Where do you fit in the new digital ecosystem? has been saved

Where do you fit in the new digital ecosystem? An overview of the trends shaping the technology, media, and telecom industry

02 April 2016

Over the last 30 years, in a constantly shifting environment, TMT companies have struggled to gain solid ground, aiming to ride the trends of digital evolution and navigate the resulting disruption. Better understanding the underlying trends is key—as is comprehending the digital ecosystem as a whole.

Introduction

So much is changing, so fast, in technology, media, and telecom (TMT) that it can be hard to grasp. From almost any vantage point, it’s increasingly difficult to understand your place in a network that is rapidly growing both larger and more complex, and to clearly identify the sources of value creation today, much less tomorrow.

And it’s not hard to find examples of TMT companies—and even entire sectors—damaged by a failure to understand and adapt to a changing industry landscape. Smartphone companies disrupted prominent mobile handset makers, which are still struggling to catch up. Many established enterprise software providers, late in adapting to cloud-based models, lost significant market share to software-as-a-service firms.

So this article aims to demystify the trends shaping what we call the digital ecosystem, to show the trends’ direction and how they intersect; we look at what’s behind today’s value shifts and offer a structured way to view these trends. In presenting a new framework—based on analysis of ecosystem companies over 30 years and interviews with TMT strategists—our goal is to help you anticipate and leverage the trends with the goals of competing successfully and staying relevant.

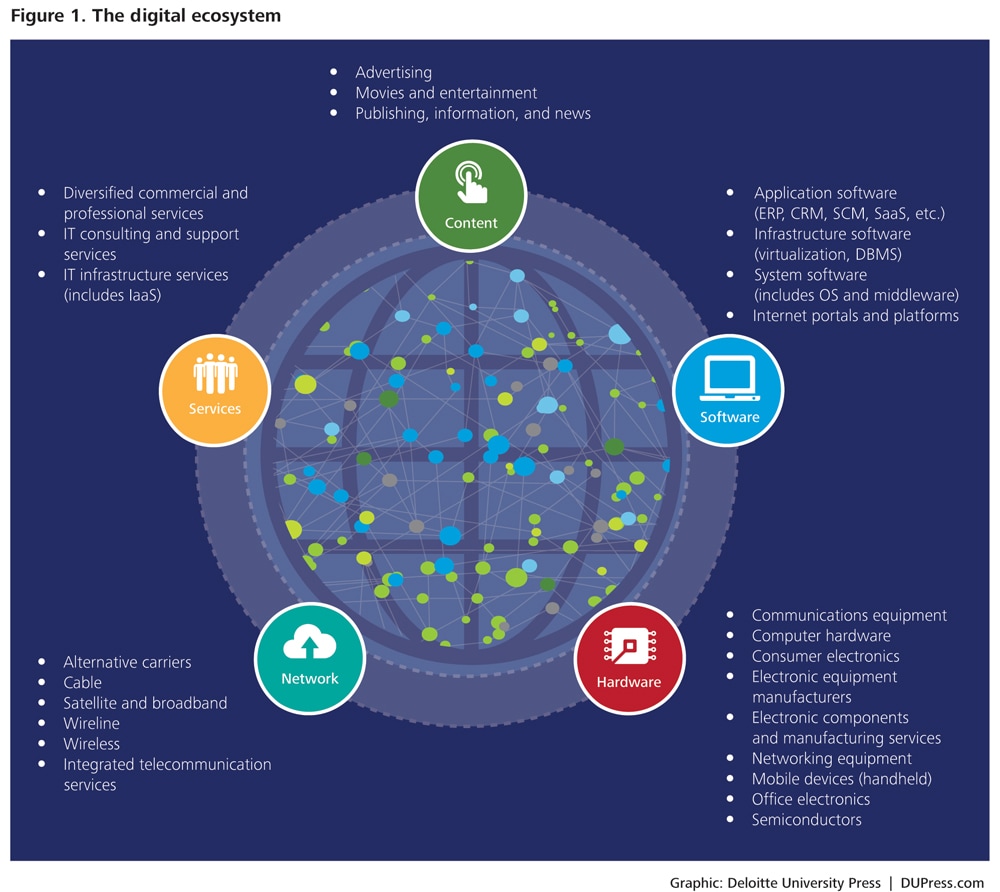

What is the digital ecosystem? It’s a subset of TMT companies that specialize in the development of hardware, content, and software applications and provide a platform for the creation, distribution, and consumption of content, applications, and services. Deloitte’s TMT practice sees these companies as comprising an ecosystem by virtue of their complex interrelationships and their collective impact on a wide range of customers. For example, taxi aggregators—through the use of mobile apps, delivered over wireless networks to mobile devices—have swiftly transformed the private transportation sector. And over-the-top content providers have been able to aggregate, curate, and provide content to end customers by leveraging cloud infrastructure over wireline and wireless broadband networks—which, in turn, has impacted the way network companies capture and retain value.

