AI leaders in financial services Common traits of frontrunners in the artificial intelligence race

19 minute read

13 August 2019

Nikhil Gokhale United States

Nikhil Gokhale United States- Ankur Gajjaria United States

Rob Kaye United States

Rob Kaye United States Dave Kuder United States

Dave Kuder United States

Financial services are entering the artificial intelligence arena and are at varying stages of incorporating it into their long-term organizational strategies.

Running the AI leg of the digital marathon

The financial services industry has entered the artificial intelligence (AI) phase of the digital marathon.

The journey for most companies, which started with the internet, has taken them through key stages of digitalization, such as core systems modernization and mobile tech integration, and has brought them to the intelligent automation stage.

Learn more

Read more from the Financial services collection

Explore the AI & cognitive technologies collection

Download the Deloitte Insights and Dow Jones app

Subscribe to receive related content

Many companies have already started implementing intelligent solutions such as advanced analytics, process automation, robo advisors, and self-learning programs. But a lot more is yet to come as technologies evolve, democratize, and are put to innovative uses.

To effectively capitalize on the advantages offered by AI, companies may need to fundamentally reconsider how humans and machines interact within their organizations as well as externally with their value chain partners and customers. Rather than taking a siloed approach and having to reinvent the wheel with each new initiative, financial services executives should consider deploying AI tools systematically across their organizations, encompassing every business process and function.

Key messages

Embed AI in strategic plans: Integrating artificial intelligence (AI) into an organization’s strategic objectives has helped many frontrunners develop an enterprisewide strategy for AI that various business segments can follow. The greater strategic importance accorded to AI is also leading to a higher level of investment by these leaders.

Apply AI to revenue and customer engagement opportunities: Most frontrunners have started exploring the use of AI for various revenue enhancements and client experience initiatives and have applied metrics to track their progress.

Utilize multiple options for acquiring AI: Frontrunners seem open to employing multiple approaches for acquiring and developing AI applications. This strategy is helping them accelerate the adoption of AI initiatives via access to a wider pool of talent and technology solutions.

As with any race, some companies are setting the pace, while others are struggling to hit their stride after leaving the starting gate. What can those who are seemingly at the back of the pack do to keep up with their frontrunning competitors? How can they jump-start or adapt their AI game plans to come up on top as the race heats up?

To answer these questions, Deloitte surveyed 206 US financial services executives to get a better understanding of how their companies are using AI technologies and the impact AI is having on their business (see sidebar, “Methodology: Identifying AI frontrunners among financial institutions”). The report identified some of the following key characteristics of respondents who have gotten off to a good start and taken an early lead:

Embed AI in strategic plans: Integrating AI into an organization’s strategic objectives has helped many frontrunners develop an enterprisewide strategy for AI, which different business segments can follow. The greater strategic importance accorded to AI is also leading to a higher level of investment by these leaders.

Apply AI to revenue and customer engagement opportunities: Most frontrunners have started exploring the use of AI for various revenue enhancements and client experience initiatives and have applied metrics to track their progress.

Utilize multiple options for acquiring AI: Frontrunners seem open to employing multiple approaches for acquiring and developing AI applications. This strategy is helping them accelerate the adoption of AI initiatives via access to a wider pool of talent and technology solutions.

Methodology: Identifying AI frontrunners among financial institutions

To understand how organizations are adopting and benefiting from AI technologies, in the third quarter of 2018 Deloitte surveyed 1,100 executives from US-based companies across different industries that are prototyping or implementing AI.1 In this report, we focus on a sample of 206 respondents working for financial services companies. All respondents were required to be knowledgeable about their company’s use of AI technologies, with more than half (51 percent) working in the IT function. Sixty-five percent of respondents were C-level executives—including CEOs (15 percent), owners (18 percent), and CIOs and CTOs (25 percent).

All financial services respondents in the survey were required to be currently using AI technologies in some form or another (see “Appendix: The AI technology portfolio”). The entire respondent base of individuals working for financial institutions could thus be considered as early adopters of AI initiatives.

Within this respondent base, we wanted to identify the practices adopted by those leading the pack in terms of AI deployment experience and tangible returns achieved from them. Using data from Deloitte’s AI survey, we identified two quantitative criteria for further analysis: performance (financial return from AI investments) and experience (number of fully deployed AI implementations, which represents AI projects that are “live,” fully functional, and completely integrated into business processes, customer interactions, products, or services).

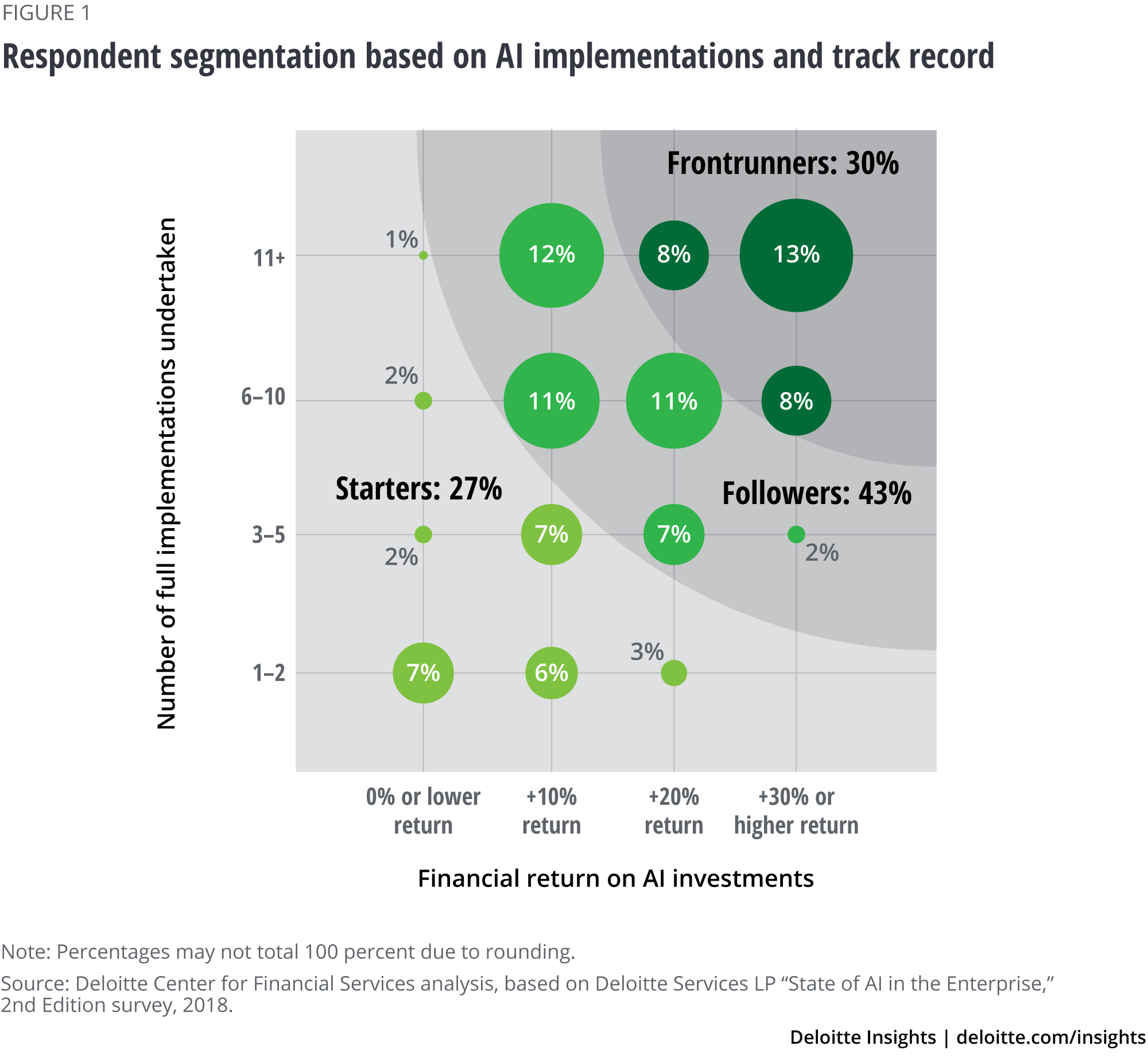

We found that companies could be divided into three clusters based on the number of full AI implementations and the financial return achieved from them (figure 1). Each of these clusters represents respondents at different phases of their current AI journey.

