Oilfield services: Caught in the cycle Decoding the O&G downturn

7 minute read

23 April 2019

The current oil and gas supply boom has turned into doom for oilfield service companies. How can they survive these difficult times?

The oilfield service (OFS) segment is the backbone of the upstream O&G industry, helping producers overcome technological challenges associated with offshore development and commercialize the newly found shale resource through new technologies such as hydraulic fracturing. The segment, despite its critical role, seems to be struggling to recover from the downturn, and is witnessing the highest disconnect with the ongoing supply boom. Since 2015, for example, over 170 OFS companies have already filed for bankruptcy.1 Why and where did things go wrong for this segment?

Although many industry pundits have provided piecemeal perspectives across the phases of the downturn and recovery, a consolidated analysis of the past five years and a complete perspective covering the entire O&G value chain could help stakeholders—from executive to investor—make informed decisions for the uncertain future.

With this in mind, Deloitte analyzed 843 listed O&G companies worldwide with a revenue of more than US$50 million across the four O&G segments (upstream, oilfield services, midstream, and refining & marketing) in an effort to gain both a deeper and broader understanding of the industry. The ensuing research yielded a six-part series, Decoding the O&G downturn, which sets out to provide a big-picture reflection of the downturn and share our perspectives for consideration on the future.

In part three of the series, we explore the state of the oilfield service segment—assessing its overall health, identifying possible reasons behind its underperformance, analyzing its changed margin profile, and comprehending the role of large service companies in this downturn.

