Article

Restructuring Report 2023/2024

Increasing complexity and growing challenges for the restructuring industry

Market conditions are growing increasingly difficult as the restructuring wave reaches Germany. Many German companies are struggling as they are faced with the challenge of structural changes and a necessity to adapt their processes and strategies. At the same time, significant change in the financing sector is adding to the pressure on borrowers: business models must be crisis-proof and costs reduced – while at the same time it is necessary to position oneself for the future. Add to the mix geopolitical uncertainties and overlapping crises that are also an almost constant part of business life. Against this backdrop, Deloitte has again invited restructuring experts throughout Germany to share their views and practical experiences in order to gain a clear picture from the perspective of those involved. One thing is apparent: the work of restructuring professionals is becoming more diverse and also more complex. What are the most important issues, the most vulnerable sectors and the most urgent fields of action? The experts' assessments and the corresponding classifications in our latest Restructuring Report offer fascinating insights.

The last Restructuring Report was published during the coronavirus pandemic, when the restructuring environment was dominated by its effects. At that time, temporary disruptions were expected, but now terms such as polycrisis or multicrisis have become commonplace. The industries and business models of companies are changing – and those of the restructuring industry have to change with them– as continued crises are becoming the new normal.

What does this mean for the restructuring industry in 2024?

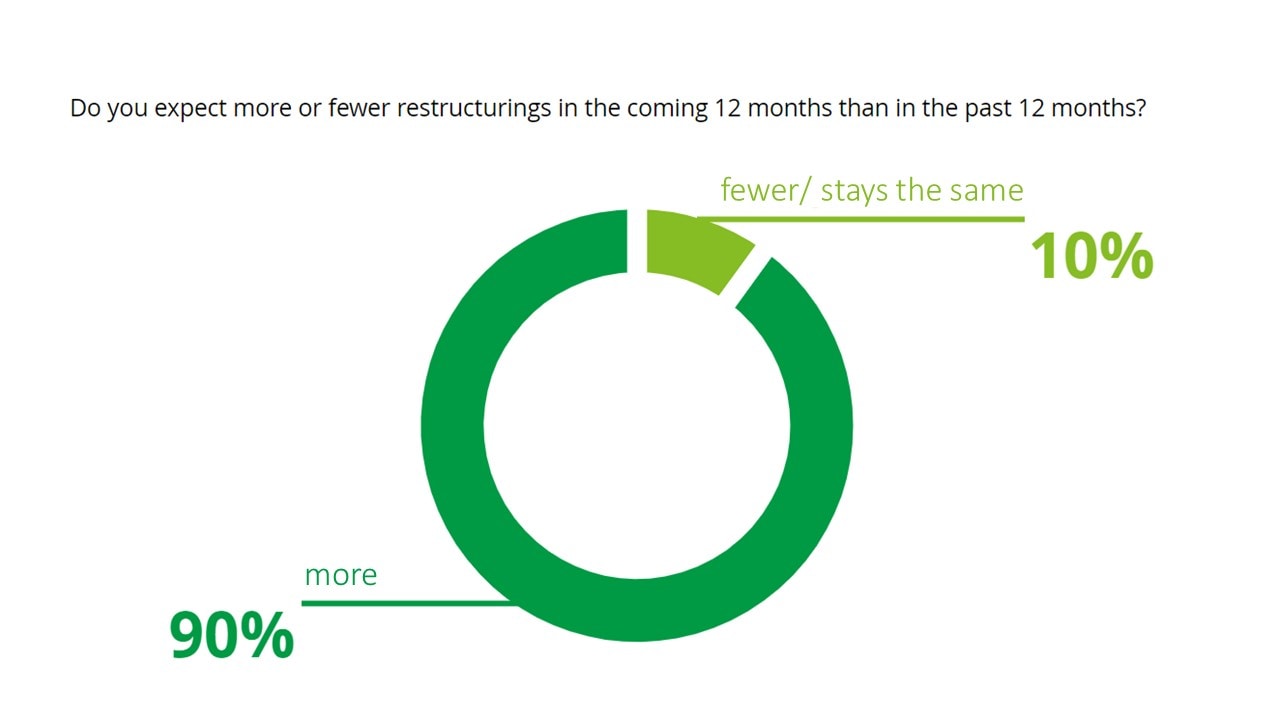

The results of our survey show that 90 percent of the experts expect more restructuring in the next twelve months compared to the past. There are many reasons for this, including the fundamentally unstable geopolitical situation, central bank monetary policy and inflation. In the medium and long term, digitalization remains a key issue, now coupled with advances in artificial intelligence (in German language) and demographic change.

Which sectors are most affected?

We asked the experts which sectors will face particular challenges in the future. Construction and real estate, automotive, retail (brick and mortar) and healthcare were the most frequently mentioned.

The construction and real estate industry (in German language) is already experiencing a significant crisis due to a sharp increase of interest rates and costs at a time of decreasing real estate values. There is also increased uncertainty with respect to investment decisions.

In the automotive sector, suppliers are facing major challenges (in German language). While car manufacturers are reporting record profits, the supply industry is going through a fundamental industry transformation that not all market participants are likely to survive.

Retail continues to face the challenge of adapting to changes in customer behavior. The core tasks are likely to be the development of new retail concepts and the creation of sustainable offerings (in German language). One of the problems here is the poor financial situation of many retailers, who often lack the funds to develop existing concepts.

The economic situation of German hospitals in the healthcare sector has been deteriorating for years and is currently characterized by numerous insolvencies. Whether the announced hospital reform (in German language) will be able to stem the tide is doubtful, to say the least.

The German engineering sector is less in the spotlight at the moment but is also likely to face problems in the medium to long term. Companies in this sector need to attend to their product portfolios in the face of global competition and drive innovation in a targeted but cautious manner. At the same time, working capital and key cost items must be consistently adjusted and made more flexible.