- Frontrunners: Thirty percent of respondents worked for companies that had achieved the highest financial returns from a significant number of AI implementations.

- Followers: Forty-three percent of respondents worked for companies in the middle ground of AI implementations and financial returns.

- Starters: Twenty-seven percent of respondents worked for companies that were at the start of their AI journey and/or lagging in the level of return achieved from AI implementations.

Three common traits of AI frontrunners in financial services

As financial institutions look to find a rhythm in their AI race, frontrunners could provide an early-bird view into how to effectively integrate the technology with an organization’s strategy, as well as which approaches companies could adopt for implementing such initiatives throughout their organization.

From the survey, we found three distinctive traits that appear to separate frontrunners from the rest. Frontrunners are generally able to embed AI in strategic plans and emphasize an organizationwide implementation plan; focus on revenue and customer opportunities, rather than just cost reduction; and adopt a portfolio approach for acquiring AI, where they utilize multiple development models for implementing AI solutions (figure 2).

Embed AI in strategic plans with emphasis on organizationwide implementation

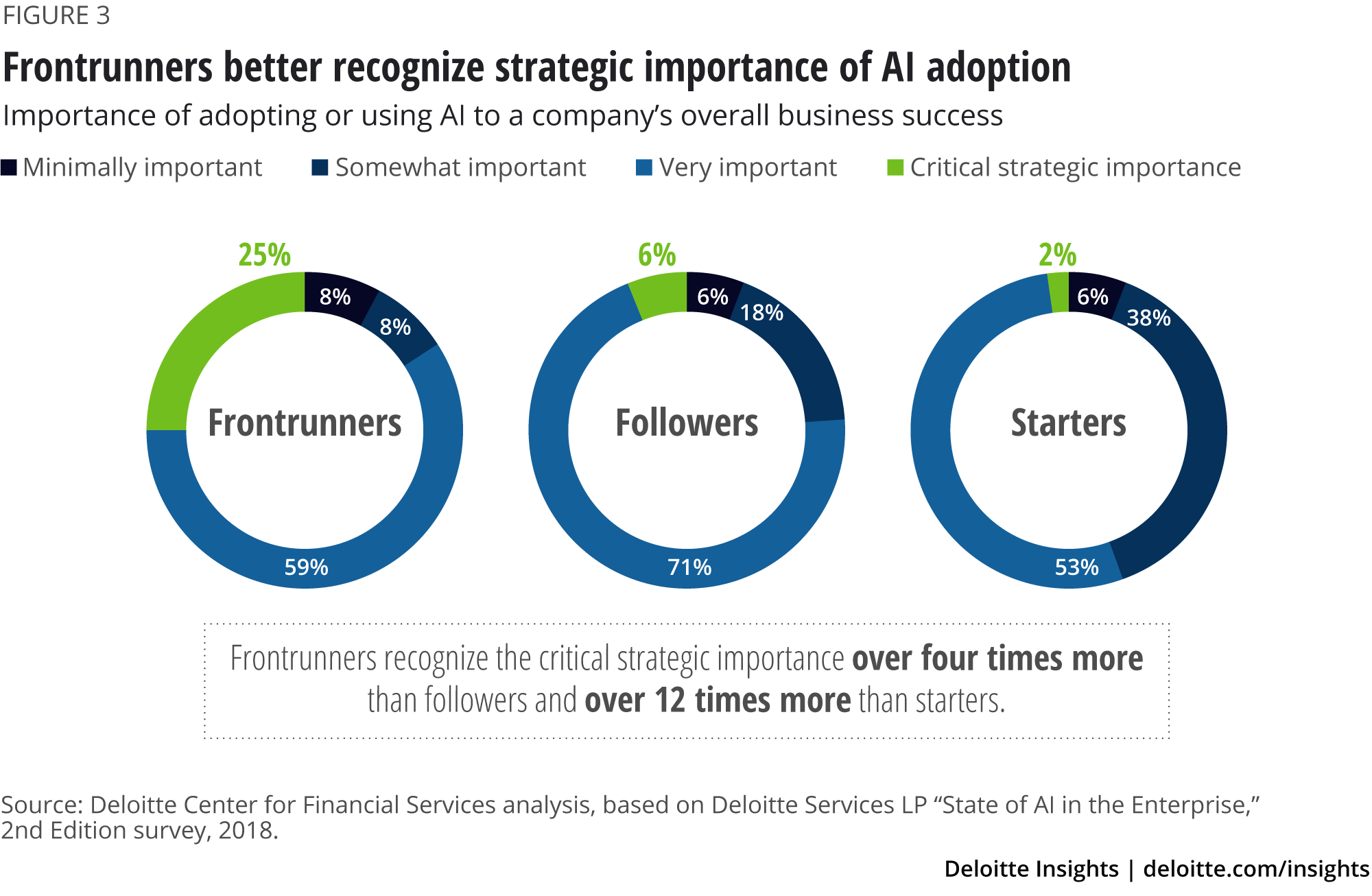

While many financial services companies agree that AI could be critical for building a successful competitive advantage, the difference in the number of respondents in the three clusters that acknowledged the critical strategic importance of AI is quite telling (figure 3).