Learn more

Create custom PDF or download the full report

Read all articles in the series—Decoding the O&G downturn

Browse the Oil, Gas & Chemicals collection

Read an article featuring these insights from Rigzone

Read an interview with Deloitte’s Andrew Slaughter

Read an article on this report from Oil & Gas Journal

Subscribe to receive related content

A boom that turned into doom

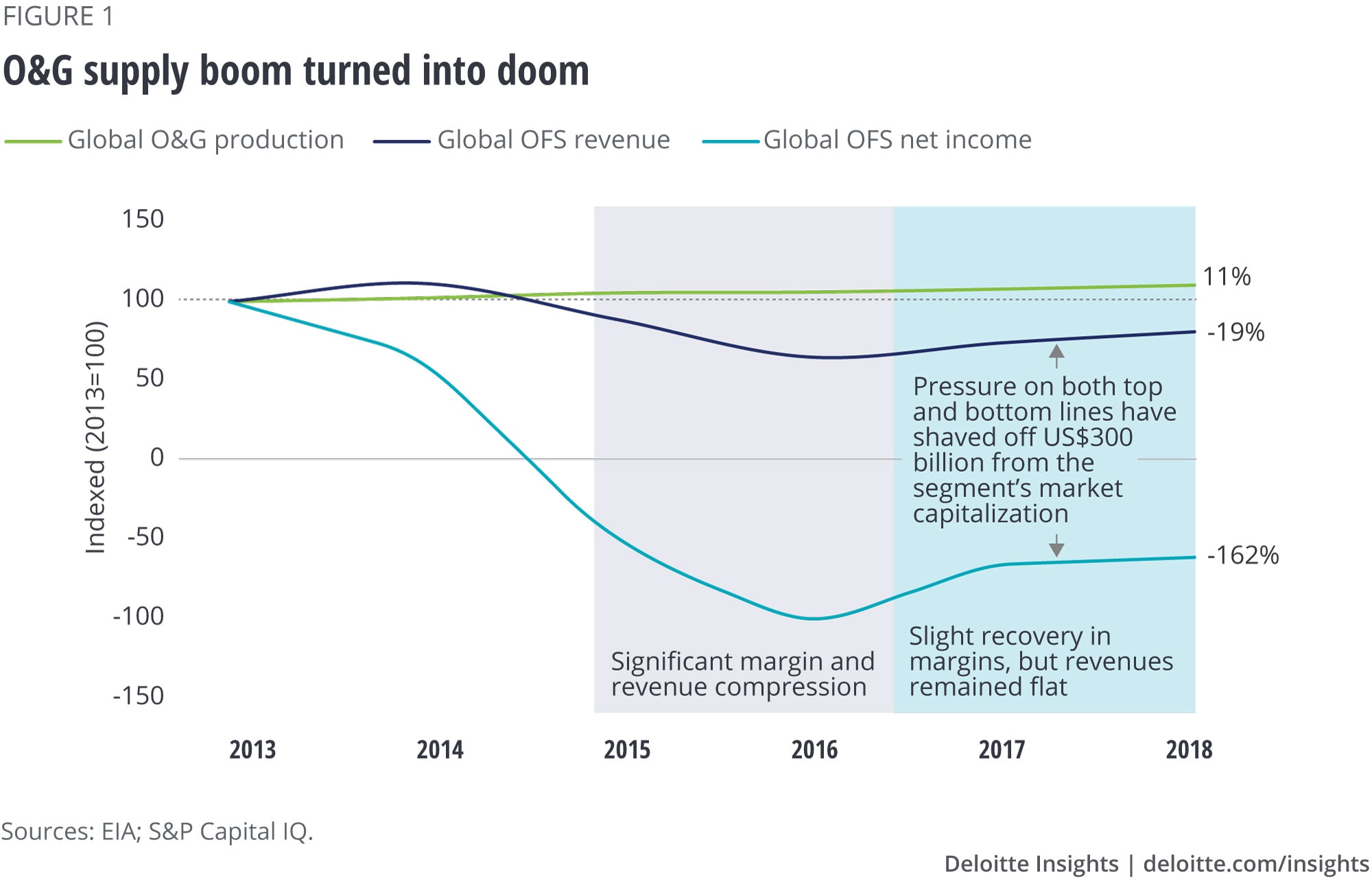

Global liquids (crude oil and natural gas liquids) and natural gas supplies grew by 11 percent in the downturn, the highest five-year supply growth in the O&G history.2 Increased drilling, completion, or production of resources, however, didn’t translate into more business for OFS companies. In fact, the segment’s revenue fell by 20 percent during the downturn, due to both reduced activity and a downward pricing structure (figure 1).3

Worryingly, the segment’s negative top-line growth came along with a severe contraction in its margins. The OFS segment, for the first time in its history, reported negative net income for four consecutive years, with a cumulative loss of about US$96 billion.4 Even in 2017 and most of 2018, when oil prices were recovering and the completion activity in shales was at the highest level, the segment reported a net loss.

The result: From one of the most heavily owned and highly valued O&G segment in the run-up to the shale boom, OFS turned into a liability for its investors in the downturn where they lost US$300 billiovn of invested capital—by the end of 2018, the entire size of the global OFS segment was less than the size of the biggest supermajor.5 In other words, the O&G supply boom has turned into doom for OFS companies and their investors.

Gains became losses

The collapse in oil prices challenged the economics of likely every operator, especially those operating in the highly competitive US shale market. Their challenges of reducing cost and improving productivity became an opportunity for service companies as that meant selling enhanced well designs and larger completion jobs.

