Do you have a finance-talent strategy? has been saved

Do you have a finance-talent strategy? A CFO Insights article

29 June 2011

Who knows what kind of talent finance needs better than the CFO and his or her leadership teams? Three core principles can help CFOs build a finance-talent strategy that can position the finance function for long-term effectiveness.

As finance’s depth and scope of responsibility grow, so does the need for highly skilled talent and leaders. As CFO, how do you identify the skill sets you need now and those you require going forward? In other words, do you have a finance-talent strategy that supports your broader finance and corporate strategies? Is it robust enough to evolve with your needs? And is it unique enough to allow you to focus on what differentiates your company—and yourself?

As finance’s depth and scope of responsibility grow, so does the need for highly skilled talent and leaders. As CFO, how do you identify the skill sets you need now and those you require going forward? In other words, do you have a finance-talent strategy that supports your broader finance and corporate strategies? Is it robust enough to evolve with your needs? And is it unique enough to allow you to focus on what differentiates your company—and yourself?

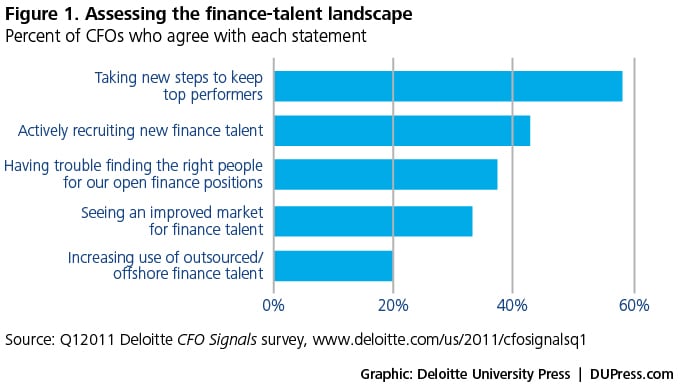

Answering these questions is critical for today’s CFOs. In the Q1 2011 CFO Signals survey, we asked finance leaders about the biggest challenges for their companies and their industries. In each case, talent availability was a top four concern. The strong message was that despite continued high unemployment levels, the elevated skill sets companies now require are not easy to find. One out of three CFOs surveyed said they were having trouble filling open positions, and nearly 60 percent were taking steps to engage and “lock in” top performers.1

Unfortunately, finding and securing finance-talent is just the first step in developing a finance-talent strategy. The goal should be to develop an integrated plan that identifies the people and skills needed at the macro, micro, and individual levels; integrates and deploys those people and skills into both the finance and business functions; and supports finance professionals across the employee life cycle—from recruitment to retirement. It is the rare company that has such a program in place, but with specialized finance skills at a premium, it is essential that CFOs develop programs and processes that foster talent retention and that they do not leave career development to chance.

In this edition of CFO Insights, we will review what a finance-talent strategy is, why it is important to have one now, and what you as a CFO can do to facilitate the development of your talent strategy. In future issues, we will drill into some of the specific components of an integrated talent strategy, including how to retain critical staff, strategies for effective finance career development, and the implications of the generation gap in finance.

What is a finance talent strategy?

Most companies have a talent strategy—one overseen by human resources (HR). While HR plays an important role as the leader and keeper of the organization’s approach to talent, functional and business-unit leaders must play the main strategic roles that drive talent planning, processes, and experience within their divisions. Talent is a key area where the tone and actions at the top matter.

This is especially important in finance. Who knows what finance needs more than the CFO and his or her leadership teams? Plus, given growth and the regulatory challenges companies face, coupled with the finance portfolio complexity and resource scarcity, no one is better positioned to determine talent needs and allocate talent within the department.

Research conducted by Deloitte and the Economist Intelligence Unit in 2007 suggests that one of the hallmarks of a world-class finance-talent organization is that the CFO sees it as his or her responsibility to lead talent development both for the finance function and, often, more broadly for the organization.2 In our experience, it is often the CFO who initiates a finance-talent strategy. Why? In trying to move beyond their operator to catalyst roles and become more strategic, CFOs tell us that they are often held back by their own staff’s capabilities. When they honestly assess their teams, they don’t see the talent to take them to the next level or to free them up to spend more time on broader strategic business priorities (see Crossing the chasm: From operator to strategist).3

Once that realization sets in, there are several key questions that must be asked. And answering these questions effectively is critical to developing a finance-talent strategy:

- What knowledge, skills, abilities, and experiences do you need now? Where do you need them? How many do you need? When do you need them?

