How digital technologies can elevate the car-buying experience

8 minute read

05 January 2019

Digital technologies are starting to fundamentally change the way people buy cars, but manufacturers and dealers should think carefully about where to invest in order to elevate the customer experience.

Some of the best experiences people have in their lives are those that are customized and connected to them on a personal level. These days, people increasingly expect to have such experiences across all of their brand interactions, whether it’s paying for coffee, ordering groceries online, booking travel, or buying a car.

Learn more

Learn about this trend in Italy: Automotive: il ruolo delle tecnologie digitali nel processo d’acquisto

Subscribe to receive updates on the Future of Mobility

Download Deloitte’s 2019 Automotive News supplement

View more content from the Automotive collection

One way that companies are meeting this challenge is by integrating advanced digital technologies into the buying process—and automotive companies are no exception. Many automotive manufacturers and dealers in the United States are making significant investments in a variety of consumer-focused digital technologies, ranging from tablet-based product guides to virtual reality (VR)-enabled applications with an eye to increasing customer engagement on the showroom floor. The intent is to update and improve a sales process that has not changed for the better part of a century. But which digital investments will yield the most significant returns?

This question is the more difficult because manufacturers and dealers differ in the outcomes they need from digital transformation at the retail level. Generally, manufacturers are looking to large digital investments to drive overall mobility strategies aimed at reshaping the way consumers engage with their brand. On the other hand, dealers are typically pursuing much more immediate digital solutions to drive operational efficiencies, reduce overhead, empower sales staff, and increase transparency while reducing friction in the sales process. Whereas manufacturers are investing to create omnichannel customer experiences, dealers are more focused on tactical solutions that integrate disparate data systems to ease information flow across the dealership.

This lack of common ground often leads to disagreement between manufacturers and dealers on the best approach to digital implementation. However, our experience suggests that both parties could benefit from thinking more collectively about digital transformation, particularly in the “upper-to-mid funnel” where consumers are still researching a potential purchase online. Results from the 2018 Deloitte Global Automotive Consumer Study indicate that, out of all sources of information, brand and dealer websites have the greatest impact on new car-buying decisions (tied with input from family, friends, and coworkers; see figure 1). The importance of identifying, intercepting, and influencing potential buyers online is underscored by the fact that half of US auto buyers do not engage in any dealer cross-shopping after they first visit a showroom. Indeed, 30 percent buy a vehicle the very same day they step onto a dealer’s lot. Being top of mind when people first head out to kick some tires can thus significantly increase the odds of a sale.

But creating a truly engaging online experience that compels people to visit a physical retail location can be harder than it looks. Many dealers complain that manufacturers exert too much control over their online presence by using standard website templates, while manufacturers are frustrated by the wide variety of dealer management systems (DMS) applications among dealers that ultimately waters down their vision for a seamless, integrated Web experience. Perhaps as a result, study results show that more than half of all auto shoppers find manufacturer and dealer websites to be merely meeting expectations.

The good news is that ample opportunity exists for brands and dealers to create a differentiated digital experience via their websites, potentially adapting useful ideas from sectors such as consumer electronics and online retailing. Building a strong bridge that facilitates a seamless move from online research to a physical shopping experience can be an especially important goal. For example, making sure any information and preferences people input online follow them into the dealership can significantly streamline the salesperson’s discovery process. Also, keeping critical information, such as vehicle pricing, consistent between the Web and the dealer’s showroom could enhance the buyer’s experience by improving his or her perception of dealer transparency and integrity.

A compelling argument also exists for digital investments that directly address customer pain points in the vehicle-buying process. Study results confirm the long-standing notion that people dislike excessive paperwork and the overall length of time it takes to buy a car. Digital tools that streamline these processes, such as used vehicle valuation algorithms and remote document “e-signing” capabilities,1 can elevate the overall shopping experience. They may even increase the likelihood of a sale by reducing the amount of time customers are exposed to anxiety-inducing aspects of the purchase process. And they can also provide the necessary conditions for effectively transitioning the customer into a long-term service relationship.

