Modernizing insurance product development Overcoming challenges to make the most of 21st-century opportunities

16 minute read

09 October 2019

While other industries are squarely focused on delivering superior customer experiences, the insurance industry's product development pipeline and processes lag behind. It's time to catch up.

Key messages

Product development modernization is imperative

At a time when exceptional client experience is pervasive throughout most other industries, customer-centricity, speed, and flexibility are becoming necessities in insurance product development. As companies such as Amazon and Netflix raise the bar in terms of customer expectations for products and services that are convenient, fast, and personalized, the insurer of the future will likely need to follow suit. And, for all intents and purposes, that future is now.

Learn more

Explore the Financial services collection

Subscribe to receive related content

Download the Deloitte Insights and Dow Jones app

The good news is that the insurance industry in general, and those targeting the small commercial segment in particular, seem to be coming to terms with this new reality. Many insurers are reconsidering outdated product-driven business models to meet customer experience–driven market expectations.

Easier said than done, though. Time to market and agility remain slow and unwieldy for insurance product development, due to cumbersome regulatory oversight, legacy infrastructure, business unit and functional silos, and long-entrenched processes and culture. The challenge could only increase as the rate of digitization accelerates, consumer expectations keep rising, and traditional borders between lines of business continue to blur.

Interviews with small commercial insurance and InsurTech product development leaders in the United States and Canada revealed a keen awareness of these challenges. However, actual transformation remains slow, even though the focus on modernizing product and service development appears to be high. With new risks emerging, and traditional coverage requiring updates to stay relevant in the evolving landscape, the need for more rapid product development transformation seems to be intensifying.

Insurers will likely be tasked with eliminating or minimizing friction throughout their business models, processes, and infrastructure. This could require revisions to the industry’s traditional ways of doing business, such as the potentially onerous and difficult-to-understand application process small business owners may face when trying to obtain a policy. Instead, insurers should evolve toward creating a more seamless, customer-driven experience that incorporates tailored options and services, which is already table stakes for most other industries. This article looks at a number of tactics insurers may consider to reach these goals, including several already being implemented by pioneering organizations today.

New market realities demand changes in product development

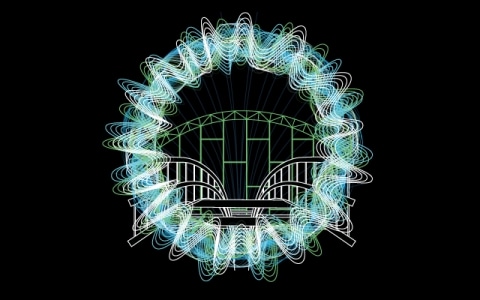

For small business insurers, external dynamics as well as internal company ambitions are the underlying forces driving product development transformation (figure 1).

From an external environment perspective, most consumers now expect service everywhere, at any time, in any channel. They also want products that can be activated or deactivated, as needed, in real time. These were key considerations for insurers looking to modernize their products and business models, according to several small commercial product development leaders interviewed.

One niche-market small business insurance leader believes, “The demand from the small business consumer is, ‘I expect you to have it, I want you to cover me, and I need the information at my fingertips 24/7,’ even in the commercial space.” An executive from a large carrier said, “It’s the user experience expectations of the buyer driving momentum—the changes that are happening around service available everywhere at any time, and the expectations that people have around their ability to procure a product that is more closely aligned to the length of time they may have an exposure versus an annual policy.”

Motivated by competitive pressure from within the industry and nontraditional players’ success in implementing digital channels, even insurers exclusively aligned with intermediary networks are exploring the possibility of offering more self-service distribution capabilities. One insurer said, “I see an increase in demand for ‘give me information’—‘I want to understand this myself’—‘I want to be able to take care of my insurance myself.’”

From an internal company perspective, leaders appear to remain focused on the quest for market share. This is not surprising, given that this segment seems significantly underpenetrated: Forty percent of small businesses in the United States have no insurance at all.1 One insurer opined: “The shift from product- to experience-based models will create more opportunities to gain market share than we’ve seen since the first insurer in the US was established to offer fire policies in the 1700s.”

