Biopharma leaders prioritize R&D, technological transformation, and global market presence Findings from a new survey and analysis of investor calls in the first half of 2020

19 minute read

25 August 2020

Jeff Ford United States

Jeff Ford United States Alex Blair United States

Alex Blair United States Bushra Naaz United States

Bushra Naaz United States Jessica Overman United States

Jessica Overman United States

While COVID-19 has forced biopharma companies to focus on immediate priorities, findings from a new survey indicate strategizing for tomorrow may be key to thrive in the future.

Executive summary

Leaders of pharma companies are in the midst of unprecedented change. While this was true even before COVID-19, the pandemic and the ensuing economic downturn have brought about a sea change in the way organizations look at the road ahead. Pharma companies are up against a fresh set of challenges even as the pandemic has spurred adoption of technologies and other innovations to support virtual work and other functions.

Learn more

Explore the Life sciences collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

The Deloitte Center for Health Solutions set out to understand these organizations’ strategic priorities, and learned that maintaining and expanding R&D, technological transformation, and their global market presence are their immediate focus areas.

Additionally, here’s what our analysis found:

- COVID-19: Executives expect the pandemic to accelerate research, manufacturing, and marketing of drugs to treat and prevent the disease; some also said it will accelerate investments in a few areas—for example, in digital technologies—that companies were planning to invest in even before the crisis.

