Accelerating smart manufacturing The value of an ecosystem approach

19

21 October 2020

Ben Dollar United States

Ben Dollar United States Stephen Laaper United States

Stephen Laaper United States Heather Ashton United States

Heather Ashton United States David Beckoff United States

David Beckoff United States

As COVID-19 necessitates greater agility and speed, leaders should consider engaging in smart manufacturing ecosystems to accelerate digital transformation and drive results in the next normal.

Introduction

On March 11, the novel coronavirus disease, COVID-19, was officially declared a pandemic by the World Health Organization.1 As regions in North America and Europe faced critical shortages of personal protective equipment (PPE) to protect frontline workers and ventilators to treat patients, global supply chain bottlenecks and scarcity of supply put pressure on overwhelmed health care systems in the hardest-hit regions. Leaders in many countries were desperate for supplies, and many turned to the manufacturing industry for assistance. The solution? Regional manufacturing networks ramped up production of the much-needed equipment.

The examples below illustrate the possible value of manufacturing ecosystems and digital tools in delivering faster turnaround and enabling better collaboration among partners. They also demonstrate how quickly coinnovation and collaboration can occur when organizations have a common goal and can leverage digital technologies.

How manufacturing ecosystems accelerate production

In the United States, the government invoked the Defense Production Act2 and directed two US automakers to build up a national stockpile of ventilators. Each of these automakers quickly established a temporary ecosystem to fulfill the orders, partnering with medical equipment manufacturers. The combined contracts for both ecosystems will produce more than 200,000 ventilators by the end of the year.3 As part of the efforts, the automakers also shared design specifications and manufacturing plans with automotive industry associations and other manufacturers to ramp up their own production efforts.4

In the United Kingdom, the VentilatorChallengeUK consortium brought together manufacturers from the aerospace, automotive, and medical sectors to produce more than 10,000 ventilators in just 14 weeks.5

Another effort in March 2020 mobilized the additive manufacturing (AM) community to address medical equipment shortages through a public-private partnership led by America Makes, a leading public-private partnership for AM research and technology, and a US Department of Defense manufacturing innovation institute. This initiative included an online portal for designers, manufacturers, and the health care community to match the needs of health care providers with clinically reviewed 3D print designs and available manufacturers to produce PPE. By May 2020, manufacturers in the ecosystem had printed and distributed more than 280,000 units of PPE across the country.6

Learn more

Explore the Deloitte Smart Factory Experience

Explore the Industrial products collection

Read Using ecosystems to accelerate smart manufacturing

View the Smart manufacturing playbook

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

But what exactly is an “ecosystem” in smart manufacturing terms? Essentially, an ecosystem is formed when different entities come together in meaningful ways to solve shared challenges and meet shared objectives.7 Effective ecosystems enable a cumulative “network” effect for participants and create value greater than the sum of parts, driving higher performance and creating exponential results. Underlying all of this is the concept of collaborating and coevolving. For smart manufacturing, Industry 4.0 necessitates this notion of evolution as advanced technologies continue to propagate.

In the 2019 Deloitte and MAPI Smart Factory Study,8 connecting to an ecosystem was a hallmark of the Trailblazers, a cohort of manufacturers that was making great strides by adopting Industry 4.0 technologies to solve for specific business problems and opportunities.9 The results of the study sparked our interest in further examining the dynamics of how manufacturers are reaching outside their organization to deliberately connect with vendors and service providers to further advance their smart manufacturing journey.

While the examples in the sidebar (Research methodology) illustrate how an ecosystem can serve a singular purpose, the 2020 Deloitte and MAPI Smart Manufacturing Ecosystems Study revealed a number of insights around longer-term ecosystem participation that companies can use to accelerate digital initiatives and drive results. The manufacturing industry was already on a digital transformation journey—one that’s been complicated by the complexity of digitally connecting assets that, in some cases, are more than 50 years old. But as the 2019 Smart Factory Study showed, a majority of manufacturers surveyed were making progress in this direction.

Research methodology

Deloitte and MAPI jointly launched a study in July 2020 to identify the ways in which smart manufacturing ecosystems can potentially accelerate smart factory initiatives. The study included an online survey of more than 850 executives at manufacturing companies across three regions globally: North America, Europe, and Asia. It also included executive interviews with more than 30 leaders from manufacturing companies and ecosystem participants.

The disruption and economic hardship caused by the ongoing pandemic have increased the urgency to accelerate smart manufacturing initiatives for future competitiveness. In a recent MAPI CEO poll, 85% of leaders agreed or strongly agreed that investments in smart factories will rise by June 2021.10 And, while economists predict that overall business investments could be low for the next three cycles, respondents in the study indicated they are directing a greater share of their factory investments toward smart manufacturing initiatives—36% vs. 30% in the 2019 study.11 This indicates that budgets in the area of smart factory investments may not be shrinking as quickly as overall budgets.