There was consensus among those interviewed that process simplification and digitization will likely result in lower costs for coverage. One leader from a large insurer revealed: “You start to see opportunities to create protection around those exposures that you wouldn’t have been able to deal with in an analog environment because the cost of providing the coverage may have exceeded the exposure. In a digital environment that changes, and we are starting to figure that out, and that is driving product development pressure.”

Moreover, a broad range of evolving exposures (figure 1) have cropped up, such as cyber risk and a burgeoning cannabis industry, as well as the blurring of traditionally siloed personal and commercial business lines in the sharing and gig economies. Insurers are trying to determine whether and how to capitalize on such emerging opportunities. According to one product development insurance leader, “The changing landscape is creating gaps in coverage which are generating opportunities in product development. Everyone is trying to figure out as we go forward what those policies look like.”

If insurers fail to adapt to meet the demands of emerging industries, they run the risk of seeing more premium dollars shift to alternative markets. Such has been the experience in the property-catastrophe space, where innovation has taken place outside the insurance industry, with substantial market share shifting to the capital markets with the creation of cat bonds and parametric products.

Overcoming frictions to respond to market evolution

With few exceptions, the general consensus among those interviewed is that it usually takes 12 to 18 months to create and roll out a new product, and three to six months to modify existing coverage. In an age of instant gratification and fast-developing markets, these time frames are no longer viable.

Insurers will likely need to eliminate or minimize friction throughout the value chain, from product design through deployment and customer engagement, to respond to customer needs and market opportunities more nimbly and effectively. Making these changes would require internal multifunctional teams to work more seamlessly. Firms might also need to align themselves with external business partners, such as data vendors and service providers, as ecosystems of product and service offerings become more integrated. While product development modernization initiatives may be implemented in tandem or in succession, ideally, they should be prioritized in line with a firm’s overall strategic focus.

