Building the tax function of tomorrow—today As the pressure mounts, the tax office sits at the confluence of change

19 minute read

20 March 2019

The tax function is no longer all about compliance. Cognitive technologies and new digital models are driving changes in how tax leaders are looking to the future, aiming to add both value and transparency.

As the forces of globalization, digitization, and social transformation take hold, the way companies operate has changed dramatically.1 The pressure on the tax function to transform has never been greater.

Learn more

Visit the AI and cognitive technologies collection

Explore the Future of Work collection

Subscribe to receive related content

Indeed, it is hard to miss the signals of change: in business’s adoption of cognitive technologies in the workplace; in the new digital models being rolled out by tax authorities around the world; in the continued demand from corporate leaders for improved back-office efficiency and cost structures; in the growing public scrutiny on, and calls for greater transparency from, corporate taxpayers.

Constrained by time and resources, most tax teams simply strive to remain compliant in an ever-changing world. In fact, Deloitte’s “Reporting in a digital world” survey showed that tax teams spend almost half of their time creating and updating reports.2

While many tax functions regularly implement new technologies, they are generally responding to a specific regulatory or reporting change, and put in place sub-optimal solutions rather than innovative programs. Furthermore, the tax function is an area that can’t exactly exhort people to fail-fast-fail-often as enthusiastically as other parts of the business.3

But some tax leaders, feeling the pressure of these increasing demands, are beginning to recognize that the status quo is simply no longer good enough. They are starting to explore the value that technologies utilized in other parts of the organization could deliver to the tax function. They are recognizing that when properly adopted, integrated, and managed—and when viewed in the context of pairing people with machines rather than replacing people with machines—these technologies are able to unlock new efficiencies and enhance agility.

This report does not advocate for a specific operating model or technology for tax. Rather, it draws on Deloitte professionals’ experiences to look at some of the pressures for change, cognitive technologies and their application in the tax function, and practical steps to establishing the tax function of tomorrow, today.

Time for change

Tax functions have been coming under increasing pressure for years. It’s not only the way that tax codes and rules change at an exponential pace. Further, the environment in which the tax function operates is rapidly evolving.

