The new frontier

Bringing the digital revolution to midstream oil and gas

Executive summary

Given the current hype around digital technologies, it might be easy to imagine them as a ready fix for managing evolving business challenges. For instance, the industrial Internet of Things, a part of the broad digital opportunity, is projected to add US$15 trillion of value to the global economy by 2030.1 But when the industry in question is undergoing a fundamental change because of shales, how can US midstream companies not just adopt a digital mindset but also derive actual value from going digital for its legacy and new assets?

The extent of digital adoption in the midstream sector will likely depend on companies’ receptiveness to change—while some of them are realizing that even pipes, valves, etc., can be “smart,” the fact remains that only 50 percent consider existing data management as a high-priority item.2 Understanding the value of digital—a data-driven approach can potentially reduce annual downtime by 70 percent and bring down unplanned cost to 22 percent of the total, compared to 50 percent currently3—may be of utmost importance for midstream firms, as they start on this path of digital transformation. More importantly, in the long term, digital technologies could help lessen the high capital intensity of the industry.

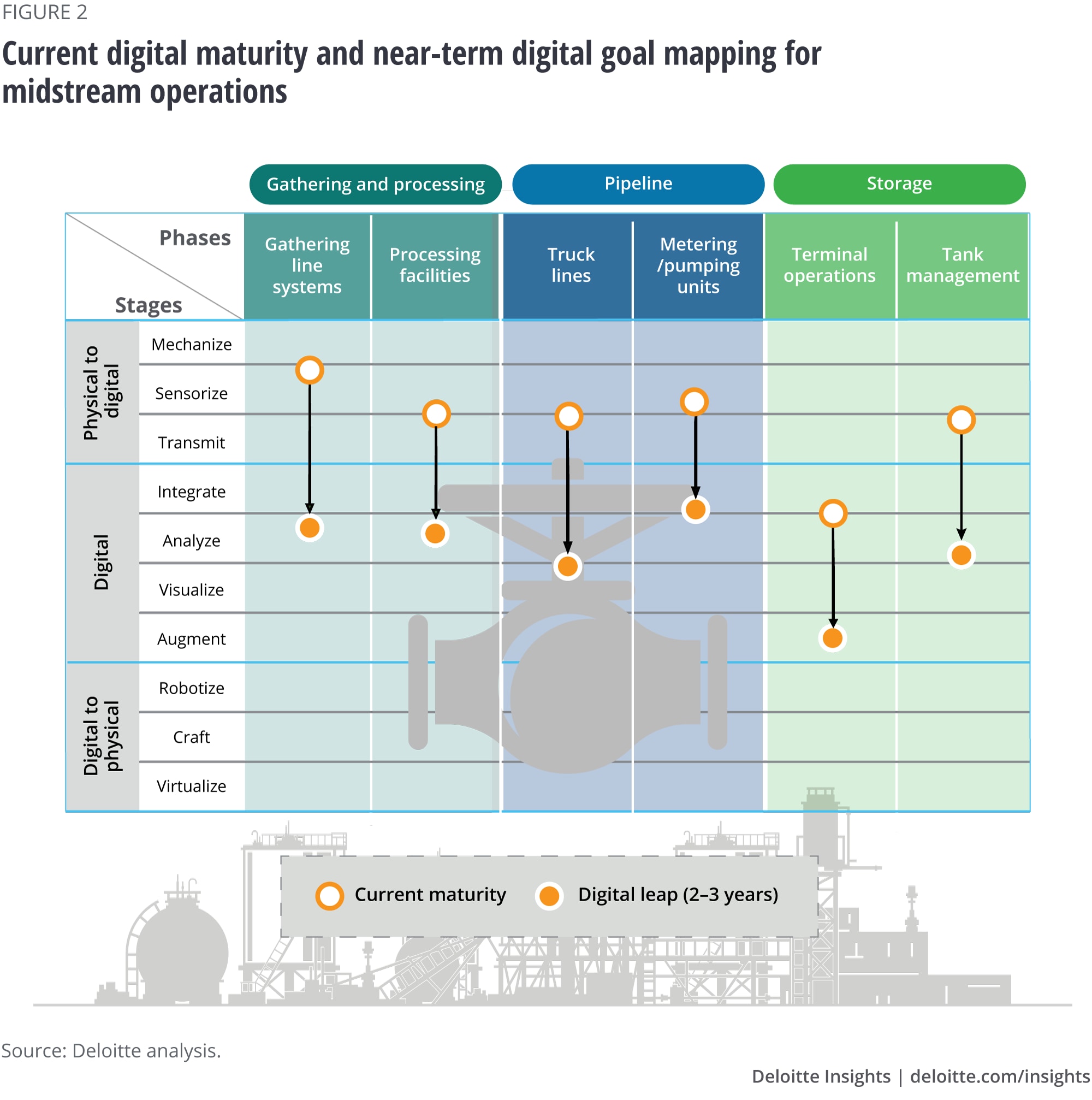

This paper, the second in our series on digital transformation in O&G, maps the digital standing of all major segments of midstream, identifies near-term digital leaps that companies can take to meet their near- and long-term objectives, and puts forward a comprehensive road map for companywide digital transformation (see the sidebar, “Deloitte’s Digital Operations Transformation Model” or From bytes to barrels: The digital transformation in upstream oil and gas).

Converting challenges into opportunities with digital

The business outlook for the US midstream sector seems to indicate a period of promising growth opportunities, irrespective of fuel type. On the one side, accelerating technological innovations to cut down cost have enabled strong growth in US light tight oil (LTO) production, and on the other, the long-term trend of using natural gas as an alternative fuel is simultaneously driving shale gas growth. Further, growing export opportunities for US oil and LNG—due to price competitiveness and US policymakers’ focus on building domestic infrastructure—make the sector outlook appear more attractive.4 Lastly, the recent surge in basin price differentials has repositioned midstream as a sector whose infrastructure planning capabilities are now critical to the market attractiveness and growth opportunities for upstream firms—for instance, in June 2018, infrastructure constraints devalued Permian pure-play companies by around US$15.6 billion in just two weeks’ time.5

