Forces of change: The future of mobility has been saved

Forces of change: The future of mobility

16 November 2017

A number of forces are converging to change the way people and goods travel from point A to point B. The resulting new mobility ecosystem could have wide-reaching impacts that span a host of industries and players.

Executive summary

Learn More

Visit the Future of Mobility collection

The entire way people and goods travel from point A to point B is changing, driven by a series of converging technological and social trends: the rapid growth of carsharing and ridesharing; the increasing viability of electric and alternative powertrains; new, lightweight materials; and the growth of connected and, ultimately, autonomous vehicles. The result is the emergence of a new ecosystem of mobility that could offer faster, cheaper, cleaner, safer, more efficient, and more customized travel.

While uncertainty abounds, in particular about the speed of the transition, a fundamental shift is driving a move away from personally owned, driver-driven vehicles and toward a future mobility system centered around (but not exclusively composed of) driverless vehicles and shared mobility. The shift will likely affect far more than automakers—industries from insurance and health care to energy and media should reconsider how they create value in this emerging environment.

What’s our view of the future of mobility?

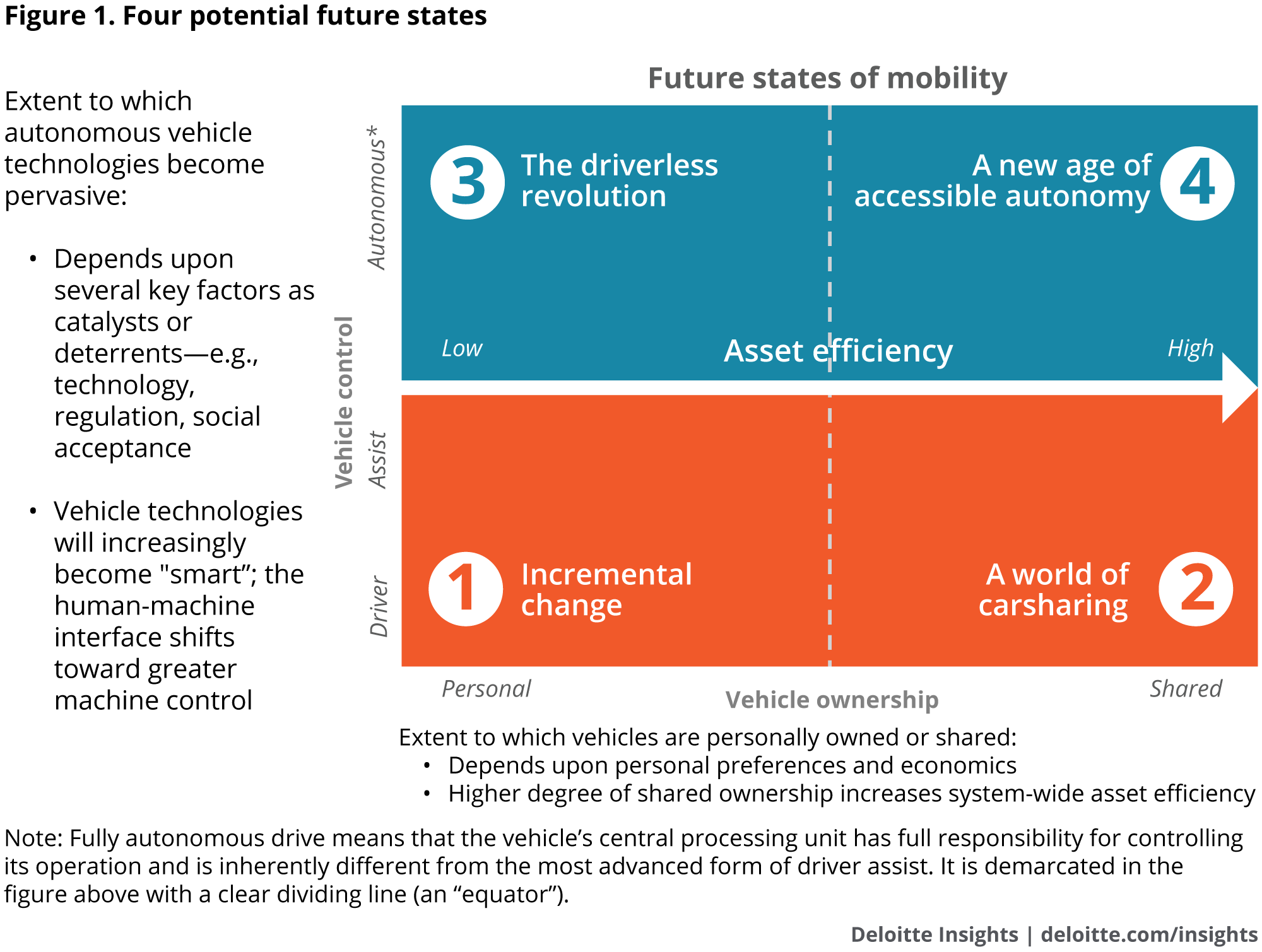

We believe a series of technological and social forces, including the emergence of connected, electric, and autonomous vehicles and shifting attitudes toward mobility, are likely to profoundly change the way people and goods move about. As these trends unfold, four concurrent “future states” could emerge within a new mobility ecosystem, emanating from the intersection of who owns the vehicle and who operates the vehicle (figure 1).1

- Personally owned driver-driven: This vision of the future sees private ownership remaining the norm as consumers opt for the forms of privacy, flexibility, security, and convenience that come with owning a vehicle. While incorporating driver-assist technologies, this future state assumes that fully autonomous drive doesn’t completely displace driver-controlled vehicles anytime soon.

- Shared driver-driven: The second future state anticipates continued growth of shared access to vehicles through ridesharing and carsharing. Economic scale and increased competition drive the expansion of shared vehicle services into new geographic territories and more specialized customer segments. As shared mobility serves a greater proportion of local transportation needs, multivehicle households can begin reducing the number of cars they own, while others may eventually abandon ownership altogether.

- Personally owned autonomous: The third state is one in which autonomous drive technology2 proves viable, safe, convenient, and economical, yet private ownership continues to prevail. Drivers still prefer owning their own vehicles but seek driverless functionality for its safety and convenience. This future sees a proliferation of highly customized, personalized vehicles catering to families or individuals with specific needs.

- Shared autonomous: The fourth future state anticipates a convergence of both the autonomous and vehicle-sharing trends. Mobility management companies and fleet operators offer a range of passenger experiences to meet widely varied needs at differentiated price points. Taking off first in urban areas but spreading to the suburbs, this future state provides seamless mobility across modes that is faster, cheaper, cleaner, safer, and more convenient than today.

