Analysis

2017 Q1 Global CFO SignalsTM

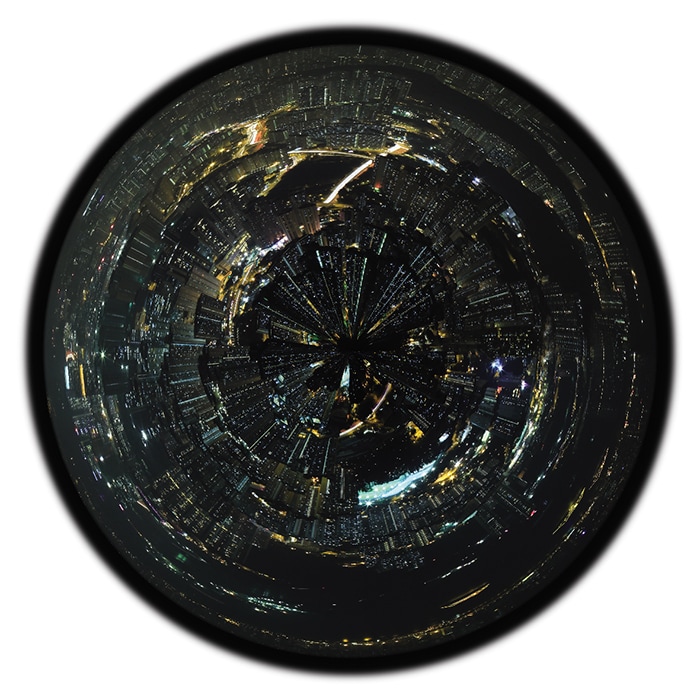

Across the globe, the yeas have it

This quarter, with results in from 21 surveys, net optimism increased in 17 surveys, sometimes reaching new highs.

Explore Content

- Download the report

- CFO Sentiment 2017 Q1

- Regional perspectives

- Download the infographic

- Global CFO Signals-By the numbers

How does CFO sentiment in Q1 2017 break down? What follows is a synopsis by region:

- Argentina: Slightly clouded optimism

- Austria: Heightened positive sentiment

- Belgium: Favorable business environment drives expansion

- China: Positivity and prioritizing business expansion

- Finland: Solid signals

- France: Political woes dampen economic outlook

- Germany: Economics prospects swayed by politics

- Ireland: Driving on in an increasingly uncertain climate

- Italy: Strengthened economic outlook

- Japan: Growing corporate earnings, despite geopolitical uncertainties

- Netherlands: Optimism shooting up all over the place

- North America: Large company optimism high and rising

- Norway: Optimism, but careful growth

- Portugal: Hope for the best, prepare for the worst

- Spain: Renewed economic optimism

- Sweden: Signs of relief and growth opportunities

- Switzerland: Brighter horizons, but concerns remain

- Turkey: Uncertainty persists; optimism collapses

- United Kingdom: Brexit shock eases

CFO Sentiment 2017 Q1

Last quarter’s Global CFO Signals found that finance leaders in the nine surveys reporting were optimistic across several measures, despite political and economic uncertainty. This quarter, with results in from 21 surveys, the happy chorus has only gotten louder: net optimism increased in 17 surveys, sometimes reaching new highs.

The evidence is apparent in many regions. In North America, for example, net optimism spiked to a survey-high +50. Nearly 60 percent of CFOs expressed rising optimism (up from 43 percent last quarter), and about 10 percent cited declining optimism (down from 20 percent). In Europe, the strengthening of the regional economy has bolstered CFO sentiment across the board, with the strongest net optimism recorded among CFOs based in Austria, Finland, and Sweden. And even in Asia, where the two countries reporting—China and Japan—have not expressed much optimism in past surveys, there are signs of some stabilization at least.

Patricia Buckley, Managing Director, Economic Policy and Analysis, Deloitte Services LP, believes that the improvement in optimism, particularly in North America, owes much to the fact “that the underlying fundamentals of the US economy are in good shape.” In the first quarter, she noted, GDP growth was only 0.7 percent, but business investment picked up by 9.4 percent (the biggest uptick since 2013), according to the Bureau of Economic Analysis, which not only reflects company optimism but “will be important for driving future growth.”