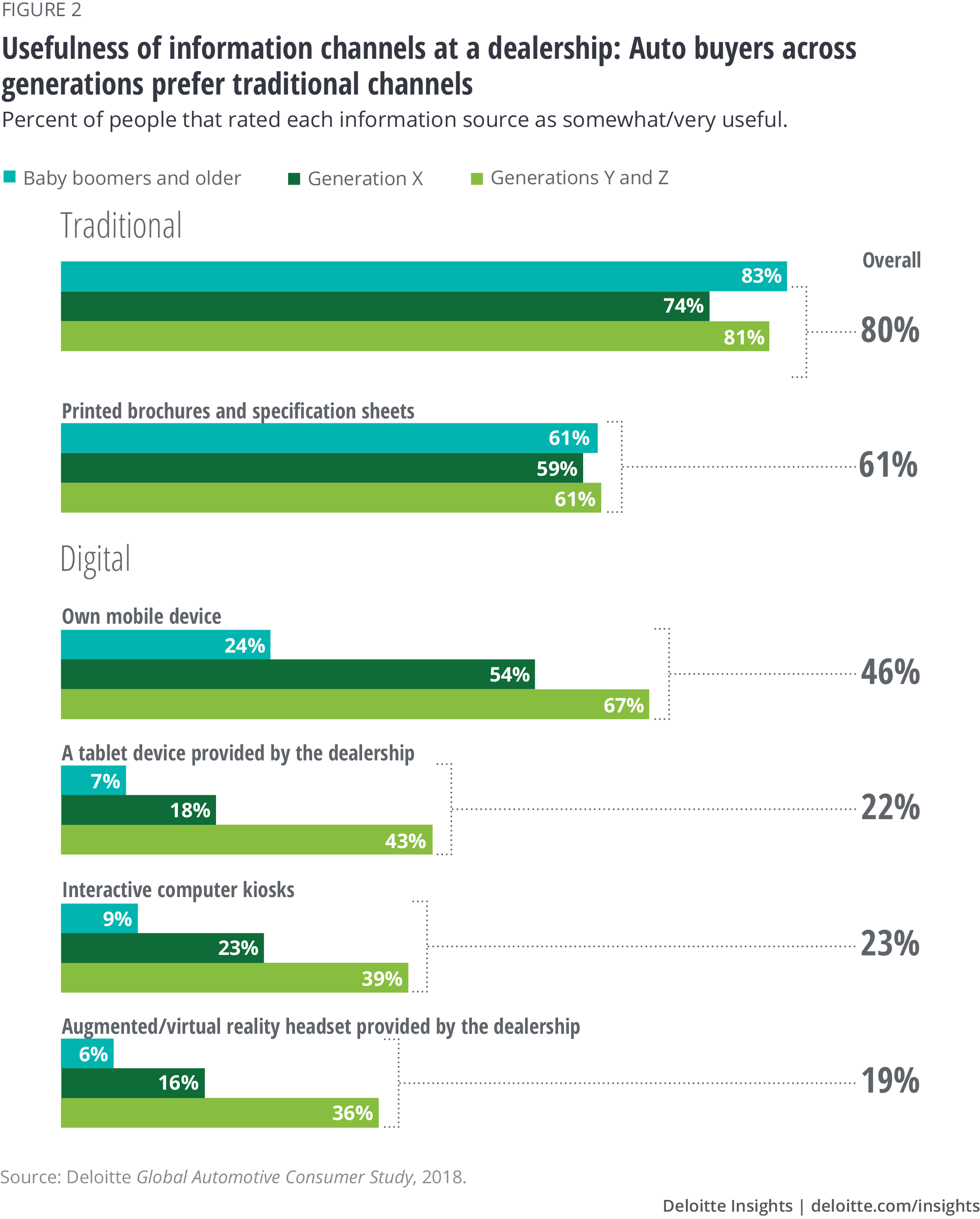

Companies should also recognize that many people shopping for their next vehicle have yet to fully embrace digital sales aids as the primary means of researching a purchase. Study findings show that vehicle shoppers across all generations prefer more “low-tech” information tools while they are in a dealer showroom. In fact, 80 percent of US vehicle buyers rate conversations with salespeople as the most useful information channel, followed by printed brochures and spec sheets (figure 2). This preference for “traditional” information tools could be attributed to a number of factors, including a consumer base that does not yet fully understand or appreciate the types and benefits of enhanced user experiences these technologies can create. This suggests that good customer handling fundamentals are still the foundation of a truly exceptional customer experience, which can then be enhanced by the judicious use of digital sales aids that increase convenience, transparency, and flexibility.

That’s not to say that no one is interested in digital enhancements to the showroom experience. Millennials and younger buyers, according to our study, are open to such experiences—but they ultimately favor their own mobile devices to access the information they need. Premium car brand owners, too, show higher-than-average interest in digital showrooms: Nearly one-third (31 percent) find tablet devices to be helpful while shopping at a vehicle dealer, compared to only 21 percent of nonpremium car owners.

Notably, our study found that 60 percent of US consumers are at least “interested” in the overall concept of buying their next vehicle online directly from a manufacturer. This should be a wake-up call for auto dealers that the expectation of a completely digital buying experience could be closer than they think. For their part, rather than trying to go around the dealer (which would likely involve a long and painful legal process), manufacturers could see this as a golden opportunity to work with dealers to explore what a wholly virtual sales process could look like. For example, giving salespeople digital tools and moving them out of the dealership to interact with customers where they live or work could significantly improve the sales experience by increasing the perception of convenience while reducing anxiety.

That said, it’s unlikely that in-person sales will ever disappear entirely, as several important aspects of the showroom experience can be hard to “digitize.” For example, our survey shows that nearly nine out of 10 shoppers prefer the immediate, tactile experience of physically interacting with a vehicle before buying it, while 70 percent of buyers indicate they prefer in-person interactions with dealership personnel. And nearly two-thirds of buyers say they would rather conduct price negotiations in person to secure the best deal. These preferences imply that most auto buyers have yet to envision a fully digital vehicle-purchasing experience—and may also help explain why the wave of online shopping that is taking over many retail subsectors has yet to fully disrupt the automotive retail industry.

Manufacturers and dealers seeking to invest in customer-focused digital capabilities may wish to consider the following:2

- Engage potential buyers during the online research phase with targeted, tailored messaging. Retain any data collected during the online research phase to help create a seamless, tailored experience at the dealership.

- Leverage related online capabilities, such as financing preapprovals and finance protection product explanations, to increase transparency and accelerate the car-buying transaction. Create horizontal data aggregation capabilities that integrate information across dealer systems to reduce friction in the vehicle-purchasing process.

- Expand the pool of available customer data points by exploring strategic partnerships with mobile device providers, social networks, application developers, location-based service providers, and network services that are already seeking to position themselves as integration hubs for an individual’s mobility profile.

- Develop pricing strategies that engage the customer as a partner, with systems offering price match guarantees that encourage future loyalty to both the dealer and the brand.

- Don’t let the dealership be defined by the walls that hold up the roof. Potential customers are everywhere. The flexibility to engage with customers on their own terms in an office, home, or coffee house with video chat or AR/VR can be integral to auto retailing going forward.

In an industry where competition for consumer attention is likely to intensify in the face of softening overall demand,3 the need to embrace new technologies to improve the car-buying experience seems critical. However, digital transformation can mean a variety of things, and investments should be prioritized in the areas where customers see the most value.

© 2021. See Terms of Use for more information.