The future of virtual health Executives see industrywide investments on the horizon

19 minute read

01 May 2020

As virtual health gains momentum, it is becoming a core component in helping consumers improve or maintain their well-being, as well as playing an increasingly important role in the diagnosis and treatment of illness.

Executive summary

By the year 2040, empowered consumers, radically interoperable data, and scientific and technological advances will transform the health care system we know today. Virtual health is a key component of our future of health vision. Virtual health has the capacity to inform, personalize, accelerate, and augment prevention and care.

Learn more

Explore the health care collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

In November 2019-January 2020, the Deloitte Center for Health Solutions collaborated with the ATA (American Telemedicine Association), to survey and interview health care executives and find out how virtual health is likely to shape the health care landscape over the next two decades. Executives were from hospitals and health systems, health plans, medical device and technology companies, and virtual-health vendors that are members or partners of the ATA. Their areas of expertise included digital health, strategy, innovation and technology, business development, and medicine.

We found:

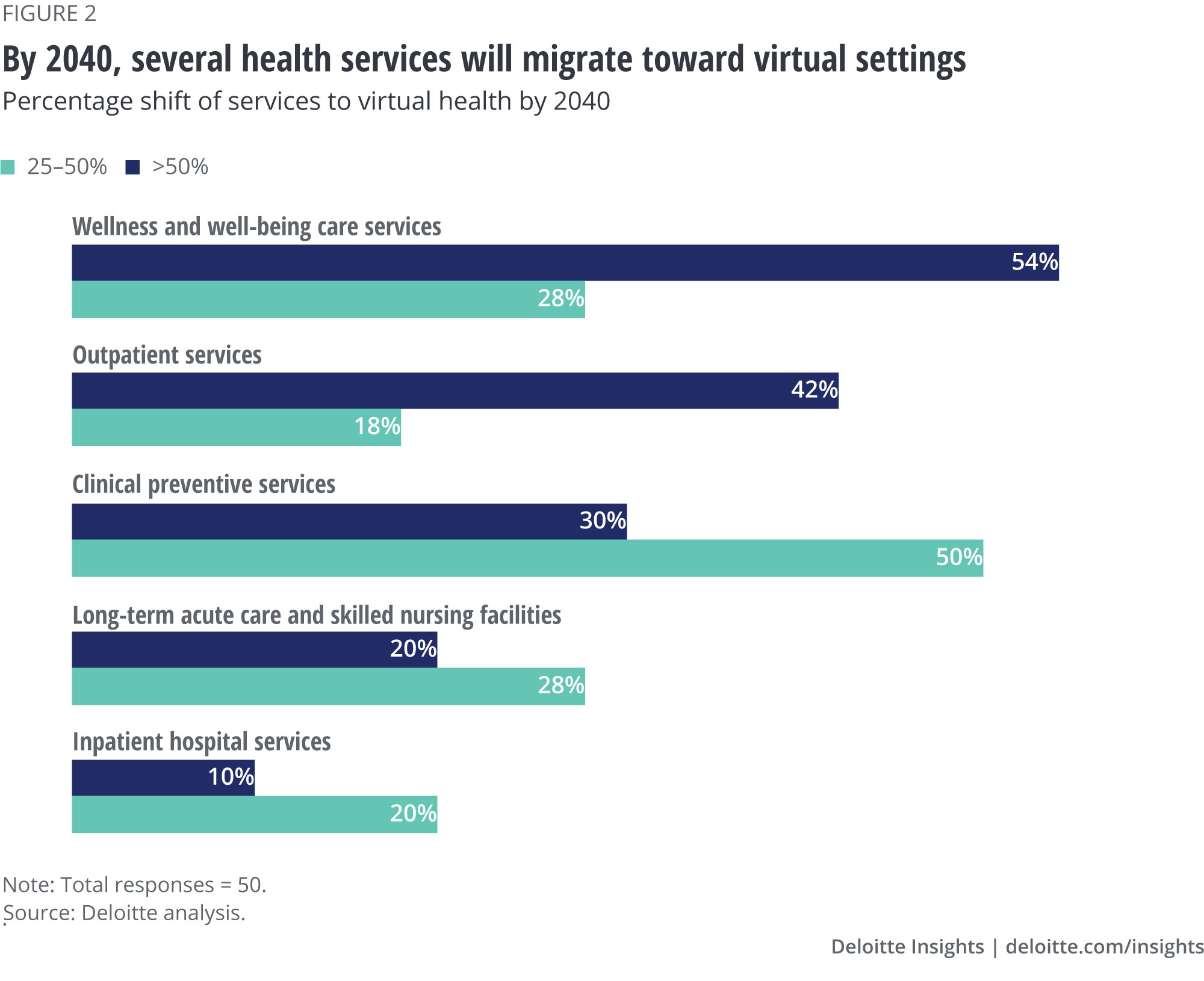

- Fifty percent of executives thought at least a quarter of all outpatient care, preventive care, long-term care, and well-being services would move to virtual delivery by 2040.