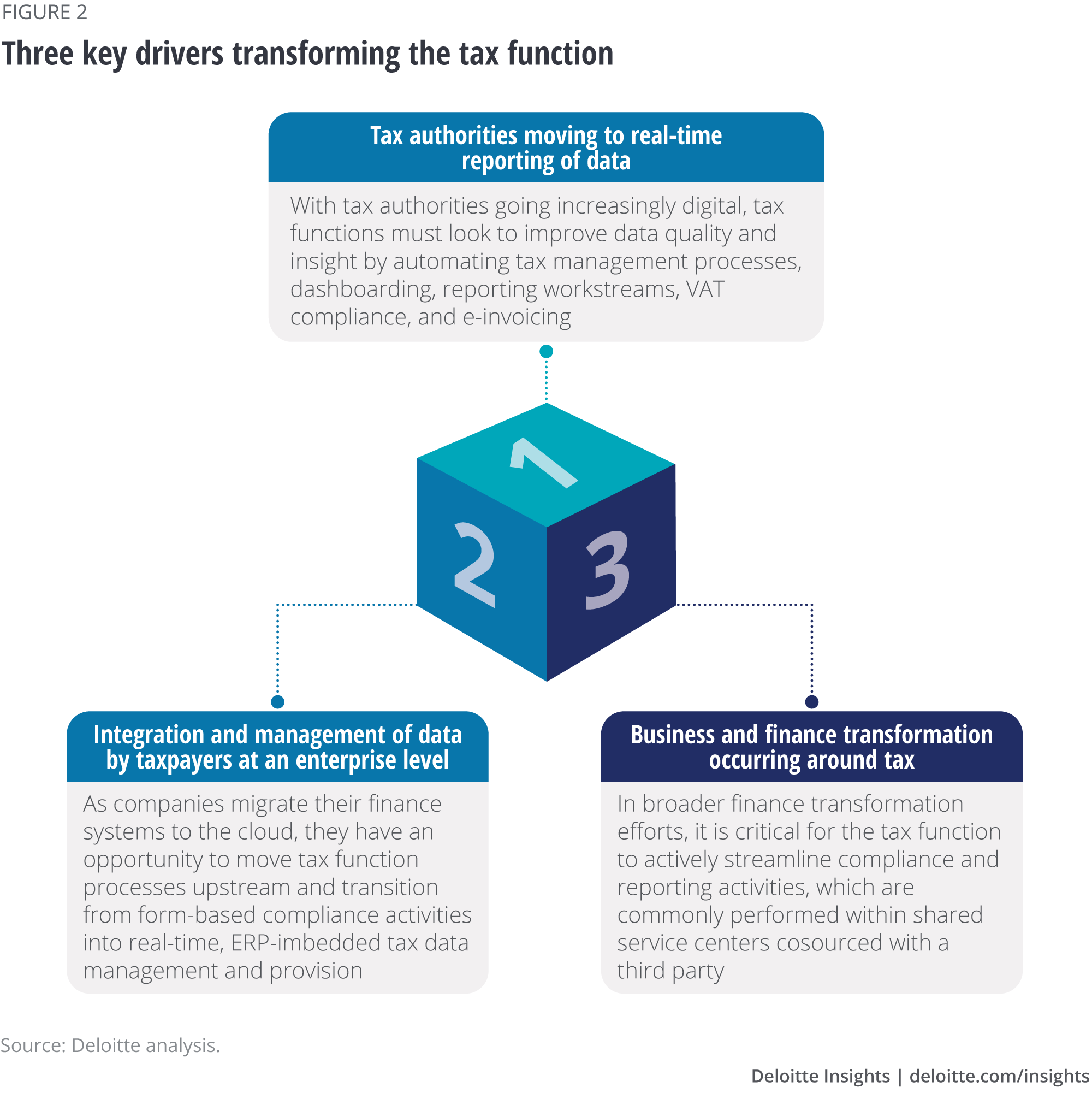

Three distinct pressures are reaching a tipping point in which tax functions are struggling to keep up: the digitization of business, the evolution of tax authorities, and the continued demand for efficiency in the back office.

The digitization of business

The fact that businesses of all shapes and sizes have embraced digital technologies and channels is self-evident. And that is having a profound impact on the environment in which the tax function operates. On the one hand, tax leaders are seeing digital deliver exponential growth in speed and performance, enabled by ever more capable systems and machines that are available anywhere and at any time. And they understand the value that represents.

On the other hand, their enthusiasm is being somewhat tempered by reports—and, increasingly, personal experiences—of poor performance, concerns about data privacy, and general uncertainty about what these new technologies really mean within the context of the tax function.

As the business adopts digital technologies and operating models, the stakes are rising. Deloitte has scanned the market and concluded that five disruptive digitization trends are already shaping the future of the tax profession:

- Big data. Large volumes of structured and unstructured data are now accessible and usable at scale.

- Process automation. Robots and automations are becoming increasingly sophisticated and experienced.

- Decision-making. The augmentation of human decision-making is being enabled through cognitive computing, machine learning, and other forms of artificial intelligence.

- Democratization of knowledge. Massive new data sets and sources of knowledge are becoming widely available online.

- Open networks. New collaborative ecosystems are bringing together talent, technologies, and revenue authorities.

(Deloitte’s Our digital future: A perspective for tax and legal professionals examines these trends in more detail.4)

The digitization of business is making tax more complicated while, at the same time, making the world a little smaller. Consider, for example, how digitization has allowed businesses to reach into new markets without requiring massive investment. This, along with tax authorities introducing new digital taxes, is undeniably complicating tax leaders’ lives. But at the same time, the world is becoming smaller through the availability of data and analytics, granting tax directors visibility into their data at a granular level.

