characterize today’s digital media landscape: Mobile-first Viewers, Power Streamers, Highly Subscribed, Hybrid Adopters, and Linear TV Consumers. (See figure 2.) These behavior-based personas aim to help M&E companies classify customers far more accurately than do traditional demographic buckets.

Five personas that should be top-of-mind for M&E companies

Each of the following five personas has specific traits and patterns that differentiate it from the others. Let’s take a closer look.

Mobile-first Viewers

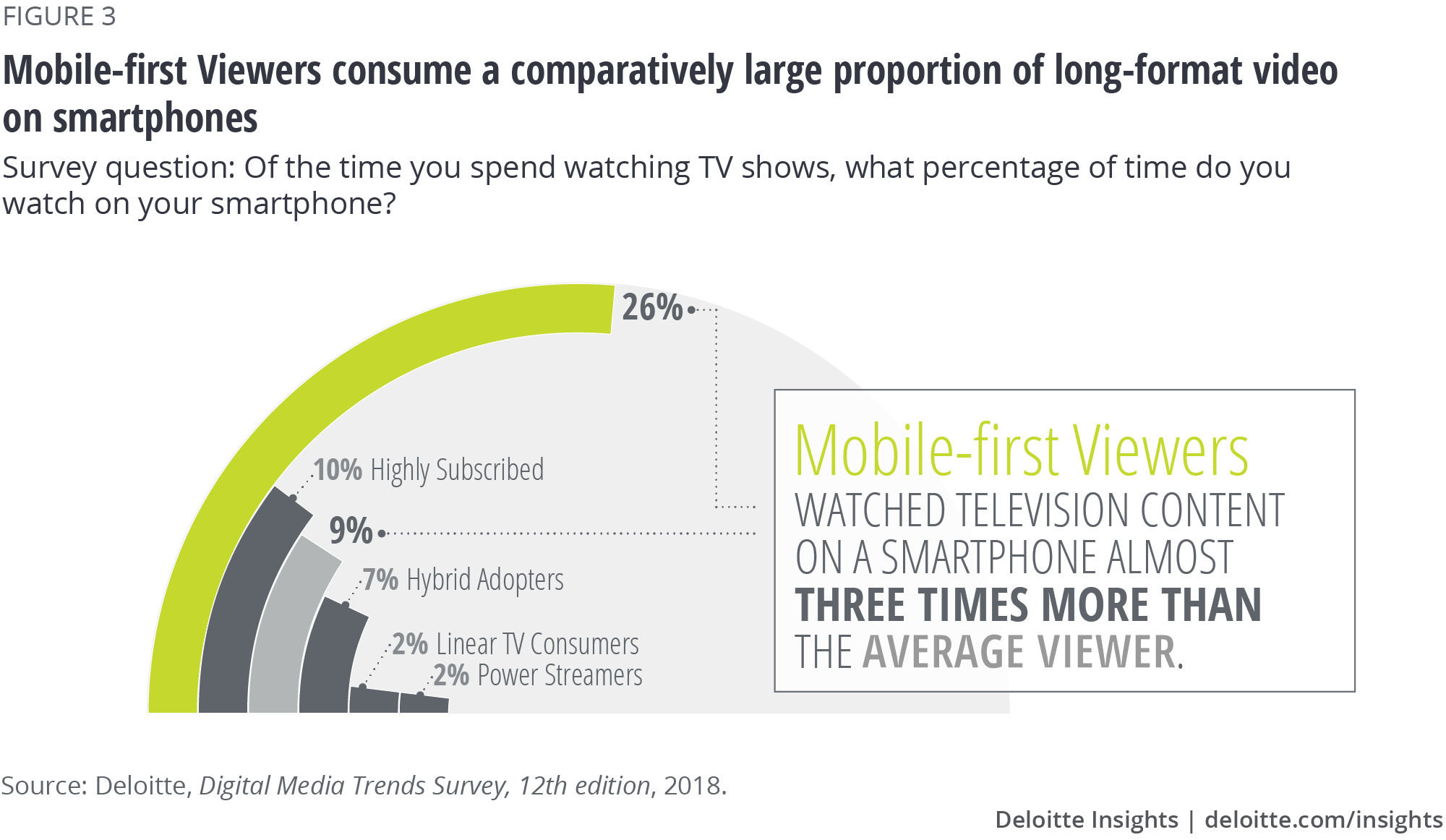

This segment of consumers is entrenched in the mobile revolution that is sweeping the M&E industry. Streaming video, mobile data plans, and home internet are this group’s top three services. They spend close to 30 percent of their movie-watching and 25 percent of TV shows watching time on a smartphone, highest among all segments. Around 70 percent use voice-based digital assistants on a monthly basis. They eschew appointment-based video viewing and look to consume content anywhere, anytime, on the device of their choice. Hence, they watch around 26 hours of streamed video weekly. Around 79 percent have a video streaming service subscription—much higher than the overall average. Their preference for both mobile video and streaming makes them a crucial target segment for streaming and mobile companies.

Mobile-first Viewers segment at a glance

Size: 18% of market

Mean age: 33 years

Mean household income: US$74,400

Generational profile: Gen Z 16%; millennials 43%; Gen X 34%; boomers 6%; matures 1%

Mobile-first Viewers do watch about 16 hours of live broadcast TV per week,12 but not all of this is through traditional pay TV. Indeed, fewer than half have a pay-TV subscription—far below the average. Among those who do subscribe, 25 percent said they are planning to cut the cord in the next 12 months. In addition, they are the most prolific users of social media among the five segments, with significantly higher penetration on social media platforms. They are ardent gamers as well: More than half play video games on a weekly basis and pay for in-app video game purchases at least a few times per year. A quarter of them have attended an eSports event13 in the last year, the highest among all groups.

