Within reach? Achieving gender equity in financial services leadership

Alison Rogish United States

Alison Rogish United States Neda Shemluck United States

Neda Shemluck United States Patty Danielecki United States

Patty Danielecki United States Tiffany Ramsay United States

Tiffany Ramsay United States

Despite their efforts, many financial firms have yet to achieve a greater representation of women leaders. This report offers a roadmap for cultivating more female executives to lead the industry forward.

Key messages

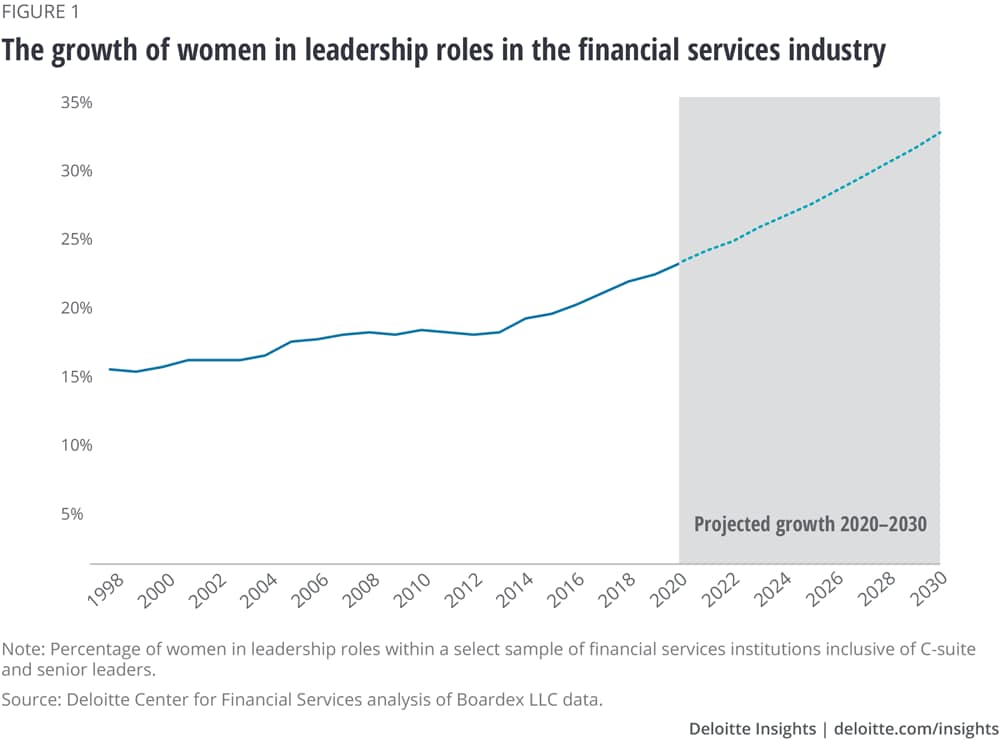

- In 2019, the proportion of women in leadership roles within financial services firms is 21.9 percent, which is projected to grow to 31 percent by 2030—still below parity.

- At an organizational level, our analysis reflects that across financial services organizations, for each additional woman added to the C-suite, the number of women in senior leadership roles rose threefold.

- Among the key challenges that could impact succession, the percentage of women in senior leadership roles has not kept pace with those in the C-suite, and this gap has widened since 2010.

- Strategies for improving leadership outcomes for women should be multifaceted and inclusive.

Foreword by Amanda Pullinger, CEO of 100 Women in Finance

The Deloitte report in your hands, Within reach?, presents something rare—long-duration research coupled with practical tactics to more fully realize one of the financial services industry’s best opportunities, namely, cultivating larger numbers of female executives to lead the industry forward.