- Which skills will be most critical to your business in the next three years? Five years? Longer? How are these skills and the skill mix changing?

- What are the specific competencies that you need to develop in your finance workforce, from both the technical and the leadership perspective? Are there new competencies required in both finance and the business generally?

- What are the “people” or talent programs, policies, and practices necessary to realize both those technical and managerial competencies? Can you leverage or build upon what HR already provides, or do you need something new or unique?

- Why would somebody join your company’s finance department, given the high demand for finance professionals? Why would they stay? What makes your finance function a career destination rather than a career way station?

- What is your role—and those of your finance leaders and C-suite colleagues—in fostering a talent experience within finance that emphasizes the right combination of development, opportunity, and work-life balance?

Pillars of success

Answering these questions requires a clear and honest assessment of your current talent and the creation of a vision for your finance department. The extent to which you can do that often depends heavily on the culture of your organization. A company that is developmental in nature and encourages stretch roles where people may make mistakes will typically be much more open to a finance-talent vision than an organization that is very job-specific and has no patience for failure. The corporate culture and your organization’s unwritten ways of doing business will influence your ability to recruit, develop, and retain the skills you need.

We’ve also found that a CFO’s attitude toward talent development can be strongly shaped by his or her own experiences. Finance chiefs truly value developmental opportunities, such as training, rotational assignments, or stretch projects, that they view as having been essential to their own careers. But if the organization is not open to these tactics, CFOs may be limited to making inroads in their own functions.

Whether on the functional or the corporate level, there are three pillars of a successful finance-talent strategy:

- Fully developed competency models. CFOs who tend to be successful at talent development have defined what talent means in their organization. They have a clear view of the near- and long-term technical finance, business, and leadership skills they need for their staffs. They also recognize that it takes a combination of job rotation, special assignments, mentoring, and formal development to deliver that talent. And they see both the big picture and the long-term nature of talent development.

- Articulated views of career development and job advancement. One of the main challenges in any finance-talent strategy is meeting career satisfaction expectations. A strategy that outlines career opportunities that meet the needs of the finance department and the finance professionals is crucial to success, particularly for the talent you are counting on as future leaders in the finance function.

- Positive talent experiences. While this may seem intangible, talent experience is what differentiates one finance function from another in the same way customer experience distinguishes companies in the product market. It may encompass how a finance professional is valued or respected, how much autonomy he or she is given to do the job, and corporate attitudes toward work-life balance and community/social values. These issues are becoming more important as talent programs focus on the expectations of different generations of workers. The talent experience may be the secret sauce to why a finance professional joins a company and chooses to stay, and it is the CFO’s role to ensure that the experience is positive.

Finance-talent for the long term

Putting a finance-talent strategy into action is not easy. Developing talent within a finance department needs to be both functionally specific and individually focused to address native talents and needed abilities. For example, what does a financial planning and analysis professional need in terms of competencies? How should those skills differ from what a tax specialist or a controller needs? And what constitutes a positive talent experience for a treasurer versus a cash manager?

To complicate matters, the strategy must also be dynamic. It must take into account different scenarios in terms of retirement, scarce skills sets, and increasing global competition for talent in the new entry job market, the university entry market, and the experienced-hire market. It must also consider the CFO’s needs for developing and executing strategy, since your finance-talent should help your company differentiate itself in the market now and going forward.

Being dynamic across time is not easy. Leaders change, markets change, customers change, staffs change, regulations change, and competitive conditions change. But if you have the right talent strategy in place, it should be constantly adaptive and work effectively as a change management tool. To ensure that it is, CFOs should review the finance-talent strategy on an annual basis as part of their finance planning process and address any new issues and opportunities. Every three years, it makes sense to reassess the overall finance-talent strategy relative to your business and your finance plans and determine if your strategy supports those priorities and plans.

CFOs are ultimately responsible for having the people, the leaders, and the specialist skills necessary to run and grow their function and their company. Changing regulations, global challenges, and critical skill scarcity reinforce the need for finance-talent strategies and plans. To put these plans in place requires answering a few not-so-easy questions and focusing on the three pillars of a successful finance-talent strategy. This is one area of investment for the CFO and his or her team we expect can yield significant—seen and unforeseen—benefits.

Being dynamic across time is not easy. Leaders change, markets change, customers change, staffs change, regulations change, and competitive conditions change. But if you have the right talent strategy in place, it should be constantly adaptive and work effectively as a change management tool.