United States Economic Forecast 4th Quarter 2018

20 minute read

13 December 2018

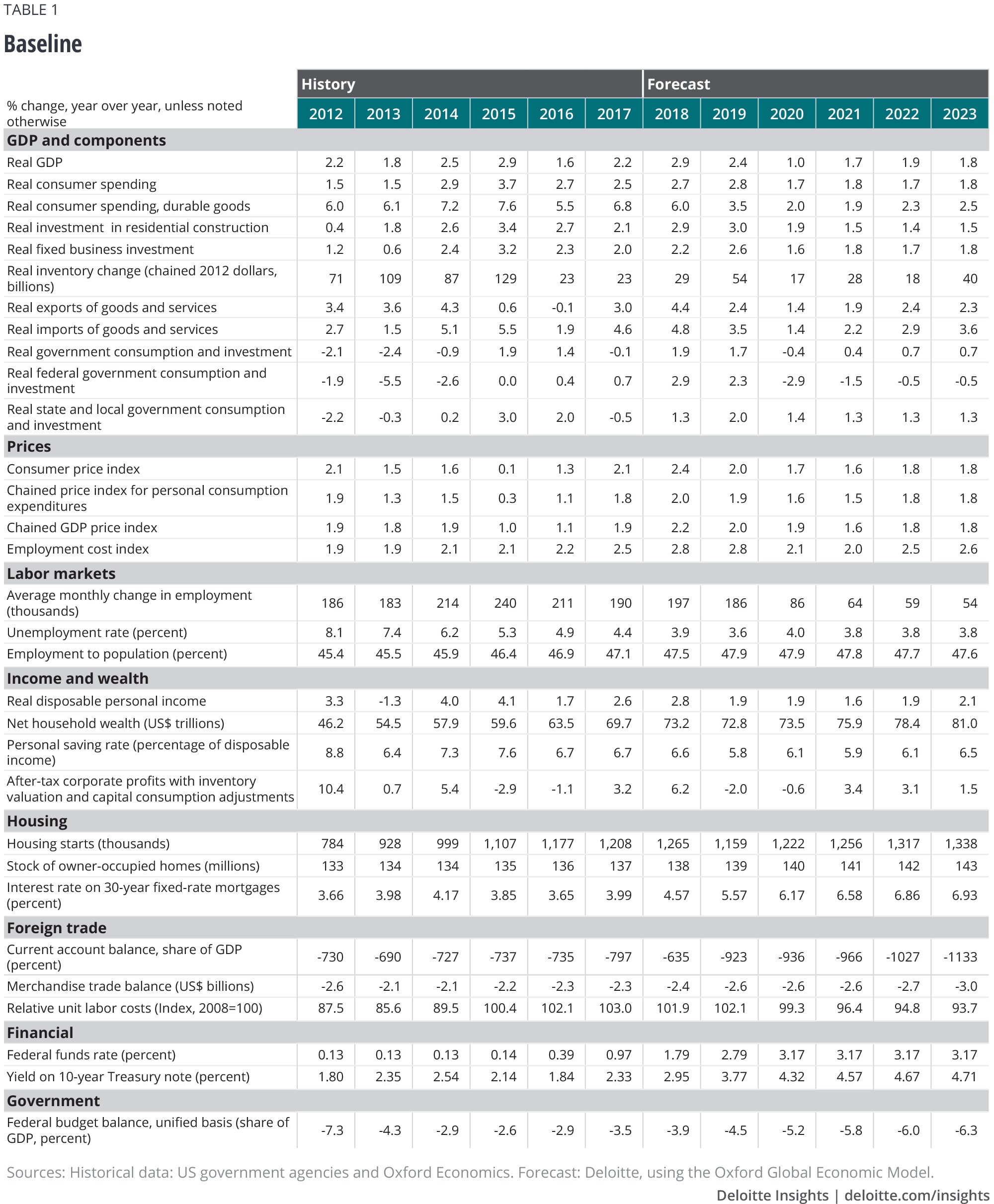

The midterm election results didn't alter our forecast, which still shows strong growth with a few clouds on the horizon. But policy decisions—both those made in 2018 and those to come—could pose a real threat to the US economy.

Introduction: Partly cloudy skies ahead

The US midterm elections are over, with the House of Representatives changing hands and a shift in power in several state governments. The outcome so closely matched pollsters’ and pundits’ expectations that the impact on our forecast is muted; indeed, our previous baseline forecasts assumed the outcome that occurred.1 More important, the key economic decisions driving the forecast were made by policymakers back in 2017 and ’18, meaning that few election outcomes would have shifted it. That said, policy will likely continue to create significant risks for the economic outlook, especially in 2020.

For now, the US economy is doing very well, indeed. GDP growth has been above 3.0 percent for two quarters and promises to come in above 2.0 percent in the third quarter. Job growth continues at the 200,000-per-month level, considerably higher than most estimates of the long-run growth potential of the labor force. Inflation is under control, running just about at the Fed’s target level of 2.0 percent.2

There are a few clouds on the horizon. Some monthly indicators of investment spending are beginning to weaken. Housing construction has started falling, and foreign economic conditions are worrisome, with European growth slowing sharply and China struggling to contain the impact of US tariffs.

But the main risks are likely the direct result of policy decisions made over the past year.3 Fiscal policy has been extremely stimulative in 2018 and will continue to be so for another few quarters. By late 2019 or early 2020, that is likely to be reversed, with the tax policy stimulus in the past and falling government spending (the aftereffect of the agreement to temporarily raise spending in FY 2018 and 2019) becoming a potential drag on the economy.

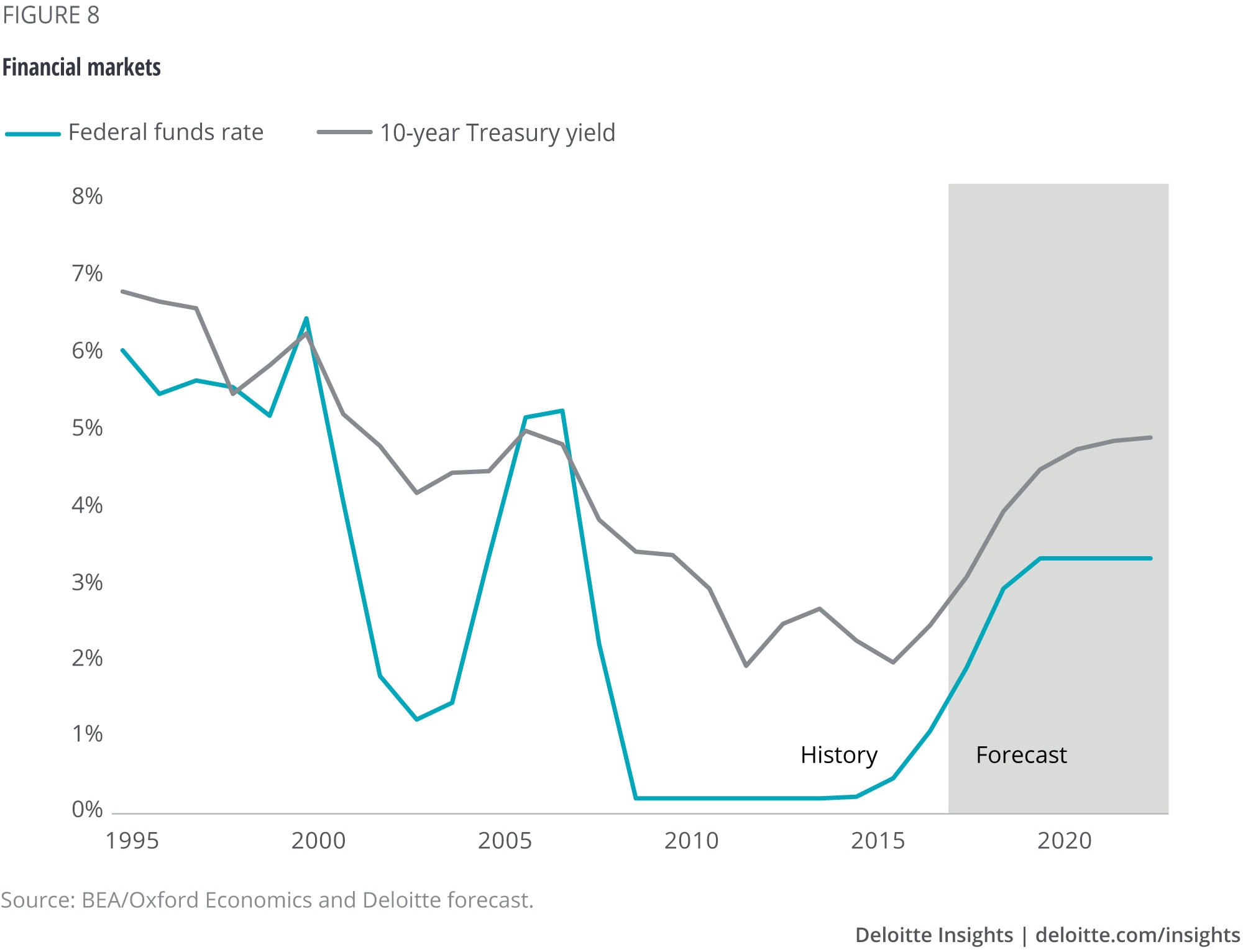

The Fed has been gradually raising interest rates and is likely to continue to do so in 2019. Fed watchers should be careful about reading too much into any single statement or comment by a Fed official, instead paying attention to the stability of officials’ views about the appropriate long-run interest rate in the many documents the Fed provides at each FOMC meeting. Higher interest rates affect the economy only after some time, so in 2019 and ’20, the economy will likely feel the full impact of the current tightening cycle.

Finally, the impact of the recently levied tariffs is likely to be significant by late 2019. The pre-tariff inventory build (a key factor behind the high Q3 growth rate) will eventually be run down. Faced with higher prices for intermediate products, manufacturers will have to decide whether to try to pass on price increases or cut back production. And just as important, businesses may decide to delay investment until the uncertainty about trade policy is reduced. That may not happen until after the 2020 presidential election, leaving a considerable period of unexpectedly low business investment.