Smartphone and social media platforms are likely the best ways to engage and influence the Mobile-first Viewers. Online reviews and social networks are their most preferred sources for receiving information on products and services. In addition, most Mobile-first Viewers are open to sharing personal information to receive more customized ads, so long as the provider is transparent about how their data is used. Marketers thus need to prioritize their social media and small-screen strategies to win these users’ confidence.14

Power Streamers

Power Streamers love watching TV content, but not in the same way as other personas: They are harnessing video streaming to move away from linear viewing. Power Streamers watch about 22 hours of streamed content per week, behind only Mobile-first Viewers. They account for 25 percent of the streaming video market by value and hence are a growth segment for streaming companies.

Power Streamers segment at a glance

Size: 18% of market

Mean age: 41 years

Mean household income: US$72,960

Generational profile: Gen Z 11%; millennials 25%; Gen X 36%; boomers 24%; matures 4%

Power Streamers want control over how and when they watch video content, and when it comes to where they watch, they have a clear preference: the flat-panel TV. About 70 percent of their movie viewing happens on TV screens—a key differentiator between them and Mobile-first Viewers, who view only about 40 percent of their video on a TV.

Although Power Streamers watch about 16 hours of live broadcast TV per week, fewer than half have a pay-TV subscription—and about 30 percent of those with subscriptions are considering cutting the cord within the next 12 months. Unsurprisingly, streaming video and home internet are the two subscriptions these viewers value most.

