Preparing for the world outside the box Mastering external complexity

5 minute read

22 October 2019

While challenges posed by external factors are difficult to tame, CPOs and their organizations should shift from reactive to predictive supply chain management to offset risks as much as possible and be more resilient against both planned and unplanned events.

Global supply chains are vast, dynamic, and interdependent, creating a complex environment that could produce business disruptions at any moment. No organization or business can claim that it is impervious to the damage that external factors can cause. In a world where the success of the procurement business depends hugely on its ability to effectively capture value from external supply markets, it is imperative that chief procurement officers (CPOs) master external complexity.

Learn more

Explore the survey

Download the full report or create a custom PDF

View the industry and regional survey results

Subscribe to receive related content from Deloitte Insights

Download the Deloitte Insights and Dow Jones app

View the overview webcast (live or replay)

Nearly all procurement practitioners are familiar with the Kraljic 2x2 matrix of supply market segmentation and its two dimensions: value and complexity. In practice, this external complexity has evolved to become a broader proxy for risk—that is, high complexity creates more opportunities for things to go wrong across the value chain.

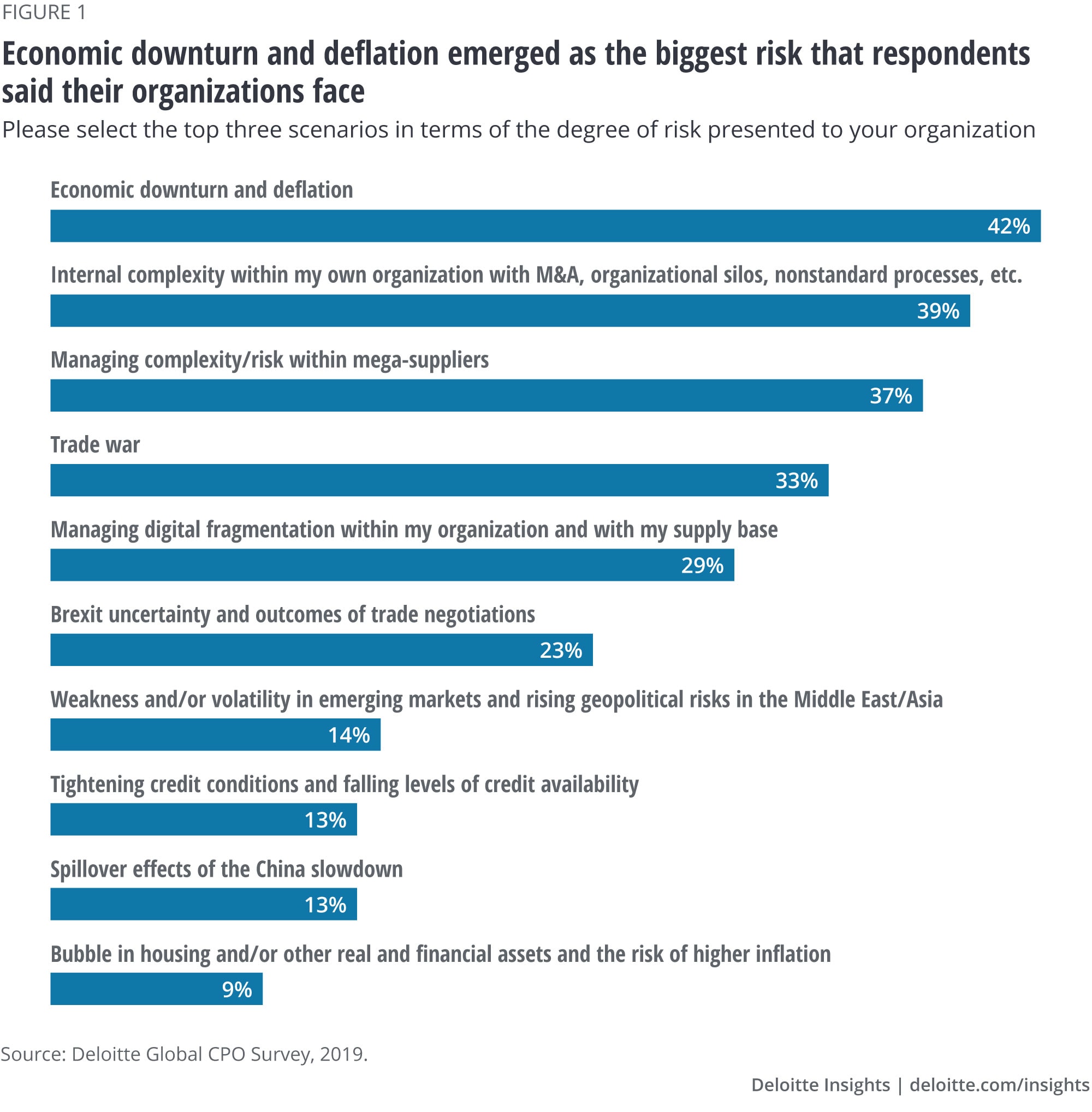

In the last year alone, several risk factors have added complexity to external supply markets—trade wars and resulting tariffs, climate change, uncertainty about the outcomes of global trade negotiations, and ultimately, the possibility of an economic downturn and deflation (figure 1).