Or consider how the pace and scale of the introduction of new production models under Industry 4.0 is impacting the tax function. Almost any shift in the way the business works—such as changes to supply chains, the introduction of new products or services, additional capital expenditure, or product customization—can have significant ramifications on the tax position.5

What’s driving tax authority transformation?

Following discussions at the Organisation for Economic Co-operation and Development’s (OECD’s) Forum on Tax Administration in Beijing in 2016, Deloitte categorized four distinct “groups” of tax authorities in the digitization of tax.

The compliance group. This group sees the digitization of tax as a smart, efficient means to transition a large “informal” economy into the tax system. Projections for revenue generation drive most decisions about digitization. This group includes South America and the Mediterranean.

The efficiency group. This group recognizes that the digitization of tax can deliver massive efficiencies to tax administration and management. These authorities are often seeking to leverage existing technology penetration to drive digital adoption in the economy. This group includes Southeast Asia, Scandinavia, and the former Baltic states.

The developing market group. Encouraged and supported by international financial institutions such as the World Bank, this group is looking to leverage new technologies to help developing markets leapfrog into a new era of tax administration. This group includes Africa and Asia.

The legacy group. This group’s tax authorities are relatively advanced and mature. They are struggling to achieve the value from digitization within legacy IT environments. This group includes markets such as Canada, France, Germany, the Netherlands, the United Kingdom, and the United States.

The evolution of the tax authorities

While tax functions may be somewhat slow to adopt digitized processes, tax authorities appear to be increasingly embracing the value of digital as they look for more real-time reporting. In fact, for perhaps the first time in history, we have entered an era in which all tax authorities agree on the same position: The digitization of tax is good for everyone.

Observers have several models to study, and many have looked to Brazil’s early adoption of digital tax models. Businesses operating there are not only required to submit a Nota Fiscal Eletrônica (or NF-e) form every time a taxable action takes place—they are required to electronically submit all of their transactional accounting information to the authorities for review.6

And the OECD’s Standard Audit File for Tax (SAF-T) has been in use for more than a decade in parts of Europe. In 2020, Norway will join the existing six European markets that currently require their corporate taxpayers to abide by this international standard for electronic exchange of data with tax authorities. Other workstreams aimed at improving the digitization of tax authorities continue at the OECD level.7

Other governments and tax authorities are catching on. In July 2017, Spain introduced the Immediate Supply of Information system, requiring certain taxpayers to provide real-time reporting of data related to VAT invoices.8 Italy9 introduced a requirement for some taxpayers to submit e-invoices through their Sistema di Interscambio (SdI) platform beginning January 1, 2019.10 Poland is widely expected to replace VAT returns with SAF-T sometime in 2019.11 Notwithstanding the relative lack of progress by some of the more mature tax authorities, many other tax authorities around the world are executing on a digital tax strategy.

