Patient engagement 2.0 How life sciences companies can take patient engagement to the next level

17 minute read

31 July 2020

Mark Lush United States

Mark Lush United States Christopher Zant United States

Christopher Zant United States Sherilyn Notte Tuthill United States

Sherilyn Notte Tuthill United States Alicia Saddock United States

Alicia Saddock United States

The life sciences industry is moving beyond core patient services to the next generation of engagement platforms that seamlessly span the entire patient life cycle to help improve health outcomes.

In our 2016 article Patient engagement strategies in a digital environment, we described life sciences companies’ essential opportunity to make a meaningful impact on patients’ lives by engaging more closely with them.1 At that time, various technologies were being launched to help make patient engagement more holistic and seamless across the spectrum of emergent tools, including patient services platforms, wearable monitoring devices, mobile wellness apps, and the like.

Learn more

Explore the Life sciences collection

This article is featured in Deloitte Review, issue 27

Download the issue

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Many life sciences companies were embarking on transforming their organizations, people, processes, and platforms to strengthen patient engagement with a focus on optimizing therapy adherence and patient health outcomes.

Four years later, the pursuit of a seamless, meaningful patient experience still remains a top priority for all participants in the health care delivery ecosystem, including life sciences companies, health care providers, health care payers, and others. With this mission remaining steadfast, additional considerations related to patient marketing, patient data and security, global operations, organizational impacts, and other factors are driving further evolution in patient engagement strategies, even as they become more critical.

The 2016 focus on traditional “patient services”—including capabilities for patient enrollment, patient education, financial assistance, patient therapy, and clinical programs—has evolved to encompass a broader scope of services to engage patients in new ways. In four years of ongoing societal and cultural consumerization, patients have increasingly come to expect cohesive digital solutions that protect the data they provide and use it responsibly to optimize their health outcomes. Gone are the days of settling for stand-alone patient services programs, operating in well-intentioned silos, yet detached from patient marketing campaigns and communications. Companies and brands are now focusing on human experience and patient-centricity in an integrated fashion,2 aiming to execute patient marketing, communications, and support services with a continuous, informed, and humanistic approach—one that senses and responds to patients’ and their families’ needs in all the moments that matter across the journey from diagnosis and therapy to recovery and wellness.

Now that patient data can be collected in new ways across both well-known channels (such as doctor visits, patient calls, and email) as well as omnichannel connected and wearable devices, updated standards for securely managing this information are also at the forefront of life sciences companies’ strategies for interacting with patients. Patient privacy and other regulatory requirements for managing patient health information (PHI)—such as Europe’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), or regulations for products being classified as “software as a medical device” (SaMD)—were once viewed as “nonstarters” for innovative programs and devices. Today, however, such regulations are now more clearly understood, and leading life sciences companies are planning for them as part of their product launch, marketing, and engagement strategies.

As more solutions across the patient life cycle are created both in the United States and globally, the question for life sciences companies is shifting from “How do we stand up basic patient engagement capabilities, primarily to serve our patients’ needs after they have been diagnosed?” to “How can we create a holistic patient engagement capability that seamlessly combines communications, marketing, and education with services to support onboarding, therapy, financial assistance, clinical trials, and optimal adherence-based outcomes, all supported by enabling technologies, secure data, and a unique experience personalized to meet each patient need?” We believe this latter question is more relevant than ever, requiring a deeper evaluation of how to achieve a “patient engagement 2.0” capability.

How can we create a holistic patient engagement capability … supported by enabling technologies, secure data, and a unique experience personalized to meet each patient need?

Market trends shaping the landscape

In 2016, we presented a patient services maturity model that highlighted “table stakes” patient engagement offerings, including educational materials, access to providers, startup assistance, and reimbursement support. Now, these services are essentially the norm. Life sciences companies have increased their investment in patient-facing programs to accompany new product launches and to bolster both existing products and products facing end-of-life patient protection. As the market continues to experience pricing pressures and patients become more informed and open to changing therapies, pharmaceutical companies are continuing to invest in creating a differentiated patient experience; for example, transitioning from all-in-one “brochureware” websites to interactive, omnichannel brand-level experiences that drive improved patient education, onboarding, and adherence to maximize therapy efficacy.

Also, in 2016, we observed the opportunity for leading life sciences companies to step into the void by establishing self-owned patient engagement capabilities. These patient engagement offerings have become more robust and innovative. Indeed, in addition to pharmaceutical companies, health systems, providers, and payers are also vying to get patients to engage with their own platforms, tools, and systems, typically leveraged from leading enterprise cloud-based platform companies. This, however, can create issues. Today, patients being prescribed a new drug may be asked to enroll in their health care provider’s (HCP’s) hospital or clinic patient engagement system, the life science company’s patient engagement program, and a wellness application from their health insurance company, leading to a potentially overwhelming and conflicting patient experience despite the best intentions by all participants. The opportunity here, though potentially complex, is to coordinate these diverse engagement tactics into a seamless orchestration of touchpoints with the patient with the unified purpose of supporting optimal health outcomes.