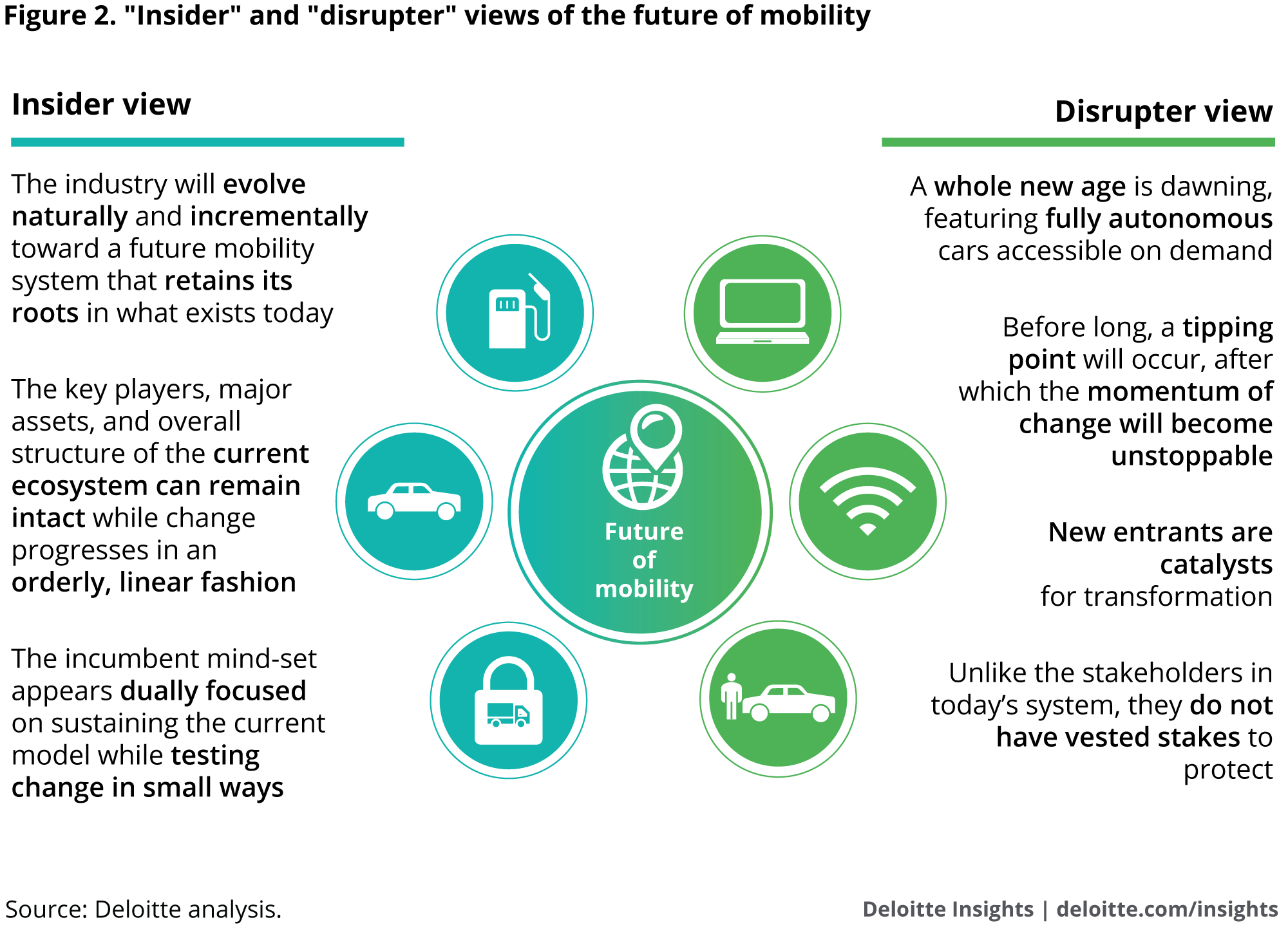

While we have seen surprising agreement that a fundamental shift is driving a move away from personally owned, driver-driven vehicles and toward a future mobility system centered around (but not exclusively composed of) driverless vehicles and shared mobility, there are two profoundly different visions about how this future could evolve. The incremental “insider” perspective of industry incumbents believes that today’s system can progress in an orderly, linear fashion, in which the current industry assets and fundamental structure remain essentially intact. The “disrupter” view of new entrants envisions a tipping-point approach to a very different future, one that offers great promise and potential societal benefits (see figure 2).

Within the high-tech community, many companies are working to arrive at something radically different than today’s system of personally owned driver-driven passenger automobiles. According to this perspective, which we label the disrupter view, a new age is dawning, featuring fully autonomous cars accessible on demand. Progress toward it might be measured at first, but before long, a tipping point would occur, after which the momentum of change could gather speed.

Most insiders, heavily invested in the current auto industry, see change evolving slowly toward a future that retains its roots in what exists today. Many major auto companies are pursuing strategies that address the converging forces incrementally, creating future option value while preserving flexibility. These industry players’ efforts and investments seem to be yielding a steady stream of benefits for customers. For example, in introducing connected-car technology, manufacturers offer drivers many of the benefits associated with autonomous drive without fundamentally altering how humans currently interact with vehicles.