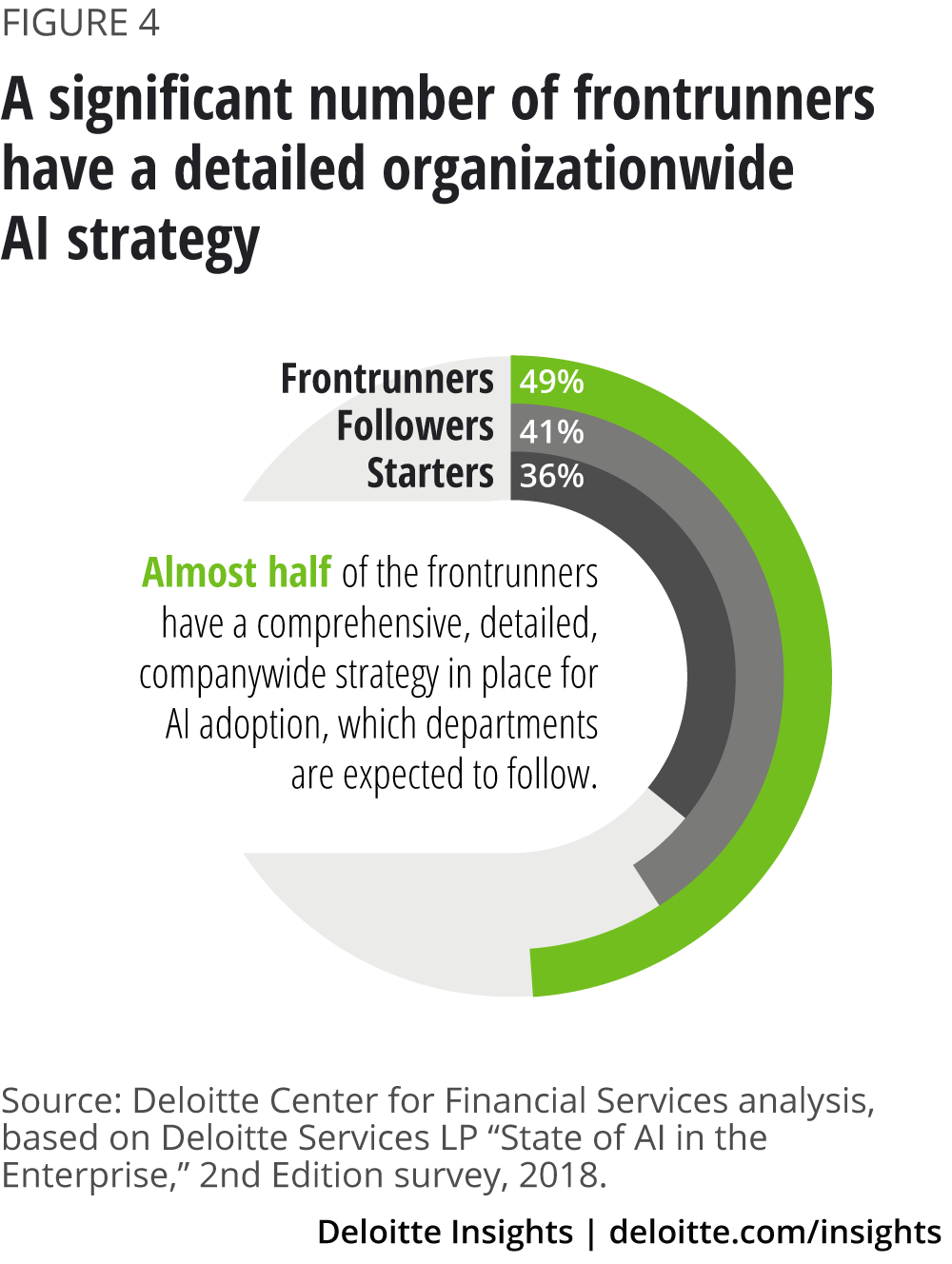

An early recognition of the critical importance of AI to an organization’s overall business success probably helped frontrunners in shaping a different AI implementation plan—one that looks at a holistic adoption of AI across the enterprise. The survey indicates that a sizable number of frontrunners had launched an AI center of excellence, and had put in place a comprehensive, companywide strategy for AI adoptions that departments had to follow (figure 4).

For example, as part of an overall strategy to become a “bank of the future,” Canada-based TD Bank set up an Innovation Centre of Excellence (CoE). Acting like an umbrella organization, the CoE connects all the innovation initiatives, including AI, to broader bank business units. It provides a platform for experimentation across the organization with the purpose of reducing operational complexity and improving customer experience. The CoE thus helps in testing and identifying best practices from AI pilots before introducing them as full-scale customer solutions.2

