Governing workforce strategies New questions for better results

11 minute read

15 May 2020

To make bold choices today, leaders need to understand what the future may hold through metrics that can help them anticipate risks, inform strategy, and prepare for the future of work, the workforce, and the workplace.

2021 Global Human Capital Trends

Sign up to receive a copy of our new approach to Trends launching this winter

As workforce strategies and operations have evolved over the past decade, many workforce metrics and governance have not kept pace. Today, new metrics are needed to enable forward-looking insights on every trend shaping human capital if leaders are to gain the perspective they need to be able to anticipate and meet the challenges posed by today’s rapidly changing environment. Organizations must begin to ask fundamentally new questions to find relevant, actionable workforce metrics that can inform bold decisions around critical human capital risks and opportunities, even as uncertainty about the future of work, the workforce, and the workplace remains.

The Readiness Gap: Seventy-one percent of organizations say governing changing workforce strategies is important or very important for their success over the next 12 to 18 months, but only 8 percent say they are very ready to address this trend.

Learn more

Explore the Human Capital Trends collection

Watch the video

Learn about Deloitte's services

Order a copy of Work Disrupted, Deloitte's new book on the accelerated future of work

Explore 5 lessons from the pandemic for the future of work

Go straight to smart. Get the Deloitte Insights app

Create a custom PDF

Current drivers

The demand for new workforce insights is reaching new heights, and it is nearly universal. Ninety-seven percent of respondents to this year’s Global Human Capital Trends survey said that they need additional information on some aspect of their workforce. Despite the fact that our report has issued a call to action on people analytics since 2011, only 56 percent of respondents to this year’s survey said that their organizations had made moderate or significant progress in this area in the past 10 years. And while 83 percent of respondents said that their organization produces information on the state of their workforce, only 11 percent of organizations produce the information in real time; 43 percent said they produce it either ad hoc or not at all.

The pressure to generate deeper insights about the workforce often starts at the highest levels: More than half of our survey participants (53 percent) reported that their leaders’ interest in workforce information has increased in the past 18 months. The desire for better workforce metrics spans a diverse set of needs that mostly focus on the future, with information on the readiness of the workforce to meet new demands the clear leading priority (figure 1).

Several factors from both inside and outside the organization are driving the surge in demand. There is increasing uncertainty about the future within many organizations. One key driver of this uncertainty is the rapidity with which skills become obsolete due to technological and economic change. As the “half-life” of skills decreases, the need for a more dynamic view of the workforce has increased. Another source of uncertainty is the pace at which the nature and composition of teams are changing. As organizations begin to redesign work by integrating technology into teams, they will need to understand the implications for team members and leaders alike in terms of their skills and development needs.

This internal uncertainty is being matched by external pressures as well. As human capital–centered issues—culture, inclusion, leadership behavior, the treatment of workers—become more transparent, their potential for affecting an organization’s brand and financial value has increased. In the past year alone, billions of dollars’ worth of valuation have been lost because of issues related to leadership and culture. Relying on lagging indicators for these types of issues has proven ineffective; investors, boards, and organizational management are looking for predictive metrics to help them gauge and guard against risks that may be growing underneath the surface.

This desire for deeper insights has reached the point where some regulators are starting to mandate greater disclosure on the state of an organization’s human capital. Organizations have generally been slow to publish detailed information on their human capital operations beyond headcount and compensation. Now, regulators such as the US Securities and Exchange Commission (SEC) are responding with proposed revisions to current business disclosure requirements in an effort to incorporate more human capital–related information.1 Companies seeking to enhance how they measure and report on human capital may look to leading frameworks such as the Sustainability Accounting Standards Board (SASB) standards. As these pressures continue to increase, it is critical that organizations update the metrics that are governing human capital in today’s disrupted world.

Tipping point

In the past year, two key regulatory actions have put a spotlight on the growing demand for better information on organizations’ human capital practices. The SEC has proposed modernizing Regulation S-K, which would require public companies to report on a wider set of human capital information such as retention and turnover, productivity, incentives for innovation, and training costs.2 And the SASB Foundation is currently working on a project to assess the prevalence of financially material human capital topics such as labor practices, employee health and safety, and employee engagement, diversity, and inclusion across SASB’s sectors and within its 77 industries.3 The SASB aims to create a market-informed and evidence-based framework that identifies the financially material impacts of relevant human capital management issues, which will enable the assessment of these themes on an industry-by-industry basis.4

