Bringing new therapies to patients Transforming clinical development

23 minute read

19 November 2020

Transformative approaches to drug development have the potential to improve the efficiency of R&D, bring new therapies to market earlier, and improve the patient experience during clinical trials. What can biopharma companies do to expand their application?

Executive summary

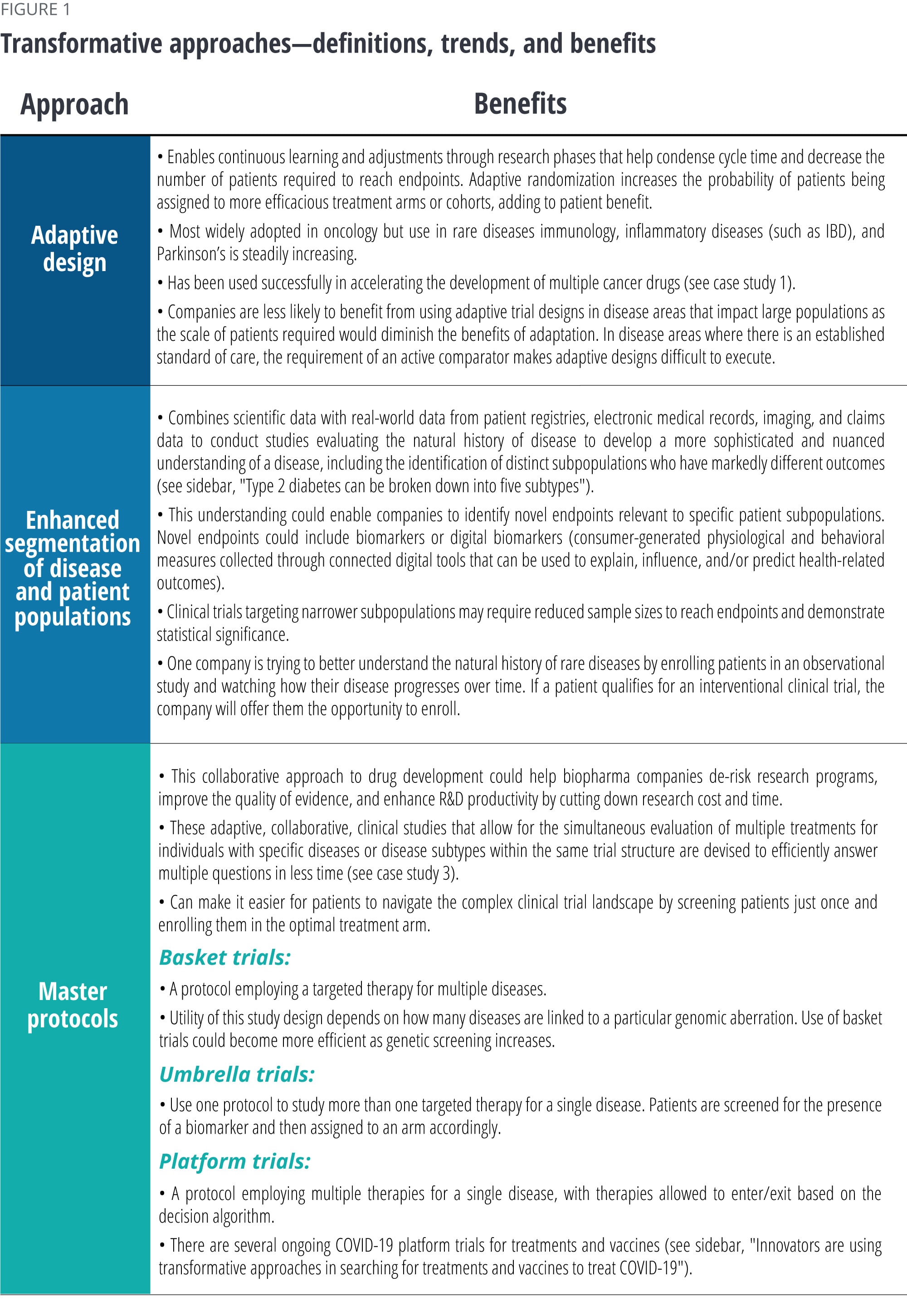

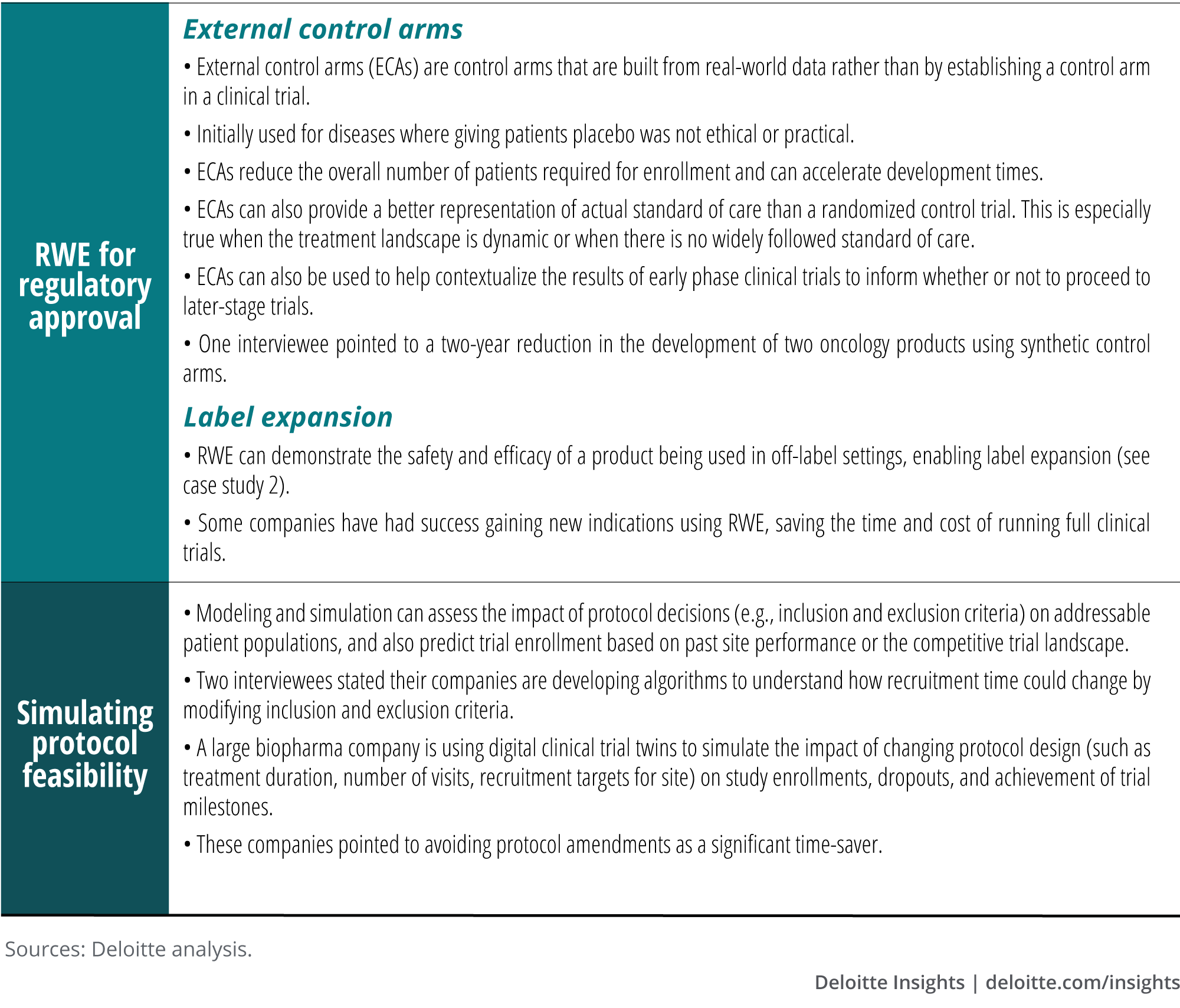

A proliferation of data sources and advances in data science and analytics has spurred the adoption of several transformative approaches to drug development. These approaches—which include adaptive trial design, enhanced segmentation of disease and patient populations, master protocols, real-world evidence (RWE) applications for regulatory approval, and simulating protocol feasibility—have the potential to dramatically improve the efficiency of R&D and the quality of evidence generated, and to accelerate the drug development process without compromising on scientific rigor. Importantly, these approaches are patient-centric and can improve the patient experience.

Learn more

Explore the life sciences collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

To better understand the current adoption of transformative approaches, their impact, and what is required to scale their applications, the Deloitte Center for Health Solutions interviewed 19 R&D executives and found:

- While some of these approaches such as adaptive trials and master protocols have been around for many years, they have yet to be scaled more broadly or used in an integrated fashion. While some companies have experimented with a few approaches but only in one-off trials, others have more extensive experience.

- Companies that are further along in their adoption of transformative approaches tend to have portfolios heavily focused on oncology and/or rare disease. The high unmet needs and life-threatening nature of these diseases make stakeholders such as regulators and payers much more willing to consider novel development approaches.