Digital trends are reshaping TMT businesses in a variety of ways, unsettling their environments and forcing constant reevaluation of strategies and forecasts. Understanding the digital ecosystem, and the trends within it, is critical for forward-looking executives struggling with, for instance, whether and how to use technology to differentiate their company.

Methodology for classifying digital ecosystem companies into sectors and segments

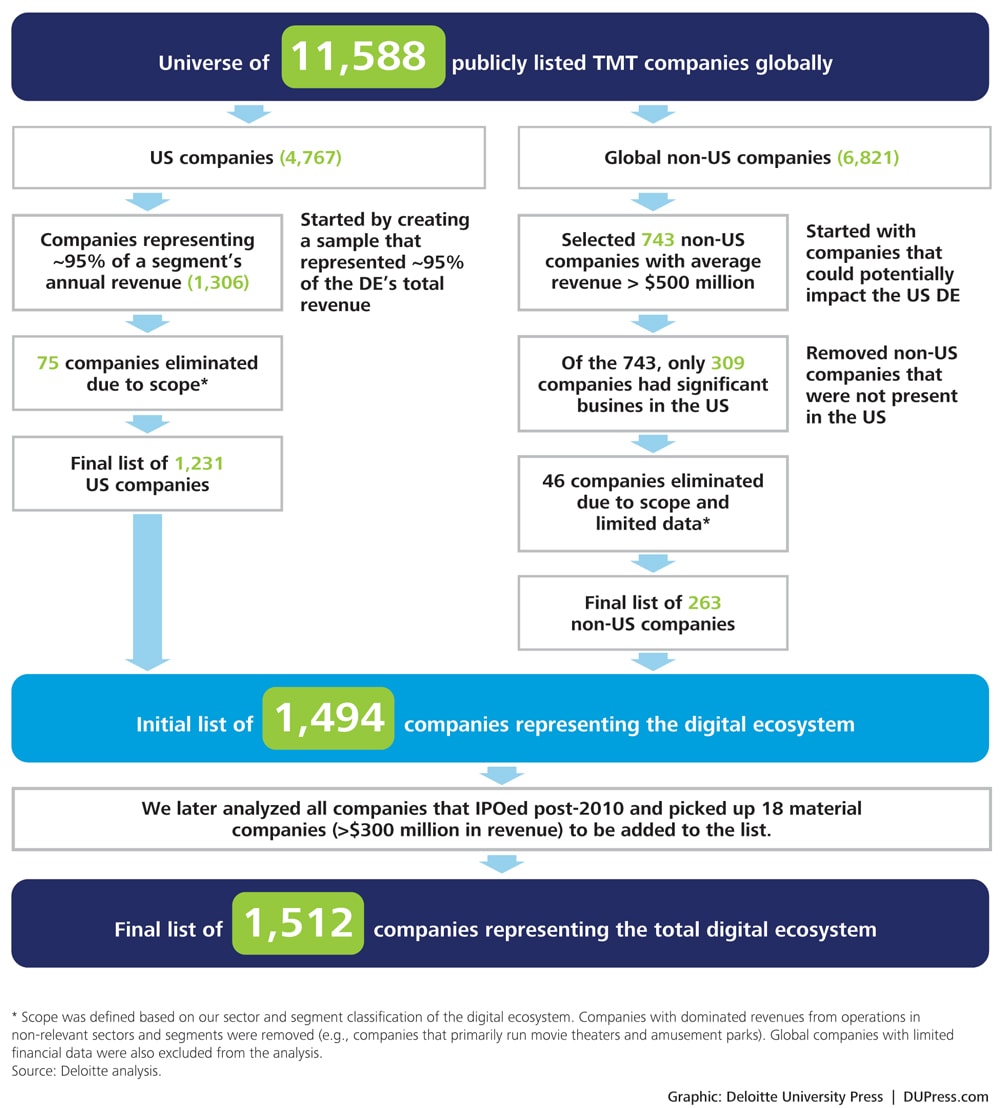

The digital ecosystem comprises a vast universe of TMT businesses that provide a broad range of products and services. We began with a set of more than 11,500 TMT companies from the CompuStat database, applied a down-selection methodology (see the appendix) that resulted in a final set of 1,512 companies, and used S&P’s Global Industry Classification Standard to classify these TMT companies into 25 mutually exclusive segments. To study the impact of technology and business structure shifts, we then grouped these segments into five sectors: content, software, hardware, network, and services (see figure 1.) We used the CompuStat database to pull the financial data for these companies for the period 1980–2013. The companies are either based in the United States or generate significant revenue from the US market. We assigned companies competing in multiple sectors/segments to a single dominant sector/segment based on their largest revenue-generating business. To support our classifications, we also performed primary research (subject-matter expert interviews) and secondary research (industry reports and case studies).