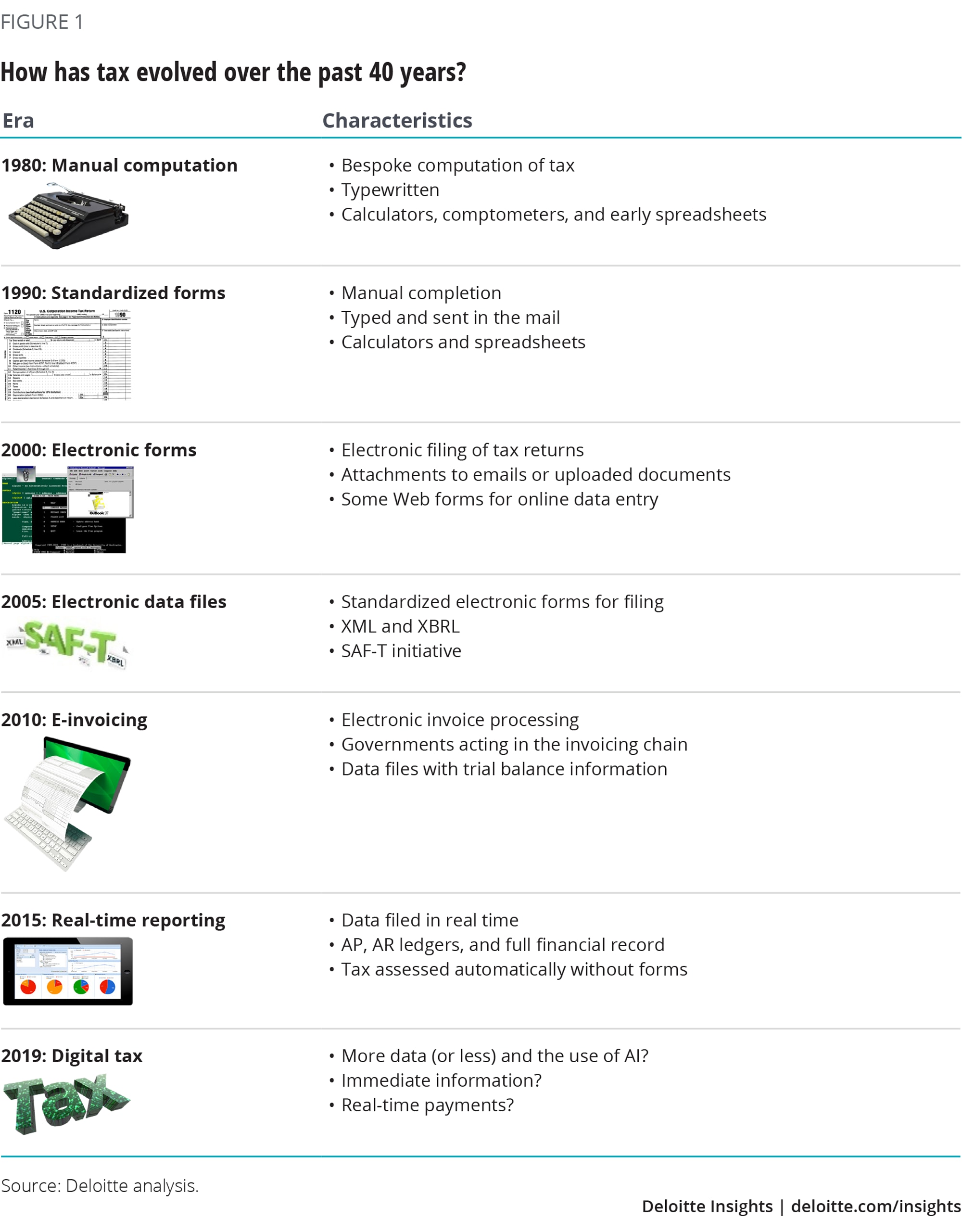

As figure 1 illustrates, it is hardly the first time that tax authorities have adopted new technologies to improve the way tax is administered, reported, and managed. But recent history suggests that this wave of digitization will fundamentally change the relationship between tax authorities and taxpayers.

Indeed, tax authorities’ increased demands for greater transparency and more timely data are making tax functions consider how they can move further upstream in their data sources and (enterprise resource planning) ERP systems. And that is forcing them to think much more critically about the quality of their data and the way they collaborate with Finance and IT to not only improve access but help explain any gaps that may be found between the ERP data and the data reported to tax authorities.

The continued demand for efficiency in the back office

Every back-office function is under perpetual pressure to cut costs, improve efficiency, and enhance overall organizational agility. And there are many tax activities that are, relative to other functions, comparatively manual-intensive and repetitive. Finance leaders—many having already conducted a digital transformation of the wider finance function—are starting to look for potential efficiencies in the tax function.

For many organizations, the business itself is also applying pressure for greater efficiency and agility. Business leaders want to make data-driven decisions, and they want to make those decisions quickly. If tax is to assist in delivering on the company growth agenda, tax leaders recognize that they need to deliver services that are more timely, insightful, and strategic.