- Biopharma companies have an opportunity to take the learnings from oncology to scale transformative approaches across their portfolio to other therapeutic areas. However, they cannot do it alone and will need to engage stakeholders across the R&D ecosystem, including health care organizations, to curate novel real-world data sets, regulators to shape and pilot new approaches, payers to initiate proactive conversations around evidence hurdles, and patient advocacy groups to define endpoints that matter. Companies could benefit from coming together to share data and set data standards as well.

- Scaling transformative approaches also often requires cultural and operating model changes within the four walls of biopharma. Leaders should push their teams to consider where these novel approaches might apply and invest in the necessary capabilities, infrastructure, and partnerships to reduce the barriers to implement them.

- Data science expertise is essential to many of these transformative approaches, as is drug development and therapeutic expertise. Cultivating a talent pool of data scientists who possess both skill sets should be a high priority.

Companies can start by piloting transformative approaches in oncology and rare disease, scaling these more systematically in these areas, and then expanding to applicable disease areas in their broader portfolio. They should ask themselves where these approaches can be applied, who are the key stakeholders that need to be engaged, and what investments need to be made.

Introduction

Bringing effective medicines to market quickly without compromising on patient safety and scientific rigor is essential in the battle against chronic or life-threatening diseases. But continued investment in R&D is threatened by declining returns on innovation, which fell from 10.7% to 1.8% over the past 10 years.1 While the industry has been attempting to improve R&D productivity through process improvement, such attempts have not had a significant impact.

