Down but not out Transforming oilfield services

18 minute read

17 December 2019

Oilfield services companies seem to have largely borne the brunt of the 2014 oil price crash. While their services and products continue to be crucial to the industry, they may need to restructure their businesses and change their operating models to ensure long-term success.

Executive summary

While lower oil and gas prices have impacted returns across the entire value chain, many oilfield service (OFS) providers seem to have suffered the most since the oil price crash in 2014. Their revenues and earnings are down almost across the board as most upstream companies, reacting to investor skepticism and negative market sentiment, are cutting their cost structure, with the goal of decoupling their costs from the movement of hydrocarbon prices. OFS companies are largely facing the brunt of these cutbacks and their share values are trailing both the price of oil and the broader stock market, even though they hold valuable assets and intellectual property.

Learn more

Explore the Oil, gas & chemicals collection

Subscribe to receive related content from Deloitte Insights

Download the Deloitte Insights and Dow Jones app

This impact has been felt across the OFS universe, including integrated oilfield service providers, engineering, procurement, and construction (EPC) companies, North America–focused (NA-focused) service companies, onshore and offshore drillers, as well as more niche, specialty service providers. To better understand this impact—and outline possible opportunities for future performance improvement—we analyzed the data of 70 OFS companies worldwide.

The financial picture leads to a logical conclusion: OFS companies should deliver products, services, and capabilities that help operators boost productivity. These companies can use their heritage of unique engineering talents and ingenuity to reshape their approach to their differentiated capabilities, which would allow them to create a more resilient portfolio for the future. But first, leaders should rethink the way they structure their businesses today, to drive investment in those capabilities.

This is not expected to be an easy lift. Many OFS companies rely on the same business models that worked for US$100 plus per barrel of oil, which are stifling innovation and efficiency today. The market has changed and will likely not be the same; service providers should stop fighting the last war and focus on the future. They should use five levers to improve performance: portfolio strategy, commercial approach and pricing, operating model redesign, integrated business planning, and digital solutions. Getting these right today can help prepare for the uncertain markets of tomorrow.

Key takeaways

- Oil prices have declined 45 percent since 2014, but OFS market capitalization has fallen by 50–90 percent, depending on the segment.

- Despite the 2017–18 increase in oil prices and the boom in US shale, only integrated and NA-focused OFS companies saw an increase in revenue, and, for most, the uptick was modest.

- Revenues have fallen faster than costs, compressing operating margins for many service providers.

- Average margins fell from 15 percent to less than 5 percent across the 70 companies between 2014 and 2019.

- OFS players still have a chance to build a financial structure that enables profitable growth. Increasing margins could be key. If these 70 companies could increase margins to 2014 levels (admittedly a big challenge), they would collectively earn an additional US$20 billion each year—and potentially more than US$30 billion per year across the entire OFS industry.

The landscape remains challenging for OFS companies

The OFS sector’s performance has lagged both the price of oil and the broader stock market.1 The industry has been battered by commodity markets, and clients looking to cut (or even decouple) the cost of services from the movement of energy prices. OFS companies are not only trying to address external challenges, but internal ones as well. Most are not prepared for what increasingly looks like the new normal.

Oil prices declined by 70 percent between 2014 and 2016, only partially recovering in recent years amid substantial volatility (figure 1). US natural gas prices remained at multidecadal lows over the same period. While international gas prices have become more robust, they are still well below their 2014 levels, as the United States exports its surplus through its rapidly growing liquefied natural gas (LNG) industry (figure 2). Lower prices have impacted returns across the entire oil and gas value chain. The lower-for-longer concept seems too simplistic to describe energy prices in 2019, but most upstream companies are still reacting to investor skepticism and negative market sentiment by allocating capital cautiously. Oilfield services have faced the brunt of these cutbacks and have been navigating an adverse economic environment since 2014, without adjusting their structural and intrinsic cost parameters.2

Change resistance can be seen in OFS companies’ share prices and market capitalizations, as both have tracked the price of oil, albeit loosely. OFS market capitalization has fallen, rebounded, and dropped again much like oil, but these companies fell from a higher peak than Brent, and the 2017 rebound proved short-lived (figure 3). Different types of OFS companies have been affected differently (see the sidebar, “The OFS universe”). In the case of offshore drillers, the bottom dropped out of the market in 2015 and has not yet recovered. On the other hand, North American companies fared better in 2016 and 2017 due to the Permian engine, but have since dropped.