For these leaders, now is not the time to retrench and shore up resources. Rather, it’s the time to make deliberate, targeted investments in smart manufacturing initiatives to enable their organizations to thrive in the next normal. This article defines smart manufacturing ecosystems, highlights the benefits manufacturers are seeing by tapping into these ecosystems, and offers a playbook for manufacturing leaders to identify steps toward ecosystem adoption.

The “perfect storm” speeding up ecosystem adoption

Since early 2020, manufacturers have experienced notable disruptions—from supply-demand imbalances to regional work stoppages—due to the arrival of COVID-19. This disruption has also had an impact on digital transformation initiatives. As of August 2020, 38% of manufacturers surveyed had paused their smart factory investments as they assessed the impact of the economic conditions caused by COVID-19. A majority of them expect to resume their smart manufacturing investments in the next 12 months. However, 12 months is a long time in the world of technology and digital transformation, and companies that wait too long could risk falling further behind their peers in smart manufacturing adoption. Especially since 62% of manufacturers surveyed are committed to forging ahead with initiatives and some are even accelerating them (figure 1). In fact, these companies on average are dedicating 36% of their factory investments toward smart manufacturing investments, which is a 20% increase from those surveyed in last year’s study.

Why is the current environment ripe for acceleration? In many ways, the uncertainty of today’s fluid environment necessitates smart manufacturing capabilities for greater agility and speed. As one executive said about the changes COVID-19 has brought, “Capacity moves on a dime . . . we don’t know what’s going to sell or who’s going to be able to come to work, so we’re being forced to move quicker [with smart manufacturing initiatives].”

Many of the companies we spoke with have quickly pivoted to expanding the use of Industry 4.0 technologies in their plants in response to the disruptions caused by COVID-19. Executives shared examples of installing computer vision systems to enable virtual plant tours for customers; adding wearable devices for line workers to signal when they are crossing into a coworker’s six-feet personal space zone; and even quickly adding collaborative robots or “cobots” to augment the workforce as workers can’t be shoulder to shoulder on the line any longer.

By and large, there is an assumption that adopting advanced technologies takes many months. However, this is not the case when companies have existing relationships with vendors, forged through prior outreach around the use of technology to solve business issues. An executive interviewee from a US$20 billion global manufacturing company noted, “[Because of COVID-19] we have deployed many more cobots than we were planning to. And, in three months, you can apply a cobot easily in your facility … they are very intelligent and connect with employees.”12 This worked because the company has standardized a specific network of suppliers for capabilities such as cobots. Put another way, the manufacturer has tapped into an ecosystem of solution providers to accelerate its smart manufacturing initiatives.

I already have vendor relationships for smart manufacturing. Isn’t that the same as an ecosystem?

A common misperception when discussing ecosystems for smart manufacturing is that they’re the same thing as existing relationships with partners or vendors. While many manufacturers may have a number of connections with external parties to assist with smart manufacturing initiatives, the ecosystem approach requires deliberate coordination among and between various parties. This coordination around shared business objectives for the manufacturer is what differentiates an ecosystem from a group of vendors providing solutions related to smart manufacturing.

It is difficult for manufacturers to maintain the pace of rapid digital transformation on their own and ecosystems allow for greater capacity and flexibility in adapting to the new world at scale. The win-win is that the success of these many-to-many relationships can be shared by all participants. And, like in a biological ecosystem, all players in a business ecosystem share their fate. This makes it necessary to foster balanced ecosystems and maintain their health.13

We have identified four primary ecosystems that support smart manufacturing initiatives: production, supply chain, customer, and talent. While there are many subecosystems, they likely align with one of these four categories (figure 2). The 2020 Deloitte-MAPI Study focuses on production ecosystems, but all of these four ecosystems share an important interconnectedness.