Deloitte’s baseline forecast shows substantial slowing in economic growth in 2020. Year-over-year growth is just 1.0 percent. That’s slightly higher than in the previous forecast, since the new forecast incorporates the CBO’s latest spend-out rates for the additional budget authorizations that Congress allowed in the 2018 budget bill.4 It also reflects an updated view of the housing market. But the 2020 slowdown remains a key feature of the most likely future path of the economy. The midterm elections—as exciting and distracting as some may have found them—likely did little to change that.

Scenarios

Our scenarios are designed to demonstrate the different paths down which the Trump administration’s policies and congressional action might take the American economy. Foreign risks have not dissipated, and we’ve incorporated them into the scenarios. But for now, we view the greatest uncertainty in the US economy to be that generated within the nation’s borders.

The baseline (55 percent probability): Consumer spending continues to grow. A pickup in foreign growth helps to tamp down the dollar and increase demand for US exports, adding to demand. Fiscal stimulus from the tax bill and the budget agreement pushes growth up in 2019 but is somewhat offset by the impact of US tariffs and foreign response. However, the US government comes to an arrangement with US trading partners, and the tariffs are removed fairly quickly. With the economy near full employment, the faster GDP growth creates inflationary pressures. The Fed responds with an aggressive interest-rate policy, and long-term rates rise quickly as alternative assets (abroad) become more appealing. A small increase in trade restrictions adds to business costs in the medium term, but this is offset by lower regulatory costs. As the impact of stimulus fades and the economy feels the effect of higher interest rates, growth slows below potential in 2020.

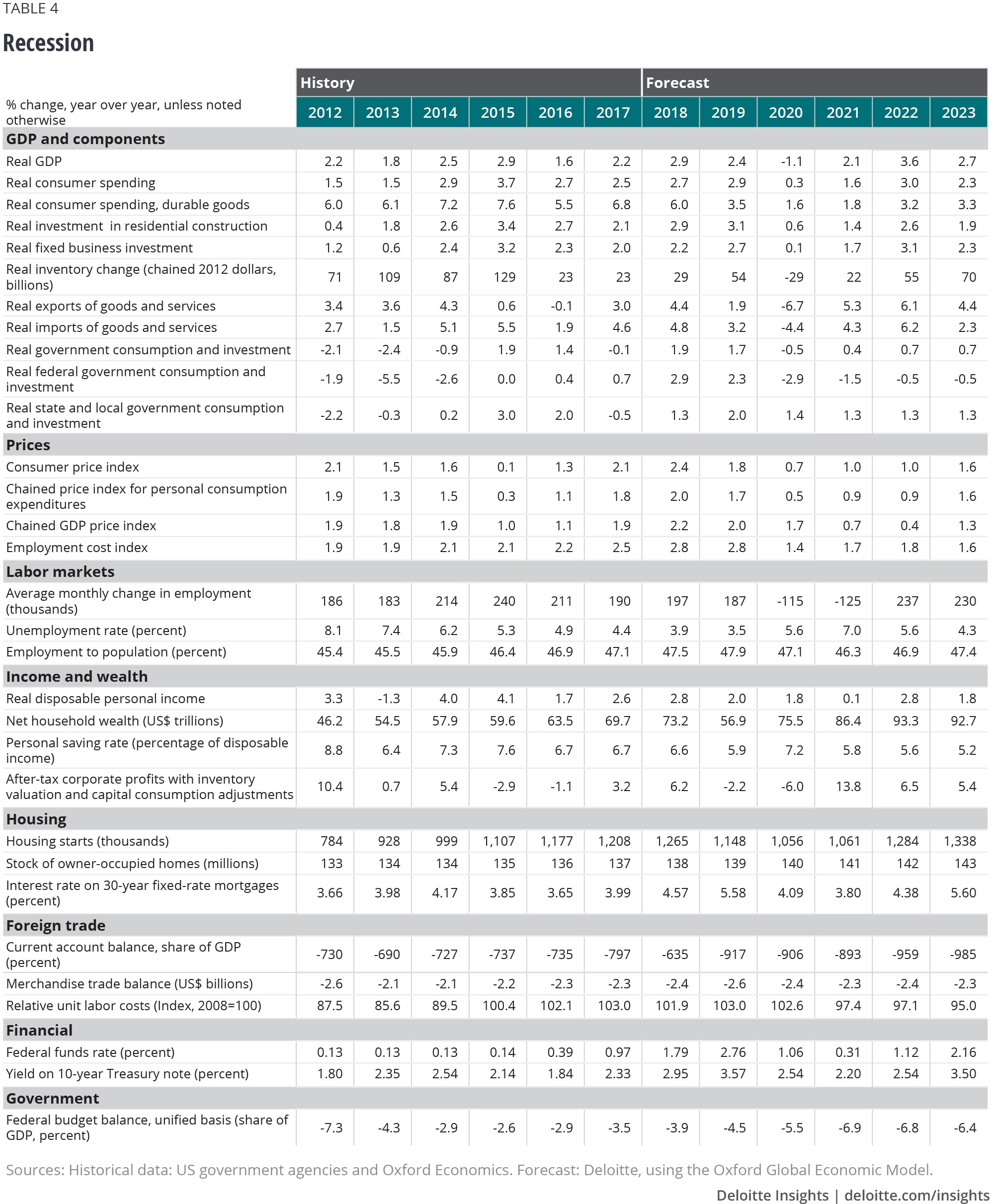

Recession (25 percent): The economy weakens in late 2019 and early 2020 from the impact of tariffs and the withdrawal of stimulus as the additional spending from this year’s budget agreement goes away. With the economy already weak, a relatively small financial crisis pushes the economy into recession. The Fed and the European Central Bank act to ease conditions, and the financial system recovers relatively rapidly. GDP falls in the second half of 2019 and first quarter of 2020, and then recovers.

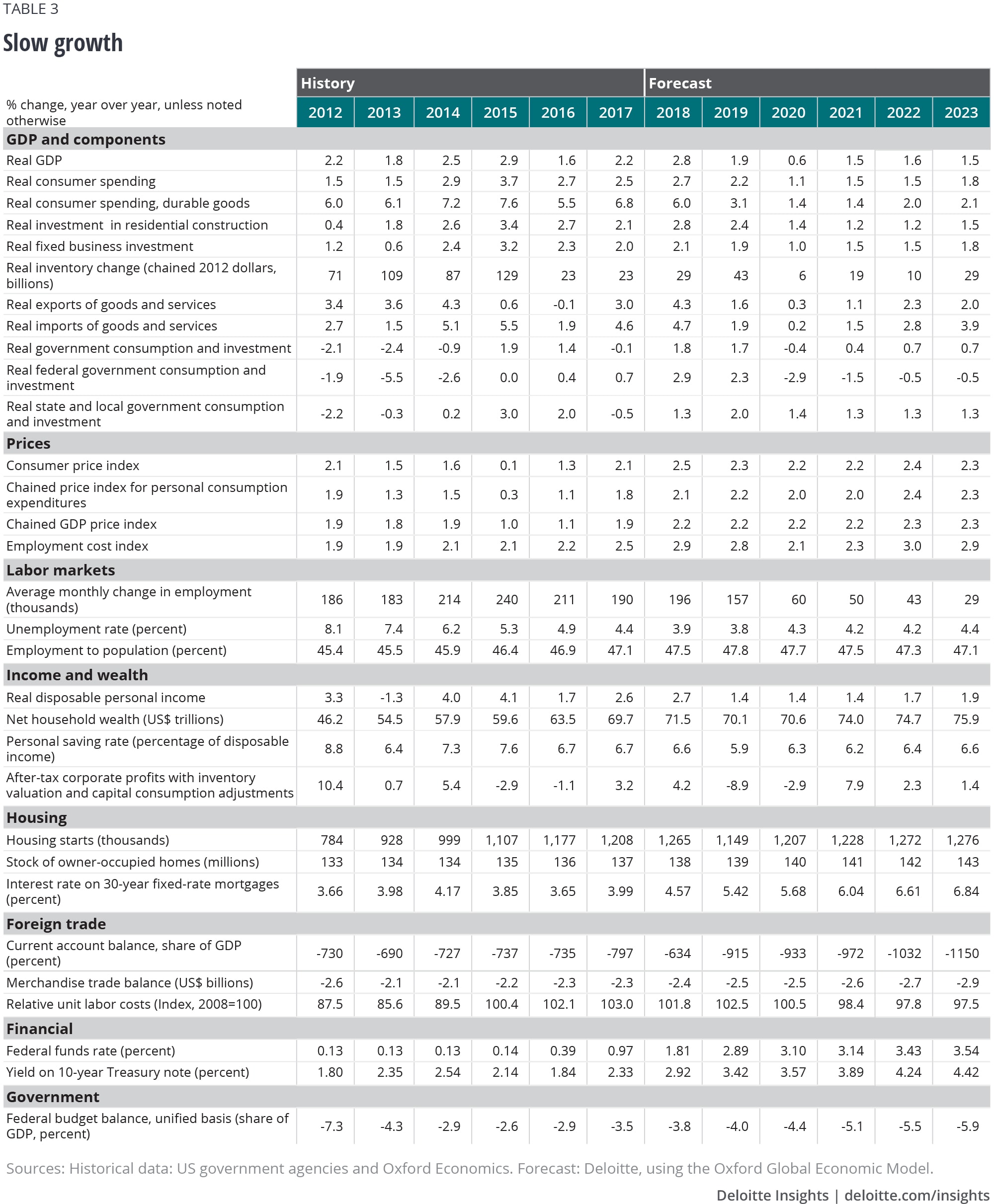

Slower growth (10 percent): Business tax cuts induce little investment spending, while households save their tax cuts. Tariffs remain in place as the United States and its trading partners can’t agree on new global trade arrangements. The tariffs raise costs and disrupt supply chains. Businesses hold back on investments to restructure their supply chains because of uncertainty about future policy. The higher spending authorization from the budget bill translates only slowly into additional federal outlays, reducing the budget bill’s impact on the economy. GDP growth falls to less than 1.5 percent over the forecast period, while the unemployment rate rises.

Productivity bonanza (10 percent): Technological advances begin to lower corporate costs, as deregulation improves business confidence. Improved infrastructure boosts demand in the short run and, in the long run, capacity and the productivity of private capital. Tariffs are short-lived and turn out to have a smaller impact than many economists expected. The economy grows over 3.0 percent in 2019, with growth staying above 2.0 percent between 2021 and ’23, while inflation remains subdued.