This report contains some positive news. We’re encouraged by the fact that women are now the majority of financial services industry employees and that the percentage of female executives is expected to grow from 22 percent today to 31 percent by 2030, but recognize there is more work to be done to realize more than just incremental growth in the next decade. We should take a moment to reflect on factors that most certainly contributed to the growth so far—intentional recruitment, innovation in retention, supportive reentry, as well as mentoring, sponsorship, and strong peer networks. The industry deserves credit for important initiatives toward improved gender diversity that are now paying off. Today, more women enjoy longer, more satisfying, and more senior-level careers in financial services, and the industry is stronger, in part, for their collective presence and contributions.

Learn more

Explore the full Within reach? collection

This article is featured in Deloitte Review, issue 27

Download the issue

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Progress, of course, is never as swift or evenly distributed as we’d wish to see. Representation equity in leading lines of business and in risk-taking roles often lags meaningfully across financial services. We note that women still manage only single-digit percentages of client assets, this being an obvious next area of opportunity for the industry’s use of women’s abundant skills. As fiduciaries, our paramount concern should be bringing forward this pool of talent for immediate client benefit.

100 Women in Finance, along with our industry colleagues, such as Deloitte, is working to address this opportunity. We propose that the finance community should think about cultivating female talent much earlier, among precareer young women who are just starting to form career ambitions and those entering the workforce. As we work to advance progress for women now working within the financial sector, we should direct equal attention to inspiring the next generation of young women to favorably view our industry, and to evolve the workplace to be worthy of their career selection.

We are grateful for Deloitte’s enduring work to explore the past, present, and future status of women in the financial services industry, as well as its diligence in identifying potential levers for continued progress. We agree with Deloitte that momentum likely depends upon a number of factors, including transparency, visibility of female leaders, support from men, and strong peer networks for women.

We encourage all industry leaders to incorporate Deloitte’s recommendations into their leadership praxis, while maintaining confidence that Deloitte’s vision for gender equity is, indeed, within reach.

— Amanda Pullinger, CEO, 100 Women in Finance

“As we work to advance progress for women now working within the financial sector, we should direct equal attention to inspiring the next generation of young women.”—Amanda Pullinger

CEO, 100 Women in Finance

A call to action

The case for organizational diversity has never been more convincing. Diversity within firms has been shown to drive innovation1 and increase productivity.2 Gender diversity, in particular at the leadership level, has even been linked to boosts in profitability.3 It’s no wonder, then, that 34 percent of CEOs recently ranked diversity and other societal impact indicators as a key measure of success when evaluating firm performance.4

Our findings suggest an array of opportunities for financial services institutions to retain, develop, and grow the share of women in leadership.

Despite this, achieving a greater share of women in leadership roles remains a challenge for many firms. The numbers alone should spark a call to action: While women and men are nearly equally reflected in the US labor force,5 the representation of women dwindles the higher up they rise in leadership ranks. Women account for a mere 5.4 percent of CEOs at S&P 500 companies.6 Unfortunately, while many firms have instituted diversity and inclusion initiatives in response to gender disparities and other diversity issues, many traditional programs have not led to a significant acceleration in the share of women in leadership.7

Organizations should consider rethinking their strategies to improve leadership outcomes for women. One of the key ways they can do that is by making intentional efforts specifically aligned to growing the share of women in leadership roles. Only then might greater gender diversity in leadership be within reach. Notably, these trends are playing out across industries, and financial services firms are not immune.

Our Within Reach? series will explore topics related to women in financial services. While there are multiple dimensions to diversity, this inaugural report is focused on gender equity in leadership. We analyzed more than 100 large US financial services institutions to assess how women have fared in leadership roles since 1998. To complement our analysis, we impaneled a virtual forum of executive women leaders, which we called “The future of women leaders in the financial services industry” (see sidebar, “About the project”), to obtain their insights on the path to leadership. They shared their inputs on the programs and networks they find most valuable, the leadership skills and styles needed to meet the future business environment’s complex realities, and their experiences on what, and who, has motivated and inspired them throughout their careers. Our findings suggest an array of opportunities for financial services institutions to retain, develop, and grow the share of women in leadership.