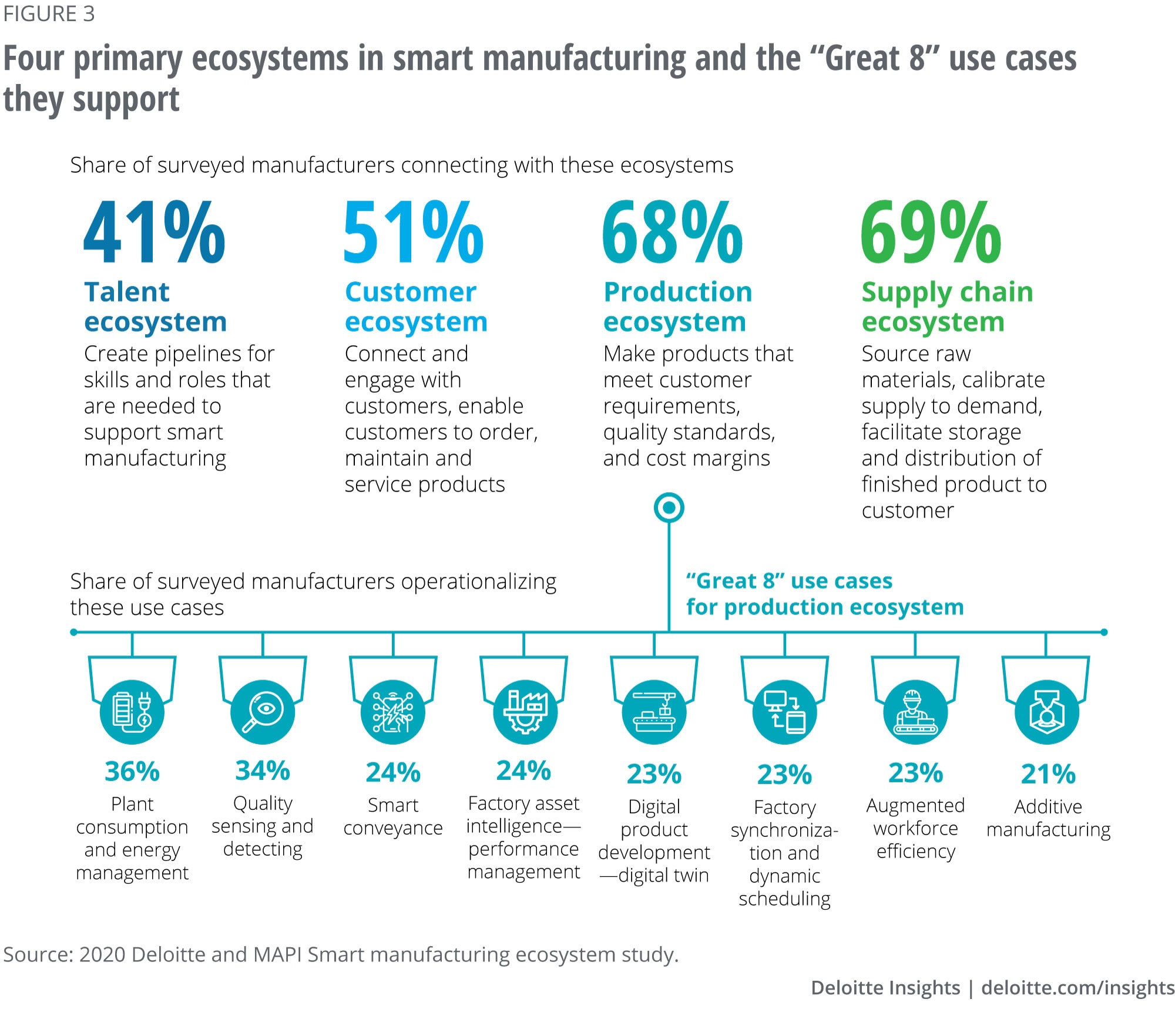

In the production ecosystems area, we have identified a set of use cases for smart manufacturing—the “Great 8”—that manufacturers are more likely to adopt, and both the 2019 and the 2020 study highlight the adoption levels (figure 3).

Why now? The benefits of smart manufacturing ecosystem participation

When you are in an ecosystem, you are gaining access to innovative capabilities to help you transform and are leveraging everyone’s collective wisdom.14