Deloitte’s research on returns on pharmaceutical investments shows that companies are now taking longer than ever to bring new drugs to market.2 This is driven by increasingly complex protocols, the need to generate endpoints to satisfy multiple stakeholders, antiquated processes and technologies to collect and report data, and increasing competition for the still limited pool of clinical trial participants.

A proliferation of health care data and advances in data science and analytics techniques have powered the use of novel clinical trial paradigms to drastically improve R&D productivity and the quality of research output. Over the past few years, regulatory agencies have been encouraging the use of novel approaches that expedite the development of new therapies. The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have issued guidance on the use of adaptive trial designs,3 while the US FDA is crafting guidance on the use of RWE.4 In December 2019, Amy P. Abernathy MD, Ph.D., former chief medical officer, chief scientific officer, and senior vice president for oncology at Flatiron Health and the FDA Principal Deputy Commissioner said, “We (the FDA) serve as a gateway for scientific promise. We do this by continuing to speed development of effective therapeutics through the promotion of innovative clinical trial designs such as platform trials, basket studies, adaptive trials, and pragmatic randomized controlled trials.”5

The Deloitte Center for Health Solutions interviewed R&D executives at companies that have had experience with emerging approaches for drug development. We focused on understanding the impact of these approaches, lessons learned, and how to scale them more broadly across the industry.

