But even with more money squirreled away, many respondents don’t know what they should do with it.

Except for high-income earners, all others surveyed said their chief retirement income strategy was to save “as much as possible” for retirement with no specific goals in mind.

And even among the 19% of respondents who say they raised their retirement contributions during the pandemic, many still had no specific end goals.

The problem here is that when goals are this abstract, research shows people often struggle to stick to a plan. And without a clear plan, consumers tend to procrastinate, avoid taking action, or have unfocused prioritization of assets.3

This is a key reason why, right now, financial services firms have a unique opportunity to help US consumers find solid, well-planned paths to savings. With more people aware of their financial shortfalls and the perils of financial instability, FSIs and their intermediaries could step up education programs, teaching consumers how to determine targets to achieve financial stability through goal-setting and helping them find the correct balance between short-term financial needs and long-term retirement savings with appropriate asset diversification.

Timely financial guidance could be the key to expanding retirement savings

Many respondents to our survey have a heightened awareness of financial instability, and they know they need to save more since COVID-19. But they haven’t yet made any changes in how—or how much—they save. Often, this is because they don’t exactly know how to do it.

Indeed, inadequate financial literacy is a big reason for retirement underfunding. This factor was most prevalent among the youngest respondents (28%) who say they aren’t saving enough (or at all) for retirement because they don’t know what to do. And compared to the oldest respondents, the youngest were nearly twice as likely to say they don’t save adequately because they don’t understand how retirement savings work.

FSIs can explore new ways to address financial literacy disparities with more personalized initiatives for demographics that need the most help understanding how to adequately prepare for retirement.

For example, FSIs should be connecting with Generation Z prospects through tools, such as interactive podcasts and infographics, where they commonly live: social media platforms like Twitter, Instagram, TikTok, and LinkedIn. In a recent Deloitte Digital media trends survey, 55% of Gen Z and 66% of millennial respondents say marketing on social media is influential.4 FSIs can focus on the benefits of investing early, even with small amounts, to benefit from the principle of compounding, as well as taking advantage of employer plan-matching. Insurers can also benefit from younger demographics’ interest in gamification. For example, TIAA created a quiz called Square Up Your Savings and Financial IQ at more than 7,000 of its plan participant offices nationwide, which displays gaps in financial knowledge in a competitive way. The millennial employees logged 50% more clicks than other demographics.5

The Deloitte Global survey further highlights how Gen Z respondents were nearly twice as likely (33%) to covet more advice on retirement savings than were the oldest age group (18%). One program, introduced by America Saves, offers young employees a guide to opening accounts, using direct deposit, and auto-saving to teach this segment how to save for both short- and long-term goals.6

Financial literacy challenges also impacted women respondents (39%) more than men (23%). Since the pandemic unfolded, 41% of women surveyed are more aware that they need to save more for retirement, and 19% say they need to save much more. To help bridge this gap, Ellevest7 created a model that targets women who want to get on track with their retirement savings. It offers coaching plans for retirement investing using a hybrid advisory model of robo advisors plus access to live financial advisors.

While capitalizing on heightened awareness with guidance and advice may prompt more consumers to seek help in securing financial stability, FSIs can also continue to employ more established behavioral economics practices, such as forced opt-out retirement plan enrollment and auto-escalation. Vanguard research shows that among new hires, participation rates nearly double to 93%, under automatic enrollment in a retirement plan, compared to 47% under voluntary enrollment.8 It also reveals that participants enrolled in a plan with auto-escalation save, on average, 20% to 30% more after three years in the plan, compared to participants in an automatic enrollment plan that does not automatically increase participant contributions.9 These steps may serve as additional nudges for those who say they don’t know how to save for retirement, because employees only need to act if they’re opting out.