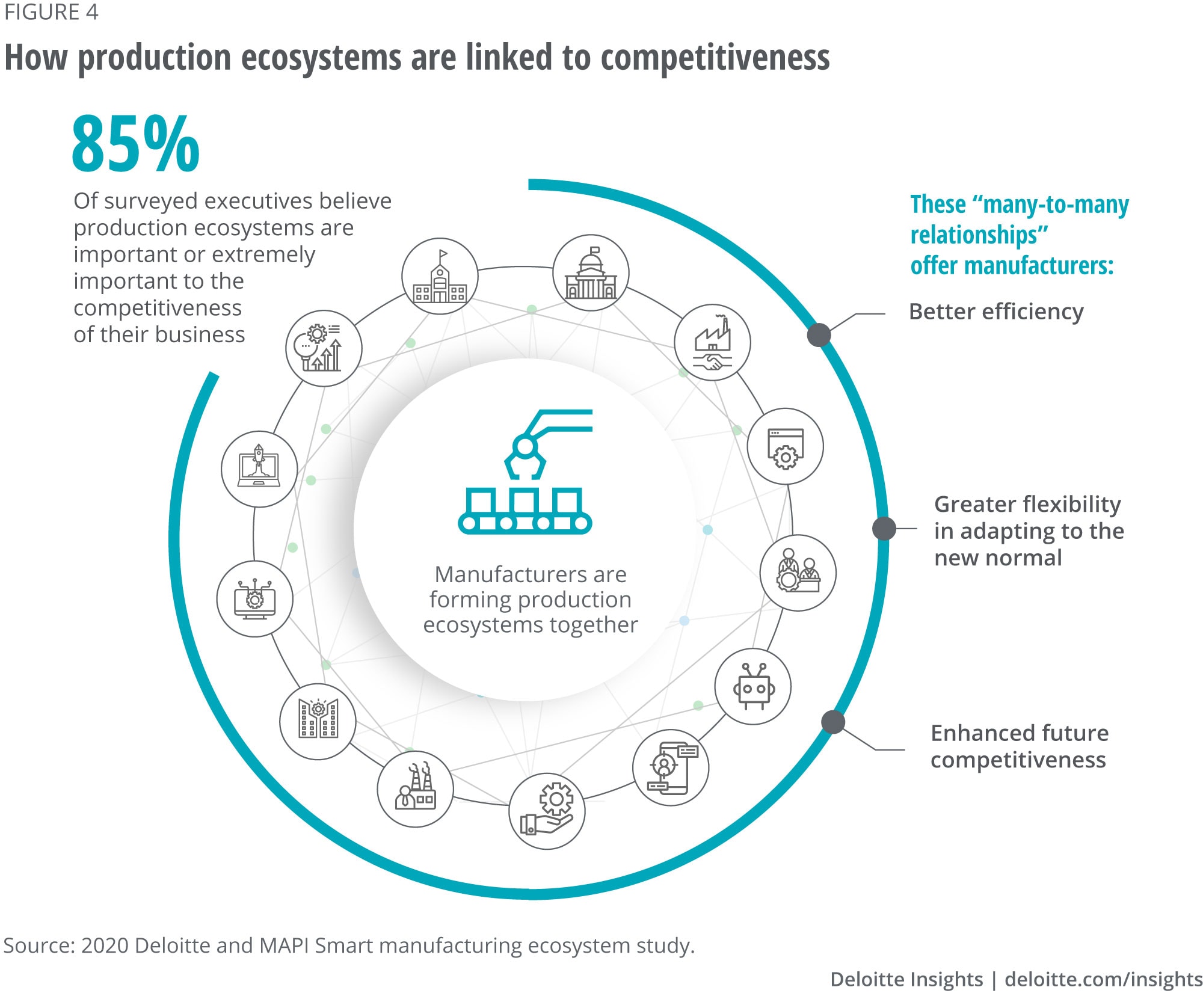

To remain competitive, today’s manufacturers must produce more relevant, better products at a faster pace. The stakes are high to evolve production processes using advanced technologies and technology-savvy talent. Given the complexity, most manufacturers do not have these areas all figured out, and yet their future success depends on it. Ecosystems can help facilitate a more rapid digital transformation, providing near-term growth and strategic long-term benefits to companies (figure 4). And these ecosystems could even have a direct impact on financial performance (see sidebar, “Ecosystem focus associated with better financial performance”).

Ecosystem focus associated with better financial performance

An analysis of Fortune 500 manufacturers identified that companies with more than 15 strategic alliances registered twice the year-over-year revenue growth in 2019 compared with companies with fewer than 15 alliances. These high-growth manufacturers used the word “ecosystem” in their annual reports more than three times as often as their peers.15

Benefits vs. metrics

The diffused nature of ecosystem benefits can often make it difficult to measure their impact on operations. In a standard vendor-client relationship, the solution provider is typically measured against a set of tangible metrics, many of which reflect the core metrics that the company uses to assess its performance—such as on-time project completion or realized cost savings from efficiencies gained. With ecosystems, the metrics for partner evaluation may be specific but the benefits are often defined as “bigger picture” ones, capturing aspects of the potential of these networks to transform the way business is done. The surveyed executives shared the metrics they use.