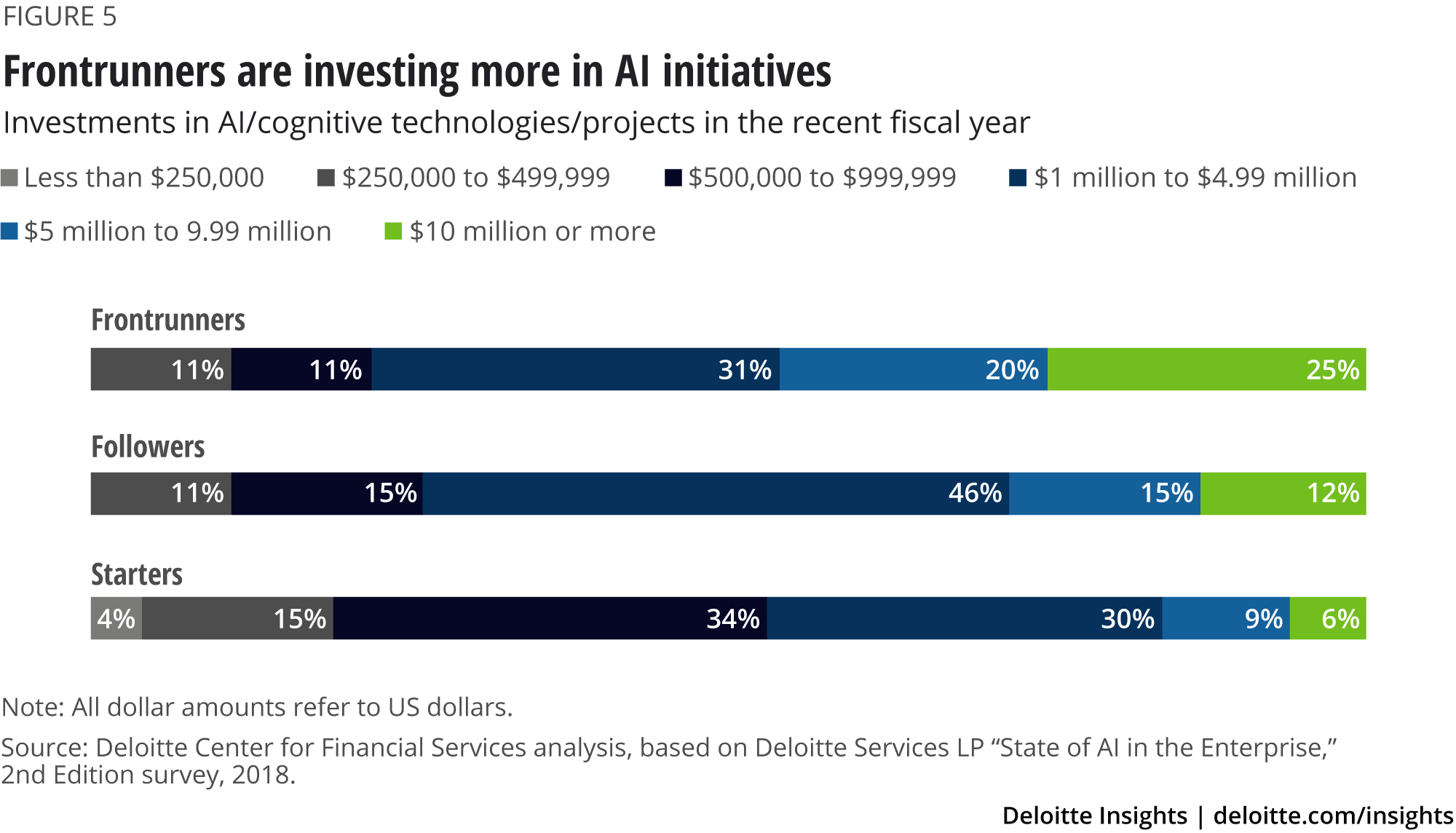

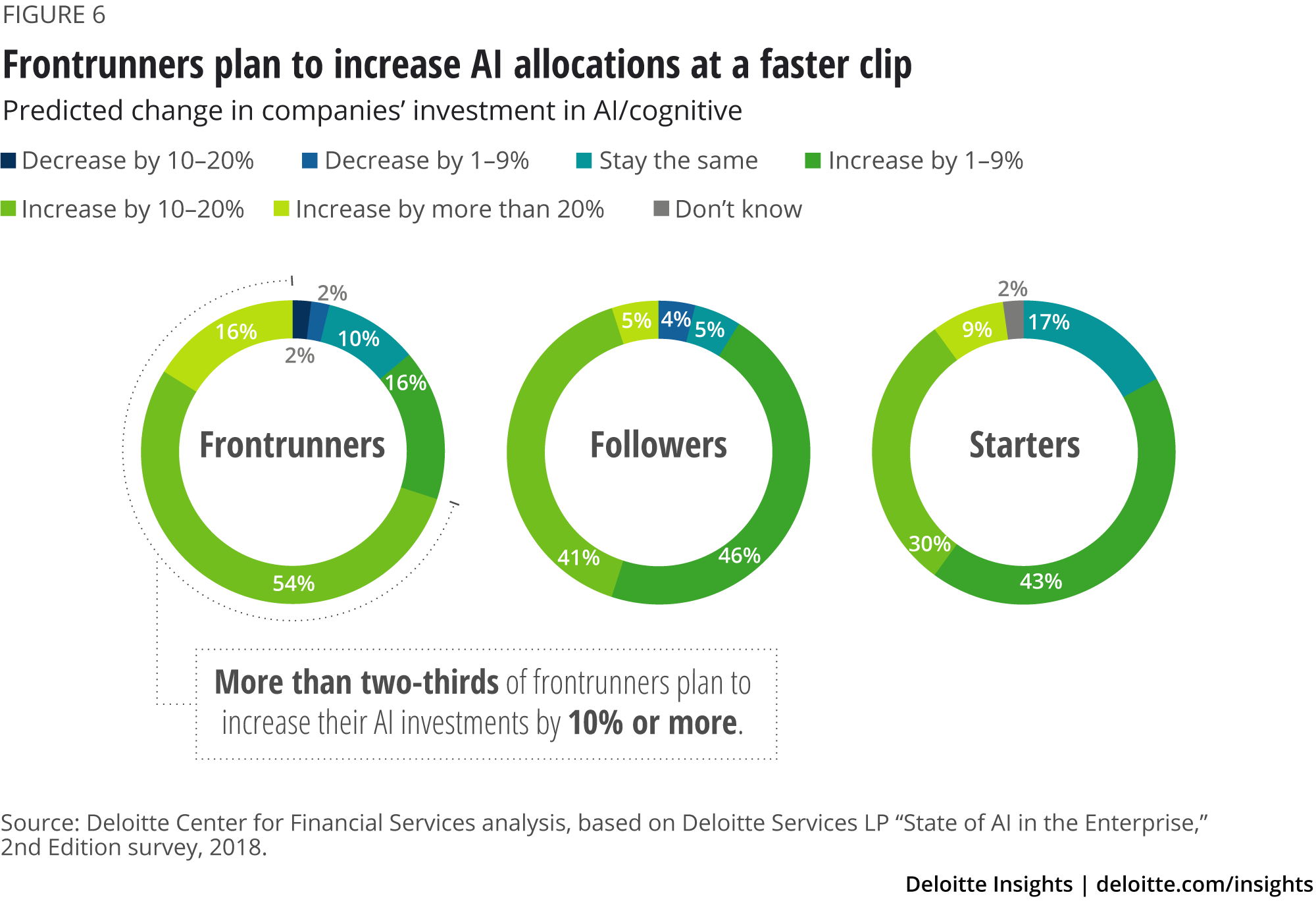

It is also no surprise, given the recognition of strategic importance, that frontrunners are investing in AI more heavily than other segments, while also accelerating their spending at a higher rate. Close to half of the frontrunners surveyed had invested more than US$5 million in AI projects compared to 27 percent of followers and only 15 percent of starters (figure 5). In fact, 70 percent of frontrunners plan to increase their AI investments by 10 percent or more in the next fiscal year, compared to 46 percent of followers and 38 percent of starters (figure 6).

A major emphasis of these investments likely was to secure the talent and technologies necessary for the transformational journey ahead.3

Calls to action

For financial institutions early in their AI journey, embedding AI in strategic initiatives is an important first step. Elevating the critical importance assigned to these initiatives, along with building a long-term AI vision and strategy, lays out the foundation for the strategy. As companies customize their AI strategy based on their scale, size, and complexity, it is important that they consider what value they are trying to deliver for clients using AI.

Value delivery could either include customizing offerings to specific client preferences, or continuously engaging through multiple channels via intelligent solutions such as chatbots, virtual clones, and digital voice assistants.

For developing an organizationwide AI strategy, firms should keep in mind that these might be applied across business functions. Starting purposefully with small projects and learning from pilots can be important for building scale.

For scaling AI initiatives across business functions, building a governance structure and engaging the entire workforce is very important. Adding gamification elements, including idea-generation contests and ranking leaderboards, garners attention, gets ideas flowing, and helps in enthusing the workforce. At the same time, firms should develop programs for upskilling and reskilling impacted workforce, which would help garner their continued support to AI initiatives.

Focus on applying AI to revenue and customer engagement opportunities

Despite steady improvement in the economy following the 2008 financial crisis, the pressure to reduce costs at financial institutions has continued to increase. At the same time, rising competition from incumbents and nontraditional entrants, as well as greater regulatory oversight and compliance demands, are raising the cost of doing business. The return on average equity of commercial banks, for example, has yet to reach pre-financial-crisis levels.4

It is no surprise, then, that one in two respondents were looking to achieve cost savings or productivity gains from their AI investments. Indeed, in addition to more qualitative goals, AI solutions are often meant to automate labor-intensive tasks and help improve productivity. Thus, cost saving is definitely a core opportunity for companies setting expectations and measuring results for AI initiatives.