Automakers are experimenting and inventing, and have passionate voices within their ranks describing much-altered futures. In our ongoing conversations with various auto industry leaders, they repeatedly and collectively argue that outsiders simply do not appreciate the sheer complexity of developing a vehicle today, the challenge of introducing new advanced technologies into a vehicle’s architecture, or the rigor and inertia of the regulatory environment. All of this may encourage incumbents to believe that they can be at the center of actively managing the timing and pace of these converging forces.

But the interplay of the converging forces of change may be less predictable and lead to faster upheaval than they think. Automakers might be overestimating how much power they have to manage the course of future events.

A new ecosystem enables seamless intermodal mobility

As these changes unfold, there will likely be massive shifts in economic value, which could increasingly be derived from consumer-centric data, systems, and services-oriented business models. Enabling seamless intermodal mobility would require a future ecosystem that is much more complex than today’s extended automotive industry. New opportunities will likely emerge to deliver the diverse experiences that customers demand. Companies can look to design new products, services, and solutions that serve each future state and multiple modes of travel simultaneously—or accept a narrowing of their future horizons in a more diverse mobility ecosystem. Both incumbents and disruptors are beginning to stake out positions, and in the process providing the contours for how that ecosystem might look (see figure 3).

Vehicle development

The development and manufacturing of cars (and trucks, buses, trains, and bikes) will likely continue to provide a critical source of value. But like the mobility ecosystem as a whole, the carmaking business could be more complex than ever. New products will likely emerge, from small utilitarian autonomous “pods” to highly customized, personally owned self-driving cars. And the changes won’t be limited to the passenger auto: Self-driving technology will likely infuse trains, buses, commercial trucks, and other forms of transit, demanding that developers and manufacturers evolve their capabilities accordingly.

Enabling the in-vehicle transit experience

The in-vehicle transit experience will increasingly be a defining feature of the future of mobility.3 “Experience enablers”—content providers, in-vehicle service providers, data and analytics companies, advertisers, entertainment equipment providers, and social media companies—will likely clamor to make the in-transit experience whatever we want it to be: relaxing, productive, or entertaining. Many of the capabilities in this space already exist but could be vastly expanded to become even more immersive and interactive: high-quality content creation, effective content sourcing, targeted advertising, and product placement. New needs could emerge as data and analytics support not only entertainment but a broader set of experiences.

Infrastructure enablers

The safe and efficient movement of people and goods hinges critically on underlying infrastructure, a fact that will likely be just as true tomorrow as it is today. Accordingly, the important role played by providers of both physical infrastructure and energy infrastructure would persist.4 Transit stations, roads, highways, waterways, and public parking could become even more interconnected as customers increasingly expect multimodal transportation.

In addition to these physical assets, a parallel digital infrastructure could emerge that will be every bit as critical as roads and bridges. As data becomes the new oil, companies—including providers of telecommunications,5 cybersecurity,6 and operating systems—can capture value by providing fast, safe, reliable, and ubiquitous connectivity for all the data that the future mobility ecosystem requires.

Mobility management

Today, ride-hailing companies act as network orchestrators, connecting people requiring a service with those offering that service. Along with automotive original equipment manufacturers (OEMs), however, many of these companies are pursuing a more integrated set of mobility options and services. These efforts are tangible demonstrations of the future of mobility management.7 As providers begin to set up infrastructure, autonomous technologies are tested and proven, and the in-vehicle experience improves, we are seeing indications that an integrator could emerge to connect autonomous vehicles and other modes of transit to the end consumer. Fully realized mobility advisers will likely look to enable a seamless intermodal transportation experience, ensuring easy access, exemplary in-transit experience, a smooth payment process, and overall customer satisfaction. They would take into consideration customer preference, traffic data, and other circumstances to arrive at the most convenient and cost-effective mobility plan—whether that entails a shared car, a train, a bike, or all of them.