Other members of the Deloitte Global Economist Network, which operates in more than 14 countries, point to the strength of the European economy as another source of increasingly positive outlooks. “This improved optimism comes on the back of strengthening growth in Europe,” explains Michael Grampp, European CFO Survey lead and chief economist at Deloitte AG (Switzerland). ”Europe’s recovery gained traction in the final quarter of 2016 and was further boosted in early 2017 with a number of economic indicators suggesting resilience in the face of political uncertainty.”

Given these macro trends, CFOs are also optimistic about their own companies’ performance and investment. In Europe, for example, a majority of CFOs in every country surveyed are optimistic about revenues, with the most optimistic CFOs in Sweden (+80 net balance), Ireland (+75), and Austria (+75). In North America, capital investment growth expectations of 10.5 percent are up drastically from last quarter and sit at their highest level in nearly five years. And in Japan, CFOs’ earnings outlooks improved, with nearly 70 percent saying they expect increases, while those expecting a decrease fell from 11 percent to five percent.

Amid these positive signals, there is still plenty of noise. Uncertainty continues to plague CFOs in the UK, for example, because of questions around the impact of Brexit. In Germany, the economy’s reliance on exports could be affected by geopolitical risks. In Greece, the government is trying to manage the terms of their bailout while domestic demand continues to suffer. And there are still questions about the direction of trade policy, the future of interest rates, and broader questions about deglobalization, which could have significant effects on business. As Ira Kalish, Chief Global Economist, Deloitte, puts it: “There is a cacophony of concerns CFOs have to deal with, and while optimism is high at the moment, longer-term success will hinge on how events unfold and how policymakers approach those events.”

Regional perspectives

Americas

The strength of optimism in North America extends to perceptions of the region’s economy, with 66 percent of CFOs rating current conditions as good (a four-year high), and 62 percent expecting better conditions in a year. Perceptions of Europe improved to 12 percent and 28 percent respectively, while those for China rose to 20 percent and 19 percent. North American CFOs also indicate a strong bias toward revenue growth over cost reduction (60 percent vs. 18 percent) and investing cash over returning it (59 percent vs. 15 percent). Meanwhile, in the one South American country reporting—Argentina—CFO outlooks remain strong, but down somewhat from the previous survey. Still, a net 45 percent of Argentina’s finance chiefs (compared with 51 percent) have a more optimistic view regarding their companies’ financial prospects than six months ago. As for the economy, 65 percent of CFOs expressed optimism about the impact of the government’s economic policies on their businesses over the next year.

Asia-Pacific

There are some positive indicators in both China and Japan, too. In Japan, for example, financial outlooks appear to be stabilizing with 78 percent of CFOs saying their views are “broadly unchanged,” compared with three months ago, up from 55 percent last quarter. In addition, 25 percent of CFOs now also see a clear sign of economic recovery in Japan, and only 63 percent view the level of uncertainty as “high” or “very high,” down from 80 percent last quarter. Still, the majority of respondents see “political risks” on the horizon associated with both the US and European economies, particularly protectionism and changes in foreign policy. Meanwhile, in China, a brightening (yet still negative) outlook is also apparent, with 26 percent reporting optimistic economic sentiment, up from eight percent in the previous survey. Risk factors remain, however, including the potential for adverse government measures and future economic turmoil. But CFOs point to plenty of opportunities as China evolves to more of a consumer-based economic model, and growth ambitions such as market expansion (17 percent) and revenue growth (16 percent) are top of mind. “Even though they are facing policy regulations and geopolitical concerns, CFOs in China are becoming optimistic toward the economy and believe that consumption upgrading will be the most important driver of business growth,” says Sitao Xu, Chief Economist, Deloitte China.

Europe

As reported here and in the latest European CFO Survey, companies across Europe have become more optimistic about the prospects for their own companies. At the same time, CFOs’ perceptions of external uncertainty are falling. In fact, countries that saw the largest increases in optimism also saw perceptions of uncertainty fall compared with Q3 2016 (Sweden -24pp, Austria -18pp, Finland -6pp, and the UK -2pp). Improved optimism and falling uncertainty have also led to increased risk appetite, particularly in Finland (59 percent) and Spain (54 percent). And this change in attitude is supported by CFOs viewing expansionary business strategies as more attractive in the next 12 months.

