2025 Global Automotive Consumer Study has been saved

Analysis

2025 Global Automotive Consumer Study

Tracking consumer trends in the automotive industry

What consumer trends and disruptive technologies will have the most impact on the automotive industry in the coming year? Explore key findings from our 2025 Global Automotive Consumer Study, including electrification adoption, connectivity concerns, car buying trends, and more.

Trends affecting the global mobility ecosystem

The global automotive industry is undergoing a tremendous amount of change at an unprecedented pace. At the center of this change sits a consumer with rapidly evolving expectations of the mobility experience. To help automotive companies better understand these shifting preferences and other emerging trends, we surveyed more than 30,000 consumers in 30 countries.

Conducted from October through December 2024, our 2025 Global Automotive Consumer Study explores four key trends that emerged from this year’s survey:

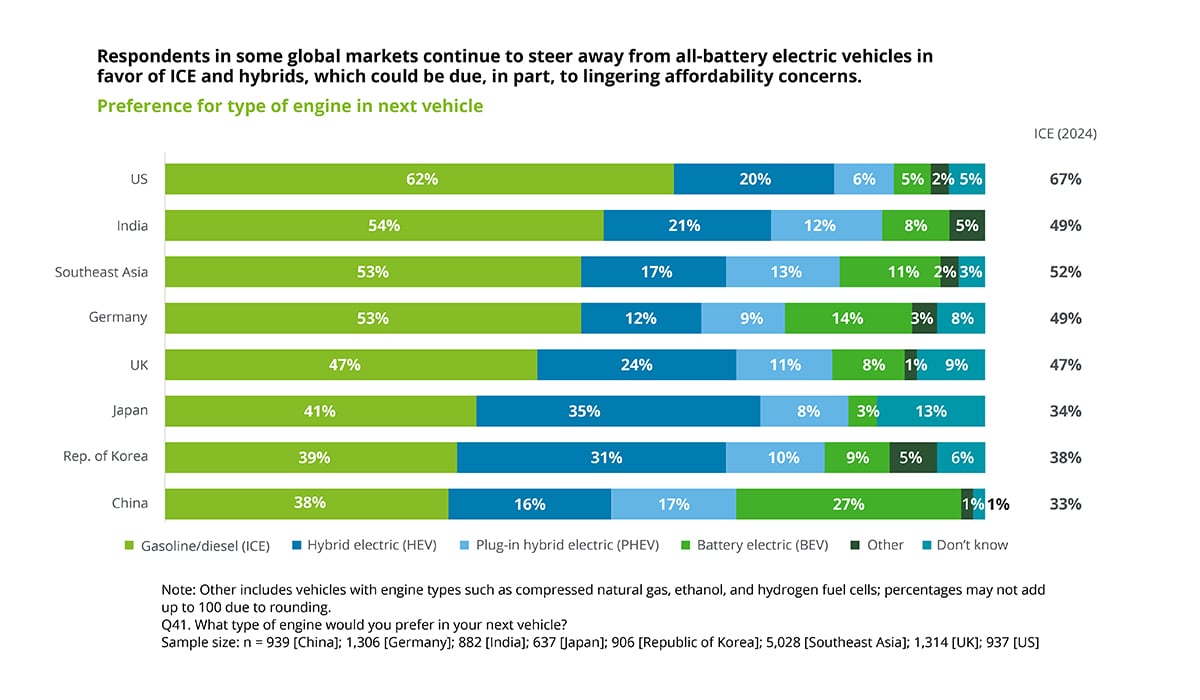

- All-battery electric vehicle (BEV) inertia remains muted in most markets as interest in internal combustion engine (ICE) and hybrid vehicles ticks up.

- Intended vehicle brand defection is on the rise in many markets around the world.

- Autonomous vehicles are coming back into view, but consumer concerns remain.