Research methodology

Between July and August 2020, the Deloitte Center for Health Solutions interviewed 19 executives from large pharma companies to understand what novel approaches to clinical development they’ve tried, their impact, and considerations to expand their use across therapy areas. Interviewees included senior leaders of global clinical development, therapeutic area leaders, chief data science officers, heads of biostatistics, and clinical innovation leaders.

Transformative approaches are just starting to gain momentum across the industry

From our interviews, we heard about several transformative approaches that can accelerate the development of safe and effective therapies while improving the quality of research output (listed and defined in figure 1). Advanced statistical techniques, data science, and analytics on curated data sets are critical to driving these approaches. The benefits of these approaches include developing a more nuanced understanding of patients and their disease, identifying and treating them accordingly, improving overall development efficiency, quality of research, and probability of success.

Some of these approaches such as adaptive trial designs and master protocols have been around much longer than others, but most gained traction only in recent years. A proliferation of data sources has made it easier for companies to study the natural history of disease, enabling better profiling of diseases and patient populations. The 21st Century Cures Act (Cures Act) passed in 2016 enhanced the FDA’s ability to use RWE in regulatory decision-making. Prior to the Cures Act, the FDA used RWE to inform regulatory decision-making in postmarket surveillance.6 For example, the Sentinel Initiative was launched in 2008 and uses RWE in a distributed database to monitor medical product safety issues.7 Since the Cures Act, early adopters have established partnerships with data and analytics providers and built enterprisewide infrastructure to make data and analyses available. These data and technology investments have also enabled other approaches such as simulating protocol feasibility and predictive analytics for patient recruitment.

Type 2 diabetes can be broken down into five subtypes

Many cancers have been broken down into several subtypes, characterized by different molecular and genetic profiles of tumors. For example, breast cancer is routinely diagnosed and treated based on molecular subtypes and this approach has been applied to other cancers such as non-small cell lung cancer. This nuanced understanding of various cancers has led to an increase in targeted therapies and in some cases, dramatic improvement in patient outcomes.

In addition to cancer, the segmentation of other common diseases into well-defined subpopulations has already begun. Our view is that this too will lead to a wave of therapeutic strategies that target specific subpopulations in these disease areas. For example, a recent article published in The Lancet demonstrated it is possible to stratify type 2 diabetics into five subgroups that have differing disease progression and risk of complications.9 This involved clustering patients based on multiple variables, including the presence of glutamate decarboxylase antibodies, age, BMI, HbA 1c, β-cell function, and insulin resistance.10 With this knowledge, companies could strip out some of the heterogeneity that exists in diseases like type 2 diabetes and focus their drug development efforts on a specific subpopulation whose disease behaves more uniformly. In turn, this reduces some of the possible variability in drug response sometimes seen in clinical trials, which can make drug development difficult. This approach should, in theory, enhance the probability of success.

The degree of experience with these approaches varied across the companies we interviewed—some had experimented with a few but only in one-off trials, while others have had more extensive experience. In the middle of the spectrum, some companies have applied multiple approaches in unison for specific research programs. Early adopters, however, have placed their bets on a single, major transformative approach. For example, one company has invested heavily in RWE, acquiring data companies to support this mission. Another company has mandated that some elements of adaptive design be incorporated in all trials: Currently, 80% of ongoing trials have an adaptive element. Lastly, one other company is training all employees to use artificial intelligence (AI), regardless of their data science experience.

Our interviewees pointed to AI as an enabler for the greater use of transformative approaches. For example, AI could be leveraged to normalize data from different platforms (e.g., gene expression data) and curate unstructured data types (e.g., images, clinical notes). Additionally, machine learning algorithms could automate much of the behind-the-scenes analysis that powers complex master protocols. However, interviewees agree it would be several years before biopharma companies have the capabilities to leverage AI extensively for these purposes (for more, see Deloitte’s publication Intelligent Clinical Trials). Most interviewees mentioned that initial investments to build capabilities to implement these approaches, such as AI, can be significant. One interviewee said, “It’s not simply huge savings. There are savings, but there are obstacles—sometimes the expertise, data sources, systems aren’t available. It’s not a small amount of resourcing.”