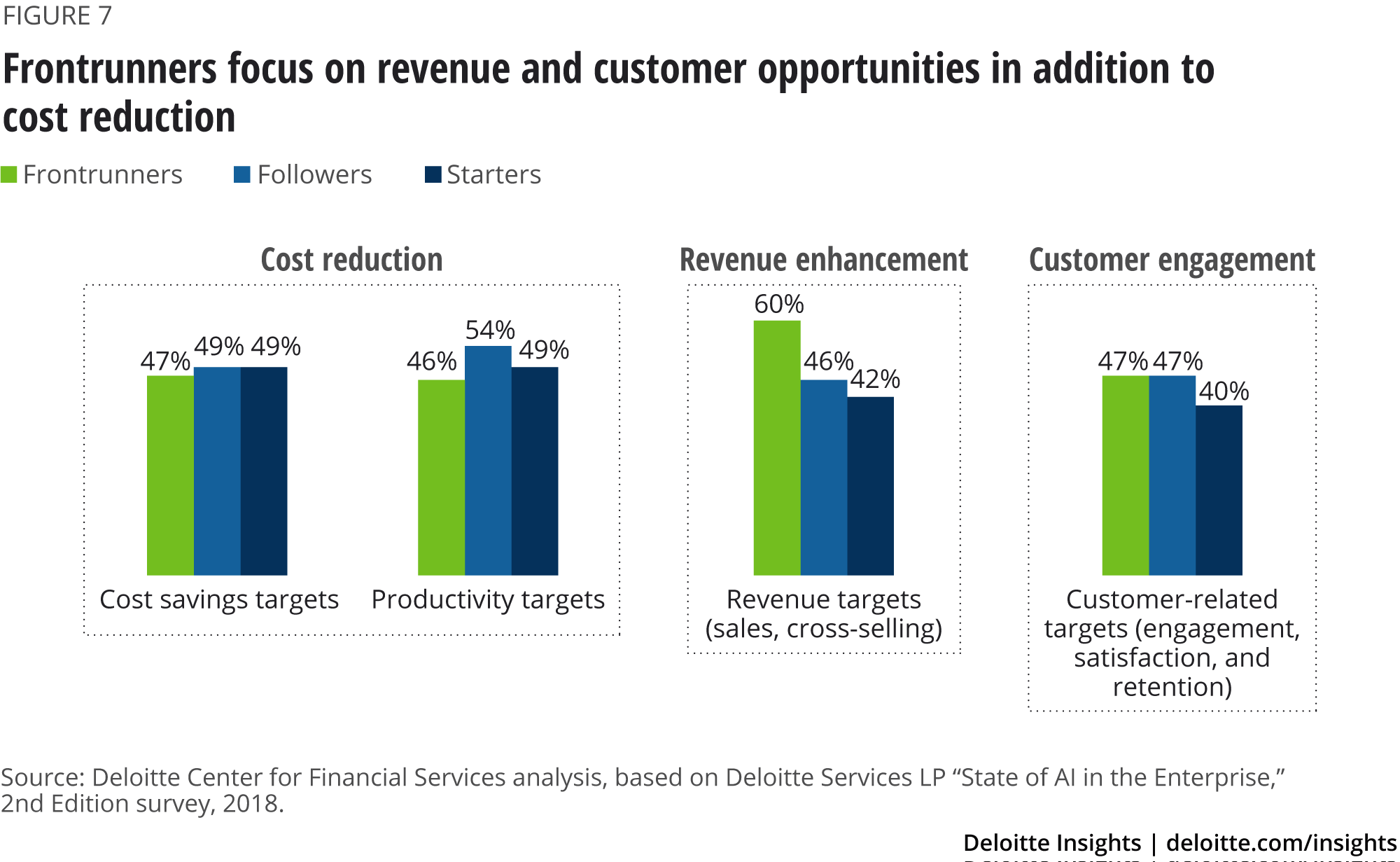

That said, what differentiated frontrunners (figure 7) is the fact that more leading respondents are measuring and tracking metrics pertaining to revenue enhancement (60 percent) and customer experience (47 percent) for their AI projects. This approach helped frontrunners look at innovative ways to utilize AI for achieving diverse business opportunities, which has started to bear fruit.

A good case could be how AI and predictive analytics were used by UK-based Metro Bank to help customers manage their finances. Working in partnership with Personetics, the bank launched an in-app service called Insights, which monitored customers’ transaction data and patterns in real time. The app then provided personalized prompts to make subscription payments and be aware of unusual spending. The AI tool also provides personalized financial advice, including savings recommendations and alerts.5

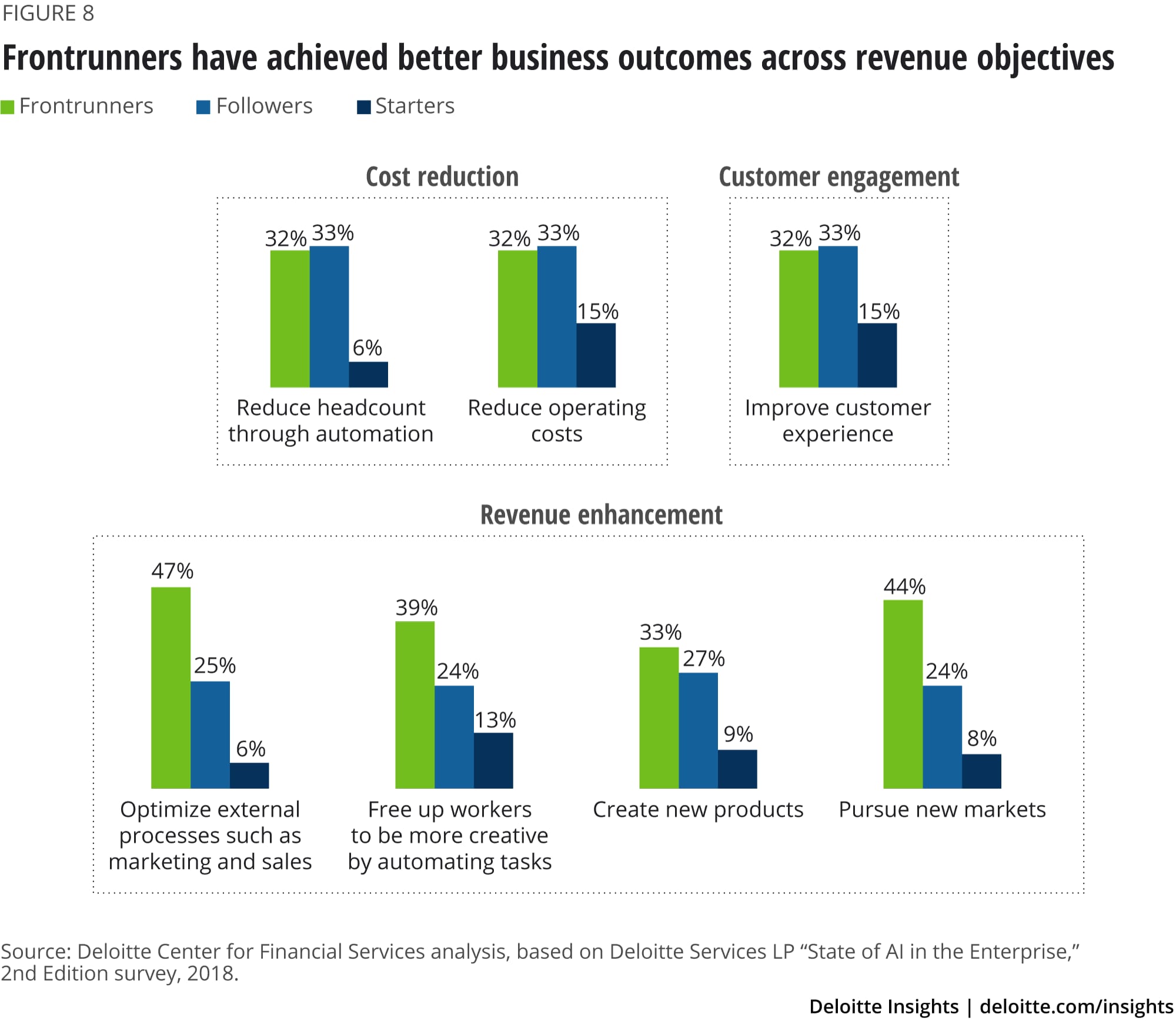

Frontrunners have taken an early lead in realizing better business outcomes (figure 8), especially in achieving revenue enhancement goals, including creating new products and pursuing new markets.

This mindset was reflected in the overall performance among respondents as well, with frontrunners reporting a companywide revenue growth of 19 percent according to the survey, which was in stark contrast to the growth of 12 percent for followers and a decline of 10 percent for starters.

Meanwhile, our research indicated that companies should give special emphasis to the human-centered design skills needed to develop personalized user experiences.6 In fact, the survey found that frontrunners are already starting to suffer from a shortage of designers for AI initiatives, which indicates the high degree of application of these skills by frontrunners during AI implementations.