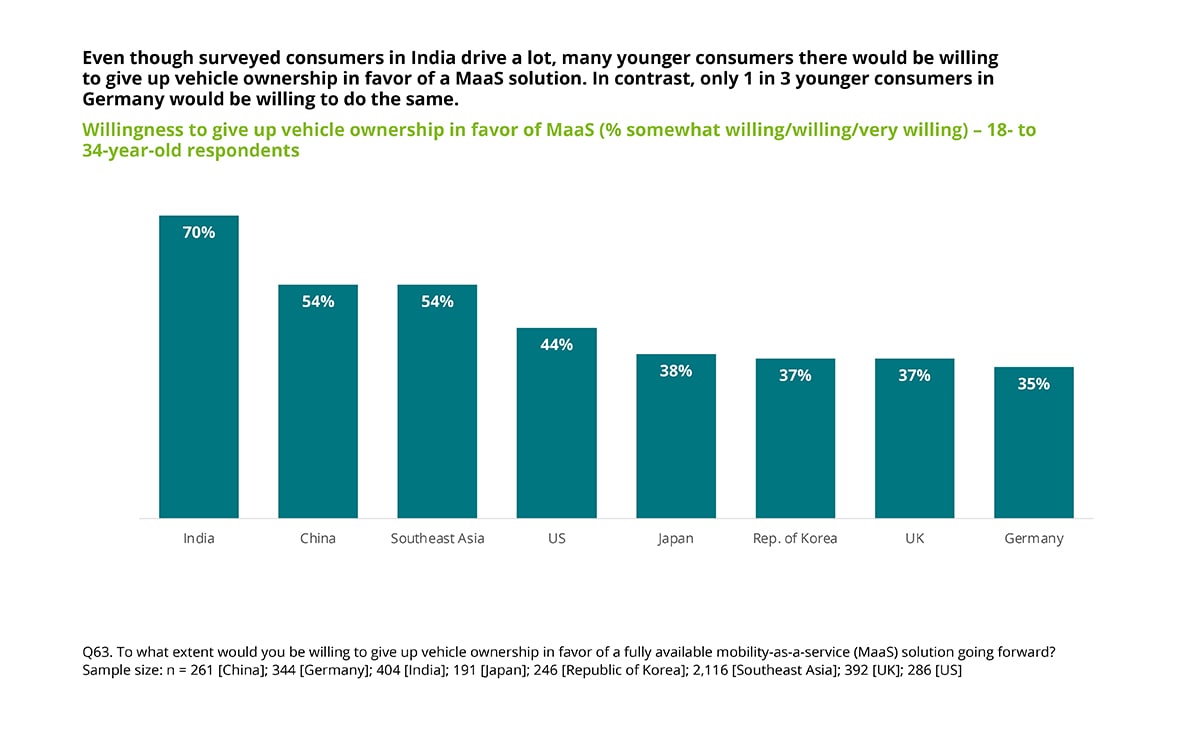

- A relatively high frequency of vehicle use persists in many markets, but many younger consumers surveyed are interested in mobility-as-a-service (MaaS) over ownership.

This annual study provides important insights that can help companies prioritize and better position their business strategies and investments in the year to come. For more details on these evolving automotive consumer trends, download the full report.

Trend 1: BEV inertia remains muted in most markets

Consumer interest in full hybrids and range extender technology (i.e., no external charging plug) is gaining momentum in several global markets as consumers seek a “best of both worlds” solution to reduce fuel costs and lower emissions without the need for charging infrastructure.