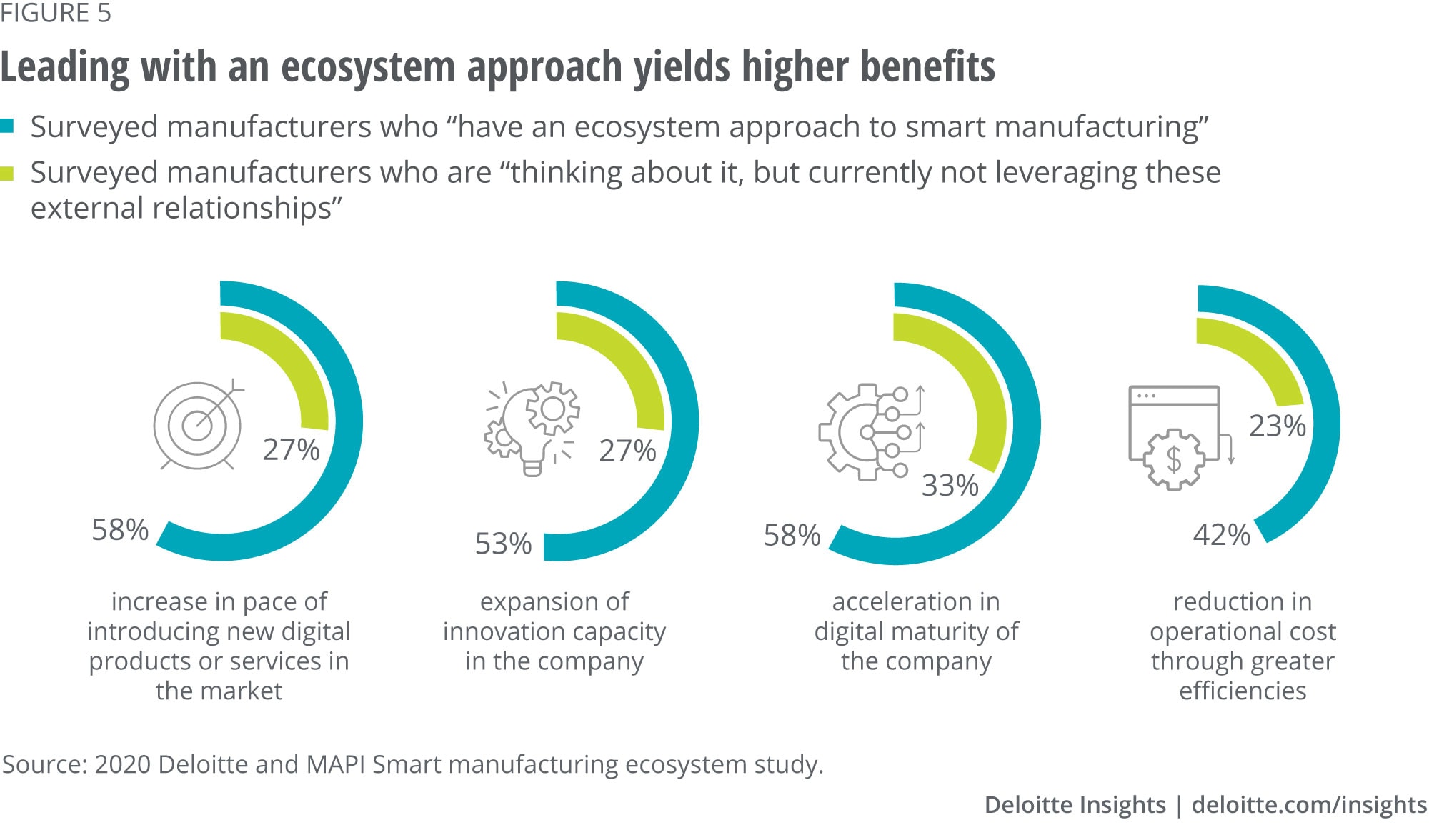

For example, the top way most manufacturers measure the value their ecosystem partners provide is by using productivity- or efficiency-related metrics. However, the top two benefits surveyed manufacturers report overall from having an ecosystem of partners and alliances for smart manufacturing production are “increasing the pace of new products/services delivery” and “increased revenue from products/services.” Last on the list is “reducing operational costs through greater efficiencies.” So, while reduced costs can be a positive outcome of working with an ecosystem for smart manufacturing, surveyed manufacturers appear to be noticing faster time to market and new channels/markets for their products through these production ecosystems. Figure 5 highlights some of the additional benefits experienced, further broken down by the maturity of the manufacturer’s ecosystem approach.

Use case 1

Creating a marketplace to accelerate a smart manufacturing ecosystem

The Volkswagen Industrial Cloud is an open platform that has been developed since 2019 with Amazon Web Services (AWS) to combine data from all machines, plants, and systems across all 122 facilities of the Volkswagen Group. The platform leverages machine learning, IoT, and data analytics tools to process information at Volkswagen’s production facilities in real time to improve processes. The Industrial Cloud is now moving forward with its longer-term goal of connecting with more than 30,000 locations and over 1,500 suppliers and partners globally. To this end, Siemens has joined the Industrial Cloud to enable the platform to integrate with other technology and manufacturing firms and likely provide a “marketplace” for smart factory software applications that Volkswagen plants and its suppliers and partners could use.16