Our 2020 perspective

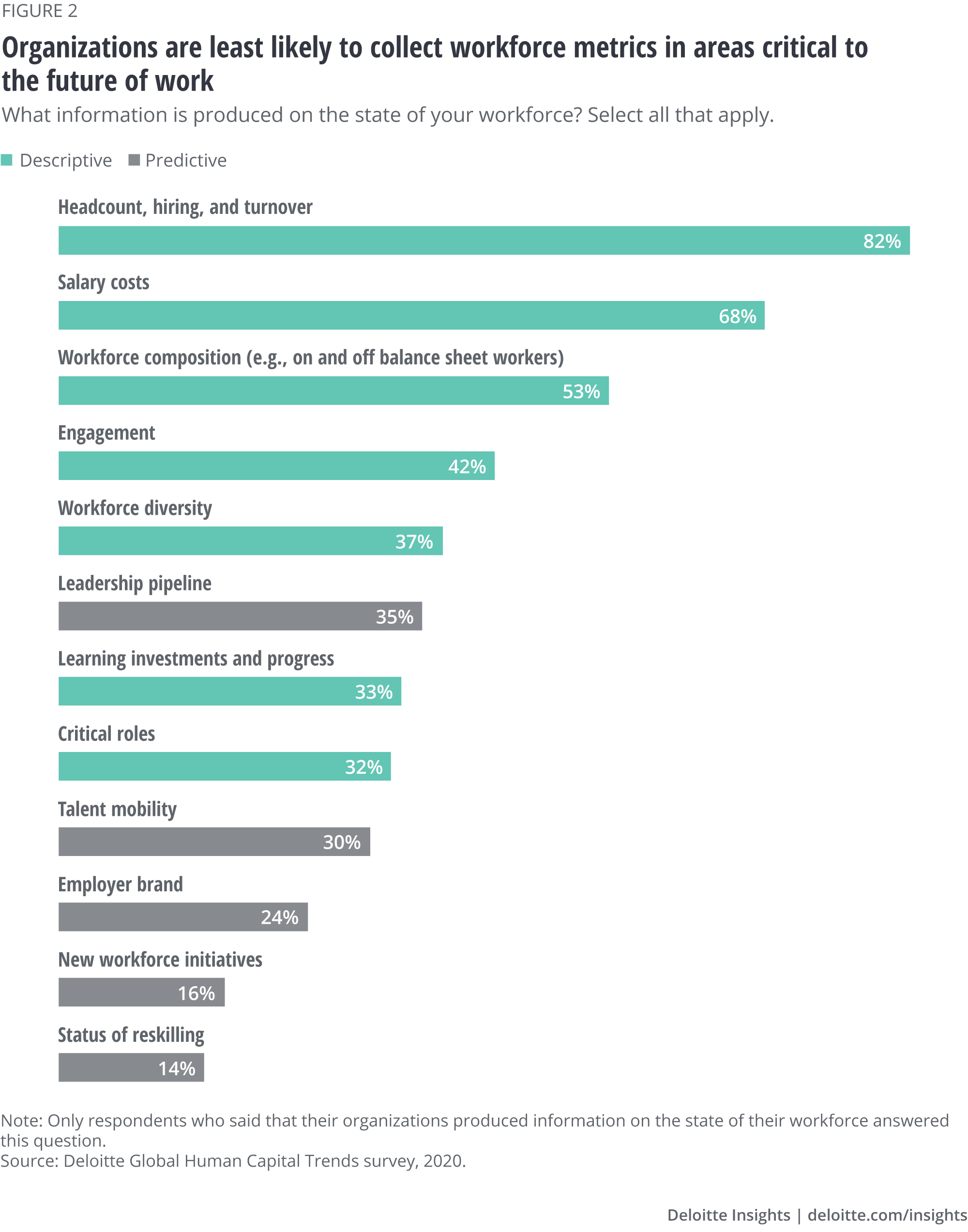

Our survey shows only three areas—headcount, hiring, and turnover; salary costs; and workforce composition—are where the majority of our respondents collect workforce information (figure 2). On the other hand, the areas in which respondents were least likely to collect workforce information—employer brand, new workforce initiatives, and the status of reskilling—are areas that are critical to an organization’s success in the future of work. This suggests that many organizations may not be focusing their workforce data collection efforts where they could be most effective.