The business case for gender equity

Tomorrow’s business environment will continue to be full of change. In addition to societal forces, firms must also contend with technology’s impact on business models and persistent uncertainties within the economic environment.8 As a result, organizations are imploring their leaders to keep up with this changing landscape and guide them through uncharted territory.9 Over 80 percent of financial services institutions surveyed in Deloitte’s Global Human Capital Trends report, however, believe their organization is only somewhat effective, or not effective at all, in identifying and developing leaders that can keep up with these evolving challenges.10

What capabilities might tomorrow’s most effective leaders in financial services possess to navigate these challenges? The overwhelming majority of financial firms listed relationship-oriented skills that are often undervalued—like leading through complexity and ambiguity, leading through influence, and managing remotely—as top leadership requirements in the future.

When asked to describe the type of skills future leaders would need, tellingly, the responses by our panel of financial executives aligned with the future leadership requirements of those financial services institutions surveyed. The panelists almost unanimously championed the importance of relationship-oriented skills. Confronted with the shifting nature of work11 and increasingly remote or siloed workforces, the panelists argued that thriving leaders will be strong communicators and connectors who can unite and motivate people to action quickly.

With this in mind, the gender imbalance in leadership at the top in financial services could be a missed opportunity for many institutions. Why? A recent Harvard study12 revealed that women outscore men in 17 of 19 leadership capabilities, many of which were noted in the survey as requirements for leading in the future. Some of the areas where women were perceived to excel include taking initiative, building relationships, collaboration and teamwork, leadership speed, powerful and prolific communication, and innovation.

The panelists also highlighted the importance of continuous learning, which arguably must become lifelong13 in the future business environment, as the nature of work continues to evolve and competition increases. Once again, respondents from the Harvard study rated women higher than men in practicing self-development.14

With many financial services institutions citing challenges with future-ready leadership, it might behoove those that want to remain competitive in the face of change to take a closer look at the untapped talent of women within their ranks. Women are just as capable to lead financial institutions into the future.

“Too often, inclusion and diversity are used synonymously. Inclusion is a collaborative, supportive, and respectful environment that increases the participation and contribution of all employees. Inclusion efforts make it easier for companies to become more diverse. Finding similar interests, experiences, goals, and values draws people together, focusing on their similarities and not their differences. Inclusion efforts give employees a sense of belonging. Formal inclusion efforts can foster individuals to thrive in an organization, allowing them to contribute to their full potential. Companies that are focused on inclusion can help their organization retain talent, grow new markets, be innovative, create a more positive work environment, and foster good community relations and customer satisfaction.”—Panelist, “The future of women leaders in the financial services industry”

Not enough progress: What our data revealed

It is fair and important to acknowledge the progress that has been made over the past two decades. The financial services industry has witnessed a slow but steady rise in the proportion of women serving in leadership positions. The efforts that financial services institutions have made to attract and retain women for these positions can be clearly seen in this rise in leadership. As mentioned earlier, more institutions in recent years have begun to prioritize diversity, partly due to growing societal pressures that heavily emphasize diversity.15 Some customers, for instance, have begun to demand diversity in leadership from the companies that serve them.16 Government requirements to disclose diversity metrics and policies are also already underway in some financial segments.17

However, more work should be done. Though women make up more than 50 percent of the financial services industry’s US workforce,18 they account for just under 22 percent of leadership roles, according to our analysis (figure 1).

The proportion of women in financial services leadership could reach 31 percent in 2030—an improvement, but still well below parity. We might not see an equal number of women in overall US leadership roles until at least 2085.

Assuming growth continues at the slightly greater rate observed since 2013, the proportion of women in financial services leadership could reach only 31 percent in 2030 (figure 1)—an improvement, but still well below equity. This forecast is in line with some predictions that estimate we might not see an equal number of women and men in overall US leadership roles until at least 2085.19

It’s important to note, however, that much of the research widely available on women in leadership does not distinguish between the types of roles within leadership and how women are faring within each level. Someone in the C-suite, for example, may progress very differently than someone who is a senior vice president. For firms to further address gender diversity in their top ranks, understanding the nuances within leadership could be an essential factor to consider. Accordingly, we divided the data, based on reported titles, into two major categories: C-suite, which includes all C-titled roles at the corporate leadership level, and senior leadership, which includes senior-level roles that are typically one to three levels below the C-suite. (Figure 2).