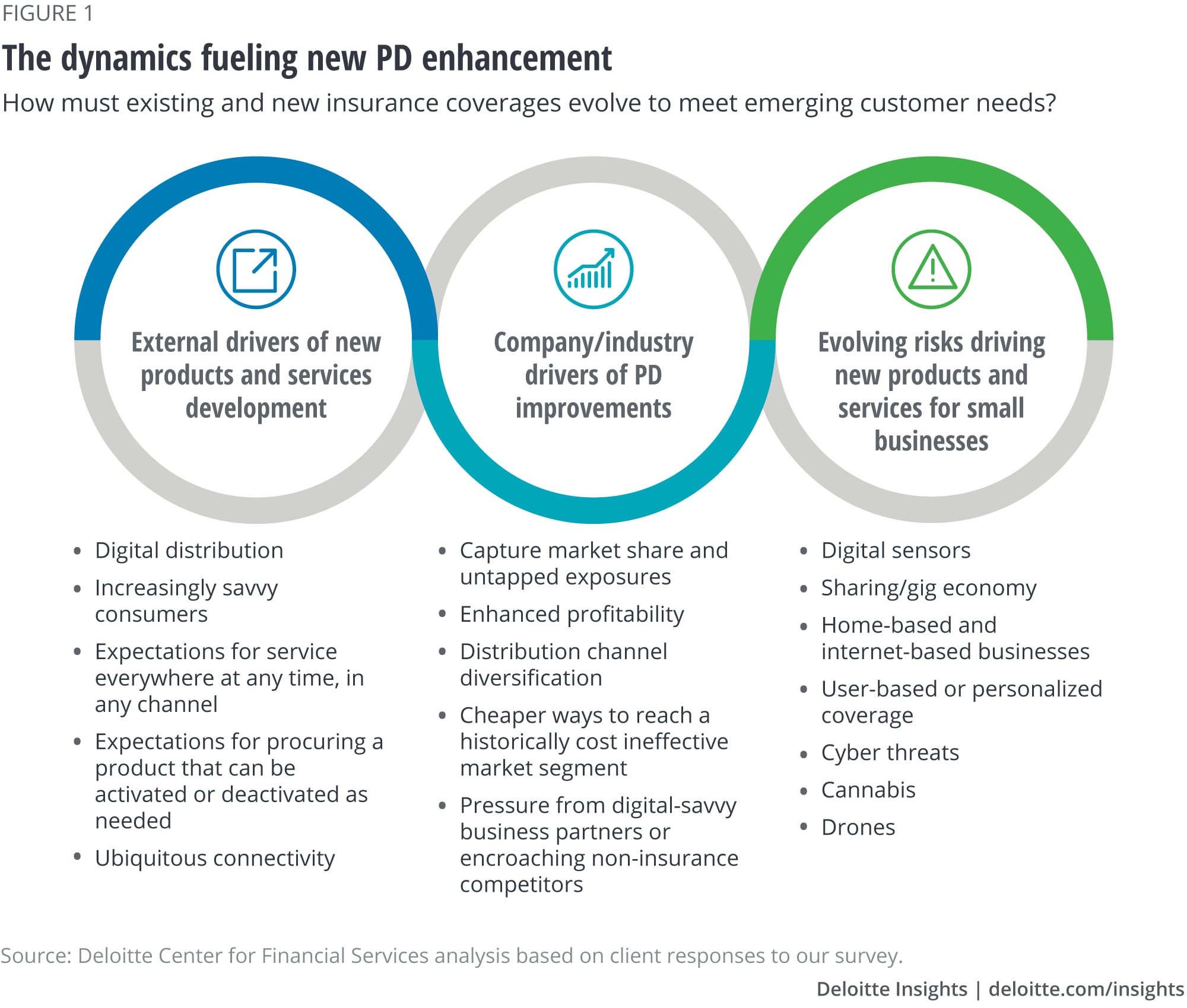

To shift from a product-focused mentality to a customer experience–driven business model, carriers will likely need to restructure cumbersome processes, simplify products, increase flexibility of policies, promote digital connectivity, and expand distribution options. Our product development framework (figure 2) illustrates how this could work.

To maximize product development agility and speed to market, insurance carriers should focus on knocking down silos between traditional lines of business and functions, working proactively with adjacent industries to jumpstart product and service innovation, enhancing capabilities with cutting-edge technologies, and reinventing industry culture to attract the right talent for the future.

While those interviewed represented carriers in various product development transformation stages, from early adopters to fast followers to even slow followers, all agreed the die is cast. Business as usual could be the death knell for those with their heads stuck in the sand.

Following are some potential tactics and real-world examples of carriers taking steps to overcome key friction points in current models to achieve a customer experience–driven target state.

Friction—Unwieldy legacy infrastructure: One common challenge among most of those interviewed involved having dated technology and platforms. These systems, often patched together with only minor upgrades over the years, continue to impede agility in product development and user experience for customers, intermediaries, and other ecosystem collaborators.

Tactics: Depending on a carrier’s tactical plan and budget, minimizing such friction may be as broad as launching an entire technology system overhaul or as targeted as aligning with one or several third-party vendors to exploit innovative technology capabilities.

Pinnacol Assurance developed a digital workers compensation platform, CAKE, to offer policies to small businesses online. The platform is simple, fast, and responsive to customers’ individual requirements, minimizing friction and complexity in meeting clients’ needs. It allows small businesses to easily purchase workers’ comp coverage in three to five minutes, compared to traditional carriers' timing of several days to a few weeks to complete the process.2

Opportunely, advanced technology is now available that may enable alignment with alternative data sources for more seamless and precise underwriting and pricing of coverage. It could ideally help prepopulate information about prospective clients, making the application and onboarding processes quicker and easier. Moreover, having the ability to mine alternative data to use in tandem with the wealth of data insurers already collect from customers could help insurers understand customer needs and pain points more precisely. Others may build out digital distribution capabilities to meet a growing demand among small commercial customers for digital purchasing options. Replacing or supplementing legacy systems with such advanced technology may also help minimize cumbersome processes such as developing, configuring (coding), and testing new or updated products, which would shorten time-to-market rollout.