Nordic bank Nordea is using AI to lead multiple efforts across the organization. Nova, an internally developed chatbot, uses natural language processing to interpret customers’ queries and decide the relevant response. Another project uses algorithms to study central bank documents and understand the central bank’s economic perspective. The bank is also actively evaluating opportunities to deploy AI for automating claims handling, detecting fraud, and providing personalized recommendations to clients.7

Calls to action

While exploring opportunities for deploying Al initiatives, companies should explore product and service expansion opportunities. This could be kick-started by measuring and tracking outcomes of AI initiatives to the company’s top line. Adding AI adoption to sales and performance targets and providing AI tools for sales and marketing personnel could also help in this direction.

To boost the chances of adoption, companies should consider incorporating behavioral science techniques while developing AI tools. Companies could also identify opportunities to integrate AI into varied user life cycle activities. While working on such initiatives, it is important to also assign AI integration targets and collect user feedback proactively.

Companies can also look at making best-in-class and respected internal services available to external clients for commercial use.

Adopt a portfolio approach for acquiring AI

As market pressures to adopt AI increase, CIOs of financial institutions are being expected to deliver initiatives sooner rather than later. There are multiple options for companies to adopt and utilize AI in transformation projects, which generally need to be customized based on the scale, talent, and technology capability of each organization.

From our survey, it was no surprise to see that most respondents, across all segments, acquired AI through enterprise software that embedded intelligent capabilities (figure 9). With existing vendor relationships and technology platforms already in use, this is likely the easiest option for most companies to choose.

For example, Guidewire, maker of enterprise software solutions for insurance companies, offers its users access to AI capabilities through its Predictive Analytics for Claims app. The app utilizes machine learning algorithms to categorize claims based on their severity and the potential for litigation, automatically routing any high-priority claims to the correct departments.8 Similarly, Salesforce helps users access AI through its Einstein program, which applies machine learning to historical sales data and predicts which prospects are most likely to close.9

However, the survey found that frontrunners (and even followers, to some extent) were acquiring or developing AI in multiple ways (figure 9)—what we refer to as the portfolio approach.

This portfolio approach likely enabled frontrunners to accelerate the development of AI solutions through options such as AI-as-a-service and automated machine learning. At the same time, through crowdsourced development communities, they were able to tap into a wider pool of talent from around the world.

Adopting the portfolio approach could help companies preserve the legacy business process while utilizing AI for incremental gains. American Fidelity Assurance, a US-based health and life insurance company, was evaluating options to improve the handling of a growing volume of customer emails and mapping the flow to different departments. The company’s R&D team was exploring both robotic process automation (RPA) and machine learning applications, albeit separately. While RPA was a good match for automatically sending mails to the correct department, it was providing too many rules for identifying the right department based on the email’s subject and keywords. To resolve this, the team decided to explore automated machine learning with the help of a third-party vendor. Using the database of customer emails and eventual department response (outcome), the company found a well-fitting model within a few hours. This model was converted to an application programming interface (API), which was combined with RPA to automate the entire email classification, department identification, and mail-forwarding process.10

Calls to action

Financial institutions that have never utilized multiple options to access and develop AI should consider alternative sources for implementation. Companies would need time to gather the requisite experience about the benefits and challenges of each method and find the right balance for AI implementation.

Once companies start implementing AI initiatives, a mechanism for measuring and tracking the efficacy of each AI access method could be evaluated. Identifying the appropriate AI technology approach for a specific business process and then combining them could lead to better outcomes.

Significant challenges could lie ahead

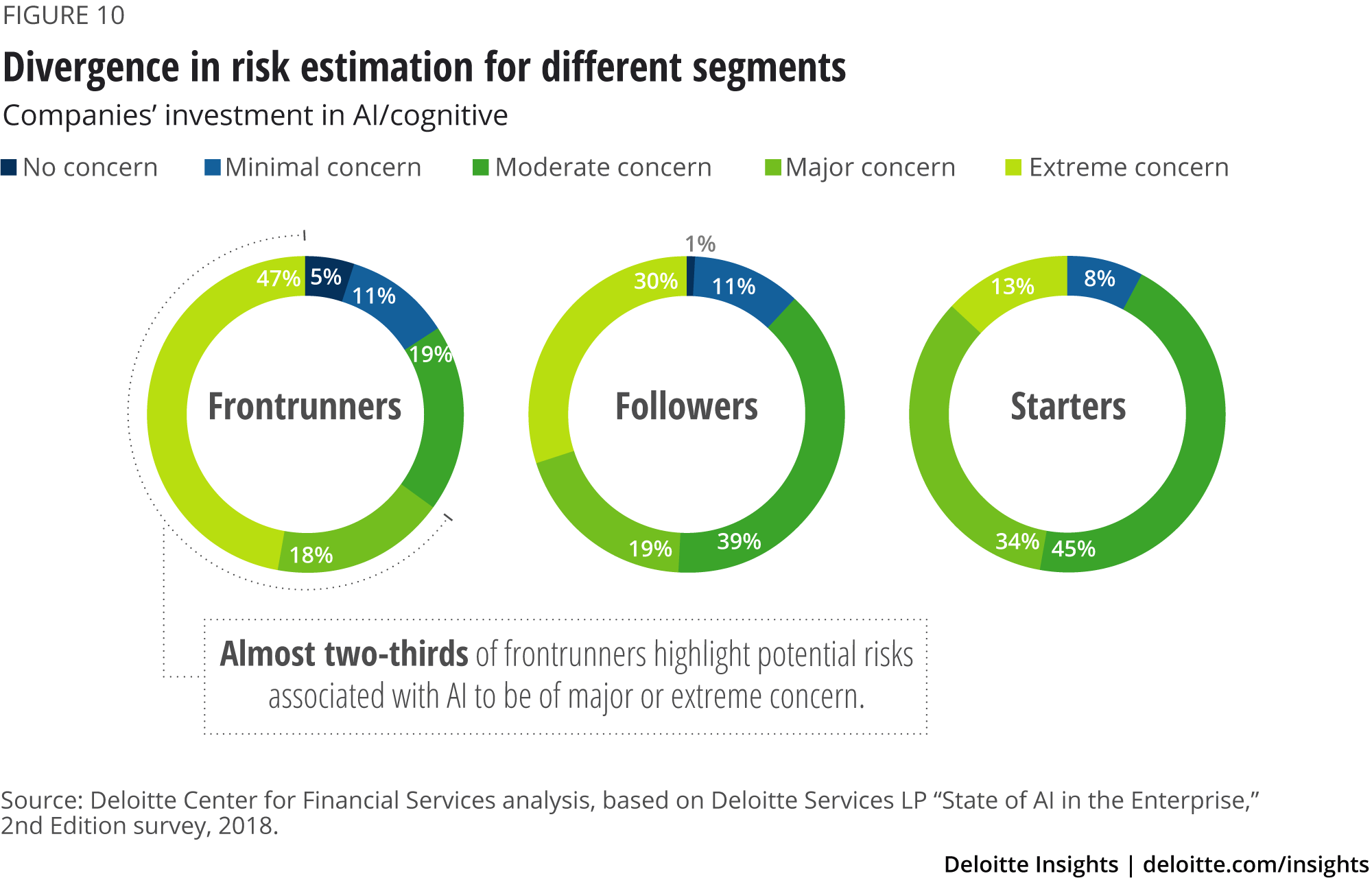

As financial services companies advance in their AI journey, they will likely face a number of risks and challenges in adopting and integrating these technologies across the organization. But not all are facing the same set of challenges. Our survey found that frontrunners were more concerned about the risks of AI (figure 10) than other groups.