We see both customer-facing and asset-owning dimensions to mobility management, and while the two roles are distinct, in practice a company could fill both of them simultaneously. The mobility adviser directly interfaces with the customer, who would expect a customized experience that relies on the mobility assistant’s ability to execute trip planning, adjust routes to allow for traffic and disruptions, and handle payments. A variety of technology companies that collect consumer business data (for example, venue information and activity information) could work with the mobility managers and end-consumer businesses to enhance the user’s experience. Social networks would further enhance the user experience by suggesting consumer preferences to shape the journey. And navigation providers will likely look to optimize routes using prime data from environment and weather companies.

Because shared autonomous vehicles will likely play a critical role in the future mobility landscape, especially in cities, fleet operation is a second opportunity to create value around mobility management. Fleet operators would deploy a range of vehicles matched to users’ preferences, managing their upkeep and storage, and leverage enhanced smart routing capabilities to match supply and demand effectively.

The roles described here are illustrative and not exhaustive, but many players will vie for these new opportunities. Winning in many cases would require significant transformation of their business system and operating model. While some stakeholders may find themselves naturally well positioned for certain opportunity spaces or value-capture strategies, others could find themselves at a disadvantage. The future need not take companies by surprise, however. The key lies in understanding your capabilities against the emerging needs of the ecosystem to decide “where to play” and “how to win.”8

Why does the future of mobility matter?