Adding to this influx of patient engagement offerings, which many companies are offering at the brand level for larger, “blockbuster” drugs, life sciences companies are now also developing patient engagement programs that are not product-specific, but tailored to a specific therapeutic area to increase disease awareness and provide support to patients before they are prescribed therapy or even diagnosed. Examples include AbbVie’s “SpeakENDO” program to encourage women to seek treatment for endometriosis, the Amgen/Novartis “#SpeakYourMigraine” program to help migraine sufferers seek important information and assistance, and Novartis’s “Eyelove” program to raise awareness for chronic dry eye. These programs make support materials available to any patient, although they do still have a marketing lens, as the companies offer branded treatments for these conditions. The next step that we see some companies exploring is the formation of partnerships with advocacy groups with the goal of bringing a single solution to an entire disease state population, regardless of what drug they are prescribed. However, such programs are still in the exploratory phase, as they are driving companies to develop new and nontraditional reimbursement models to fund them.

The idea of life sciences companies offering solutions broadly to benefit an entire patient population, rather than only to those patients prescribed their brand, reflects the industry’s continued shift to value-based care, which provides reimbursement based on improvement in patient outcomes. As part of this shift, companies have needed to expand their organizational capabilities to collect and analyze real-world data for regulators and payers (that is, data from a variety of postmarketing sources such as electronic health records, disease registries, and at-home patient-reported data). Managing the life cycle of these new sources of data, which have historically been siloed, will require increased transparency, advanced analytics, and better linkages between clinical data and real-world data.

Demand and supply: The convergence of omnichannel patient marketing and patient services