Examples of the use of transformative approaches

Case study 1: Combining transformative approaches to expedite approvals for multiple indications

Leveraging a combination of transformative approaches, Merck was able to expedite approvals for Keytruda to treat multiple indications. Using an adaptive trial design, Merck tested Keytruda’s tolerability and impact on advanced solid tumors. It then added melanoma and non-small cell lung cancer (NSCLC)–specific expansion cohorts for dose-finding and efficacy assessments. Coupled with breakthrough therapy designations for these two indications, Merck reduced development timelines to four years from new drug application to initial approval.11

Merck was also the first company to use a basket trial for registration of a tumor-agnostic cancer therapy. This involved testing Keytruda on 15 different solid tumor types with microsatellite instability high (MSI-H)/mismatch repair deficiency (dMMR) biomarkers. In 2017, the US FDA approved Keytruda for patients with MSHI-H or dMMR biomarkers irrespective of tumor type or location.12

Case study 2: Expanding label indications using RWE

Originally approved to treat female breast cancer in 2015, physicians began off-label prescription of Pfizer’s Ibrance to male breast cancer patients. Pfizer worked with Flatiron and IQVIA to collectively evaluate EMR and claims data to prove the safety and efficacy of using Ibrance to treat male breast cancer patients. This analysis led to Pfizer receiving US FDA approval in less than a year and at a fraction of the cost of a clinical trial.13

Case study 3: Evaluating multiple experimental therapies in parallel14

Over the last decade, the I-SPY master protocol has been used to evaluate several treatment agents for breast cancer. This design enables agents to enter and leave the study without having to halt enrollment or resubmit the protocol for regulatory review.

On entering the study, a patient’s tumor is screened and classified into one of 10 molecular or disease subtypes. This master protocol enables for up to five agents (or combinations of agents) to be evaluated in parallel. A randomization engine assigns a patient to a particular study arm and outcome measurements (MRI volume, biopsies, and physical examination) for patients receiving a particular agent are collected. This is used to update the predictive probabilities of efficacy for a particular agent in various disease subtypes in real time. If predictive probabilities reach a predetermined level of efficacy in one or more molecular subtypes, the agent is successfully graduated out of the trial.

Innovators are using transformative approaches in searching for treatments and vaccines to treat COVID-19

The pandemic has highlighted the importance of balancing patient safety with getting effective treatments to patients quickly. Researchers, nonprofits, and public agencies are using transformative approaches to identify the safest and most effective treatment options to help thwart the pandemic as quickly as possible. Examples include:

- RWE: The Reagan-Udall Foundation in collaboration with the Friends of Cancer Research launched the COVID-19 Evidence Accelerator as a venue for major data organizations, government and academic researchers, and health systems to collectively use RWE to help answer questions related to the management of COVID-19 patients. The collaboration is also running repeat analyses to compare results using different techniques and data sources.15 One interviewee said that retrospective analyses using RWE to supplement data collected in randomized controlled clinical trials will help validate analytical techniques to generate RWE and accelerate the adoption of RWE across stakeholders.

- Master protocols: Public health agencies—using master protocols—are bringing stakeholders together to evaluate the clinical potential of treatments and vaccines for COVID-19. In March, the World Health Organization stood up the global mega-trial SOLIDARITY to evaluate four treatment options for severely ill patients in more than 100 impacted countries. France established a European add-on called Discovery, and the United Kingdom its RECOVERY trial.

In mid-April, the National Institutes of Health and the Foundation for the National Institutes of Health (FNIH) announced the Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV) partnership. This public-private partnership, which includes other health agencies and 16 biopharma companies, is developing a collaborative framework for prioritizing and testing vaccine and drug candidates, including a master protocol. A precompetitive consortium has also come together to apply the learnings and infrastructure of the I-SPY master protocol platform (with over 10 years of experience in breast cancer) to evolve our understanding of what works for acute respiratory distress syndrome caused by COVID-19.

