Advancing environmental, social, and governance investing A holistic approach for investment management firms

15 minute read

20 February 2020

With the growing focus on social responsibility globally, many investment management companies are including environmental, social, and governance aspects in their decision-making, aided by emerging technologies such as AI and advanced analytics. Not only might this help build credibility with investors, it could also create opportunities for alpha.

The sustainability movement is growing

Social consciousness has spread throughout many facets of life, and many companies are making a concerted effort to align with these principles. This effort has likely contributed to the steady rise in the media coverage afforded to “sustainable” brands over the past two years.1 Evidence suggests a similar growth in a desire for what are characterized as “sustainable” or “socially responsible” investments. Globally, the percentage of both retail and institutional investors that apply environmental, social, and governance (ESG) principles to at least a quarter of their portfolios jumped from 48 percent in 2017 to 75 percent in 2019.2 While directing investments based on one’s values has been around for decades, discussions between advisors and their clients about ESG investing have become commonplace.

Key messages

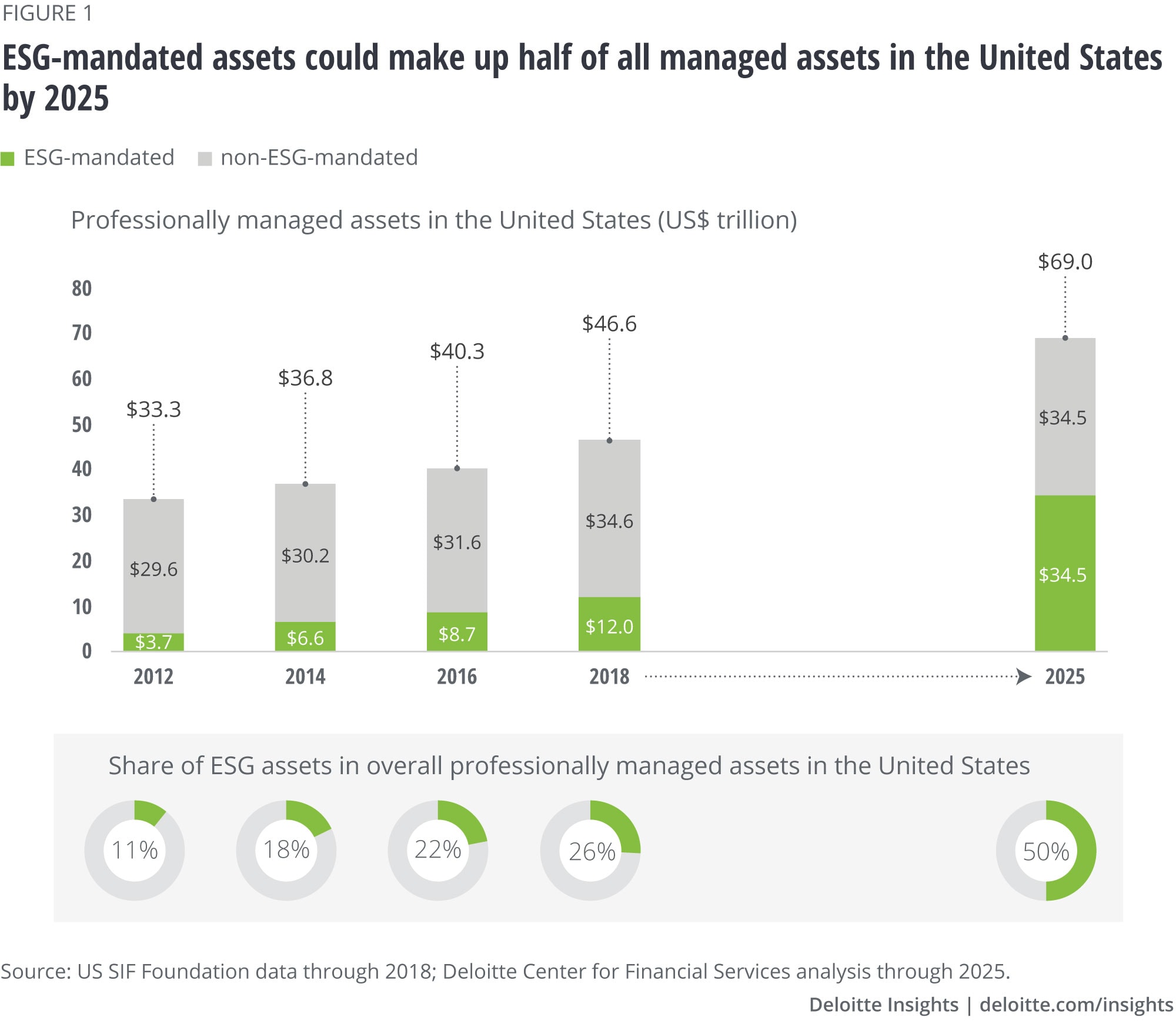

- ESG-mandated assets in the United States could grow almost three times as fast as non-ESG-mandated assets to comprise half of all professionally managed investments by 2025.

- An estimated 200 new funds in the United States with an ESG investment mandate are expected to launch over the next three years, more than doubling the activity from the previous three years.

- The use of artificial intelligence (AI) and alternative data is giving investment managers greater capabilities to uncover material ESG data and possibly achieve alpha.

- Investment management firms that act today to transition from siloed ESG product offerings toward enterprise-level implementation will likely capture a greater percentage of future ESG asset flows.

Learn more

Read the 2020 investment management outlook

Explore the Financial services collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Despite greater adoption within the investment community, the varying approaches to ESG incorporation by investment management firms, regulators, and investors suggest the full potential has yet to be realized. This will likely happen if investment managers routinely consider ESG metrics in all investment decisions.3 While this scenario seems unlikely in the short term, the Deloitte Center for Financial Services (DCFS) expects client demand to drive ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025. According to the DCFS, investment managers are likely to respond to this demand by potentially launching up to a record 200 new ESG funds by 2023, more than double the previous three years. Firms may capture a greater share of this growing allocation to ESG by utilizing emerging technologies for incorporating quality ESG data into the investment decision process, developing products with clear ESG objectives, and embracing an ESG-driven culture across the organization to gain credibility with investors.