Nevertheless, a deeper look into this growth suggests that several strategic and tactical challenges should be cleared as companies outline their growth strategies. As volume growth is likely to be most focused on key prolific basins, opportunities are expected to be fiercely contested by large midstream and even upstream players—over the next five years, 60 percent of oil and gas volume growth in the United States will likely come from the Permian and Appalachian regions, respectively.6 The competition aspect may also play out strongly in attracting capital, especially from private equity investors who have lately expressed interest in gathering and processing (G&P) assets.7 Further, the short-cycled nature of shales could test the flexibility of midstream companies where misplaced infrastructure investment may either lead to stranded assets or significant opportunity losses.

The situation may further get exacerbated by the existing challenge of managing aging infrastructure, which, unlike other industries, is geographically dispersed. Further, obsolete technologies and automation systems make this infrastructure vulnerable to theft and cyberattacks, potentially leading to outages and health, safety, and environment damage costs to operators.8 To put this in context, there are about 2.7 million miles of O&G pipelines in the United States with an average asset age of 20 years, and two-thirds of Americans live within 600 feet of a pipeline.9

This context implies executives should address three big questions as they plan their growth journey: How do you ensure sustainable growth and create business value in a dynamic and competitive business environment? How can you optimize the operating and business model of an industry with a huge legacy asset base? How do you protect this value and growth from the potential risks? Although sound technical and business excellence of operations can help midstream players, the diversity and complexity of midstream assets tend to require technological solutions that can unearth hitherto hidden value. We propose embracing digital technologies could be the key to working successfully in a dynamic business environment.