Workforce metrics through the years in Global Human Capital Trends

Developing a predictive view of human capital is the next step in the evolution of people analytics that has been gaining momentum over the past decade. Our inaugural report in 2011 exhorted organizations to “move beyond instinct, gut, and tribal wisdom in making workforce decisions,” pointing out that organizations not using data and analytics to manage their talent risked losing their competitive edge. 2012’s “Seeing around corners,” 2013’s “Thinking like an economist,” and 2014’s “Talent analytics in practice” continued to track organizations’ sometimes halting progress toward developing robust people analytics capabilities—which, as we described in 2015’s “People data everywhere,” were beginning to be augmented by the availability of external as well as internal organizational data. By 2018, organizations’ increasing sophistication in people analytics was enabling them to do far more with their data, prompting us to caution readers, in “People data: How far is too far?,” not to neglect the ethical and security concerns related to the expansion of worker data and analytics. But people data, as we discuss in this year’s chapter, can only get organizations so far if they fail to ask the right strategic questions. The challenge for organizations today: to find new questions and new workforce metrics that can illuminate a path forward for leaders in an uncertain world.

What is needed to make progress? Many survey respondents believe the biggest barrier is technical: 52 percent said that the lack of systems to produce data prevents them from getting the information they need to understand the workforce moving forward. However, this perception may not be accurate. More than 130 providers offer access to externally available HR data,5 and technology has enabled organizations to collect more workforce data than ever before. Organizations looking to better understand their employer brand can draw new insights through technologies, including those that scrape employee review data, analyze trends in hiring and attrition, or assess the language used in external communications for potential biases. Organizations hoping to understand the effectiveness of their workforce initiatives can use new organizational network analysis tools to help understand workforce connections and sentiment analysis tools to help understand worker attitudes. And new technologies can support reskilling efforts by helping organizations baseline the skills in their workforce today (by augmenting internal employee data with externally available data) and understand their strengths and weaknesses when it comes to competitive advantage.

We believe the core issue is actually foresight and creativity, not technology. Many organizations are stuck in outdated ways of thinking, recycling the same old metrics that have been around for years. The challenge is not getting the data but finding the right strategic questions to ask.

