One Downstream Strategic imperatives for the evolving refining and chemical sectors

20 minute read

25 June 2019

The downstream industry, although currently in its golden era, is likely to face disruption from a confluence of five forces in the future. Having a unified view of the industry is important for long-term success.

Executive summary

In the oil and gas business, the downstream segment traditionally includes refining, distribution and fuel sales, and marketing to retail and commercial customers. However, with growing interconnectedness between refining and chemicals, in terms of feedstocks, opportunities for process integration, and evolving end-markets, much is changing. In this report, we propose a “One Downstream” view to explore the trends that can impact both oil and gas downstream and chemicals.

Learn more

Browse the Oil, gas and chemical collection

Read all articles in the series - Decoding the O&G downturn

Subscribe to receive more related content

Currently, the downstream business seems to be in the midst of a golden age, driven by a heady combination of low feedstock prices and healthy demand for both transportation fuels and chemical products. This recent period of healthy growth and profitable margins, however, may not necessarily signal brighter days ahead.

In fact, risks that have been on the horizon but were perhaps masked by near-term margins have started to strengthen, causing many downstream companies to worry about potential disruption. And while these risks—feedstock changes, long-term sustainability, the state of globalization, end-market disruption, and large-scale technology transformation—are already converging margins among the refining and chemical sectors individually, an emerging confluence of these risks may challenge the current arms-length transfer pricing integration and siloed segmentation in the entire downstream value chain.

Given the complexity of the market forces that could transform downstream in the next decade, it is important for companies to consider ways to tackle them. The cost of ignoring this interconnection and missing the One Downstream view of the industry is expected to be high for any participant along the downstream value chain. In this report, we provide a brief but comprehensive study of the forces of disruption on the horizon and their potential impact on each downstream segment and share considerations for seeing these forces as interconnected rather than merely linear or isolated.

Rising risks: Coming to the boil?

Executives and analysts in the downstream sector (petroleum refining and chemicals) will likely remember the current decade as one of the most promising periods in its history. A lengthy period of lower feedstock (crude oil and natural gas, and their derivatives) prices and strong end-user demand for both petroleum and chemical products improved the financial health of the entire sector. Who thought that downstream (with operating margins of 8 percent in 2017) would make more money than even service-oriented oilfield businesses (with operating margins of 3.8 percent in 2017) in the O&G industry?1