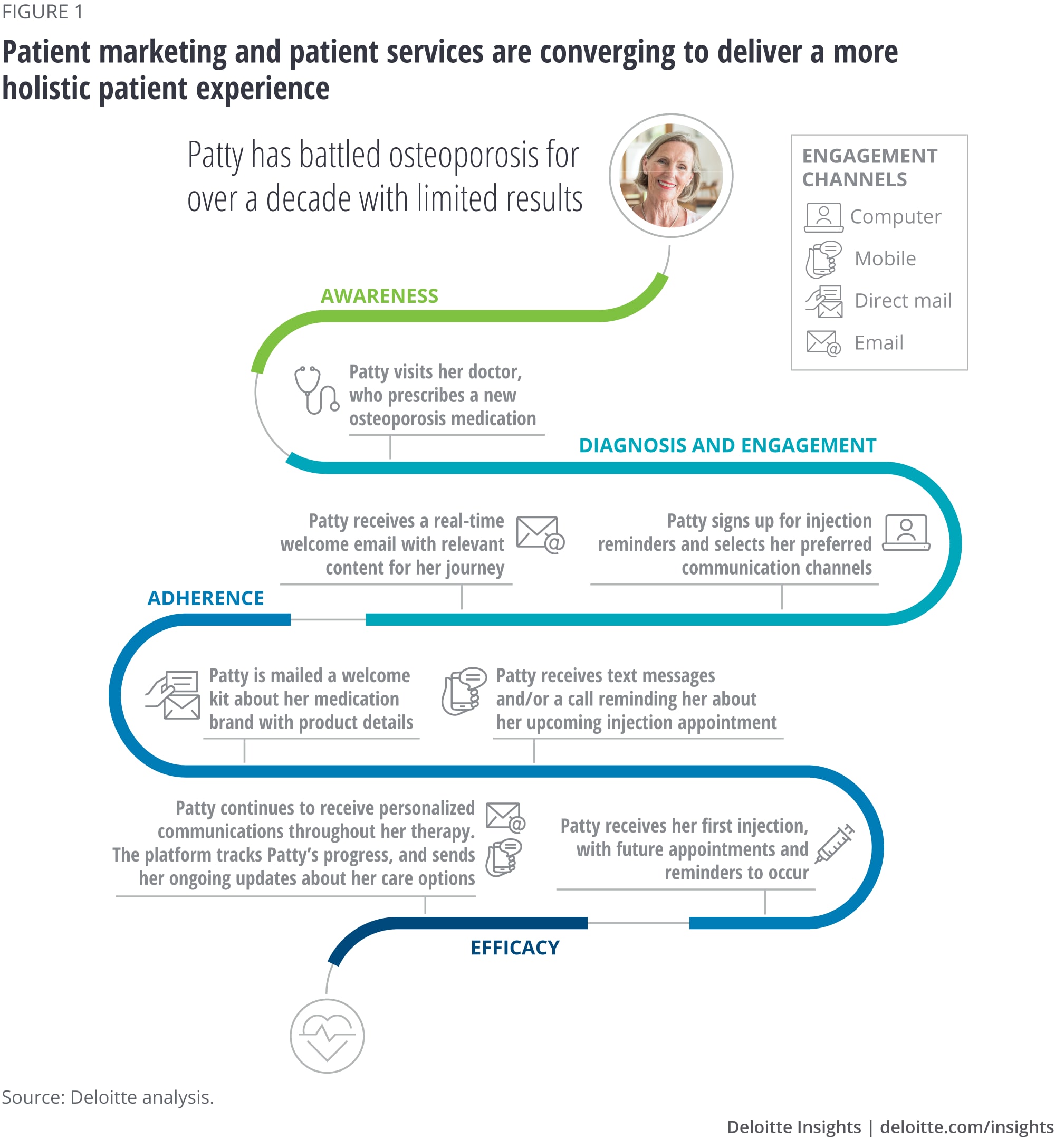

We mentioned above that life sciences companies are pursuing a more holistic array of patient engagement capabilities. In particular, patient marketing and communications now play a key role in helping patients, their families, and care providers better understand how a given drug therapy is relevant. This is the front-end, “demand side” of the patient engagement experience that has emerged in recent years: Companies are using enterprise marketing technology platforms to engage, educate, and onboard patients much earlier in the disease life cycle in an effort to drive better health outcomes. These “martech” platforms provide key omnichannel capabilities for communicating with patients, families, and providers, including email, SMS/text, and mobile/wearable device integration. Through such platforms, life sciences companies can enable and deliver product information, HCP collaboration, therapy scheduling, dosage reminders, financial assistance, and other activities.

Importantly, these capabilities equip life sciences companies with more relevant and timely patient data, helping them to better understand unique patient needs (such as their channel preferences or behavioral tendencies). Better data can help companies integrate patient marketing efforts with the “supply side” of patient engagement—the ability to provide patient services capabilities such as therapy administration, appointment reminders, financial assistance, and clinical programs at the quality and scale needed to meet the demand created by patient communications and marketing. Through such experience- and data-driven platforms, companies are aiming to “hyper-target” patients based on disease state or other relevant data, then rapidly respond through the patient’s preferred channel to provide timely communications that aid the care process.

The patient journey illustrated in figure 1 illustrates the growing convergence and cohesion of demand-side patient marketing and supply-side patient services to enable a more holistic patient experience.

Platforms such as these are allowing life sciences companies to continually improve their interactions with patients and their care network through ongoing insights and testing. As life sciences companies aim to share more of their patient marketing and services insights with care providers to improve patient care, this continuous learning cycle allows providers to gain greater insight into the patient’s needs, interact on a more relevant (not necessarily frequent) basis, and deliver more personalized care to optimize therapy adherence and efficacy.

Supported by these core patient platforms, additional opportunities to complement patient marketing and patient services capabilities include:

Digital coaching. Patients can receive interactive care directly from their mobile devices through apps that enable them to select and share information with their HCP and other care providers in a variety of areas, including medical, nutrition, fitness, and rehabilitation. Wellness coaches can provide fully integrated and personalized care plans based on patient needs, helping to increase patient accountability to drive adherence to treatment.

Privatized health information. Engagement platforms are offering patients more options when it comes to managing their privacy, allowing them to tailor what information they share with providers/caregivers and giving them the ability to manage personal goals in line with care plans. This provides a layer of protection for private health information, and it also affords patients greater control over how they mobilize their care ecosystem to support them through diagnosis, therapy, and recovery.

Telehealth. Providers can expand their offerings to include at-home care for patients to receive routine check-ups, as well as mobile-enabled hospice care with on-call capabilities that are aligned with therapeutic call centers and local partnerships. Through these offerings, patients could interact with providers in real time without waiting weeks for appointments, thereby accelerating therapy adherence and the overall healing process. Similarly, health care providers will be able to provide virtual care to mobility-impaired or remotely located patients. It is interesting to note that the COVID-19 pandemic, despite the societal trauma it has inflicted, may have enhanced the opportunity to expand telehealth by increasing patients’ and providers’ acceptance and adoption of telehealth capabilities such as videoconferencing and remote diagnostics and care, though the level of long-term adoption remains to be seen.

Artificial intelligence. Life sciences companies, health care providers, and health care payers should all seek to increase their investments in artificial intelligence (AI) and machine learning (ML) platforms. These technologies can leverage large patient data sets to identify key insights that can inform more relevant patient communications, enable better point-in-time care, execute improved clinical trial programs, and generate more efficient patient case management at higher volumes over time.