Sectors

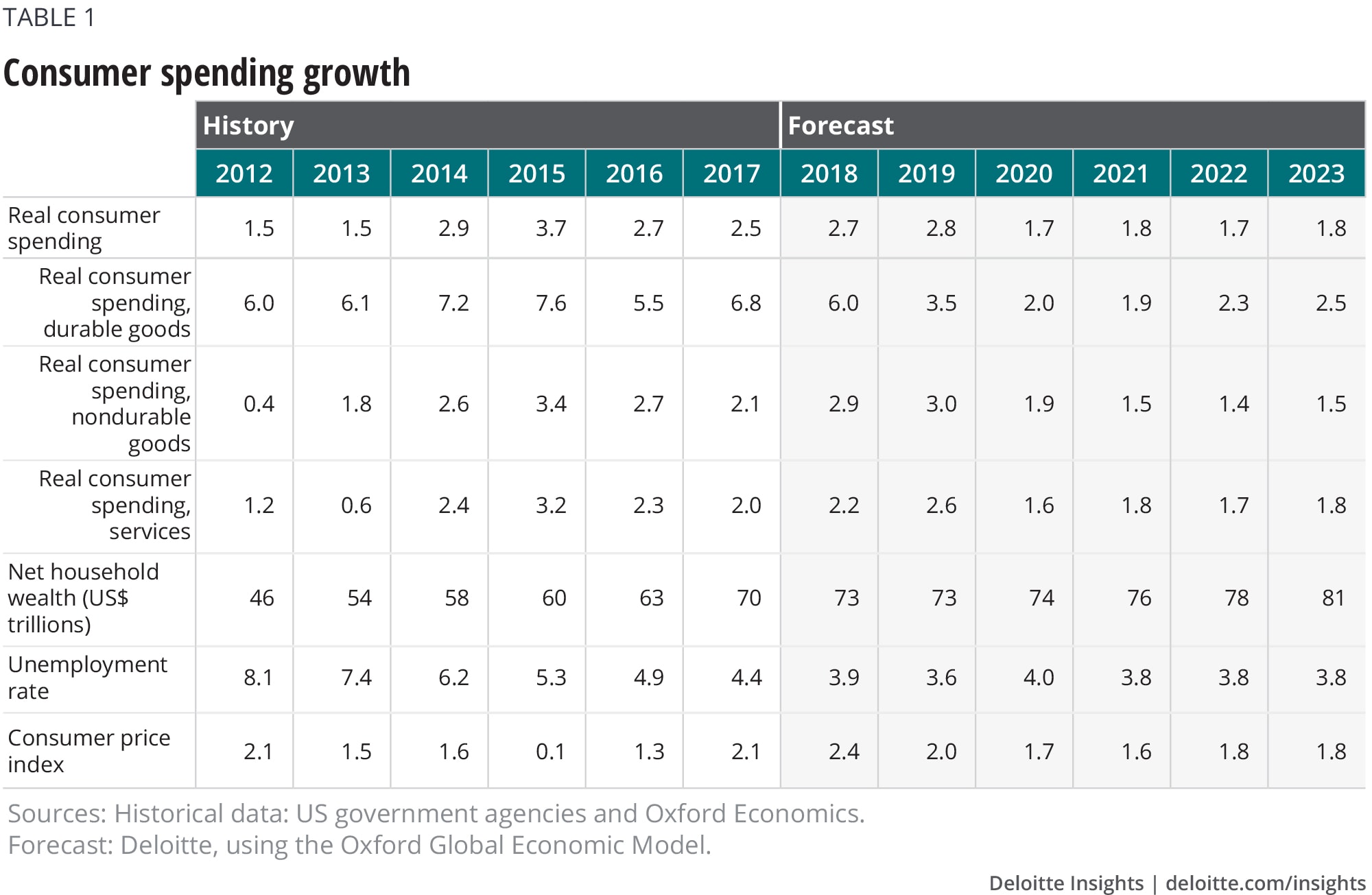

Consumer spending

The household sector has provided an underpinning of steady growth for the US economy over the past few years. Even while business investment was weak, exports faced substantial headwinds, and housing stalled, consumer spending grew steadily. But that’s unsurprising, since job growth has been quite strong. Even with relatively low wage growth, those jobs have helped put money in consumers’ pockets, enabling households to continue to increase their spending. The continued steady (if modest) growth in house prices has helped, too, since houses are most households’ main form of wealth.

For all the daily speculation about how political developments might affect consumer choices when it comes to spending decisions, political noise seems to be just that—in the background—to consumers who seem focused on their own situations. As long as job growth holds up and house prices keep rising, consumer spending should remain strong. And the tax cut, while modest for most consumers, will likely bolster their confidence that they can safely spend. More importantly, the tax bill’s fiscal stimulus has continued to tighten the job market. At some point, wages might begin to rise—and that could give consumer spending a further boost.

The medium term presents a different picture. Many American consumers spent the 1990s and ’00s trying to maintain spending even as incomes stagnated. But now they are wiser (and older, which is another challenge, as many baby boomers face imminent retirement with inadequate savings5). That may constrain spending and require higher savings in the future.

One piece of good news is that government statisticians have found more savings. This year’s comprehensive revision of the national accounts included a substantial increase in income. As a result, we now know that the saving rate has remained about 6 percent since 2013 (the previous data showed a substantial decline in the rate, to about 3 percent). Most of the change involved upward revisions to asset income and proprietors’ income. This makes the household sector appear less vulnerable to another downturn.

Although American households seem to face fewer obstacles in their pursuit of the good life than just a few years ago, rising income inequality could pose a significant challenge for the sector’s long-run health. For instance, low unemployment hasn’t alleviated many people’s economic insecurity: Four in 10 adults would be able to cover an unexpected US$400 expense only by borrowing money or selling something.6 For more about inequality, see Income inequality in the United States: What do we know and what does it mean?,7 Deloitte’s most recent examination of the issue.