At the same time, the tax function is looking to extract some efficiencies of its own. The reality is that—particularly for larger multinational organizations—the processes required to comply with increasingly complex tax requirements are soaking up significant resources. As the pressure to deliver more strategic tax insights to the business mounts, tax leaders are looking for ways to reduce their manual activities and shift resources to more value-added services.

Tomorrow’s tax function today

Pressure on the tax function may be rising, but the good news is that recent technological advancements are enabling new solutions. In fact, tools and technologies are already forming the foundation stones and characteristics of tomorrow’s tax function.

What will tomorrow’s tax function look like? That is difficult to predict with precision. But some of the key characteristics are already clear. For one, the tax function will be hugely data-driven, working in real time to take a more holistic approach on an enterprise level. It will have access to all of the ERP data sources at a much deeper level of granularity, precision, and accuracy. Algorithms will deliver tax expertise and knowledge, while robots will take the strain by relieving humans of manual processes. Tax professionals will be focused on strategy, working with their machines to deliver valuable insights to the business. Indeed, with will be a key word in the tax function, as leaders create advantages by tapping the power of well-structured data with design thinking with analytics with machines.

While a number of technology “families” are emerging, there are two—robotic process automation and cognitive computing—that seem set to affect the most fundamental change on the tax function in the near future. However, it must be noted that the greatest use cases for new technologies in tax are created when multiple tools and technologies are integrated together and plugged into the ERP system. The key is in understanding how each drives value in the tax environment and applying those insights to each unique situation.

Tax and cognitive technologies

What is robotic process automation (RPA)? At its most basic, RPA is about automating existing manual processes. Often referred to as robotics or robots, RPA is defined as the automation of rules-based processes with software that uses the user interface and that can run on any software, including Web-based applications, ERP systems, and mainframe systems.12

What is it good at? RPA is spectacular at automating current manual processes and interacting with graphical user interfaces. That makes it particularly valuable for the automation of repetitive and manual tasks such as populating reports and gathering and transforming data to feed downstream processes and advanced analytics.

How are tax functions using RPA?

- Indirect tax leaders are using RPA to perform data-gathering, adjustments, reconciliations, processing, and e-filing. Bots gather and convert multiple source files to generate jurisdiction-specific adjustments, perform reconciliations and notify teams of any exceptions, and produce standardized output files and jurisdictional summaries. Bots can then submit finalized data to tax authority websites and monitor and document acceptance confirmations.

- Automated processes are also being used to collect and reconcile company and vendor data to ensure accurate value-added tax reporting. The increased speed and accuracy can generate meaningful cash savings in the form of reduced interest and penalties, and accelerated refunds due to shortened or eliminated audit cycles.

What is machine learning? Machine learning is about enabling machines to become increasingly more accurate at spotting patterns in data and then using that ability to help make decisions. This includes technologies that can perform and/or augment tasks, help better inform decisions, and accomplish objectives that have traditionally required human intelligence, such as planning, reasoning from partial or uncertain information, and learning.13

What is it good at? Machine learning and related cognitive technologies are great at automating and enhancing decision-making. Many cognitive technologies not only develop the ability to make decisions based on a history of human decision-making data—they improve their decision-making capability as they uncover, and work with humans to solve, new “exceptions.”

How are tax functions using machine learning?

- Rather than spend human resources on classifying expenses for tax purposes, indirect tax leaders are using machine learning algorithms to automatically categorize expense data across tens of thousands of potential categories to support partial exemption calculations, saving significant amounts of resource hours and reducing potential errors.

- Optical character recognition and machine learning are assisting tax departments with indirect tax overpayment recovery, not only eliminating recurring manual reconciliation and analysis but accelerating cash recovery and reducing the potential for future over/underpayments.

Encouraging change

The future of work is rapidly changing.14 And there is massive scope for technology to deliver value creation to the tax function. However, the reality is that it will take significant effort, investment, and innovation to unlock it. Experience suggests there are four broad areas in which tax and finance leaders will need to catalyze significant change.