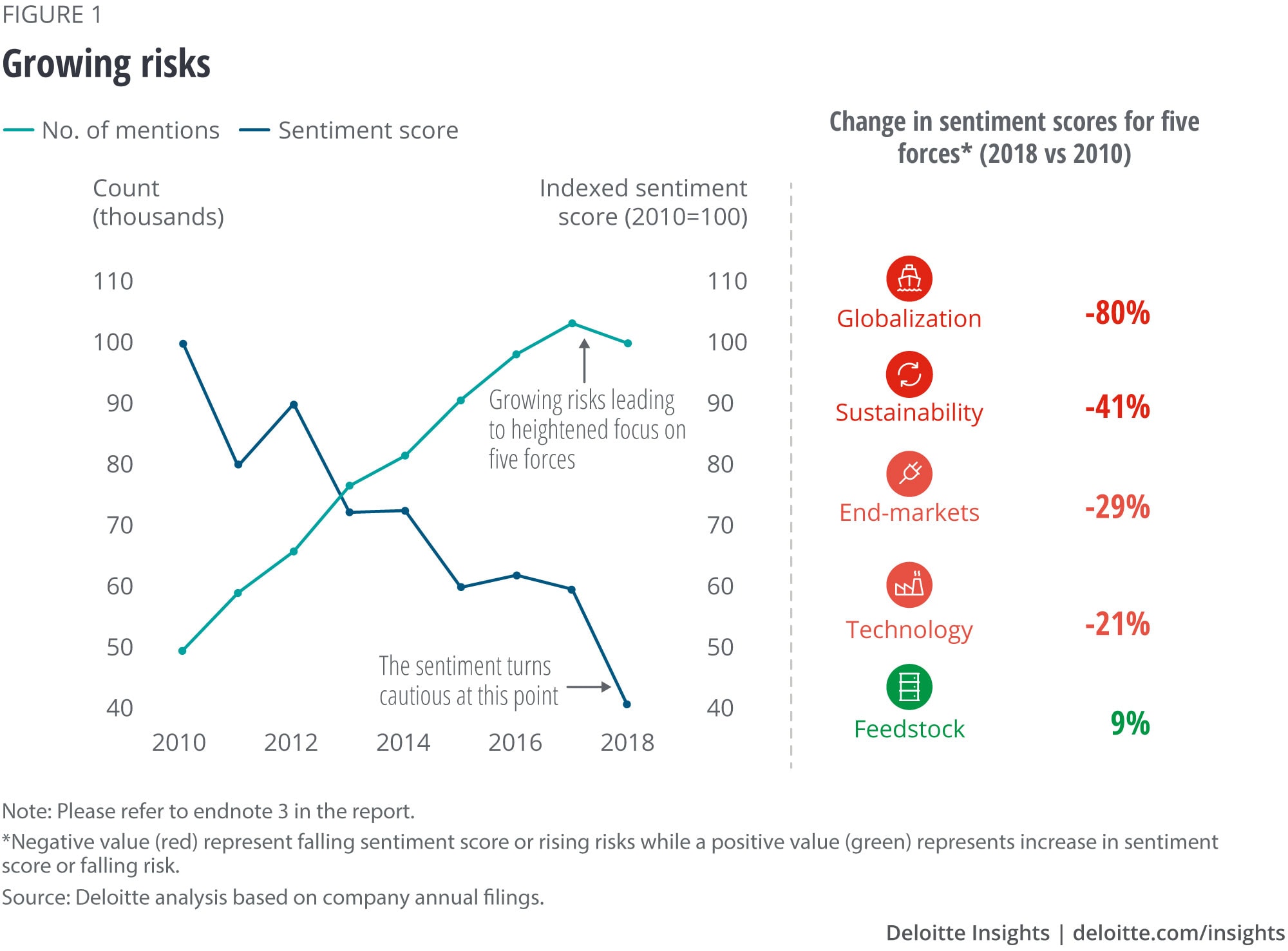

This recent golden past, however, may not be an indicator of future prosperity. In fact, the sector is already showing some signs of softness—in early 2019, the ethane crack spread was 40–50 percent below its 2018 levels although the start of many polyethylene projects will balance out ethylene oversupply to some extent in the future.2 Market forces that have positively supported the sector (e.g., lower feedstock prices) or posed only minimal obstacles until now (e.g., sustainability goals) may not hold true in the next decade. Indeed, our text mining and sentiment analysis on the annual SEC filings of more than 80 US refining and chemical companies highlight five rising risks (or forces) for the sector (see figure 1):3

- Feedstock changes and choices

- The state of globalization

- End-market disruption

- Circular economy and long-term sustainability

- Large-scale operational technology transformation

Although the overall sentiment for the sector is still positive, it has been falling lately. Among the five forces, volatility and uncertainty in the feedstock market is highlighted as the biggest risk, while sentiment has most weakened on the state of globalization (80 percent fall since 2016).4

Forecasting the future is impossible but ignoring it or not detailing (new) probable risks for shareholders can be troublesome. Only 40 percent of risks stated in the “risk factor” section (Item 1.A, 10-K filings) have been updated by US downstream companies over the past five years.5 Only 5 percent of the analyzed companies have revised/updated their risk section by more than 70 percent since 2013, in a period where the change and the associated opportunity/risk was the highest.

One Downstream

Most downstream segments, in the past, followed a reactive or outside-in approach to business, which not only restricted them from gaining a broad market perspective but also may have established suboptimal silos along the value chain. With constant pressure to tap limited growth while expanding margins, depending upon which segment one operates in, companies stayed focused on internal objectives such as asset optimization, driving synergies, product differentiation, and portfolio optimization. In fact, knowing most of these segments operate in a commoditized market, even value expectations from R&D spending diverged.

While appreciating the importance of a segment-specific focus and priorities, rising market volatility and business risks (discussed above) typically demand a much more comprehensive—or One Downstream—view of the value chain (see figure 2). The idea is not to get into a business that doesn’t align with the company strategy but to allow a constant flow of information and trends that can help each segment stay ahead of market disruptions and avoid any further migration of margins between businesses.

Disruption: An imbalanced equilibrium

Why have these emerging risks been largely ignored? And why should we study refining and chemical businesses together in the context of these risks? A few downstream executives may argue that some of the above downstream risks don’t impact their subsector (e.g., changing mobility trends impact refiners more than chemical companies), won’t play out in the near term (e.g., the circular economy is a long-term challenge for many), or are only relevant for integrated oil, gas, and chemical companies.