Crisis detection and response. Patient engagement platforms could help health professionals manage public health crises by providing communications with key patients and the general public. For example, the Takeda Pharmaceutical Company, a leader in blood plasma-based therapies, is using patient engagement technology to help recovered COVID-19 patients register online and potentially donate blood plasma for ongoing research in pursuit of a COVID-19 vaccine. More generally, the COVID-19 pandemic crisis has pushed companies to use patient engagement capabilities to rapidly reimagine the care delivery process, condense the testing and drug approval processes, and expedite logistics to distribute care across geographies out of pure necessity for the general public welfare.

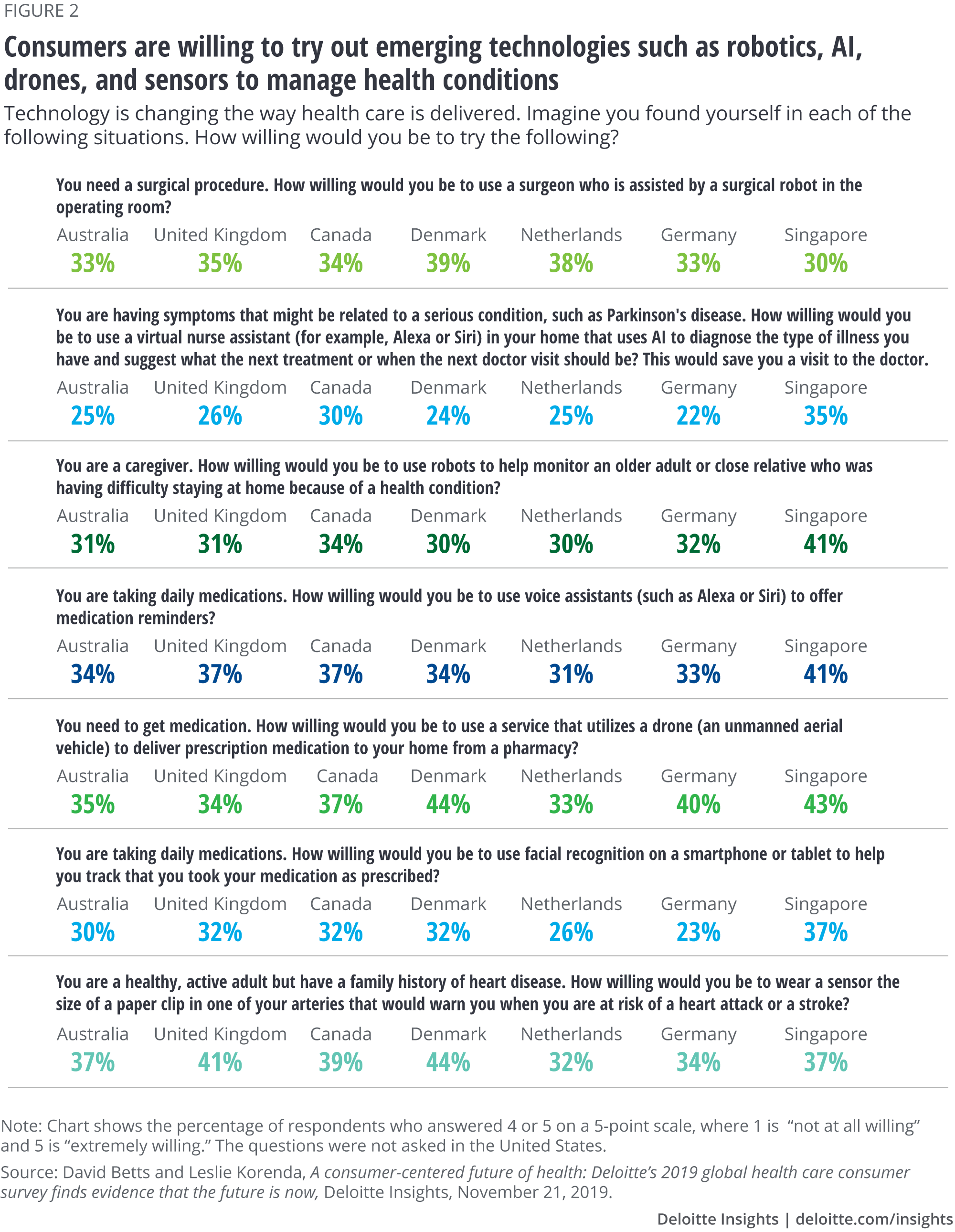

Patients are increasingly open to next-generation patient engagement channels, tools, and techniques involving virtual care, robotic surgery, AI, biosensors, and even drones to deliver prescriptions.

As a further encouragement to life sciences companies to put such capabilities in place, recent Deloitte Center for Health Solutions research provides evidence that patients are increasingly open to next-generation patient engagement channels, tools, and techniques involving virtual care, robotic surgery, AI, biosensors, and even drones to deliver prescriptions (figure 2).