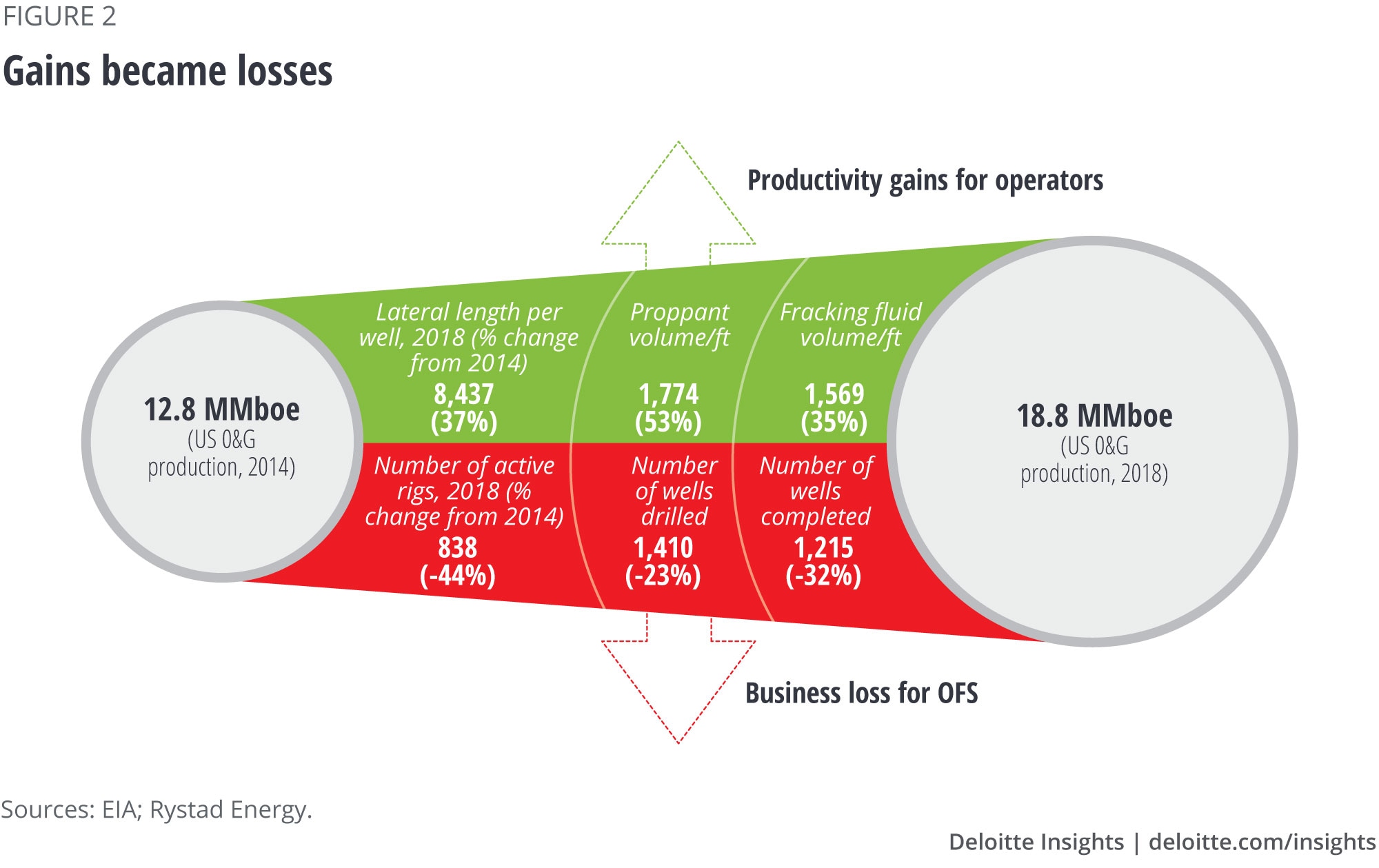

A right mix of innovation, determination, and desperation on the both sides to sustain their business got them together, and the results started flowing. Average length of laterals and volume of proppants and fluid increased by 35 percent to 50 percent during the downturn, supporting a 50 percent rise in US O&G production and 50–60 percent fall in well-head breakeven.6

However, gains have skewed toward operators as more business from high-intensity completion jobs came at an increased cost of consumables and lower contract rates for service companies. On the other hand, greater use of technology (multi-pad drilling) and increased well productivity reduced requirement and day-rates for rigs and wells. For example, the average number of rigs deployed in the United States dropped by 45 percent, while the number of drilled and completed wells dropped by 25–30 percent during the downturn (figure 2).7

In short, efficiency and productivity gains led by the combined efforts of operators and service companies turned into losses for OFS companies. When they were just getting hopeful of regaining their business and pricing power in an improved oil price environment, a steep fall in oil prices to below US$55/bbl (WTI) in late 2018 dragged them down even further. 8