Clearing the path toward digital adoption

Apart from the ever-extending reach of technology to address business issues, the falling cost of implementing digital technologies means that even small-to-mid-size midstream companies can access them competitively. However, a vast physical asset base and the mechanical operating culture have restricted companies from deploying high-end technologies on a large scale. The skill-matrix evolution of the workforce in midstream companies further seems to affirm the fact that digital “concepts” have not yet translated to changes at the grassroots level—90 percent of new midstream jobs in the last eight years have been in the field of construction, maintenance, and materials movement, compared to a couple of hundred jobs added in the digital and operation experts field.10

A senior executive at Emerson also highlighted this in a recent statement: “It is extremely important for the midstream industry to foster digital transformation—rethinking outdated business models and strategically applying technology to change them—rather than focusing on simply cutting costs.”11

From an investment perspective, the prevalent Master Limited Partnership (MLP) model in the industry has always prioritized growth over maintenance, restricting the emphasis on digital upgrades—for an asset-intensive industry like midstream, maintenance capex has mostly remained below 10 percent.12 Besides, there seems to be a lot of ambiguity around where to channel the limited digital investments and which technology is most likely to address specific business needs.

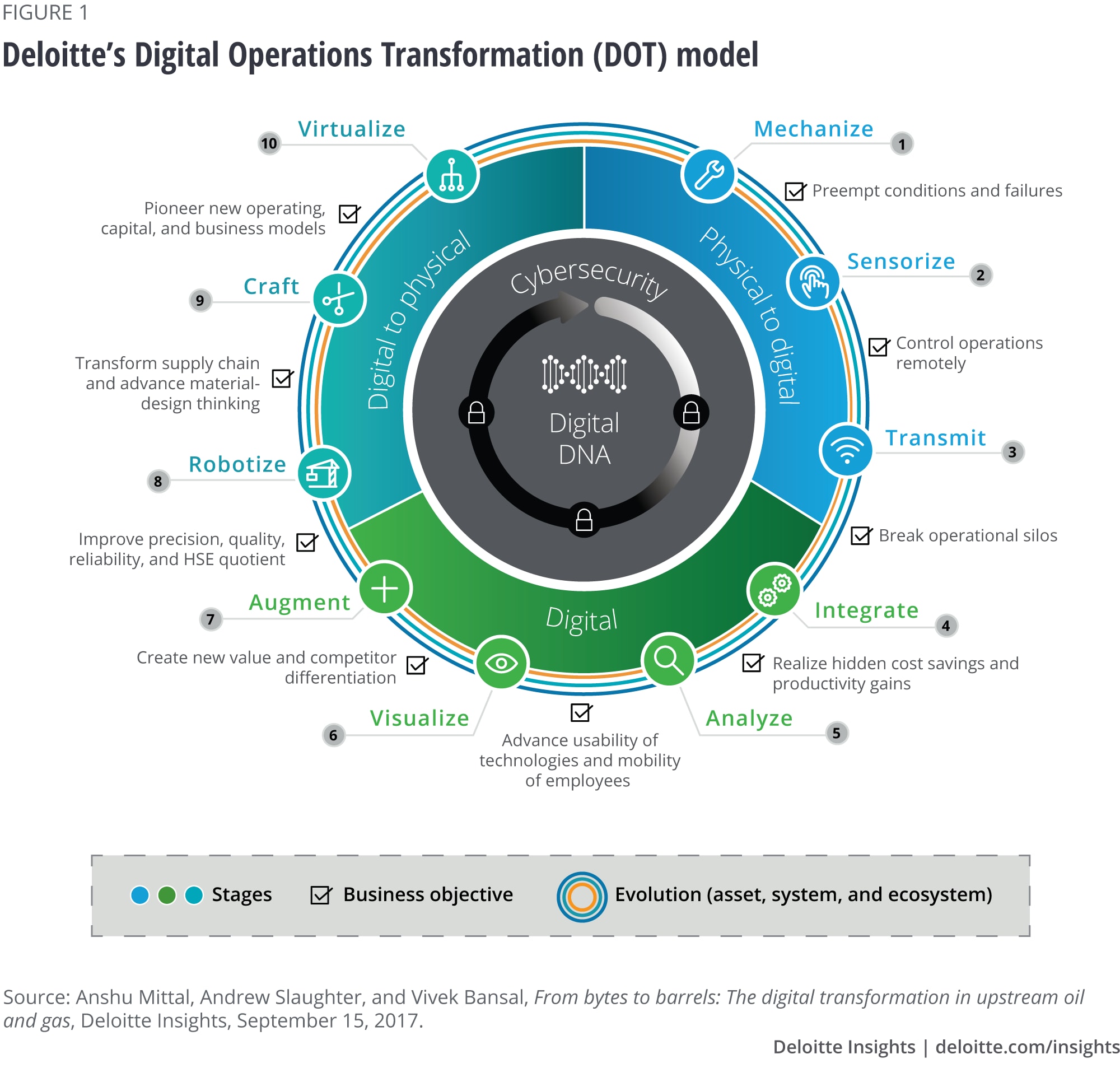

Getting started on the digital journey would require companies to conduct a detailed digital assessment at an operation level using a comprehensive model. This can be enabled by Deloitte’s DOT model—a framework designed to explain the digital journey through 10 stages of evolution, with cybersecurity and digital culture at the core (see the sidebar, “Deloitte’s Digital Operations Transformation (DOT) model”).

Deloitte’s Digital Operations Transformation (DOT) model

Deloitte’s Digital Operations Transformation (DOT) model is a road map—a digital journey of 10 milestones, where the leap from one milestone to another marks the achievement of specific business objectives, and puts cybersecurity and digital traits at the core. Although the journey technically completes at stage 10 for an asset or operation, it must be broadened and started again to include a wider set of assets or business segments, the entire organization and, ultimately, the ecosystem of a company, including supply chain and external stakeholders. A comprehensive cyber risk management program that is secure, vigilant, and resilient (read Protecting the connected barrels) and an organization’s DNA that would enable this transformation remain at the core of the model. For more details on the model, please refer to the article From bytes to barrels: The digital transformation in upstream oil and gas.