Skills and capabilities

People have been talking for years about integrating new technical skills into the tax function. At first, it was so that tax leaders could better communicate with the business. Now, the trend is toward developing more technology-focused skills within the function—particularly capabilities in areas such as analytics, data science, and process optimization.

While, in many cases, this might mean onboarding new talent from a range of diverse backgrounds and technical capabilities, current experience suggests that existing tax professionals can—and indeed, must—be the ones to develop many of the new necessary capabilities. As automation removes routine tasks, professionals will need to engage in more value-adding activities, requiring a certain level of upskilling and technical education to achieve. Tax leaders should be seeking an evolution in tax capabilities rather than a revolution.

It’s not just new and middle-manager tax professionals who will need upskilling. So, too, will tax leadership and other members of the tax ecosystem. Tax lawyers, for example, should be considering how automation will change how they work and the type of work they do—for instance, they may want to study how digitization has changed the controversy and audit landscape in places such as Mexico and Brazil. New technology skills will be part of the mix; new ways of working will also be required.

Understanding the skills that will be required in tomorrow’s tax function will take some deep thought and analysis—another use case for advanced analytics, by the way. But one thing is clear: Today’s tax capabilities are insufficient to deliver value for the tax function of tomorrow.

Operating models

As operational complexity grows and technologies reshape the tax function’s roles and responsibilities, finance and tax leaders will need to carefully consider how they create new operating models that support and sustain existing operations while enabling professionals to focus on more value-added activities.

Fortunately, new technologies are generating new operating models. The market already has a range of outsourced, managed-service, and as-a-service solutions that offer tax leaders opportunities to move some of the more tactical tax activities out of the function. In fact, according to a recent survey, most tax executives expect their use of tax outsourcing to rise significantly over the coming years.15

New resourcing models for tax will also emerge. As Deloitte Insights’ Future of Work series suggests, technology is enabling the workplace and workforce to expand far beyond a company’s walls and balance sheets. And that is creating new opportunities for tax leaders as they plan to build a future-ready team.

To effectively take advantage of technology, tax leaders will need to redesign work itself, moving beyond processes that were designed solely for humans to find ways to enhance machine-human collaboration, drawing out the best of both and expanding across alternative workforces.16

Technology strategy

The greatest value of new technologies in the tax function is found when multiple technologies and tools are integrated and plugged into an ERP system. Bots can gather and transform data to feed machine learning algorithms; machine learning can “observe” and improve bots’ performance. Finance and tax leaders will need to start thinking much more holistically about the technologies they are assessing and how they might fit into the current IT infrastructure.

In part, this will involve understanding current technology capabilities (and barriers) within the business’s wider technology stack. Having a clear view of what technologies are already in play within the organization (and, particularly, the finance function) will be key. So, too, will be assessing whether current systems will remain fit for purpose in the tax function of tomorrow.

At the same time, it will require tax leaders to reorganize their assessment of technologies around particular use cases and pain points rather than simply looking for opportunities to apply the next big thing—to first understand the problems they are trying to fix and then select the right suite of technologies to solve them.