The imbalance of volume over value

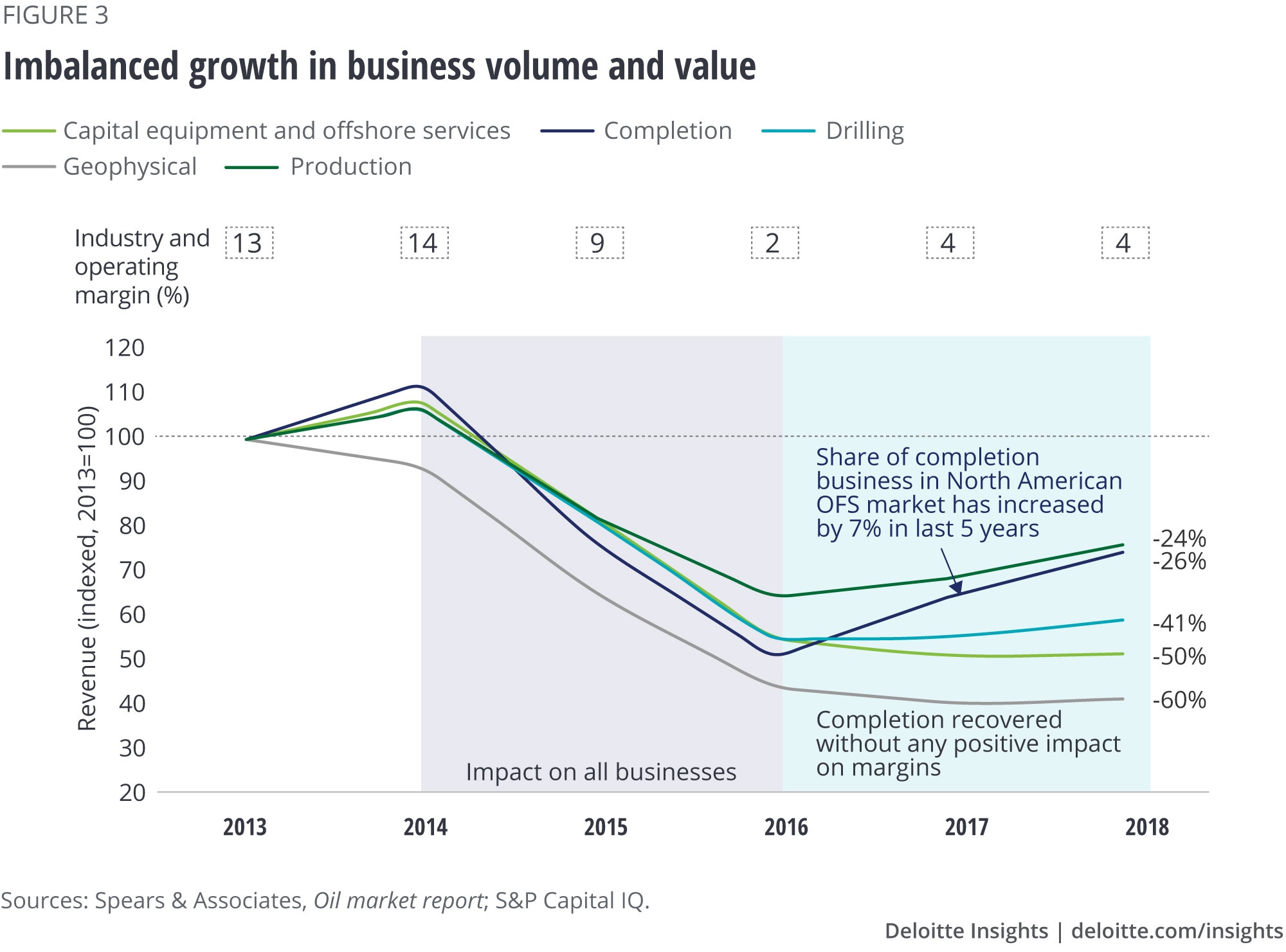

Although shales have broken the linear relationship between O&G production and OFS growth (i.e., before the development of shale resources, for more production, more rigs needed to be deployed and more drilling needed to be done), the completion business has kept the top line of OFS companies at a respectable level. In 2017 and 2018, in fact, it was the only major business category that registered a sizeable revenue growth of 49 percent.9