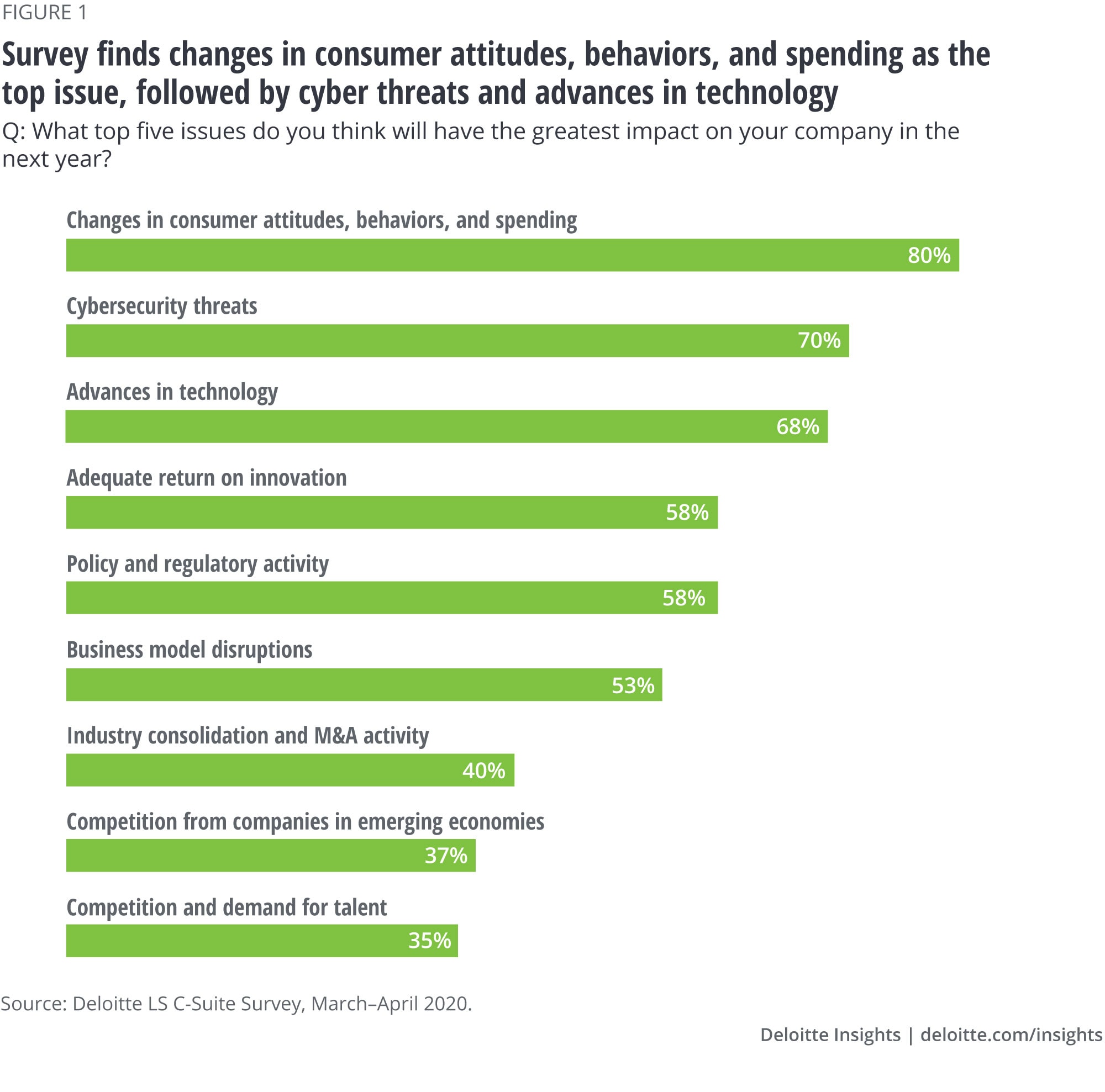

- Challenges: Respondents rated changing consumer behavior, cyberthreats, and accelerated technology advances as the top challenges that will have the greatest impact on their company in the next year. Our analysis of the transcripts from investor meetings also prominently featured the word “consumer.”