The landscape may seem somewhat bleak, but the last five years have taken a toll on balance sheets. The post-2014 oil and gas industry is increasingly looking like the new normal. OFS companies that wish to survive should take lessons learned from the downturn, and double-down on improving financial performance to create a lower-cost, more resilient portfolio of equipment and service offerings supported by a fit-for-purpose operating model.

The OFS universe

OFS companies provide a range of equipment and services necessary to discover, produce, and bring oil to market. Some services are well known, such as hydraulic fracturing (or pressure pumping) services that convey water, sand, and various chemicals deep underground at high pressure to release oil and gas in tight reservoirs. Other services, including packer manufacturers, supply boat providers, and downhole tool purveyors, are less familiar to those outside of upstream oil and gas, and OFS companies. These companies are typically defined by the type of services they offer—e.g., specialized value-added versus commoditized—as well as their focus—equipment manufacturing or rental versus more hybrid services requiring both equipment and specialized technologies. Many larger OFS companies manage service offerings across the spectrum, and often across the world. However, there are a number of highly focused firms, and quite a few focused solely on the North American shale market.

We divided OFS companies into six categories based on their focus for practical analysis:

- Integrated OFS companies that provide multiple services such as pressure pumping, wireline, and downhole tools, as well as manufacture equipment. The big three, Schlumberger, Halliburton, and Baker Hughes, are the prototypical examples of the genre, but there are a number of smaller companies that take a similar approach.

- EPCs (engineering, procurement, and construction companies) that provide offshore and onshore construction, manufacture heavy equipment, and design facilities to produce and export oil from field to market. Some EPCs also manufacture more commoditized equipment such as onshore wellheads and tubular goods. Tenaris and TechnipFMC are the largest companies by market capitalization in the space.

- NA-focused OFS companies such as Calfrac and Trican that specialize in serving operators in shale basins. Most, though not all, have a strong presence in the pressure-pumping market.

- Onshore drillers such as Helmerich & Payne primarily offer rotary contract drilling services with supporting crew and auxiliary equipment. Some, such as Nabors, also operate a smaller number of offshore rigs.

- Offshore drillers such as Transocean and Valaris, like their onshore cousins, mainly focus on providing offshore contract drilling and associated services to oil and gas producers. In the last decade, the market has increasingly shifted toward deepwater-capable rigs, that is, drillships and semisubmersibles, though the jack-up market remains active in a few key geographies.

- Specialty providers offer a few services or products, usually tied to a specific part of the business. It is a diverse group with companies such as Tidewater offering offshore support vessels, and larger companies such as CGG that focus primarily on seismic and geophysics.

Our analysis covers 70 companies from all six groups, worth US$195 billion, representing 70 percent of the value of all publicly traded OFS companies worldwide.3

The lasting impact of the oil price downturn

US production continues to grow substantially year after year, and oil and gas E&P earnings are rebounding and, in some cases, exceeding their profitability during the boom.4 Most service companies, however, are not feeling the benefit of that rebound. This leads to an obvious question: What disconnected the energy markets and OFS companies in the last couple of years?