There are also positive expectations regarding financial metrics. The optimism linked to revenues is evident across the European countries reporting, particularly in Sweden, Ireland, and Austria, and although the outlook for margins is not as optimistic, it has also improved. Moreover, this quarter has seen a strong shift toward capital expenditure (particularly in Belgium, Austria, Netherlands) and in hiring expectations overall. “Recent political shifts and upcoming elections across Europe have seen uncertainty persist among CFOs, but that has not dented their optimism, their willingness to take on risk, and the confidence they have in their companies’ performance,” said Grampp.

What’s next? According to the Buckley, there may be an increasing “risk to the downside going forward.” She sees it coming from two directions: one being increased disruption due to technology and the other escalating geopolitical risks. “There are just so many hot spots all over the globe, any one of which could ignite and spread,” she said. Which is to say, today’s happy chorus could become muted should bad news erupt in any significant way.

2017 Q1 Global CFO Signals

Global CFO Signals–By the numbers

Risk appetite

With European optimism on the upswing, you would think risk appetite would also improve. But continued uncertainty seems to be leading to a “wait-and-see” attitude among CFOs. The only countries in which a majority of CFOs believe now is a good time to take on greater risk are Finland (59 percent) and Spain (54 percent), where there have also been marked improvements in optimism among CFOs. The most risk-averse CFOs are in Turkey, Greece, and Portugal—where more than 80 percent of CFOs in each country do not think now is a good time to be taking a greater risk on their balance sheets.

Uncertainty

Continuing geopolitical challenges are leading to sustained uncertainty—but there are small signs of improvement. In Japan, for example, not only did the number of CFOs who consider the level of uncertainty as “high” or “very high” decrease from 80 percent in Q4 2016 to 63 percent in Q1, but those who now see it as “low” or “very low” increased from zero percent in Q4 to six percent. Meanwhile in Europe, countries that saw the largest increases in optimism also saw perceptions of uncertainty fall compared with Q3 2016 (Sweden -24pp, Austria -18pp, Finland -6pp). Still, CFOs in the UK, Germany, and Greece report high levels of uncertainty often tied to political uncertainties.

Metrics

There is positive news for revenues among the European countries reporting, with the most optimistic CFOs in Sweden (+80 net balance), Ireland (+75), and Austria (+75). Meanwhile, CFOs in Sweden are also the most optimistic about margins (+62), followed by Belgium (+57). In line with an increasingly stable financial outlook, nearly 70 percent of Japanese CFOs also expect an increase in earnings. And in North America, capital investment growth expectations are up drastically from last quarter (10.5 percent vs. 3.6 percent), reaching their highest level in five years.

Hiring

More than half (53 percent) of Chinese CFOs say they will hire more people than they let go, and 71 percent expect to hire more higher-skilled than lower-skilled workers. Unemployment remains relatively high in many of the European countries reporting, but there are country differences in expectations. CFOs in Ireland (net balance +63), Belgium (+51), Poland (+40), and Spain (+30) are the most optimistic on employment, while CFOs in the UK, the Netherlands, Finland, Turkey, and Italy are the most pessimistic. Meanwhile, in North America, this quarter’s domestic hiring growth expectation of 2.1 percent* is well above the 1.3 percent reported last quarter.

Corporate strategy

Growth strategies remain strong in North America. Some 60 percent of North American CFOs say they are biased toward revenue growth over cost reduction (18 percent). In Europe, growth has returned to the agenda, with only three countries (Belgium, Portugal, and Norway) identifying more defensive than expansionary strategies in their top five priorities. While growth ambitions (market expansion, 17 percent; revenue growth, 16 percent) remain top of mind for China’s CFOs, resetting focus to core business (14 percent) and ensuring efficient resource spending (13 percent) are also key topics.

Funding

As CFOs await possible interest rate increases, they continue to benefit from a favorable funding environment. Bank borrowing again dominates the sources of funding for CFOs in Europe, while views on equity funding have improved in line with the continued strength in European and global equity markets. Meanwhile, in North America, 81 percent say debt is currently an attractive financing option, and 40 percent of public company CFOs view equity financing favorably.

To access previous Global CFO Signals reports, please visit the Global CFO Signals library page.

Recommendations

Global CFO Signals™

Library of previous issues