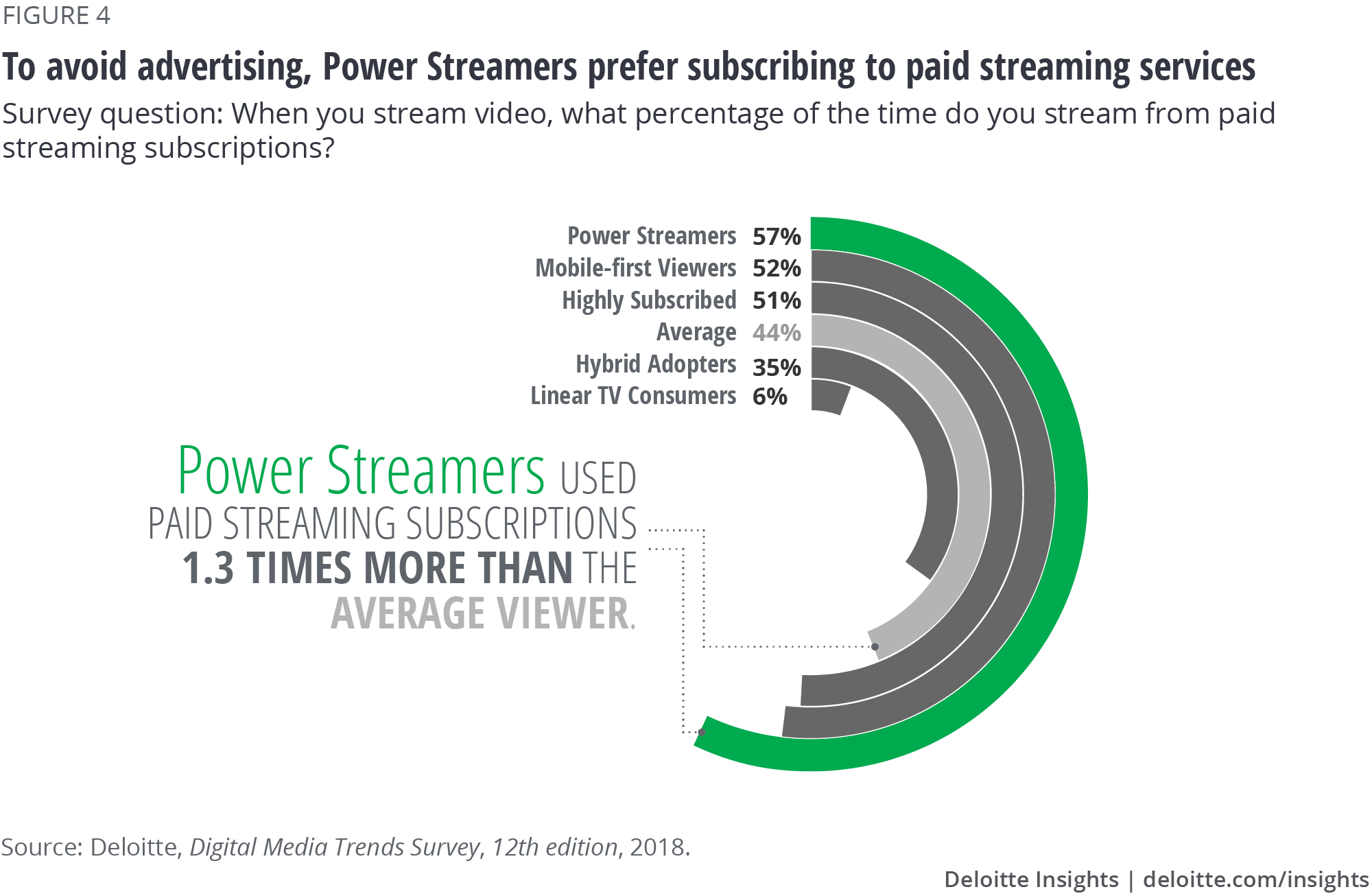

Power Streamers are a hard segment for marketers to reach, since they aim to avoid ads and are suspicious of targeted marketing: About 40 percent of them have installed ad blockers, and more than half desire a reduction in the duration of TV ads. Concerned about identity theft and privacy violations, they’re uncomfortable with sharing personal data with marketers and prefer online reviews for help in making buying decisions.