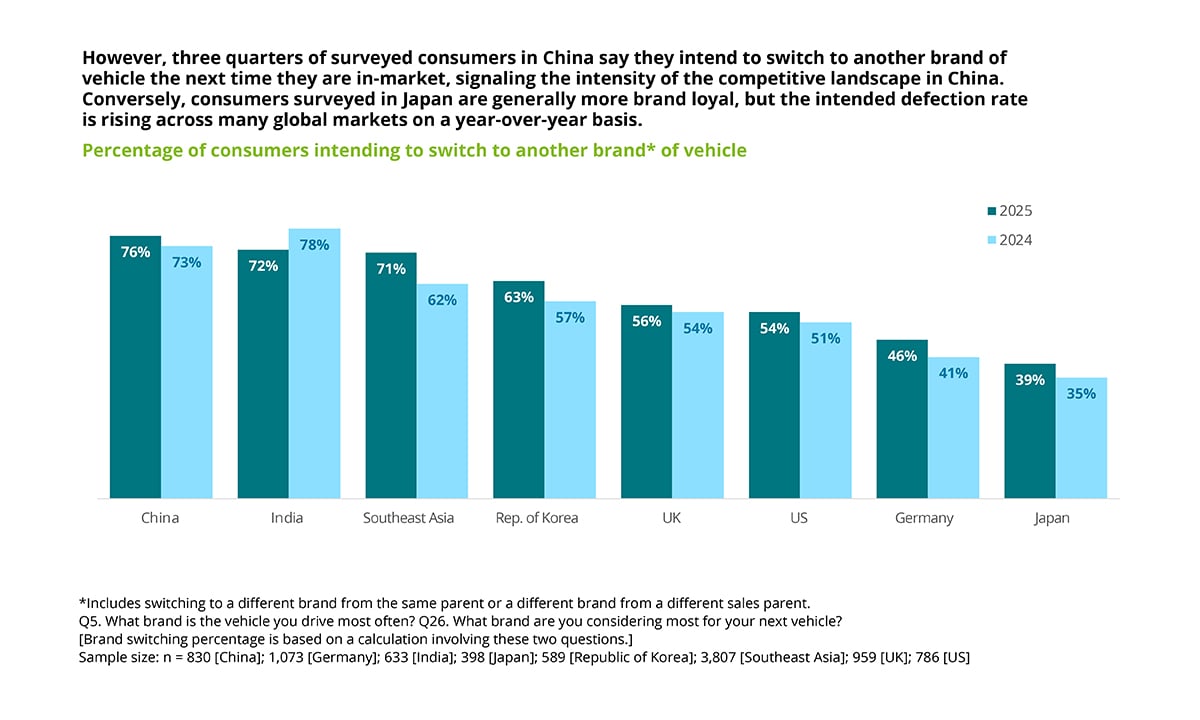

Trend 2: Intended vehicle brand defection is on the rise around the world

The percentage of surveyed consumers intending to switch brands the next time they are in-market for a vehicle increased on a year-over-year basis across several markets, signaling the need to build strong customer relationships, particularly in developing markets with a significant percentage of first-time buyers (e.g., China).

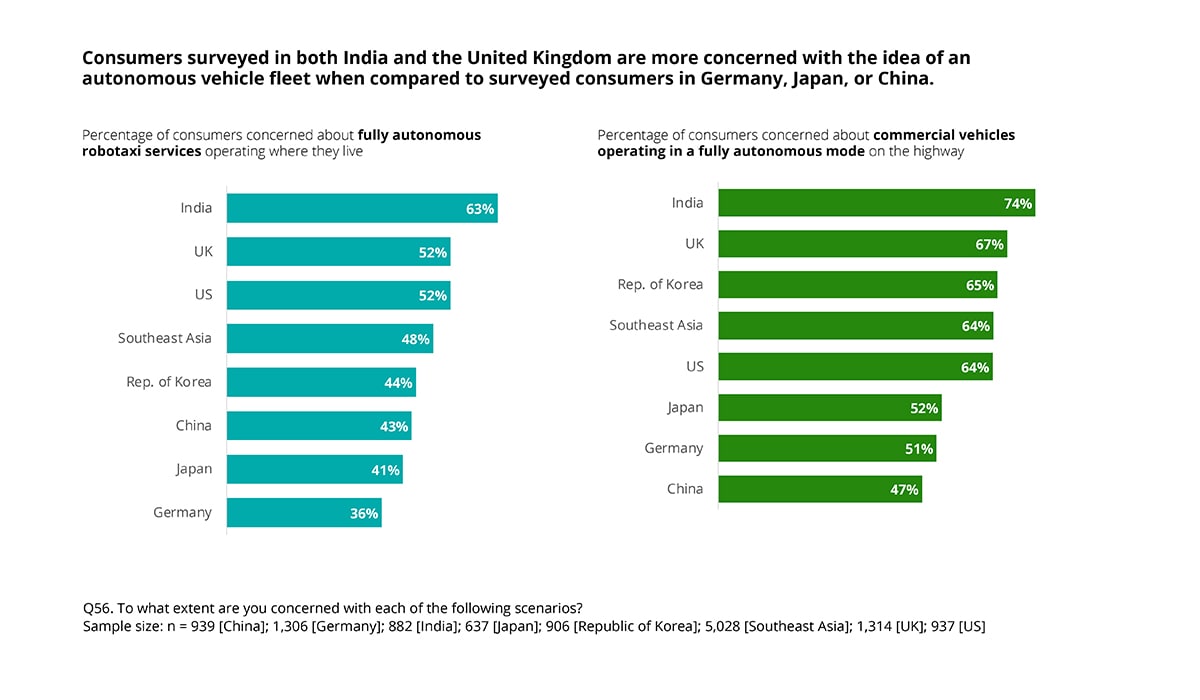

Trend 3: Autonomous vehicles are coming back into view

An evolving view of the regulatory environment governing the development of autonomous technology in some global markets may ease the deployment of self-driving vehicle fleets for both consumer and commercial applications, but more than half of surveyed consumers in India, the United Kingdom, and the United States remain concerned about their safety. Having said that, the integration of artificial intelligence into vehicle systems to enable self-driving features is seen as largely beneficial, particularly in Asia-Pacific markets.

Trend 4: Many younger consumers are interested in MaaS over ownership

Half of surveyed consumers in India, Southeast Asia, and the United States drive their vehicle every day (roughly twice the number of consumers in South Korea or Japan). However, a significant number of 18 to 34-year-olds surveyed in those markets (among others) are at least somewhat interested in giving up traditional vehicle ownership in favor of a MaaS solution.

Get in touch

Want more findings from our 2025 Global Automotive Consumer Study? Let's connect.

Keep up with the latest monthly consumer purchasing patterns, insights, and trends across 24 countries.

Consumer behavior trends state of the consumer tracker.

Recommendations

Software-defined Vehicles

Explore the next evolution of mobility and learn how to drive advantage with Deloitte’s Software-defined Vehicle practice.

Electrification Solutions and EV Industry Trends

Dive into our capabilities and latest insights to help you navigate electric vehicle industry trends.