However, in tomorrow’s connected and dynamic ecosystem of molecules, processes, and end-users, having a 360-degree view of the entire downstream value chain will likely be a bare minimum for both refiners and chemical companies (see sidebar, “One Downstream”). The cost of ignoring the future, or missing this holistic view, could be high. In fact, our analysis of more than 1,350 downstream companies listed worldwide suggests that these five forces have already started to alter the balance across the downstream value chain (which broadly starts with simple and complex refiners, extends to integrated refiners with petrochemical operations, as well as commodity chemicals and diversified chemicals, and ends with specialty and agro chemicals).

In 2010, the operating margin spread between the least and most profitable business in the downstream value chain was close to 13 percent. By 2018, the spread had narrowed to 8 percent.7 Similarly, within the four pure-play chemical subsegments (commodity, diversified, specialty, and agricultural chemicals), the differentiation has narrowed, and the margin spread is now less than 1 percent. This convergence of margins in the downstream industry may be surprising as commoditized businesses have done extremely well, while differentiated businesses (agrochemicals, speciality chemicals) have lost premium over the past few years (see figure 3).

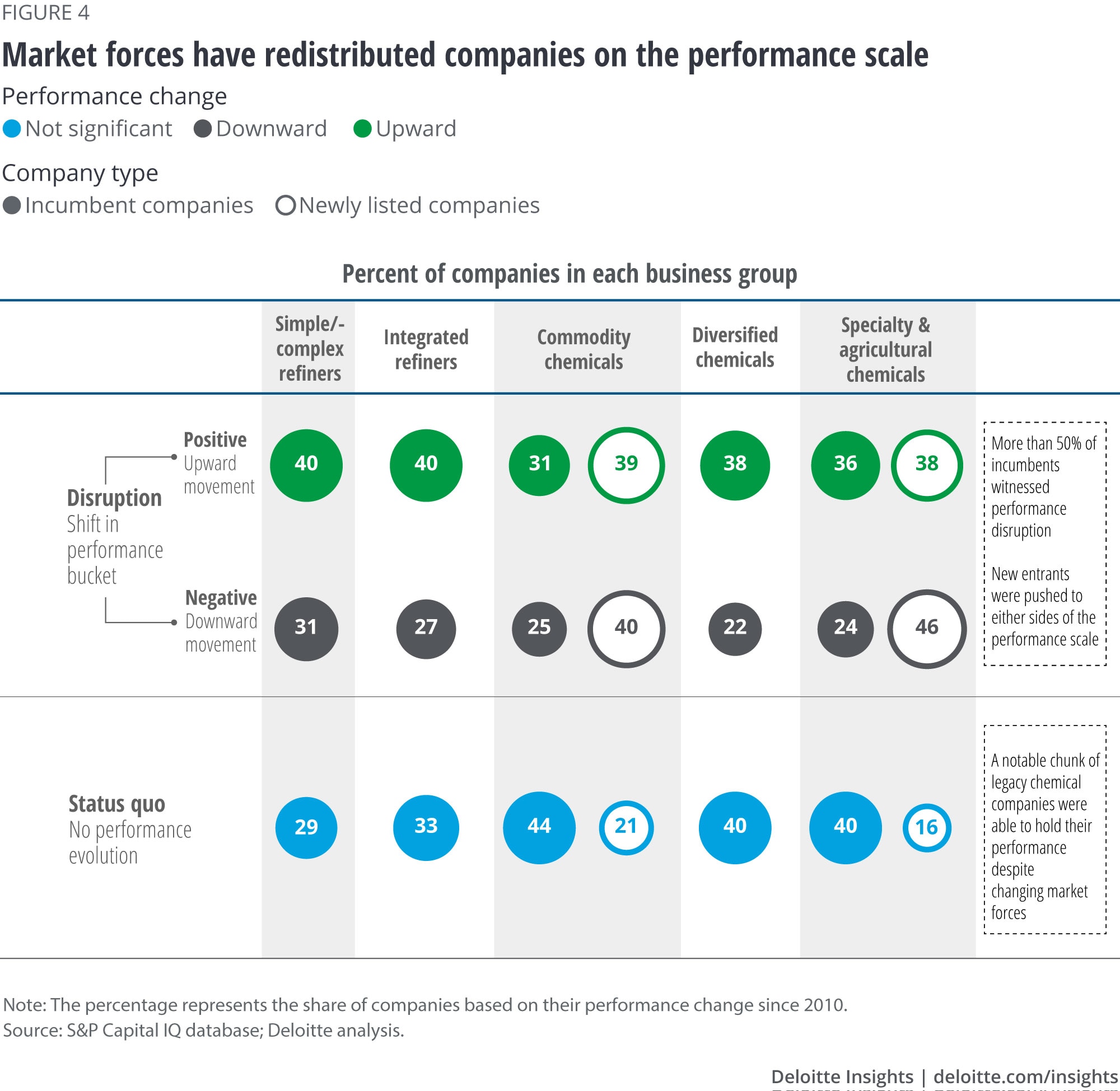

A closer look at these companies highlights some interesting changes that each segment seems to be undergoing. For example, 60 percent of newly listed downstream companies have performed at par with incumbents or above the average, suggesting that they are ahead of incumbents in dealing with new market forces through their differentiated strategies and new-age processes.8 What did performers do differently in each segment?

Simple and complex refiners

Although no new major listing happened and almost every refiner made more money in the past few years, only 40 percent of refiners delivered above-average returns over the past 10 years and 31 percent of the companies were negatively disrupted.9 The advantaged light oil feedstock has benefitted many simple refiners in the United States, while it has challenged both operational efficiency and yield management of several complex refiners worldwide—since late 2018, US Gulf Coast topping refiners have been realizing 65–100 percent higher margins than complex refiners in Singapore that are processing Dubai crude.10

With varying feedstock and price differentials, complex refiners that have adapted in real time and yet maintained strong control over the supply chain have outperformed. For example, HollyFrontier’s level of apportionment of the advantaged heavy oil on the Enbridge system remains high despite tightening of Western Canadian crude in 2018.11 Similarly, most refiners with forward-looking, higher sustainability standards seem to have carved out a niche for themselves even in a commoditized market. Neste Oil, for example, drives more than 70 percent of its earnings from renewable products (biodiesel, residues feedstock, biopropane, etc.) on a revenue share of 20 percent.12

Integrated refiners