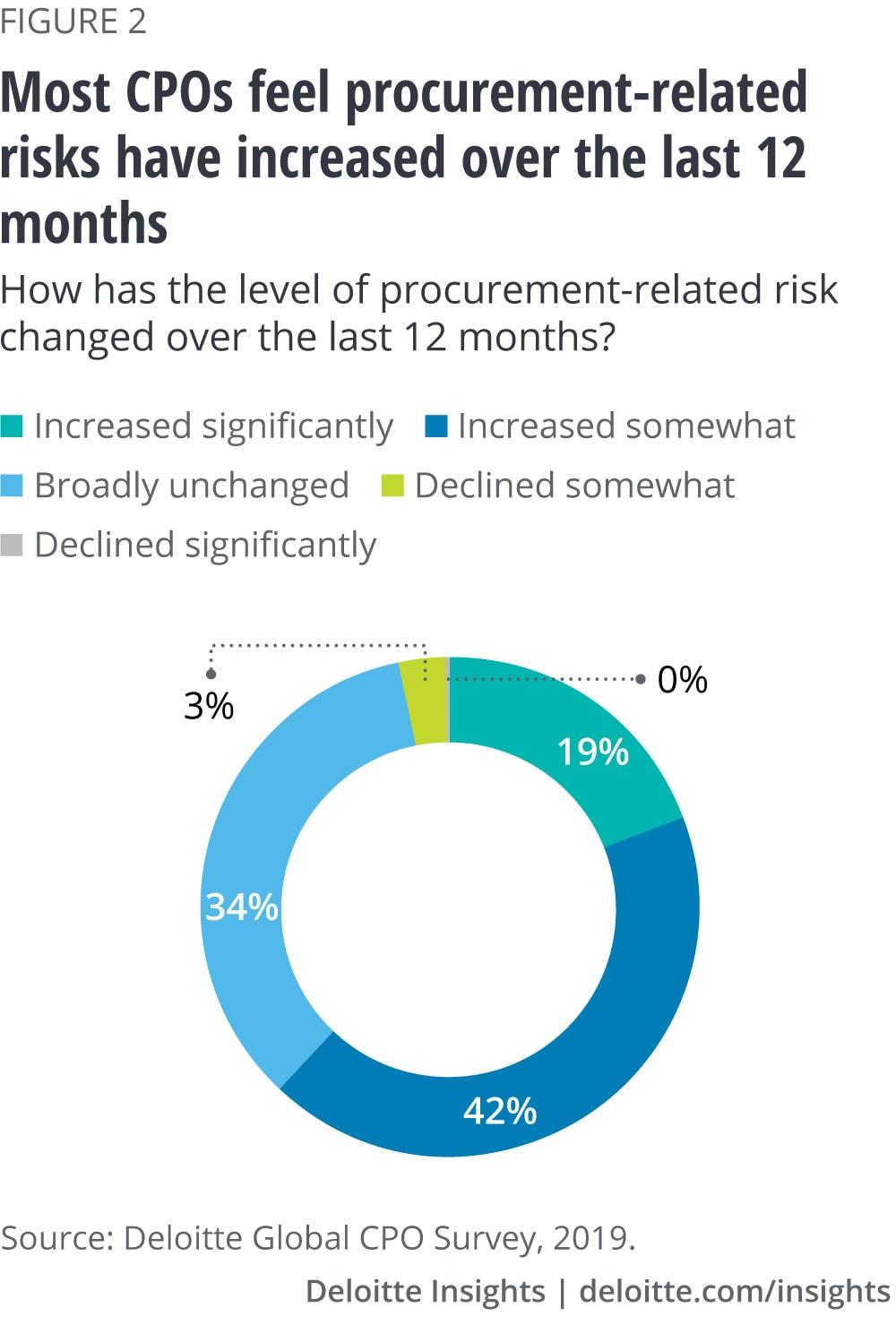

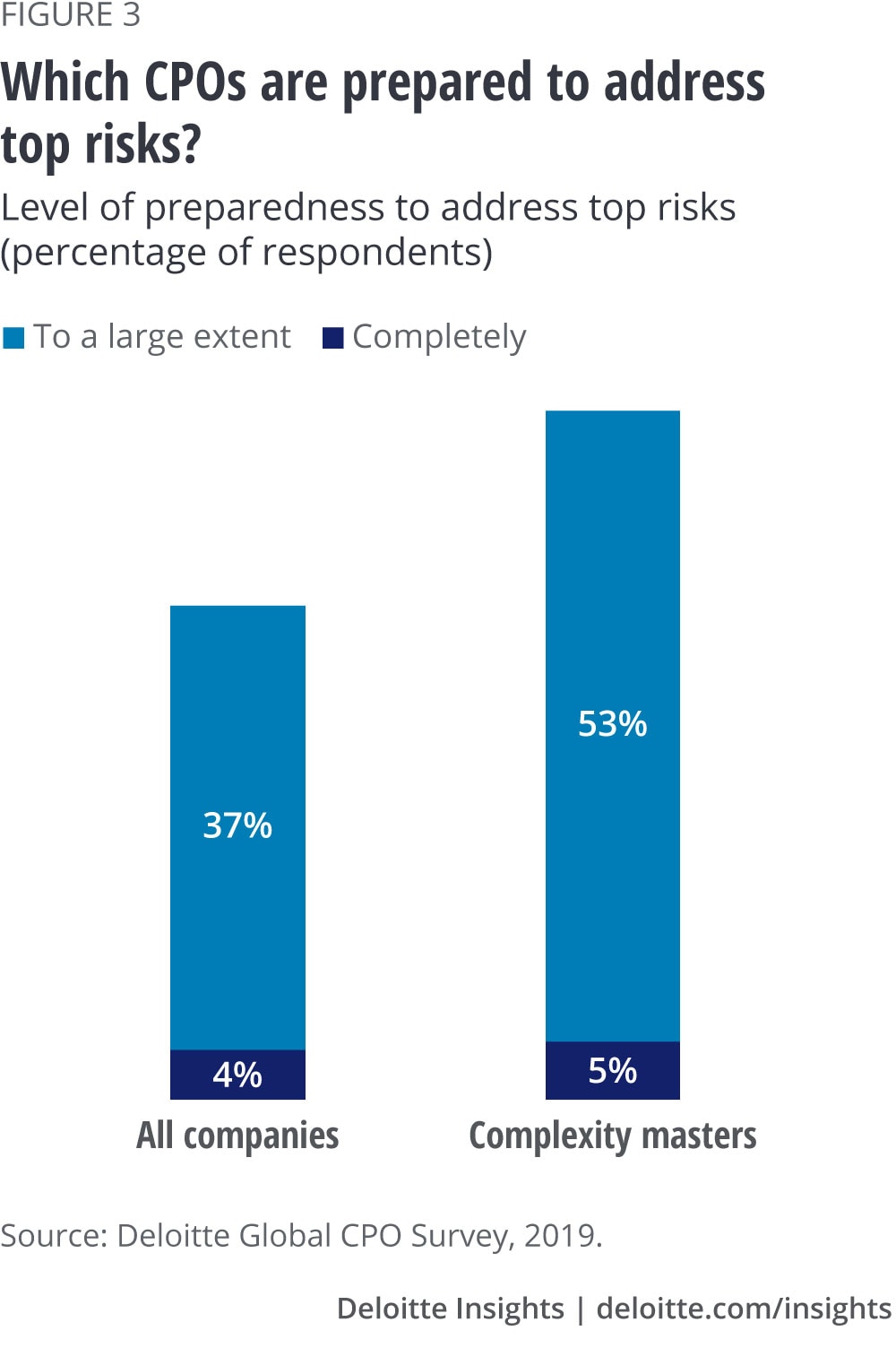

CPOs largely view these “outside-in” events as the continuation of an already high-risk environment, but even so, 61 percent of respondents found that risks increased over the last 12 months (figure 2). Familiarity with these risks, however, did not necessarily translate into confidence in managing them. Only 37 percent of CPOs surveyed were prepared “to a large extent” (as compared to 53 percent of the “complexity masters”—the group of procurement organizations that deliver a top quartile performance of those surveyed and also deal with highly complex environments.), and only a few said that they were “completely prepared” (figure 3).