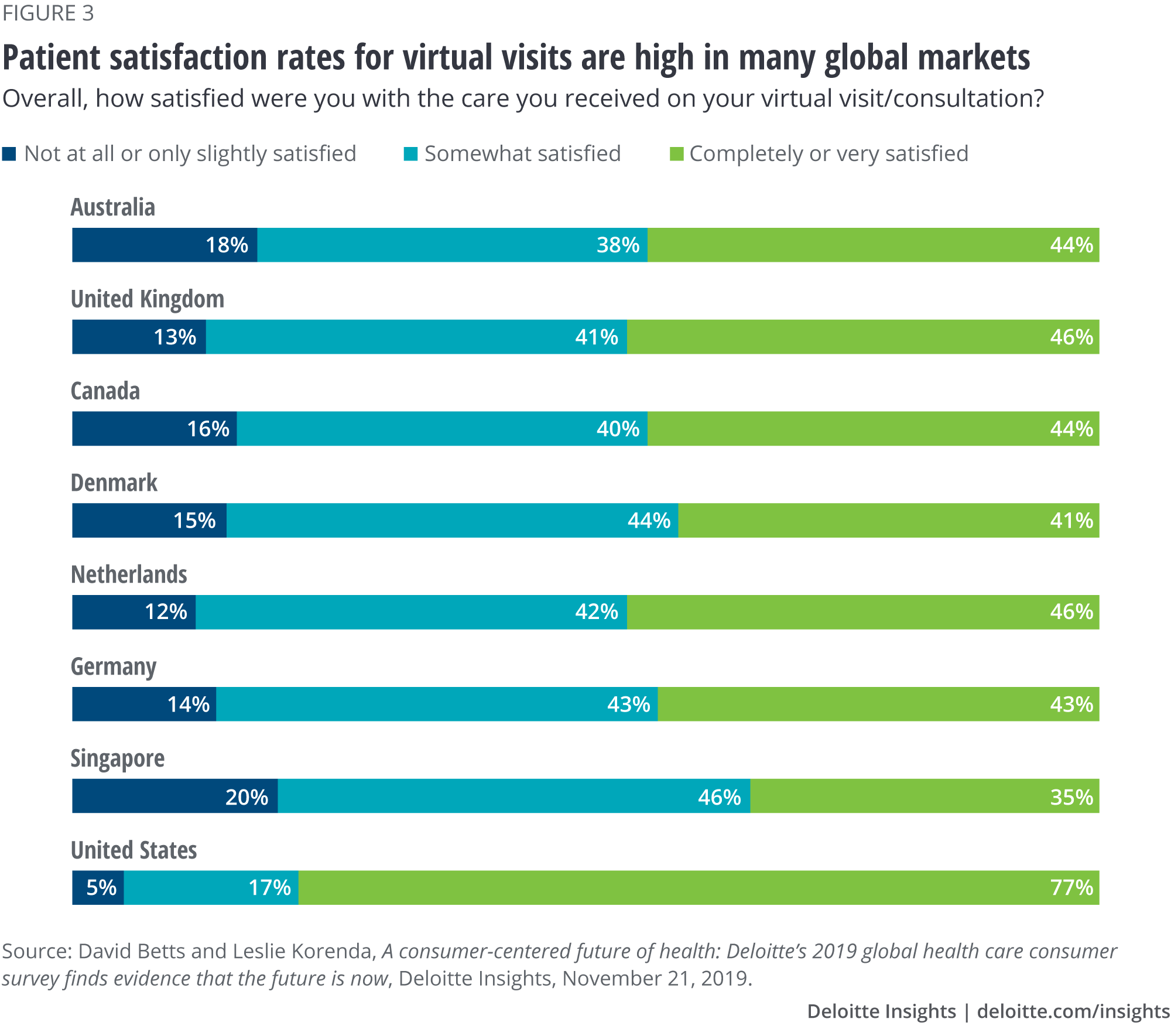

What’s more, our research also shows that the move to virtual services had already been welcomed by many patients worldwide prior to the pandemic (figure 3).

The case for owning the underlying patient engagement platform

Historically, most life sciences companies have outsourced their patient platforms and data to third-party suppliers that specialize in patient-support operations. The challenge with this model, however, is that, based on our experience working with leading life sciences companies, these suppliers’ processes, technology, data, and insights tend to lag behind the fast-moving, dynamic life sciences marketplace. As their goals and priorities for patient engagement shift, life sciences companies with outsourced engagement platforms risk finding themselves mired in contract/service level agreement negotiations, aging supplier-owned technology, and a growing frustration about the way these suppliers are capturing and reporting patient data (such as data about patient marketing campaign effectiveness or patient service efficiency), which may not equip these companies with real-time, data-driven insights to enhance nimble tactical patient engagement or support strategic business decisions.