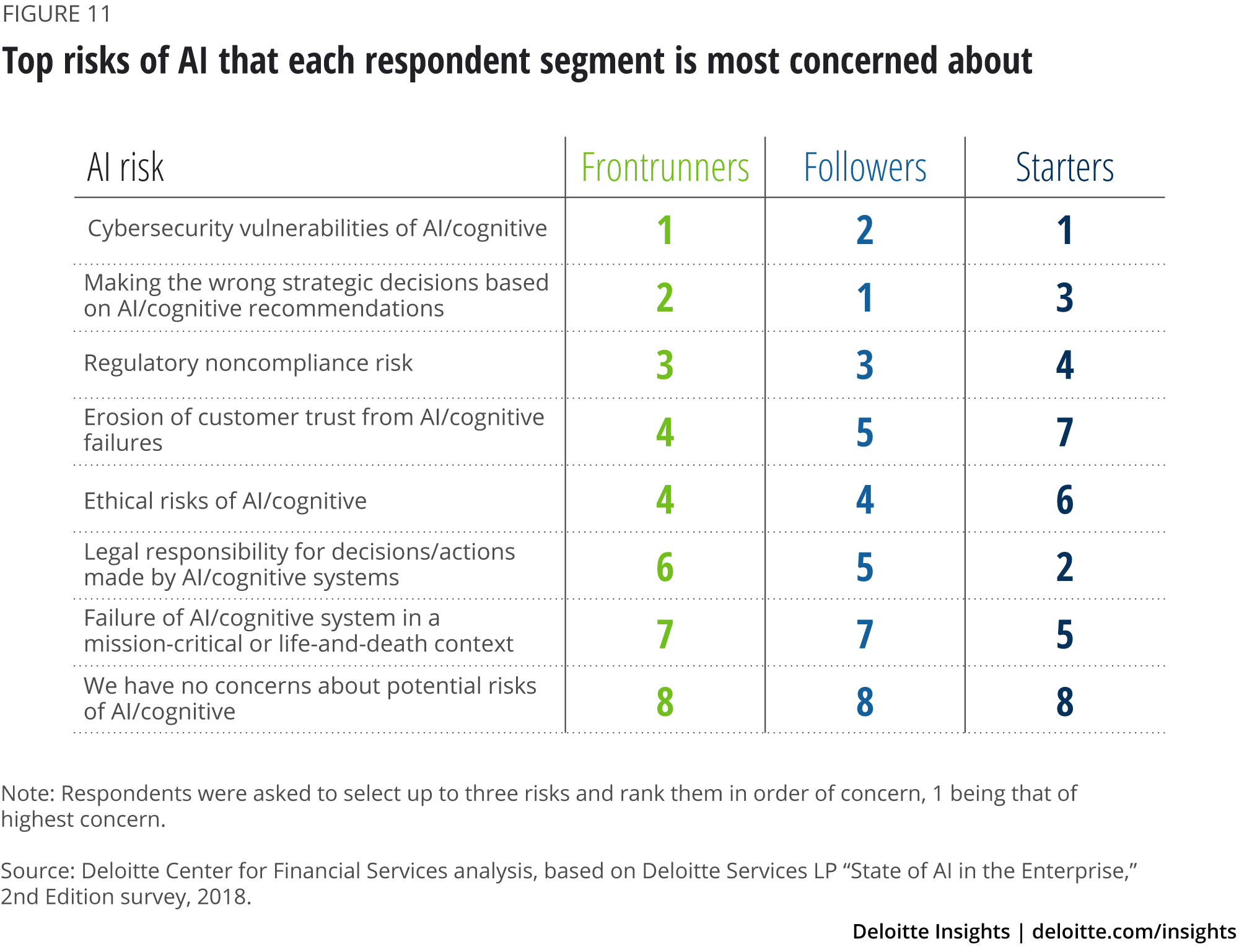

With the experience of several more AI implementations, frontrunners may have a more realistic grasp on the degree of risks and challenges posed by such technology adoptions. Starters and followers should probably brace themselves and start preparing for encountering such risks and challenges as they scale their AI implementations. Indeed, starters would likely be better served if they are cognizant of the risks identified by frontrunners and followers alike (figure 11) and begin anticipating them at the onset, giving them more time to plan how to mitigate them.