Much of what we now know about therapy options has been learned in master protocols. In fact, the RECOVERY trial has shown that dexamethasone reduced the death rate of COVID-19 patients on ventilators by a third, which is now used as a standard of care for severe COVID-19 patients.16

Expanding the application of transformative approaches requires an ecosystem approach

Companies that are further along in their adoption of transformative approaches tend to have portfolios heavily focused on oncology and/or rare disease. Given the high unmet needs and life-threatening nature of these diseases, stakeholders such as regulators and payers are often more willing to consider evidence from flexible development approaches. An advanced understanding of the molecular and genetic basis of disease has led to the characterization of patient subpopulations and more targeted development strategies. This is in large part due to the significant investments made in oncology over the last 20 years, the widespread adoption of tumor profiling in research and the clinical setting, and the emergence of highly curated oncology real-world data sets. Now, there is an opportunity for companies to take the lessons learned from oncology and/or rare diseases and build toward a future where these approaches can be used in other disease areas. This often requires companies to enable a robust data ecosystem and engage proactively with regulators, payers, patient advocates, and each other to accelerate the adoption of new approaches. Lastly, companies should work with payers and regulators to evaluate the merits of these approaches in new disease areas and address any challenges.

Enabling a data ecosystem: Scaling the use of transformative approaches requires expanding the availability of high-quality curated data sets in therapeutic areas beyond oncology. Biopharma companies should work collaboratively and transparently within the health care ecosystem to unlock the data necessary to inform these transformative approaches. However, this does not come without challenges. Health care organizations are often not set up to curate electronic medical records at scale, nor do they have the technical infrastructure to manage that data once it is curated. Furthermore, patient privacy and data security must be maintained, and this requires well-defined protocols and controls to govern data access. That said, biopharma companies would be well served to have thought through how to address these realities before approaching potential partners with proposals. Regeneron, for instance, built a clinico-genomics database in partnership with Geisinger Health and the UK BioBank Consortium to support the company’s R&D efforts in nonalcoholic steatohepatitis (NASH). This enabled identifying a new therapeutic target for NASH. The company is currently collaborating with Alnylam Pharmaceuticals to develop a potential RNAi therapy for this target.17

In addition to direct collaboration with health care organizations, biopharma companies can play a critical role in cultivating the ever-increasing ecosystem of data startups that aim to take on much of this work. Pharma companies can supply capital to fuel their growth or play an advisory role, providing a customer perspective on high-priority R&D use cases. One example is Holmusk—a Singapore-based data science company that has curated research-grade real-world data sets on mental health disorders.18 Another is the Crohn’s and Colitis Foundation, which curates clinical, genomic, and patient-reported outcomes data on inflammatory bowel disease to create a registry for academic and industry research to speed up therapy development.19

The real-world data (RWD) ecosystem in the US and Europe is mature compared to the rest of the world. Accessing RWD in the rest of the world to represent global populations presents unique challenges and, in most cases, will require partnering and significant effort to curate the data. Further, there can be limits on cross-border data-sharing. This is especially true in emerging markets such as China and India.

Engaging regulators: While top leaders at regulatory agencies are encouraging the use of transformative approaches, transformation across these agencies may take time. Acceptance of these approaches may also vary across divisions. Companies should engage as early and transparently as possible with review teams to understand their perspective and discuss and explore potential concerns and issues. In fact, regulators actively seek direct interaction, discussions, and alignment with industry on new therapies. Having a clear purpose and rationale backed by statistical relevance for use of an approach can help improve alignment and the quality of evidence generated as part of potential future submissions.

One biostatistics leader we interviewed pointed to the need to better account for biases in the source data used to build external control arms. She said that reasons for rejection of external control arms by regulators include unclear definition of data sources and the inability to account for biases in the way data was sourced and collected. Researchers have recently acknowledged there is no road map for using historical controls, and suggested techniques to overcome the data challenges.20 With a road map, the industry should seek to work collaboratively with regulators when exploring the use of external control arms in new disease areas.