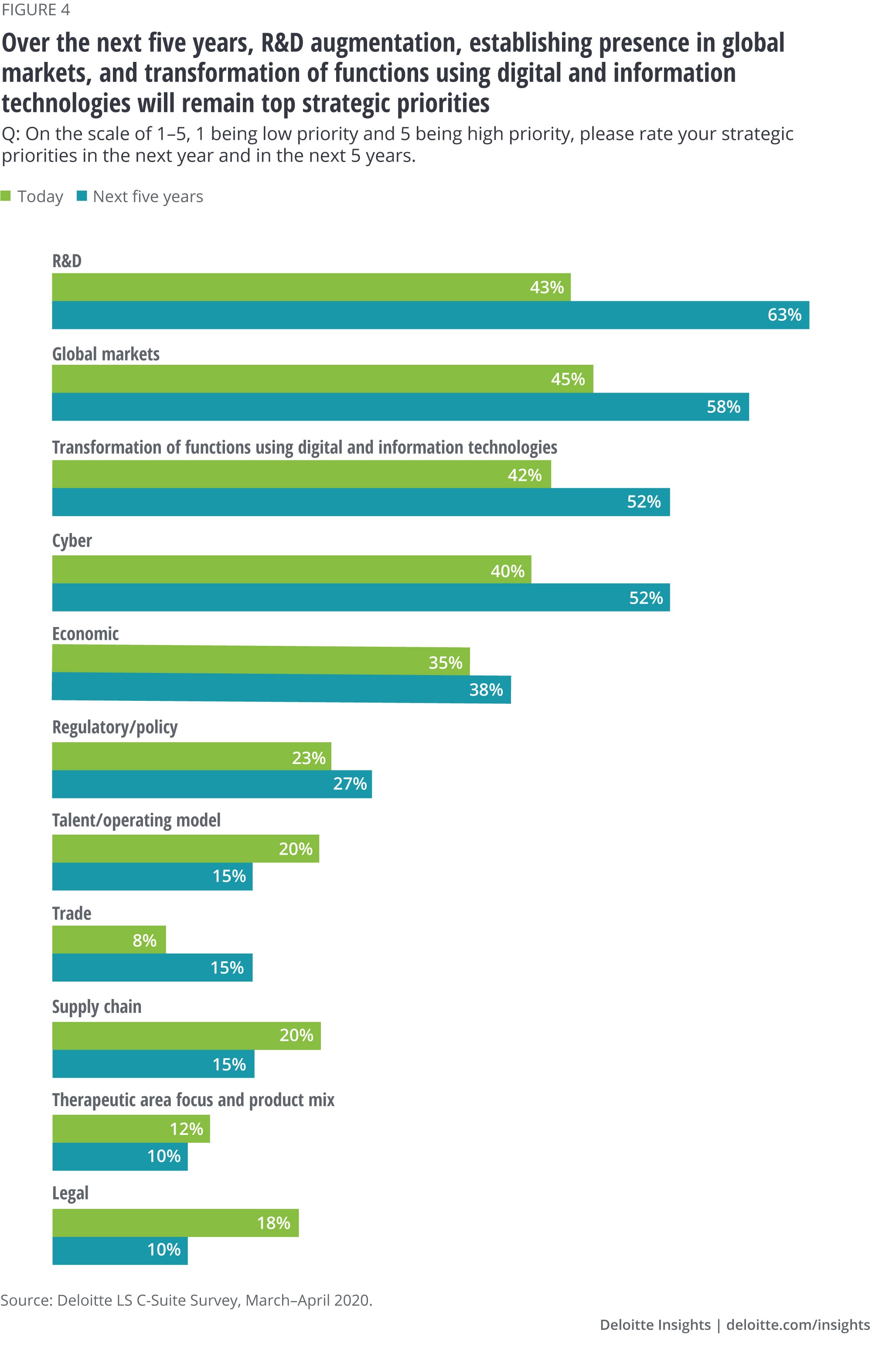

- Priorities: Global market growth, strengthening R&D, and transformation of digital and IT are currently the top strategic priorities for biopharma companies, and will continue to be so in the future.