Tax control frameworks

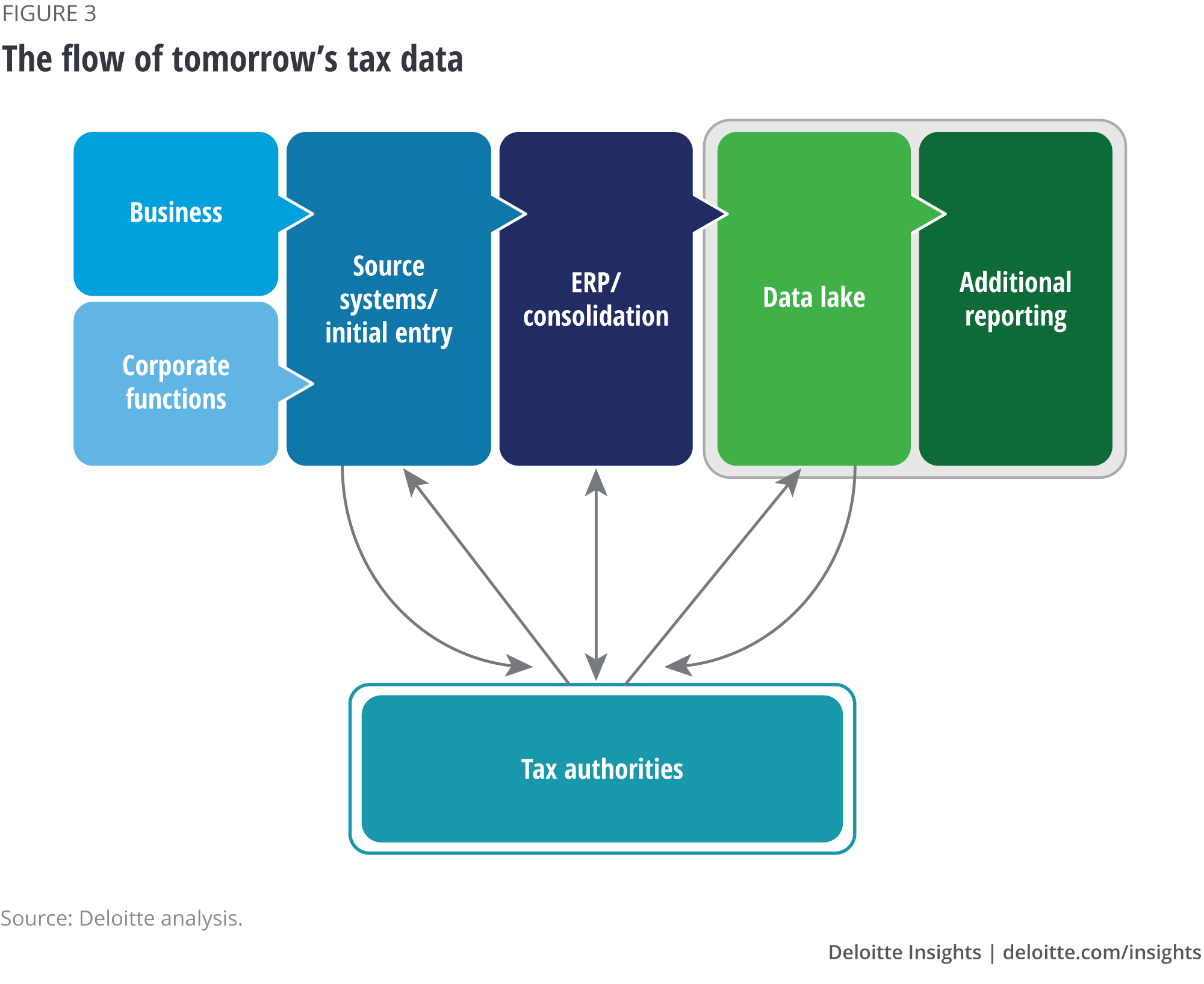

Whereas, today, tax functions tend to spend the vast majority of their time analyzing and reworking data from the source before submitting it to tax authorities, the signs are that tax authorities are also looking to move further upstream in the data sources (figure 3). And that will require tax functions to rethink their tax control frameworks.

As figure 3 suggests, tax authorities are starting to gain access to much more granular real-time data—from source systems, ERP systems, data lakes, and other reporting sources—which is forcing the tax function to manage controls in real time. As digital audits become more widespread, data analytics will largely replace tax return compliance and drive a need for better data quality. More comprehensive reporting will be required in order to establish a full tax position, and reconciliations will need to become more standardized.

As tax authorities move closer to the source data, the tax function will need to begin thinking less about how they can rework the data and more about how they can ensure the data is correct in the source systems from the start.

Accordingly, control frameworks will need to move much further upstream to remain effective. Tax professionals should look at starting work much closer to the data sources. And tax will need to be much more deeply integrated into the business and functional processes to ensure ongoing compliance.