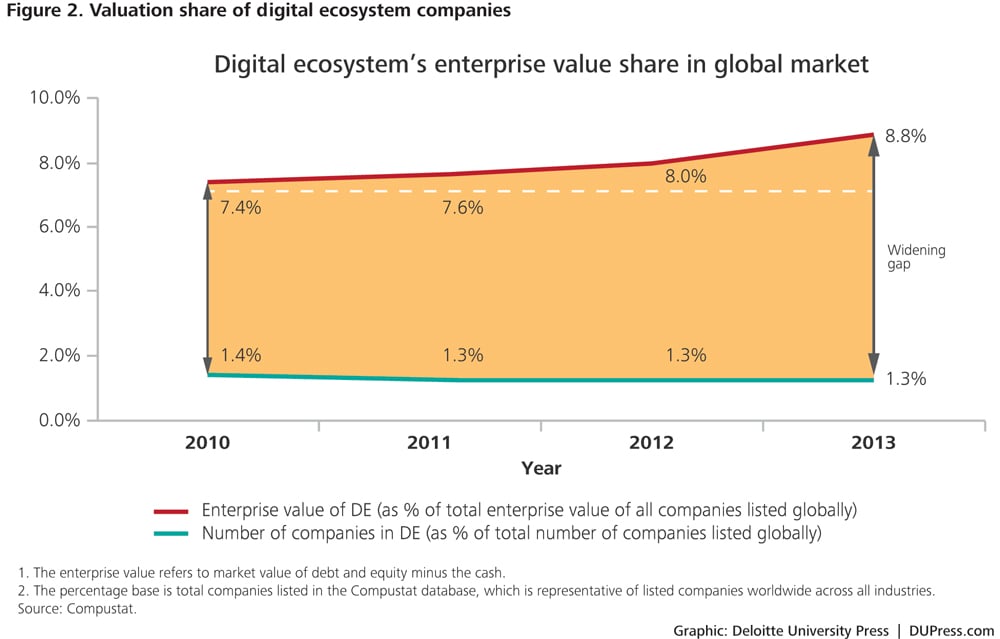

The businesses in the digital ecosystem are disproportionately strong: Though just over 1 percent of all globally listed companies, they represent about 9 percent of global enterprise value. In recent years, investors have driven up ecosystem companies’ share of global enterprise value from 7.4 percent in 2010 to 8.8 percent in 2013 (see figure 2).

Ecosystem companies, beyond driving innovation within the TMT sector, are transforming industries and becoming a breeding ground for competition more broadly. For example, Amazon, a company within the digital ecosystem, has disrupted retail, and some large retailers have responded by opening innovation labs staffed by teams of engineers.1 Google and Apple Inc. are laying strong technology foundations on which other industries, including automotive and financial services, are building.2

Value creation in the digital ecosystem

The digital ecosystem is driving value along three tracks: creating new sources of revenue, rationalizing cost structure, and enhancing the speed of technology adoption.

Creating new sources of revenue: In recent years, the digital transformation has introduced a number of new revenue streams and, by forcing a change in business models, has already begun disrupting industries and companies. Financial services and retail are digitizing their market offerings, such as digital payments and e-commerce platforms, and health care, automotive, energy, education, and government are on track to follow similar digitization efforts, aiming to generate top-line growth by leveraging digital technologies.