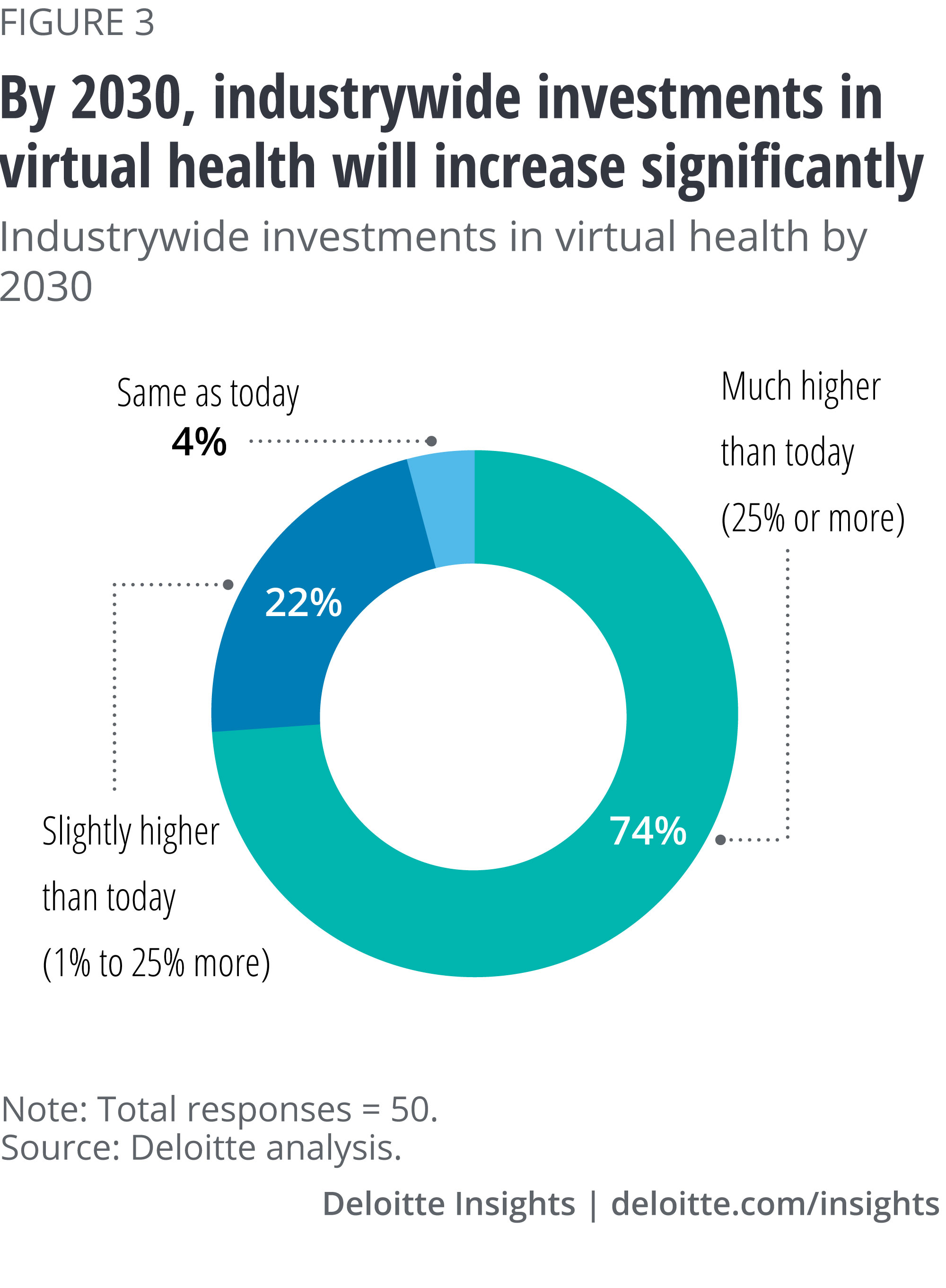

- Three out of four executives predicted that industrywide investments in virtual health would be significantly higher (more than 25 percent) over the next decade than today.