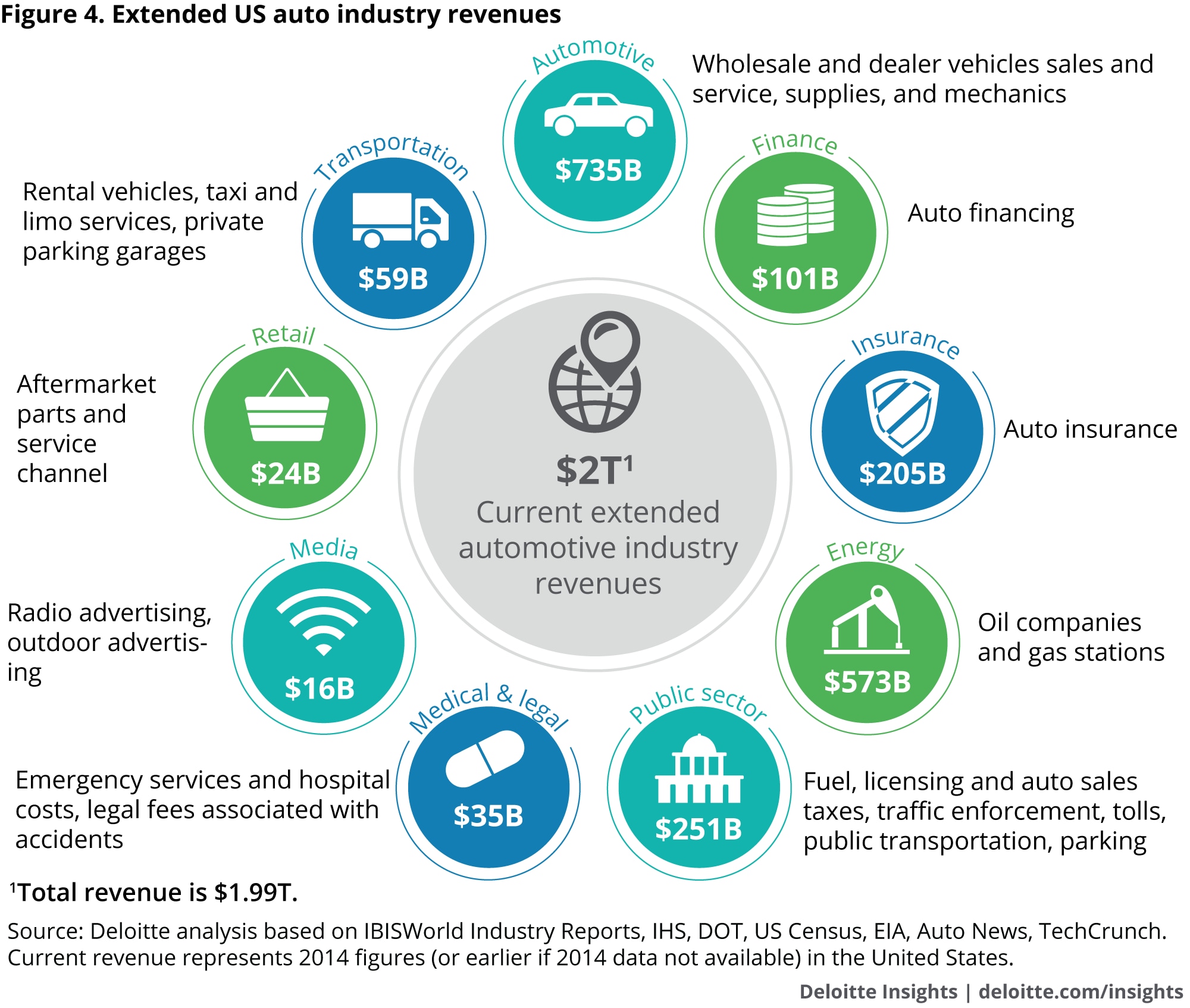

The stakes are high, and the implications of these shifts look to be wide-ranging (figure 4). The extended auto industry alone touches nearly every facet of the American economy. It represents nearly $2 trillion in revenues—more than 10 percent of US gross domestic product (GDP).9 The commercial trucking industry adds another $700 billion to that figure.10 Almost 7 million people worked in the US auto industry in 2015, with another 3.8 million employed as motor vehicle operators.11 Those figures, significant in themselves, don’t include the many additional jobs that rely on the provisioning of transportation, such as warehouse workers, public works employees, and those in delivery services. For that matter, the future of mobility could affect nearly everyone who commutes to and from a job, and nearly every company’s supply chain.

What are the impacts of the future of mobility?

The transition toward a new mobility ecosystem could have wide-reaching impacts that span a host of industries and players, including—but not limited to:

Global automotive OEMs face momentous and difficult decisions. OEMs will need to determine if they should evolve from a (relatively) fixed capital production, first-transaction, product-sale business into one centered on being an end-to-end mobility services provider. This would represent a profound business model change and the development of entirely new capabilities to be competitively and sustainably viable.

The traditional capabilities of vehicle manufacturers and suppliers will likely need to expand, collaborating with autonomous vehicle technology suppliers, software developers, and others to provide a much broader range of product choices.12 There are complex economics in being able to manufacture vehicles similar to today’s mass-produced driver-owned cars, highly customized personally owned autonomous vehicles, and utilitarian pods for urban