Attacking commercial complexity and the risk of supplier power

The real supply risk surprise in this year’s survey was the second-highest cited risk (by 37 percent of respondents): the threats posed by “mega suppliers” that have emerged as a byproduct of years of strategic sourcing and industry consolidation. Supplier power means greater commercial/relationship complexity, which creates not only price risk but also agility risk if the supplier can’t be managed strategically for mutual benefit. Even so, 36 percent of all organizations still plan to continue performing spend consolidation—the top procurement strategy to be employed over the next 12 months—and two-thirds of firms will also perform the “tried-and-true” strategies of competitive bidding with new suppliers and contract negotiations with existing suppliers. In contrast, the complexity masters pursue these strategies but also seek to reduce costs and risk by reducing complexity in demand through SKU rationalization (56 percent compared with 25 percent for all firms) and through specification improvement (40 percent compared with 24 percent for all firms).

Tariffs played a prominent role this year, with 33 percent of total respondents (and 48 percent of manufacturers) naming it a major risk. But this seemingly transitory risk has foreshadowed the more systematic and longer-term risk of an economic downturn, cited by 42 percent of respondents and echoed in certain sectors such as US Manufacturing.1 Fears of a recession are clearly on the mind of many CPOs, who when presented with this response option in this year’s survey for the first time placed it ahead of all other regularly tracked factors.