Formulating a digital transformation road map for midstream companies

Charting a digital strategy that can engage midstream strategists typically requires a narrative that focuses on assets or the value chain and then aligns the operational objectives with digital technologies. While acknowledging that the variability of business units and time frame to execute digital initiatives would differ from company to company, this paper outlines the digital transformation road map at an aggregate value chain level, that is, starting from gathering to processing, and finally, to storage. Although each operation is critical and needs a digital focus, we have highlighted only one key operation under each aspect of the value chain, so that the methodology and implications can be discussed in detail.

At an overall level, storage operations seem digitally ahead of other midstream operations. A focus on safety and efficiency has likely helped storage operations, while a legacy asset base and upstream volatility have generally restricted other operations from reaping the benefits of digital technologies. Even within these operations, some are digitally ahead, while some are still catching up—within storage, for instance, terminal operations are much more mature than tank management systems.

Gathering line systems

Gathering line systems, the first receiver of hydrocarbons before they are processed and transported, is at an emergent stage of sensorizing in the DOT model. Operators typically record only pressure and volume data available from the LACT (Lease Automatic Custody Transfer) units as there tends to be a limited appetite to sensorize such a huge network; even the limited access to rights-of-way can act as a barrier to install sensors. Limited sensing capabilities on the gathering network are also reflected in the fact that many critical tasks such as leak detection are done using linear balancing equations such as negative pressure wave, real-time transient models, and corrected volume balances.13

Limited data capabilities were acceptable during the early shale-growth era where operations and infrastructure planning were more linear and predictable. However, greater uncertainty stemming from a more diverse and dynamic shale development has shifted the focus from tapping growth to managing complex operations with notable product variability and extracting maximum value from existing infrastructure for all stakeholders. This could be key as product composition varies depending on the well and there are usually no density measurements available to the supervisory control and data acquisition (SCADA) from each well.14 Further, production variability in shale basins due to economics and market conditions are leading either to stranded assets or under capacity—during the lowest point of the oil downturn, Bakken production was 25 percent below its previous high, while the Permian continued to register record high volumes.15