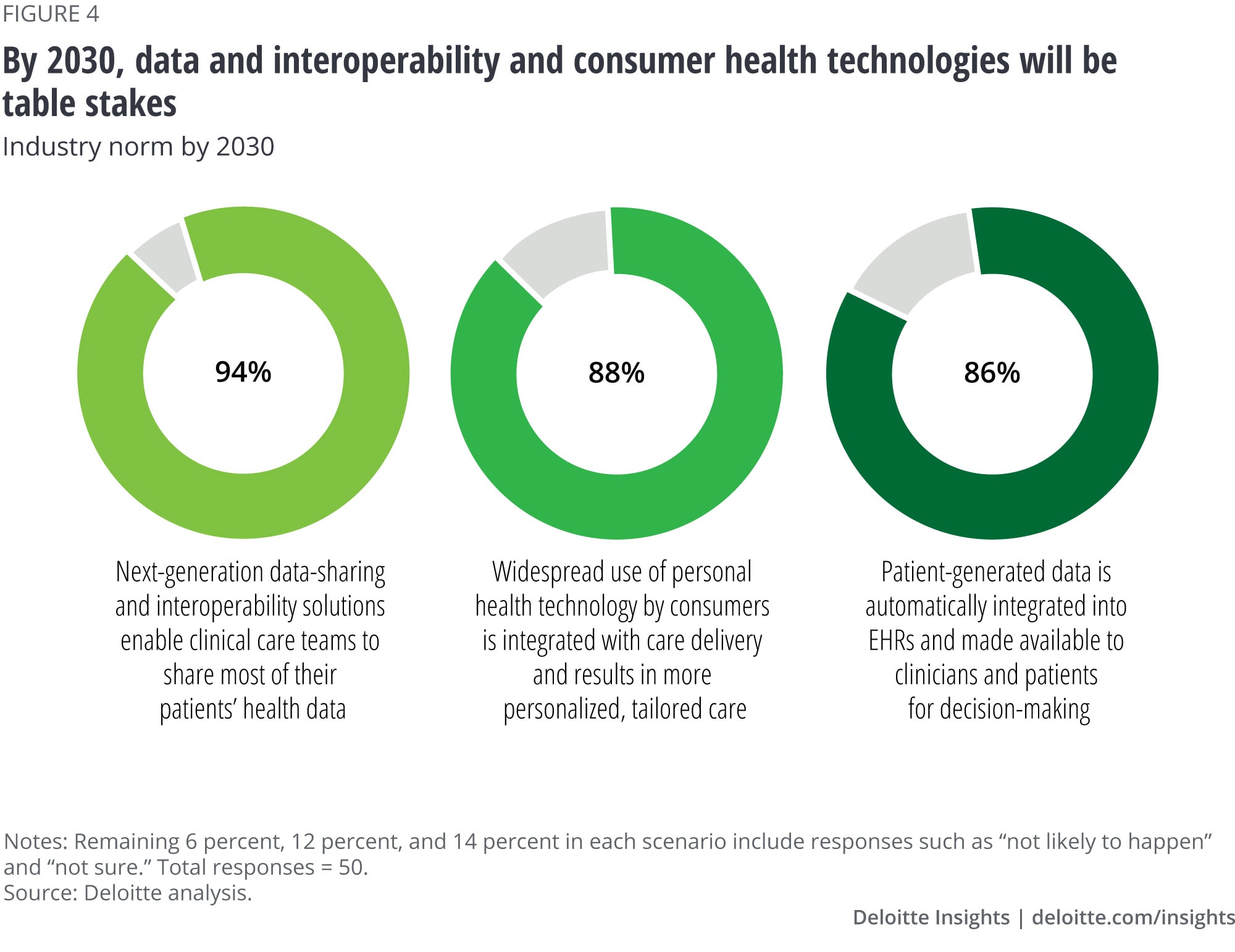

- Nearly all respondents (94 percent) expect that next-generation data and interoperability solutions will enable widespread data sharing; and 88 percent of executives predicted wearable devices will be integrated with care delivery, resulting in a more tailored, personalized virtual health experience for consumers.

- About two-thirds of surveyed executives thought that removing regulatory and payment barriers would accelerate virtual health adoption. Only 35 percent thought that new entrants would accelerate virtual health.

- Executives agreed that addressing the challenges around the drivers of health (also known as social determinants) would not be easy. Almost 75 percent of respondents expect the challenges related to the drivers of health will remain in the coming decades, regardless of a virtual-first system that could expand access to care.

Our research shows that virtual health is changing the industry landscape, and traditional health care business models will likely need to evolve to stay competitive and win over consumers and patients.

Virtual health has started to transform the health care system

Virtual health gives health stakeholders and patients the ability to share data and content and perform personalized interactions remotely. This can allow for convenient, high-quality access to care that can enhance provider-patient interactions. In addition, virtual health-facilitated robotics and automation can help relieve clinicians of mundane, administrative, or routine tasks, giving them more opportunities to practice at the top of their license. For example, virtual assistants can handle appointment scheduling, prescription orders, and transcribing clinician notes automatically into the electronic medical record so that clinicians can spend more time treating and engaging in face-to-face interactions with their patients.