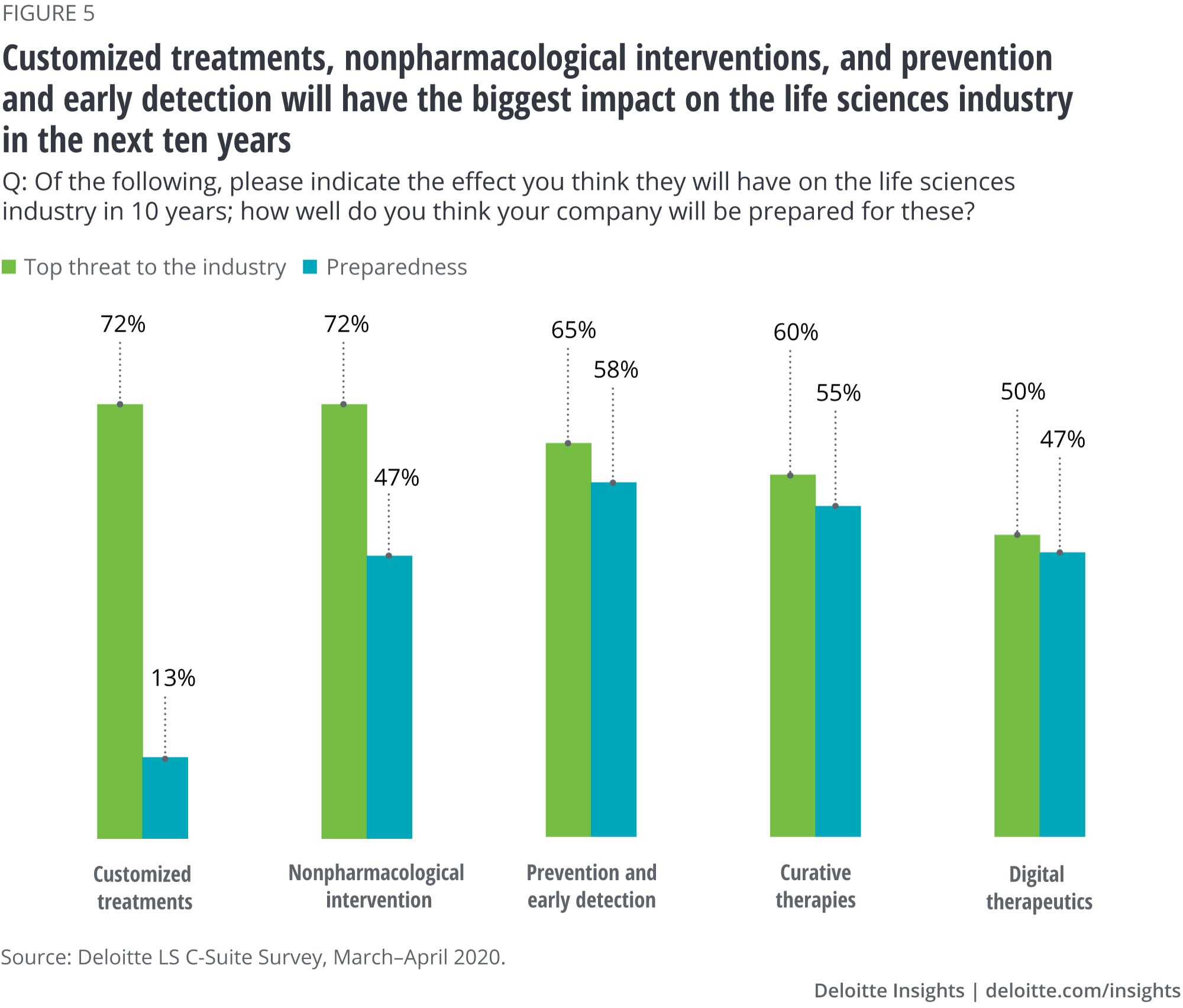

- Next frontier: Respondents believe customized treatments, nonpharmacological intervention, and prevention and early detection will have the greatest effect in the life sciences industry in the next 10 years. While most respondents are prepared to address nonpharmacological intervention and prevention and early detection, respondents are not prepared to tackle customized treatments.

The data comes from two different sources. One is a survey of 60 biopharma company leaders —primarily middle-sized companies in terms of revenue. The second is a text analysis of investor statements from the largest pharma companies in the last quarter of 2019 and the first quarter of 2020. Both the survey and the second round of investor statements were sourced during March and April 2020, at the peak of the COVID-19 pandemic.

These are challenging times for pharma companies as economic, supply chain, and other forms of uncertainties abound. Even as many of these companies are focusing on therapies and vaccines for the pandemic, leaders should think strategically about their investments—in terms of therapeutic area, digital technologies, and talent—in order to thrive in the future. Some companies have said that the pandemic has forced them to provide immediate attention to existing priorities (e.g., R&D, digital transformation, cyber). Despite this urgency, bets should be selective and strategic; companies should prepare for risk but not let it hold them back.

Introduction

Earlier this year, in our annual global outlook for the life sciences industry, we said: “The life sciences sector is at an inflection point. The promise of cell and gene therapies is being delivered to patients; rare diseases, previously believed to be incurable, are on the precipice of real cures. Artificial intelligence (AI) and machine-learning approaches are raising expectations that therapy discovery and development may not only be more innovative, but also more time- and cost-effective. Data-driven approaches have the potential to create value across manufacturing, the supply chain, and the entire health care ecosystem.”1

Even though it seems like a lot has changed around us in the last few months, our analysis of investor call transcripts and a survey conducted during the pandemic suggest that many of these statements are still true. (For details on the survey methodology, see sidebar, “Methodology.”) COVID-19 has presented challenges to many aspects of pharma companies, but the focus on new technologies and data and value creation remains.

COVID-19 provides both opportunity and risk

Biopharma companies have been racing to discover effective treatments and vaccines for COVID-19. Over 233 treatments are currently under consideration, and 161 vaccines are in development as of June 2020.2 While the pandemic has created opportunities for the biopharma industry to demonstrate the industry’s value, it also has led to potential short- and long-term challenges.3

The direct effects of the pandemic include suspended trials for drugs other than those for COVID-19, delayed product launches, inability of the sales force to carry out in-person visits, supply chain disruption, and overall delays in drug commercialization. A recent report found that the pandemic has decreased the number of novel late-stage assets, which already were declining in the last four years.4 The report also shows merger and acquisition activity to be slower in 2020 than other years.

Other challenges include the global economic volatility, and uncertainty regarding trade and supply chain regulation and sourcing going forward. Additionally, globally, social unrest around racism issues is increasingly calling on leaders to develop, implement, and sustain new initiatives.

While these challenges continue to disrupt the industry, the pandemic has also propelled multiple partnerships to develop a COVID-19 vaccine. Biopharma companies and regulators are exploring opportunities to work together to streamline the drug development and review processes, which could lead to the emergence of new business models.

But while this work on therapeutics and a vaccine is on companies’ to-do list, some of them said that the pandemic has compelled them to focus on immediate and existing priorities (e.g., R&D, digital transformation, cyber) across therapeutic areas and functions.