Highly Subscribed

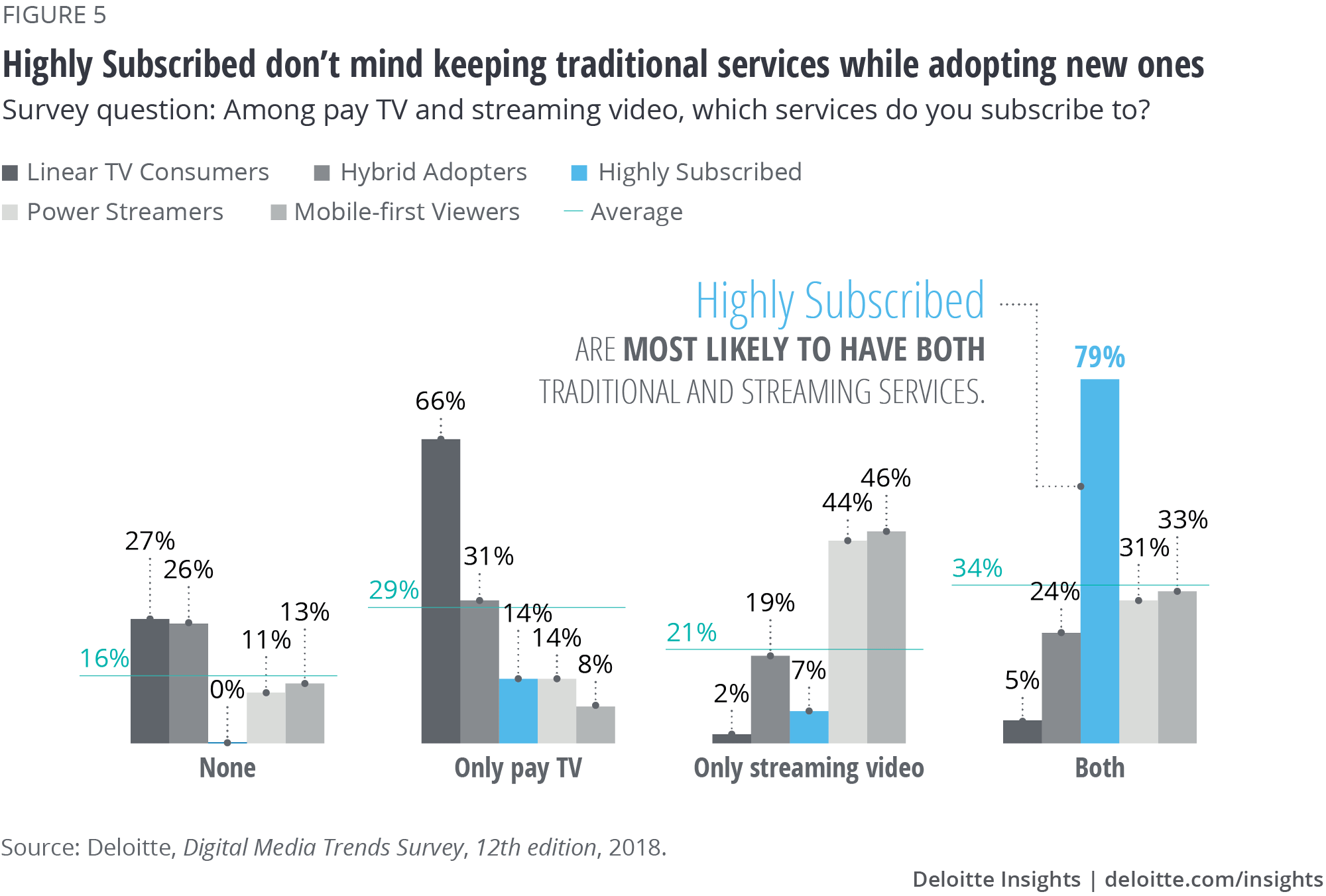

As the name suggests, this segment includes people who subscribe to the most paid subscription services. Highly Subscribed on average subscribe to around eight paid services, compared to an overall average of five.15 These consumers’ approach toward service subscriptions is complementary rather than substitutional: They readily adopt new services while keeping traditional ones. About 80 percent have both pay-TV and video streaming subscriptions—twice the average among all five segments.

Highly Subscribed segment at a glance

Size: 21% of market

Mean age: 42 years

Mean household income: US$101,980

Generational profile: Gen Z 16%; millennials 24%; Gen X 25%; boomers 29%; matures 6%

Highly Subscribed viewers also show positive intent when it comes to paying for premium services: They’re more willing than the other segments to pay for premium video on demand, in-app game purchases, and online news. Based on their economic power and propensity to subscribe to entertainment services, Highly Subscribed are very attractive to M&E companies. They account for, by value, 32 percent of the streaming video market and 30 percent of the pay-TV market.

These consumers love watching live sports—perhaps one of the reasons they stick with their pay-TV subscriptions—and advertisers can use TV ads to influence them, particularly during sports broadcasts. However, like Power Streamers, more than half of Highly Subscribed want a reduction in ad duration. In addition, they are especially conscious of data security, with more than 80 percent interested in controlling their personal data.

Hybrid Adopters

Hybrid Adopters are the nimblest segment, being the most easily able to shift between devices and services across traditional and nontraditional platforms to optimize content discovery and value. They are the most prolific linear-broadcast TV watchers, consuming close to 30 hours per week. Most depend on pay TV, though many use a combination of over-the-air antenna, skinny bundles, and streaming services as an alternative. On average, they watch about 12 hours of streamed video per week. However, close to half of them use a friend’s or family member’s login information to stream content.