Rationalizing cost structure: For established businesses, increasing digitization has lowered costs through improved internal business processes such as sales, operations, and supply chain management. For start-ups, open innovation and pay-per-use services have lowered the entry barriers. And for many participants inside and outside the ecosystem, these trends have reduced both investments to replace assets and the scale of capital investments necessary for success. Digitization is also enabling intelligent automation, which can enhance both effectiveness and efficiency and help drive down costs.

Enhancing the speed of technology adoption: Through smart bundling and innovative products and services, companies are creating new avenues to bring aboard new technology more swiftly. The rate of adoption is increasing, as technology capabilities are reinforcing and creating a virtuous circle of value while lowering the risk of adoption; this is happening due to incremental and fast learning as well as faster access to information. Companies are also creating multiple touchpoints to engage customers, increasing the utility of their products and services and giving customers more reasons to use them.

What trends are shaping each ecosystem sector?

To see which forces TMT companies will harness for value creation in the coming years, it’s important to understand the rise and fall of the sectors within the digital ecosystem (see figure 4), and how different trends have affected each sector. As the ecosystem migrates beyond its core sectors and industries, these factors will, independently or through their linkages, likely have significant impact on TMT companies.

Figure 4

From 1980 to 2013, the hardware sector’s revenues rose just 5 percent CAGR, barely matching the entire ecosystem’s overall growth. This sector’s sluggish performance can be attributed to its commoditization, fueled by virtualization technologies and a fall in the cost of hardware, resulting in a shift in value to the software layer.

Over the years, storage and computation costs have plunged as computation power has dramatically increased,3 meaning that companies need less—and smaller—equipment. In the 1980s and ’90s, PCs, networking equipment, and semiconductors were key; the last decade has seen exponential growth in mobile devices, as affordability and utility increased for end customers. Combined with ubiquitous network coverage, Internet protocol, and high broadband speeds provided by advancements in wireline and wireless technology, miniaturization has paved the way for the connected world we see today. Internet of Things (IoT) and smart-city applications are likely to be the next major sources of value from the digitized and connected world.4

The software sector has seen explosive growth over the last three decades, primarily driven by infrastructure software in the late ’80s to early ’90s, system software in the ’90s, and, in the last decade, applications software. Cloud-based “everything-as-a-service” (XaaS) business models that include software, platform, and infrastructure have begun to drive value, with each segment showing high growth potential.5 The performance of application software is fueled by the democratization of software, which, using its array of development platforms and open-source technologies, has led to lower capital expenditure requirements and faster time-to-market.

In our research, we calculated that over the last 13 years, the software sector’s Internet portals and platforms segment revenue grew at a CAGR of 23 percent; it now contributes close to 40 percent of the sector’s overall revenues. Google, Amazon, and Facebook exemplify how the digital ecosystem’s scope is expanding beyond core technology sectors into shopping, marketing, and the digitization of everything. Software is helping businesses generate incremental revenues by leveraging advancements in data and analytics to gain critical business intelligence and insights. Businesses are starting to build a better understanding of customer preferences, helping them to adapt their products and services and develop new ways of engaging with customers on multiple platforms. The more things get connected and personal and the more enterprise data gets digitized, the more critical security becomes at all levels: applications, networks, and devices.

As the key trends discussed above mature further and interlink with each other, new opportunities and value will be created. It is important for TMT executives to dig further and gain a better understanding of the trends that have recently been driving the evolution of the ecosystem, so as to be able to make sensible bets on the future.