As emerging technologies, such as AI, enable better-quality ESG data and the regulatory landscape becomes clearer, institutional, and retail investors are expected to increasingly demand that ESG factors be applied to a greater percentage of their portfolios. In this scenario, ESG assets should continue to grow at a 16 percent compound annual growth rate (CAGR), totaling almost US$35 trillion by 2025 (figure 1).

New ESG fund launches to accelerate as demand spreads across geographies and investor types

The largest amount of sustainable investing assets is in Europe, totaling US$14.1 trillion, followed by the United States with US$12 trillion.4 While Europeans may hold the highest amount of ESG-aligned assets, much of the world’s recent growth in this space may be attributed to investors’ increased interest in the United States. From 2014 to the beginning of 2018, assets under management with an ESG mandate held by retail and institutional investors grew at a four-year CAGR of 16 percent in the United States, compared with 6 percent in Europe.5

Flows into ESG funds in the United States picked up the pace in 2019. Barring a dramatic turnaround in the final few months of 2019, equity and bond ESG mutual funds and exchange traded funds (ETFs) are likely to achieve record inflows for the fourth straight year.6 Flows into sustainable funds reached US$8.9 billion through the first six months of 2019, compared to US$5.5 billion in all of 2018.7

The driving force behind ESG at investment management firms is evolving and leading to increased fund launch activity. Client demand from both retail and institutional investors is now the top reason reported by money managers to incorporate ESG factors into investment decisions.8 Client demand for ESG mandates has increased over the past three years, supporting the rise in investment management firms’ product portfolios.9 DCFS expects a record number of ESG fund launches over the next three years as client demand increases. Investment management firms may benefit from this rise because ESG funds tend toward active management, with 92 percent delivered through actively managed portfolios.10

The ESG investing regulatory landscape remains fluid globally

While many clients are becoming comfortable with incorporating ESG into their portfolios, there are some concerns about the transparency and quality of ESG disclosures. Some institutional investors petitioned the Securities and Exchange Commission (SEC) in the fall of 2018 for rules to harmonize ESG investments.11 Without a consistent framework governing ESG principles, investors are left to navigate through the seemingly ever-changing landscape of definitions. Providing consistent definitions for “environmental,” “social,” and “governance” will likely generate more efficiency in the ESG data value chain and drive more effective investor engagement—including between asset owners and asset managers.