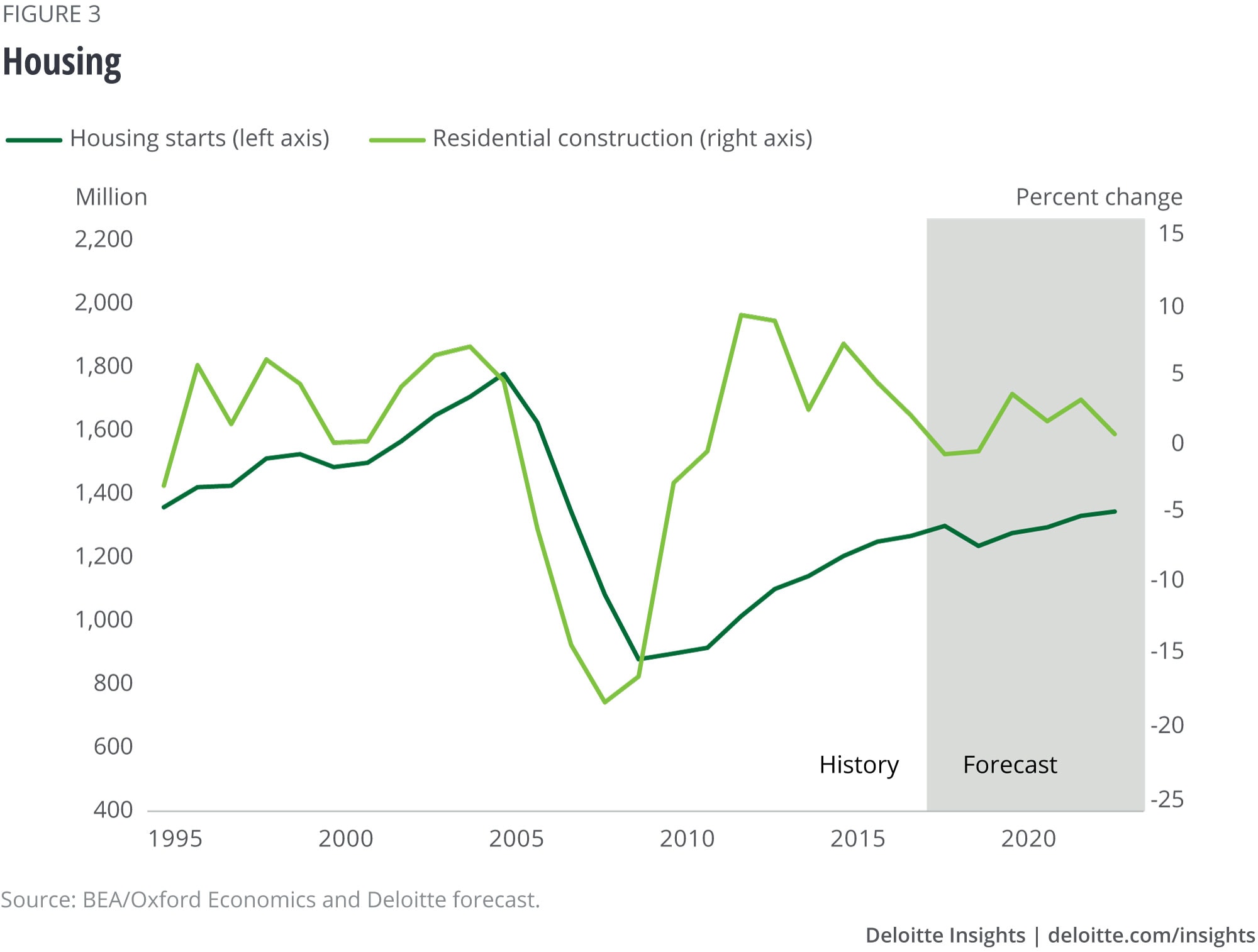

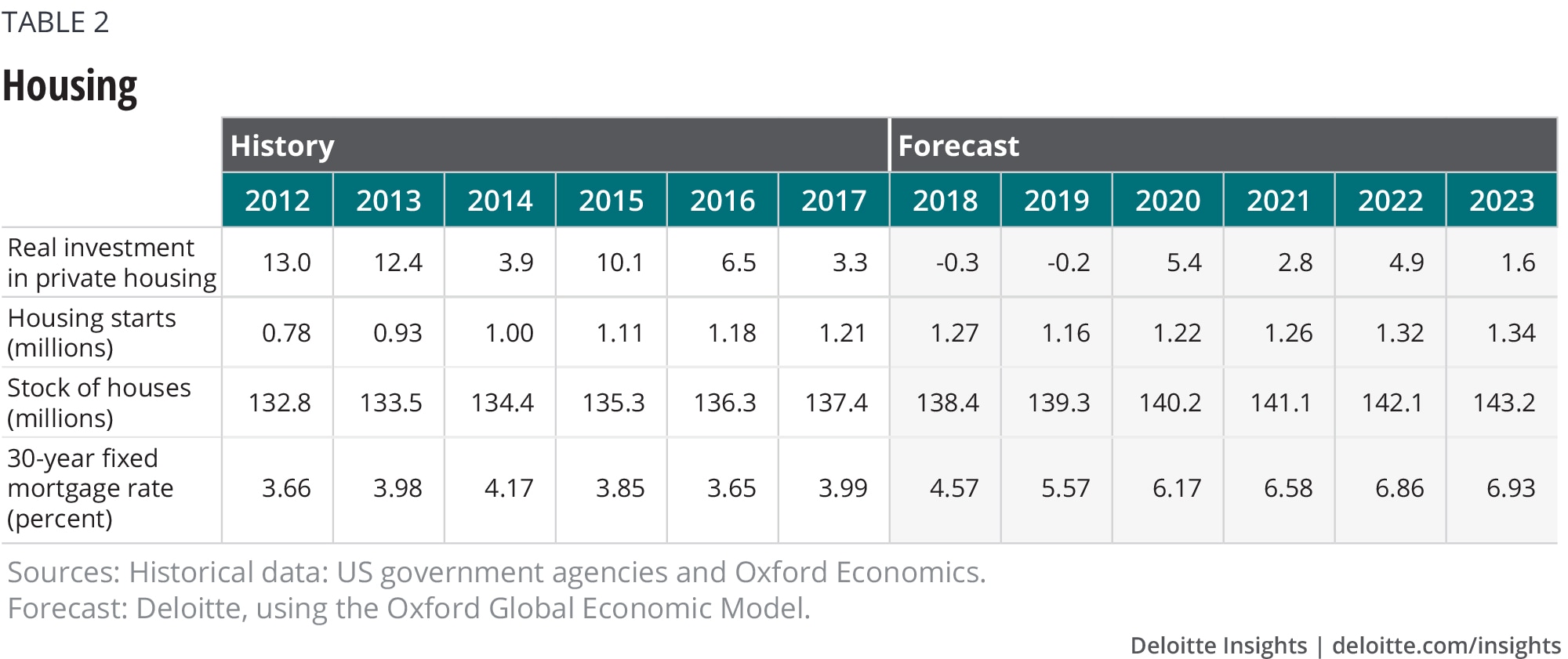

Housing

The housing market has weakened. In fact, we might have seen the best of the recovery from the sector’s destruction in the 2007–09 crash. Housing starts at the current level of around 1.2 to 1.3 million may be the best we can get. In fact, our simple model of the market based on demographics suggests that housing starts are likely to stay in the 1.1–1.2 million range. They will gradually increase over the five-year horizon to 1.3 million units, but that’s pretty far below the 2 million-plus units registered in the mid-2000s.

Housing remains a smaller share of the economy than it was before the Great Recession, and that’s to be expected. In some ways, it’s a relief to realize that the sector has returned to “normalcy.” But with slowing population growth, housing simply can’t be a major generator of growth for the US economy in the medium and long run.

Some folks are pointing to the slowing housing market with alarm, remembering something about how the last recession was connected to a housing problem.8 It’s certainly not a happy sight, especially for anybody in the home construction business. But a construction decline didn’t cause the last recession: Construction began subtracting from GDP growth in the fourth quarter of 2005, two years before the recession, and GDP growth remained healthy. It was housing finance that ultimately created the crisis, not housing itself. Today, housing accounts for just under 4 percent of GDP (in 2005, it accounted for about 6 percent). The sector simply isn’t large enough to cause a recession—unless, once again, huge hidden bets on housing prices come to light.

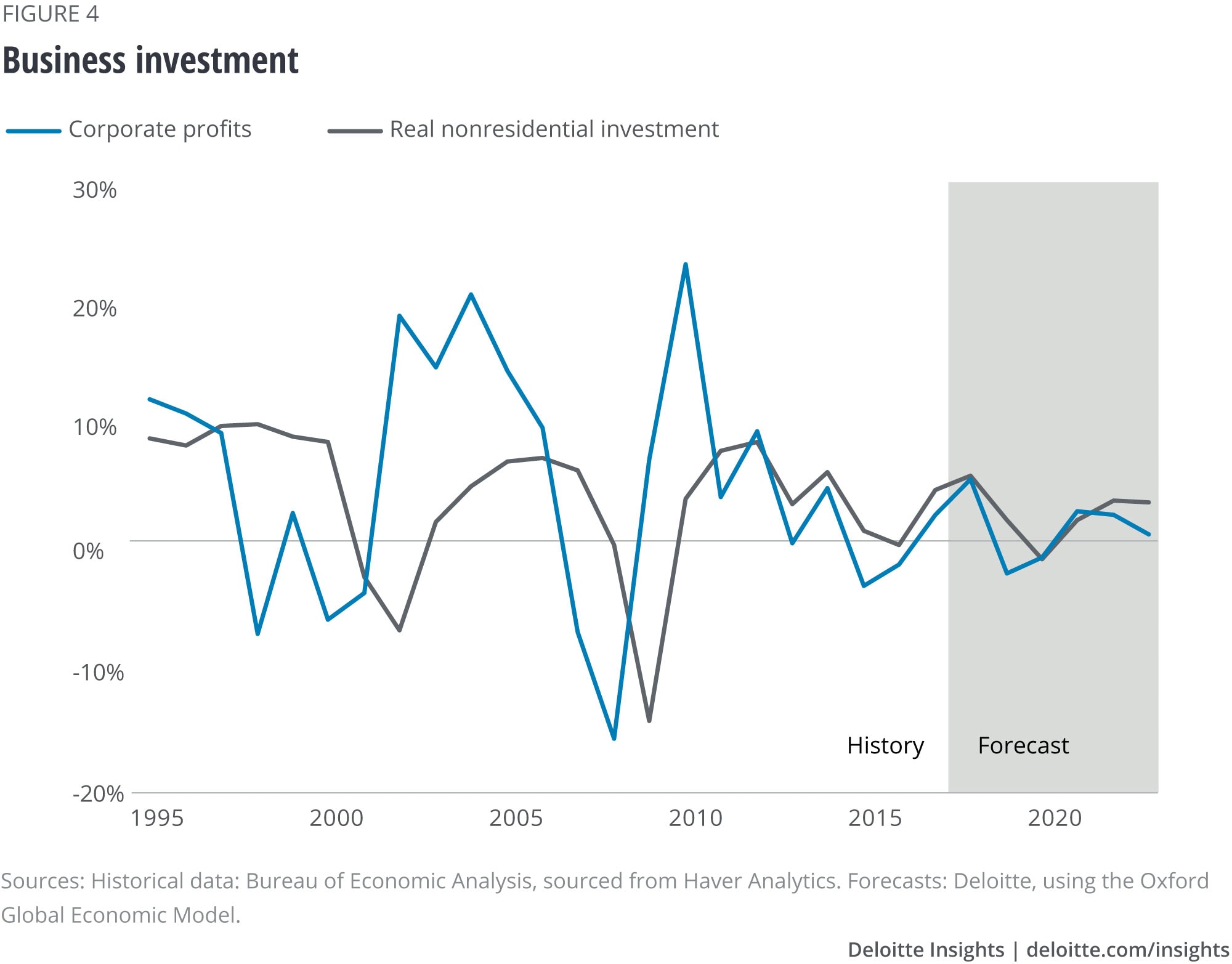

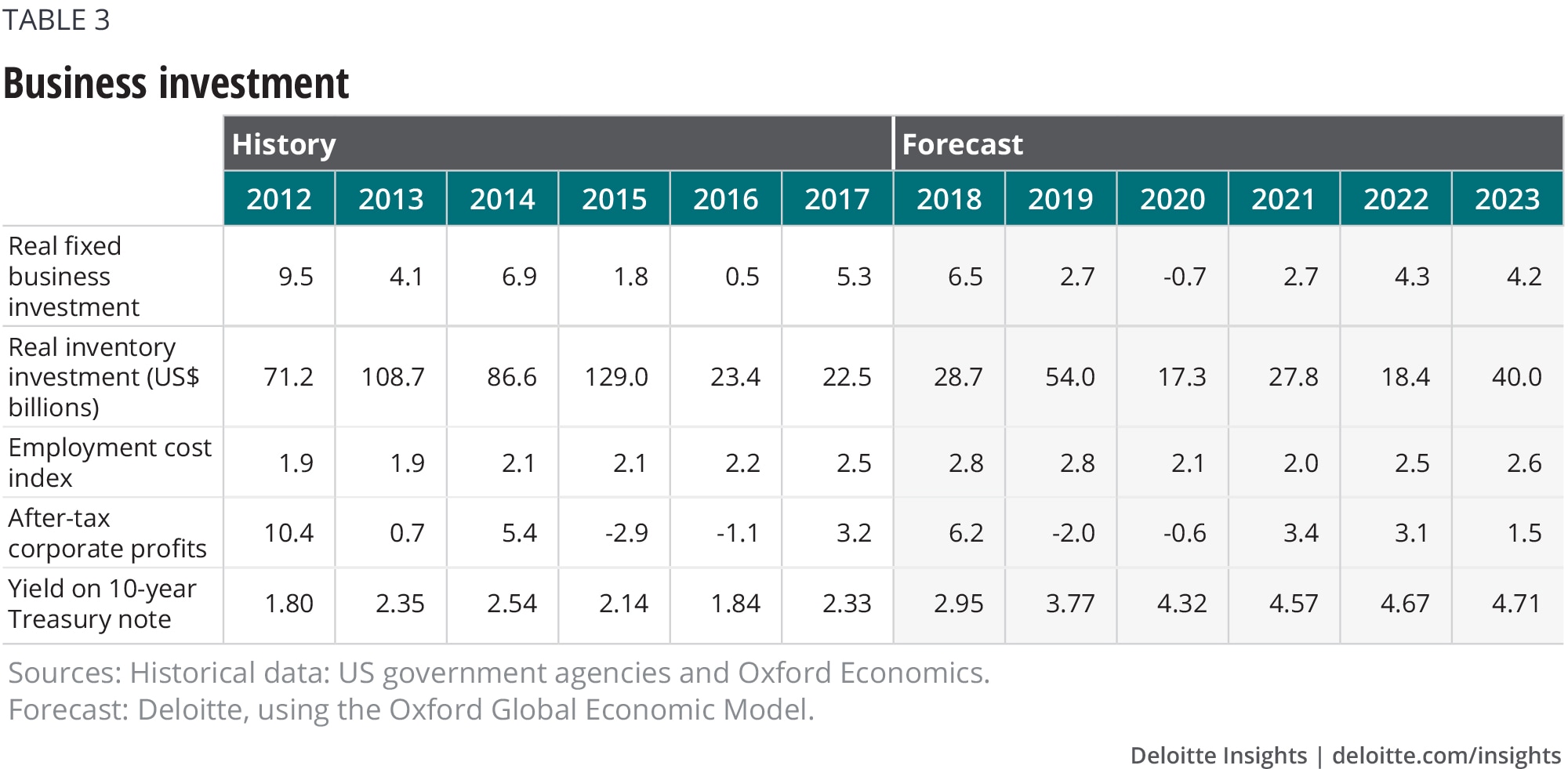

Business investment

While businesses were still reckoning with the implications of the tax bill for investment, the US government introduced additional uncertainty in a radical shift in international trade policy. On top of that, the economy once again faces budget uncertainty.

