CFO Insights 2021 November Bookmark has been added

Article

CFO Insights 2021 November

Updates to Japan’s document preservation rules may require companies to retool their record retention processes

CFO Insights is a monthly publication to deliver an easily digestible and regular stream of perspectives on the challenges confronting CFOs. In this article, we highlight how CFOs and tax teams play an important role thru transitions to electronic document storage to maintain productivity.

Explore Content

- CFO Insights 2021 November

- Overview of Japan’s current record retention rules

- Changes to the existing rules under 2021 tax reform

- Benefits of electronic storage

- Conclusion

Due to recent events, the need for companies to go digital has increased dramatically. In response, the 2021 Japan tax reform included a number of items intended to promote digitalization and help companies ease the transition from their current working environments. One such item included in the tax reform package was certain fundamental revisions to the Electronic Record Retention Law (“ERRL”) and the preservation of transaction information sent/received electronically. Under the current document preservation rules, preservation in hard copy format is permitted as an alternative to preserving transaction data electronically. However, hard copy preservation will now be abolished for certain documents beginning 1 January 2022.

For many countries where electronic document storage is and has been the norm, rule changes requiring companies to store certain documents electronically may seem unusual. As such, it may be beneficial to first give a brief overview of the existing rules to provide more context for the changes and help companies better understand what is changing and why it is important to take the necessary steps to ensure compliance with the new rules.

Overview of Japan’s current record retention rules

Unlike many countries, documents in Japan must generally be stored in hard copy and retained for at least 10 years under the current record retention rules, unless the taxpayer meets certain conditions to store documents electronically.

In particular, electronically stored documents are required to meet certain authenticity requirements (e.g., timestamps, retaining revision/deletion history, preparing manuals, etc.) and certain visibility requirements (e.g., ensuring readability, meeting specified search function criteria, etc.). Additionally, except for electronic transaction records (i.e., transaction information such as purchase orders, invoices, etc. exchanged electronically), the taxpayer is required to submit an application to the local tax office and receive prior approval before it can begin storing documents electronically. As for electronic transaction records, approval is not required, but a company must satisfy certain prescribed conditions under the ERRL.

Storing documents electronically without complying with the requirements mentioned above may result in certain documents not being treated as sufficient for national tax purposes. In addition, failure to comply could also result in the taxpayer potentially losing blue form taxpayer status, which would cause the taxpayer to lose certain benefits such as the ability to carryforward net operating losses.

Changes to the existing rules under 2021 tax reform

As shown above, Japan’s existing electronic document storage rules were fairly complex and burdensome, requiring taxpayers to complete several steps before they could take advantage of electronic storage. As a result, the Japanese government, in an effort to promote digitalization and keep Japan’s rules competitive on a global scale, introduced extensive reform measures to its document storage rules as part of its 2021 tax reform package.

In particular, taxpayers no longer need to apply and receive approval from the tax office to begin storing documents electronically. Additionally, certain requirements related to the search function, authenticity, and timestamping were eased to encourage taxpayers to take advantage of the system.

However, the biggest change came in the form of taxpayers being no longer able to store certain electronic transaction records in hard copy starting 1 January 2022. After that date, all electronic transaction records must be stored electronically. Failure to do so may result in the revocation of approval for tax consolidation and/or blue form tax taxpayer status and may also result in certain documents not being treated as sufficient for national tax purposes.

Benefits of electronic storage

As mentioned above, storing documents electronically is commonplace in many jurisdictions, but for many companies in Japan, hard copy storage of documents is still the norm. Such companies still implementing hard copy storage systems, will be required to switch to digital storage for electronic transaction records beginning 1 January 2022 to avoid the potential ramifications discussed above. However, there may be additional benefits to switching to digital storage as well.

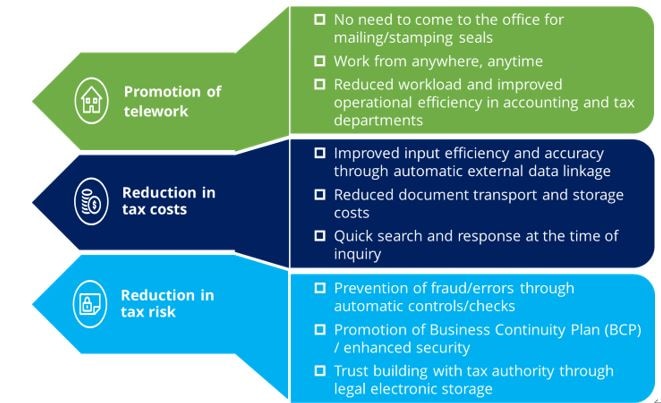

Electronic storage may allow companies to reduce costs, as well as risks and administrative burden. The table below demonstrates some of the benefits of maintaining documents electronically, including reducing tax costs/risk and the ability to support teleworking, which has become a necessity in the current pandemic environment.

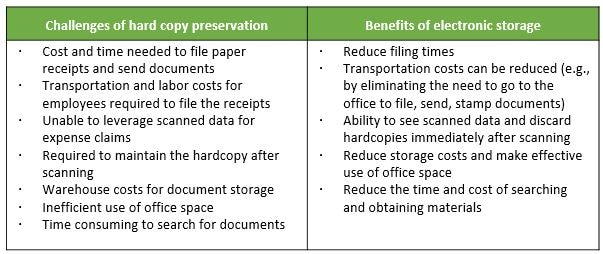

In addition to the benefits above, electronic storage may also help alleviate many of the challenges presented by preserving documents in hard copy format. Below are some of the challenges of preserving documents in hard copy and some additional benefits of electronic storage that may be able to help in addressing those challenges.

Conclusion

The recent pandemic has dramatically changed the environment and working conditions for many companies across the globe. In order for tax functions to assist their companies in the recovery process, it is becoming increasingly important for companies to implement digitalization process to maintain productivity and meet new challenges. Recognizing this, the new rules introduced by 2021 Japan tax reform related to electronic document storage were aimed to help taxpayers implement such digitalization processes.

However, with the new rules related to electronic document storage going into effect soon, companies have little time before having to make the change to electronic data storage for certain documents. As such, companies need to act quickly to implement responses measures to ensure compliance. In particular, companies should develop an action plan for how they should best respond to the changes. Actions plans should properly:

- Analyze the situation, identifying issues in the company’s current operations and points to be addressed,

- Design operational flows and prepare operation rules while introducing an appropriate system in accordance with the company’s specific circumstances and the new rule changes, and

- Deploy the new system, while disseminating information about the plan to related departments and conducting operational tests and final adjustments.

As the new rules and requirements can be complex, analyzing a company’s particular needs in connection with such rules and developing an action plan can be difficult. Accordingly, we recommend that companies seek advice from their tax advisors as soon as possible to ensure that they will be compliant when the new rules take effect 1 January 2022.

If you would like more information, please speak to David Bickle (david.bickle@tohmatsu.co.jp), Hideo Arai (hideo.arai@tohmatsu.co.jp), and Brian Douglas (brian.douglas@tohmatsu.co.jp)

Additional resources

Applying for digital transformation and carbon neutrality tax incentives

As part of its 2021 tax reform package, the Japanese government has introduced new tax incentives related to investments in digital transformation (DX) and carbon neutrality (CN) to help further two of its long term goals of promoting digitalization and environmental sustainability. The new incentives went into effect on 2 August 2021, which is the date the Industrial Competitiveness Enhancement Act (ICE Act) was revised.