High cost of entry, vertical integration, and established supply chains constitute strong entry challenges for this part of the value chain. However, despite the segment’s dominant role in the entire downstream value chain, it continues to deliver middle-of-the-pack returns—60 percent of companies moved to below-average performance group or could barely hold their position during the past decade (see figure 4).13 Although a large operation base evenly spreads out the benefits of low-priced feedstock supply and the pressure to mitigate climate-related risks across the companies, there are a few companies that have captured market opportunities differently or strongly.

Within this segment, several regional players continue to outperform supermajors, largely due to their better crude optimization, optimal performance of all secondary units, and a greater focus on heavier products (e.g., butadiene and aromatics). Refining margins of major Asian players, for example, have remained US$4–5/bbl higher than their local benchmarks, while maintaining high utilization rates. 14 The result: Despite refining constituting more than two-thirds of their revenue mix, investors value them at par with highly valued chemical companies—at a price-to-earnings ratio of about 20, as against 10–15 for pure-play refiners and supermajors.15

Commodity chemicals

With oil in a lower-for-longer oil price environment and increased availability of primary feedstock (ethane, propane, etc.), the segment saw more than 118 new listings (about 50 percent of the new listings in the entire downstream industry) in the formal equity market over the past 10 years.16 But these additions have made it into one of the most fragmented segments of the industry—more than 650 listed companies with average revenue of about US$1 billion.17 How have the incumbents fared against new entrants in this fragmented space?

Performance of these new entrants, which are mostly small-sized companies listed in China, has largely been mixed. Companies with limited economies of scale, lower feedstock flexibility, higher cost of feedstock & energy, and presence in the crowded plastics market (e.g., China’s Shenzhen) have underperformed significantly.18 On the other hand, a strong dealer/distribution network, presence in high-growth markets such as electronic boards and battery materials, and a focus on various grades of the same product (carbon black) to serve many industries seem to have helped companies such as Westlake Chemical and Sunstone Development sustain their performance.19

On the other hand, incumbents—especially those with high feedstock flexibility (not just access to low-cost feedstock), diversified presence across markets and products, a focus on advanced polymer solutions, and a multipronged strategy for sustaining operations in the long term—have consistently performed across cycles. LyondellBasell, for example, reportedly acquired A. Schulman to not only enhance the scope of its advanced polymer solutions but to also gain from the latter’s established relationships with customers in growing high-margin end-markets such as automotive, construction materials, electronic goods, and packaging.20

Diversified chemicals

The diversified chemicals group appears to have remained one of the most “stable” segments in the downstream value chain and has maintained its “value share” of nearly 14 percent across the value chain.21 In fact, starting with this segment, differentiated offerings and strategies start becoming more apparent in the entire downstream value chain. And this is also the segment where both feedstock and end-market disruption seem to be currently playing out most strongly.