Use case 2

Creating a central resource that taps into a broader external ecosystem

To accelerate innovation around Industry 4.0, Fortive Corporation launched The Fort, an AI and data analytics hub, in 2019. Located onsite in Pittsburgh, Pennsylvania, at Industrial Scientific, one of Fortive’s 20 operating companies, The Fort has a collaboration with Carnegie Mellon University to help fortify the company’s talent pipeline for Industry 4.0 skills. Data scientists at The Fort work on projects that are requested from any of the operating companies, frequently reaching out to a broader ecosystem of research labs and start-ups to identify solutions that can address the business needs.17

An ecosystem approach amplifies impact

As manufacturers advance toward their broader digital transformation specifically through smart manufacturing initiatives, ecosystems can make a significant difference in the speed and scale of their efforts. In particular, when manufacturers engage their network partners to solve for specific business challenges or opportunities, they can make better progress. The study identified two different approaches to making progress with smart manufacturing initiatives. The first approach prioritizes in-house efforts, reaching out to partners only as needed. The second approach prioritizes looking externally for enabling capabilities and making connections across external partners.

The study found that among the companies surveyed, those that were more external-oriented while tapping into capabilities went further faster. Surveyed companies that led with an external partner approach were “operational” on average across 31% of the use cases they are implementing, compared with only 15% of use cases for those that start with in-house development. This finding reinforces the findings from the 2019 Deloitte and MAPI Smart Factory Study that identified the pace of the Trailblazers, who were leveraging external support to enable their smart factory initiatives.18

Taking a closer look at how these companies are connecting can be helpful for other manufacturers as they consider connecting with partners and expanding their network to implement smart manufacturing initiatives. For companies that use an external ecosystem to enable smart manufacturing, figure 6 highlights the key partners within production ecosystems and the way these connections can amplify a traditional approach to engaging with individual partners.

Use case

Getting from Point A to Point B faster

To solve for the need of rapidly innovating around digital solutions for supply chain challenges, Georgia Pacific formed a supply chain ecosystem—Point A Center for Supply Chain Innovation—in late 2018 with several charter members. Today, the consortium has more than 40 members that span manufacturers, technology vendors, and service providers. The group selects “problems” that reflect the real business needs of its members and sources new technology and solutions through its members’ extended networks. The process involves problem pitch presentations, use case workshops, joint agreements, programs, and more.19

What makes a strong connection?

One manufacturer that is at the mature end of the smart manufacturing spectrum has adopted an ecosystem approach for the past several years. This company has brought together more than 24 partners to more rapidly evolve its use of advanced technologies such as artificial intelligence, robotics, machine learning, and vision systems. Recently, the transformation leader noticed that participants (vendors) have started co-investing in some of the problems related to smart manufacturing that the ecosystem is trying to solve. This has been an organic outcome of these partners coming together to achieve a shared goal and is leading to further amplification of the ecosystem.

But ecosystems can result in much more than just accumulating legions of partners or driving up the volume of smart manufacturing use cases. In their best form—as the above example illustrates—the members of an ecosystem coinnovate around common problems, looking for solutions that benefit more than one participant. This is where strong connections can deliver amplified results within an ecosystem. Manufacturing respondents who lead with an external approach to smart manufacturing reported being more than twice as likely to find value through the number of additional connections or capabilities their partners bring. These additional connections can offer serendipitous new opportunities that may accelerate a given initiative.

Manufacturing respondents who lead with an ecosystem approach to smart manufacturing are more than twice as likely to find value through the additional connections or capabilities their partners bring.

Besides looking at the number of connections companies are making, the study strongly indicates that the type of partners manufacturers choose to work with drive the results. For surveyed companies that start with an "in-house first" development effort, the most common connections with vendors include enterprise IT, operation technology, and automation/robotics vendors. In contrast, surveyed companies who see greater benefits from engaging in an ecosystem reported choosing and working with a wider variety of partners. While they do partner with enterprise software vendors and operation technologies vendors, they cited being four times more likely to partner with Industry 4.0 technology (cloud, IoT, analytics, etc.) providers (figure 7). And, as shown in figure 5, these surveyed companies reported seeing higher benefits from their efforts.