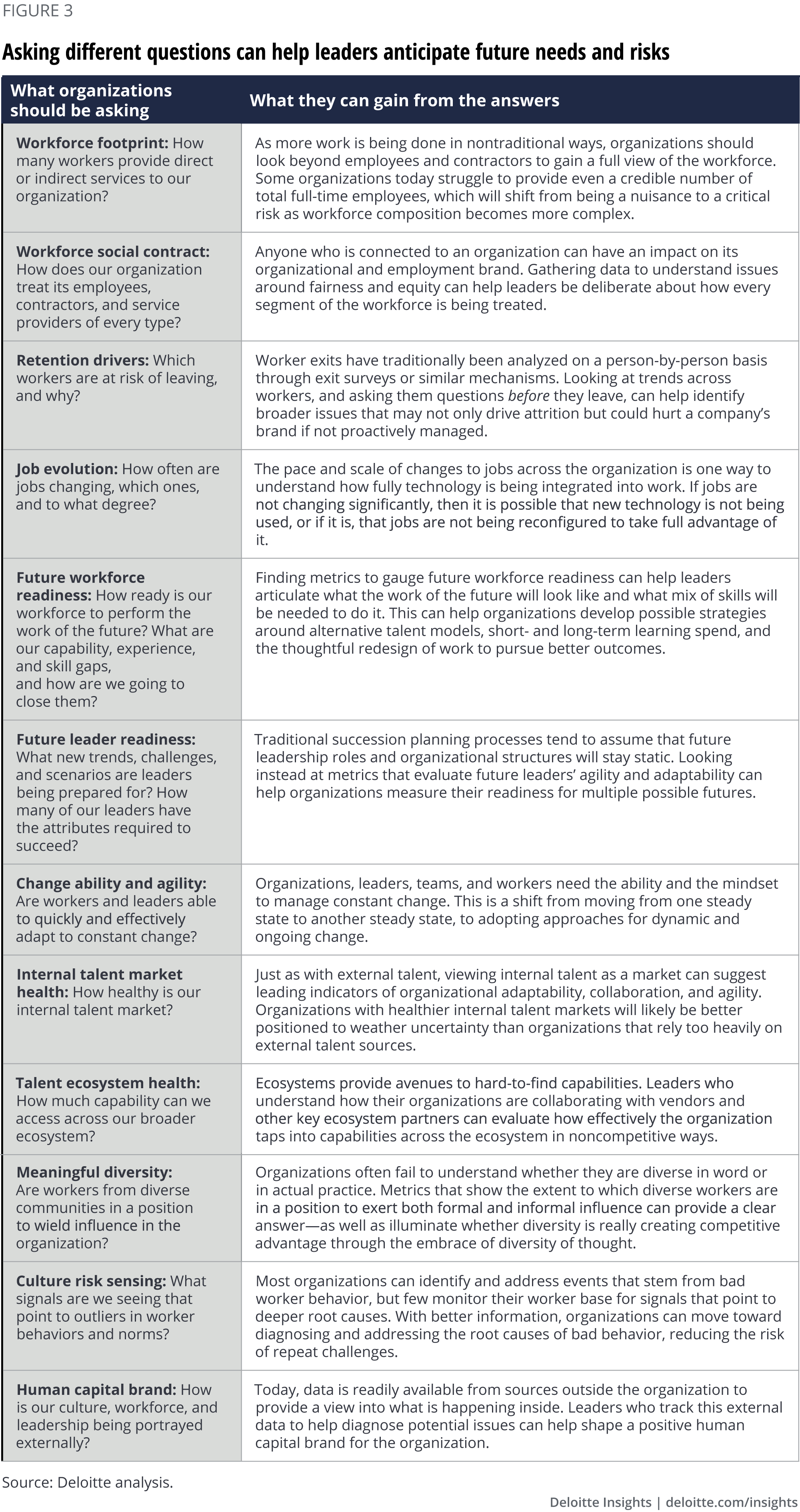

To identify metrics that can govern and guide 21st-century workforce strategies, organizations need to determine what questions can help them navigate the future effectively, not just more fully report on the past. We give a sampling of these kinds of questions in figure 3—questions whose answers can empower leaders to meet uncertainty head-on with insights that can inform decisive action.