Given today’s more mature patient engagement platforms and data management tools, consolidating patient processes and data internally is not only achievable for life sciences companies, but can give them a key competitive advantage. As companies continue to invest in an all-encompassing approach to patient engagement, it is becoming more important to assimilate information quickly, understand patient behavior, and optimize how patients and surrounding care systems are educated, informed, onboarded, and serviced across a variety of digital and analog channels. In our view, to own the patient experience, a life sciences company should own the patient platforms and the patient data with appropriate consent to drive the real-time insights needed to provide an agile, relevant patient experience.

To own the patient experience, a life sciences company should own the patient platforms and the patient data with appropriate consent to drive the real-time insights needed to provide an agile, relevant patient experience.

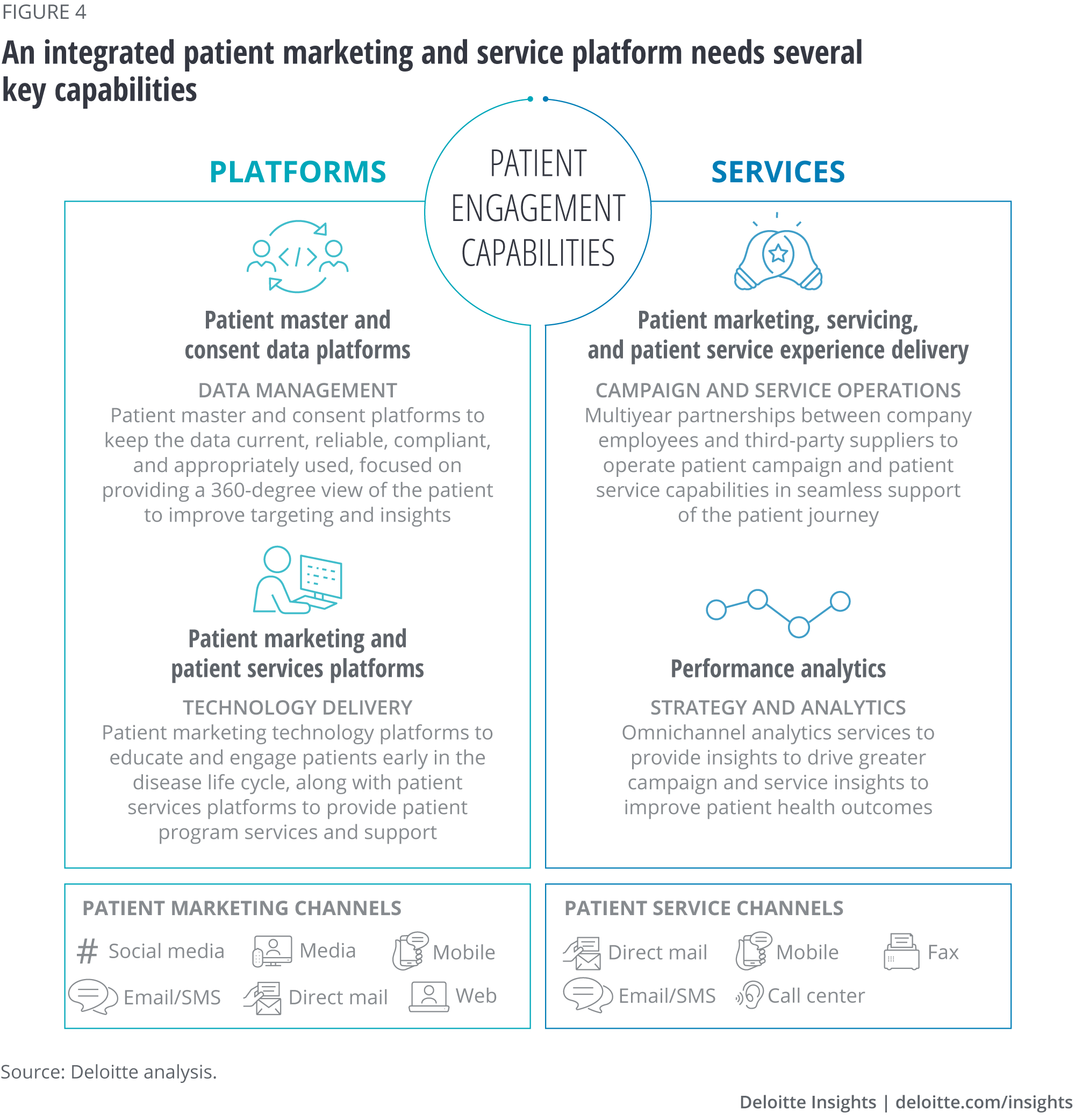

The leading model today of establishing a “single source of truth” for patient information and a consistent patient experience is to migrate all processes, data, and integrations to a consolidated company-owned patient engagement architecture and platforms consisting of:

- Patient marketing technology platforms to educate and engage patients early in the disease life cycle

- Patient services platforms to provide key patient program services and support

- Patient master and consent platforms to keep the data current, reliable, compliant, and appropriately used

- Data management and integration platforms to manage, distribute, and protect patient data

- Third-party patient services plug-ins for supplemental patient services such as copay card acceptance, Sharps kit fulfillment, or samples delivery

- Wearable and mobile devices that help patients, families, and care providers stay tightly connected and coordinated throughout the patient journey

Figure 4 illustrates some of the key capabilities that an integrated patient marketing and service platform would need to deliver a seamless patient experience.