Emerging leadership

Closer examination of C-suite titles also revealed a subset of roles that have mostly emerged within the last decade (for example, chief data officer, chief sustainability officer, chief inclusion officer, chief diversity officer, and chief digital officer). Women account for approximately one-third of these emerging leadership roles. We’ll explore this subset, and the other leadership categories, in more detail in future reports of our Within Reach? series.

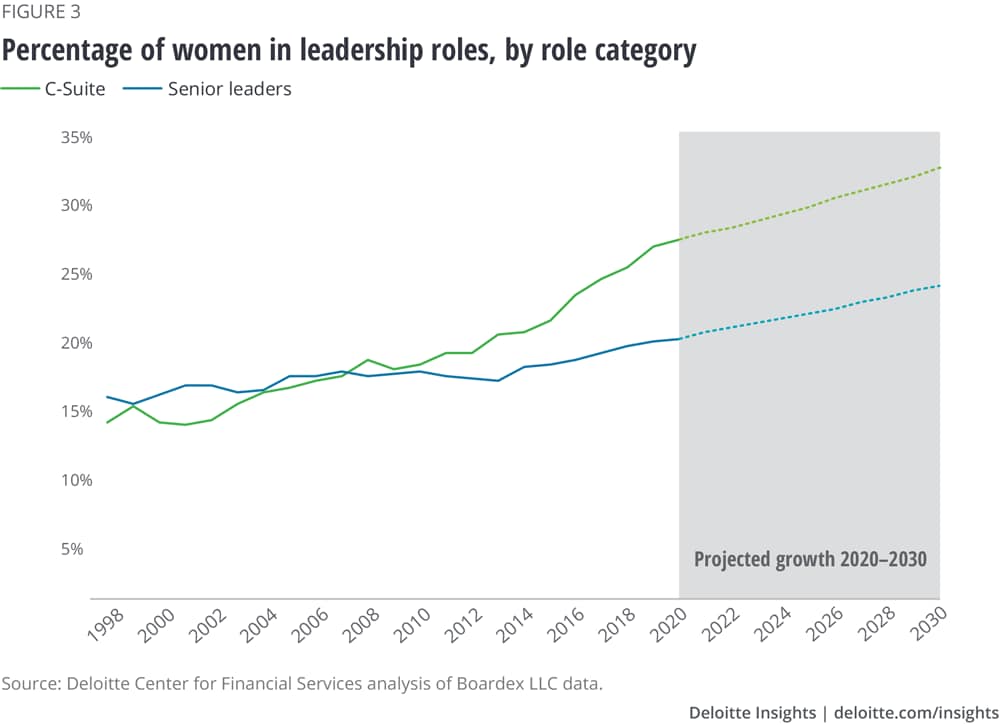

When segmenting the data into C-suite and senior leadership categories, another picture emerges (figure 3). The percentage of women in senior leadership has not kept pace with women in the C-suite. The gap has continued to widen since 2010 and reached 7.6 percentage points in mid-2019. If nothing else changes and growth in both segments continues at the pace observed since 2010, when the percentage of each group was relatively equal, the share of women in the C-suite could reach 34.1 percent in 2030 compared with just 24.8 percent in senior leadership. This suggests that institutions might need to place extra emphasis on improving the outcomes for women in the latter category. Without more deliberate effort to add more women to senior leadership roles, institutions could face a talent gap when searching for women with the right experience for top positions in the near future.

Tapping into talent: Strategies to help achieve gender equity

Given these findings, what can financial services institutions do to fully unlock the potential of women in their pipeline? How might they accelerate the growth of women in leadership roles? Strategies for improving leadership outcomes for women should be multifaceted and inclusive across leadership levels. Below are some recommended areas of focus.