Regulators across the globe may have different receptivity to the use of transformative approaches. Dealing with a lack of regulatory harmonization results in companies using the “lowest common denominator” approach to ensure access across target markets of highest interest. Finding ways to modernize data exchange among sponsors and multiple regulators could enable filings across multiple geographies. Recently, a few large pharma companies have come together to build Accumulus, a cloud platform for real-time, secure, and rolling exchange of data between sponsors and the FDA. Such a platform could potentially streamline the application submission and assessment processes for new drugs, end the reliance on digital PDFs and other static data formats, and enable submitting data to multiple regulators in parallel.21

Engaging payers: Interviewees told us that payers also have varying receptivity to evidence generated from nontraditional clinical development approaches. Payers may not find the evidence generated from such approaches compelling enough to justify coverage and reimbursement, especially when prices are high. Companies should work collaboratively with payers early on in development to anticipate potential concerns and to define endpoints that could meet the needs of their patient populations. Companies should also focus on generating RWE after launch to demonstrate the long-term clinical outcomes and economic benefit of new therapies to further support the value proposition.

Engaging patient advocates: Patient groups could be important partners in data curation, designing clinical trials, or defining new endpoints. Designing trials around patient-centric endpoints could demonstrate the value of a new therapy to other stakeholders. Patient advocacy groups could be important partners helping to gain buy-in from other important stakeholders including regulators, payers, and physicians. Ultimately, all stakeholders are seeking to do what’s in the best interest of patients.

Precompetitive collaborations: Companies could benefit from collaborating and sharing data and insights more openly than they have traditionally, forging partnerships amongst themselves as well as with other stakeholders in health care. In fact, master protocols typically involve collaborations across public agencies, investigators, labs, and biopharma companies. Further, companies could come together to curate data sets in targeted disease areas or to set data standards. For example, through TransCelerate BioPharma, companies are collaborating to share historical trial data to build historical control arms and develop industrywide data standards and metadata in priority therapy areas.22 More such collaborations within the industry could be beneficial for the future.

Biopharma should change existing operating models and build new capabilities to enable innovation: Wider adoption of transformative approaches often requires cultural and operational changes within biopharma companies. As drug development is inherently risky, project teams are reluctant to try new approaches and challenge the status quo. But, many of our interviewees agreed that the time has come for companies, scientists, and clinical researchers to embrace the reality that the old way of doing things is too time-consuming and results in more failures than successes. Leaders should encourage development teams to consider these approaches, invest in the necessary technology capabilities, and build talent pools to reduce the barriers to implement them.

Cultural and operational change: Companies that have scaled these transformative approaches successfully have created a culture of innovation and set expectations and priorities around their use. They pointed to cultivating an environment where development teams can experiment and not be penalized if any unintended consequences arise. Leaders should recognize that this type of experimentation and the learnings from it are necessary to help advance the industry toward a new future for drug development. Interviewees from companies that have successfully leveraged some of these approaches provided the following insights:

- Leaders should push their teams to consider where and when these approaches can be applied. This may require setting expectations and priorities around using transformative approaches. For example, one interviewee noted that leadership required teams to come to stage-gate meetings prepared to discuss a traditional clinical trial approach as well as an innovative trial design. This process led to 50% of trials across the organization being simulated after just 18 months.

- One interviewee shared that his organization is enabling more of a servant leadership style, where leaders provide team members with the right experience and ideas the freedom to experiment with implementing transformative approaches while senior executives can provide resources and guidance as and when required.

- Better alignment between early and late stage development functions has enabled joint decisions on critical elements of clinical development strategy, such as endpoints at companies we interviewed. Early involvement of and alignment with regulatory strategy would also be highly beneficial to drive interactions with regulators.