In our research, we defined virtual health as continuous, connected care delivered via digital and telecommunication technologies. It includes video visits and telemedicine, remote monitoring, asynchronous communication, medication adherence, and clinician or provider-facing solutions, such as virtual consults and virtual second opinions. Virtual health has the potential to touch the so-called four Cs that are critical to the success of consumer well-being and care delivery. It can drive:

- Continuity—agnostic of care setting (home, outpatient, or inpatient)

- Connectivity—encompassing asynchronous and synchronous modalities

- Coordination—linking all stakeholders (consumers to providers; providers to providers; consumers to life sciences companies, and more)

- Care continuum—from well-being to acute to postacute care

We think virtual health will be the near-default option for well-being and care in the future of health. But even today, virtual health has shown value in improving well-being and care delivery, along with better patient engagement and experience (figure 1).

The Deloitte Center for Health Solutions surveyed 50 executives, and conducted 12 executive interviews, to find out how virtual health might be used in the future of health. (See the sidebar, “Research methodology.”)

Research methodology

The Deloitte Center for Health Solutions collaborated with the ATA to survey 50 health care executives who have experience in strategy, technology/innovation, and business-development from health systems, health plans, medical device and technology companies, and virtual health vendors. The survey focused on understanding the impact of virtual health in the medium to long term (10–20 years), and investments required.

In addition, we interviewed 12 executives, including three physician executives, from these same settings. The interviews went deeper into the state of the industry today and explored how these organizations are developing their strategies to prepare for the future of virtual health. Please note that we conducted this research right before COVID-19 began impacting the US (see sidebar).

Key findings from the research

By 2040, a major portion of care, prevention, and well-being services will shift to virtual settings

Health care delivery and health management will look significantly different by 2040, according to the executives we interviewed and surveyed. About half of the executives we surveyed thought at least a quarter of all outpatient care, preventive care, long-term care, and well-being services would move to virtual delivery over the next two decades. Even some inpatient care, which now takes place in physical, brick-and-mortar settings, will likely shift to virtual settings. About one-third of surveyed executives thought at least 25 percent of all inpatient care will be delivered virtually (figure 2).

We are seeing organizations design virtual services across every part of the care delivery spectrum:

- Online programs are helping patients with prediabetes delay or prevent the onset of the disease.

- For patients who have complex chronic conditions, remote outpatient monitoring allows physicians to connect with them in their homes to provide ongoing evaluations, potentially reducing hospital admissions and increasing patient satisfaction and treatment adherence.

- Telehealth and artificial intelligence (AI) capabilities can enable remote imaging. Physicians can securely view patient images and reports, facilitating practitioner collaboration and quicker diagnosis. In some cases, AI is detecting and highlighting suspected abnormalities to aid diagnosis.

Interviewed executives agreed that in the future, the accelerated adoption of virtual health will help expedite this shift toward well-being, with consumers opting for care at home, in outpatient or retail settings, or even on the go via mobile devices. With the proliferation of technologies such as AI, we can picture a world where you wake up in the morning and your personalized smart device tells you exactly which supplements to take based on your nutrition profile, environment, activity, and stress levels over the past week. The device might know when you are coming down with the flu before symptoms appear. It might know when you need more sleep, or even predict risks of a mental health disorder, based on changes in speech patterns.

Over the last several years, hospital inpatient revenue has been shrinking as more care shifts to outpatient settings, according to a recent Deloitte analysis of hospital revenue trends.2 In the future, we expect some outpatient care will shift to virtual settings. To prepare, health care organizations should think about how these industry trends might line up with their investments in the coming years.

Virtual health is playing an increasingly important role in COVID-19 response: Could this be a tipping point?

We conducted our research well before COVID-19 began to cause major disruptions in the United States, but some of the findings are pertinent to the future of virtual health:

- Digital tools are enabling early detection: A key challenge in the United States and elsewhere has been the ability to quickly identify and test people who might have been exposed to the virus. China quickly deployed an app and other sensors that monitors body temperatures.

- Virtual visits are helping to support and triage patients: Early lessons are showing that virtual health can support the demand for medical support when it is advisable for most people to stay at home. Many physicians’ offices are having people conduct virtual visits to help ensure scarce inpatient and intensive care beds, staff, supplies, and other resources are available for those who need them most. For people who don’t need to leave their homes because they are having medical issues or appointments unrelated to the virus, they can protect themselves and others in their communities and still get the care they need. Even those with the virus—if their symptoms are mild—can most often be treated at home. Although the technology to conduct virtual doctor visits has existed for decades, as we demonstrate in our research, some regulatory and financial barriers have hindered adoption. In March 2020, CMS released guidelines to loosen some of the restrictions around telehealth, demonstrating that regulators are recognizing the importance of virtual health for access. Could COVID-19 be a tipping point for widespread adoption of virtual health? We think real life examples show it is possible.