environments. Manufacturers will likely require not only today’s traditional supply chains but new manufacturing capabilities that allow advanced, low-cost, efficient customization. They will need to determine if they should redesign their business model to compete in all four future states or to focus on one segment.

Automotive suppliers would have to adjust as OEMs transform. Portfolio economics may be challenged as value shifts toward software and systems that define the ride experience. New entrants have already started upending competition in the supply base and are likely to continue to do so. Selling parts, components, and systems may be insufficient to deliver desired returns to shareholders, necessitating that suppliers look to new offerings and adjacent markets. And in order to access the assets and capabilities to compete in the future, suppliers may have to collaborate across a web of relationships with participants different than those in today’s more linear supply chain.13

Technology firms are driving much of the change under way. These companies have shown to be adept at building large, complex information networks and operating systems, introducing artificial intelligence to help minimize human error and randomness, creating compelling environments that drive consumer behavior, and creating digital communities. They view the vehicle as another platform in a multidevice world. Vehicle sensors and personal devices could generate ever-greater amounts of data, with insights producing personalized customer experiences and delivering targeted advertising and services.14 Integrated information systems can enable effective intermodal transportation. And mobile, wireless, location-based systems can create opportunities for dynamic-pricing, single-payment, and consumption-based models to become much more prevalent. Technology leaders in general appear to be in highly advantaged positions to capture this information and data-based value.