Understand and embrace the multiplier effect

Despite the disparity in overall numbers, financial institutions have an opportunity to shift the balance at an organizational level. We analyzed the data of our representative institutions to determine if having a greater number of women in the C-suite creates a positive, or multiplier, effect on the number of women in senior leadership. Our analysis revealed a threefold increase in senior leadership for each additional woman added to the C-suite. This finding, along with Deloitte’s Women in the boardroom, 5th edition study, which found that “organizations with women in the top leadership positions have almost double the number of board seats held by women,”20 suggests that having a greater share of women at the most senior leadership levels creates a tangible ripple effect across the organization.

It also gives credence to the familiar and powerful refrain, “If you see it, you can be it,” which many on our panel of executive women echoed. Knowing it can be done, as well as seeing and experiencing diverse representation at the highest levels of leadership, can motivate women as they climb the ranks. Additionally, women at the top may be positioned to advocate for other women rising through the ranks. They also represent an attainable ideal for the next generation of women who, upon entering the workforce, may be weighing recruitment options.

“She did not mentor me. She did not sponsor me. But she absolutely inspired me. Because she was there. It was like seeing someone break the four-minute mile for the first time and forever after just knowing that it could be done.”—Panel facilitator, “The future of women leaders in the financial services industry”

Improve transparency and accountability

Actionable, measurable, and transparent diversity policies signal to employees, clients, and the broader community that attracting, retaining, and advancing women are priorities.

Our panelists noted that the diversity of their clients is rapidly changing—faster than their own firms, in some cases. Consequently, many clients view diversity in leadership as a requirement and review diversity policies and practices of the businesses that serve them before engagement. Lack of transparency or falling short of diversity expectations could lead to missed business opportunities.

Transparency alone may not be enough, though.

New requirements at the state and federal level are also prompting institutions to disclose diversity initiatives. California was the first state to legally mandate public companies, with principal offices in the state, to have at least one female board member by the end of 2019.21 The law also requires incremental increases by the end of 2021. Four other states are currently considering similar measures.22 At the federal level, the House Committee on Financial Services’s Subcommittee on Diversity and Inclusion, the first of its kind in Congress, plans to address the diversity levels, policies, and practices of the country’s largest banks.23

Companies still grappling with transparency and accountability can find examples of positive outcomes both within and outside the financial services industry. Westpac Banking Group, for instance, reached gender parity in its leadership ranks in 2017, after publicly declaring its goal and openly detailing its path to achieve it.24 Salesforce, another example, publicly identified gender pay equality as a core value and actively worked to even the disparity.25

“Some of our line-of-business executives have tracked all categories of diversity at their leadership levels with great outcomes.”—Panelist, “The future of women leaders in the financial services industry”

Invest in programs that support women reentering the workforce

Women are more likely than men to pause their careers to address family needs, pursue additional education, or for any number of other reasons.26 Doing so can have lasting consequences when they choose to restart. Those within our panel who restarted their careers after a significant pause noted that they did so by relying on their personal networks or engineering their own paths back, which indicates there is still much progress to be made to support restarts.

In 2008, Goldman Sachs launched its Returnship program, the first in the financial services industry,27 and many institutions have since developed similar initiatives. With more than 3 million women estimated to be seeking restart opportunities,28 restart efforts are making their way into inclusion and experienced hire recruiting programs. Several consultancies focused on restarts, such as Après, iRelaunch, and reacHIRE, have also launched in the last few years. These companies and others help large financial services institutions and other organizations develop restart channels within their inclusion programs and help identify candidates. They also work directly with women who are ready to restart, offering services to prepare them for the path back, as well as matching them to opportunities.

Still, more progress should be made. Of the 230 global firms in Bloomberg’s 2019 Gender-Equality Index, only about one-third reported having some form of a restart program for women in place.29 Creating or expanding existing programs to support women who are pursuing a restart could be a differentiator within diversity program planning and lead to better leadership outcomes for women.