A digital leap to the analytics stage by clearing the data generation and integration bottlenecks could allow companies to tackle these challenges. Innovations in the field of sensors for trunk lines could certainly guide gathering operators to tackle data generation challenges—a key could be to define data relations to draw meaningful insights. A US-based service provider is enabling this transition by first assimilating diverse data sets on a virtual server, then allowing users to define physics-based relations or calculations, and finally running auto-tuning algorithms to refine the results using non-physics-based concepts. Apart from bare minimum functions such as leak detection and batch optimization, this model can predict optimal operational parameters, simulate properties of products, and illustrate characteristics of zones with any potential issue.16

Apart from operational excellence, network optimization through analytics can enhance capacity utilization and provide a competitive advantage to line operators by maximizing netbacks of exploration and production (E&P) companies. To enable this, four North American operators are leveraging a solution based on the GE Predix platform that integrates operational and economic aspects of production, transportation, storage, contracts, etc., and then allows users to run scenarios in a virtual collaborative environment. This allows network planners to add/edit the network lines or hubs in the existing map and then see the ultimate economic impact on basin production and gathering lines.17 Further, these can be augmented with more data and behavioral analytics to get answers to questions such as:

- Are the logistics hubs well-located?

- Where is the best site to install a new production line?

- What multimodal solution should be adopted?

- What is the optimal trade-off between bearing extra operational cost vs. investing to build infrastructure?

Trunk lines

The deployment of sensors and communication networks is a prerequisite for trunk lines, an operation where computational monitoring via PVT (pressure, volume, and temperature) analysis, controller monitoring via SCADA systems, and scheduled line balance calculations are a regular affair.18 Of late, this segment has fast progressed to an advanced sensorizing stage in the DOT model as companies are trying to enhance their response strategy during an incident. For instance, some companies are now deploying unmanned aerial vehicles (UAVs) to take readings at sensitive pipeline points using thermal, infrared, light detection and ranging, and multispectral sensors in real time.19 Although new pipelines are often pre-equipped with such technologies, there is a significant opportunity to upgrade legacy infrastructure and even generalize sensor deployments throughout the pipeline network rather than sensing only key junctions.

Some results of these efforts to monitor pipelines were evident from the fact that despite the number of overall pipeline incidents remaining flat in 2017, incidents causing significant damage to people or the environment were down by 20 percent.20 Undoubtedly, these are encouraging results, but is this enough for the industry? A huge base of legacy infrastructure requires companies to follow a proactive approach to not only enhance asset integrity but also optimize their core operations. This appears to be of the utmost importance in the current market scenario where companies are trying to fund growth capital while preserving their balance sheet. According to recent estimates, effective prediction of leakage incidents could avoid a potential cost of nearly US$30 billion per annum for US pipeline companies; such savings could fund almost 50 percent of the midstream capex required by 2030.21

Further, obsolete SCADA systems, legacy tools and technologies with limited integration capabilities, and an increasing trend of migrating pipeline management tools to online platforms are exposing the industry to potential cyberattacks.22 In 2018, many US midstream companies witnessed a cyberattack on their Electronic Data Interchange (EDI) system, which is used to encrypt, decrypt, translate, and track key energy transactions.23 Many times, such incidents are downplayed as the work of hackers, but the potential severity of a cyberattack cannot be underestimated—in an incident reported by the US Department of Homeland Security, hackers had enough operational data of 23 pipelines to blow up their compressor stations simultaneously.24

To address these challenges, companies could consider a digital leap to advanced analytics and visualization, so that engineers can better pinpoint the potential hazards in their pipeline network. For instance, Enbridge worked with a leading technology company and Finger Food Studios to first integrate 132 discrete sets of pipeline data (collected by in-line inspection tools, strain sensors, LiDAR remote sensors, etc.), along with terrain information, to create a 3D rendering of the pipeline network by processing the vast quantity of data in real time. This allowed them to predict and visualize the zones where potential hazards, including dents, cracks, corrosion, and strain, may occur, as well as track the parameters (geological and operational) responsible for risks to integrity.25