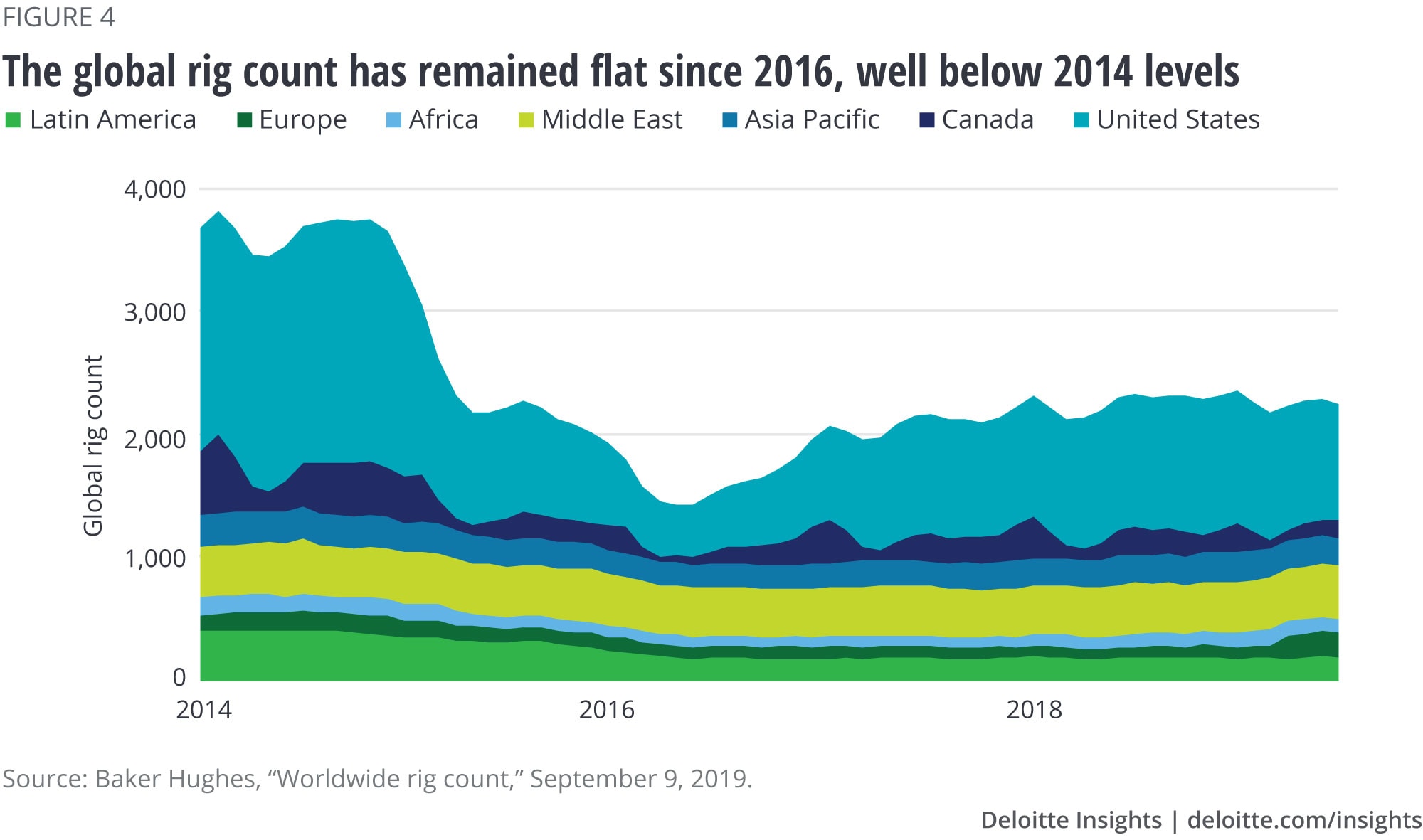

Part of shale’s outsized success is driven at the expense of the companies providing the horse power. As we noted in our prior report, Oilfield services: Caught in the cycle, higher efficiency and limited market power means that in the last five years, more has been done with less, and for those providing the services and equipment that run the oilfield, this means lower revenue for most, and compressed margins for all. For example, rig count globally fell from 3,600 to 2,200 between 2014 and 2019, and from 1,800 to 1,000 in the United States—a decline of roughly 40 percent (figure 4). The number of wells drilled in US shale regions, however, only declined from 22,000 to 16,500—roughly 25 percent (figure 5).5 US wells are increasingly complicated, as operators push to boost production by drilling longer laterals and pumping more complicated fluids and sand mixtures during completions. The typical shale well is 50 percent more completion-intensive in 2019 than it was in 2014 (figure 6).

Doing more with less—or perhaps more accurately in many cases, doing more for less—is negatively impacting balance sheets. For the 70 OFS companies we analyzed across the six groups, total shareholder return (defined here as the change in market cap adjusted for dividends paid), dropped more than 50 percent between the first quarter of 2014 and the first quarter of 2019, with some segments seeing a much larger drop than others. Only five companies out of 70 reported positive shareholder returns across the period. The decline in shareholder value reflects weakening financial fundamentals (figure 7). Four factors explain most of the overall trend in returns: revenue growth rate, operating margins, return on capital employed (ROCE), and the debt-to-equity ratio.