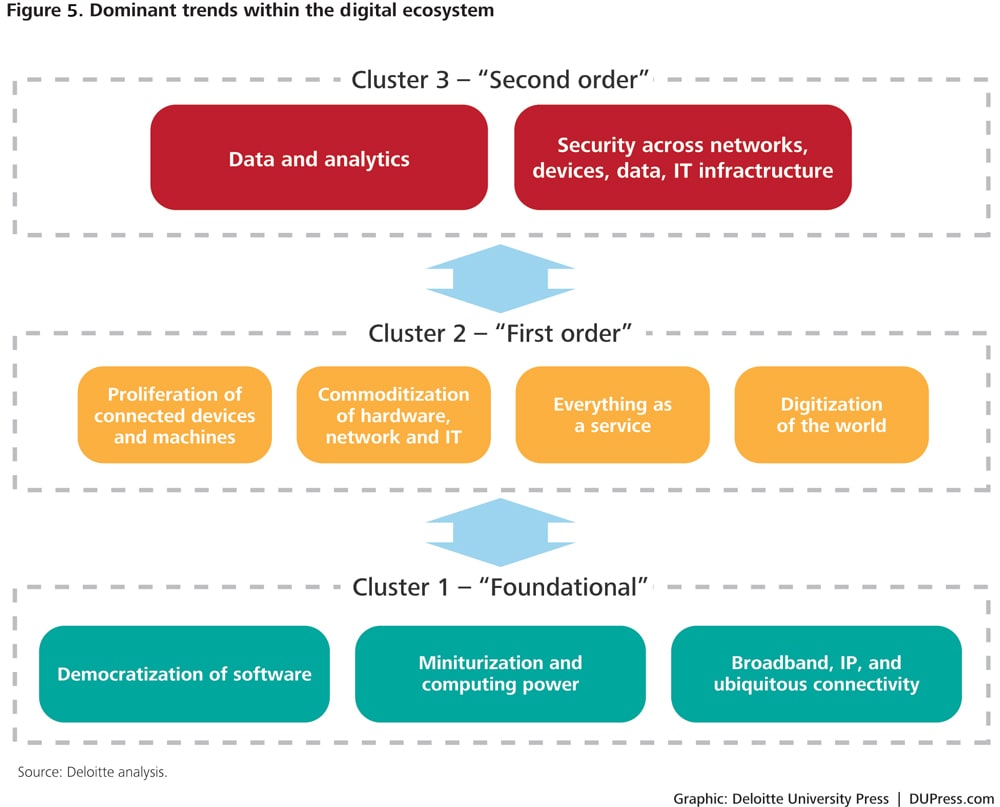

On the basis of our research on how these trends originated, we categorized the trends into three clusters: foundational (bedrock trends that led to others’ emergence), first order (those emerging from foundational trends), and second order (those that emerged from first-order trends). The categorization is helpful in assessing each trend’s impact on different businesses; it may also help in understanding how one or more trends enabled the emergence of another wave of value creation in the digital ecosystem (See figure 5.) Even though trends in any particular cluster primarily emerge from the layer below, further growth will likely be due to bi-directional influence. For example, the proliferation of connected devices was possible only after network connectivity became omnipresent. However, after attaining a certain scale, proliferation forced network providers to invest in providing increased bandwidth and better speed.

The following section examines the trends from the bottom up, with a focus on how each plays a role in the creation or destruction of company value internally and externally, as well as inside and outside of the ecosystem. As such, this section highlights how companies can capitalize on a trend to identify potential revenue sources, reduce costs and capital investments, and drive customer value—the three wheels of modern-day businesses.

Foundational trends

We classified three trends within the foundational cluster: “democratization of software,” “miniaturization and computing power,” and “broadband, IP, and ubiquitous connectivity.” Since these trends have long been prevalent, we will give only an overview of how they have shaped the industry and how companies have responded to these trends in the past.

Developers are creating open-source algorithms such as application programming interfaces (APIs) to interact with other applications to create product offerings that are better, faster, and cheaper. Open-source libraries of capabilities such as APIs have democratized software development. Software can now be “assembled” by customers or boutique software players, as opposed to a large “enterprise software company” alone. For example, application vendors use telecom APIs to benefit from customers’ location data that they possess.6 APIs also foster a smoother flow of information between customer touchpoints and back-end systems, enhancing overall customer experience—consider how Alaska Airlines uses APIs to create a richer mobile experience for its end consumers and employees.7 These APIs also track usage patterns, helping companies determine avenues for future investment.

Miniaturization has enabled mobility by bringing the processing power of PCs to mobile devices. Riding the wave of miniaturization, semiconductor companies have developed new designs and architectures to make processors smaller, faster, and more power-efficient. Miniaturization has reduced the size of computing devices at price points acceptable for mass-market adoption; a user can plug one of these powerful portable devices into any display and use it as a PC.8

IP interconnections and broadband availability have sparked a phenomenal rise in Internet adoption worldwide. Mobile networks are now beginning to play a bigger role and have already connected 3.8 billion subscribers globally,9 with this subscriber base likely to increase as we move to successive generations of technologies. This wave of ubiquitous connectivity is disrupting other industries as well. mHealth services, for example, can provide real-time remote medical diagnostics by transmitting ultrasound images and scans directly to mobile phones via SMS, MMS, and email.