A key part of product development enhancement is simplification of the sales process. The Hanover Insurance Group is using a digital platform to help its independent agents acquire new business customers in the gig economy, including freelancers, contractors, and other self-employed professionals. The platform runs on technology from a third-party digital agency. From start to finish, the simplified sales process can be completed in less than 15 minutes.3

Insurance carriers could also align or partner with adjacent industries or InsurTechs to help resolve infrastructure frictions. This could likely be more cost-effective, enabling insurers to roll out new products and services without a full system renovation. For example, carriers that are interested in offering consumers a digital distribution channel, but that are unable to do so using current systems, could use a partner’s platforms to provide products and services on an accelerated basis.

Friction—Product and process complexity impeding ease and transparency: Those we interviewed also identified complexity as a top challenge in achieving greater speed to market, although whether the solution calls for simplification in policy language, coverage terms and conditions, or just the buying process drew a diversity of viewpoints.

To remove complexity from its products, Berkshire Hathaway developed “THREE,” a three-page policy that uses simplified language to provide small businesses with comprehensive insurance coverage for workers’ compensation, multiple liability coverages (including general liability, errors and omissions, and cyber), property, and commercial auto. This packaged policy minimizes time-consuming multiple applications and coordination of multiple coverage needs. Efficiency is increased further by providing “THREE” direct to small businesses, eliminating a broker or third party.4

Tactics: The case for removing complexity from insurance products and services is evolving in line with the market landscape. Whether it is entrepreneurs skipping college to launch small businesses and/or a younger demographic unfamiliar with insurance coverages, insurers that want to cast a wider net and gain market share may need to find more simplified processes and language to make it more intuitive to small business owners to explain their value proposition. One Canadian insurer cited “a big opportunity to create simplified coverage solutions that will attract small business customers who haven’t bought any or enough insurance.”

Most insurance leaders interviewed agreed that stripping out complex language from policies to achieve greater transparency and comprehension would be the ideal scenario. But they were concerned that simplification might create coverage gaps for the consumer, while exposing their firms to risks they hadn’t necessarily intended to insure. One contended, “It’s not the complexity of the products. If you can find me a small business owner that’s read their coverage form, I’ll give you $100. I haven’t met that person. You need a complex product because people have complex needs. It’s the experience that needs to be simplified and made transparent.”

Therefore, an alternative (or, in some cases, an additional) option may be to simplify the buying and renewal process by tapping into alternative data sources. This would help insurers prefill, validate, or gather client information in an automated way and, hopefully, would eliminate the current practice of quizzing small business owners with an endless stream of underwriting questions. These simplifications could potentially improve the customer’s buying experience and add further precision to underwriting and pricing of the risk.

In addition, when developing a new product, insurers can take a page out of a large digital retailer/wholesaler’s playbook: Begin with something simple and add complexity as required. Developing a minimally viable product (MVP), which starts as bare bones and grows with iterations, may eventually prove to be a backbone of agility for product development.

When Amazon started, it was just an online book store. Then the company kept iterating on the MVP given customer feedback and interest. They continuously evolved, each time driving costs down and margins up, drawing new customers and growing the overall business. The company is now the country’s largest retail outlet ever, accounting for over half of Cyber Monday transactions.5

For insurance products, several carriers are adopting more modular product structures to achieve this MVP-type approach in a regulated environment. Carriers may develop a longer-term product strategy based on a vision of what the future will look like. But they can start by building the foundational coverage, or “chassis,” for certain business segments that have similar coverage needs and buying profiles. However, these modular products are structured so that coverage terms, forms, and pricing can be efficiently tailored or scaled based on learnings from the market without significant product development and filing effort.

Friction—Siloed lines of business and functions: Long-standing silos between lines of business, business and IT functions, and market channels are also pervasive throughout the sector. Traditional product development processes are often hindered by multiple rounds of handoffs and competing priorities between functional teams. A Canadian insurance leader noted that “developing an agile, customer-centric product development approach is likely unattainable in an old-fashioned, siloed structure that slows you down and interrupts the flow.”

For instance, as the sharing economy flourishes, and personal property is increasingly also used for commercial purposes, long-standing boundaries between the two lines of business may hinder development of essential hybrid coverages. Impediments may include incompatible underwriting components (for example, while the main focus in personal lines auto is on the driver, in commercial lines, it’s on the vehicle), and the fact that few people working in personal or commercial lines have a solid background or are even licensed in both segments.