Turning short-term savings into long-term stability

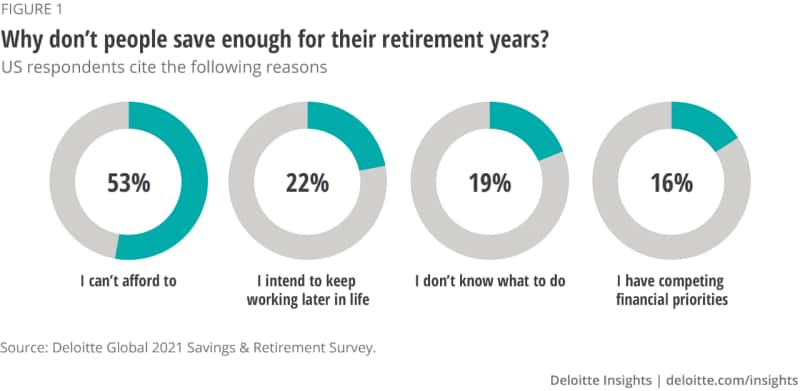

Beyond lack of awareness or simple inertia, not being able to afford to is the No. 1 reason why respondents say they are not confident they are saving enough or have enough saved to be comfortable when they retire.

After experiencing or witnessing pandemic-driven financial shocks or disruptions to income, the survey showed that consumers are now more likely to conserve money for emergencies. In fact, 52% of respondents say they intend to use excess pandemic cash for emergency savings, while 32% intend to hold more money for immediate access to prevent against potential risks going forward.

Some FSIs are already beginning to offer emergency savings accounts as part of their employee benefit packages, which could help improve retirement savings outcomes. Prudential Financial Inc. provides a range of financial wellness solutions, including an omnichannel approach, education programs, digital tools, and individual guidance to address employees’ financial security needs.10

According to a study conducted by Commonwealth as part of BlackRock’s emergency savings initiative, low-income and moderate-income plan participants were half as likely to tap into retirement savings if they had an emergency savings fund outside of their retirement account.11

FSIs can benefit from shifting workforce dynamics by intercepting money in motion

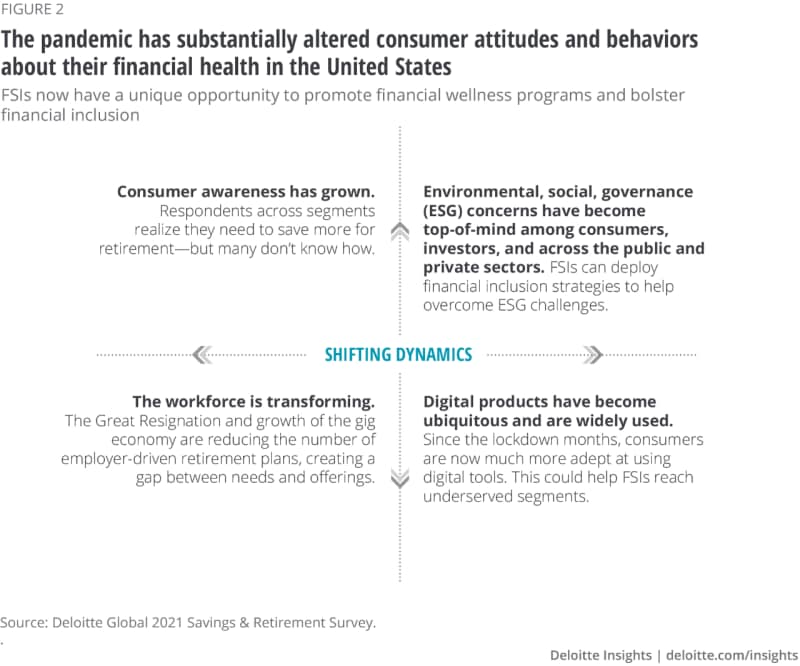

Changing dynamics in the workforce over the past few years may also reshape the retirement savings market and create opportunities for financial services firms. The “Great Resignation” of 2021 resulted in an average of more than 3.95 million workers quitting their jobs each month, the highest average on record in the United States.12 With 56% of US workers having retirement accounts with their employers,13 any mass exodus will likely fuel significant plan rollover, retention, and cash-out challenges.