Characteristics of a mature ecosystem approach

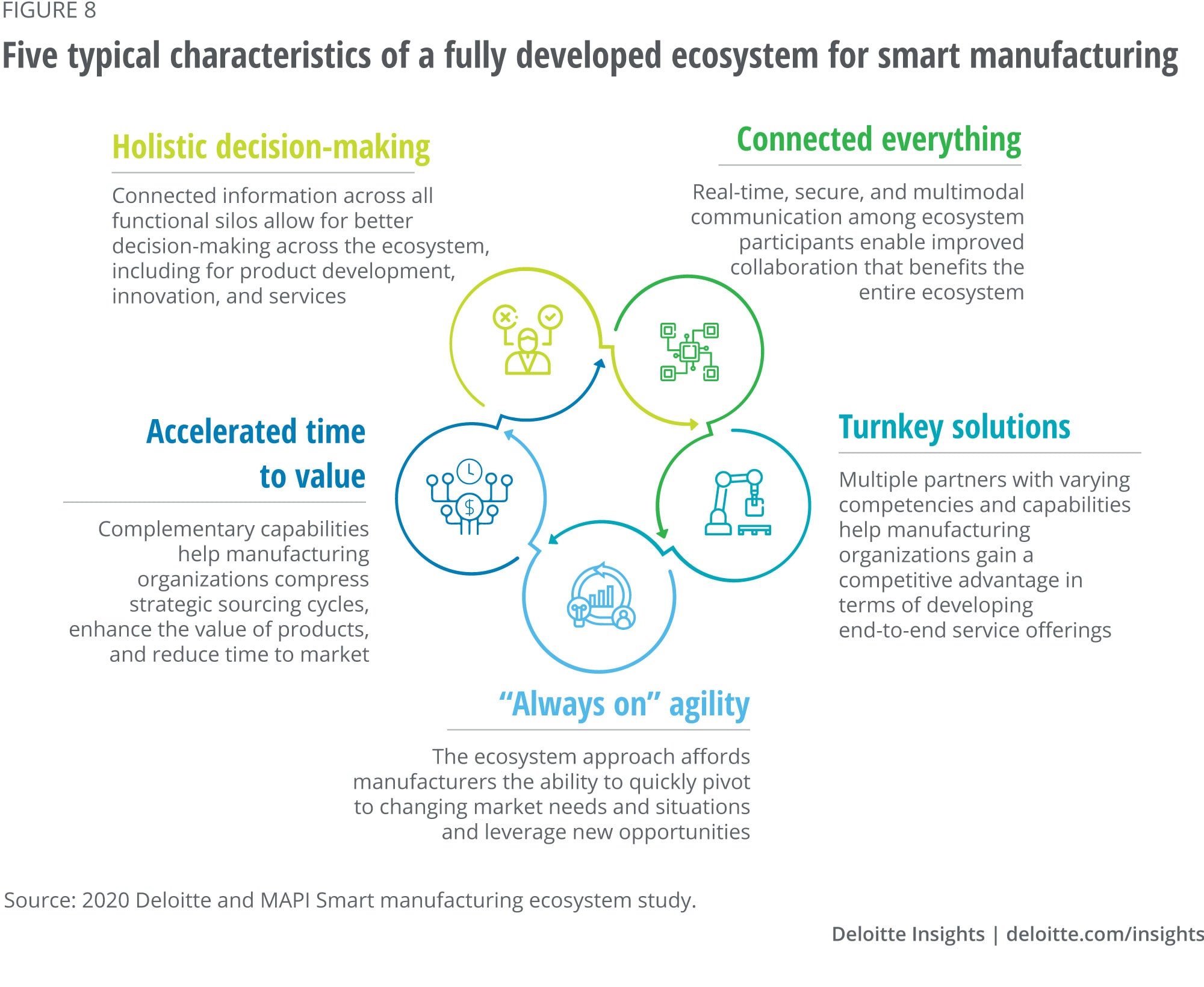

As most manufacturers are still largely working toward fully realized ecosystems for smart manufacturing, survey respondents have a somewhat nuanced view of where they currently sit along their ecosystem journey. Deloitte has identified five characteristics of a typical fully mature ecosystem approach. These are:

- Connected everything

- Holistic decision-making

- Accelerated time to value

- “Always on” agility

- Turnkey solutions

Considering all five characteristics of a typical fully developed ecosystem for smart manufacturing (figure 8), respondents’ self-reported maturity appears to be lower than their actions bear out.

When asked to look at the current state of maturity of their ecosystems, between 23% and 39% of surveyed executives rated themselves at a maturity level of 4 or 5 out of 5 across each of the five characteristics. This seems incongruous with the finding that 73% of respondents are using some form of external connections to drive acceleration of their smart manufacturing initiatives. The gap suggests that while companies have many external connections supporting their efforts related to smart manufacturing ecosystems, there is likely more to creating a value-delivering ecosystem than just having a strong partner network. This is likely due to some of the key challenges the study uncovered. One of the key recommendations in the playbook for creating a smart manufacturing ecosystem is that manufacturers consider applying the philosophy of strategic sourcing to their approach; it also suggests front-loading this approach with strong relationship development that focuses on finding partners who share the same value and passion as the company.

Challenges and risks can complicate ecosystem development

Creating an ecosystem for smart manufacturing initiatives isn’t easy. There are many factors that could hinder manufacturing organizations’ efforts to connect with a broader network to advance their key smart manufacturing initiatives. Some of the challenges reflect the risks inherent to making external connections while others highlight some of the challenges in managing them.