In addition, from a function standpoint, IT and business professionals often do not speak the same language. As digitization is increasingly exploited to improve both customer-centricity and time-to-market in product development, and given the continued adoption of agile methodologies in the technology sector, employees will likely need to become bilingual. IT should learn the language of business and business should learn the language of IT to effectively and efficiently collaborate.

Tactics: Insurers can reach across business lines and functions to build teams specifically focused on product innovation, using shared incentives. This may help raze the siloed models currently in play throughout the industry.

An organizational network assessment for a professional services firm revealed distinct communities operating beneath the organization chart that had to cross structural boundaries to get work done. It also identified that mistrust in the organization stemmed from an inability to understand the responsibilities of other siloed groups. This situation is common as leaders attempt to control unpredictability through hierarchical organization designs. Understanding these networked relationships enabled the firm to create cross-functional teams aligned around how people actually worked to improve the customer experience. The newly formed groups significantly improved trust and productivity.6

One InsurTech leader suggested, “Opening your horizons has to start from the top and cascade down to a SWAT team that has the autonomy to come up with a solution and then to execute.” Building on the SWAT team idea, another leader from an innovative insurer said they had “created a physical environment with a cross-functional team that spans business lines and functions but is not embedded in any one business. The key is to bring them all together with a common objective—design a product around a user experience.”