Although at an overall level, this segment has been resilient to market shifts, some upward as well as downward performance shifts are visible here as well. Some companies with a siloed R&D focus and a disconnect with customers struggled despite the size advantage, while some companies realized exceptional margin expansion by strategic expansion into high-growth Asian economies and niche performance products for infrastructure related to energy efficiency, water cleaning, 5G, vehicle lightweighting, etc.

Specialty chemicals (including agrochemicals)

Among all the downstream segments, the specialty chemicals segment seems to be witnessing the highest disruption, primarily from changes in end-markets and the growing forward movement of integrated refiners/diversified chemical companies into this space. The segment is slowly losing its “premium tag” with its market capitalization share falling by 5 percentage points to 36.5 percent over the past 3–4 years.22

Additionally, new players in this segment aren’t making it easy for incumbents as they seem to be getting ahead or are in sync with forthcoming changes. Entrants that are focused on a differentiated, emission-free product portfolio that keeps them ahead of mobility and sustainability trends seem to be rewarded more by investors. Some successful agrochemical companies are disrupting the segment or breaking away from the homogeneity in the segment, by developing machine learning and artificial intelligence capabilities that can help farmers to target a specific weed species and possibly even create new value pools for farmers.

Margin convergence and performance disparity among companies suggest that the disruption is already underway in the industry. Even a linear extension of the current trend suggests that the pace and impact of disruption will be unprecedented in the next decade.

Confluence: Too many irons in the fire

Until now, the five forces have largely played out linearly and individually. In the next decade, however, all the five forces are expected to play out together and, most importantly, influence each other and cut across the value chain (see figure 5). Although each of the five forces can be detailed in length, our objective is to provide a big-picture perspective on the confluence of these forces to help downstream strategists not miss out on seeing the forest for the trees.

Feedstock changes and choices

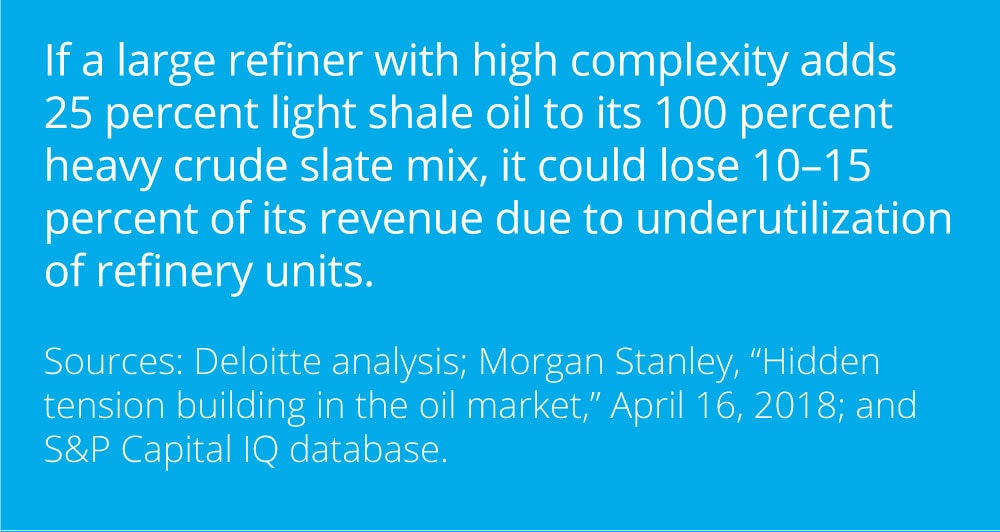

The first and the most important feedstock for the downstream, crude oil, is undergoing fundamental changes. Increased availability of light oil and higher relative prices of heavy oil have changed the value equation of the O&G industry; narrower light-heavy spreads further alter the relative processing economics. The blending of crude grades—the available option until now for refiners—is reaching its upper limits especially as the United States is expected to add more than 4 MMbbl/d of light oil production by 2023.23 Similarly, for chemical companies, the ongoing advantage of processing cheaper lighter products (natural gas liquids) seems to be narrowing due to lower throughput of premium-priced heavy products (e.g., pygas, benzene, and toluene).