“Considering the pandemic, the world is witnessing, strategies for drug development is our focus. This involves research and marketing of drugs for COVID-19.”—COO, biopharma company

“Looking for new and potential markets to maximize revenue. The current COVID-19 crisis will bring more challenges into the picture and is likely to impact our goals in many areas.”—EVP, biopharma company

Methodology

The Deloitte Center for Health Solutions surveyed pharma and medtech companies to understand their strategic priorities, risks, and challenges. This article focuses only on the results for biopharma companies; insights on the results for medtech companies can be found here. Survey respondents included individuals in the following roles: chief executive officer (CEO), chief operating officer (COO), chief commercial officer (CCO), and EVPs/VPs business/corporate development of 60 biopharma companies (~60% companies with revenue more than US$1 billion and less than US$5 billion). The survey was conducted in March and April of 2020.

We also analyzed investor call transcripts from 38 of the largest (by revenue) biopharma companies for Q4 2019 and Q1 2020. The text analysis used relevance analysis of keyword/ontology and natural language processing.

Change in consumer behavior prompting a change in strategic thinking

When asked about the top issues that will have the greatest impact on their company in the next year, pharma company leaders ranked the following challenges as their biggest concerns:

Changes in consumer attitudes and behavior: Consumers are changing their attitudes and behaviors in numerous ways—from increased use of technology and willingness to share data, to their interest in using tools to make decisions about prescriptions and care.5 Survey responses aligned with Deloitte’s vision of the future of health centered on the consumer—80% of respondents chose changes in consumer attitudes and behavior as an issue that will have the greatest impact on their company (figure 1).

Pharma companies’ focus on the consumer may reflect gains in information symmetry between manufacturers and plans. In the past, pharma companies knew the most about their products. Now, through real-world evidence, health systems and health plans may know even more about how well drugs work in patients than pharma companies do. Emerging ecosystems may accelerate this trend; it is critical for pharma companies to arm themselves with data so that they can continue to have a seat at the table.

One way that companies are addressing this strategic priority is through explicit patient-centric strategies. As we wrote in an article on patient-centricity earlier this year, “companies should not only embrace [a patient-centric] approach, but prepare to participate in an emerging ecosystem where philanthropies dedicated to particular diseases, patient advocacy groups, health plans, health systems and physicians, regulators, competitors, and technology and wellness companies are all better connected so that the patient is at the center.”6

“We are not prepared for meeting rising customer expectations. We need to grow our reachability to a larger extent.”—COO, biopharma company

“Need to adapt to market changes with respect to customer needs.”—EVP/VP business/corporate development, biopharma company

Cyber and advances in technology: The next most common issues cited were cybersecurity threats (70%) and advances in technology (68%). Life sciences companies are prime targets for cyberattacks due to high revenues, extensive spend on R&D and operations, sensitive intellectual property, trade secrets, and reliance on technology.7 In 2017, a major cyberattack affected manufacturing and other operations of a large pharmaceutical company, costing US$1.3 million in losses.8

Adequate returns on innovation: More than half of respondents cited adequate return on innovation as an issue. A 2019 Deloitte study points out that while biopharma companies made significant R&D investments to innovate in the last 10 years, the returns declined significantly during that same period—from 10.1% to 1.8%. This represents an average decline of 0.83% per year. A transformational change in R&D productivity is required to reverse this trend. The issue is also compounded by the decrease in average peak sales per asset.9

Policy and regulatory activity: More than half of respondents listed policy and regulatory activity as a top issue. Pharma companies face a range of policy and regulatory issues—activity that affects the pace at which drugs come to market, supply chain and safety, tax, and pricing polices limiting payment rates. In addition, the US Food and Drug Administration (FDA) has, in partnership with the biopharma industry, introduced many regulatory changes around approving COVID-19-related treatment research. As Stephen M. Hahn, FDA commissioner, stated, “We want to help patients by expediting promising treatments and are committed to maximizing our regulatory flexibility and proactively bringing the best innovators together to ensure we are getting the right treatments to the right patients at the right time.”10

The public debate about drug prices in the United States has subsided while the focus has shifted to the pandemic and the development of vaccines and therapies, along with their associated costs. It is, however, an issue that will likely return. With the upcoming election and pressure on state and federal budgets, the issue could well rise in prominence later this year. Biopharma companies will likely keep an eye on these developments and revisit their strategies accordingly.