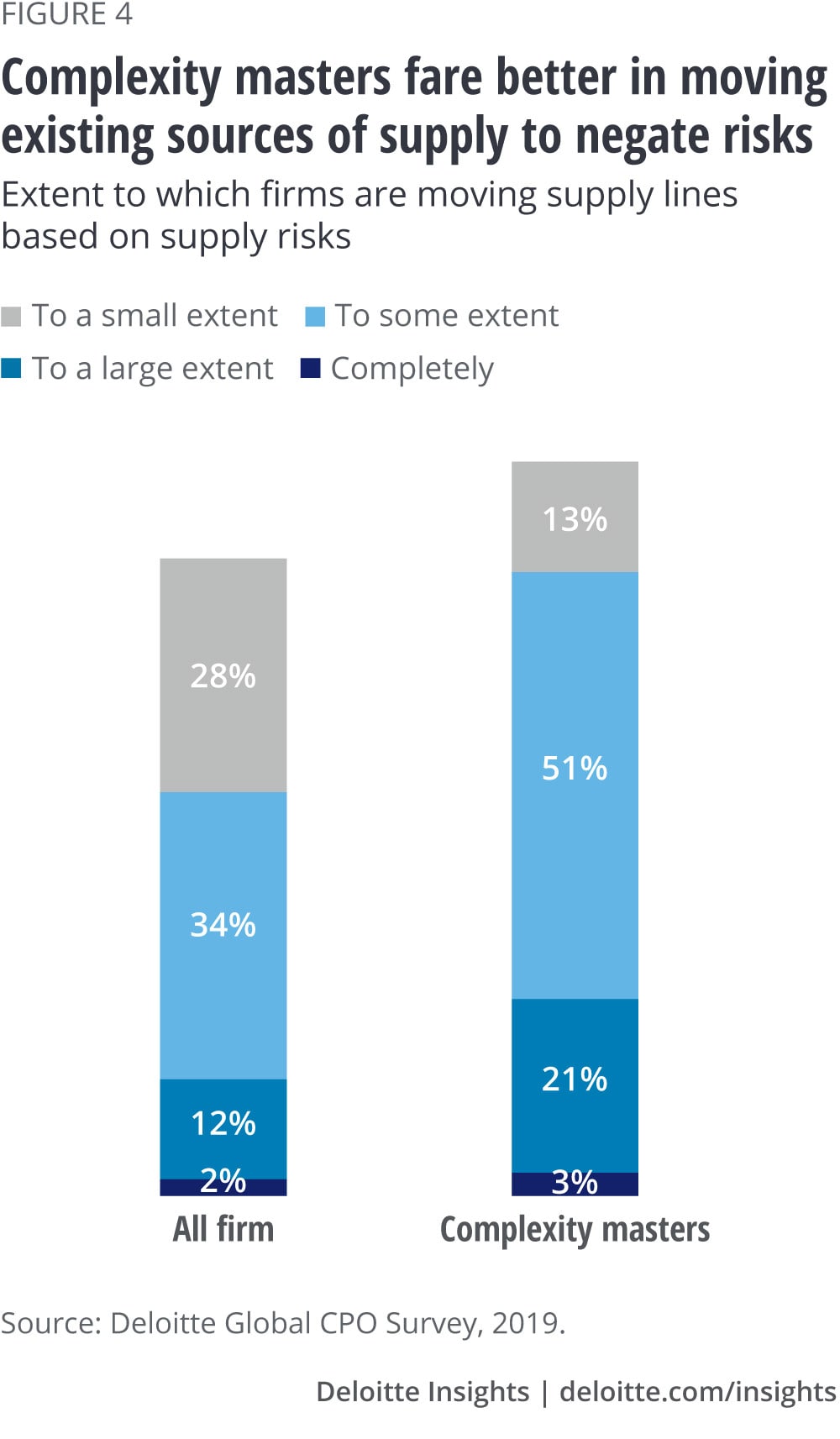

Despite this growing external complexity, procurement leaders are managing risk selectively. Trade disputes, for example, are primarily driving CPOs to pursue reactive and tactical redesign of their inbound supply chains. While 14 percent of respondents said they were “completely” or “to a large extent” planning to move to existing supply sources, nearly two-thirds (62 percent) only used this strategy “to some extent” or “to a small extent.” Interestingly, the complexity masters have been more aggressive here, with 24 percent doing so “completely” or “to a large extent” and 64 percent doing it “to some extent” or “to a small extent” (figure 4).

Although discussions on trade disputes and protectionism may have dominated market commentary in 2019, there hasn’t been any exodus to localized sourcing. For over a decade, progressive manufacturers have developed more domestic, regionally focused supply chains for the purposes of speed and resiliency/redundancy, and the recent trade wars have merely forced a change in supply mix rather than making them scramble to redesign their networks purely from the supply side.

Since risk levels appear to have remained elevated, however, procurement can use the burning platforms caused by such complexity to light a fire within the company to address the resulting risks—and potentially save some money, too. But this is no simple, one-time effort. In order to be able to achieve a sustainable advantage, companies must continually digitize and analyze their supply chains to help make them less risky and more resilient against both planned and unplanned events.

As research from MIT Sloan Management Review illustrates, the desired end-state is one in which an organization’s supply chain is able to “pivot” based on real-time analytics and flexible decision-making and execution processes.2 Evolved direct-sourcing capabilities are one example of this, with rapidly advancing capabilities for activities such as commodity hedging, Internet of Things (IoT), advanced analytics, and cost modeling giving leading organizations a competitive advantage.

So, what are some next steps for CPOs to help improve their mastery of the external environment? Here’s what they can do:

1. Develop playbooks and contingency plans to address the most pressing risks. Whether it’s global trade uncertainty, increasing tariff pressure, or natural disasters, external risks will always arise at inconvenient times. The best thing CPOs can do is to be proactive: Make an honest assessment of their organization’s exposure to various risks and develop playbooks for addressing them. Key starting questions include:

- What are the key failure points in our supply chain, and how can these be mitigated in the event of a disruption?

- What are the measurable risk thresholds (e.g., price increases) that need to be defined?

- What indicators do we need to track to assess the likelihood of each risk coming to fruition, and what action will we take in the event it does?

- How would each risk impact our organization in terms of talent, technology, and cost?

- Do our supplier contracts have the necessary language (e.g., force majeure clauses) to address trade risks or other disruptions?

- How quickly can we respond to changes in the environment, both foreseen and unforeseen?

2. Evaluate structural changes in your supply base that could reduce risk exposure. CPOs need to evaluate the global value chain their organization relies upon to determine whether they can increase the security of their business and their trading relationships. If their organization has previously moved operations offshore, they can consider whether there is an opportunity to leverage changes in the marketplace to re-shore and not only potentially save money, but also reduce risk exposure. Structural shifts aimed at diversifying the supply base can also help reduce the power of megasuppliers.

3. Go digital: Explore the potential of dedicated supply chain risk management solutions. While risk management is a growing priority within procurement, adoption of tools to address it lags behind core procurement technologies such as P2P. Emerging risk management tools capable of mapping a complete supply network (beyond just tier 1 relationships) and developing customized risk profiles for various risk factors can be used to make an honest assessment of an organization’s supply base and encourage cross-functional planning needed to mitigate external risks in a dynamic environment.

© 2021. See Terms of Use for more information.

Read more

-

Building a cognitive digital supply network Article5 years ago

-

The rise of the digital supply network Article8 years ago

-

Synchronizing the digital supply network Article6 years ago

-

How blockchain enables the digital supply network Article6 years ago

-

The path to supply chain transparency Article10 years ago

-

The supply chain paradox Article6 years ago