It would be wrong to say that the downstream industry is oblivious to these feedstock changes; in fact, several of them are already exploring many investment and location options to adapt. Although this “light” ride itself won’t be smooth as it impacts the input–output ratio across the value chain, envisage the challenge when a confluence of factors alters the entire feedstock landscape of the industry.24

Sustainability, in the next decade, will likely demand higher mechanical, chemical, and thermal recycling of plastics where both the hydrocarbon and energy content is fed into polymerization units. Extending this thought further, Eastman Chemicals, for example, is not only recycling complex end-of-life plastics (nonpolyester plastics, flexible packaging, etc.) but also converting them to advanced materials and fibers where the margin differentiation is higher.25 Similarly, end-market disruptions could exponentially call for using “renewable” as a primary feedstock for petroleum products and chemicals (the global renewable chemicals market size is estimated to be more than US$100 billion by 2022) as against fossil fuels.26

Essentially, the future feedstock mix of the industry will not be limited to primary fossil fuels as higher recycling of end-products could lead to disintermediation of intermediate feedstock and a combination of “good” regulations and the “proactive” renewable movement (bioethanol, bioethylene, solar) may replace a portion of primary fuels. Feedstock grade, type, and usage in the petrochemical industry is on the edge of a period of great change, calling for a flexible and diversified fuel mix. Moreover, massive overinvestments in some petrochemicals will require companies to pay more attention to their feedstock strategy to sustain in a low-margin environment. And this is where both strategists and specialists should come together in a company.

The state of globalization

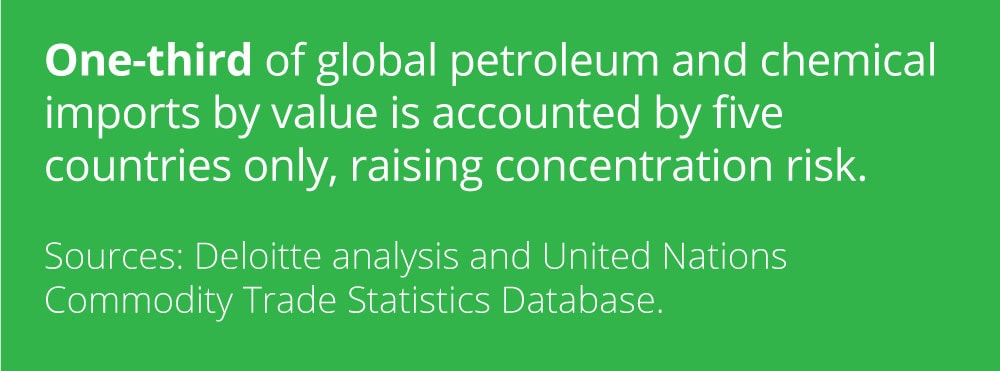

Energy commodities have traditionally played an important role in international trade as energy resources are unevenly distributed among countries and the substitutes for energy aren’t available in the quantity or price needed. That’s why recent trade activities had a marginal impact on the energy trade, which is also cushioned by real-time adjustment in unaffected markets. But can this industry remain oblivious to “make in my backyard” campaigns of policymakers or “save the domestic industry” appeals of industry associations, especially when big investments and large employment are at stake?

In fact, growing availability of new resources (e.g., shales), large build-up in capacity over the past few years (especially in commodity chemicals), and upcoming production from mega, export-oriented integrated projects (the proposed oil-to-chemical complex in the Middle East is estimated to produce about 5 times that of the largest naphtha-based ethylene cracker in the world) will most likely keep the globalization topic hot even in the next decade.27 With energy trade and investment becoming more regionally concentrated—within Asia or between Asia and the Middle East—the downstream industry cannot afford to stand aside or adopt a defensive approach to globalization.