Learning by example

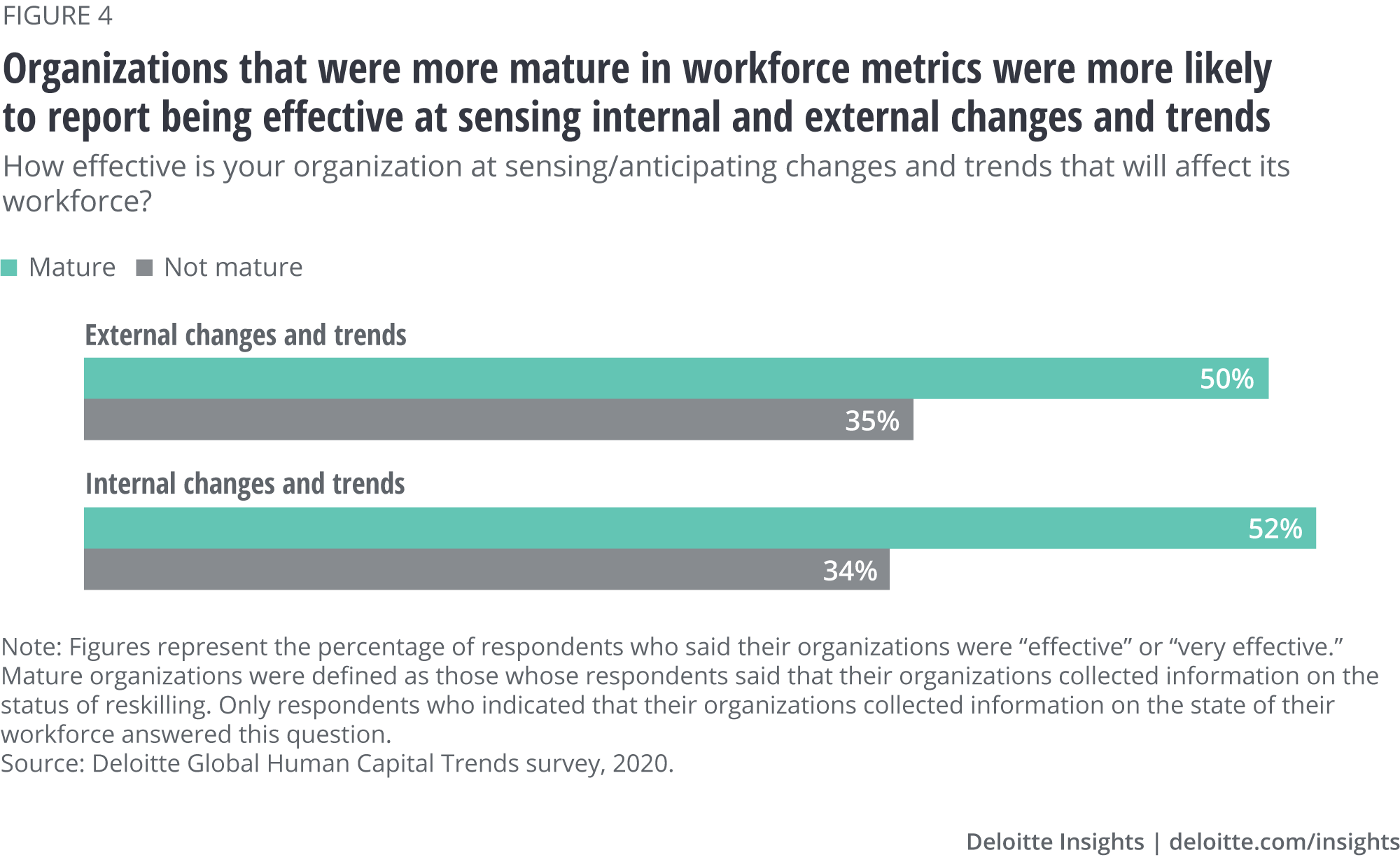

Early signs suggest that organizations using forward-looking workforce metrics are reaping benefits. The leading organizations on workforce metrics in our survey,6 which are about twice as likely as the rest to report on issues such as talent mobility, learning investments and progress, new workforce initiatives, and critical roles, are also more likely to say they are effective at anticipating both internal and external changes that will affect their workforce (figure 4).

In some cases, organizations may develop specialized metrics to help better understand specific aspects of the workforce. For example, Ageas, an international insurer, has created innovative ways to measure executives’ readiness to lead technology transformations. First, the company established a technology readiness index framework to quickly assess their leaders’ technology readiness and abilities. Then, it created a 10-minute assessment, the “technology quotient scan” (TQS), that produces individualized reports for each leader detailing their technology “hot spots,” providing personalized learning recommendations, and recommending content to deepen their expertise. At the enterprise level, Ageas uses TQS data to understand their workforce’s overall digital readiness in each division or region, identifying where they are most prepared to adopt new technologies.7

Organizations can also enhance workforce insights by combining data from various sources. At Lufthansa, for instance, the workforce transformation team developed a workforce readiness “radar” that integrates traditional HR data, future of talent data, and future readiness skills data. The radar, which shows which jobs are more or less likely to be affected by digitization, offsite or hybrid work, or new contract types, allows the team to visualize which departments and functions are most likely to experience disruption, which enables the company to prioritize future of work planning and transformations. In a successful pilot implemented in its revenue steering department, Lufthansa used the underlying data to optimize job descriptions for future needs and establish plans for workforce reskilling.8

Finally, the most advanced organizations are pairing new technologies with data and analytics expertise to look at human capital information in new ways. Mastercard, in an industry known for its advanced analytics expertise, recognized that it could benefit from integrating its people analytics teams with its broader organizational capability to stay on top of emerging analytics trends. To this end, the company has developed new partnerships between its strategic workforce planning and people insights team and other parts of the organization. In one example, the people analytics team worked with the company’s AI Garage team to analyze more than 17,000 performance review development cards. The resulting insights helped inform Mastercard’s skills taxonomy and helped leaders better understand strengths and development areas in different workforce segments, guiding more focused talent acquisition and upskilling strategies. Mastercard’s ability to leverage its broader analytics expertise in its approach to human capital management has allowed it to better understand the organization’s human capital “health” and, by moving from descriptive to predictive and prescriptive analytics, respond and react to cultural signals more effectively. This in turn has helped Mastercard’s leaders enhance both the organization’s readiness for action and its external employer brand.9

Pivoting ahead

Over the last decade, the conversation on HR data and analytics has expanded to include internal and external data, privacy and ethical concerns, and a range of workforce issues that are essential for boards and C-suites to understand. This year, the bar has been raised once again. The road ahead includes a focus on technology, but it also includes an enhanced focus on foresight, creativity, and how organizations manage the use of data to develop future-oriented, actionable workforce insights. The imperative is clear: To make bold choices today, leaders need to understand what the future may hold through metrics that can help them anticipate risks, inform strategy, and prepare for the future of work, the workforce, and the workplace.

© 2021. See Terms of Use for more information.

Explore the collection

-

Knowledge management Article4 years ago

-

Superteams Article4 years ago

-

The postgenerational workforce Article4 years ago

-

Designing work for well-being Article4 years ago

-

Belonging Article4 years ago

-

Introduction Article4 years ago