Business investment soared in the first two quarters of 2018. However, it takes time for business decisions to result in new investment being put in place. That suggests that this investment spike was unlikely to have been the result of the tax bill passed at the very end of 2017. In Q3, investment spending growth almost stopped. And monthly data for construction and shipments of capital goods suggests that investment spending growth will remain slow in Q4. In truth, the cost of capital has been at historic lows over the past decade, and many businesses have remained reluctant to take advantage to raise investment over that period. So cutting the cost of capital further by slashing the tax rate may have at best a modest impact. While our forecast is optimistic about the potential impact of the tax reform bill, that amounts to likely adding only 0.1 to 0.2 percentage points to GDP growth in the next few years.

The imposition of tariffs on a wide variety of goods—and foreign retaliation in the form of tariffs on American products—create a large degree of uncertainty, particularly for manufacturing firms. Some CEOs may face a painful medium-term dilemma: deciding whether their businesses need to rebuild their supply chains. Industries such as automobile production have developed intricate networks across North America and are reaching into Asia and Europe, based on the longstanding assumption that materials and parts can be moved across borders with little cost or disruption. There is some evidence that a substantial number of business leaders are beginning to think about postponing investment: The Atlanta Fed found in early August that some 30 percent of manufacturing firms are reassessing capital expenditure plans because of uncertainty about tariffs.9

And budget uncertainty is back. Even before the two-year budget agreement passed last January ends, there is the need to pass partial appropriations for the rest of FY 2019 and the need for a divided Congress to pass appropriations for FY 2020. This adds additional uncertainty and may suppress investment spending.

The Fed is now playing a role as well. Higher interest rates are likely more than offsetting any impact of lower capital costs due to tax reform.

The Deloitte economics team remains optimistic about investment in the medium term because the US economy remains a fundamentally good place to invest. But business investment plays a key role in differentiating between Deloitte’s baseline, slow-growth, and productivity bonanza scenarios. If business spending does indeed fall off because of policy uncertainty, the likelihood of the slow-growth scenario would substantially increase.

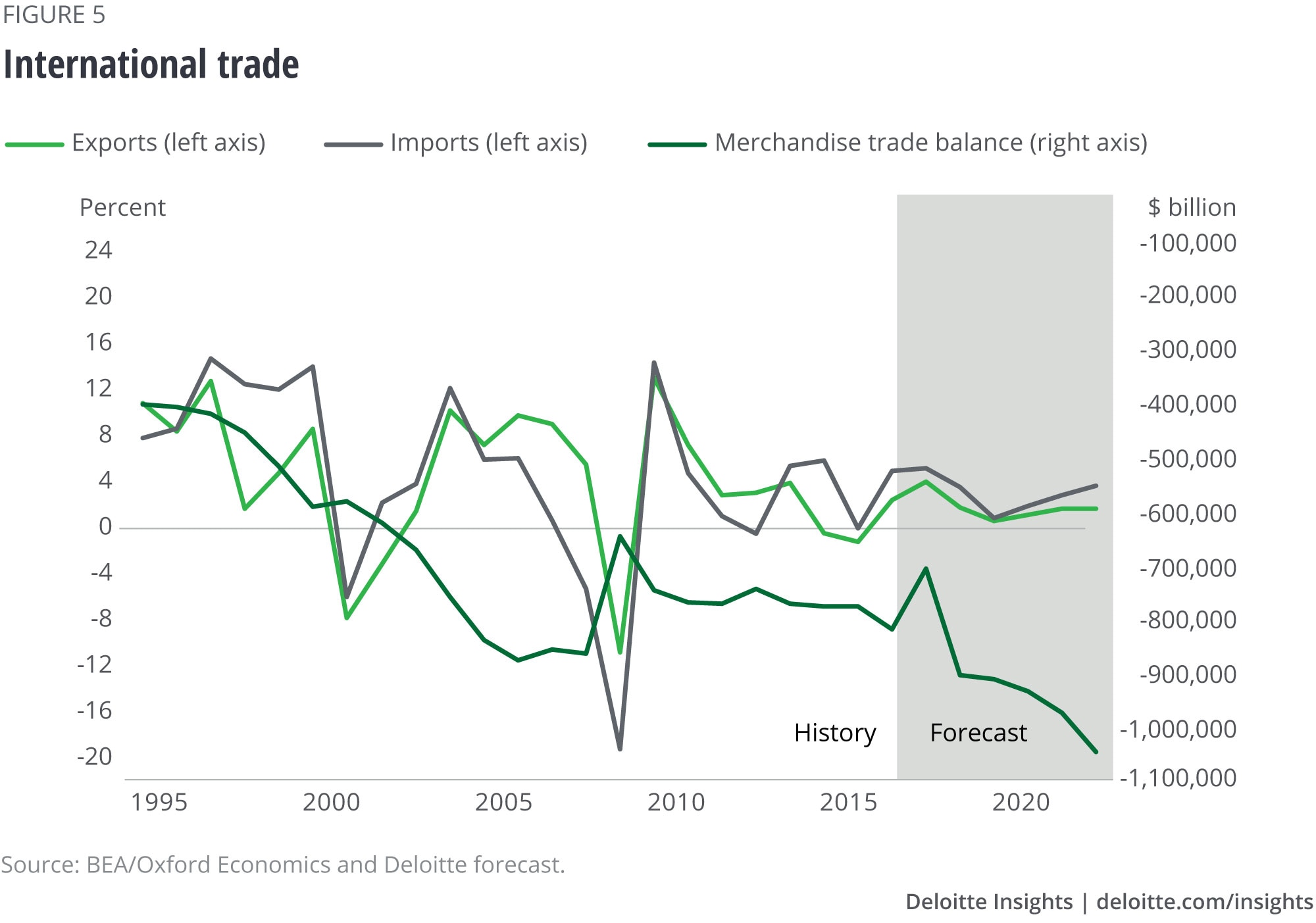

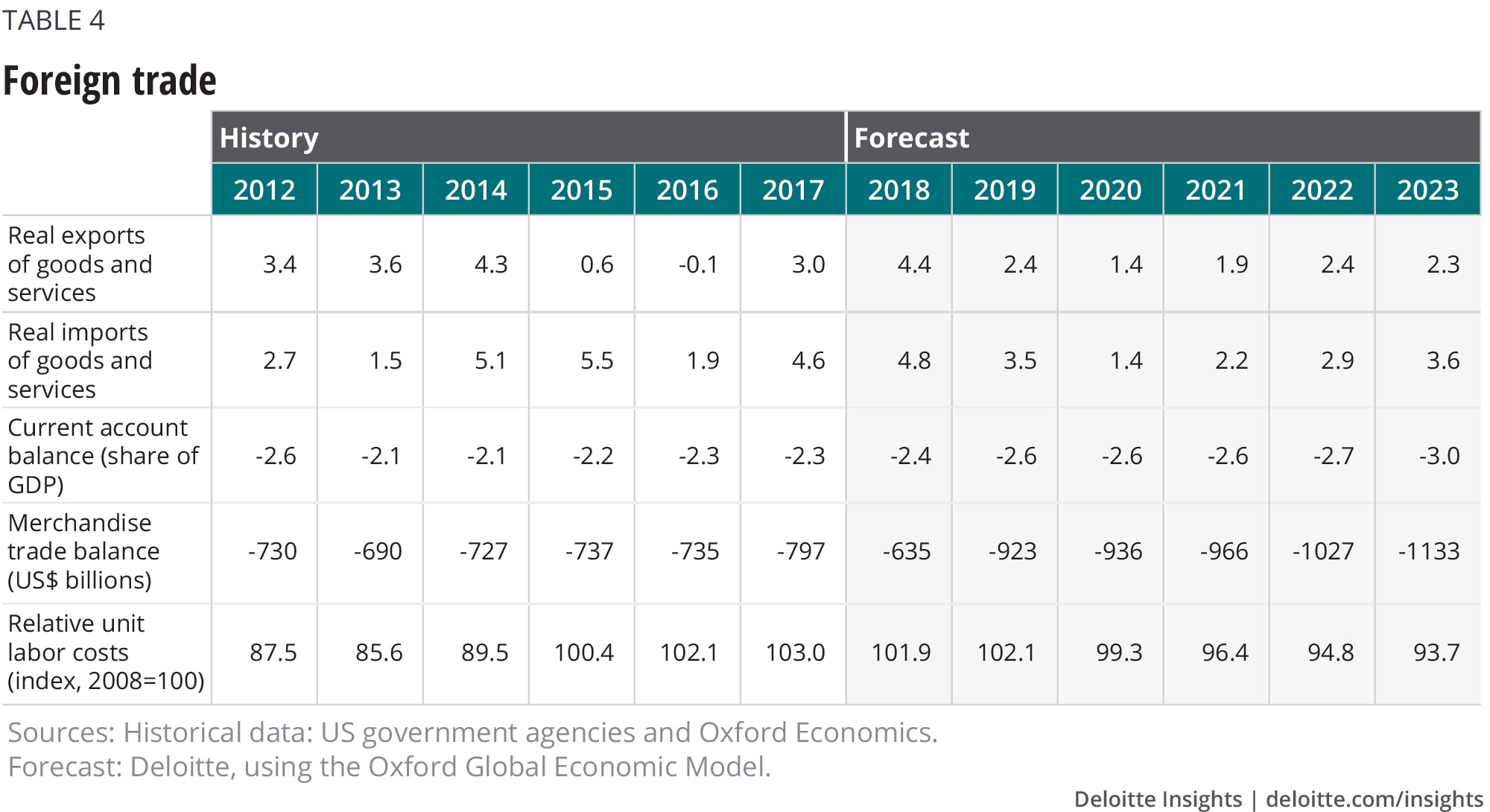

Foreign trade

Over the past few decades, business—especially manufacturing—has taken advantage of generally open borders and cheap transportation to cut costs and improve global efficiency. The result is a complex matrix of production that makes the traditional measures of imports and exports somewhat misleading. For example, in 2017, 37 percent of Mexico’s exports to the United States consisted of intermediate inputs purchased from . . . the United States.10

Recent events appear to be placing this global manufacturing system at risk. The United Kingdom’s increasingly tenuous post-Brexit position in the European manufacturing ecosystem,11 along with ongoing negotiations to replace the North American Free Trade Agreement,12 may slow the growth of this system or even cause it to unwind.