The uncertainty and, hence, the risks can expand as technology-led disruptions on the feedstock, process, and end-market front start demanding higher agility and dynamism from companies. Although the strategy of going “solo” has its own merits, global partnerships are a win-win for both and provide a natural hedge to globalization risks. ADNOC’s approach to partnerships and coinvestments is a case in point where it is securing access to target markets for its products across the value chain—a joint venture with Austria’s OMV and Borealis for petrochemicals and joint investments in Chinese plastics and Pakistani refining complexes.28

With the global energy industry changing rapidly, “energy cooperation” between supply and demand centers are expected to be the need of the hour—more so for large producers and exporters to de-risk themselves from oil’s uncertainties, trade conflicts, and changing demand patterns. The proactive and open partnership model of a few national oil companies is likely to give several private oil companies following closed operating models a run for their money.

End-market disruption

Automotive, building & construction, and packing industries—key end-markets of the downstream industry—have been undergoing a transformation for a while, but the pace and degree of change seem to have now reached a point of disruption. Changing mobility trends, apart from cutting into oil’s demand growth, may eliminate demand for a few products (primarily engineering plastics) from the 40+ distinct classes of synthetic material used in the modern automobile.29 Concurrently, tomorrow’s automobiles are expected to need new high-performance materials to make everything from batteries to customizable interiors. Similarly, a growing number of online customers are demanding a good packaging experience but at the same time less waste from boxes and wrappers.

The disruption is not limited to end-markets; in fact, end-users are increasingly driving systemic change in circular thinking at an industry level. In 2018, 13 leading retailers and packaging companies—together representing more than 6 million metric ton per annum of plastic packaging per year—joined hands to move toward 100 percent reusable, recyclable, or compostable packaging by 2025.30 According to the CEO of a European major in consumer industry, “As a consumer goods industry, we can go further in addressing the challenge of single-use plastics by leading a transition away from the linear take-make-dispose model of consumption, to one which is truly circular by design.”31

End-markets/end-users impacting demand for intermediates (polymers such as polyethylene and polypropylene) through higher recycling is one thing; end-products becoming primary fuels or raw materials for manufacturing is another. BASF’s ChemCycling project, for example, converts unrecyclable plastic waste, such as mixed or uncleaned plastics, into primary feedstock or fossil fuels (syngas or oils).32 Put simply, it is both fascinating and challenging to see end-markets disrupting the first part of the value chain, feedstock, or disrupting the current linearity in the value chain.

Circular economy and long-term sustainability

Sustainability is not a new theme for the downstream industry—just that the definition has fast evolved and now extends beyond plant-level emissions. The industry, in fact, has been improving its environmental and carbon footprint through higher fuel switching (from liquids to natural gas and renewables for energy and electricity), material and process efficiencies (flaring, wastage, etc.), low-carbon processes and products (largely led by “good” regulations such as on high-sulfur fuel oil), energy-efficient transportation systems, and growing recycling and reuse of end-products.

With rising energy demand in “absolute” terms, however, the pressure on the industry to reduce its carbon footprint will likely only accelerate, intensified further by growing end-user, societal, and shareholder activism—the chemicals industry emits about 10 percent of global CO2, 5 percent through energy and 5 percent through production and distribution.33 Self-regulation by companies and expectations from stakeholders could rise to a level where sustainability starts encompassing all other internal and external forces (feedstock, technology, end-markets, and globalization) and featuring prominently on the boardroom agenda of companies.

Successful examples of renewables as a feedstock have already started to flow in, where not only are they commercially viable but also margin accretive and capex friendly. As against investing in a greenfield biodiesel complex, for example, a few refiners have started to blend lipids/animal fats in middle distillates before they are hydrotreated to produce diesel.34 The result: carbon credits and higher production of premium distillate needed to meet IMO 2020 regulations. Similarly, in sustainability-related technologies, examples such as crude-to-chemicals breakthroughs presage a new era of sustainable energy.

Considering about 90 percent of plastic waste isn’t recycled yet, booming global e-commerce sales dependent on premium packaging material is still less than 10 percent of total retail sales, and the share of energy-from-waste is miniscule, the next decade will likely need and witness much faster improvements in energy and emission intensity.35 The result: sustainability at the core of every decision-making, feedstock and portfolio strategy, technology selection, branding for stakeholders, and relationship with suppliers and partners.