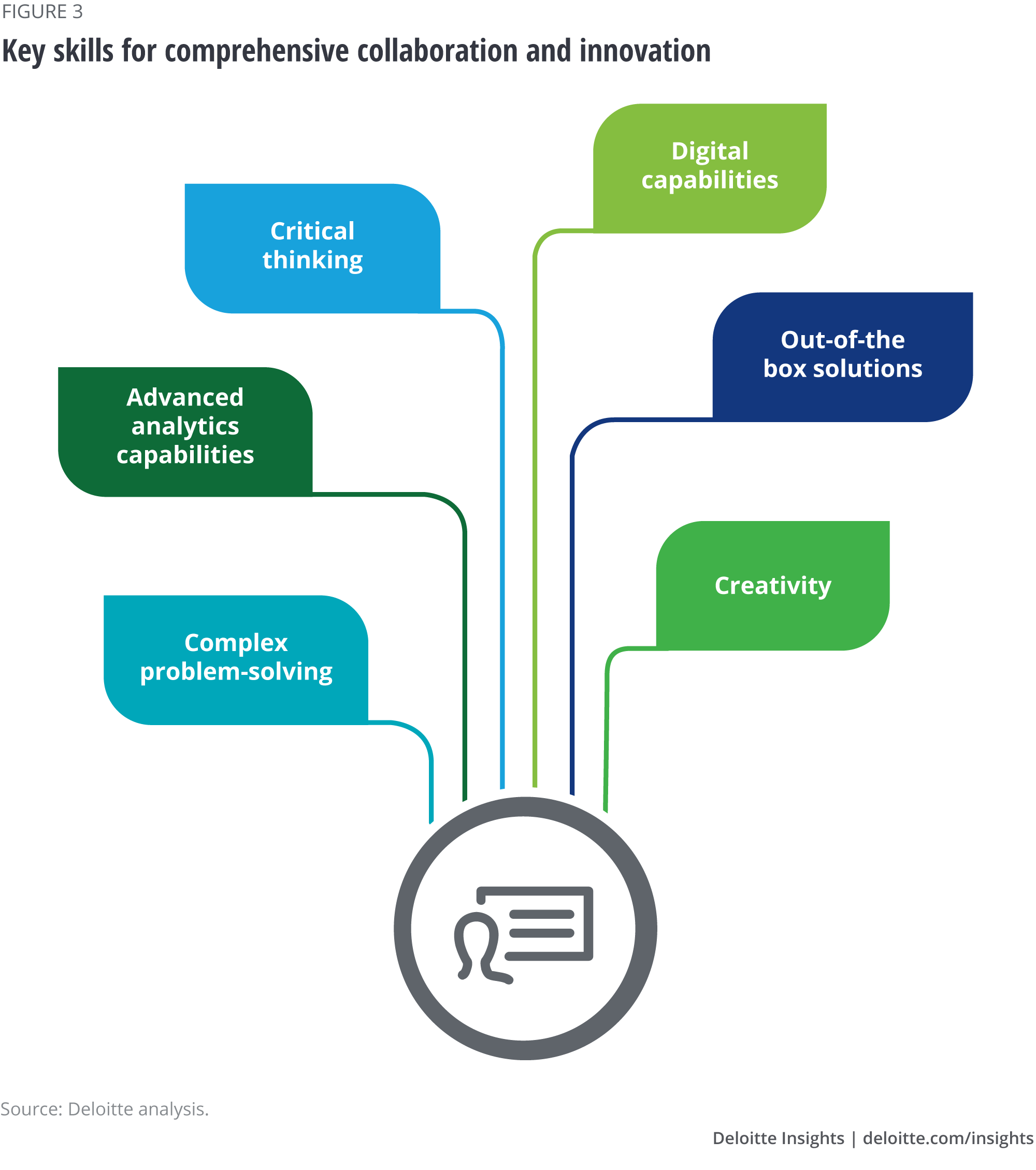

To achieve this level of internal cross-collaboration, insurers may need to embed more diverse skill sets into their workforce as well. This would involve recruiting innovative and creative thinkers, some of whom may not come from an insurance background, to generate out-of-the-box brainstorming ideas throughout the product development process.

Friction—Lack of necessary skills in talent pool; entrenched processes and culture: On a related note, while insurance-specific capabilities such as underwriting, actuarial modeling, pricing, and claims handling are clearly the foundation of the industry, the evolving landscape will likely require more innovative, creative, and digitally inclined proficiencies.

Unfortunately, much of the industry is facing challenges acquiring these skills because it is often perceived as quite conservative. This is particularly the case among younger workers who insurers seek to recruit as a large portion of their workforce approaches retirement7 (figure 3). Compounding this challenge is fierce competition to attract and retain these same competencies within the broader financial services community and across many other, seemingly more alluring industries.

Tactics: To attract the skill sets necessary for product development modernization, insurers should find ways to vastly elevate their appeal to make a career in insurance more relevant and attractive to innovative and tech-savvy individuals.

One insurance leader suggested, “In acquiring innovative skill sets, you need to think about it in terms of, How do I become the greatest place in the world to work, what’s my value proposition to talent, and how do I enable them to have a great career and be successful?”

This could start with initiatives to modernize the company culture. Leaders can demonstrate a commitment to innovation, diversity, and social impact through related incentives and career development opportunities. If handled successfully and holistically across the organization, these efforts can help convince those with cutting-edge skill sets that a career in insurance can immerse them in an intriguing, exciting, diverse, and innovative world of risk solutions.

Location may be key as well. One of the insurance leaders lamented that “an office with a view of cornfields in a rural region would likely not attract innovative thinkers who may be more enticed by fast-paced, dynamic environments.” An insurance ratings analyst agreed: “A company may be headquartered in a rural area or a suburb, but they may still need to set up an office in an urban center to attract people with the right backgrounds. Insurers should ask themselves, Where will it be easiest to recruit those skill sets?”

Organizations may also need to retool their cultures to emphasize application of cutting-edge technologies, such as artificial intelligence. They should also champion collaboration, encourage and support mentoring, and promote career path diversification.

Friction—Dearth of client touchpoints: For decades, cultivating strong client relationships has been challenging for most insurers, given that an insurer’s opportunity to connect with a client only appeared at the point of sale, during annual renewals, or in the claims process. And, let’s face it, many small business owners may view connecting with their insurance representatives as necessary but not exactly appealing, much like going to the dentist. Given this reality, transitioning from product focus to client-centricity will likely be difficult to achieve without having more meaningful and frequent interactions with customers.