The noticeable revenue growth in the completion business, however, is largely driven by rising share and cost of consumables (e.g., proppants and fluids) procured from third parties by service companies and billed to operators, as against a revenue expansion entirely led and owned by service companies. For example, proppants and fluids now constitute more than 70 percent of a typical well’s completion cost in Delaware.10 And, the cost of frac sand has more than doubled over the past 12–18 months in the Permian.11

The result: The completion business has altered both the top line and margin profile of US service companies. Our analysis reveals a 10–12 percent contraction in the segment’s operating margin profile because of the oversupplied and highly competitive state of the completion business, exacerbated by the falling share of high-margin businesses such as geophysical services and offshore contract drilling (figure 3).

A missed opportunity?

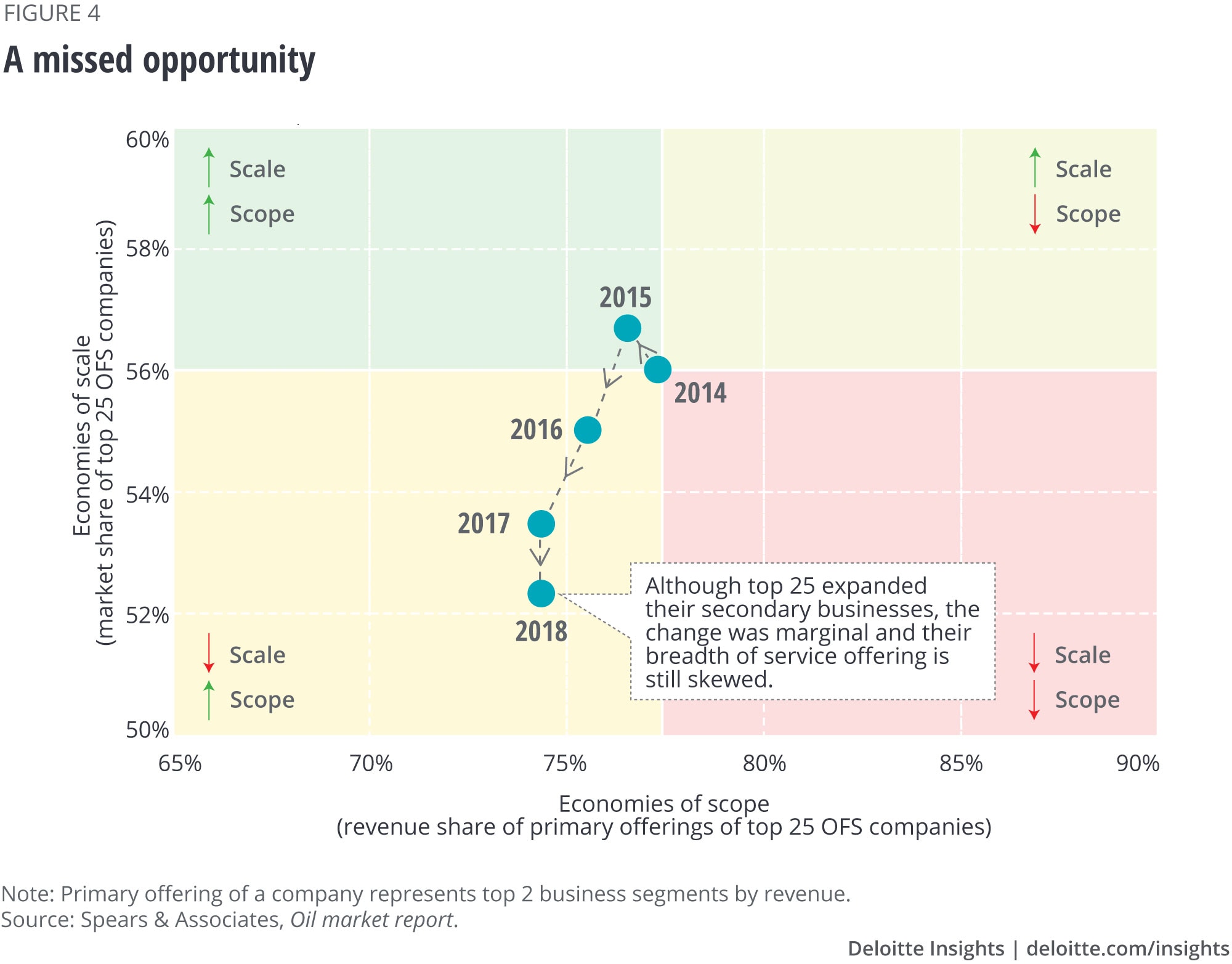

History suggests that a fragmented industry in distress often paves the way for consolidation; large and financially sound players monetize such situations to strengthen their bargaining power and diversify their growth/risks. How have large OFS players evaluated and addressed fragmentation in the industry? Have they expanded their economies of scale (market share) and economies of scope (breadth of offerings) during the downturn?

Surprisingly, the OFS segment has never seemed as fragmented as it is today, five years into the downturn. OFS has now more than 1,000 listed and private companies worldwide and only 6 have a market capitalization of more than US$10 billion. And, the market share of the top 25 OFS companies in the overall segment’s revenue has been at its lowest level of 52 percent, a fall of 4 percentage points from 2014 (figure 4).

In terms of scope, the story is only slightly better. Although the revenue share of nonmajor/secondary businesses has grown by 3 percentage points for the top 25, primary businesses still constitute about 75 percent of their revenue mix. Businesses such as downhole drilling tools, floating production services, and contract compression services seemed least impacted in the downturn but remained under-owned by large service companies.