But the biggest challenge now facing the global trading system is the imposition of tariffs and retaliatory tariffs. The process began with US tariffs on solar panels and washing machines and now encompasses a wide variety of US imports from China and other countries. And those countries have responded, leaving an increasing amount of US exports subject to foreign retaliatory tariffs. The Trump administration has also suggested putting a 20 percent tariff on automobile imports from the European Union.13 Additional tariffs are possible.

Whether this qualifies as a “trade war” is a semantic question—the real issue is the uncertainty about the tariffs and the US government’s goals in imposing the tariffs. White House trade adviser Peter Navarro argues that the tariffs are necessary to reduce the US trade deficit and to help the United States retain industries such as steel production for strategic reasons.14 This suggests that tariffs in “strategic” industries could be permanent. But Commerce Secretary Wilbur Ross has stated that the goal is to force US trading partners to lower their own barriers to American exports.15 That suggests that the administration intends the tariffs to be a temporary measure to be traded for better access to foreign markets.

The lack of clarity in the administration’s stated objectives with regard to tariffs adds to the overall uncertainty involved with the escalating actions that began in the spring. In the short run, uncertainty about border-crossing costs may reduce investment spending. Businesses may be reluctant to invest when facing the possibility of a sudden shift in costs. Deloitte’s slow-growth scenario assumes that the impact is large enough to affect overall business investment.

The challenge that companies face is that a significant change in border-crossing costs—as would occur if the United States withdrew from NAFTA without adopting its replacement, USMCA, or made tariffs on Chinese goods permanent—could potentially reduce the value of capital investment put in place to take advantage of global goods flows. Essentially, the global capital stock could depreciate more quickly than our normal measures would suggest. In practical terms, some US plants and equipment could go idle without the ability to access foreign intermediate products at previously planned prices.

With this loss of productive capacity would come the need to replace it with plants and equipment that would be profitable at the higher border cost. We might expect gross investment to increase once the outline of a new global trading system becomes apparent.

In the longer term, a more protectionist environment will likely raise costs. That’s a simple conclusion to be drawn from the fact that globalization was largely driven by businesses trying to cut costs. How those extra costs are distributed depends a great deal on economic policy—for example, central banks can attempt to fight the impact of lower globalization on prices (with a resulting period of high unemployment) or to accommodate it (allowing inflation to pick up).

The current account is determined by global financial flows, not trade costs.16 Any potential reduction in the current account deficit is likely to be largely offset by a reduction in American competitiveness through higher costs in the United States, lower costs abroad, and a higher dollar. All four scenarios of our forecast assume that the direct impact of trade policy on the current account deficit is relatively small.

Government

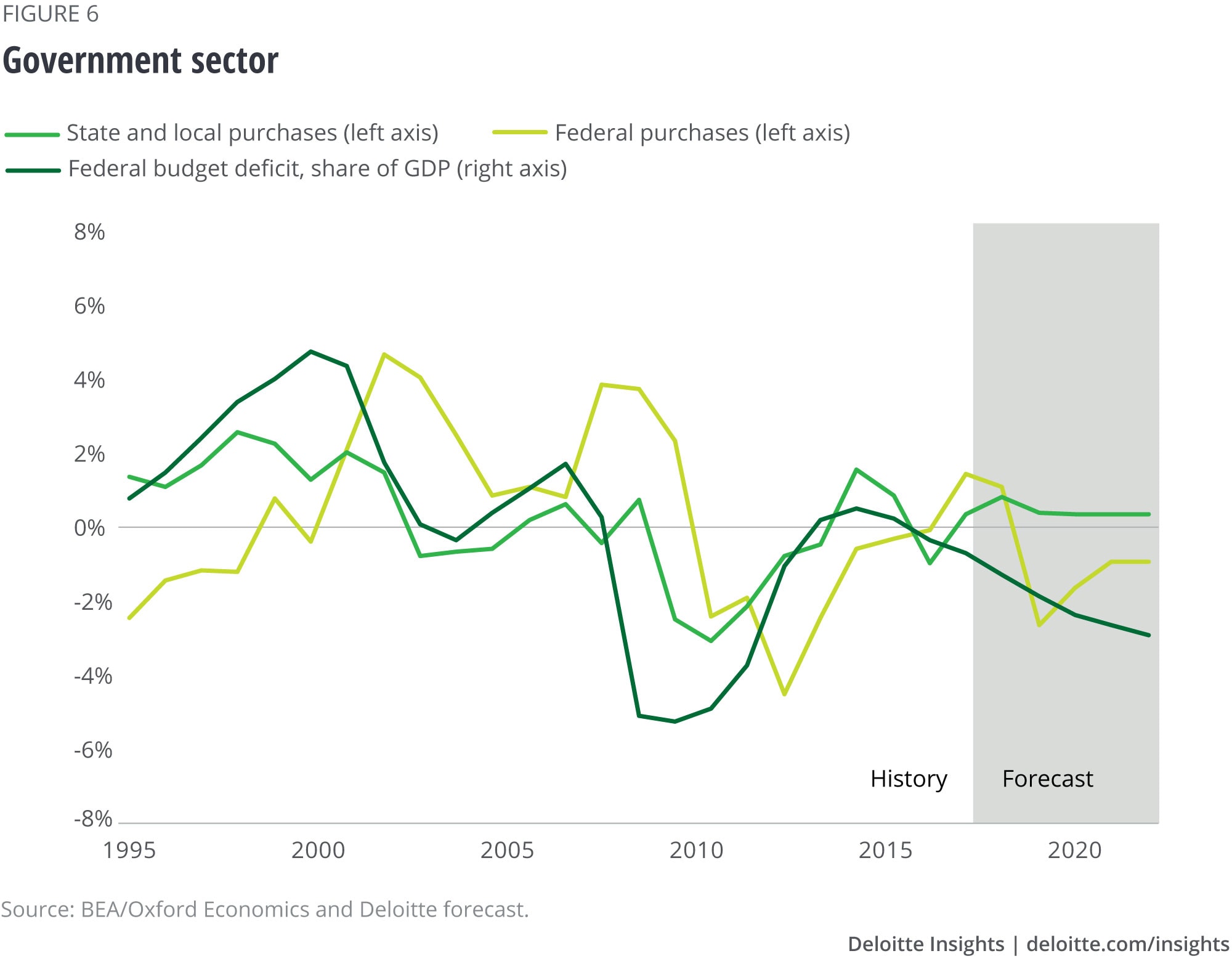

Government spending provides an unusual source of volatility in the Deloitte forecast. The tax bill passed in late 2017 and the budget bill passed in early 2018 together created a large stimulus—over 2.0 percent of GDP, by Deloitte calculations—in 2019. As the stimulus ends, that government spending will likely start falling in late 2019 and through 2020. This drag on the economy is large enough to slow growth substantially. The Deloitte baseline forecast sees GDP growth at just 1.0 percent in 2020, quite a bit below potential.

The tax bill’s long-run impact on the economy’s capacity remains a matter of debate, with estimates ranging from no real change after a decade (Tax Policy Center) to 2.8 percent, or almost 0.3 percentage points annually (Tax Foundation).17 In this forecast’s five-year horizon, the supply-side impact is likely too small to be noticeable.

The midterm elections, as expected, returned a Democratic House and Republican Senate, likely taking major economic policy changes off the table until after 2020.18 The split Congress may also complicate budget decision-making over the next couple of years (although the budget has been a source of uncertainty even as Congress has been under single-party control recently). The main unknown involves an infrastructure spending package, since, in theory, increased infrastructure spending has bipartisan support. However, obtaining agreement on this may be difficult because the Trump administration and the House leadership have very different views of how, specifically, to proceed on infrastructure. Our baseline assumes no infrastructure plan, while the productivity bonanza scenario assumes some additional government spending as well as additional productivity from these investments in the medium and long runs.

But there is more facing the new Congress. The agreement to suspend the debt ceiling expires in March. This is not a hard deadline, as the Treasury Department can use what it calls “extraordinary measures” (various accounting maneuvers) to prevent the debt ceiling from affecting spending for several months. But eventually, the new Congress will have to pass a bill to raise the debt ceiling. Then work on the FY 2020 appropriations bills will begin. Although we did not include the possibility in this forecast, Congress might not agree on appropriations bills acceptable to the White House before October 2019, and the country could once again face the threat of a shutdown.

After years of belt-tightening, many state and local governments are no longer actively cutting spending. However, many state budgets remain constrained by questions around the effects of new federal tax policy19 and the need to meet large unfunded pension obligations,20 so state and local spending growth will likely remain low over this forecast’s five-year horizon.

Pressure is building for increased spending in education, as evidenced by the spring public teacher protests in several states.21 With education costs accounting for about a third of all state and local spending, a significant upturn in this category could create some additional stimulus—or could require an increase in state and local taxes.