OFS companies saw their market capitalizations fall substantially since 2014. The average OFS company in our dataset earned about US$150 million from revenue of US$1 billion in 2014—an operating margin of 15 percent. Across the group, 2014 revenues ranged from roughly US$100 million to US$50 billion, with margins typically around 10–20 percent. Integrated OFS and EPC companies tended to be larger, with NA-focused and specialty service providers being smaller. In the first half of 2019, average margins fell to less than 5 percent (and less than zero for some). If the average OFS company maintained its margins, it could have made close to US$100 million despite reduced revenue, rather than the US$30 million that it did earn. Subsequently, the average debt-to-equity ratio of our company set almost tripled between 2014 and 2019 to about 150 percent, and ROCE fell from mid-to-high single digits to only 1 percent. This does not bode well for long-term success.

OFS leaders are acutely aware that they should boost financial performance, and therefore shareholder returns; but the “vines” (layers of upper and middle management and business processes that thrive on the structure and practices that exist) that have grown through their organizations make it difficult to bring about change.

Many companies have been focusing on efficiency by trying to generate more revenues from their existing asset base while reducing headcount, limiting capital spend, and slashing tactical overhead costs. These efforts helped them survive previous downturns, so why wouldn’t they work again? But actual success in these efforts was limited—since costs have not fallen as fast as revenue, it is stressing margins, lowering ROCE, and increasing the debt-to-equity ratios of even the healthiest balance sheet. These companies should take a new, more intrinsic approach to making their revenue and cost structures work for 2019 and beyond. The industry should make the decision to stop fighting the last war and prepare for the future.

Preparing to fight the next war

OFS companies, independent of whether they offer higher value-added or commoditized services or equipment, should honestly assess their current competitive positioning, and identify their future differentiated capabilities. What makes sense for one might not work for another. For example, offshore drillers may be less exposed to oil price volatility than NA-focused OFS companies, but they typically have higher equipment costs (e.g., stacking costs) that could exacerbate the impact of low prices on their margins.

This cannot be an exercise in tinkering at the edges; the low-hanging fruit is mostly gone. Most companies have already cut where possible. For example, 2019 US oil and gas headcount is not only below 2014, but even below 2009.6 Cuts have been made elsewhere as well, with service providers cannibalizing idled equipment for spare parts. The sector should focus on making strategic, structural changes.

How can OFS companies begin to make these changes? Leaders should focus on five levers to begin improving performance: portfolio strategy, commercial approach and pricing, operating models, integrated business planning, and digital solutions. Getting these right today can help prepare for tomorrow.

Portfolio strategy

Many large OFS companies face challenges being agile; rapid expansion into new services, products, and regions during the five years of US$100 plus per barrel of oil did not help. The Permian went from 150 rigs to 500 rigs, and the number of wells drilled per month tripled in just two years—and the service companies followed.7 Years of successive mergers, acquisitions, and divestitures (M&A&D) brought disruptive internal restructuring as successive integrations caused organizational drift. Organizations that did not perform adequate postmerger integration ended in even tougher silos with duplicative cost structures.

These companies should realistically assess whether it still makes sense to serve these markets in the same capacity today, or if they should consolidate operations, divest assets, or exit service lines altogether. If it is not part of a company’s core capabilities, and it is not a differentiated, scalable, or high-margin service, it may not fit in the portfolio. Companies also should break the instinct that they need to be good at everything they do; sometimes it is fine for a function to perform adequately at a lower cost.

Portfolio management is not just about pruning. Companies should get a realistic understanding of two self-examination questions:

- Does my projected growth and expected financial performance reflect the market growth potential of my businesses? (i.e., do the parts all add up to equal the whole?)

- Could my limited capital be allocated differently if I had fewer growth efforts? (i.e., am I spread too thin?)