“Our major concerns would include security issues because of intervention of technologies like IoT, managing the epidemic going on right now and finding a cure, and working on customized treatments based on previous data available.”—CEO, biopharma company

Strategic priorities

Key priorities for companies include R&D, establishing presence in global markets, and transformation of functions using digital and information technologies

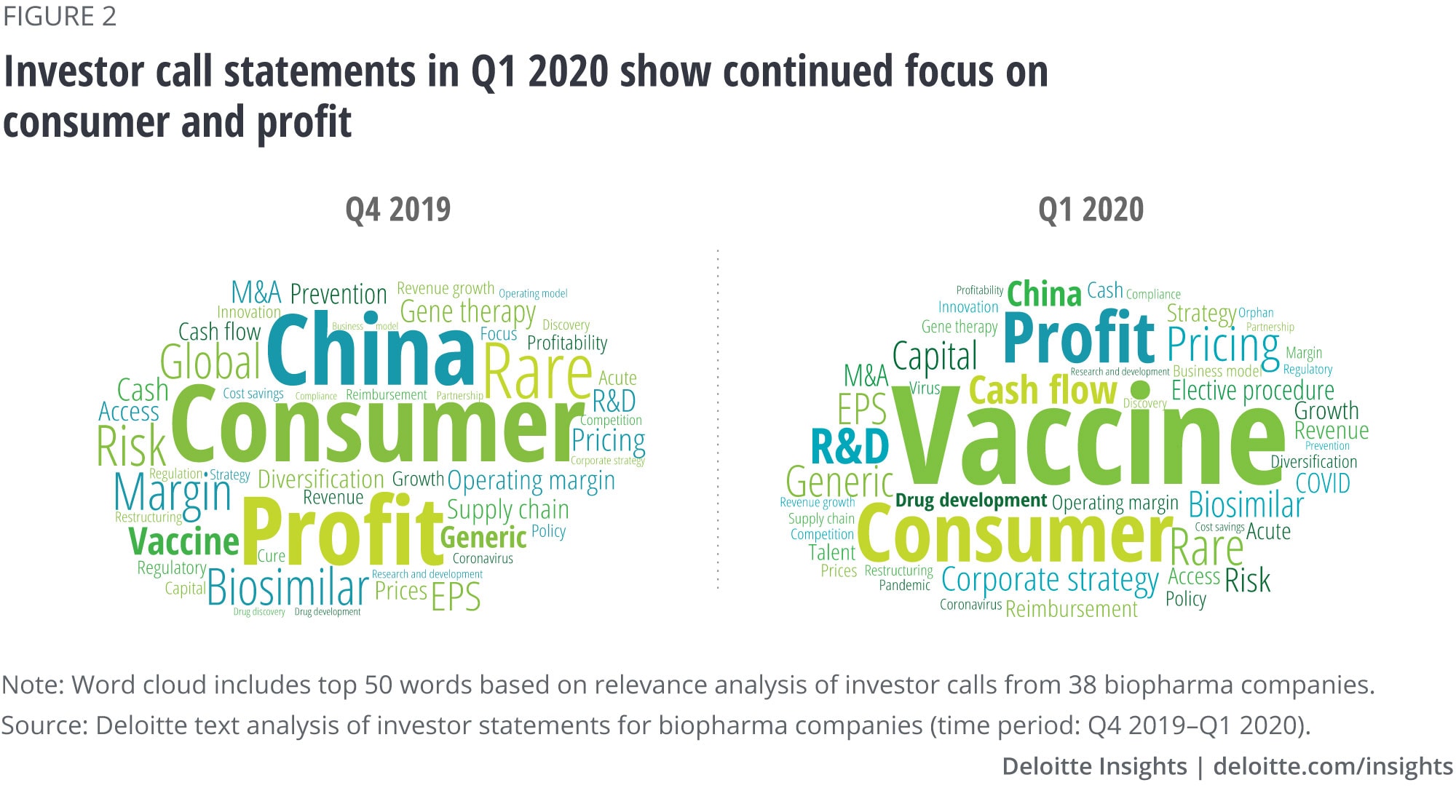

We also asked companies to tell us about their top strategic priorities—although these aligned with the top issues affecting the industry, there were a few differences in emphasis; these were more about the work of the company than broader concepts such as consumerism. Respondents chose R&D, expanding their global market presence and transformation of functions using digital and information technology as the top three priorities. Findings from our analysis of transcripts from investor calls for 38 biopharma companies found that between Q4 2019 and Q1 2020, statements continue to focus on consumers and profit (figure 2). These results are consistent with the survey findings—consumer behavior is a top issue.