- Convenient, accessible care, and home-based testing: Drive-through testing labs are helping local communities get a handle on the spread of contagion while enabling people to avoid hospitals and close contact with others. We could also see more widespread home-based testing in the future. Today, consumers already have the ability to test themselves for a wide range of potential health problems, from strep throat to urinary tract infections. In the future, home-based tests for a new virus might be developed quickly and distributed to people or communities at risk.

We know that health systems and health plans around the country are using some of these solutions to help manage COVID-19, and expect the coming months to yield some important lessons learned. It’s possible that as consumers and clinicians increasingly use and realize the benefits of virtual health during the pandemic, this heightened understanding could serve as a catalyst. When we look back on this outbreak 20 years from now, we might recall it as being a tipping point for how the United States and other countries respond to potential health emergencies, and a tipping point for virtual health.

Three out of four executives think that in the next decade, industrywide investments in virtual health will be significantly higher than today

The virtual health market in the United States is projected to grow more than 23 percent annually over the next five years, reaching close to US$100 billion by 2025, according to a recent estimate.3 Our surveyed executives predict industrywide investments in the next decade will be significantly higher than today—74 percent anticipate that investments in virtual health will increase by 25 percent or more (figure 3).

Some of our interviewees noted that virtual visits and virtual consults have the potential to offset or ameliorate the shortages or uneven distribution of specialists such as nutritionists, genetic counselors, and palliative care. Other services ripe for significant virtual health migration include:

- Behavioral health: In-person office visits for behavioral health will be the exception, and telehealth visits will be the rule, according to many of our interviewees. Executives discussed the potential of tele-behavioral health to treat depression, anxiety, substance abuse, and weight management, to name a few. Having access to behavioral health could help improve the prevention and treatment of chronic conditions. People who struggle with depression, for example, can find it difficult to adhere to treatment regimens or stick to a healthy diet or fitness plan.

- Oncology: Patients who receive cancer treatment, along with their caregivers, can spend a lot of time navigating the health care system. Some advanced health systems have already rolled out virtual check-ins to reduce time spent in waiting rooms. For some patients who do not live near a specialist, telehealth in a facility near their home can enable visits with a specialist from a different part of the state or the country. When patients return home, virtual visits and remote monitoring with the care team can help them manage side effects and other issues without having to travel. Remote monitoring is becoming more common as the use of oral chemotherapy grows.

- Musculoskeletal care: According to the National Business Group on Health’s 2020 Large Employers’ Health Care Strategy and Plan Design survey, 44 percent of employers ranked musculoskeletal issues—such as knee, hip, and back pain severe enough to warrant surgery—as the top condition impacting their costs, while 85 percent ranked it among the top three conditions.4 Companies such as Hinge Health, Inc. and Kaia Health, Inc. offer digital physical-therapy platforms to help employers reduce the need for surgeries and opioids among their workers. These tools include tablets preloaded with exercises specific to a patient’s condition. Sword Health provides tech-enabled physical therapy, combining a wearable motion tracking device, an AI-powered digital therapist, and a clinical portal through which human therapists can access users’ data.

- Provider-to-provider consultations: Virtual health capabilities allow for a direct channel between clinicians and specialists without the need for face-to-face visits, enabling cost-effective, convenient, and efficient care for patients. Organizations can provide patients with expert opinions through online programs or crowdsourcing platforms where specialists look at patients’ medical records, test results, imaging, and medical history.

Health systems should consider these findings in light of their own virtual health strategies:

An overarching enterprisewide virtual-health strategy should balance short-term investments with the ability to scale in the future. The strategy should reflect an organization’s overarching objectives. Organizations should determine how they intend to fit into the evolving ecosystem, what patient populations they want to target, which technologies, analytics, and interoperability solutions they should be investing in, and what metrics will help them evaluate success.

Health consumers of the future are likely to benefit from a more tailored, personalized virtual health care experience, driven by interoperability, data-sharing, and consumer health technology

The future of health envisions timely and relevant health and other data flowing between consumers, health care incumbents, new entrants, and regulators. An overwhelming 94 percent of the executives we surveyed expect next-generation data-sharing and interoperability to be industry norms in the next 10 years. In addition, almost 90 percent of respondents thought integration of personal health technologies and patient-generated data with electronic health records (EHRs) for clinical decision-making will be standard. These broad trends will be key to the widespread use and success of virtual health. Over the past several years, we have seen a significant increase in the use of personal health technologies for virtual visits—and higher satisfaction rates—based on our surveys of health care consumers.5

Health care stakeholders are acknowledging these trends and acting accordingly. For instance, 73 percent of executives surveyed in Deloitte’s 2019 interoperability research reported having a dedicated and centralized team overseeing interoperability.6 Also, according to the Findings from the Deloitte 2019 Health Care CEO Perspectives Study,7 CEOs from leading health systems and health plans are investing heavily to bring the customer experience in health care closer to the standards set by other industries, such as technology companies and retail companies. While increased interoperability and the shift to a more empowered consumer are encouraging, it is critical that the additional data is integrated into the clinician workflow and that clinicians believe the data is reliable and useful to decision-making.