OFS companies should scale up their core capabilities in line with these answers rather than focus on specific service lines. For a company such as Nabors, which acquired Robotic Drilling Systems, investing in new capabilities can help increase market share by offering a premium product in an otherwise commoditized business. As automation technologies are piloted and commercialized, drillers can deploy them more widely across the entire rig fleet.8

Another example is Schlumberger’s joint venture with Sensia, which could accelerate the adoption of digital technologies across the oil and gas value chain, including many current OFS clients—creating potential offerings, and even expanding the addressable market for their services beyond upstream oil and gas.9 Similarly, Halliburton is focusing on leveraging Microsoft’s digital capabilities to enhance its existing Landmark digital services.10 In both cases, the companies are creating new types of services by leveraging their existing technology-focused portfolio.

For companies in highly competitive, commoditized markets that they cannot compete in effectively, the best option may be to exit the market altogether. For example, many seismic companies have divested large parts of their operations, with asset sales allowing them to prioritize more strategic parts of the business. For instance, both Schlumberger and CGG sold all or part of their offshore seismic acquisition fleets to focus on data processing and interpretation.11

Companies will need to balance short-term tactical benefits (e.g., overhead reduction) with longer-term, strategic goals (e.g., differentiated, profitable offerings). Taking a smarter, more targeted approach to portfolio management can help navigate the trade-offs.

Commercial approach and pricing

The OFS industry has traditionally been grounded in a cost-plus commercial framework, where higher volumes led to higher revenues and with less focus on margins. Limitations to entry via high fixed costs (e.g., real estate, equipment, overhead) let higher revenues equate to higher margins. The industry has explored alternative pricing models in the past, but those often put a lot of risk on the service providers, with limited upside.12 Value-based billing has potential but remains niche and untrusted. There has been some tinkering at the margin, such as contracts that tie blowout preventer performance and uptime to payment for pressure control services.13

The specific pricing model is not always the problem; it can often be the execution and consistency of deployment. OFS companies have been using different pricing models in different regions for the same services without clear underlying commercial logic. Decentralized commercial frameworks and inconsistent pricing can decouple revenue and costs, making it difficult for OFS companies to make targeted decisions to improve profitability. Novel commercial frameworks can have an impact, but so can improving how companies leverage their existing pricing models today.

To achieve commercial improvement, offerings should be based on customer behaviors, knowing what the true cost is to deliver that bundle of services, and then creating a pricing structure that can flex to ensure sustainable margins. Henry Heinz once said, “To do a common thing uncommonly well brings success.”14 Oilfield services commercial leaders should pivot from a decentralized to a more structured and sophisticated approach to pricing.

Operating models

A company is more than real estate, employees, and equipment—management culture, technology, and operating rhythms can be critical to success. A company’s operating model is what ties together strategy and execution. Just as OFS companies’ portfolios drifted over the last 10 years, so have many of their operating models, often leading to bloated cost structures. Even for those that cut spend dramatically over the last few years, costs are largely still out of sync with revenues, and their margins remain compressed.15 Overlapping functions, decentralized internal systems, and a lack of connection between overall corporate strategy and the individual business units drive the inability to adapt.

Economies of scale and scope help, incentivizing consolidation; opportunities exist to raise revenue and cut cost by redeploying assets more effectively. For example, when Schlumberger purchased Weatherford’s pressure-pumping fleet,16 it could rationalize capacity through scrapping, shifting assets to other markets, and potentially increasing utilization by taking advantage of its larger organizational footprint. Still, even these actions will likely not solve the fundamental problem on their own.

The goal is to align outputs and inputs, with corporate structure supporting service delivery. Part of that will be more clearly connecting cost centers to revenue, and segmenting capabilities to better match internal client needs. Internal functions do not have to be good at everything and should explore alternative delivery models for capabilities that just require “table stakes.” Streamlining operating models means focusing on what is important (i.e., leveraging core capabilities to deliver products and services), while minimizing money and attention spent on peripheral activities.

Integrated business planning

OFS companies, particularly larger integrated ones, can be siloed and face communication challenges. Many operate across the world, with services lines stretching from the asset-intensive and commoditized, to the bespoke. The very legitimate desire to be “uber” responsive to the customer and the poor historical experiences with centralized services led to this path of “independent kingdoms.” The communication behavior of customers can exacerbate this bullwhip effect, and in the end the operational support functions might feel as if they have no way to succeed.