Regulators have recently been demanding more depth and transparency from public firms regarding their environmental impact. Bringing uniformity to the ESG taxonomy seems to be the goal of both US and global regulators—although both appear to view ESG investing through different lenses.

Traditionally, US disclosure requirements from the SEC on shareholder resolution votes have provided investors with information concerning a company’s ESG practices. Investment managers have utilized these disclosure rules to influence a corporation’s adoption of ESG principles. Updating disclosure requirements to include language related to ESG has received attention from the Congress, with a proposal that requires companies to include ESG metrics in their annual SEC disclosures recently passing out of committee.12 The proposed bill calls for a committee of industry experts to recommend specific ESG metrics to the SEC for required disclosure.13

Apart from disclosure rules, an Executive Order released in April 2019 directed the Department of Labor, through its power granted under the Employee Retirement Income Security Act (ERISA), to review all pension fund investments to determine whether the funds’ implementation of ESG principles excluded energy companies and thereby hindered the return of plan assets.14 In other words, US-based institutional investors, such as pension funds subject to ERISA, must demonstrate that ESG investing benefited the long-term growth of plan assets.

In the European Union (EU), the European Securities and Markets Authority (ESMA) recently clarified questions surrounding ESG investments. ESMA proposed several additions to existing regulations that set out how financial market participants and financial advisors must integrate ESG risks and opportunities in their processes as part of their duty to act in the best interest of clients.15 The proposed amendments dictate that advisors must explain why sustainability factors were not considered as part of the process. The necessity of ESG integration in investment decisions might help explain why 97 percent of institutional investors in Europe are interested in ESG investments.16 EU regulators have also taken the lead in developing a common ESG taxonomy to facilitate sustainable growth financing and investing.17 The stricter standards now applied to sustainable investments may explain why the percentage of ESG assets to total assets shrank in Europe between 2014 and 2018 even as interest in sustainable investing increased.18

In Asia, regulators have determined that increasing disclosure requirements about sustainability practices can encourage foreign investment.19 In 2018, the Chinese government, in a bid to increase transparency and investment, announced that listed companies and bond issuers will be required to disclose ESG-related risks.20 Singapore was an early adopter of ESG-related standards in Southeastern Asia, which had a positive effect on the development of its capital markets. Investor confidence in the quality of ESG data was established in Singapore after sustainability reporting was mandated in 2016.21

Globally, while different regulators may have taken different approaches to ESG, similar outcomes for investors may be generated. Ultimately, all investors stand to benefit from greater transparency of ESG factors in the investment process. Frameworks such as those created by the Sustainability Accounting Standards Board (SASB) can help companies report material information related to ESG in a consistent manner. Some companies have recognized that the increased value placed on transparency by investors can benefit them and have begun reporting performance on relevant ESG factors in much more detail than would be otherwise required by regulators. For example, BP p.l.c. disclosed to investors that it is testing blockchain to track natural gas produced using more environmentally friendly methods throughout its supply chain.22 Whether it be from the regulators or companies themselves, the trend of greater ESG data disclosure is likely to only increase.

Emerging technologies create opportunities for alpha and ESG product innovation

Some investment professionals have expressed concern that alignment with ESG principles may hinder performance. However, a recent research study demonstrates that ESG metrics may in fact aid the quest for alpha. The study back tested ESG metrics for materiality and found that a strategy that solely based its investment decisions on these metrics outperformed a global composite of stocks, strengthening the case for an active ESG investment strategy.23 As a result, ESG may provide an opportunity to both meet client demand as well as improve returns.