At the same time, the gig economy—a blend of full-time and part-time workers, short-term contractors, and freelancers—continues to grow. This segment of the workforce encompassed 16% of the US job market in 201514 and experts predict that by 2023, 52% of the American workforce will have spent some time participating in the gig economy.15

As with the Great Resignation, the rising percentage of gig workers means fewer participants are now enrolled in employer retirement plans. According to the Employee Benefit Research Institute (EBRI), nearly one-third of plan participants that switch jobs prematurely withdraw cash from their 401(k) savings accounts within the first year—a trend more prominently seen among younger workers and lower income earners.16

Approximately 40% of respondents in these two segments say they need to save more for retirement since the pandemic. But many may lack the financial acumen to understand what they may be leaving on the table if they cash out their plans when switching jobs. Premature withdrawals can reduce overall 401(k) savings for retirement by as much as 25%, according to the Center for Retirement Research at Boston College.17

To prevent mass rollovers due to shifting workforce dynamics, financial firms may need to develop innovative processes and products. Creating comprehensive financial wellness solutions may improve retention and deter retirement plan rollovers. For example, FSIs could target employees leaving one full-time position for another by linking emergency savings solutions to employer-sponsored retirement plans. If deployed effectively, initiatives like these could even help FSIs grow market share in the retirement space.

For employees switching jobs who want to roll over their savings to their new employers’ plan, FSIs can offer digitally enabled retirement-savings portability options. If broadly implemented over a 40-year period, auto-portability could preserve up to US$2 trillion in additional retirement savings, according to the EBRI.18

Several FSIs are also beginning to develop products that cater to more unique working models. While gig workers can open individual retirement savings accounts (IRAs), in general, tying retirement planning to employment has been found to be much more effective: Americans are 15 times more likely to save for retirement in payroll deduction savings plans through work than they are through IRAs.19 Solutions for gig workers may include flexible pay-as-you-go options or monthly subscription models for savings and investing.

Employers that primarily hire gig workers, such as Uber and DoorDash, are considering proposals to fund portable benefits to provide their workforces access to IRAs. In Massachusetts, these types of employers are backing a bill that would establish portable benefits for app-based drivers.20 Through a partnership with robo-advice firm Moneyfarm, Uber is also offering their drivers access to discounted pension and IRA products.21

The absence of traditional, easy-access, employer-sponsored retirement plans may also necessitate additional education initiatives for gig workers looking to secure their long-term financial stability. U.S. Bank offers goal coaches to help gig workers navigate their unique financial positions.22 In 2021, DoorDash partnered with the National Urban League to launch GoalUp, a website that delivery workers can use to improve their financial literacy. Workers can enroll in online modules on financial topics such as retirement, budgeting, investing, and more.23

Financial inclusion spotlight should prompt more proactive engagement

Consumers, shareholders, employees, and regulators are increasing their focus on the financial services industry’s equity and inclusivity efforts.24 At the same time, more than 30 million US households have limited access to basic financial products and services.25 Our survey showed the top reason why lower income respondents say they don’t save for retirement is because they can’t afford to.

As a result, our lowest income respondents have the least confidence in their retirement savings, compared to higher earners. While the 42% and 40% of the lowest earners say they experienced reductions in income and cash savings, respectively, since the pandemic started, this segment is also most aware that they need to save more.

For financial firms, penetrating low-income segments may not represent a big potential boost in top-line sales numbers in the short term. But according to Deloitte’s recent article, there are many reasons why “doing good” and “doing well” shouldn’t be seen as separate goals.26

In fact, providing affordable and accessible retirement products should help FSIs appeal to socially conscious customers, employees, and investors, promote innovation, and meet the rising expectations of regulators, rating agencies, and environmental, social, and governance (ESG) assessment firms. For the long term, socially conscious strategies could also stimulate opportunities for profitable growth by penetrating new market segments.27

FSIs should be able to provide starter solutions, even for the 64% of lower-income respondents who say they don’t save enough for retirement because they can’t afford to. FSIs can promote easier entry and wider access for those impeded by affordability concerns by offering microinvesting opportunities, for example. Microinvesting allows participants to begin saving in tiny increments, starting small and making every penny count.