Such innovations may seem essential, but since there are competing cash priorities, a good approach could be to invest in solutions that create value from existing data using advanced algorithms. For instance, a service provider is helping companies implement a vigilant as well as a resilient cyber strategy by copying data from an existing SCADA network and running continuous algorithms on it to establish baselines and detect anomalies in real time.26 Similarly, a consortium of pipeline companies is working with a vendor to develop a platform where they share their complete historical pipeline data and proprietary algorithms allow them to predict when and how a failure may occur on their pipeline segments.27 Solutions such as these don’t add latency, require less capex, and, most importantly, are easily scalable.

Terminal operations

Terminal operations, a continuous system of process controls and operational procedures to facilitate the storage and delivery of products, is at an intermediate stage of data integration in the DOT model. An unremitting focus on quality, safety, and efficiency, while executing a vast number of orders, has always motivated companies to record and feed all possible data points to control centers—a typical medium-size terminal has more than 1,500 transfer operations a day, and countless sub-operations.28 High penetration of enterprise resource planning (ERP) tools has also allowed companies to integrate relevant data sets and effectively automate many aspects of lease contracting, inventory and cargo management, maintenance, etc. However, a siloed implementation strategy has created islands of automation, which now require a difficult integration process to eliminate the risks associated with piecemeal solutions.29

Integration of various systems can be crucial for operators as terminals are becoming increasingly complex and the disjointed pace in the supply and demand of products is posing complex operational challenges.30 The aspect of becoming digitally equipped is important in the current market environment where terminal companies need to create new business value for themselves and gain a competitive edge. Opportunities from trends such as increasing oil export options for the United States, volatile price differentials within the United States and globally, and increased spot buying of LNG can be best enabled by terminal integration with markets. The financial benefits of such efforts could be understood from the fact that a US-based service provider was able to deliver a 4 percent reduction in operating expenditure and a 3 percent increase in capacity by running elementary analytics on core terminal data.31

To realize this business value, companies should first bring a coherence in internal operations through effective integration and then quickly move to the augment stage of the DOT model. A global supplier of aviation fuel worked with a leading US technology and manufacturing firm to tackle the challenge of product traffic management, volume measurement ambiguity, and unplanned scheduling by integrating all the key systems such as batch controllers, access control units, and SAP/ERP systems. Further, the company augmented this system by adding aspects such as demand fluctuations, folio reconciliation, and product transfer and exchange agreements to add flexibility in responding to volatile market changes and scale operations as required.32

Such solutions could extract the most value from specific scenarios, but even better would be to have a digital solution that augments the behavior in any possible scenario by running self-learning algorithms on huge data sets. Some LNG companies along with a European vendor are attempting to unlock new business value by first assimilating terminal operations with data on spot prices, vessels, potential delivery port, tides and weather, contractual obligations, operations and maintenance costs, open buy/sell contracts, etc., and then using its proprietary supply chain optimization algorithms to find the most profitable action in any possible situation.33 Such cognitive analytics can enable terminal and fleet operators to turn idle asset time into opportunity, manage disrupted schedules due to market constraints, seize spot opportunities, and understand the exact financial consequence of day-to-day business decisions.

Embarking on a long-term digital goal

Data-driven insights to enhance midstream operations should deliver considerable operational gains to midstream companies, but embracing digital solutions during the pipeline planning and construction phase can actually lessen the high capital intensity of the industry. About 48,310 miles of pipeline projects worth US$310 billion are in the planning/construction phase as of mid-2018. According to some estimates, effective project execution could bring down these projects’ construction cost by over 20 percent.34 In fact, the gains could be a lot more as high-cost inflation factors such as labor, survey, engineering, and overheads can be reduced using digital technologies.35

To realize such gains, companies could consider exploring the digital-to-physical loop of the DOT model where they can make an impact on the physical state of the assets. This leg of the digital road map would require companies to leverage augmented robotics to efficiently lay down pipelines; adopt advanced crafting techniques to high-grade pipeline parts and optimize logistics cost; and virtualize assets for effective planning and execution. As an industry that is at an early stage of digital maturity, the aspect of digital-to-physical may seem ambitious. However, some small cases and initiatives in recent years suggest that the industry is making headway in this direction.