The trifecta of foundational trends, either independently or in conjunction with each other, has enabled the digital revolution we are experiencing. Recent concepts such as blockchain, the IoT, and artificial intelligence are possible because of the development in these foundational capabilities over the last 50 years.

First-order trends

We identified “proliferation of connected devices,” “commoditization of hardware and IT,” “everything as a service,” and “digitization of the world” as the key trends that gained prominence as direct beneficiaries of the foundational trends. Each of these factors continues to exert influence inside and outside the digital ecosystem.

Proliferation of connected devices

In a multi-device world, consumers demand seamless integration,10 and it is only a matter of time until this need transcends smart devices to connect with other devices at home or at work. IoT applications will drive the next wave of growth in connected devices, linking machines with other machines and people to take automatic actions utilizing information captured through remote sensors. The introduction of IPv6 is also fueling growth in connected devices.11

FitBit and GOQii are examples of innovation within connected devices.12 While wearables are gaining fast adoption, other IoT segments such as automotive technologies, smart cities, and home automation will likely be bigger business in the long run. Connected cars represent another emerging area, paving the road for self-driven vehicles, as companies try to develop safer and efficient transportation models.13 Advances in IoT infrastructure, along with consumer adoption of the technology, will lead us toward smart cities.

Communication standards suitable for automating low-power end devices at home are still evolving; ongoing struggles over standards are testimony to the value of occupying the central orchestrator role.14 Value from connected devices could be captured by the entire ecosystem of players, including low-power network providers, software platforms that create analytics-based solutions, and integrators that enable the core infrastructure.

What it means for businesses

Creating new sources of revenue: Digital ecosystem companies in the near to medium term should focus on creating specific solutions such as smart home appliances, smart energy meters, and telematics services as opposed to selling core capabilities in the market. In the long term, they could form an integrated ecosystem by partnering with traditional suppliers, system integrators, and other key participants.

Rationalizing cost structure: Connected devices can help enterprises save costs through automated processes that can be monitored remotely, often without human intervention. These can also improve supply chain traceability, sales force optimization, and so on.

Enhancing the speed of technology adoption: To foster greater adoption and maximize value capture, companies should address the utility, price, security, and privacy concerns of enterprises and end consumers using real-time data logging. They could use new technologies built on existing technologies already adopted by customers.

Commoditization of hardware and IT

Virtualization has been one of the biggest factors driving the commoditization of hardware: As hypervisors—virtual machine managers—made the OS independent of the underlying hardware, servers lost differentiation. Many companies are abandoning branded hardware in favor of low-cost hardware sourced from different vendors.

IT services are also facing commoditization, driven by XaaS, cloud, and democratization of software. The next wave of commoditization is happening within networks: In software-defined networks (SDNs), software controls the bandwidth allocation and direction of traffic flow, and it optimizes the overall network infrastructure off of commodity hardware rather than custom switches.15 Such networks have become an existential threat for networking hardware giants, which, as a result, have begun investing in programmable switch lines supporting OpenStack and distributed data storage.

What it means for businesses

Creating new sources of revenue: Companies should create embedded software for their underlying hardware; this can aid development of custom solutions that can act as key differentiators. Companies could also provide their hardware “at cost” and drive revenues through their software ecosystem.

Rationalizing cost structure: Companies can reduce manufacturing complexities and operational cost by producing fewer hardware models, using licensing to customize and unlock certain product offerings. Companies should continue to aspire for a lean IT footprint to reduce upfront set-up costs and employ pay-per-use services to keep down operating expenses.

Enhancing the speed of technology adoption: Enterprise customers should use virtualization to decouple network functions—such as network address translation, firewalling, domain name service, and caching—from proprietary hardware appliances so they can run on software. Decoupling can become an enabler for end customers’ adoption and could be leveraged to better customize and optimize infrastructure.

Everything as a service

The world is racing toward everything as a service (XaaS), which encompasses not only software and hardware but also areas such as data management, business process management, and content.

The proliferation of XaaS is augmented by underlying foundational trends that enable enterprises to connect and work with multi-tenancy, become location- and device-independent, and enjoy rapid scalability. XaaS’s pay-per-use and on-demand model can not only reduce capital requirements—it helps in rapid implementation, cost predictability, agility, and balanced ROI. All of these combined make XaaS a potential disruptor to current business dynamics and open up avenues of value creation.