With only US$20 billion of M&A activity in 2018, would the segment have fared better if there was a consolidation?12 Although results are unclear—because even a few mega-mergers over the past few years are yet to deliver on stated synergies—alliances that reduced total “ownership cost” for both the parties, offered integration value to clients, provided cost and schedule certainty, and reduced interface risk/time of operators seem to have fared well. After a muted M&A activity, could there be a big M&A wave or consolidation in the offing?

Lessons from the downturn

Continuing oil price volatility, the downside of efficiency gains at the operators’ end, and a highly fragmented market continue to present unprecedented challenges to the OFS segment. Growing cyclicality in its asset utilization, commoditization of fees, and industrialization of processes suggest that the segment’s path to recovery may not be smooth either. Although challenges are unique to each company and thus require tailored solutions, the following considerations could help bring a balance:

- Rapid changes in business dynamics, especially in the competitive hydraulic fracturing and capital-extensive offshore markets, could require higher operational agility and a nimble-and-timely scalability (scale up, scale down, and even scale out) approach across the value chain of their offerings.

- Overcoming the consequences of efficiency gains may require greater acceptance of performance-based contracting. This is likely to happen only if OFS companies can display the additional value they are bringing to operators while distinguishing themselves technologically and demonstrating their grip over the supply chain.

- With operators moving toward flexible investments and capital-light models, OFS companies should explore new forms of alliances and partnerships, even with operators and vendors, to reduce their “total cost of ownership” of assets and gain back some control over their rising “variable cost.”

Times are tough, but we are optimistic that OFS companies can thrive amid uncertainty. A healthy OFS segment is an important component for the success of the entire upstream business. Considering the segment’s broader impact, having a perspective across the O&G value chain can be critical for OFS strategists. Explore the entire Decoding the O&G downturn series to gain a 360-degree view on the industry.

More insights for Oil, Gas & Chemicals

-

Oil & Gas Collection

-

From bytes to barrels Article7 years ago

-

Refining at risk Article6 years ago

-

Following the capital trail in oil and gas Article9 years ago

-

A renaissance in the domestic oil and gas industry Article11 years ago

-

Global renewable energy trends Article6 years ago