Alternative investment managers are providing a greater number of ESG-aligned strategies as detailed in Form D filings. These filings show that exempt offerings with ESG-aligned themes grew 50% in 2021, outpacing the 33% growth in total Form D filings.24 Private fund offerings aligned with the “impact” theme within ESG, which include opportunity zone funds, surpassed general ESG-themed funds in 2018 to represent the largest percentage of sustainability funds (45%) and remained at the top in 2019 and 2020 (45% and 44%, respectively).25 However, in 2021 a different theme gained traction with alternative investment managers: climate-focused funds. Fund offerings with this theme jumped to represent 27% of all ESG-aligned themes in 2021, up from just 1% in 2020.26 This recent attention given by investors to climate-focused private funds is consistent across other alternative investment products. Much of the focus for recent hedge fund offerings is also related to carbon reduction and the transition to clean energy.27

Alternative investments are demonstrating more ESG specificity than ETFs. This finding is likely due to the qualified nature of alternative investors, which typically have significantly larger portfolios than retail investors. The large differences in portfolio size may allow alternative investors to be more specific and targeted in their ESG approach. However, overall, both the general ESG funds and their more targeted counterparts are experiencing strong growth in both the ETF and alternative investment space.

Adopting a sustainability ethos as a differentiator

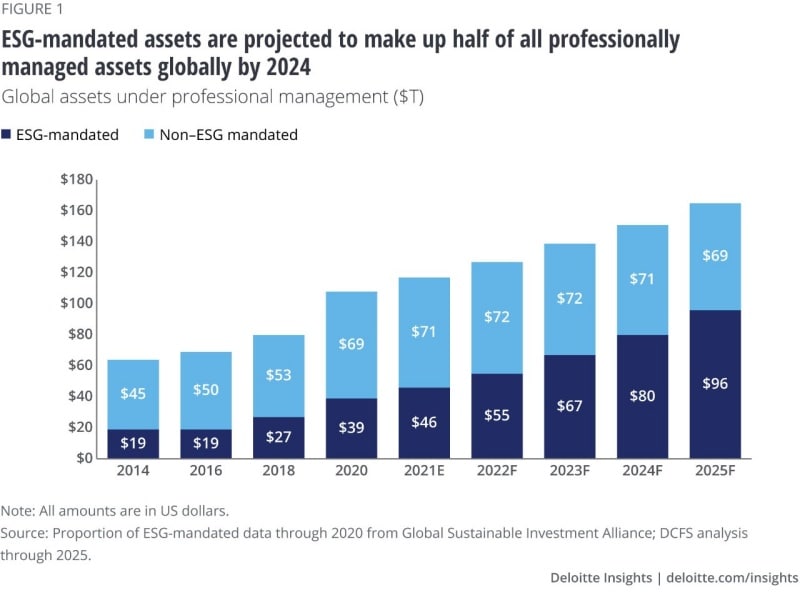

Investment management firms such as Candriam and T. Rowe Price are adding an ESG lens to the investment process and integrating ESG research into the investment decision-making process. ESG incorporation may no longer be a differentiator for investors, but rather a standard input for consideration in the investment decision-making process. Also, regulators around the globe may follow in the footsteps of the EU and require categorization of all funds to help investors more easily determine the level of ESG incorporation. As more and more funds are labeled with any degree of sustainability, it will likely become more difficult for investment managers to stand out from the crowd solely on their product lineup. Moving beyond bespoke ESG products to developing a sustainability ethos within a firm may help align with regulators’ objectives, create credibility with investors, satisfy employees, and ultimately allow a firm to obtain a greater share of ESG-mandated AUM.

Authenticity may provide additional benefits to a firm by reinforcing the firm’s vision and building comradery. As a result, talent retention and productivity may improve as shown in the 2022 investment management outlook. People generally want to work for firms with values that align with their own.28 Disclosing ESG objectives with specific goals at a firmwide level may help drive collaboration across different functions by aligning sustainability goals across functions. Without a cohesive message from leadership, some firms have seen tensions rise between sales and compliance teams as a result of uncertainty surrounding the impact of regulations such as SFDR.29 One solution may be for firm leadership to show a top-down commitment by tying executive compensation with meeting specific ESG targets. Leading firms are communicating their vision and backing that vision with incentives.

As many investment management firms more fully integrate ESG within the investment decision-making process, collaboration between ESG specialists, whose sole responsibilities involve conducting ESG analyses, and traditional portfolio managers will likely become an important component of successful implementation of the sustainability ethos that employees are seeking. Vision and purpose are an important aspect for talent retention and hiring. The financial services industry is currently experiencing high turnover. Data from the US Bureau of Labor Statistics indicates that the September 2021 rate of voluntary separation within the finance and insurance sectors reached its highest level since January 2008.30 Not only are employees today more willing to explore new opportunities, a shortage of investment professionals with ESG skills also currently exists.31 The talent pool of professionals with the necessary skill sets has not kept pace with demand.32 By disclosing their firm’s progress toward its sustainability objectives, investment managers may gain increased credibility with its employees, which may help reduce voluntary turnover.