Culture

Perhaps the greatest foundational changes that will need to occur in order to evolve toward the tax function of tomorrow relate to culture. Tomorrow’s tax function must be innovative, strategic, data-driven, and nimble. Helping people shift time away from rules-based manual activities toward more strategic roles will require a cultural evolution.

At the same time, the culture of the wider business—particularly the finance function—will need to change as the tax function moves toward more strategic activities. Partnering with key stakeholders such as Finance and IT will be key. Indeed, tax will need to be elevated, not only in the minds of the tax professionals themselves but in the minds of business’s decision-makers and IT leaders.

To be clear, new technologies on their own will not create value for the tax function. Unlocking the desired value will require tax professionals, finance partners, IT partners, and the business to rethink and reimagine work, the workforce, and the workplace. And that requires a big change in the current culture.

Getting started

So what will it take to embody tomorrow’s tax function today? Obviously, the exact technologies, models, and capabilities will largely depend on the particular industry segment, existing technologies in place, pain points, and the context within which the tax function operates. Every company will be different. And there are no off-the-shelf tools or standardized road maps to offer a silver bullet.

However, experience suggests a number of steps that tax and finance leaders could be taking today in order to better prepare the function for tomorrow.

Monitor regulatory and tax trends. Tax authorities are leading the way, offering strong signals of how tax will evolve over the coming decade or more. Continue to invest in understanding the rapid regulatory changes around the globe and build collaborative relationships and dialogue with your tax authorities as they evolve. And form a viewpoint on digital disruption, based on your view of the market and key trends. Leveraging signals in the market, current technology trends (both consumer and business), and a clear understanding of the organization’s overall digital strategy and expectations, develop your own stance on how digitization and automation will influence the tax function of tomorrow.

Envision your target operating model. Creating your operational vision for the future will be key to helping define and execute your long-term technology road map. Look outside of the traditional tax infrastructure to assess existing capabilities and technologies across the organization that can be leveraged and then develop your digital road map, recognizing where you want to go in the long term, and how that can be achieved through practical and achievable steps. Focus on investments that solve immediate pain points while building toward the longer-term vision.

Start enhancing your data now. Given that the tax function relies upon every transaction housed in the data generated by the business, tax data requirements can help drive an enterprise data model that will support enhanced planning and analysis. Remember that emerging digital technologies are only as good as the data they have to work with.

Generate internal support. Evolving into tomorrow’s tax function will require broad-based support from across the organization. Building the business case for change will be critical, not only for generating internal buy-in for change programs but to secure the investment and leadership support that will be required over the longer term. Look for other large IT or finance initiatives (such as a move to cloud, finance transformations, or adoption of new outsourcing models) that can concurrently help your tax goals and objectives.

Cultivate the right framework. Given where most tax functions are today, the shift toward the tax function of tomorrow will require significant change management and leadership. This isn’t just about ensuring that existing employees and stakeholders go along for the ride. It is about creating a progressive, adaptive, and forward-looking culture within the tax function—one that not only instills confidence in every decision or task but continuously evolves and innovates as external pressures and technology models change.

At the end of the day, it is important to remember that the transformation happening around you—shared data, social engagement, digital assistants, cloud platforms, connected devices—is not about people versus machines. It’s about human collaboration and impact made greater with machines. It’s about creating advantage by validating and managing your data, using it with purpose, unlocking insights in real time, arriving at smart decisions, and creating better business outcomes—then automating and repeating that in myriad ways across your company. People alone can’t do it. Technology alone can’t do it. It takes humans with machines, working together in a designed system.

As the pressure for change on the tax function reaches a boiling point, the future offers tax leaders opportunities to not only relieve the pressure but also to change the status quo entirely. The goal: to turn tax into a source of agility, strategic insight, and even innovation.

Explore AI and cognitive technologies

-

Future of work Collection

-

Intelligent interfaces Article5 years ago

-

Cognitive technologies: A technical primer Article6 years ago

-

From smart products to smart systems Article6 years ago

-

Tax governance in the world of Industry 4.0 Article6 years ago