Tactics: Insurers can potentially use growth in digital connectivity as a gateway to becoming more relevant in the everyday lives of their policyholders. The Internet of Things (IoT) will potentially shift products from focusing on cleaning up after disruptions to forestalling those disruptions before they happen. IoT-based data, carefully gathered and analyzed, could help insurers evolve from a defensive posture—spreading risk among policyholders and compensating them for losses—to an offensive posture: helping policyholders prevent losses and avoid claims in the first place.8

USAA is piloting a program in which 6,000 policyholders test water-detecting sensors to help uncover potential water damage in early stages before it becomes more widespread. Such smart home sensors could detect moisture in a wall from pipe leakage and alert a homeowner to the issue prior to the pipe bursting. This might save the insurer from a large claim and the homeowner from both considerable inconvenience and losing irreplaceable valuables. The same can be said for placing IoT sensors in business properties and commercial machinery, mitigating against property damage and injuries to workers and customers, as well as business interruption losses.9

One insurance leader posited, “Imagine how infrastructure sensors could drive a shift from insurance premiums as we know them today, to loss prevention services where you pay a monthly fee.”

By aligning or partnering with third parties as part of their product development team, insurers can facilitate capabilities such as infrastructure sensors or employee wearables that they may be unable to offer through proprietary systems. Participation in the digital ecosystem could fundamentally shift the insurer value proposition from reactive to a proactive approach with a focus on risk prevention, thereby cultivating enhanced customer experience while also providing value to the carrier.

The end game: Attaining a customer experience–driven organization

Many industries have already conformed to the notion that customers are no longer buying products and services; they are buying experiences that products and services provide. But in the small commercial insurance segment, there are still wide gaps between what could be done and what is being done to make the shift to a product development framework that enables customer experience–driven modernization.

As insurers continue to clear the minefields obstructing each phase of the product development life cycle—from concept to development to launch to monitoring—they can clear the path toward a future customer experience–driven state (figure 4).

This target state would embrace a combination of many, if not all, of the friction-busting tactics. It will not be a destination, but an ongoing journey. In the future paradigm, insurers could deliver:

Seamless distribution by:

- Aligning with adjacent industries to help stream alternative data, which would enable ease in distribution by prefilling information, as well as more personalized, seamless underwriting and pricing

- Partnering with InsurTechs to form digital online distribution capabilities for small businesses and intermediaries inclined toward self-service

- Building proprietary digital online distribution capabilities, while continuing to provide coverage and service advice

Ubiquitous connectivity by:

- Joining or creating third-party alliances for access to real-time data exchange through the Internet of Things (IoT) devices and sensors to add value by providing more frequent and meaningful client touchpoints

- Joining or creating ecosystems that enable sensor technology and other services to shift underwriting focus from risk coverage to prevention, enhancing customer experience and value for both consumers and insurers

A streamlined product life cycle by:

- Implementing technology infrastructure upgrades, either on proprietary systems or by aligning with third parties, for agility and speed-to-market

- Making intentional changes to modernize culture and attract pioneering and innovate talent and diverse skill sets

- Collaborating between functions, lines of business, and third-party business partners for crossover products and seamless interaction (multifunctional, SWAT teams)

- Leveraging modular product structures to increase ease and transparency for customers and facilitate more efficient product launch, maintenance, and enhancement capabilities

A personalized/user-based experience and coverage by:

- Employing advanced technology, through proprietary systems or by aligning with third-party providers, to offer service everywhere, any time, though any channel

- Building upon modular product structures to provide tailored products and services based on client-specific needs and expectations for an ideal customer experience

- Relying on cross-business line, cross-functional, diverse skill set SWAT teams to quickly and flexibly create or revamp products and services that customers will value

As the bar rises across industries to create an optimal client experience, success-driven insurers can no longer remain locked into 20th-century product development capabilities. To add value for customers and stakeholders and seize the vast opportunities unfolding in the 21st century, insurers must knock through long-standing challenges and transform in line with the constantly evolving marketplace.

More from the Financial services collection

-

Tapping into the aging workforce in financial services Article5 years ago

-

Infusing data analytics and AI Article5 years ago

-

Reimagining customer privacy for the digital age Article5 years ago

-

Bringing digital to the boardroom Article6 years ago

-

A moving target: Refocusing risk and resiliency amidst continued uncertainty Article4 years ago

-

The digital banking global consumer survey Article6 years ago