While back-testing supports the case for finding alpha with ESG data, the challenge remains for investment managers to apply current ESG data to their investment process and client reporting. Much ESG data, such as carbon emissions, is provided inconsistently across companies and industries. Almost 80 percent of investment managers agree that they could improve client service by providing performance related to an investment’s ESG impact in addition to financial performance.24 However, only 44 percent of managers share ESG data with institutional clients and even less (30 percent) do so with retail clients.25

This conundrum of wanting to build material ESG data into the investment process and report ESG performance to clients yet finding it difficult to do so is largely due to the inconsistent availability and quality concerns of data. Global investment managers describe inconsistent data across assets as the biggest barrier to integrating ESG into investment processes.26 ESG disclosures tend to be produced by larger companies with more resources. Skewed disclosure may cause ESG investments to flow toward the largest companies even though smaller firms may have a similar or better impact regarding ESG issues.27 Investment management firms have recognized this disconnect, and as a result, spending on ESG content and indices is expected to rise from 2018 levels by 48 percent to US$745 million in 2020.28 Larger investment management firms have accelerated their spending on ESG data and tend to supplement it with proprietary metrics.29

With greater standardization of ESG measures progressing slowly, advanced data analytics has become an essential component of ESG analysis. Investment management firms can leverage AI, such as machine learning, as well as alternative data to develop ESG metrics for analyzing investments, making decisions, and informing investors. By aligning advanced analytics tools with sustainability metrics, investment managers may be able to move beyond simple screening methods to actively make the case for alpha (see sidebar, “Innovative firms provide solutions for integrating ESG data into investment analysis”).

Innovative firms provide solutions for integrating ESG data into investment analysis

TruValue Labs leverages AI to continuously monitor more than a million data points based on the SASB framework to track ESG-related performance over time.30 This approach allows investment managers to test the materiality of ESG data on their portfolios, which may help in future outperformance.

Another firm, Arabesque, built its tool around the core principles of the United Nations Global Compact to identify financially material ESG issues.31 Its platform provides a filter for screening out companies based on personal values and uses self-learning quantitative models and big data to assess the performance and sustainability of companies. A more complete set of ESG data enables investment managers to make more informed ESG investment decisions.

AI allows investment managers to uncover additional material data that may not have been disclosed by a company. One investment management firm uses an AI engine to scan unstructured data to identify material ESG data and then prioritize investments with low valuations for the highest expected return.32 This approach may help gain insight into, say, a company’s carbon emissions regardless of whether the company chooses to report them. The AI engine also searches unstructured data such as patent filings to identify companies that may be close to deploying cutting-edge low-carbon technologies. Identifying these types of investments before the companies tout their achievements may be the basis for higher future returns.

ESG ratings firms also utilize alternative data in their ratings processes. MSCI Inc. estimates that only 35 percent of the data inputs used to compile a company’s ESG rating come from voluntary company disclosures.33 In one case, the firm used satellite imagery to identify material risks to the environment and the safety of workers in a mining company’s operations to fill the gap between company disclosures and material ESG data metrics.34 As a result, the use of alternative data to identify risks and opportunities for ESG investments is expected to accelerate over the next year.

As ESG gains greater acceptance with portfolio managers, differentiation often becomes critical. Going beyond transparency into product customization may be the future of ESG product innovation. About 68 percent of investment managers believe that much of the growth in ESG investments will be fueled by product customization.35

Yet, as mentioned previously, while ESG is a priority for institutional investors, only 23 percent have integrated ESG principles throughout their organizations and 30 percent have separate ESG and investment teams.36 This presents a significant opportunity for investment managers to deliver customized solutions for clients who want ESG to play a larger role in their portfolios but lack an implementation road map. DWS Group and Blackrock were able to provide such guidance to a large European pension fund in 2019. By each tailoring a unique ESG strategy based on the pension fund’s philosophy to favor companies with strong corporate governance and to avoid certain industries, the two investment management firms were able to bring two new sustainable ETFs to market, each garnering more than US$800 million inflows on their first trading day.37 The success of these launches highlights the acceleration of interest in US retail ESG funds by a diverse set of investors.