“Our top strategic priority would be to start more and more R&D initiatives globally so we have a good hold in each market for research.”—EVP/VP business/corporate development, biopharma company

As expected, the word “vaccine” gained prominence between the two periods. The words “China” and “rare” shrunk from their relatively prominent position in Q4 2019.

In our survey, we posed several open-ended questions to our respondents, to understand their strategic priorities in their own words. Text analysis of those responses found emphasis on words such as “business model,” “collaboration,” and “growth.” Consistent with other findings and the industry trend, leaders and analysts on the investor calls also spent a lot of time discussing “R&D.” Some of the other words that found a prominent mention were “competition,” “regulatory,” “counterfeit,” and of course, “coronavirus.”11

Digital maturity

Investments rise, but many aren’t there yet

Companies believe that transforming functions using digital technologies will be of high strategic priority in the next five years. Survey responses indicate that the focus of digital investments for biopharma companies will remain on gaining insights into the execution of business strategies—inclusive of understanding and adapting to changes in customer behavior (28%), improving the efficiency of the R&D process (25%), and fast-tracking products to market (15%) (figure 3).

Although executives did not prioritize talent issues, it is a given that a talent strategy will be needed to fully leverage new technologies and be a digitally enabled company, either through recruitment or through partnerships.

“Overall productivity by digital partnering and advancements in technology is key. Most important is selecting the right technologies and integrating them.”—EVP/VP business/corporate development, biopharma company

“It is the time of digital presence. Our top priority right now would be to be more available on social platforms in order to reach our customers. Reaching out to users through online medicine delivery portals for over the counter drugs is the future for us.”—EVP/VP business/corporate development, biopharma company

In our previous research, global executives, business leaders, and analysts of biopharma companies said they were somewhere along the half-way mark in terms of achieving digital maturity and adoption of flexible leadership and learning models.12

While many biopharma companies are experimenting with digital, most have not yet made consistent, sustained, and bold moves to take advantage of new capabilities. In this year’s survey, we asked respondents to grade themselves based on our definition of digitally mature: an organization that uses digital technologies and capabilities to improve processes, engage talent across the organization, and drive new value generating business models. Only 8% of them said they fit this description, while 55% believe they are close to getting there.

COVID-19 may have accelerated investment trends for pharma companies. Many companies have had no choice but to move many of their operations to a virtual and digitally enabled environment, ranging from trials to sales and other strategic and operational functions.

A five-year view of strategic priorities

When asked about the top strategic priorities for the next five years, 63% of respondents rated R&D compared to only 43% of respondents who consider R&D as a current top priority (figure 4). More than half (52%) selected transforming business functions. M&A, leveraging digital (including AI) for transforming business, refocusing on therapeutic area strategy, and balancing new opportunity with risk are also being considered important in the next five years.

Global market presence continues to be a top focus area for companies, with close to 60% of respondents rating it as a high priority. For example, many multinational players who formerly regarded China primarily as a source of raw materials or research are now viewing China as a key market. Others who have previously entered the market through joint ventures with Chinese companies and research institutes are now ready to ramp up their growth in China through drug licensing and acquisitions. But China is not the only source of innovation and growth; many companies are focusing on growth in the EU region and other parts of the global economy, sometimes through direct market entry, or out-licensing.13

“Major issues could be getting funding for R&D, chances of success during regulatory approvals, and ability to keep up with innovation.”—EVP/VP business/corporate development, biopharma company

“There is lack of sufficient money to invest in R&D, affording more operational facilities and their maintenance, and reduced supply of raw materials and resources due to the pandemic.”—EVP/VP business/corporate development, biopharma company

The future of health for biopharma companies in the decade ahead

We asked respondents to consider five areas that align with our future of health perspective for biopharma companies, with a focus on R&D, since that is one of their long-term strategic priorities (see sidebar, “The five areas”). The objective was to understand which areas, according to them, will have the biggest impact in the next 10 years.

The five areas

- Curative therapies: Treatments that cure disease could reduce or eliminate the demand for some prescription medicines. Developing, marketing, and pricing curative treatments could require biopharma companies to adopt new capabilities.