Labor markets

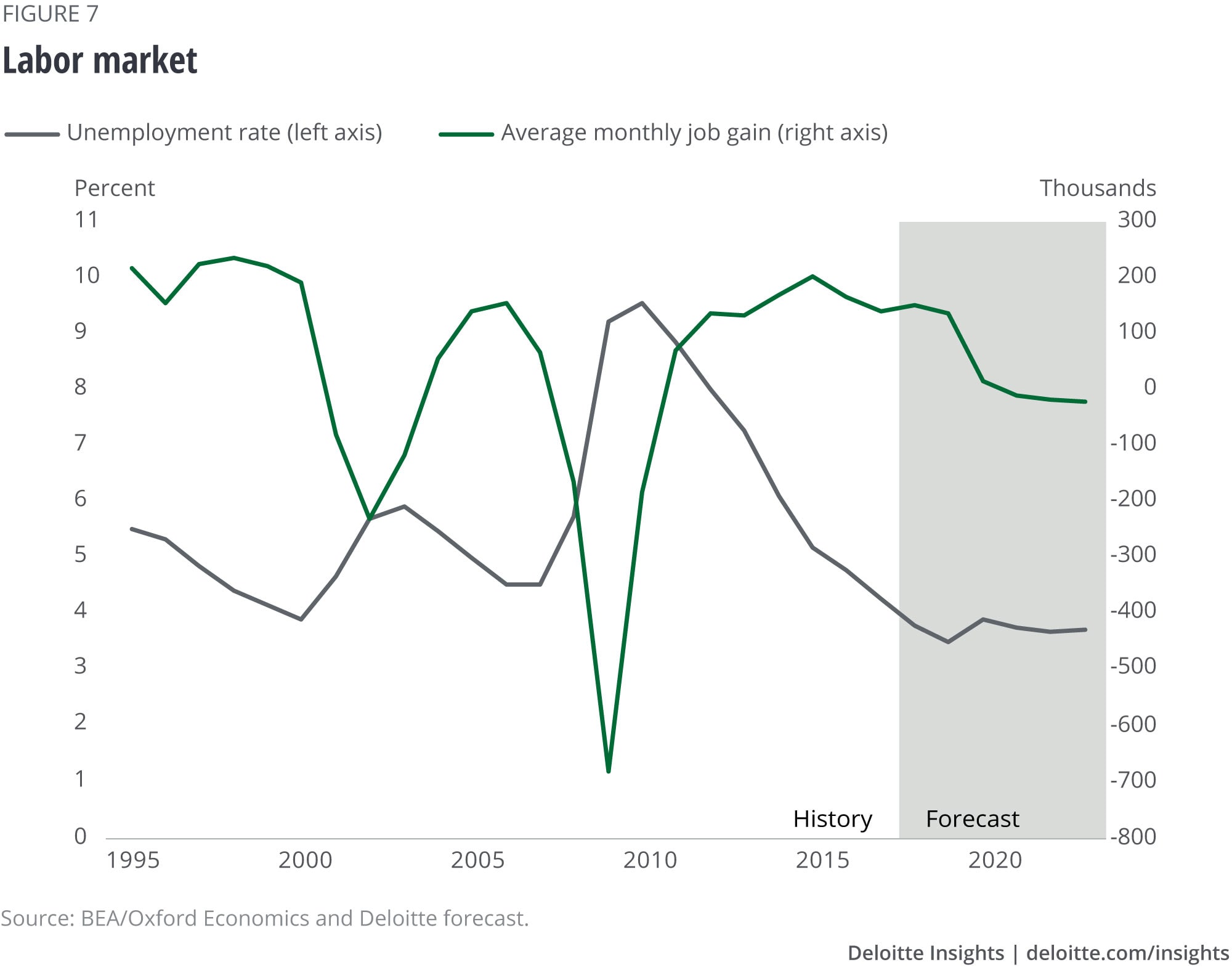

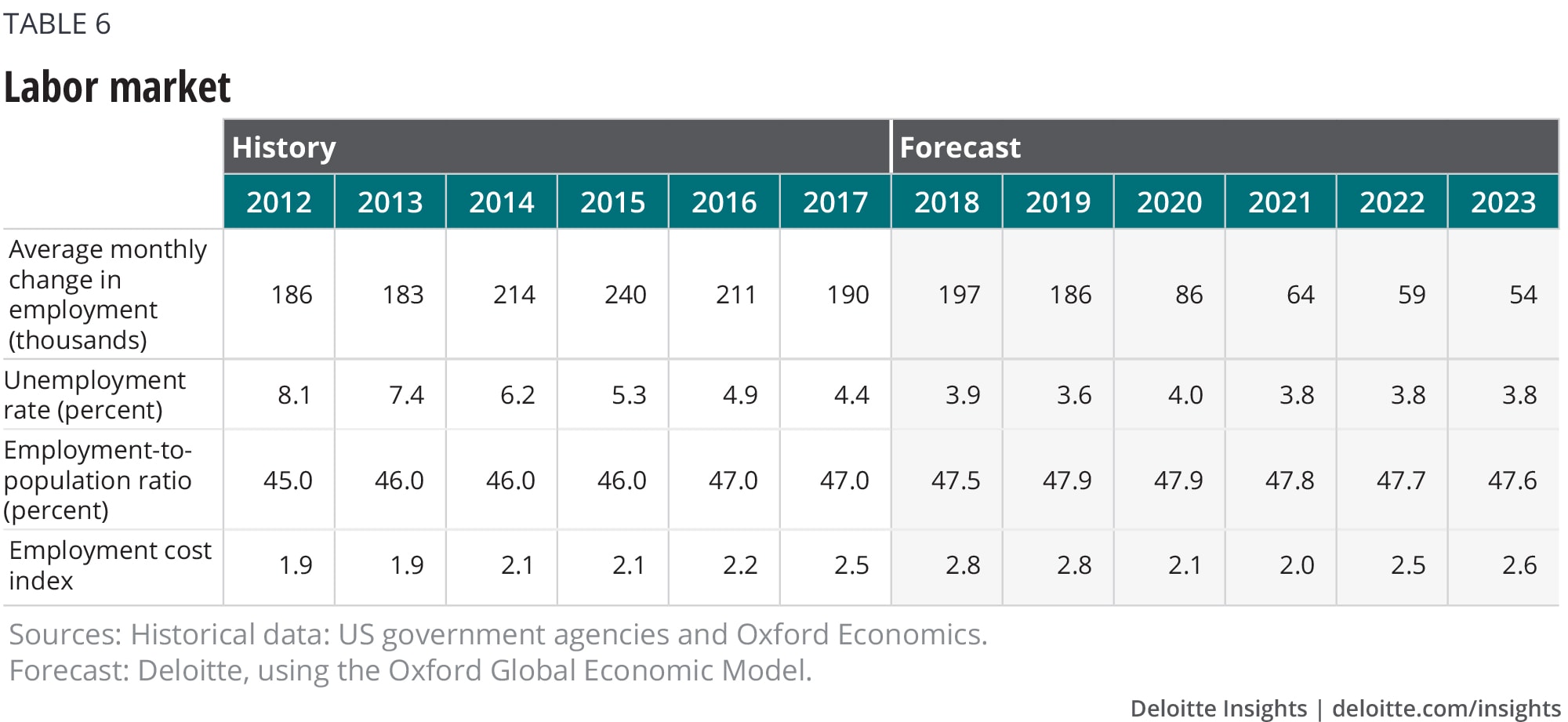

If the American economy is to effectively produce more goods and services, it will need more workers. Many potential employees remain out of the labor force, having left in 2009, when the labor market was challenging. But they are returning. The labor force participation rate for 24–54-year-old workers has been rising since the middle of 2015 and is, as of October, over 80 percent. But there are still more workers who can be enticed back into the labor market as conditions improve, and our baseline forecast reflects that possibility.

Meanwhile, the labor force participation rate for over-65s has flattened out. It’s still much higher than the historical average—and it is certainly possible that, with better labor market conditions, employers can entice more over-65s back into the labor force as well.

But a great many people are still on the sidelines and have been out of steady employment for years—long enough that their basic work skills may be eroding. Are those people still employable? So far, the answer has been “yes,” as job growth continues to be strong without pushing up wages. Deloitte’s forecast team remains optimistic that improvements in the labor market will prove increasingly attractive to potential workers, and labor force participation is likely to continue to improve accordingly. However, we are now close enough to full employment that average monthly job growth is likely to drop from the current 200,000 per month to about 100,000 per month in the next two years, even if the economy remains healthy.

In the longer run, demographics are slowing the growth of the population in prime labor force age. As boomers age, lagging demographic growth will help slow the economy’s potential growth. That’s why we foresee trend GDP growth just a bit above 1.5 percent by 2021: Even with an optimistic view about productivity, we expect that slow labor force growth will eventually be felt in lower economic growth.

Immigration reform might have a marginal impact on the labor force. According to the Pew Research Center, undocumented immigrants make up about 4.8 percent of the total American labor force.22 Immigration reform that restricts immigration and/or increases the removal of undocumented workers might create labor shortages in certain industries, such as agriculture, in which some a quarter of workers are unauthorized,23 and construction, in which an estimated 15 percent of workers are unauthorized.24 But it would likely have little significant impact at the aggregate level.