“Networking has strengthened my business relationships. I have developed a group of diverse professionals that I can now reach out to for support and guidance on a professional as well as personal level.”—Panelist, “The future of women leaders in the financial services industry”

Support and enable mentorship, sponsorship, and peer networks

Institutions should not underestimate the power of support and the value of networks in advancing women. Both mentorship and sponsorship, for instance, have often been instrumental to employee retention, higher employee success rates, and promotion readiness.30 Mentors, who lend career advice, might be more critical earlier in a woman’s career, the panelists said. However, as she moves into more senior-level positions, having a sponsor, or someone with the personal capital to advocate for her advancement, typically takes on greater importance.

Sponsorship has also been linked to having a measurable influence on an employee’s satisfaction related to their career progression.31 Most panelists highlighted, however, that finding a sponsor throughout their careers was difficult. Thus, given how sponsorship can directly and positively impact the advancement of women, current financial leaders should reassess their existing efforts as sponsors and then look for ways to improve their support—such as coaching, strategizing, providing high-visibility opportunities, and making introductions to other leaders.32

Notably, our panelists also emphasized that greater gender diversity in leadership will require support from all leaders, including men. They asserted that the gender of sponsors wasn’t as important as the sponsor’s commitment to help advancement. Along with women, men can be allies and serve as champions of change as well.

Peer networks are also important and can impact leadership outcomes. Networks, both internal and external, give access to new ideas, fresh perspectives, and opportunities. Internal networks can connect women across all levels of the organization and provide an open forum for dialogue on the common issues they are facing and how to address them. External networks, meanwhile, yield broader perspectives and connections for women both within their industry segments and beyond them. A recent study found that women who secured high-ranking leadership positions were most likely to be well-connected within their peer network and have strong ties to other connected women.33 With this in mind, institutions can provide tools and guidance for how to build, access, and make the most of these valuable channels.

Reaching higher

The first Women’s Rights Convention in the United States was held in 1848, during which Elizabeth Cady Stanton released the Declaration of Sentiments. Modeled after the US Declaration of Independence, the document not only called for women’s suffrage, but also for the opportunity for “one portion of the family of man” to participate in “profitable employments.” It took 70 more years of campaigns and protests until the US Senate passed the 19th amendment, giving women the right to vote.34

Even today, much more can be done to create opportunities for women to participate at the highest levels of the US financial services industry. At the current pace, the share of women leaders is expected to reach almost one-third of total leadership roles by 2030. That’s good progress. But if financial institutions reach higher to adopt the ideas set forth in this report, with the support of both women and men in the corner office, many could show even greater progress in the coming years. Achieving gender equity in leadership roles seems the right thing to do and also makes good business sense. This is a call to action for all leaders to help make sure it doesn’t take another 70 years to get there.

About the project

The insights in this report are based in part on a crowdsourced exercise (“panel”) by Currnt on behalf of the Deloitte Center for Financial Services. The project, fielded over four days during July 2019, involved 20 senior-level women leaders representing banking, insurance, investment management, and commercial real estate firms. The project was designed to augment the quantitative analysis portion of the project by exploring the leaders’ insights, including how people and experiences inspire and shape leaders; the path to leadership for women; sponsorship, mentorship and inclusion programs; and perceptions about the attributes and skills required of future leaders.

The quantitative analyses reported in the “Not enough progress: What our data revealed” and “Understand and embrace the multiplier effect” sections are based on the Deloitte Center for Financial Services’ proprietary analysis and custom segmentation of 107 financial services institutions’ data from BoardEx. The 107 institutions represent the top 25 each in banking, investment management, insurance, and commercial real estate firms by asset size, in addition to select payments provider firms included in the banking segment. A cross-sectional association analysis was conducted at the organizational level to determine the multiplier effect. Where used throughout the report, “financial services” denotes the previously listed industry segments.

More from the Financial services collection

-

2025 commercial real estate outlook Article1 month ago

-

Fair valuation pricing survey, 17th edition, executive summary Article5 years ago

-

Executing the open banking strategy in the United States Article5 years ago

-

Artful investment Article5 years ago

-

Reshaping the cybersecurity landscape Article4 years ago

-

AI leaders in financial services Article5 years ago