How are health care organizations serving patients with virtual health solutions?

Health plans and health systems should decide which platforms and solutions they want to build themselves, vs. which ones they might want to partner on, and with whom. Some organizations, including Anthem, Inc., are partnering with others to create an ecosystem approach rather than building all solutions in-house, to meet the goals of offering a tailored, personalized experience for each member. Care coordination, virtual care, telehealth, and condition-specific apps are all top-of-mind areas for Anthem.8

Many health systems have launched incubators to gain insights and to develop innovative virtual health approaches. Boston Children's Hospital’s Innovation & Digital Health Accelerator seeks to broaden its digital health offerings and encompass remote care services, clinical decision-support tools, and interoperable technologies. The accelerator's portfolio of solutions includes KidsMD, a voice-enabled tool that allows the health system to extend its expertise in pediatrics beyond its walls. Parents and caregivers can access KidsMD’s web, mobile, and voice tools from anywhere to receive high-quality clinical knowledge that help them understand a child’s symptoms. Interacting with the tool gives parents meaningful health recommendations and personalized content to help them make better-informed decisions about their child’s health.9

Executives said that removing regulatory and payment barriers could accelerate virtual health adoption

We asked executives what they thought would accelerate the adoption of virtual health in the coming years. Not surprisingly, about two-thirds said that top accelerators included overcoming regulatory barriers such as licensing restrictions and allowing for site-neutral payments, along with payment methods that reward better health outcomes. Nearly one-third of respondents said technological developments such as 5G, better connectivity, and more sophisticated AI capabilities, would push adoption. Many of our interviewees saw value-based care as a potentially powerful enabler of virtual health and said fee-for-service (FFS) was a barrier. A few mentioned that health systems and providers are straddling two canoes, trying to grapple with a system that is moving toward value but is still heavily based in FFS.

“Fee-for-service is still baked into much of the system,” one executive said. “If you are a hospital, you are going to get paid more to treat a heart attack than prevent it. But we are going through a fundamental shift. We are seeing a proactive shift to value…we are moving every year. Smart health systems are creeping in that direction because they realize FFS is the cause of unsustainable costs.”

Getting paid for remote and virtual health services has long been a gray area for providers, but lately the path has become clearer. In November 2018, the US Centers for Medicare and Medicaid Services (CMS) issued its final 2019 Physician Fee Schedule and Quality Payment Program,10 which opened the door to payment for services that allow providers to manage and coordinate care at home.11 Telestroke and end-stage renal disease home dialysis services were also granted nationwide Medicare coverage—along with expanded coverage for remote patient monitoring—beginning in 2019 (for more context on the regulatory landscape since COVID-19, see sidebar, “Virtual health is playing an increasingly important role in COVID-19 response: Could this be a tipping point?”). In the private sector, a 2019 National Business Group on Health survey showed that nearly two-thirds of employers thought virtual health solutions would have a significant impact on health care delivery in 2020. Fifty-one percent said that implementing more virtual-health solutions should be a top priority for 2020.12