For example, a robot named Ryonic Armadillo has been designed with advanced sensing and imaging capabilities to survey any sort of rough or underground terrains.36 Similarly, a Chinese additive manufacturing company is working for CNPC to explore if electron beam manufacturing can be commercially done for large pipelines and its components. Apart from the established benefits of 3D printing, this project aims to ensure that there is no residual stress on the crafted parts.37 Further, a consortium of companies and research institutions in Europe have combined 3D printing and robotics to develop a prototype model called BADGER that can trench/drill the path, while simultaneously 3D printing and laying down pipelines.38 For now, this initiative is focused on gas and water lines, but once commercialized, it can be replicated for O&G gathering lines.

Apart from efficiently constructing assets, notable capital gains can also be realized by standardized planning and designs and operational decision-making. This can be enabled by developing a digital thread and then developing a digital twin of the entire system using information such as drawings, models, materials, engineering analysis, dimensional analysis, manufacturing data, and operational history. A twin model can ensure that vendors stick to established baseline designs; provide high-end prescriptive analytics once the project is complete; optimize the existing assets by suggesting ways to extend their life; and enhance the retrofit strategy. Although most midstream players are still scratching the surface in terms of virtualizing the assets, firms such as Enbridge and Plains Canada are exploring ways to combine this with their ongoing digital efforts.39

Planning for a digital future

As soon as companies are able to complete the loop of the DOT model at an asset or business unit level, they should consider scaling it to the company and, then, to an ecosystem level. A gradual succession of digital efforts would often make a lot more sense for midstream players as they typically have a limited pool of money to invest. Every completed loop would add clarity to the digital road map and could reveal new operating and business models for a company.

While planning a long-term digital road map, companies should consider the fact that failing in a digital transformation effort is as easy as it is to get fascinated by the benefits of technological solutions. Digital transformation is generally a multiyear playbook that requires continuous calibration and multilevel communication, rather than a one-time investment. To enable this, midstream companies, along with their vendors and investors, should consider incorporating the below-mentioned digital traits to benefit the entire ecosystem.

Companies

- Cultivate new and different pools of talent: Accelerate the transformation process by using talent as a catalyst to innovate and collaborate in a way that can fundamentally drive outcomes of digital efforts.

- Drive digital deployment from the board room: Realize that true transformative benefits of digital typically demands commitment from the board level and establish the role of the CIO and data managers.

- Address common challenges, together: Avoid sub-optimization of digital investments by ignoring legacy asset base and come together as an industry to address asset integrity issues by collaborative, not competitive, learning.

Investors

- Reward digital efforts: Realize the low-risk profile and potential upside of digital investments and promote them in parallel with investments on volume or throughput growth.

- Bring in their expertise: A broader pool of investors, especially tech-savvy private equity firms and institutional investors, could help management envision, plan, and execute long-term, technology-driven transformation.

Vendors

- Build on existing workflows: Make the best use of already standardized process flows (or data) and focus on integration and visual elements of analytics to possibly give midstream strategists a feel of technology (e.g., collaboration rooms).

- Balance aspirations and needs: Maintain a balance between cutting-edge innovations that can drive differentiated value and nonintrusive, low-cost solutions that generally deliver quick ROI and build confidence for mass acceptance of digital.

Appendix

The mapping of each midstream operation on our Digital Operations Transformation (DOT) model is based on extensive secondary research on the process flows and study of some of the latest solutions and technologies provided by major automation and software firms.

Further, the near-term digital leap is defined based on the objectives that most of the companies are trying to achieve from their respective operations. These business objectives were established by the detailed examination of recent corporate presentations of various US and global firms. Further, they were aligned with the stages in the DOT model by developing and analyzing an inventory of research on new digital solutions that are being implemented or planned for various midstream operations.