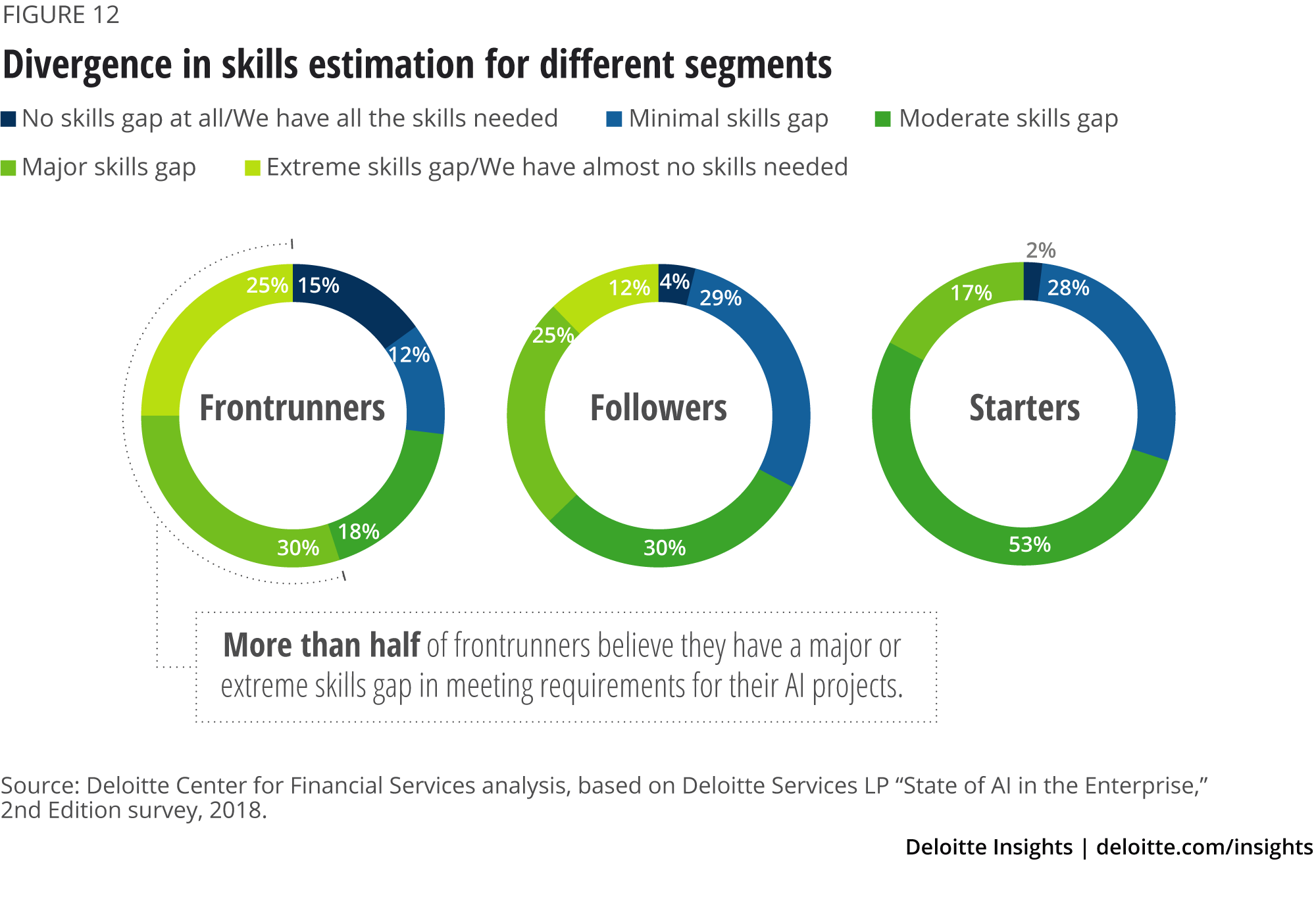

We observed a similar pattern in terms of the skills gap identified by different segments in meeting the needs of AI projects (figure 12). More frontrunners rated the skills gap as major or extreme compared to the other groups. While a higher number of implementations undertaken could partly explain this divergence, the learning curve of frontrunners could give them a more pragmatic understanding of the skills required for implementing AI projects.

Delving deeper into the capabilities needed to fill their skills gap, more starters and followers believe they lack subject matter experts who can infuse their expertise into emerging AI systems, as well as AI researchers to identify new kinds of AI algorithms and systems.

While these skills are often necessary in the initial stages of the AI journey, starters and followers should take note of the skill shortages identified by frontrunners, which could help them prepare for expanding their own initiatives. Frontrunners surveyed highlighted a shortage of specialized skill sets required for building and rolling out AI implementations—namely, software developers and user experience designers (figure 13).

User experience could help alleviate the “last mile” challenge of getting executives to take action based on the insights generated from AI. Frontrunners seem to have realized that it does not matter how good the insights generated from AI are if they do not lead to any executive action. A good user experience can get executives to take action by integrating the often irrational aspect of human behavior into the design element.

That said, financial institutions across the board should start training their technical staff to create and deploy AI solutions, as well as educate their entire workforce on the benefits and basics of AI. The good news here is that more than half of each financial services respondent segment are already undertaking training for employees to use AI in their jobs.

Getting off to a solid start

As companies prepare for the AI leg of their digital marathon by revamping their processes and working environments, it is imperative they revisit their fundamentals—goals, strengths, and weaknesses. This could help organizations lay a solid foundation for rethinking how humans and machines interact within working environments. Answering the following questions could be a good start:

- What existing business goals and missions can the organization achieve by deploying AI?

- How could AI be used to build a competitive advantage?

- Does the organization have adequate technology building blocks for supporting an AI-based organization? What are the gaps that should be addressed?

- Does the organization have talent possessing strong business and technology understanding, who can serve as translators between the business and technology functions, thereby aiding the development of AI solutions?11

The answers to these questions could be different for each organization, indicating the need for a customized approach to integrating AI within an organization. In particular, it is important for financial institutions to evaluate which segment they occupy now, when compared to peers. Based on their current position, each company should design, plan, and implement the following actions to progress in their AI journey:

- Start purposefully and be bold. Be ambitious in AI implementations, even if you are playing catch-up. Build a strong AI foundation that can be ramped up quickly across the organization.

- Get early wins under your belt. Aim at generating early success by pursuing a diverse portfolio of achievable projects. This would help generate confidence among management and the broader workforce at the beginning of the transformation process, while building momentum to roll out more AI initiatives for multiple business functions.

- Emphasize organizationwide AI implementation once experience (and success) is achieved. Develop a holistic approach by improving both technology and business talent capability areas to support AI adoption across the enterprise.

- Adapt governance and risk structure to scale AI implementations. Build in operational discipline and actively mitigate AI-related risks, including cybersecurity, compliance, and ethical risks (such as whether new types of data-gathering and correlations might make consumers uncomfortable).

It is important, however, to realize that we are still in the early stages of AI transformation of financial services, and therefore, organizations would likely benefit by taking a long-term view. Those that find the right mix of strategic integration and execution of large-scale AI initiatives would likely be better able to achieve their goals to cut costs, improve revenue, and enhance the customer experience, which could position them to leverage AI for competitive advantage.

Appendix: The AI technology portfolio12

Machine learning. With machine learning technologies, computers can be taught to analyze data, identify hidden patterns, make classifications, and predict future outcomes. The learning comes from these systems’ ability to improve their accuracy over time, with or without direct human supervision. Machine learning typically requires technical experts who can prepare data sets, select the right algorithms, and interpret the output.

Seventy percent of all financial services respondents were using machine learning.

Typical use cases of machine learning for financial institutions include:

- Predicting cash-flow events and proactively advising customers on spending and saving habits

- Expanding the data set for developing credit scores and applying machine learning to build advanced credit models for expanding reach and reducing defaults

- Providing machine-learning-based merchant analytics “as a service”

- Detecting patterns in transactions and identifying fraudulent transactions as early as possible

Natural language processing (NLP). This technology allows users to extract or generate meaning and intent from text in a readable, stylistically natural, and grammatically correct form. NLP powers the voice- and text-based interface for virtual assistants and chatbots. The technology is increasingly being used to query data sets as well.

Sixty percent of all financial services respondents were using NLP.

Typical use cases of NLP for financial institutions include:

- Reading documents and identifying errors for support activities such as information verification, user identification, and approvals

- Improving the underwriting process and capital efficiency

- Understanding customer queries via voice search on digital voice assistants or smartphones

Deep learning. Deep learning is a subset of machine learning based on a conceptual model of the human brain called a neural network. It’s called deep learning because neural networks have multiple layers that interconnect: an input layer that receives data, hidden layers that compute data, and an output layer that delivers the analysis. The greater the number of hidden layers (each of which processes progressively more complex information), the deeper the system. Deep learning is especially useful for analyzing complex, rich, and multidimensional data, such as speech, images, and video. It works best when used to analyze large data sets. New technologies are making it easier for companies to launch deep learning projects, and adoption is increasing.

Among all financial services respondents, 52 percent said they were using deep learning.

Typical use cases of deep learning for financial institutions include:

- Reading claims documents and ranking their urgency, severity, and compliance to expedite triage

- Building dashboards that provide users with data analytics in a simple and intuitive format

- Developing innovative trading and investment strategies

Computer vision. Computer vision is the ability of computers to identify objects, scenes, and activities in a single image or a sequence of events. The technology analyzes digital images and videos to create classification or high-level descriptions that can be used for decision-making.

Fifty-eight percent of all financial services respondents were using computer vision.

Typical use cases of computer vision for financial institutions include:

- Classifying drivers based on their attention levels—safer drivers can then be targeted to offer lower premiums

- Building biometric security for clients in a secure environment, such as for bank ATMs

- Providing investors and traders with immersive experiences for making portfolio allocations and trading decisions

Explore the Financial services collection

-

Tapping into the aging workforce in financial services Article5 years ago

-

Reshaping the cybersecurity landscape Article4 years ago

-

Recognizing the value of bank branches in a digital world Article5 years ago

-

A moving target: Refocusing risk and resiliency amidst continued uncertainty Article3 years ago

-

Payments and the future of mobility Article5 years ago

-

Evolution of blockchain technology Article7 years ago