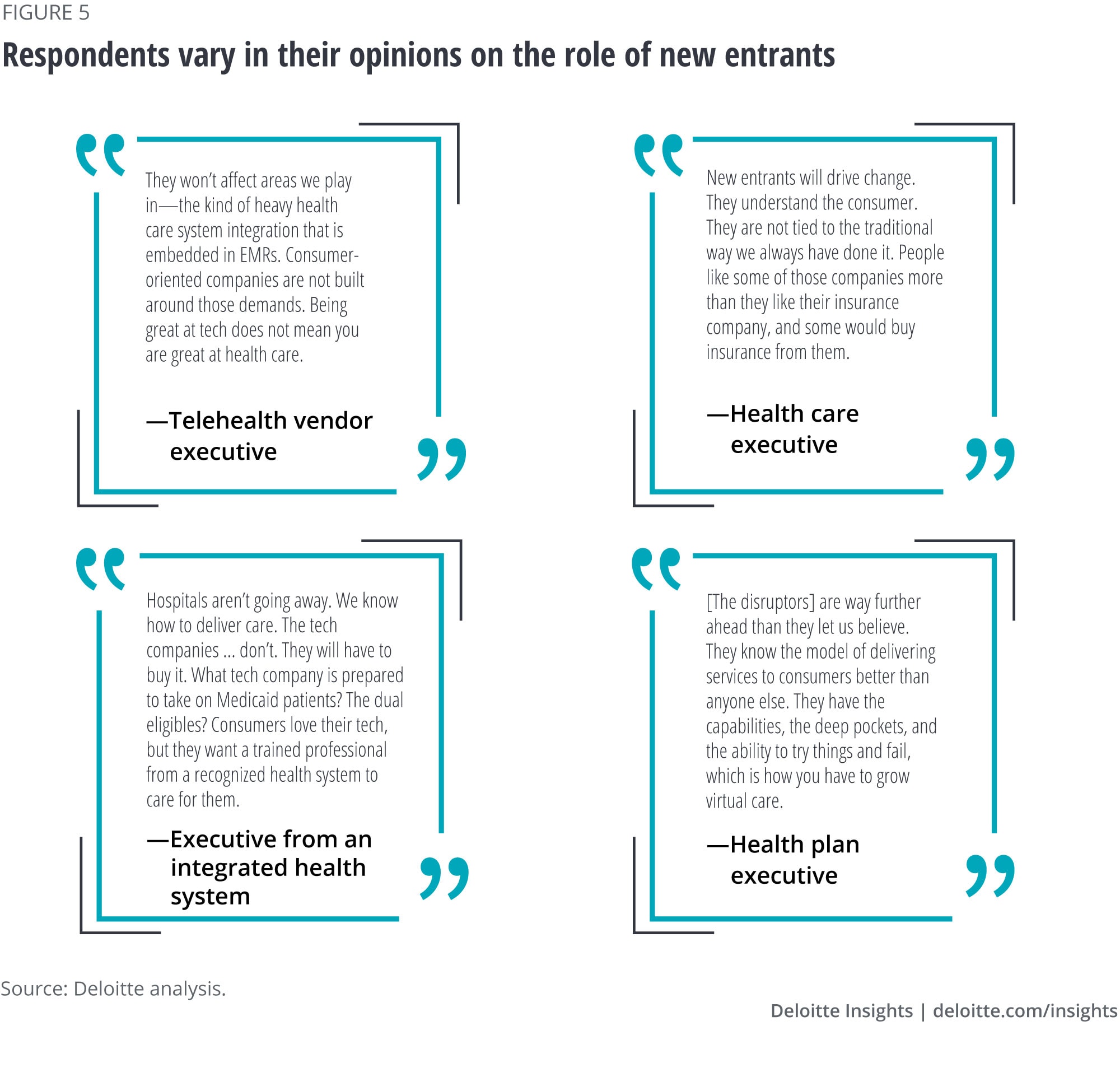

Executives were dubious that new entrants would impact virtual health acceleration

Only about one-third of surveyed executives thought that new entrants to health care—such as big technology companies, startups, and other nontraditional companies that are investing in health care strategies—would accelerate the adoption of virtual health. In our interviews, there was quite a split of opinions when it came to the new entrants’ impact on the health care system in general (figure 5).

Deloitte’s Health tech investment trends research examined which products, services, and solutions venture capitalists, certain private equity investors, and corporate venture funds are investing in to enable the future of health. The research found that health technology startups focusing on remote patient monitoring and virtual-care delivery solutions have received increasing venture funding over the past eight years. It is possible that traditional incumbents could risk overlooking the reach and impact of these new entrants. Some large technology companies as well as startups have made major strides with devices and interoperability. Virtual health makes sense as a logical next step for these companies.

Clinician buy-in is a business imperative to widespread virtual health adoption

According to our survey, half of executives thought that the acceleration of virtual health would reduce physician burnout. That could mean the other half thought virtual health could maintain the status quo or potentially make burnout even worse.

Improving work performance and satisfaction among physicians and clinicians, and reducing burnout, is a business imperative. Health care systems can get the most value from physicians and other clinicians who are practicing at the top of their license—focusing their time, attention, and effort on providing patient care rather than completing administrative tasks. Technology should enable this, but thus far, it has largely proven to be more of a burden than an enabler.

Automation and virtual health solutions—such as virtual visits, virtual consults, AI, and others—could free clinicians from administrative tasks to focus on patient care. However, this is not a foregone conclusion. Physicians are often reticent to fully embrace new technology-enabled care models such as virtual health.13 Typically, physicians want to be sure that any new technology or protocol is reliable, evidence-based, validated, and good for patients. They also want to know they will be able to implement the new model and get paid for it.

With the wider health care ecosystem transforming around them, hospitals and health systems should prioritize a system that can enable all caregivers to practice at the top of their license and affirms physicians as partners in care rather than employees to be managed. It’s also imperative that physicians and clinicians within the organization are the drivers of change. When developing criteria for specific technology investments, organizations should include physician time and workflow in addition to business value. Organization leaders should consider investing in training tools that can help clinicians feel confident about their changing role.14

Addressing the critical challenges around the drivers of health won’t be easy, even if a “virtual first” system expands access to care

In many ways, the executives we surveyed thought the future looked bright for health and health care in 2040. Most thought that for many services, consumers would have a “virtual first” experience with the health care system. Almost all (94 percent) thought that the use of AI would enable earlier and proactive identification and intervention. This could help keep people well and prevent disease, which would translate to a reduction in acute or episodic care. Patient satisfaction will increase, according to 82 percent of respondents, because patients will have a more seamless, convenient experience accessing certain services.