Bank of America provides a solution that rounds up payments to the nearest dollar, transfers the difference into savings accounts, and invests that money in low-cost index funds.28 Betterment offers low minimum investment and lower fees to democratize access and promote financial inclusion.29

Expansion of digital footprints may translate into more profitable, inclusive growth

Digital technology can help financial firms achieve financial inclusion goals in multiple ways. The surge of digital options and online footprints created by necessity during the pandemic may help FSIs market, target, and service a broader client base more efficiently, profitably, and effectively.

Lockdowns prompted even the least digital-savvy consumers to turn to online and mobile devices to access products and services. Meanwhile, FSIs across sectors made rapid upgrades to digital systems and processes to maintain engagement with customers and intermediaries. Two years later, the net effect is that many more customers are willing to use digital options, and there are many more options to use now. These developments put FSIs in a stronger position to eventually improve profitability in penetrating and servicing some of the historically less profitable segments and make others less of a loss leader.

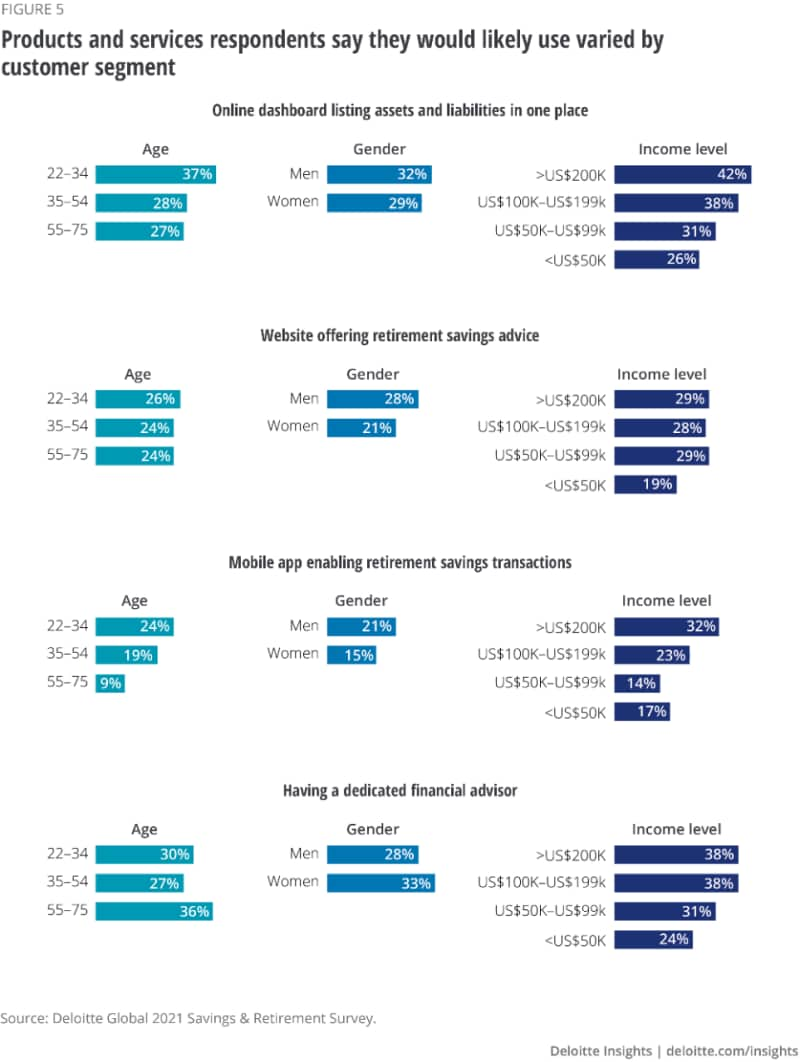

But FSIs will still have to plant some new seeds: Lower earners were least interested among the income segments surveyed in using online retirement-planning solutions (figure 5), which could be due to financial literacy challenges. Higher digital buy-in may require guidance and advice efforts to ramp up financial literacy, which eventually may create more comfort in leveraging digital solutions for independent financial management.