Cargo delivery and long-haul trucking currently face significant challenges that the future mobility ecosystem could alleviate.15 In the most ambitious version of the future, cargo transportation and delivery systems could become predominantly driverless through daisy chains or remote operation—an appealing scenario, considering the US trucking industry’s growing labor shortages.16 Autonomous vehicles offer a way to overcome restrictions on hours driven and increase capital utilization. As “last-mile” delivery becomes increasingly important with the rise of e-commerce, digitization and new supply concepts in urban areas (such as shared assets) could become more crucial.

Insurers face a complex set of strategic questions in how they will serve various segments, geographies, and demographic groups depending on which future states take hold.17 Operating within a heavily regulated environment, insurers will likely have to continue supporting the classic insurance model, in which accidents are often the result of driver error, while also adapting to an autonomous-drive world where the risk is more technical, related to systemic failure of a self-guided vehicle. Where risk pools change in demographic composition, dramatic changes in cost structure could ensue. Alternatively, the flood of new information provided by connected vehicles offers the opportunity to more accurately judge risk.

The US public sector will likely have to figure out how to offset anticipated declines in the $200 billion annually generated from fuel taxes, public transportation fees, tolls, vehicle sales taxes, municipal parking, and registration and licensing fees. All these revenues are tied to today’s reality of individually owned and operated vehicles—for instance, the need for parking diminishes with the rise of autonomous-drive shared mobility. Agencies may need to evaluate alternatives—for example, taxing “movement” vs. ownership. Monetization for road usage in the future could transition to a much more dynamic model based on the time of day, market demand, routes traveled, distance, and vehicle form, aligning the use of public assets more directly to usage than today’s system.

At the same time, urbanization and population growth are straining many cities’ existing transportation networks, leading to increased congestion and negative economic and health outcomes. Cities should consider how best to harness and coordinate the multitude of mobility innovations that have entered the scene in recent years—ride-hailing, bikesharing, dynamic shuttles, and more—to ensure individual citizens’ and the broader society’s goals are being met.

What should you do next?

Depending on your perspective, the changes discussed here—shared mobility, autonomous vehicles, and seamless intermodal transit—may seem thrilling or daunting. Any actor involved in the movement of people and goods should begin identifying now where it wants to play in the new mobility ecosystem.

Evaluate the potential impact: Each player should analyze how and by how much the future of mobility will impact their current business or operations. The magnitude of the transformation is likely sizeable, the velocity of change could be rapid, and businesses and governments will likely have to operate in a multistate, multimodal future that demands flexibility and adaptability. While the change may seem distant, the time frame for adoption could shrink surprisingly quickly. An analysis would give management a more empirical understanding and help build consensus around the degree of urgency required to make the transition to the new mobility ecosystem.

Determine which role or roles you aspire to in the new mobility ecosystem: While change is imminent, new opportunities will likely continue to emerge and expand. Amid the ecosystem’s complexity, we anticipate the emergence of distinct value creation roles. These roles are closely linked and would require collaboration to serve the customer. The car-centric extended automotive industry has become a customer-centric mobility ecosystem, where the focus is on the experience of moving from point A to point B—rather than the physical vehicle itself.

Assess how your current capabilities match those required for future success: Not all opportunities are created equal. Stakeholders should carefully examine their own capabilities against those required to succeed in their chosen role. This paper only scratches the surface of the opportunity spaces. In reality, there are a host of players and capabilities that could support and enable the ecosystem.

Evaluate competitive intensity, and be clear-eyed about how you stack up against incumbents in that space: You will not be alone in seeking to capture value in the new mobility ecosystem. Many players—both incumbents and disrupters—are already making moves to play.

Develop a road map to build the needed capabilities: Enterprise transformation rarely happens overnight and takes time and planning. Understanding the broader ecosystem and the required capabilities can help companies and governments better lay out their path to success, whether that be through acquisition, partnership, or internal development. Part of this journey will likely require making hard decisions around your winning aspiration.

© 2021. See Terms of Use for more information.