A life sciences company that owns its patient engagement platforms and data in-house, yet still contracts with third-party service providers (such as creative agencies, martech firms, and “hub” vendors) to perform the marketing and patient services activities on top of these company-owned platforms, can secure several potential advantages:

Greater control over the patient and provider experience. With an owned platform and effective governance mechanisms, companies can make improvements to processes more quickly, without having to wait for business leaders to organize and interpret data from disparate third-party supplier sources. This can drastically reduce the time needed to implement updates to technology systems and processes. In addition, real-time access to consolidated patient data can allow for greater innovation and problem-solving to better address issues in patient therapy onboarding and adherence. And owning the data offers companies more flexibility to try innovative new partners when they are not beholden to incumbent providers based on “data jail” ownership.

Greater agility through greater vendor collaboration and consolidation. Bringing all suppliers that support the same patients and sites onto the same company-owned platform encourages cross-vendor collaboration, which can offer opportunities for cost savings and reinvestment as well as enhance visibility into the patient journey. This greater visibility into handoffs can allow users to view patients’ status in real time and take immediate action when needed.

Greater operational efficiency. Companies that own their platforms can enforce standardized processes across third-party providers. This enables companies to establish a uniform training program for users, which reduces overhead and increases patient engagement consistency. In addition, improved collaboration opportunities and better patient engagement operations can increase internal productivity. One company that has successfully implemented both patient marketing and patient services capabilities and platforms has realized a 27 percent increase in patient campaign effectiveness, a 33 percent reduction in patient campaign delivery costs, and a 27 percent reduction in patient services contact center transaction costs.

Accelerated program launches. Owning an integrated patient platform can accelerate the time to market for new programs accompanying a product launch. Companies can quickly and seamlessly integrate new program content and designs onto an existing back-end platform, alleviating delays that can arise from the need to work with suppliers to stand up an entirely new system and program to accompany a product launch.

Greater data empowerment. An in-house integrated platform can give companies the visibility into their data needed to comply with relevant laws such as GDPR and CCPA. It also can afford companies the flexibility to use different types of data to measure and motivate agents speaking with patients, as well as allow companies to use advanced analytics to predict trends and take appropriate action.

Managing patient data globally presents new and ongoing challenges

The fact that the COVID-19 outbreak reached pandemic status in a matter of weeks inspired many companies to face head-on the challenges of implementing global, digital solutions, perhaps with less apprehension around regulations than in the past. Yet the deployment and execution of these solutions remain complex—and the complexity is growing exponentially as new regulations in different regimes proliferate.

To begin with, companies face the need for global content and regulatory approval, as well as the challenges of managing a coordinated patient and human experience across geographies. Some of these considerations are not necessarily new—after all, large pharmaceutical companies have created and maintained global campaigns for decades. But what is new and top of mind are the implications for implementing digital solutions with large and robust sets of patient platforms and data that share common technology platforms worldwide but are configured and leveraged to meet local market patient needs, regulatory constraints, and data compliance requirements. Regional guidelines are specific when it comes to digital solutions and the use of data for consent. What data is considered sensitive and personal? Where must data be stored, and how it must be encrypted? The penalties for violating these regulations (such as those imposed by GDPR in Europe), and the financial and reputational cost of data breaches, make it clear that these regulations must be carefully planned for and adhered to.

The technology challenges of managing data complexity are not specific to life sciences companies. Large technology players such as Adobe, Amazon, Facebook, Google, and Salesforce.com are working to make sure their platforms are viable and compliant for the most complex, regulated markets, including life sciences and health care. However, individual programs and implementations still require diligent discovery efforts to choose a platform that is appropriate for each provider’s risk profile and the types of services a company seeks to offer to patients across geographies.

Readying the workforce to support patient engagement

Life sciences companies focused on modernizing their technology and owning their patient engagement data must also consider the foundation for driving this transformation: their workforce. With more emphasis than ever before on creating an enhanced patient journey, it has become increasingly important for organizations to change the way they work to better serve patients across the care life cycle. Often, this may require a shift from a hierarchical, siloed structure to a more team-based environment where business and technology teams are organized together by capability (such as market access, patient operations, patient marketing, commercial information technology, and so on) and focus jointly on the end-to-end patient journey: from awareness through education, onboarding, adherence, and efficacy.