A solution is a fundamental ability to conduct planning (sometimes referred to as sales and operations planning). The core idea is that each part of the organization adjusts their capabilities to meet demand according to the plan, even if it may often change. If the information exists to enable this process, then managers can make decisions that minimize the guesswork. Organizations can also fight the hours of effort expended to “get the numbers right” for internal processes.

This process should be intentionally designed based on the results of an operating model exercise; attempting to patchwork a paradigm using existing blocks could very likely result in relapse into suboptimized, traditional execution.

Internal digital solutions

OFS companies should broaden how they innovate, focusing not just on the what, but also the how (e.g., commercial and pricing structure, operating models). During the downturn, new technologies did provide efficiencies for clients, but without necessarily being profitable for service companies. For example, electric fracking fleets saved producers money at the wellsite, but cost service companies twice as much to build as conventional fleets, and cannibalized sales. This created a negative rate of return on research and development spend.17 Beyond that, more complicated technologies used in challenging environments have historically taken years, if not decades, to be commercially deployed. For example, while managed pressure drilling is used both onshore and off, true dual gradient deepwater-drilling packages were piloted in the 1990s, but have not been widely used even today despite applications.18 Service companies often face obstacles because of the technology’s complexities and need for upfront investment in novel equipment.

OFS players should rethink how they deliver services and equipment with technology, meeting operators’ expectations through the price cycles while remaining lean. This will be easier with an organization that is structured to make full use of digital technology both internally and externally.

Service providers are still trying to leverage their data to provide new offerings, with limited success. The goal should not be just data as a service solution but using that data to enhance existing capabilities. It is still early days, but companies have started to make moves. For example, when Helmerich & Payne acquired Motive Drilling, it augmented its existing services by incorporating data analytics into its drilling package. It also created a technology-focused business that can continue building software solutions to support its core offerings.19

Digitalization can help OFS companies move faster. It can also help connect equipment together to better deliver results at lower costs and increased transparency. The number of use cases for data analytics in oil and gas continues to proliferate, ranging from simple sensor hookups that look much like their controls systems predecessors to digital twins replicating complex projects.20 Data analytics is not new to service companies, many of which have extensive experience with interpreting seismic data, gathering wireline logs, and deploying measurement and logging while drilling (MWD and LWD). However, they will likely need to expand their traditional approach to managing data (figure 8).

The overall goal of a digital tool set is to lower the latency of decision velocity, process execution, information movement, and analysis, while improving reliability, predictability, cost, and transparency. There are a number of opportunities to use large and small digital solutions to improve internal performance. New operating models should be linked and grounded in the productivity that can flow from these solutions.

Toward an agile and adaptive future

Oilfield services directly support the production of physical commodities, and that will not change. There will likely be a need for a more diversified range of products and services delivered with drastically lower cost by more agile companies.

OFS companies should balance their current competitive positioning and aspirations for the next decade. The key could be to remain flexible as the downturn demonstrated an increasing pace of change. There are tangible, negative financial impacts for those that remain unprepared or who refuse to acknowledge the possibility that this market may be fundamentally different. Companies that adapt to the new normal can thrive in the new energy world, but this could require a new approach to managing their business.

OFS companies should refocus their portfolio of offerings, rethink their commercial approach, streamline their operating models, better coordinate planning, and leverage digital technologies to remain relevant. There is a lot of money on the line; success in cutting costs and increasing revenue would lead to a tripling of margins, representing US$20 billion in additional earnings each year for the 70 companies we analyzed, and potentially more than US$30 billion across the entire OFS industry.21 Increasing margins sustainably will be a tough challenge, but to thrive in the long term, OFS companies will likely need to look very different 20 years from now, and the actions outlined above could be some of the first steps toward building that future.

© 2021. See Terms of Use for more information.

More in Oil & Gas

-

Shale’s next act Article5 years ago

-

Oilfield services: Caught in the cycle Article6 years ago

-

Midstream: Charting a new course amid market dynamism Article6 years ago

-

Succeeding amid uncertainty: A preview of the years ahead Article6 years ago

-

Global renewable energy trends Article6 years ago