Looking deeper at customization, invest-tech firms Open Invest Co. and Ethic Inc. have developed platforms that allow investors to choose among environmental, social, or governance themes.38 Investors can customize their portfolios by adding or removing specific companies through direct indexing.39 Some traditional investment management firms have taken notice and are trying to increase their ESG product offerings by developing their own platforms. John Hancock Personal Financial Services designed a platform known as COIN, which is accessible from any device and provides investors with the opportunity to directly own shares of companies that align with UN Sustainable Development Goals.40 The COIN platform may strengthen relationships by putting updates on the portfolio’s ESG performance at the client’s fingertips.

Emerging technologies may provide investment managers the tools to both improve client experience and aid in the quest for alpha. With the forecasted rise in ESG data spending this year, the number of investment management firms that provide their clients ESG performance data is likely to increase. The amount of ESG data is expanding as companies increase disclosures and ESG rating firms incorporate new data points into their metrics. It has become more important for investment management firms to develop their own capabilities for gathering and managing quality data.

The need for credibility expected to lead the next wave of ESG-principled investing

There are likely to be winners and losers in the competition for ESG asset allocations. It could be crucial for investment management firms to recognize the importance of ESG and devote more resources to ESG product development to not fall behind peers. The overwhelming majority (89 percent) of investment managers believe sustainable investing will not dissipate, while the same number indicate their firms will devote more resources to this area in the next two years.41 Differentiation becomes much more difficult with many firms now preparing to expand ESG investment options.

ESG is a lens into effective risk management and an avenue to optimize performance. It has to be credibly embedded into the investment management business model, all the way through to attracting talent.—Kristen Sullivan, Americas region Sustainability Services leader, Deloitte & Touche LLP

Success could flow to the investment management firms that can align their brand with ESG principles. The most effective method to gain traction may reside in the level of credibility the investment management firm has achieved from investors as opposed to its menu of ESG products. Today, consumers often reward companies that appropriately match their brand to their actions. An investment management firm may earn credibility with ESG-minded investors by fully embracing the influence of ESG issues across its organization and demonstrating its commitment by detailing actions taken to align with these principles. Investment managers may find it difficult to effectively compete for capital allocations without a client-centric ESG strategy that encompasses credible ESG disclosure practices.

Capitalizing on a socially responsible future

The recent uptick in investor demand for ESG suggests investment management firms should take action today to maximize the ESG opportunity. The future wave of growth in ESG investing will likely not be driven by screening out “sin” stocks but could instead be fueled by managers using high-quality ESG data to increase the opportunity for alpha. A burgeoning ecosystem of customized ESG products and platforms presents investment managers with opportunities to further their value proposition to clients.

Investment management firms can take action today to enhance their likelihood of launching a successful ESG program:

- Understand the intermediary and end-investor expectations for ESG mandates

- Develop a product portfolio that meets client expectations

- Communicate and educate investors about the social benefits of the ESG program

- Adapt ESG principles throughout their firms to gain credibility as an ESG product provider

Investors are still going to consider performance when selecting an investment manager. However, investment management firms may find that ESG metrics improve the opportunity to find alpha as well as attract new clients. Having sustainable products on the shelf might be a necessary first step, but long-term success will likely reside in the ability to demonstrate to investors that the firm has holistically adopted sustainable practices. The ever-expanding expectations of investors and regulators will likely require a proactive approach. Investment management firms should identify any gaps by reexamining their processes through an ESG-principled lens, with an eye on what matters most to today’s investors. By 2025, half of all professionally managed assets could fall under an ESG mandate. For an investment manager to capture a greater share of growth in assets under management, credibility with investors will likely be critical.

© 2021. See Terms of Use for more information.

More from the Financial services collection

-

Fair valuation pricing survey, 17th edition, executive summary Article5 years ago

-

2025 commercial real estate outlook Article7 months ago

-

Modernizing insurance product development Article5 years ago