Agile methodologies are continuing to permeate many companies in how they deliver enterprise technology. However, we consider it essential to look beyond basic practices such as the standup or scrum team. To effectively use patient engagement technologies, life sciences organizations should further embrace the agile-driven method of “product teams” designed to meet the demands of the rapidly changing health care landscape. This means breaking down silos and leveraging people with cross-functional capability, technology, and data skill sets who are eager to innovate, combined with leaders who have a future-driven mindset and are committed to change.

When considering how to bring an organization’s workforce along this journey, a few leading practices to consider are:

Develop a cohesive patient engagement strategy, vision, and road map. Define a clear vision and ambition for your future-state patient engagement organization that specifies how the above-mentioned product teams will work together to deliver and sustain patient engagement capabilities that are nimble enough to meet changing patient needs and expectations, and scalable enough to meet rising patient demands. Align your workforce goals to your patient engagement technology enablement road map to bring the entire organization along throughout the digital transformation journey.

Coordinate with external vendors. Consider how you might be able to use external agencies and vendors as an extension of your current workforce for activities such as martech operations, campaign creation and delivery operations, patient services operations, patient data management, and patient insights creation. At the same time, it is important not to source outside workers for tasks that should be accomplished in-house. Evaluate your internal skill sets to understand any gaps and consider transferring and training workers to areas where resources may be scarcer or too cost-prohibitive to recruit and retain.

Be thoughtful about resourcing and demand management. In light of the many benefits that an integrated and common platform can help achieve, it is important to note that companies will need to appropriately resource in-house teams or strategic partners to stand up, manage, and improve their patient engagement platform on an ongoing basis. Demand management of business needs and expectations will also be essential to balance incoming projects with the platform support team’s available bandwidth.

Taking patient engagement forward

What are the opportunities for life sciences companies moving forward? Organizations exploring ways to take their patient engagement efforts to the next level can consider the following steps:

Aim to deliver an integrated patient experience across all touchpoints. Leading companies have taken their patient engagement activities far beyond core patient services to seamlessly integrate them with patient marketing and communications, patient insights generation, and myriad connected devices and wearables to help bring it all together in support of the patient journey.

Apply a global patient engagement investment lens while acting locally. Continue investment in enterprise patient marketing, patient services, and mobile/wearable device platforms, as they will play an increasing role in standardizing and scaling patient engagement strategies globally. At the same time, tailor actual patient engagement tactics to meet country-level market needs.

Own your platforms and involve third-party suppliers as necessary. Life sciences companies can benefit from owning their patient engagement and data management platforms in-house while drawing on third-party suppliers for important but secondary operational roles. It is important to build the right internal process, technology, and data skill sets to support an in-house platform.

Drive insights through data, AI, and machine learning. Patient data, obtained from more channels and sources than ever before, can yield relevant insights that can allow companies to craft more targeted and meaningful patient experiences. Investing mindfully in the new world of AI and machine learning-driven technologies may yield significant operational and strategic business decision-making benefits sooner than most might think.

Keep your eyes on outcomes. One danger of pursuing advanced digital patient engagement solutions is that companies can easily, though perhaps accidentally, lose sight of real-world outcomes. Either the program launch itself is viewed as a success, or measuring increased therapy adherence becomes the focus without considering patient outcomes. Setting clear goals for improvement in outcomes and partnering early with payers to understand their value drivers will help ensure that the right data is being collected from the start to accurately understand and track the impact of new, innovative digital engagement solutions.

Look for opportunities to integrate patient experience across organizations. The larger health care ecosystem—life sciences companies and health care providers in particular—has an opportunity to truly integrate patient engagement processes, technologies, and data to comprehensively improve patient outcomes. Although this high-value opportunity has tangible hurdles to clear along organizational, process, people, technology, and regulatory lines, life sciences companies may find it worthwhile to explore partnerships, consortiums, or even joint ventures to this end.

The life sciences industry is moving beyond core patient services to the next generation of patient engagement that seamlessly connects and spans the entire patient engagement life cycle—awareness, education, onboarding, adherence, and efficacy—to improve patient health outcomes. Patient marketing platforms, patient services platforms, patient data management platforms, and a myriad of patient devices and wearables are converging in a “patient engagement 2.0” opportunity to give life sciences companies the ability to deliver on their promise and passion: to exceed the needs of their patients and their families in the life moments that matter most.

© 2021. See Terms of Use for more information.

Explore the issue

-

Private 5G networks: Enterprise untethered Article5 years ago

-

The sustainability transformation Article4 years ago

-

Measuring the business value of corporate social impact Article4 years ago

-

Deloitte Review, issue 27 Collection4 years ago