How is the restructuring practice changing?

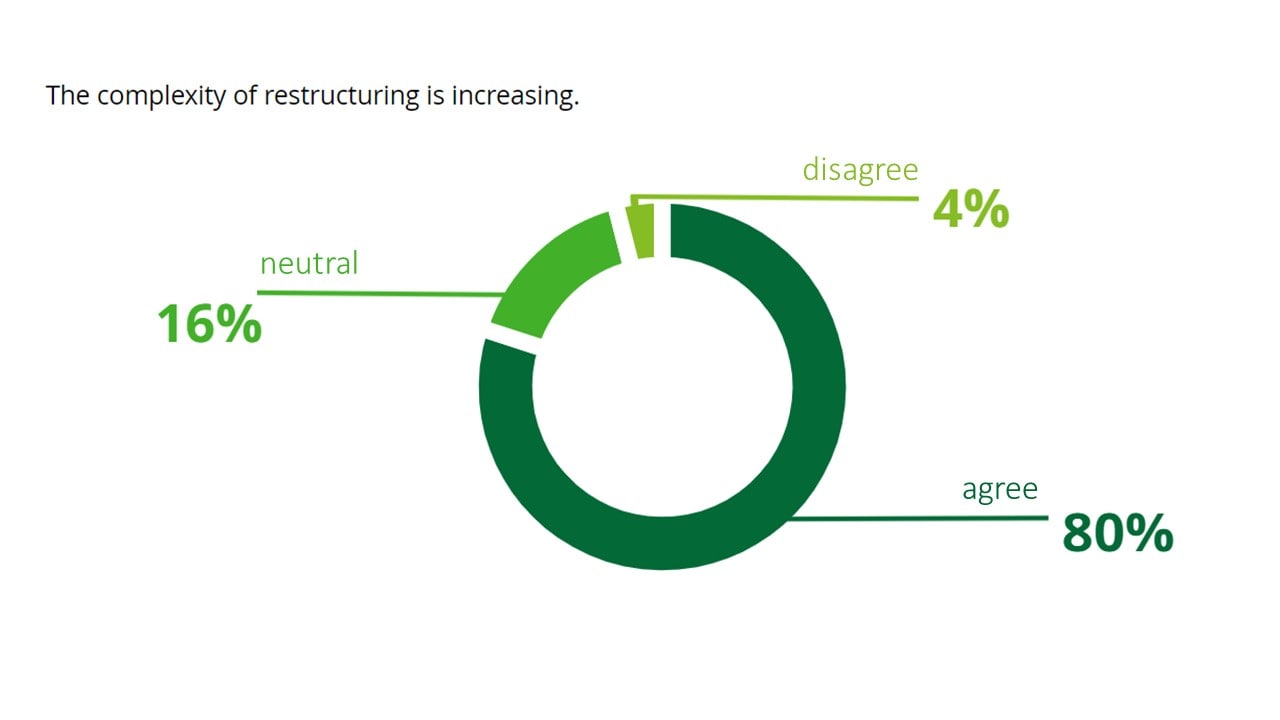

According to the feedback, restructuring cases are becoming increasingly complex, both in terms of content and the number of stakeholders involved More than ever, a clear strategic focus and an adaptable business model are the keys to a successful turnaround. In addition to these points, the feedback suggests that a failure to address operational restructuring requirements will often lead to failures later on.

The key message from the survey here is that the idea of comprehensive and wholesome restructuring is increasingly important. Rather than "just" resolving cashflow bottlenecks, business models need to be transformed and implementation must not be neglected.

Restructuring is becoming a broader and more demanding field of activity. The restructurers of the future should therefore be familiar with all the relevant tools in order to be able to make the decisions that become sensible or necessary over time. The financing environment is also changing: according to the experts, traditional bank financing is becoming less important, while the influence of debt funds is growing.Legal aspects also play an important role: The relevance of StaRUG could not be greater in the current economic situation, especially for sectors such as real estate and the automotive industry, which are often financed through loans and syndicated loans. In addition, the EU is striving to further harmonize the sometimes very different insolvency regulations of the member states. To that end, a draft directive has been published, the details of which are now being debated.

Stefan Sanne, Head of Turnaround & Restructuring at Deloitte Financial Advisory:

The strong response to our call for participation in the study shows the high level of interest in the key issues facing the industry in the future. Some of the results are clear, but others are quite surprising. Either way, they invite discussion and self-reflection in the industry.

Frank Tschentscher, Head of Insolvency & Business Recovery at Deloitte Legal:

The rising tide of challenges looks set to continue but the tools to support struggling businesses are available. The past year has seen the first major German Restructuring Schemes (StaRUG) involving German law-governed debt and this trend is going to continue in 2024. The courts will inevitably continue to grapple with the appropriate boundaries of this powerful new restructuring tool; how they handle these cases will ultimately determine the future and competitiveness of German turnaround.

About the study

The Restructuring Report surveyed office holders and advisors in the fields of insolvency and restructuring , as well as financiers (equity and debt) and (interim) managers of companies. They shared their assessments and expectations about the future economic and industry developments as well as current trends in the restructuring market. These findings are presented and reflected in the Restructuring Report. The aim is to provide a well-founded overview of the situation in the German restructuring market and to highlight trends and possible changes.

Download the full Deloitte Restructuring Report 2023/2024 in German language) and learn more. We would be happy to discuss the results and resulting topics with you.

Archive

Restructuring Report 2021

2020 was impacted by the COVID-19 pandemic and the pandemic continued to be present in the first three quarters of 2021. Deloitte took a detailed look at the future economic developments of individual sectors in the Restructuring Report 2021.