- Customized treatments: Personalization in medicine—driven by data-powered insights—could effectively match patients with customized drugs, or design therapies that would work for just a few people, or even a person. Biopharma companies are increasingly working on customized disease management programs.

- Digital therapeutics: Effective and scalable nonpharmaceutical (digital) interventions, often centered on behavior modification, can reduce the need for pharmaceutical intervention and eliminate or temper demand for medications.

- Prevention and early detection: Vaccines and improvements in wellness could help prevent disease, making treatment for some diseases no longer necessary. Advances in early detection will likely enable interventions that can halt diseases at the onset.

- Nonpharmacological interventions: Coupled with more accurate and precise imaging technologies, precision interventions that utilize robotics, nanotechnology, or tissue engineering could provide alternatives to pharmaceutical intervention.

In general, respondents rated customized treatments and nonpharmacological interventions as having the biggest impact on the life sciences industry in the next 10 years (figure 5).

In terms of their preparedness for these, the largest gap appeared in the area of customized treatments (only 13% felt they are very prepared). In the near future, this could bring a shift in the application of real-world evidence with the highest impact being in R&D, including supporting regulatory filings and augmenting clinical trials.14

Implications

Biopharmaceutical leaders are under greater pressure than ever before, with the need to accelerate R&D innovation, adapt to a rapidly evolving health care ecosystem, and deliver on the expectations of society and their investors. Pharma leaders are particularly attuned to managing risks, sometimes at the expense of innovating the model to address market evolution. To change the narrative, they may need to commit to a cultural shift that incentivizes deliberate risk-taking rather than maintaining the status quo. They need an organization that will thrive in today’s market while simultaneously preparing for the next market disruption.Most pharma companies have business models that are focused on certain geographies and customers. Pharma leaders should identify areas/customers where their current model is underperforming or failing and create innovation hubs to define the next evolution of the broader model. In doing this, large pharma companies can think and act more like their nimble small pharma counterparts. These innovation hubs can test new roles, technologies, policies, and strategies in an environment where failure is likely no worse than the status quo. Leaders can incentivize the organization to take informed risks, learn quickly from failures, and rapidly scale successes. Being deliberate about the intent of these hubs can support a more progressive culture that empowers those willing to march on to the next frontier. It can enable leaders to cultivate a playbook of informed bets they can place in response to ongoing market evolution, driving down the potential execution risk to the core business while enabling the margins to find new opportunities to perform.

While COVID-19 has fueled investments in digital R&D and customer engagement, it has also accelerated the transformation of health care delivery. Increased investment in and deployment of home-based health technologies are creating new opportunities for biopharma companies to create value. Technologies such as sensors, monitors, at-home diagnostics, and digital therapeutics create massive amounts of data that can be used for improving the clinical trial process and therapeutics, as well as for labeling and targeting products to patient populations who can benefit from them the most. Devices, apps, and other services have the potential to engage consumers and support them in becoming more active in owning their own health care information and be a part of their care plan. Evolving technologies, including blockchain, can help facilitate data interoperability, so that patient data can be more easily used for holistic and longitudinal analysis of health outcomes. Companies could be well served to take advantage of this momentum to incorporate digital technologies into the patient experience, either in clinical trials or via digital medicines and therapeutics. From a talent perspective, conquering the next frontier will likely require new talent and organizational structures to effectively play in the world of today and tomorrow simultaneously. Drawing new types of talent in high demand across industries, including engineers and designers, to inform digital investments has been a challenge within pharma. Many have sought to address this challenge by creating digital teams located in Silicon Valley, with limited success. Rather than focusing on geography, shifting the mission of these individuals to disrupt the status quo from within can be a strong recruitment driver. This model can require a dedicated team to assess, deploy, and evolve a portfolio of partnerships. The key is to build an organization that can thrive in today’s market, while being ever ready for the next market turn.

© 2021. See Terms of Use for more information.

Learn more about life sciences

-

Medtech leaders prioritize technology and consumers Article4 years ago

-

State drug pricing policies Article4 years ago

-

Real-world evidence’s evolution into a true end-to-end capability Article2 years ago

-

Key factors to improve drug launches Article5 years ago

-

The future of biopharma Article5 years ago

-

Life Sciences Collection