Sustainability could throw open many new and innovative business models—from the knowns of investing in sustainability and reducing the usage of fossil fuels, to making fossil fuels an important input for renewables growth, and to even efforts to combine fossil fuels and renewables. Mangalore Refinery and Petrochemicals Limited, for example, commissioned a 6 MW solar power plant within its refinery plant premises to reduce the net carbon footprint of its facility.36 The question is how each company sees and evaluates several available routes to sustainability—an essential cost, a branding exercise, or an opportunity to uncover hidden value.

Large-scale technology transformation (operational)

Information technologies led by automation, analytics, and artificial intelligence are expected to have a profound impact on the downstream industry. And this impact has been widely documented by solution providers/consultants and recognized by executives. Another opportunity lies in the operational aspect, which appears to be on the cusp of a big change. The context is the $3 trillion asset base of the industry.37

Changing feedstock mix (single to diversified), stricter and proactive green mandates (carbon emissions, recycling of plastics), and end-market disruption (peak oil demand by 2030s) could challenge the functionality and economics of many off-the-shelf technologies and commoditized processes that have been in operation for decades.38 For instance, the 2030 strategy of MOL Group, which aims to increase its non-fuel production in refining from the current 30 percent to 50 percent of total output, could be a preview of upcoming changes in the process and operations of downstream.39

Further, the rise of many technologies that can cut down several intermediate processes (e.g., crude-to-chemicals), lower feedstock cost and overall greenhouse gas intensity (e.g., direct oxidative coupling of methane), or have a superior catalyst and reactor process (e.g., integrated coal-to-liquids development in China) can present competition-beating opportunities for early movers and reduce the potential for late movers. 40 Saudi Aramco and SABIC’s planned oil-to-chemicals project, for example, aims to cut capital costs by 30 percent compared to conventional refining projects.41

With the ongoing disruption in feedstock and end-use consumption of downstream products, the industry should bring more agility and flexibility in their processes and operational technologies. Put simply, investment decision-making, selection of technology, reconfiguration of the original design capability of technology, or even a projection of the future demand-supply gap at a product level could challenge downstream specialists due to altered input–output relations in the industry.

Go the extra mile

The future of the refining and chemical business is expected to be shaped by a complex confluence of the five market forces—feedstock, process technologies, end-markets, globalization, and sustainability. The impact of the confluence will likely be felt across the value chain from simple refiners to specialty chemicals, challenging the current arms-length distance between transfer pricing, segmentation, and relationships among participants in the value chain. To stay ahead of the expected disruption of tomorrow, a company should:

- Reassess role and ownership along the value chain: Replace the linear product- and efficiency-centric supply chain model with an ecosystem-linked and platform-based value-centric mindset; redeploy and redistribute total cost and asset ownership across the feedstock-to-customer value chain through new business models.

- Prioritize speed-to-market strategies: Build modular operations and workflows that reduce prototyping time and cost, facilitate debottlenecking opportunities, complement chemistry and engineering with data analytics, and track and drive aggressive sustainability goals at value chain level.

- Build a strong alliance capability: Explore new alliance archetypes that focus on open innovation on molecules and materials, co-own environmental footprint of a product across the value and supply chain, swap patents and know-how (especially with EPC/tech firms), and sponsor end-market innovations.

- Deepen relationships with distributors: Specialty chemical companies could elevate the current manufacturer–distributor relationship to tap into unique insights of distributors in a specific market, provide laboratory- and application-specific support to small end-users, and offer both positive and negative incentives to reduce carbon footprint.

- Pick a new global narrative: Speak the language of jobs, investment, and sustainability standards; support nations in reducing the cost of managing their recycling programs; provide strategic and technical support to normalize the uncontrolled growth in the informal plastic recycling sector; and explore new win-win trade strategies that go beyond securing supply and demand centers.

- Preserve and advance the core: Before outlining new value creation initiatives, preserve business value from existing product lines and operations through cost rationalization, scale advantage in specific end-markets, secondary asset integration (water, heat, gases, etc.), and advanced analytics on assimilated bulk data sets such as historical plant operations, opportunity crudes, logistics cost, and end-market pricing.

Explore the Oil and gas industry

-

Refining & marketing: Eyeing new horizons Article5 years ago

-

Midstream: Charting a new course amid market dynamism Article5 years ago

-

Exploration & production: Overcoming barriers to success Article5 years ago

-

South Africa's Mining Charter 2018 Infographic5 years ago

-

Oil’s well?: Divergence and imbalance in the oil and gas ecosystem Article5 years ago

-

Strategic imperatives for chemicals companies Article6 years ago