XaaS finds applications in industries as diverse as health, insurance, education, and relief and disaster management. Pearson, for example, has started building global hybrid infrastructure to develop web-based educational products to reach out to global markets.16 HealthHiway, an online health information network based in India, has connected more than 1,100 hospitals and 10,000 doctors, facilitating improved medical services at a low cost.17

XaaS is emerging as the overarching structure for an end-to-end business process management—that is, managing business processes from their conception and design to implementation and adoption. Many pure-play software and hardware companies are shifting to cloud services to stay relevant. In fact, Fortune Global 500 organizations such as Amazon, Cisco, and a few large operating-system providers are beginning to offer suites of software, platform, and infrastructure rather than single services.18 As the product being sold changes to a service, the future will likely force industry incumbents to redefine their business models. This includes revisiting product strategy, pricing strategy, maintenance and support structure, and performance indicators.

What it means for businesses

Creating new sources of revenue: Large enterprise software companies could migrate to XaaS to generate new revenues and to accelerate revenue generation; this could open up a new opportunity to provide pay-as-you-go service offerings for the booming small and medium enterprise market.

Rationalizing cost structure: Companies could adopt asset-light models in favor of reducing operational costs in their interactions with suppliers and customers.

Enhancing the speed of technology adoption: Many enterprises now prefer subscription-based models to make it easier to consume technology on lean devices. This typically provides the much-needed agility for which businesses are constantly vying. However, lack of asset ownership may result in reduced customer confidence owing to security and privacy concerns. Hence, digital ecosystem companies should build a trusted brand in certain industries such as finance and health care to help drive adoption.

Digitization of the world

Digitization is a potential megatrend that, enabled by foundational-level trends, encompasses all other key trends and plays a major role in their manifestation. In a world shaped by connected devices and ubiquitous broadband coverage, the digitization wave is radically changing the way businesses conduct operations and how they interact with customers, suppliers, and stakeholders. Apart from the obvious efficiency gains, this is leading to lowering of entry barriers in various industries, as digital assets have started to replace traditional physical assets.

Digitization is pushing industry incumbents to pursue innovation and disrupt their own business models before competitors do. Numerous examples illustrate the lesson of “adapt or die”: Canon, for instance, recently began adapting its product line to counter the challenge from smartphones, including building cameras that connect to the Internet and run social apps.19 Plenty of industries have lost the digitization battle or have struggled since, offering cautionary examples.

Digitization will not likely remain just a differentiator but, rather, could become a means to stay relevant, and as more and more industries get subsumed in this wave of digitization, business agility will become a necessary survival tool.

What it means for businesses

Creating new sources of revenue: Just as media digitization replaced core physical goods, the next wave for TMT companies is to digitize and automate business processes. This will enable companies to engage with customers through multiple mediums, as well as gain unprecedented amounts of data about their preferences, potentially leading to customer insights that can be monetized.

Rationalizing cost structure: In an effort to reduce costs and competitive response time, companies could use digitization both internally (processes) and in their product/service portfolio.

Enhancing the speed of technology adoption: Consumers are swiftly adapting to the digital environment, embracing its convenience and utility. Companies should now endeavor to digitally engage customers, suppliers, partners, and employees, using an ecosystem approach to further increase adoption. This approach will require focus, change management, and reimagining business possibilities.

Second-order trends

Emerging from the first-order trends, “data and analytics” and “security” are gaining prominence, as companies within the digital ecosystem master the digitized business environment.

Data and analytics

Big data and data science have become a competitive necessity. With the surge of social media, digitization, connected devices, and sensors, vast amounts of data from different sources—each offering unique context—can now be gathered and converted into insights. These data-driven insights will help companies tailor their operations in terms of what is sold, how it is delivered, how to capture the consumer surplus, and how to effectively serve customers and partners. Depending on demand and inventory, Macy’s Inc. adjusts its pricing for 73 million items on a near-real-time basis. Using data transportation demand and supply data, Uber monetizes peak-demand times through its surge-pricing model.20

We are at an early stage of the evolution of data and analytics; over time, we will see more precise and near-real-time insights. The need to derive such insights has led to the emergence of data discovery platforms—indeed, the changing market landscape has prompted the traditional business-intelligence tool providers to offer their own platforms. Inspired by the success of as-a-service models, several companies have started offering analytics-as-a-service as well. Innovation, long the driving force in transforming businesses, often now materializes from aggregating and analyzing data to create new products and services.21

What it means for businesses

Creating new sources of revenue: Financial and telecom companies could use advanced analytics and cognitive technologies on the wealth of customer data they already have to identify revenue opportunities. In addition, they could explore selling data and related insights to third parties, while addressing any privacy concerns.