Ecosystem coordination can be complex

An immediate barrier to extracting value from ecosystem relationships is the coordination effort required to work in tandem with multiple parties on complex initiatives across vast factory footprints. Executives repeatedly mentioned the challenges they face in this area. There can sometimes be a danger of “scope creep,” when multiple parties are brought together to solve a problem and start to expand the project to leverage the potential that the additional resources bring. Navigating this situation can be difficult, especially when a manufacturer doesn’t have extensive experience in technology to ensure interoperability.

Suggested approach:

Consider choosing a “convener” from your ecosystem partners to help coordinate the efforts across multiple vendors. Align this convener with your executive team or the smart factory champion that is driving the smart manufacturing strategy to ensure coordination and align both scope and timelines.

Data protection and cybersecurity are top of mind

Fifty-eight percent of manufacturers surveyed have concerns about legal, financial, privacy, intellectual property (IP) theft, or cybersecurity due to a smart manufacturing ecosystem. Companies that identified in-house development as the top contributor to their smart manufacturing initiatives over the past two years were 1.4X as likely to cite lack of cybersecurity infrastructure as a major challenge to joining or forming an ecosystem. This could be holding them back from experiencing the benefits of leveraging a network, thereby slowing down progress across initiatives.

Suggested approach:

Because of the increased risk that many manufacturers are facing in the digital realm, it should be considered critical that companies develop and implement a cybersecurity plan for any activities that involve connecting plant assets (machines and people) beyond the physical building. Learn more about building cyber resilience in the smart factory here.

Intellectual property theft is a top concern

Concerns about exposing IP or smart manufacturing plans were cited as the top challenge surveyed companies face as they navigate the prospects of making connections externally to foster smart manufacturing initiatives. Intellectual property can be particularly challenging because it takes on so many forms in a smart manufacturing environment. It can be related to a manufacturing process, or to materials (e.g., involving additive manufacturing), or it can even be related to an algorithm that is developed for the company to manage its assets in a way that would increase margins.

Suggested approach:

Interviewed executives stressed the importance of performing due diligence on potential partners and consulting legal advisors to ensure any agreements protect the IP that will be shared among partners.

Skills and capabilities vary across factory footprint

Another theme that emerged in the executive interviews is the heterogeneous aspect of many manufacturers’ footprints. The 850+ global survey respondents represent a network of approximately 10,000 factories across 11 countries worldwide. With some regions more fully embracing digital capabilities than others, there can be significant hurdles in rolling out a comprehensive strategy for smart manufacturing. One of the interviewed executives lamented the challenges of reaching a higher level of data maturity that would enable predictive and prescriptive insights for production assets on the factory floor. Some locations were just starting at level 1, collecting data from disparate systems. The approach this executive’s company took was adopting an industry- standard definition of different maturity levels and then working toward getting all locations up to a minimum of level 2 (data visualization) within a projected timeframe, all the while engaging with ecosystem partners to assist its efforts.

Suggested approach:

Create a corporate-level strategy for smart manufacturing initiatives that includes standardized approaches to key capabilities and identify “vetted” ecosystem partners across regions that can be ready to help at a pace commensurate with each location.

The path forward

Despite economic headwinds, now is not the time to slow the momentum of smart manufacturing adoption. Rather, the present situation seems ripe for digital technologies to solve for many of the challenges that manufacturers face as they strive to maintain operations during the global pandemic. Surveyed companies that are continuing their smart manufacturing investments through the current market environment are directing an average of 36% of their global budget for all factory-related initiatives toward smart manufacturing. Clearly, these investments underpin the commitment companies have toward transforming operations through digital processes and technologies.

The 2020 Deloitte-MAPI study highlights the vast potential benefits of adopting an ecosystem approach to smart manufacturing. Ecosystems can provide speed while enabling partner networks to coinnovate around common challenges; they are also helping many of the manufacturers in the study accelerate smart manufacturing adoption. These companies have a higher percentage of smart manufacturing use cases operational at one or more locations than their peers, and they are measuring benefits from their ecosystems that are up to twice those as seen by their peers.

The ecosystem approach works, but it’s not easy to adopt. It generally requires a deliberate effort that involves executive commitment to smart manufacturing, an organizing strategy, intentional partners chosen to enable or provide specific benefits, and ongoing cultivation of the relationships and their shared objectives. To explore the pathways to realizing the value of an ecosystem approach for smart manufacturing, visit our playbook.

More from the Industrial products collection

-

Digital lean manufacturing Article4 years ago

-

Electrification in industrials Article4 years ago

-

Aftermarket services Article4 years ago

-

Navigating disruption Article4 years ago

-

Unlocking end-to-end digital fulfillment Article5 years ago

-

When the Internet of Things meets the digital supply network Article5 years ago