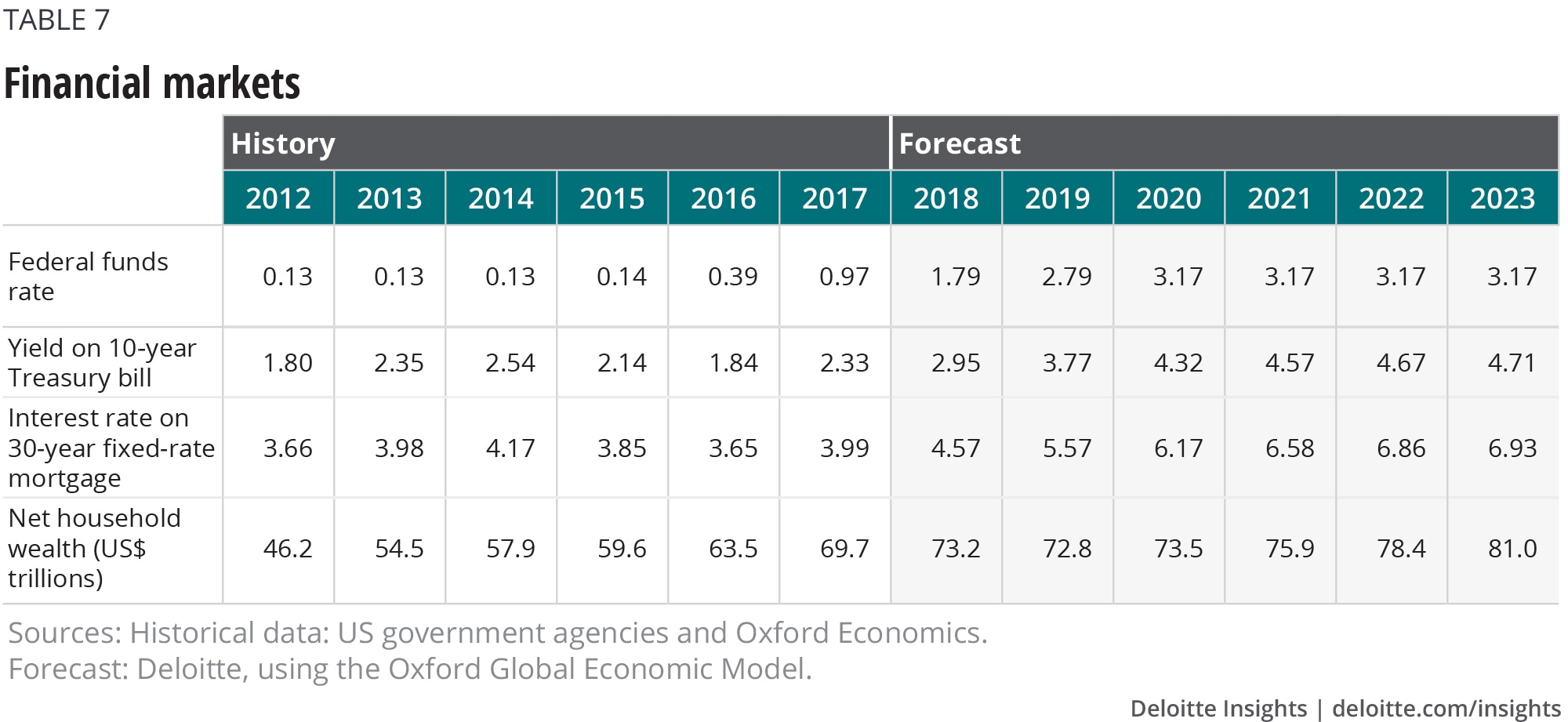

Financial markets

Interest rates are among the most difficult economic variables to forecast because movements depend on news—and if we knew it ahead of time, it wouldn’t be news. The Deloitte interest rate forecast is designed to show a path for rates consistent with the forecast for the real economy. But the potential risk for different interest rate movements is higher here than in other parts of our forecast.

The forecast sees both long- and short-term interest rates headed up. The Fed’s current (as of November) statement notes that risks are balanced and that the labor market remains strong. This is a formula for continued rate hikes until short-term interest rates are at a “neutral” level—the rate that is consistent with full employment and stable inflation. Our estimate of the Fed’s view of the “neutral rate” stands at 3.2 percent. However, some Fed officials are discussing a lower neutral rate. FOMC members’ central estimate for the longer-run value of the Fed funds rate is, in fact, 2.8 to 3.0 percent,25 so our forecast is a little higher than the Fed’s. We expect the Fed to continue to hike short-term interest rates at every second FOMC meeting in 2019, and to continue to let its inventory of short-term assets shrink at a slow rate.

As the economy approaches full employment and the possibility of higher inflation increases, long-term interest rates could rise as well—and perhaps even rise faster. That’s not necessarily a bad thing. It’s part of the “return to normal” that the US economy is experiencing.

Many forecasters believe that this “normal” long-term rate will be around 3.5 percent. At a Fed funds rate of around 3.0 percent, that would suggest an equilibrium value of the spread between the Fed funds rate and the 10-year note yield of just half a percent. That’s historically very low. The average spread over the postwar period has been about 1.0 percent, and that includes the time during recessions when the spread shrinks to almost nothing or even goes negative. The normal spread is therefore certainly above 1.0 percentage point, implying that a 3.0 percent fund rate would be consistent with a 10-year Treasury yield over 4.0 percent. Between 2002 and ’06, the spread averaged almost 2.0 percent. If the spread moves that high, long-term rates could easily hit 5.0 percent or more.

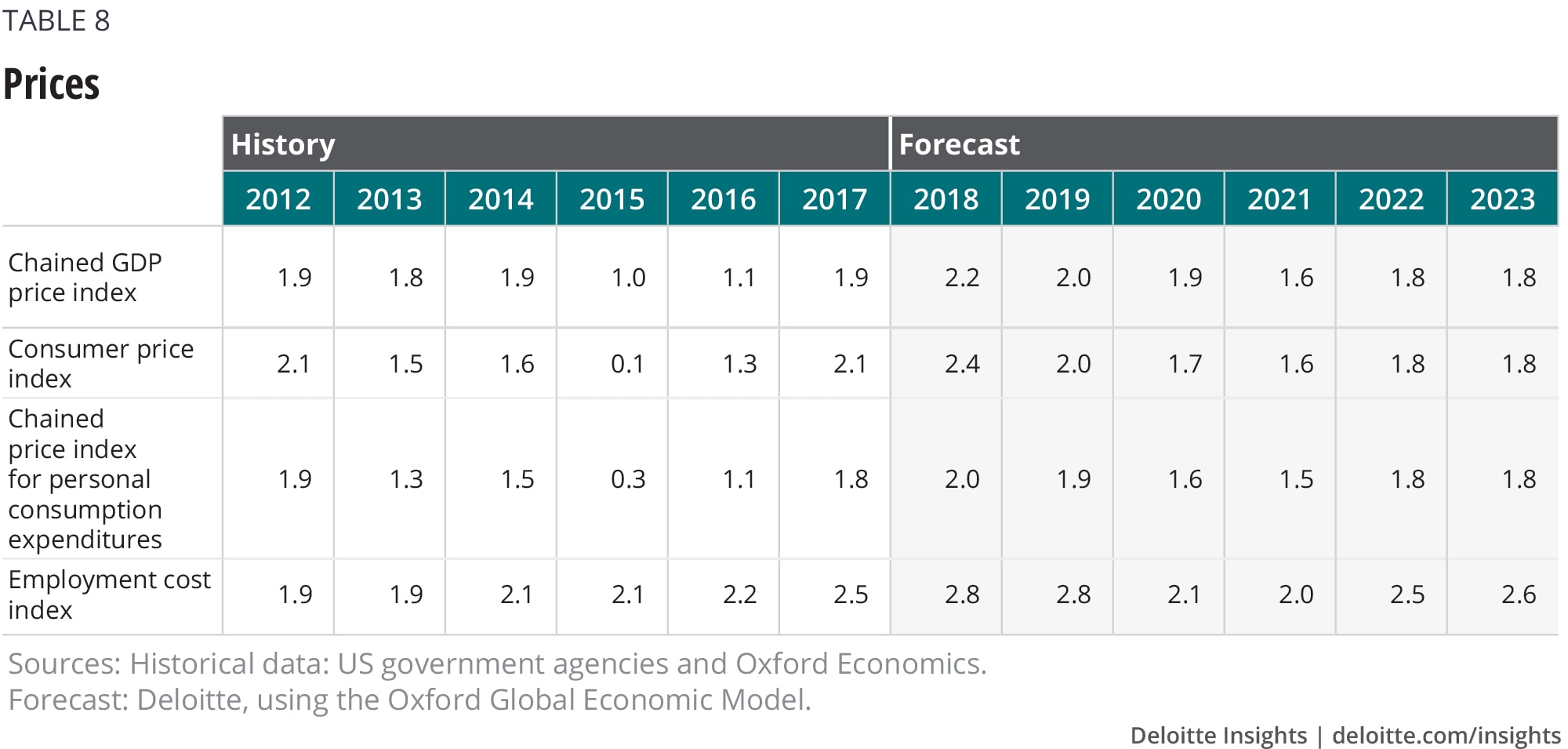

Prices

It’s been a long time since inflation has posed a problem for American policymakers. Could inflation break out as the economy reaches full employment? Many economists are increasingly wondering about this, as it becomes evident that something is amiss in the standard inflation models. These models posit that, since labor accounts for about 70 percent of business costs, the state of the labor market should drive overall inflation. US labor markets appear to be tightening, but wages have failed to rise accordingly or even keep pace with inflation. Real wages for nonsupervisory employees have risen just 0.1 percent per year in the last two years, and unit labor costs have been flat for the last two quarters. As long as businesses don’t face increasing costs, it’s hard to see what could drive a sustained rise in goods and services prices.

But it’s also quite possible that the economy simply hasn’t hit full employment. Despite unemployment dipping below 4.0 percent, the labor force participation rate for prime-age workers remains about two points below the rate before the financial crisis. Two percent of the prime working-age population suggests that about 4 million more people could be enticed into the labor force under the right conditions. Whether those people are really available is unclear, and economists are debating the issue fiercely.26 The combination of low labor-cost growth and continued high employment growth suggests that people are likely being enticed back into the labor market.

At some point, however, the combination of the tax cut and spending increase could create some shortages in both labor and product markets and, as a result, some inflation. And tariffs are something of a wild card. So far, most of the tariffs have been on intermediate products, and the price increases from these will be relatively modest and take time to work through the system. A large increase in tariffs on consumer goods would likely cause a fast, one-time rise in consumer prices, particularly for products such as apparel and furniture. Interpreting inflation data under those circumstances could be tricky. And if that rise sparks wage hikes to maintain real wages—a possibility at current unemployment rates—inflation could indeed tick up.

A return to 1970s-style inflation is about as likely as polyester leisure suits coming back into style. But it would not be surprising in these circumstances to see the core CPI rise to above 2.5 percent. Our forecast expects timely Fed action to prevent inflation from rising too much, but the price (of course) is higher interest rates.

Appendix

Explore more economics content

-

No college, no problem? Article6 years ago

-

The aging water infrastructure Article8 years ago

-

Why 2020 could be a dangerous year for the US economy Article6 years ago

-

A new understanding of Millennials Article9 years ago

-

The US housing market recovery Article8 years ago

-

Issues by the Numbers, July 2018 Article6 years ago