Hybrid Adopters segment at a glance

Size: 18% of market

Mean age: 43 years

Mean HH income: US$77,850

Generational profile: Gen Z 11%; millennials 23%; Gen X 34%; boomers 27%; matures 5%

When it comes to watching long-form video content (movies, TV series), Hybrid Adopters predominantly depend on flat-panel TV. Yet Hybrid Adopters are gradually starting to resemble more digitally savvy groups through their smartphone usage. Hybrid Adopters rely on their phones to watch short-form video content, play video games, and engage with ads. Around half of them also use voice-enabled digital assistants on a monthly basis. They also spend a substantial amount of time on social media to interact with friends and relatives.

Hybrid Adopters choose both TVs and smartphones as their preferred devices to engage with advertisements, and this group shows the least discomfort with existing ad durations. Unlike other segments, they are open to sharing personal data in order to receive targeted offers. Hence, targeted mobile or OTT advertising (through a connected TV) could be an effective way to engage and influence them.

Linear TV Consumers

Linear TV Consumers are the traditionalists. These consumers place high value on traditional media services such as linear TV, landline phones, newspapers, and magazines. This group is comparatively much older than the other four. Pay TV is their most valued service after home internet, and they depend heavily on flat-panel TV for their media consumption and interactions. These viewers watch about 28 hours of live broadcast TV weekly and spend close to 85 percent of their movie-viewing time using a flat-panel TV. Because Linear TV Consumers account for 30 percent of the pay-TV market by value, they’re an important segment for that industry’s providers to target. On the flip side, they consume just three hours of streamed video per week, and only 7 percent subscribe to a streaming video service.

Linear TV Consumers segment at a glance

Size: 25% of market

Mean age: 57 years

Mean HH income: US$78,570

Generational profile: Gen Z 3%; millennials 9%; Gen X 18%; boomers 50%; matures 20%

One of these viewers’ key differentiators is their news-consumption behavior: They prefer watching live news, and about 60 percent rely on TV news programs and networks as their primary source for news—more than twice the percentage of mobile-first viewers who expressed the same preference.

Because the behavioral traits of Linear TV Consumers are diagonally opposite those of Mobile-first Viewers (see figure 3), traditional advertising methods such as television, print, and even radio ads are excellent ways to engage with them. They are extremely concerned about privacy and suspicious of targeted ads.

Although important, this segment will almost certainly continue to shrink as consumers become more digitally adept. Industry players should have plans for targeting other segments when looking for growth.

How can these segments influence broader strategic bets?

The M&E sector is in the midst of multi-generational change as it continues to grapple with the seismic disruption caused by the emergence and propagation of digital platforms and services. Many M&E companies are investing billions of dollars to acquire content and other companies. However, as opposed to previous business cycles, acquiring your competitor, alone, will not lead to sustainable customer acquisition. The successful companies will be those that realize digital disruption has resulted in a power shift in favor of consumers. Further, amid increasing consumer power and choice, pursuing customers could require deeper analysis of consumer behavior.

For instance, the last two years have seen the launch of several virtual multichannel video programming distributor services that offer “skinny bundles”—pared-down, less-costly subscriptions to a select group of channels. These services are particularly suited to Power Streamers and Mobile-first Viewers: Fewer than half of these two segments’ members have a pay-TV connection, and we expect that percentage to decline even further. To prevent complete disintermediation, pay-TV companies are offering their own skinny bundles; while these might have a short-term negative impact on revenues, they can likely lead to new cross-selling and advertising opportunities.16

Still, pay-TV providers face a real challenge: More than half of Mobile-first Viewers, Power Streamers, and Highly Subscribed consumers show an intent to purchase content directly from studios/brands—if that content is exclusive.17 Most of the large media houses have either launched or are planning to introduce direct-to-consumer offerings. Some content owners are now calling back content from subscription video-on-demand (SVoD) platforms.18 However, once consumers' streaming subscription costs approach those of pay-TV bundles—and dealing with multiple accounts and billings becomes a real hassle—there could be a slowdown in SVoD growth. One way that larger players may combat this is through reaggregation, which could include making more services available per platform.