Rationalizing cost structure: Companies could use analytics to identify operational inefficiencies and reduce costs by optimizing supply chain processes, use of available resources, fraud detection and churn, and risk modeling.

Enhancing the speed of technology adoption: With an increase in the volume and type of data that is theoretically available but not readily accessible for analytics and insights, companies can work toward increasing adoption of big data capabilities and solutions if they focus on data harmonization and preparation across multiple environments for their customers.

Security across networks, devices, data, and IT infrastructure

Increased digitization has made organizations vulnerable to numerous security threats, as cyber crimes become more creative and collaborative. While the monetary and legal implications of such breaches are obvious, the loss of confidence of customers, employees, and other stakeholders may well be a deeper concern. The last several years have seen hackers strike any number of retailers, TMT companies, and government agencies, with the resulting security breaches costing terabytes of internal data, millions of dollars, and a large measure of user and customer trust.

Security strategies must move beyond the era of stand alone defense systems to include the broader spectrum of prevention, detection, response, and recovery. Many CIOs believe security to be a major roadblock to the adoption of shared infrastructure such as cloud services. Further, companies cannot secure everything equally. Hence they need to identify the most valuable and risk-sensitive assets and protect them.22

What it means for businesses

Creating new sources of revenue: As the world moves toward more shared infrastructure, security concerns are bound to increase. Companies could offer security services both as a differentiator and as a paid service within and outside the digital ecosystem.

Rationalizing cost structure: Enhanced security can potentially help companies save costs arising from data theft and recovery. It can also help companies minimize losses arising due to business disruptions and damage to the brand.

Enhancing the speed of technology adoption: “As-a-service” companies should invest in enhancing the security of their solutions to address CIO concerns and encourage increased adoption.

The three-wheel framework—and what’s next

With digital innovations driving changes at every stage of business, from boardrooms to factory floors to retail outlets, TMT companies face unprecedented disruption—and competition, since reduced capital expenditure requirements have lowered entry barriers, making it easier for small businesses and start-ups to innovate, enter the market, and grow. We have designed this framework to make the digital ecosystem more manageable and understandable, helping to put your business in context (see figure 6). In short, we’ve tried to sketch out the ecosystem’s vibrant and dynamic nature, the key trends that continue to shape it, and what it means for businesses.

Our follow-up paper aims to help TMT executives identify the architectural shifts rocking the TMT industry and describe their importance and evolution. Along with offering more actionable insights and specific examples, we will look at companies’ current strategies to create or capture new opportunities arising as a result of these shifts. The more comfortable you are with the digital ecosystem, the less likely you might be to be disrupted.

Appendix

We used the CompuStat database of 11,588 publicly listed TMT companies to come up with our list of digital ecosystem companies. These 11,588 companies were divided into 4,767 US companies and 6,821 global non-US companies.

US companies:

- 1,306 companies representing 95 percent of the total annual revenue were shortlisted.

- 75 companies were eliminated due to the scope of our study.*

- A final list of 1,231 US companies was populated.

Global non-US companies:

- 743 companies with average revenue over $500 million were selected that could potentially impact the US digital ecosystem.

- 309 companies having significant business in the United States were then selected.

- 46 companies were eliminated due to scope and limited data.*

- A final list of 263 global companies was populated.

18 companies were later picked with revenues over $300 million that had their IPO post 2010.

Hence we arrived at a total of 1,512 companies representing the digital ecosystem.

Deloitte Consulting LLP’s Strategy & Operations practice works with senior executives to help them solve complex problems, bringing an approach to executable strategy that combines deep industry knowledge, rigorous analysis, and insight to enable confident action. Services include corporate strategy, customer and marketing strategy, mergers and acquisitions, social impact strategy, innovation, business model transformation, supply chain and manufacturing operations, sector-specific service operations, and financial management.