- Similarly, we heard about the importance of seeking input from other important functions (such as market access, clinical epidemiology, and health economics and outcomes research, and medical affairs) as early and as frequently as possible. Building a steady cadence and flow of information from these functions could provide trial designers greater access to insights on disease epidemiology, subpopulations of interest, and value drivers for payers and patients. This could help better define study inclusion and exclusion criteria, and outcome measurements from a multistakeholder perspective for quicker access and better coverage.

Technology infrastructure: Interviewees also told us about the importance of investing in technology infrastructure to increase the interoperability and utility of data to enable wider application of transformative approaches. Such infrastructure includes knowledge management platforms and centralized analytics capabilities for greater visibility and use of data assets available to the organization. Companies should also craft standardized approaches for rapid data ingestion, clean up, and integration of data from multiple sources for downstream analysis. Building self-service data analytics tools could help nondata scientists and researchers build cohorts, understand treatment pathways, and calculate incidence and prevalence of a disease on demand without having to write up code. Additionally, investing in scalable cloud-based capabilities to access and analyze data that has been traditionally locked in silos across multiple organizations could enable a secure exchange of insights among research partners and collaborators.

Building data science talent pools: Both data science and therapeutic area expertise are essential to leveraging many transformative approaches. Cultivating a talent pool of data scientists who possess both data science skills and drug development expertise should be a high priority for companies attempting to scale the use of these approaches. Data science is a new role within biopharma, and most data scientists come from other industries and may be unaware of the nuances of drug development. Interviewees told us that this can lead to a level of discomfort or tension between data scientists and existing staff with years of development experience under their belts.

Aligning data scientists to a therapy area to apply their skills can enable them to build a nuanced understanding of drug development in that area. Also, embedding data scientists as early as possible in study planning and partnering them with biostatisticians could enable cross-fertilization of ideas and experiences and help build long-term relationships. At the same time, companies should ensure data scientists better comprehend regulatory science to understand standards accepted by regulatory agencies. Once a talent pool is built, companies should provide data scientists (who are in high demand today across industries) opportunities to develop their own ideas as well as career progression opportunities, to help ensure that valuable data skills and knowledge are retained within the organization.

Realizing efficiencies through transformative approaches

Scaling the use of transformative approaches starts by applying these more systematically in oncology and rare disease areas and then expanding their use to applicable disease areas. This requires companies to have a vision and take a staged approach to consistently apply one or more approaches in a particular disease area, learning from successes or failures along the way, and then adapting these learnings to other disease areas.

Companies should ask themselves several critical questions before they can leverage transformative approaches more extensively:

Portfolio applicability: Where can these approaches be applied today in our company’s overall portfolio? Do any assets in the future development pipeline lend themselves to the use of these approaches?

Data partnerships: What data sources are available today that are most relevant to the company’s R&D portfolio? Who can we partner with (data vendors, providers, academic medical centers, labs) to curate the data sets we need? How do we put in place a strategy to select the right partners and effectively manage partnerships?

Stakeholder engagement: Can we engage regulators and payers proactively to define how new approaches can be applied to disease areas where they may not have been used before? Can we elevate our relationship with patient advocacy groups to curate data sets, define endpoints, and design more patient-centric clinical trials?

Operating model: Is there top-down support to affect the operational and cultural changes required to enable experimentation? What resources and financial investments are needed?

Technology needs: Do we have in place the foundational infrastructure to integrate disparate data sets and derive insights from these?

Data science capabilities: How can we source or build data science capabilities? Can we upskill talent internally or source talent from technology companies, ecosystem partners, and third parties?

© 2021. See Terms of Use for more information.

More from the life sciences collection

-

Benchmarking product development in medtech Article4 years ago

-

Improved clinical efficiency and quality Article4 years ago

-

The future of medtech Video4 years ago

-

Patient engagement 2.0 Article4 years ago

-

AI in Biopharma Collection

.jpg)

.png)

.jpg/_jcr_content/renditions/cq5dam.web.231.231.desktop.jpeg)

.png/_jcr_content/renditions/cq5dam.web.231.231.desktop.jpeg)