Changing advertising dynamics

The rise of on-demand, ad-free content is challenging the traditional advertising model, pushing marketers to explore other avenues. The surge of investment in subscription-based, direct-to-consumer models has cast some doubt on the future of advertising-supported models, though major telecommunications providers and some content owners are still mapping out a future that includes an advertising market in the OTT content space. As some SVoD market leaders potentially lift monthly prices above US$10 and closer to US$20, single-digit-dollar ad-supported pricing could offer a more than 50 percent discounted alternative for video content.

Segments differ in their response to ads.19 Linear TV Consumers, Hybrid Adopters, and Mobile-first Viewers are content with the status quo, while Power Streamers and Highly Subscribed want a reduction in ad duration. Hybrid Adopters and Mobile-first Viewers don’t mind targeted ads, while other segments dislike use of their personal information. Advertisers, then, need to tailor their approach. Some networks are considering reducing ad duration; others are giving consumers the ability to edit and control their personal information shared with advertisers. Some are even allowing consumers to choose their ads.

Traditional advertisers, who spend most of their budget on TV, face audience shrinkage among Power Streamers, Mobile-first Viewers, and even Hybrid Adopters. A move to connected TVs could be a blessing in disguise due to the emergence of “online and addressable TV advertising”20: Measuring TV viewership and understanding its audience has always been a challenge for marketers, and connected TV offers a new opportunity to understand who is watching, what they are watching, and when.

New video platforms

Mobile-first Viewers are active on social media and watch a good deal of short-form content on their smartphones. Social networks are marrying these two experiences by pushing their members—especially Mobile-first Viewers—to tune into their own short-form videos as well as TV-like programming.21 In addition, they are starting to bid for live sports, entertainment, and original series.

Of course, digital video can’t function without reliable internet connectivity. In fact, connectivity is key to nearly all modern media relationships, and home internet service is of prime importance to all five of our digital media segments. Telcos are investing in 5G, believing it will give them the capability to compete directly against wireline technologies such as DSL and cable, while also providing a cheaper alternative to fiber to the home.22 This premise is driving investments in the US 5G fixed wireless space. Meanwhile, cable providers are ramping up their own investments in, and deployment of, the DOCSIS 3.1 standard, which offers high network performance and speeds that are expected to increase further with Full Duplex DOCSIS.23 Many consumers may have cut the pay-TV cord, but most are still keeping their home internet, which means the player that provides home internet service will likely hold the key to the primary consumer relationship.

Industry consolidation

The M&E industry has experienced several major transactions over the past few years. Media companies are acquiring others to enhance their content network and offerings. Disney, for example, recently announced an acquisition agreement with Twenty-First Century Fox.24 Telecom-media mergers and acquisitions, aimed at combining content with video distribution, have seen a recent uptick as well. AT&T, for example, acquired Time Warner to strengthen its hold in the video content space.25

The imperative to react to changing consumer behavior is likely driving traditional media companies’ aggressive M&A deals and strategic repositioning. Highly Subscribed and Mobile-first Viewers value mobile data and streaming video among their top three services. Bundling of these two makes sense for these segments, and telecom companies are already doing it. M&As may provide another means for media companies to strengthen their content library, quality, distribution, and value. By growing in size, media companies can potentially increase their libraries of exclusive content, which is of utmost importance for Highly Subscribed and Power Streamers.

Conclusion: Continuous connection

Heightened competition and aggressive consolidation are placing increasing pressure on operating margins across the M&E sector, highlighting the need for companies to fight harder to attract and retain customers. Companies can no longer focus solely on transactional customer relationships—instead, they need to pursue continuously connected and seamless customer experiences. And keeping people engaged and sustaining their value proposition means looking beyond traditional demographic buckets such as age, gender, and income. Our five multi-dimensional behavior profiles offer M&E companies a potentially more useful way to classify and more effectively target customers.

And there are real possibilities, even as viewing technology and user habits shift. With Mobile-first Viewers and Hybrid Adopters, a substantial portion of the market remains open to an ad-supported consumption model. By contrast, Power Streamers prefer an ad-free paid subscription-based model. In short, different business models can simultaneously flourish in this landscape. Companies can potentially devise a strategy for each segment in which they wish to play, and then tailor their products and services based on those segments’ needs.

As digital advertising—characterized by business models that track consumers’ buying history, emotions, and likes/dislikes—points the way to the future, M&E companies need a more advanced approach to evaluating consumers. Behavior-based segmentation may hold the key.

© 2021. See Terms of Use for more information.