However, executives were more pessimistic about virtual health’s ability to address and make strides in the drivers of health—or the factors outside the traditional health care system that impact our health, such as food security and nutrition, education, accessible and safe housing, employment, transportation, meaningful relationships, and a sense of community. Only 28 percent of executives surveyed thought that by 2040, we will have made significant progress in addressing the drivers of health.

This finding speaks to the complexity of addressing the drivers of health. While advancing technology and the move toward interoperability can help us bridge gaps in health care, virtual health solutions will likely be limited unless we improve data-sharing and interoperability. Before implementing new technologies and digital tools, health care organizations should determine what they want to accomplish, according to interviewees who had experience with digital transformation in their own organizations. They suggested starting with the problem to be solved rather than pointing a technology at a problem. When thinking about how to address the drivers of health, it’s important that health care stakeholders focus on how to keep consumers healthy. While there is no simple solution, a likely place to start is looking at how an expanded health ecosystem—which includes nontraditional players such as churches and schools, employers and business leaders, government leaders, financial services companies, retailers, and local organizations—can come together around the goal of improving health. Our success in addressing the drivers of health likely depends on the ability to partner more effectively within this ecosystem.

Most of our interviewees mixed optimism with realism about the ability to address the drivers of health in coming decades. A digital health strategy executive recalled how the passage of the Affordable Care Act (ACA) in 2010 brought about a sea change in terms of what most Americans expected from the health care system. “The ACA opened some people’s eyes in terms of showing us we don’t have to have an uninsured population,” he said. He also noted that down the road, there could be other policies and industry moves that will advance the dialogue.

An executive with a long history in the health plan industry explained that health care is an isolated industry that hasn’t looked enough to other sectors to help solve some of its most challenging problems. She noted that unsustainable costs and consumer demand are slowly changing that, and the willingness of health care stakeholders to look beyond their own walls can help the health industry address the drivers of health.

Virtual health solutions that connect people with care services at home, voice-activated digital assistants that connect people to information and providers, and ridesharing services that deliver patients to their medical appointments are a few ways stakeholders have already begun to address these challenges. In the future, the increases shift toward value over FFS and the ability to connect data from various platforms could lead to a far more seamless, connected experience for patients.

Four virtual health strategies stakeholders should consider

By 2040, the health care system we know today will be transformed. We will be more focused on health than health care. We will identify disease earlier, proactively intervene, and ensure consumers have a more active role in their health and well-being. Virtual health plays a major role in the future of health, and health care stakeholders likely need to adopt new business models to set themselves up to succeed. Based on our research, health care organizations should consider the following:

- Define an enterprisewide virtual health strategy: Organizations should determine their overarching objectives and define where they fit in the evolving ecosystem. They should consider the patient populations they want to target, where to invest in technology, analytics, and interoperability solutions, and what metrics will help them evaluate success.

- Strive to be both consumer- and clinician-centric with virtual health interventions: Health care stakeholders are increasingly aware that the current system is not patient- or consumer-centric. Physicians and clinical teams are on the front lines of patient care, and they should be engaged in decisions. Moving to a more consumer-centric model will likely require work flow redesign, and an aligning of clinicians and staff across the organization’s network to support and advance virtual health offerings with a focus on improving quality and health outcomes, as well as improving patient and clinician experience.

- Prepare the workforce for changes: Widespread adoption of virtual health will likely require new training opportunities, starting in medical schools. Research has shown that bedside manner is important to patient health.15 As more physician-patient interactions happen virtually, health systems should ensure clinicians are trained to focus on the patient during a virtual visit. They should convey empathy and compassion and communicate with the patient even while looking at data or notes and not making eye contact.

- Partner and collaborate: Alliances will be key to the future of virtual health. Organizations are increasingly recognizing that they cannot go it alone because they lack all of the necessary offerings to thrive in an increasingly virtual health care system. To effectively address the drivers of health—and ensure everyone can benefit from evolving technology, scientific discovery, and improved care models—health plans and health systems will likely need to partner and collaborate with community service providers, technology companies, retail pharmacies, employers, and others.

© 2021. See Terms of Use for more information.

Explore more on future of health

-

Virtual health care Video

-

The future of health Collection

-

Drug and inpatient spending lines are crossing Article5 years ago

-

2021 global health care outlook 4 years ago

-

A consumer-centered future of health Article5 years ago